Transdermal Drug Delivery System Market by Type (Patches and Semisolid formulations), Applications (Pain Management, Central Nervous System Disorders, Hormonal Applications, Cardiovascular Diseases), End User, and Region - Global Forecast to 2023

Inquire Now to get the global numbers on Transdermal Drug Delivery System Market

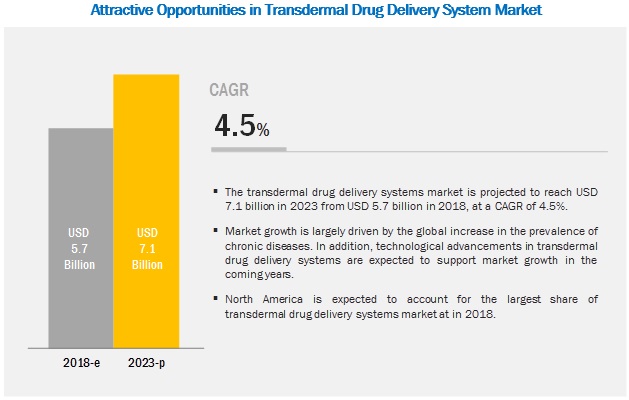

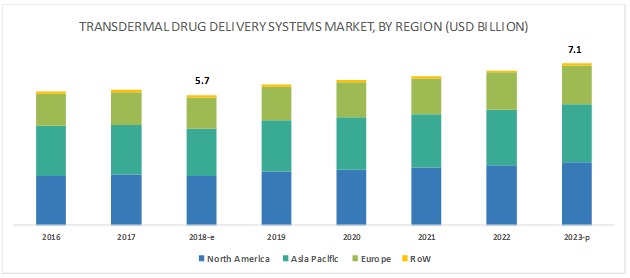

The transdermal drug delivery system market is projected to reach USD 7.1 billion by 2023, at a CAGR of 4.5%. The growth of this market is primarily driven by factors such as the increase in the prevalence of chronic diseases and technological advancements in transdermal drug delivery systems.

By application, the pain management segment is estimated to hold the largest share of the transdermal drug delivery systems market

Based on applications, the market is segmented into five categories pain management, central nervous system disorders, hormonal applications, cardiovascular diseases, and other applications (smoking cessation, motion sickness, and overactive bladder treatment). In 2018, the pain management segment is expected to account for the largest share of the transdermal drug delivery systems market. The large share of this segment can be attributed to the high burden of chronic pain worldwide and the growing availability of transdermal products for pain management.

Transdermal patches to dominate the transdermal drug delivery systems market during the forecast period

On the basis of type, the transdermal drug delivery systems market is segmented into transdermal patches and transdermal semisolids. On the contrary, the transdermal patches segment is also expected to grow at a higher rate during the forecast period. This can be attributed to the benefits offered by transdermal patches such as reduced dosing frequency, improved bioavailability, reduced adverse events, and drug input termination at any point by the removal of the patch.

Home care settings segment is expected to grow at the fastest rate during the forecast period

On the basis of end users, the transdermal drug delivery systems market is segmented into home care settings and hospitals & clinics. The home care settings segment is expected to grow at a higher CAGR during the forecast period. The high growth in this segment can be attributed to the increase in self-administration of medication at home, rapid growth in the geriatric population across the globe, and the growing need for cost-effective drug administration.

North America is expected to hold the largest market share during the forecast period

North America is one of the major revenue generating regions in the transdermal drug delivery systems market. The transdermal drug delivery systems market in the region is driven by the rising prevalence of targeted diseases (such as chronic pain, central nervous system disorders, and cardiovascular diseases) in the region, the increasing use of contraceptives, and the increasing number of research activities related to transdermal drug delivery systems.

Key Market Players

The key players in the transdermal drug delivery systems market are Hisamitsu Pharmaceutical (Japan), Mylan (US), UCB (Belgium), Novartis (Switzerland), and GlaxoSmithKline (UK). Boehringer Ingelheim (Germany), Johnson & Johnson (US), Endo International (Ireland), and Purdue Pharma (US).

