RNA Analysis Market by Product (Reagents, Instruments, Software, Services), Technology (PCR, Sequencing, Microarrays, RNA Interference), Application (Drug Discovery, Clinical Diagnostics), End User (Pharma, Biotech, CROs), Region - Global Forecast to 2028

Market Growth Outlook Summary

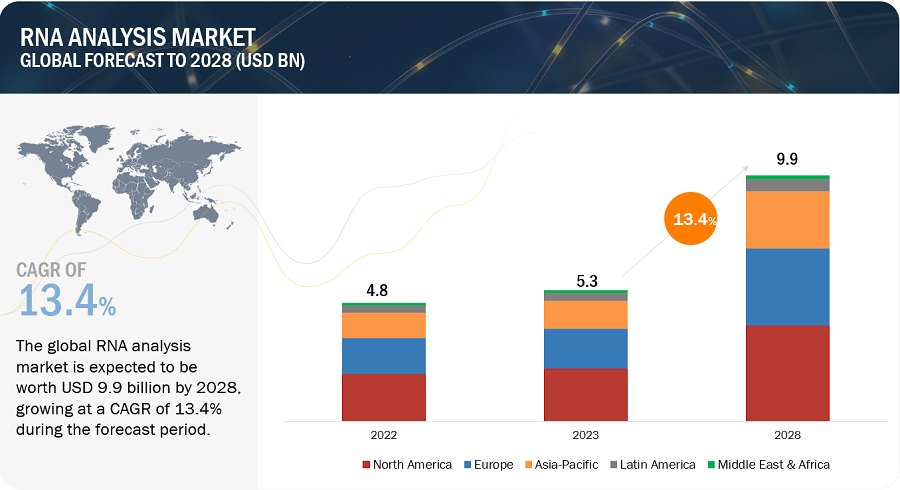

The global RNA analysis market, valued at US$4.8 billion in 2022, stood at US$5.3 billion in 2023 and is projected to advance at a resilient CAGR of 13.4% from 2023 to 2028, culminating in a forecasted valuation of US$9.9 billion by the end of the period. Various elements such as increasing R&D activities, increasing government funding for drug discovery research, and growing pharmaceutical & biological industries are the major growth factors for this market. Many peptide-based research projects are also being fostered by increasing collaborative partnerships among various companies that are driving market growth.

Attractive Opportunities in the RNA analysis Market

To know about the assumptions considered for the study, Request for Free Sample Report

RNA Analysis Market Dynamics

DRIVER: Growing demand for personalized medicine

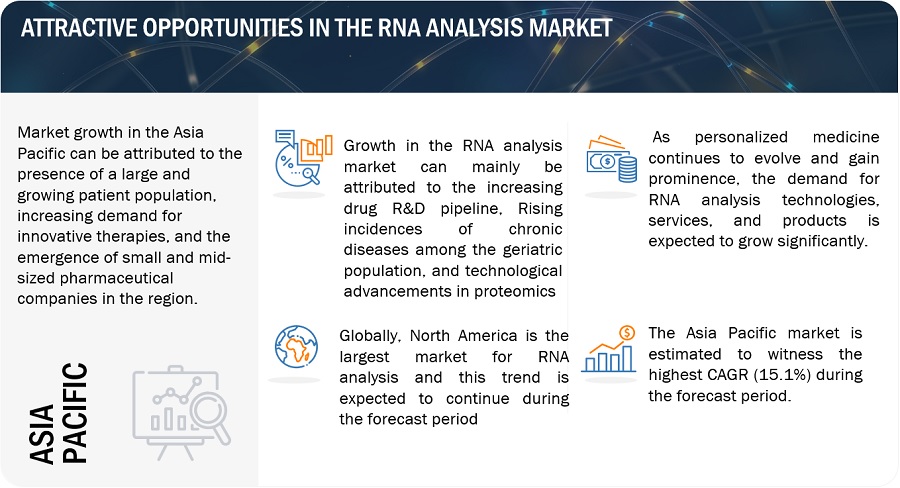

With the growing prominence of personalized medicine, there is an increased demand for rapid, highly sensitive, and quantitative methods to analyze proteins and related post-translational modifications in clinical specimens. In addition, as gene variants predict a patient’s likely response to a certain medication, researchers are increasingly focusing on identifying and studying various proteins, modifications, genetic variants, and their relevance to different diseases. Advances in omics technologies have made important contributions to the development of personalized medicine by facilitating the detection of protein biomarkers, proteomics-based molecular diagnostics, as well as pharmacoproteomics.

RESTRAINT: High capital investments

Advancements in various instruments have led to higher prices than previous-generation instruments due to their expensive development process. For instance, in 2022, an Illumina HiSeq X Ten sequencing instrument cost USD 1 million. In 2021, the cost of the same instrument was USD 750,000. Companies rely on accessible structural data and trial-and-error methods to determine the compounds that either stimulate or disable targets. All processes need a large number of laboratory hours, thus increasing the per-sample testing cost. Such high prices of instruments and reagents make it difficult for developing countries to venture into the field of transcriptomics. The high costs involved have led to the lower-than-expected adoption of transcriptomic technologies across the globe.

