Traffic Sensor Market Size, Share, Statistics and Industry Growth Analysis Report by Type (Inductive Loop, Piezoelectric Sensor, Bending Plate, Image Sensor, Infrared Sensor, Radar Sensor, LiDAR Sensor, Magnetic Sensor, Acoustic Sensor, Thermal Sensor), Technology, Application, and Region - Global Forecast to 2026

Updated on : November 28, 2024

Traffic Sensor Market Size and Growth

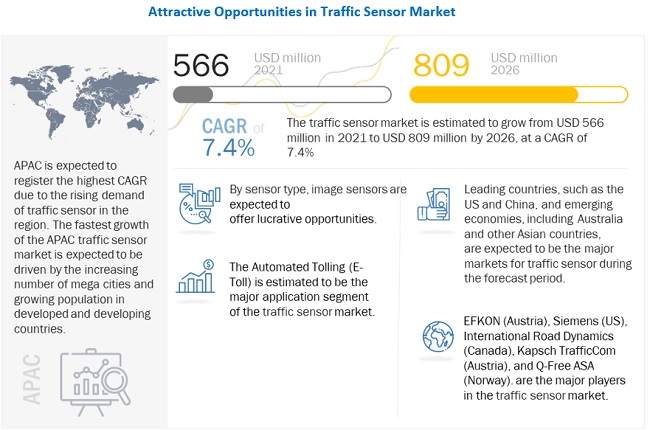

The Traffic Sensor Market Size is estimated to be valued at USD 566 million in 2021 and reach USD 809 million by 2026, at a CAGR of 7.4% between 2021 and 2026.

The growing need for real-time information system, and government initiative to upgrade transport infrastructure are the key factors driving the growth of the market. Likewise, Growth in cycling infrastructure leading to higher adoption of bicycle counting sensors in traffic sensor market are expected to create lucrative opportunities for the players in the traffic sensor industry. However, high cost and fulfilment of fundamental requirements for the installation of nonintrusive sensors are expected to restraint market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

Traffic Sensor Market Analysis:

The traffic sensors market is expected to grow significantly during the forecast period, driven by the increasing need for efficient traffic management and the growing adoption of intelligent transportation systems (ITS). Traffic sensors play a crucial role in monitoring and managing traffic flow, helping to reduce congestion, improve safety, and enhance the overall driving experience.

Traffic Sensor Market Trends:

- Increased Adoption of IoT Technology: The integration of IoT technology in traffic sensors enables real-time monitoring and data analysis, enhancing the effectiveness of traffic management systems.

- Growing Demand for Smart Traffic Management: The need for efficient traffic management is driving the adoption of smart traffic management systems, which rely heavily on traffic sensors to monitor and manage traffic flow.

- Rise of Autonomous Vehicles: The growing adoption of autonomous vehicles is expected to increase the demand for traffic sensors that can provide accurate and reliable data to support autonomous vehicle operations.

- Advancements in Sensor Technology: Advances in sensor technology, such as the development of radar and lidar sensors, are enabling more accurate and reliable traffic monitoring.

Traffic Sensor Market Dynamics:

Drivers : Rapid urbanization and increasing emphasis on road safety norms

The proportion of the urban population is increasing every day, causing traffic congestion. In 2000, only 46.72 percent of the world's population lived in cities; by 2007, more than half of the world's population (50.14 percent) lived in cities for the first time. Private and professional mobility presents significant challenges in urban areas. The increasing urbanization and population has been escalating the traffic density levels, making commuting tough for the common masses. Furthermore, as the urban population grows, so will the volume of business within cities and with business partners outside of cities. A higher urban population tends to increase the volume of transportation as business grows. For example, as cities' populations grow, so will traffic as businesses such as e-commerce, postal & logistics, and restaurant aggregator & food delivery companies expand their operations.

Restraints: High cost and fulfillment of fundamental requirements for the installation of nonintrusive sensors

The installation and maintenance of nonintrusive sensors, such as image sensors, microwave sensors, and acoustic sensors, do not have a major impact on road traffic and are associated with severe safety concerns. However, the effectiveness of such sensors depends on facing angles and mounted locations since the sensor requires large vertical and horizontal clearances. Infrared sensors need flat surfaces as roads with slopes and speed bumps may lead to errors. Furthermore, the cost of non-intrusive sensors is high compared to leading in road technologies such as inductive loops that provide detailed traffic flow data measurements. High costs impede widespread distribution and limit the application of non-intrusive sensors in gathering traffic information.

Traffic Sensor Market Segmentation:

Imaging sensor will have the highest growth in coming years

Image sensor is expected to account the largest share of the overall traffic sensor market by 2026. By image sensor the images are seen from the cameras located beside or upon the road. Moreover, the images seen from the camera located in the vehicle can be used for detection of the car behind it, measuring the distance of the following vehicle from it, detection of obstacle, and detection of lane. This traffic image sensor can be built into a traffic signal controller because of its compact size. Image sensor offers high sensitivity even in poor light conditions also, this image sensor possesses high speed imaging capabilities which offers better daytime imaging performance

2D segment is expected to hold the largest share in 2026

Despite the numerous benefits of 3D sensor technology for quality traffic monitoring applications, many traffic control authorities continue to rely solely on 2D sensor for quality control processes. While useful in a limited number of scenarios, 2D sensor is limited in its ability to achieve 100% quality control, which is considered a major concern, especially in case of multilane and heavy urban traffic congestions, where near to 100% quality control is a major preference. Due to these reasons, although the 2D sensor will continue to dominate the traffic sensor market.