Hisamitsu is a leading company in the field of drugs for external use. The company is a pioneer in the field of transdermal patches. The company markets its transdermal products in North America, Europe, Central & South America, Asia & Oceania, and the Middle East & Africa. The firm has constantly focused on research and development to enhance its transdermal products and launch them in the market. For instance, in 2017, the firm spent over USD 14.0 million compared to USD 12.8 million in 2016 on R&D activities.

Mylan is among the leading players in the transdermal drug delivery systems market. The company strives to design, develop, and manufacture high-quality, innovative transdermal drug delivery systems, such as adhesive patches. These medicines treat a variety of conditions across several therapeutic categories. In order to strengthen its position in the market, the company significantly invests in R&D activities. In 2017, the company invested USD 783.3 million in R&D activities to innovate and launch new products in the market as compared to USD 826.8 million in 2016. The company generates its revenue primarily from the sale of oral solid dosages, injectables, transdermal patches, gels, creams, ointments, and unit dose offerings.

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2016-2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018-2023 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Component, Product, End User, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies covered |

Hisamitsu Pharmaceutical (Japan), Mylan (US), UCB (Belgium), Novartis (Switzerland), GlaxoSmithKline (UK), Boehringer Ingelheim (Germany), Johnson & Johnson (US), Endo International (Ireland), and Purdue Pharma (US). |

This research report categorizes the transdermal drug delivery systems market based on applications, type, end user, and region.

On the basis of applications, the transdermal drug delivery systems market has been segmented as follows:

- Pain Management

- Hormonal Applications

- Central Nervous System Disorders

- Cardiovascular Diseases

-

Other Applications

- Diabetes

- Smoking Cessation

- Motion Sickness

- Overactive Bladder

On the basis of type, the transdermal drug delivery systems market has been segmented as follows:

- Transdermal Patches

- Transdermal Semisolids

On the basis of end users, the transdermal drug delivery systems market has been segmented as follows:

- Home Care Settings

- Hospitals & Clinics

On the basis of region, the transdermal drug delivery systems market has been segmented as follows:

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Rest of Europe (RoE)

- Asia Pacific

- Rest of the World

Recent Developments

- In January 2018, Hisamitsu Pharmaceutical (Japan) launched ALLESAGA TAPE in the Japanese market.

- In July 2018, UCB (Belgium) received the Import Drug License (IDL) for its transdermal rotigotine patch—NEUPRO from the China Food and Drug Administration (CFDA).

- In August 2018, Luye Pharma (China) signed an agreement with Bayer AG (Switzerland) to acquire the global rights to the Apleek contraceptive transdermal patch

Key Questions addressed by the report

- Which are the key players in the market and how intense is the competition?

- Emerging countries have immense opportunities for the growth of transdermal drug delivery systems market, will this scenario continue?

- Which product market will dominate in future?

- What does the future look like for transdermal drug delivery systems?

- What are the challenges hindering the adoption of transdermal drug delivery systems?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Market Data Validation and Triangulation

2.3 Assumptions for the Study

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 32)

4.1 Transdermal Drug Delivery Systems Market Overview

4.2 Transdermal Drug Delivery Systems Market, By Type, 2018

4.3 Transdermal Drug Delivery Systems Market, By Type, 2018

4.4 Transdermal Drug Delivery Systems Market: Geographic Snapshot

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Prevalence of Chronic Diseases