OPPORTUNITY: Opportunities in Emerging Countries

The focus on omics research has increased in developing countries like China, Brazil, Australia, and India. In these countries, proteomics research is mainly focused on mapping the human proteome and determining the mechanism of action of drugs. The establishment of the Proteomics Society, India (PSI) has provided proteomic scientists and researchers in the country with significant opportunities to form research collaborations and conduct workshops on proteomics. Similarly, increasing competition in mature markets also compels manufacturers to focus on emerging markets to ensure stable revenue growth in the coming years. Thus, although transcriptomics research is concentrated in the US and other developed countries across Europe, over the last decade, developing countries across the world have emerged as growth avenues for life sciences, including transcriptomics research.

CHALLENGE: Data management in transcriptomics research

Transcriptomics is a rapidly expanding field, aided by instrumentation accuracy and sensitivity, size, and affordability improvements. This offers many possibilities for personalized and precision medicine, which could improve diagnosis, treatment, and disease management in the coming years. However, with the increase in transcriptome and subsequent genomic analysis, there is an inevitable increase in the volume of data generated. These are just a few of the complexities involved in the data management of transcriptomics. Also, the lack of competent databases for data storage, comparing transcriptomic data, and the in-depth analysis of experimental results are further inhibiting the growth of this market.

RNA Analysis Market Ecosystem

The Reagents/Consumables segment dominated RNA analysis industry in 2022

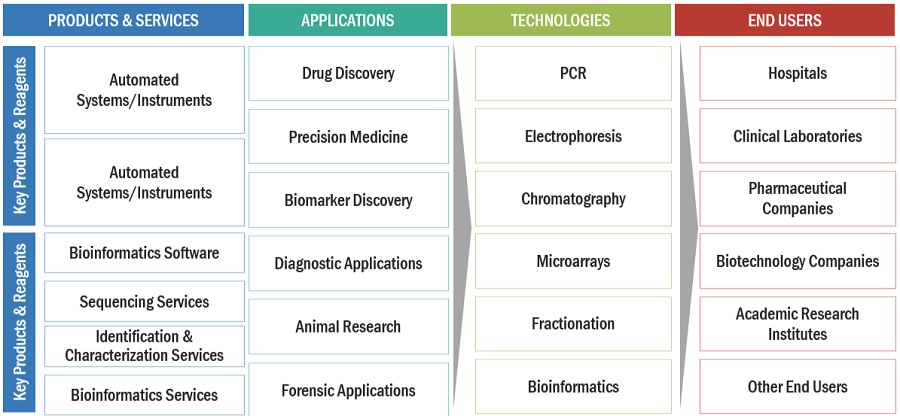

Based on product & service, the RNA analysis market is segmented into reagent/consumables, instruments, software, and services. In 2022, the reagents/consumables segment accounted for the largest share of the market. The large share of this segment can be attributed to the growth of RNA analysis reagents is fueled by the increase in demand of genome based studies, technological advancements; and the availability of various RNA analysis reagents in the market.

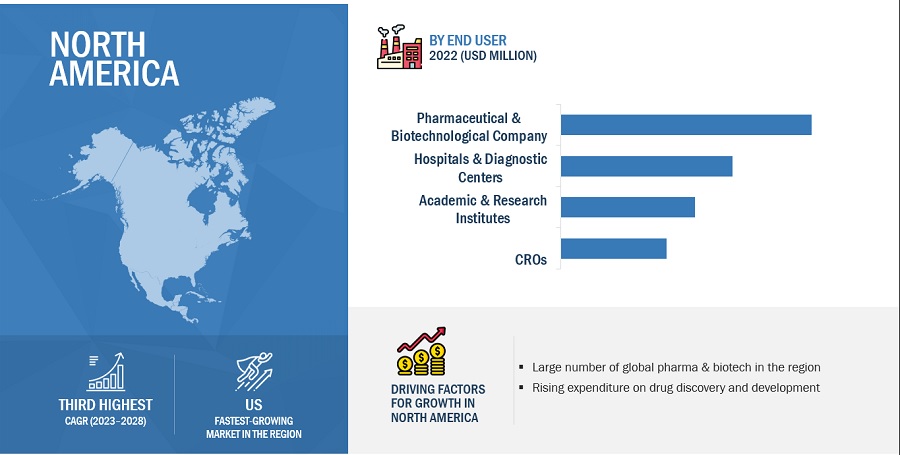

North America dominated the RNA analysis industry in 2022.

To know about the assumptions considered for the study, download the pdf brochure

Geographically, the RNA analysis market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. In 2022, North America accounted for the largest share of the market, followed by Europe and the Asia Pacific. The large share of the North American market is owing to various factors such presence of a large number of pharmaceutical companies and the growing demand for personalized medicines. Increased funding for protein-based research is furthermore driving market growth in North America.

Key players in the RNA analysis market are Thermo Fisher Scientific, Inc. (US), F. Hoffmann-La Roche Ltd. (Switzerland), Bio-Rad Laboratories, Inc. (US), Illumina, Inc. (US), Eurofins Scientific (Luxembourg)

Scope of the RNA Analysis Industry

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$5.3 billion |

|

Projected Revenue by 2028 |

$9.9 billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 13.4% |

|

Market Driver |

Growing demand for personalized medicine |

|

Market Opportunity |

Opportunities in Emerging Countries |

This report categorizes the RNA analysis market to forecast revenue and analyze trends in each of the following submarkets:

By Product & Service

- Reagents/Consumables

- Instrument

- Software

- Services

By Technology

- Polymerase Chain Reaction (PCR)

- Microarrays

- Sequencing

- RNA Interference

By Application

- Drug Discovery

- Clinical Diagnostics

- Toxicogenomics

- Comparative Transcriptomics

By End User

- Pharmaceutical & Biotechnology Company

- Hospitals & Diagnostic Centers

- Academic & Research Institutes

- CROs

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Switzerland

- Rest of Europe (RoE)

-

Asia Pacific (APAC)

- China

- Japan

- India

- Rest of Asia Pacific (RoAPAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Recent Developments by RNA Analysis Industry

- In October 2022, Agilent Technologies and CMP Scientific Corp. entered into a co-marketing agreement to provide an integrated capillary electrophoresis-mass spectrometry (CE-MS) solution for the life science and pharmaceutical industries.

- In March 2022, Eurofins acquired Beacon Discovery, a drug discovery-based CRO. Beacon supported the fully integrated drug discovery programs from target validation to pre-clinical candidates.

- In January 2021, Thermo Fisher acquired Phitonex to provide greater flow cytometry and imaging multiplexing capabilities for protein and cell analysis research needs. Phitonex’s product offerings are also an expansion of the company’s existing protein and cell analysis portfolio.

Frequently Asked Questions (FAQ):

What is the expected growth rate of the global RNA analysis market from 2023 to 2028?

The global RNA analysis market is projected to grow from USD 5.3 billion in 2023 to USD 9.9 billion by 2028, demonstrating a robust CAGR of 13.4%.

What factors are driving the growth of the RNA analysis market?

The major drivers include the growing demand for personalized medicine, increased R&D activities, government funding for drug discovery, and the expanding pharmaceutical and biotechnology industries.

What challenges does the RNA analysis market face?

The main challenges include the high cost of advanced instruments, the complexity of data management, and the limited availability of efficient databases to store and compare transcriptomic data.

What opportunities exist for the RNA analysis market in emerging countries?

Emerging countries like China, India, and Brazil present significant opportunities due to increasing government support for proteomics and transcriptomics research, as well as a growing focus on personalized medicine and drug discovery.

Which segment held the largest share of the RNA analysis market in 2022?

The reagents/consumables segment accounted for the largest share of the RNA analysis market in 2022, driven by the increasing demand for genome-based studies and advancements in RNA analysis reagents.

What role does North America play in the RNA analysis market?

North America held the largest share of the RNA analysis market in 2022 due to the presence of numerous pharmaceutical companies, increased funding for protein research, and growing demand for personalized medicine in the region.

What are the recent developments in the RNA analysis market?

Recent developments include Agilent Technologies' co-marketing agreement with CMP Scientific Corp. for a CE-MS solution and Eurofins' acquisition of Beacon Discovery to enhance drug discovery programs.

How does the growing demand for personalized medicine influence the RNA analysis market?

The growing demand for personalized medicine is a major driver of the RNA analysis market, as it increases the need for precise and rapid methods to analyze gene variants and related biomarkers for disease diagnosis and treatment.

What are the key applications of RNA analysis technologies?

RNA analysis technologies are widely applied in drug discovery, clinical diagnostics, toxicogenomics, and comparative transcriptomics, providing crucial insights into gene expression and disease mechanisms.

How is technology advancing in the RNA analysis market?

Technological advancements in sequencing, microarrays, and RNA interference are significantly enhancing the accuracy, speed, and cost-efficiency of RNA analysis, contributing to market growth and innovation.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing demand for personalized medicine- Rising pharmaceutical and biotechnology R&D expenditure and government funding- Increasing applications of RNA sequencing in transcriptomicsRESTRAINTS- High capital investmentsOPPORTUNITIES- High growth opportunities in emerging markets- Increasing applications in toxicogenomics- Increasing focus on biomarker discovery- Rising focus on outsourcingCHALLENGES- Data management in transcriptomics research- Lack of effective bioinformatics tools- Dearth of skilled professionals

-

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 SUPPLY CHAIN ANALYSIS

-

5.6 ECOSYSTEM ANALYSIS

-

5.7 PATENT ANALYSIS

- 5.8 LIST OF MAJOR PATENTS

- 5.9 TECHNOLOGY ANALYSIS

-

5.10 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSCOMPETITIVE RIVALRY AMONG EXISTING PLAYERS

-

5.11 REGULATORY ANALYSISREGULATIONS FOR RNA ANALYSIS PRODUCTSREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12 KEY CONFERENCES AND EVENTS IN 2023