5.2.1.2 Technological Advancements in Transdermal Drug Delivery Systems

5.2.2 Restraints

5.2.2.1 Drug Failure and Recalls of Transdermal Drug Delivery Systems

5.2.3 Opportunities

5.2.3.1 Collaborations Between Pharmaceutical Companies and Drug Delivery Firms

5.2.3.2 Self-Administration and Home Care Drug Delivery Systems

5.2.4 Challenges

5.2.4.1 Technical Barriers Related to Skin Irritation and Permeability

6 Transdermal Drug Delivery Systems Market, By Type (Page No. - 40)

6.1 Introduction

6.2 Transdermal Patches

6.2.1 Drug-In-Adhesive Patches

6.2.2 Matrix Patches

6.2.3 Reservoir Membrane Patches

6.2.4 Microneedle Patches

6.3 Transdermal Semisolids

6.3.1 Gels

6.3.2 Ointments

6.3.3 Sprays

7 Transdermal Drug Delivery Systems Market, By Application (Page No. - 47)

7.1 Introduction

7.2 Pain Management

7.2.1 Pain Management to Account for the Largest Share of the Transdermal Drug Delivery Systems Market

7.3 Hormonal Applications

7.3.1 Testosterone Replacement Therapy

7.3.1.1 Skin Irritation, Poor Absorption of Drugs, High Costs, and the Need for Frequent Dosing are Factors Limiting Market Growth

7.3.2 Transdermal Estrogen Therapy

7.3.2.1 Growing Use of Transdermal Contraceptive Patches is Likely to Drive the Market for Transdermal Estrogen Therapy

7.4 Central Nervous System Disorders

7.4.1 Increasing Incidence of Parkinson’s and Alzheimer’s Disease to Drive the Market for Central Nervous System Disorders

7.5 Cardiovascular Diseases

7.5.1 Availability of Alternative and Advanced Drug Delivery Options to Limit Market Growth

7.6 Other Applications

7.6.1 Increasing Demand for Advanced Transdermal Microneedle Patches for Diabetes Management—A Key Market Driver

8 Transdermal Drug Delivery Systems Market, By End User (Page No. - 59)

8.1 Introduction

8.2 Home Care Settings

8.3 Hospitals & Clinics

9 Transdermal Drug Delivery Systems Market, By Region (Page No. - 64)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.1.1 Rising Prevalence of Targeted Disease and Development of Technologically Advanced Transdermal Drug Delivery Systems—Key Factors Driving Market Growth

9.2.2 Canada

9.2.2.1 Rising Prevalence of Chronic Diseases and Funding for the Development of Transdermal Drug Delivery Systems to Drive Market Growth

9.3 Europe

9.3.1 Germany

9.3.1.1 Growing Focus of Pharmaceutical Companies in Germany on the Development of Transdermal Products to Drive Market Growth

9.3.2 UK

9.3.2.1 Increasing Funding for the R&D of Innovative Transdermal Technologies to Drive Market Growth

9.3.3 France

9.3.3.1 Development of Transdermal Drug Delivery Systems By Local Players to Support Market Growth

9.3.4 RoE

9.4 Asia Pacific

9.4.1 Japan

9.4.1.1 Increasing Number of Product Approvals and Growing Focus of Local Players on R&D of Transdermal Systems to Support Market Growth

9.4.2 China

9.4.2.1 Growing Focus of Major Players in China Towards the Development of Transdermal Drug Delivery Systems to Drive Market Growth

9.4.3 India

9.4.3.1 Growing Awareness Among Healthcare Providers and Patients and Increasing Focus on Noninvasive Methods of Drug Delivery to Drive Market Growth

9.4.4 Ropac

9.5 RoW

10 Competitive Landscape (Page No. - 99)

10.1 Overview

10.2 Market Share Analysis

10.3 Market Share Analysis, By Application

10.3.1 Pain Management

10.3.2 Hormonal Applications

10.3.3 Central Nervous System Disorders

10.3.4 Cardiovascular Diseases

10.4 Competitive Scenario

10.4.1 Product Launches and Approvals

10.4.2 Expansions

10.4.3 Agreements and Collaborations

10.4.4 Acquisitions

11 Company Profiles (Page No. - 105)

(Business Overview, Products Offered, Recent Developments, MnM View)*

11.1 Hisamitsu Pharmaceutical Co., Inc.

11.2 Mylan N.V.

11.3 UCB S.A.

11.4 Novartis AG

11.5 Glaxosmithkline PLC

11.6 Boehringer Ingelheim International GmbH

11.7 Johnson & Johnson (J&J)

11.8 Endo International, Inc.

11.9 Purdue Pharma L.P.

11.10 Lavipharm

11.11 Lead Chemicals Co., Inc.

11.12 Luye Pharma Group

*Details on Business Overview, Products Offered, Recent Developments, MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 127)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