-

5.13 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.1 INTRODUCTION

-

6.2 REAGENTS/CONSUMABLESREAGENTS/CONSUMABLES TO DOMINATE MARKET DURING FORECAST PERIOD

-

6.3 INSTRUMENTSGROWING NEED FOR ACCURATE ANALYSIS TO DRIVE ADOPTION OF AUTOMATED INSTRUMENTS

-

6.4 SOFTWAREGROWING NEED FOR DATA MANAGEMENT AND QUALITY ENHANCEMENTS TO DRIVE DEMAND FOR SOFTWARE SOLUTIONS

-

6.5 SERVICESINCREASING OUTSOURCING OF SERVICES TO PROPEL MARKET GROWTH

- 7.1 INTRODUCTION

-

7.2 POLYMERASE CHAIN REACTIONABILITY OF REAL-TIME PCR TO AID IN QUANTIFICATION OF LOW-COPY TRANSCRIPTS TO BOOST DEMAND

-

7.3 SEQUENCINGADVANCES IN NGS MULTIPLEXING CAPABILITIES TO AID MARKET GROWTH

-

7.4 MICROARRAYSWIDE ADOPTION OF MICROARRAYS IN CLINICAL DIAGNOSTICS TO SUPPORT MARKET GROWTH

-

7.5 RNA INTERFERENCETECHNOLOGICAL ADVANCEMENTS TO SUPPORT ADOPTION OF TECHNIQUE FOR DIAGNOSTICS AND THERAPEUTICS

- 8.1 INTRODUCTION

-

8.2 DRUG DISCOVERYGROWING POPULARITY OF TARGETED SEQUENCING-BASED APPROACHES IN DRUG DISCOVERY TO BOOST MARKET

-

8.3 CLINICAL DIAGNOSTICSGROWING ADOPTION OF TRANSCRIPTOMICS FOR LARGE-SCALE GENE EXPRESSION PROFILING OF ONCOLOGICAL DISORDERS TO FUEL GROWTH

-

8.4 TOXICOGENOMICSGROWING FOCUS ON ADR STUDIES TO DRIVE ADOPTION OF TRANSCRIPTOMICS FOR SYSTEMIC TOXICOLOGY

-

8.5 COMPARATIVE TRANSCRIPTOMICSWIDE ADOPTION OF TRANSCRIPTIONAL PROFILES TO STUDY EVOLUTION AMONG SPECIES TO PROPEL GROWTH

- 9.1 INTRODUCTION

-

9.2 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIESINCREASING INVESTMENTS FOR ONCOLOGY THERAPEUTICS TO DRIVE USE OF OMICS TECHNOLOGIES IN PHARMA & BIOTECH COMPANIES

-

9.3 HOSPITALS & DIAGNOSTIC CENTERSUSE OF WHOLE-BLOOD TRANSCRIPTOME PROFILES FOR DISEASE DIAGNOSTICS TO FAVOR MARKET GROWTH

-

9.4 ACADEMIC & RESEARCH INSTITUTESGROWING GOVERNMENT INVESTMENTS TO PROPEL MARKET GROWTH

-

9.5 CONTRACT RESEARCH ORGANIZATIONSGROWING OUTSOURCING OF SERVICES BY PHARMACEUTICAL COMPANIES FOR FASTER DRUG DISCOVERY TO AID MARKET GROWTH

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICAUS- US to dominate North American RNA analysis market during forecast periodCANADA- Improving funding and infrastructure for omics-based research to support market growthNORTH AMERICA: RECESSION IMPACT

-

10.3 EUROPEGERMANY- Germany to hold largest share of European RNA analysis market during forecast periodUK- Rising public and private funding for research to drive market growthFRANCE- Increasing government support for omics-based research to support market growthITALY- Improving R&D expenditure and disease diagnostics to boost marketSPAIN- Increasing collaborations for enhancing research to support market growthSWITZERLAND- Well-established pharmaceutical industry to drive market growthREST OF EUROPE

- 10.4 EUROPE: RECESSION IMPACT

-

10.5 ASIA PACIFICCHINA- China to be fastest-growing market in Asia Pacific during forecast periodJAPAN- Early adoption of technologically advanced products to drive market growthINDIA- Increasing pharmaceutical R&D spending and government funding for research to drive market growthREST OF ASIA PACIFIC

- 10.6 ASIA PACIFIC: RECESSION IMPACT

-

10.7 LATIN AMERICAGROWTH IN PHARMACEUTICAL INDUSTRY IN MEXICO TO SUPPORT MARKET GROWTH

- 10.8 LATIN AMERICA: RECESSION IMPACT

-

10.9 MIDDLE EAST & AFRICAIMPROVING FOCUS ON PRECISION MEDICINE AND DISEASE GENETICS TO DRIVE MARKET GROWTH

- 10.10 MIDDLE EAST & AFRICA: RECESSION IMPACT

- 11.1 INTRODUCTION

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.3 REVENUE SHARE ANALYSIS

- 11.4 MARKET SHARE ANALYSIS

-

11.5 COMPANY EVALUATION QUADRANT: KEY PLAYERSSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.6 COMPETITIVE BENCHMARKING OF TOP 25 PLAYERSCOMPANY PRODUCT FOOTPRINT OF COMPANIES (25 COMPANIES)REGIONAL FOOTPRINT OF COMPANIES (25 COMPANIES)

-

11.7 COMPANY EVALUATION QUADRANT: STARTUPS/SMESPROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIES

- 11.8 COMPETITIVE BENCHMARKING OF STARTUP/SME PLAYERS

-

11.9 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

-

12.1 KEY PLAYERSTHERMO FISHER SCIENTIFIC INC.- Business overview- Products & services offered- Recent developments- MnM viewF. HOFFMANN-LA ROCHE LTD.- Business overview- Products & services offered- Recent developments- MnM viewBIO-RAD LABORATORIES, INC.- Business overview- Products & services offered- Recent developments- MnM viewILLUMINA, INC.- Business overview- Products & services offered- Recent developmentsEUROFINS SCIENTIFIC- Business overview- Products & services offered- Recent developmentsAGILENT TECHNOLOGIES, INC.- Business overview- Products & services offeredCD GENOMICS- Business overview- Products & services offered- Recent developmentsPROMEGA CORPORATION- Business overview- Products & services offeredQIAGEN N.V.- Business overview- Products & services offered- Recent developmentsDANAHER CORPORATION- Business overview- Products & services offered- Recent developmentsMERCK KGAA- Business overview- Products & services offered- Recent developmentsSTANDARD BIOTOOLS INC. (FLUIDIGM CORPORATION)- Business overview- Products & services offeredSEQUENTIA BIOTECH SL- Business overview- Products & services offeredACOBIOM- Business overview- Products & services offeredGENXPRO GMBH- Business overview- Products & services offered

-

12.2 OTHER PLAYERSLEXOGEN GMBHCENIX BIOSCIENCE GMBHTAKARA HOLDINGS INC.BIOMÉRIEUX SALC SCIENCES LLCOXFORD NANOPORE TECHNOLOGIESZYMO RESEARCH CORPORATIONGENEDXPARTEK INCORPORATEDBGI GROUP

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 GLOBAL INFLATION RATE PROJECTIONS, 2024–2028 (% GROWTH)

- TABLE 2 US HEALTH EXPENDITURE, 2019–2022 (USD MILLION)

- TABLE 3 US HEALTH EXPENDITURE, 2023–2027 (USD MILLION)

- TABLE 4 RNA ANALYSIS MARKET: IMPACT ANALYSIS

- TABLE 5 SUPPLY CHAIN ECOSYSTEM

- TABLE 6 COMPARISON OF MODERN RNA ANALYSIS METHODS

- TABLE 7 RNA ANALYSIS MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 8 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 RNA ANALYSIS MARKET: DETAILED LIST OF CONFERENCES AND EVENTS IN 2023

- TABLE 12 RNA ANALYSIS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 13 RNA ANALYSIS REAGENTS/CONSUMABLES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 14 NORTH AMERICA: RNA ANALYSIS REAGENTS/CONSUMABLES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 15 EUROPE: RNA ANALYSIS REAGENTS/CONSUMABLES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 16 ASIA PACIFIC: RNA ANALYSIS REAGENTS/CONSUMABLES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 17 RNA ANALYSIS INSTRUMENTS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 18 NORTH AMERICA: RNA ANALYSIS INSTRUMENTS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 19 EUROPE: RNA ANALYSIS INSTRUMENTS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 20 ASIA PACIFIC: RNA ANALYSIS INSTRUMENTS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 21 RNA ANALYSIS SOFTWARE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 22 NORTH AMERICA: RNA ANALYSIS SOFTWARE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 23 EUROPE: RNA ANALYSIS SOFTWARE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 24 ASIA PACIFIC: RNA ANALYSIS SOFTWARE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 25 RNA ANALYSIS SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 26 NORTH AMERICA: RNA ANALYSIS SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 27 EUROPE: RNA ANALYSIS SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 28 ASIA PACIFIC: RNA ANALYSIS SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 29 RNA ANALYSIS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 30 RNA ANALYSIS MARKET FOR PCR TECHNOLOGY, BY REGION, 2021–2028 (USD MILLION)

- TABLE 31 NORTH AMERICA: RNA ANALYSIS MARKET FOR PCR TECHNOLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 32 EUROPE: RNA ANALYSIS MARKET FOR PCR TECHNOLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 33 ASIA PACIFIC: RNA ANALYSIS MARKET FOR PCR TECHNOLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 34 RNA ANALYSIS MARKET FOR SEQUENCING TECHNOLOGY, BY REGION, 2021–2028 (USD MILLION)

- TABLE 35 NORTH AMERICA: RNA ANALYSIS MARKET FOR SEQUENCING TECHNOLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 36 EUROPE: RNA ANALYSIS MARKET FOR SEQUENCING TECHNOLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 37 ASIA PACIFIC: RNA ANALYSIS MARKET FOR SEQUENCING TECHNOLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 38 RNA ANALYSIS MARKET FOR MICROARRAY TECHNOLOGY, BY REGION, 2021–2028 (USD MILLION)

- TABLE 39 NORTH AMERICA: RNA ANALYSIS MARKET FOR MICROARRAY TECHNOLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 40 EUROPE: RNA ANALYSIS MARKET FOR MICROARRAY TECHNOLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 41 ASIA PACIFIC: RNA ANALYSIS MARKET FOR MICROARRAY TECHNOLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 42 RNA ANALYSIS MARKET FOR RNA INTERFERENCE TECHNOLOGY, BY REGION, 2021–2028 (USD MILLION)

- TABLE 43 NORTH AMERICA: RNA ANALYSIS MARKET FOR RNA INTERFERENCE TECHNOLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 44 EUROPE: RNA ANALYSIS MARKET FOR RNA INTERFERENCE TECHNOLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 45 ASIA PACIFIC: RNA ANALYSIS MARKET FOR RNA INTERFERENCE TECHNOLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 46 RNA ANALYSIS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 47 RNA ANALYSIS MARKET FOR DRUG DISCOVERY, BY REGION, 2021–2028 (USD MILLION)