List of Tables (71 Tables)

Table 1 Comparison Between Transdermal Patches and Transdermal Semisolid Formulations

Table 2 Transdermal Drug Delivery Systems Market, By Type, 2016–2023 (USD Million)

Table 3 Transdermal Patches Market, By Type, 2016–2023 (USD Million)

Table 4 Transdermal Patches Market, By Country, 2016–2023 (USD Million)

Table 5 Transdermal Semisolids Market, By Country, 2016–2023 (USD Million)

Table 6 Transdermal Drug Delivery Systems Market, By Application, 2016–2023 (USD Million)

Table 7 Transdermal Drug Delivery Systems Available for Pain Management

Table 8 Transdermal Drug Delivery Systems Market for Pain Management, By Country, 2016–2023 (USD Million)

Table 9 Market for Hormonal Applications, By Country, 2016–2023 (USD Million)

Table 10 Market for Hormonal Applications, By Type, 2016–2023 (USD Million)

Table 11 Transdermal Drug Delivery Systems Available for Testosterone Replacement Therapy

Table 12 Transdermal Drug Delivery Systems Available for Transdermal Estrogen Therapy

Table 13 Transdermal Drug Delivery Systems Available for Central Nervous System Disorders

Table 14 Market for Central Nervous System Disorders, By Country, 2016–2023 (USD Million)

Table 15 Transdermal Drug Delivery Systems Available for Cardiovascular Diseases

Table 16 Market for Cardiovascular Diseases, By Country, 2016–2023 (USD Million)

Table 17 Transdermal Drug Delivery Systems Available for Other Applications

Table 18 Market for Other Applications, By Country, 2016–2023 (USD Million)

Table 19 Market, By End User, 2016–2023 (USD Million)

Table 20 Market for Home Care Settings, By Country, 2016–2023 (USD Million)

Table 21 Transdermal Drug Delivery Systems Market for Hospitals & Clinics, By Country, 2016–2023 (USD Million)

Table 22 Market, By Region, 2016–2023 (USD Million)

Table 23 North America: Transdermal Drug Delivery Systems Market, By Country, 2016–2023 (USD Million)

Table 24 North America: Market, By Application, 2016–2023 (USD Million)

Table 25 North America: Market, By Type, 2016–2023 (USD Million)

Table 26 North America: Market, By End User, 2016–2023 (USD Million)

Table 27 US: Transdermal Drug Delivery Systems Market, By Application, 2016–2023 (USD Million)

Table 28 US: Market, By Type, 2016–2023 (USD Million)

Table 29 US: Market, By End User, 2016–2023 (USD Million)

Table 30 Canada: Transdermal Drug Delivery Systems Market, By Application, 2016–2023 (USD Million)

Table 31 Canada: Market, By Type, 2016–2023 (USD Million)

Table 32 Canada: Market, By End User, 2016–2023 (USD Million)

Table 33 Developments in the Field of Tdds in Europe, 2015–2018

Table 34 Europe: Transdermal Drug Delivery Systems Market, By Country, 2016–2023 (USD Million)

Table 35 Europe: Market, By Application, 2016–2023 (USD Million)

Table 36 Europe: Market, By Type, 2016–2023 (USD Million)

Table 37 Europe: Market, By End User, 2016–2023 (USD Million)

Table 38 Germany: Transdermal Drug Delivery Systems Market, By Application, 2016–2023 (USD Million)

Table 39 Germany: Market, By Type, 2016–2023 (USD Million)

Table 40 Germany: Market, By End User, 2016–2023 (USD Million)

Table 41 UK: Transdermal Drug Delivery Systems Market, By Application, 2016–2023 (USD Million)

Table 42 UK: Market, By Type, 2016–2023 (USD Million)

Table 43 UK: Market, By End User, 2016–2023 (USD Million)

Table 44 France: Transdermal Drug Delivery Systems Market, By Application, 2016–2023 (USD Million)

Table 45 France: Market, By Type, 2016–2023 (USD Million)

Table 46 France: Market, By End User, 2016–2023 (USD Million)

Table 47 RoE: Transdermal Drug Delivery Systems Market, By Application, 2016–2023 (USD Million)

Table 48 RoE: Market, By Type, 2016–2023 (USD Million)

Table 49 RoE: Market, By End User, 2016–2023 (USD Million)

Table 50 Asia Pacific: Transdermal Drug Delivery Systems Market, By Country, 2016–2023 (USD Million)

Table 51 Asia Pacific: Market, By Application, 2016–2023 (USD Million)

Table 52 Asia Pacific: Market, By Type, 2016–2023 (USD Million)

Table 53 Asia Pacific: Market, By End User, 2016–2023 (USD Million)

Table 54 Japan: Transdermal Drug Delivery Systems Market, By Application, 2016–2023 (USD Million)

Table 55 Japan: Market, By Type, 2016–2023 (USD Million)

Table 56 Japan: Market, By End User, 2016–2023 (USD Million)

Table 57 China: Transdermal Drug Delivery Systems Market, By Application, 2016–2023 (USD Million)

Table 58 China: Market, By Type, 2016–2023 (USD Million)

Table 59 China: Market, By End User, 2016–2023 (USD Million)

Table 60 India: Transdermal Drug Delivery Systems Market, By Application, 2016–2023 (USD Million)

Table 61 India: Market, By Type, 2016–2023 (USD Million)

Table 62 India: Market, By End User, 2016–2023 (USD Million)

Table 63 RoAPAC: Market, By Application, 2016–2023 (USD Million)

Table 64 RoAPAC: Market, By Type, 2016–2023 (USD Million)

Table 65 RoAPAC: Market, By End User, 2016–2023 (USD Million)

Table 66 RoW: Market, By Application, 2016–2023 (USD Million)

Table 67 RoW: Market, By Type, 2016–2023 (USD Million)

Table 68 RoW: Market, By End User, 2016–2023 (USD Million)

Table 69 Product Launches and Approvals

Table 70 Expansions

Table 71 Agreements and Collaborations

List of Figures (35 Figures)

Figure 1 Transdermal Drug Delivery Systems Market Segmentation

Figure 2 Transdermal Drug Delivery Systems Market: Research Methodology

Figure 3 Research Design

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Data Triangulation Methodology

Figure 8 Transdermal Drug Delivery Systems Market, By Type, 2018

Figure 9 Transdermal Drug Delivery Systems Market, By Application, 2018

Figure 10 Transdermal Drug Delivery Systems Market, By End User, 2018

Figure 11 Geographic Snapshot: Transdermal Drug Delivery Systems Market

Figure 12 Increase in the Prevalence of Chronic Diseases and Technological Advancements are Key Factors Driving the Growth of the Market

Figure 13 Transdermal Patches to Dominate the Transdermal Drug Delivery Systems in North American Market During the Forecast Period

Figure 14 Transdermal Patches to Dominate the Transdermal Drug Delivery Systems in North European Market During the Forecast Period

Figure 15 Japan is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 16 Market: Drivers, Restraints, Opportunities, & Challenges

Figure 17 Market, By Type, 2018 vs 2023 (USD Million)

Figure 18 Market, By Application, 2018 vs 2023 (USD Million)