- TABLE 48 NORTH AMERICA: RNA ANALYSIS MARKET FOR DRUG DISCOVERY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 49 EUROPE: RNA ANALYSIS MARKET FOR DRUG DISCOVERY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 50 ASIA PACIFIC: RNA ANALYSIS MARKET FOR DRUG DISCOVERY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 51 RNA ANALYSIS MARKET FOR CLINICAL DIAGNOSTICS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 52 NORTH AMERICA: RNA ANALYSIS MARKET FOR CLINICAL DIAGNOSTICS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 53 EUROPE: RNA ANALYSIS MARKET FOR CLINICAL DIAGNOSTICS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 54 ASIA PACIFIC: RNA ANALYSIS MARKET FOR CLINICAL DIAGNOSTICS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 55 RNA ANALYSIS MARKET FOR TOXICOGENOMICS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 56 NORTH AMERICA: RNA ANALYSIS MARKET FOR TOXICOGENOMICS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 57 EUROPE: RNA ANALYSIS MARKET FOR TOXICOGENOMICS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 58 ASIA PACIFIC: RNA ANALYSIS MARKET FOR TOXICOGENOMICS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 59 RNA ANALYSIS MARKET FOR COMPARATIVE TRANSCRIPTOMICS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 60 NORTH AMERICA: RNA ANALYSIS MARKET FOR COMPARATIVE TRANSCRIPTOMICS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 61 EUROPE: RNA ANALYSIS MARKET FOR COMPARATIVE TRANSCRIPTOMICS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 62 ASIA PACIFIC: RNA ANALYSIS MARKET FOR COMPARATIVE TRANSCRIPTOMICS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 63 RNA ANALYSIS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 64 RNA ANALYSIS MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 65 NORTH AMERICA: RNA ANALYSIS MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 66 EUROPE: RNA ANALYSIS MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 67 ASIA PACIFIC: RNA ANALYSIS MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 68 RNA ANALYSIS MARKET FOR HOSPITALS & DIAGNOSTIC CENTERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 69 NORTH AMERICA: RNA ANALYSIS MARKET FOR HOSPITALS & DIAGNOSTIC CENTERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 70 EUROPE: RNA ANALYSIS MARKET FOR HOSPITALS & DIAGNOSTIC CENTERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 71 ASIA PACIFIC: RNA ANALYSIS MARKET FOR HOSPITALS & DIAGNOSTIC CENTERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 72 RNA ANALYSIS MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 73 NORTH AMERICA: RNA ANALYSIS MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 74 EUROPE: RNA ANALYSIS MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 75 ASIA PACIFIC: RNA ANALYSIS MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 76 RNA ANALYSIS MARKET FOR CONTRACT RESEARCH ORGANIZATIONS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 77 NORTH AMERICA: RNA ANALYSIS MARKET FOR CONTRACT RESEARCH ORGANIZATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 78 EUROPE: RNA ANALYSIS MARKET FOR CONTRACT RESEARCH ORGANIZATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 79 ASIA PACIFIC: RNA ANALYSIS MARKET FOR CONTRACT RESEARCH ORGANIZATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 80 RNA ANALYSIS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 81 NORTH AMERICA: RNA ANALYSIS MARKET, BY COUNTRY, 2021–2028(USD MILLION)

- TABLE 82 NORTH AMERICA: RNA ANALYSIS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 83 NORTH AMERICA: RNA ANALYSIS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 84 NORTH AMERICA: RNA ANALYSIS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 85 NORTH AMERICA: RNA ANALYSIS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 86 US: RNA ANALYSIS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 87 US: RNA ANALYSIS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 88 US: RNA ANALYSIS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 89 US: RNA ANALYSIS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 90 CANADA: RNA ANALYSIS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 91 CANADA: RNA ANALYSIS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 92 CANADA: RNA ANALYSIS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 93 CANADA: RNA ANALYSIS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 94 EUROPE: RNA ANALYSIS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 95 EUROPE: RNA ANALYSIS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 96 EUROPE: RNA ANALYSIS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 97 EUROPE: RNA ANALYSIS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 98 EUROPE: RNA ANALYSIS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 99 GERMANY: RNA ANALYSIS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 100 GERMANY: RNA ANALYSIS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 101 GERMANY: RNA ANALYSIS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 102 GERMANY: RNA ANALYSIS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 103 UK: RNA ANALYSIS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 104 UK: RNA ANALYSIS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 105 UK: RNA ANALYSIS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 106 UK: RNA ANALYSIS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 107 FRANCE: RNA ANALYSIS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 108 FRANCE: RNA ANALYSIS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 109 FRANCE: RNA ANALYSIS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 110 FRANCE: RNA ANALYSIS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 111 ITALY: RNA ANALYSIS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 112 ITALY: RNA ANALYSIS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 113 ITALY: RNA ANALYSIS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 114 ITALY: RNA ANALYSIS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 115 SPAIN: RNA ANALYSIS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 116 SPAIN: RNA ANALYSIS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 117 SPAIN: RNA ANALYSIS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 118 SPAIN: RNA ANALYSIS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 119 SWITZERLAND: RNA ANALYSIS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 120 SWITZERLAND: RNA ANALYSIS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 121 SWITZERLAND: RNA ANALYSIS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 122 SWITZERLAND: RNA ANALYSIS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 123 REST OF EUROPE: RNA ANALYSIS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 124 REST OF EUROPE: RNA ANALYSIS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 125 REST OF EUROPE: RNA ANALYSIS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 126 REST OF EUROPE: RNA ANALYSIS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 127 ASIA PACIFIC: RNA ANALYSIS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 128 ASIA PACIFIC: RNA ANALYSIS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 129 ASIA PACIFIC: RNA ANALYSIS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 130 ASIA PACIFIC: RNA ANALYSIS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 131 ASIA PACIFIC: RNA ANALYSIS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 132 CHINA: RNA ANALYSIS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 133 CHINA: RNA ANALYSIS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 134 CHINA: RNA ANALYSIS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 135 CHINA: RNA ANALYSIS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 136 JAPAN: RNA ANALYSIS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 137 JAPAN: RNA ANALYSIS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 138 JAPAN: RNA ANALYSIS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 139 JAPAN: RNA ANALYSIS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 140 INDIA: RNA ANALYSIS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 141 INDIA: RNA ANALYSIS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 142 INDIA: RNA ANALYSIS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 143 INDIA: RNA ANALYSIS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 144 REST OF ASIA PACIFIC: RNA ANALYSIS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 145 REST OF ASIA PACIFIC: RNA ANALYSIS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 146 REST OF ASIA PACIFIC: RNA ANALYSIS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 147 REST OF ASIA PACIFIC: RNA ANALYSIS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 148 LATIN AMERICA: RNA ANALYSIS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 149 LATIN AMERICA: RNA ANALYSIS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 150 LATIN AMERICA: RNA ANALYSIS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 151 LATIN AMERICA: RNA ANALYSIS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 152 MIDDLE EAST & AFRICA: RNA ANALYSIS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 153 MIDDLE EAST & AFRICA: RNA ANALYSIS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 154 MIDDLE EAST & AFRICA: RNA ANALYSIS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 155 MIDDLE EAST & AFRICA: RNA ANALYSIS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 156 RNA ANALYSIS MARKET: DEGREE OF COMPETITION