Figure 19 Market, By End User, 2018 vs 2023 (USD Million)

Figure 20 Market, By Region, 2018 vs 2023

Figure 21 North America: Market Snapshot

Figure 22 Europe: Market Snapshot

Figure 23 Asia Pacific: Market Snapshot

Figure 24 RoW: Market Snapshot

Figure 25 Key Developments in the Transdermal Drug Delivery Systems Market (2015–2018)

Figure 26 Market Share Analysis By Key Players (2015–2018)

Figure 27 Hisamitsu Pharmaceutical: Company Snapshot (2017)

Figure 28 Mylan: Company Snapshot (2017)

Figure 29 UCB: Company Snapshot (2017)

Figure 30 Novartis: Company Snapshot (2017)

Figure 31 GSK: Company Snapshot (2017)

Figure 32 Boehringer Ingelheim: Company Snapshot (2017)

Figure 33 Johnson & Johnson: Company Snapshot (2017)

Figure 34 Endo International: Company Snapshot (2017)

Figure 35 Luye Pharma: Company Snapshot (2017)

The study involved four major activities to estimate the current market size for transdermal drug delivery systems. Exhaustive secondary research was done to collect information about the market, peer markets, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chain through primary research. Thirdly, both top-down and bottom-up approaches were employed to estimate the complete market size. Finally, the market breakdown and data triangulation was used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as the International Association for the Study of Pain (IASP), International Parkinson and Movement Disorder Society, World Parkinson Congress, International Planned Parenthood Federation (IPPF), International Society of Endocrinology, International Diabetes Federation, International Council of Cardiovascular Prevention and Rehabilitation (ICCPR), European Pain Federation (EFIC), European Society of Contraception and Reproductive Health (ESC), European Society of Cardiology, European Parkinson's Disease Association (EPDA), European Association for the Study of Diabetes (EASD), Asia Pacific Council on Contraception (APCOC), Asian Pacific Society of Cardiology, ASEAN Federation of Endocrine Societies, Guttmacher Institute, National Institutes of Health (NIH), Centers for Disease Control and Prevention (CDC), United Nations Department of Economic and Social Affairs, directories, industry journals, databases, press releases, and annual reports of the companies have been used to identify and collect information useful for the study of this market.

Primary Research

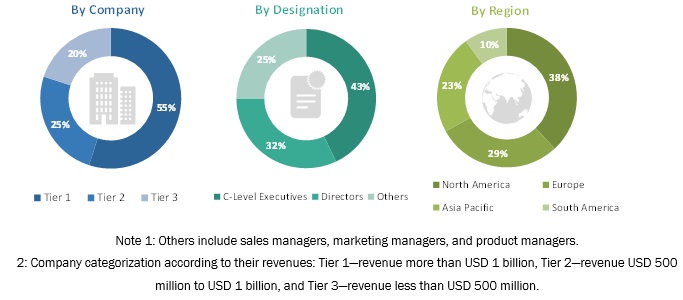

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the transdermal drug delivery systems market. The primary sources from the demand side include personnel from research organizations, academic institutes, and purchase managers.

- A robust primary research methodology has been adopted to validate the contents of the report

- Both telephonic and e-mail interviews of primary participants were conducted through questionnaires

Following the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to validate the size of the transdermal drug delivery systems market and estimate the size of other dependent submarkets. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both, the demand and supply sides.

Report Objectives

- To define, measure, and describe the transdermal drug delivery systems market by applications, type, end user, and region

- To provide detailed information about the major factors influencing market growth (drivers, restraints, challenges, and opportunities)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of market segments in North America, Europe, Asia Pacific, and RoW

- To strategically analyze the market structure and profile key players in the transdermal drug delivery systems market and comprehensively analyze their core competencies

- To track and analyze company developments such as product launches and enhancements; acquisitions; expansions; and agreements, partnerships, & collaborations in the transdermal drug delivery systems market

Available customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 3)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Transdermal Drug Delivery System Market