- TABLE 157 COMPANY PRODUCT FOOTPRINT ANALYSIS OF KEY PLAYERS IN RNA ANALYSIS MARKET

- TABLE 158 REGIONAL FOOTPRINT ANALYSIS OF KEY PLAYERS IN RNA ANALYSIS MARKET

- TABLE 159 RNA ANALYSIS MARKET: DETAILED LIST OF KEY STARTUP/SME PLAYERS

- TABLE 160 RNA ANALYSIS MARKET: COMPETITIVE BENCHMARKING OF STARTUP/SME PLAYERS

- TABLE 161 RNA ANALYSIS MARKET: PRODUCT & SERVICE LAUNCHES, JANUARY 2020–JUNE 2023

- TABLE 162 RNA ANALYSIS MARKET: DEALS, JANUARY 2020–JUNE 2023

- TABLE 163 RNA ANALYSIS MARKET: OTHER DEVELOPMENTS, JANUARY 2020–JUNE 2023

- TABLE 164 THERMO FISHER SCIENTIFIC INC.: BUSINESS OVERVIEW

- TABLE 165 F. HOFFMANN-LA ROCHE LTD.: BUSINESS OVERVIEW

- TABLE 166 BIO-RAD LABORATORIES, INC.: COMPANY OVERVIEW

- TABLE 167 ILLUMINA, INC.: COMPANY OVERVIEW

- TABLE 168 EUROFINS SCIENTIFIC: COMPANY OVERVIEW

- TABLE 169 AGILENT TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 170 CD GENOMICS: COMPANY OVERVIEW

- TABLE 171 PROMEGA CORPORATION: COMPANY OVERVIEW

- TABLE 172 QIAGEN N.V.: COMPANY OVERVIEW

- TABLE 173 DANAHER CORPORATION: COMPANY OVERVIEW

- TABLE 174 MERCK KGAA: BUSINESS OVERVIEW

- TABLE 175 STANDARD BIOTOOLS INC.: BUSINESS OVERVIEW

- TABLE 176 SEQUENTIA BIOTECH SL: BUSINESS OVERVIEW

- TABLE 177 ACOBIOM: BUSINESS OVERVIEW

- TABLE 178 GENXPRO GMBH: BUSINESS OVERVIEW

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 RNA ANALYSIS MARKET: BREAKDOWN OF PRIMARIES

- FIGURE 3 RNA ANALYSIS MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS (2022)

- FIGURE 4 MARKET SIZE ESTIMATION: APPROACH 1 (REVENUE SHARE ANALYSIS), 2022

- FIGURE 5 ILLUSTRATIVE EXAMPLE OF THERMO FISHER SCIENTIFIC, INC.: REVENUE SHARE ANALYSIS, 2022

- FIGURE 6 MARKET VALIDATION FROM PRIMARY EXPERTS

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 8 RNA ANALYSIS MARKET: CAGR PROJECTIONS, 2023–2028

- FIGURE 9 RNA ANALYSIS MARKET: GROWTH ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 10 DATA TRIANGULATION METHODOLOGY

- FIGURE 11 RNA ANALYSIS MARKET, BY PRODUCT & SERVICE, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 RNA ANALYSIS MARKET, BY TECHNOLOGY, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 RNA ANALYSIS MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 14 RNA ANALYSIS MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 15 GEOGRAPHICAL SNAPSHOT: RNA ANALYSIS MARKET

- FIGURE 16 RISING INVESTMENTS IN PHARMACEUTICAL R&D TO DRIVE MARKET GROWTH

- FIGURE 17 DRUG DISCOVERY APPLICATIONS ACCOUNTED FOR LARGEST SHARE OF NORTH AMERICAN RNA ANALYSIS MARKET IN 2022

- FIGURE 18 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 19 ASIA PACIFIC TO REGISTER HIGHEST GROWTH RATE IN RNA ANALYSIS MARKET FROM 2023 TO 2028

- FIGURE 20 NORTH AMERICA TO CONTINUE TO DOMINATE RNA ANALYSIS MARKET UNTIL 2028

- FIGURE 21 EMERGING ECONOMIES TO REGISTER HIGHER GROWTH RATES DURING FORECAST PERIOD

- FIGURE 22 MARKET DYNAMICS: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 23 PERSONALIZED MEDICINES APPROVED BY FDA, 2015–2022

- FIGURE 24 INCREASE IN GLOBAL PHARMACEUTICAL R&D SPENDING, 2012–2026

- FIGURE 25 VALUE CHAIN ANALYSIS OF RNA ANALYSIS MARKET: RESEARCH AND MANUFACTURING PHASES CONTRIBUTE MAXIMUM VALUE

- FIGURE 26 RNA ANALYSIS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 27 PATENT APPLICATIONS FOR RNA ANALYSIS MARKET, JUNE 2012–JUNE 2023

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF RNA ANALYSIS PRODUCTS

- FIGURE 29 KEY BUYING CRITERIA FOR END USERS

- FIGURE 30 NORTH AMERICA: RNA ANALYSIS MARKET SNAPSHOT

- FIGURE 31 ASIA PACIFIC: RNA ANALYSIS MARKET SNAPSHOT

- FIGURE 32 RNA ANALYSIS MARKET: STRATEGIES ADOPTED BY KEY PLAYERS

- FIGURE 33 REVENUE ANALYSIS OF KEY PLAYERS, 2020–2022

- FIGURE 34 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2022

- FIGURE 35 RNA ANALYSIS MARKET: COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2022

- FIGURE 36 RNA ANALYSIS MARKET: COMPANY EVALUATION MATRIX FOR STARTUPS/SMES, 2022

- FIGURE 37 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT (2022)

- FIGURE 38 F. HOFFMANN-LA ROCHE LTD.: COMPANY SNAPSHOT (2022)

- FIGURE 39 BIO-RAD LABORATORIES, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 40 ILLUMINA, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 41 EUROFINS SCIENTIFIC: COMPANY SNAPSHOT (2022)

- FIGURE 42 AGILENT TECHNOLOGIES, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 43 QIAGEN N.V.: COMPANY SNAPSHOT (2022)

- FIGURE 44 DANAHER CORPORATION: COMPANY SNAPSHOT (2022)

- FIGURE 45 MERCK KGAA: COMPANY SNAPSHOT (2022)

- FIGURE 46 STANDARD BIOTOOLS INC.: COMPANY SNAPSHOT (2022)

This study involved four major activities in estimating the current size of the RNA analysis market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. The top-down and other approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary research was used mainly to identify and collect information for the extensive, technical, market-oriented, and commercial study of the RNA analysis market. The secondary sources referred to for this research study include publications from government and private sources such as the Association of Biomolecular Resource Facilities, the Journal of the American Chemical Society, the Protein Science Society of Japan (PSSJ), the National Institutes of Health (NIH), World Health Organization (WHO), Analytical and Life Science Systems Association (ALSSA), Advanced Medical Technology Association (AdvaMed), American Association for Clinical Chemistry (AACC), American Public Health Association (APHA), European Diagnostic Manufacturers Association (EDMA), Biotechnology Innovation Organization (BIO), European Federation of Biotechnology (EFB), Journal of Biomedical Materials Research, Office for National Statistics (ONS), and Organisation for Economic Co-operation and Development (OECD), Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentations, Journals, Expert Interviews, MarketsandMarkets Analysis. Secondary data was collected and analyzed to arrive at the overall size of the global RNA analysis market, which was then validated by primary research.

Primary Research

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess future prospects of the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

A top-down approach was used to estimate and validate the total size of the RNA analysis market. This method was also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research

- The revenues generated from the RNA analysis business of leading players have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Global RNA analysis market size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the market size estimation process, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Transcriptomics is the study of the complete set of RNAs (transcriptomes) encoded by the genome of a specific cell or organism at a specific time or under a specific set of conditions. In the healthcare industry, transcriptomics technologies have applications in clinical diagnostics, drug discovery, and toxicogenomic research. The market study includes the assessment of various products & services, technology, application, and end users in RNA analysis.

Key Stakeholders

- Life sciences instrumentation and reagent companies

- Pharmaceutical and biotechnology companies

- Proteomics database and software providers

- RNA analysis service providers

- Research and consulting firms

- Academic medical centers

- Government research organizations

- Clinical research institutes

- Contract Research Organizations

Report Objectives

- To define, describe, and forecast the RNA analysis market by product & service, technology, application, end-user, and region

- To provide detailed information about the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micro markets with respect to the individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments in North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players and comprehensively analyze their market shares and core competencies in the global RNA analysis market

- To track and analyze competitive developments such as product & service launches, partnerships, collaborations, agreements, expansions, and acquisitions in the global RNA analysis market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Geographic Analysis

- Further Breakdown Of The Rest Of Europe Rna Analysis Market Into Respective Countries

- Further Breakdown Of The Rest Of Asia Pacific Rna Analysis Market Into Respective Countries

- Further Breakdown Of The Rest Of Latin America Rna Analysis Market Into Respective Countries

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

Company Information

- An additional five company profiles

Growth opportunities and latent adjacency in RNA Analysis Market