Traffic Sensor Market - Regional Analysis:

APAC is attributed to grow at the highest CAGR in traffic sensor market during the forecast period (2021-2026)

The APAC is expected to grow at the highest CAGR in the overall traffic sensor market. The fastest growth of the APAC traffic sensor market is expected to be driven by the increasing number of mega cities and growing population in developed and developing countries.

To know about the assumptions considered for the study, download the pdf brochure

Top Traffic Sensor Companies - Key Market Players:

Traffic Sensor Companies was dominated by EFKON (Austria), Siemens (US), International Road Dynamics (Canada), Kapsch TrafficCom (Austria), and Q-Free ASA (Norway).

Traffic Sensors Industry News:

EFKON (Austria)

One of the major companies in the traffic sensor market, EFKON AG, is a subsidiary of STRABAG SE (Austria), which was founded in 1994 and is headquartered in Raaba, Austria. STRABAG SE is one of the leading construction companies in Europe. The company provides civil engineering, building and road construction, project development, tunneling, and other services. The company and its subsidiaries often work on motorways, schools, and power plants.

EFKON AG has a significant focus on all major electronic tolling technologies and also provides customized turnkey solutions. The company is also engaged in financing, design, construction, operation, and maintenance of toll plazas and provides training programs for various personnel, ranging from toll plaza operators to administration managers. In addition, the company provides system integration and consulting engineering services as well as support services for software and hardware systems

Traffic Sensor Market Report Scope:

|

Report Metric |

Details |

| Estimated Value | USD 566 Million in 2021 |

| Expected Value | USD 809 million by 2026 |

| Growth Rate | CAGR of 7.4% |

|

Market size available for years |

2018–2026 |

|

Base year |

2020 |

|

Forecast period |

2021–2026 |

|

Units |

Value USD Million |

|

Segments covered |

Sensor Type, Technology, Application, And Geography |

|

Geographic regions covered |

North America, APAC, Europe, and RoW |

|

Companies covered |

The companies covered in the traffic sensor market are EFKON AG (Austria) Kapsch TrafficCom AG (Austria), International Road Dynamics, Inc. (Canada), FLIR Systems, Inc. (US), TE Connectivity Ltd. (Switzerland), SWARCO AG (Austria), Sick AG (Germany), TransCore (US), Axis Communication AB (Sweden), Raytheon Company (US), Q-Free ASA (Norway), Kistler Group (Switzerland), and Siemens (Germany). |

This report categorizes the traffic sensor market based on By Sensor Type, By Technology, By Application, and by Region.

Based on Sensor Type, the Traffic Sensor Market been Segmented as follows:

- Piezoelectric Sensors

- Bending Plate Sensors

- Inductive Loop Sensors

- Magnetic Sensors

- Acoustic Sensors

- Infrared Sensors

- Image Sensors

- Radar Sensors

- Lidar Sensors

- Thermal Sensors

Based on Technology, the Traffic Sensor Market been Segmented as follows:

- 2D Sensor

- 3D Sensor

- RFID

- GSM

- Others

Based on Application, the Traffic Sensor Market been Segmented as follows:

- Vehicle Measurement and Profiling

- Weigh in Motion

- Traffic Monitoring

- Automated Tolling (E-Toll)

Based on Geographic Analysis, the Traffic Sensor Market been Segmented as follows:

- Introduction

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- France

- UK

- Russia

- Spain

- Italy

- Rest of Europe (RoE)

-

Asia Pacific (APAC)

- China

- Japan

- Australia

- Rest of APAC (RoAPAC)

-

Rest of the World (RoW)

- Middle East & Africa

- South America

Recent Developments

- In August 2020, an agreement between EFKON AG and Varanasi Smart City Limited (VSCL), where EFKON India will be solely responsible for helping Varanasi Smart City Limited (VSCL) with the design, development, implementation and maintenance of the implementation of advance surveillance system across Varanasi for a period of at least 5 years following Go-Live was signed.

Frequently Asked Questions (FAQ):

Which are the major applications in traffic sensor market?

The major industries in traffic sensor market include Vehicle Measurement and Profiling, Weigh in Motion, Traffic Monitoring, and Automated Tolling (E-Toll).

Which are the major companies in the traffic sensor market?

The Autonomous underwater vehicle (AUV) market was dominated by EFKON (Austria), Siemens (US), International Road Dynamics (Canada), Kapsch TrafficCom (Austria), and Q-Free ASA (Norway).

Which are the leading countries in the traffic sensor market?

APAC is expected to grow at the highest CAGR by 2026. Countries such China, Japan, and India are expected to be the major contributors to the market in APAC. Factors such as increased military spending, growing need for energy in emerging economies, and the rising adoption of AUVs in various application areas are driving the growth of the AUV market in APAC.

Which application is expected to witness significant demand for traffic sensor in the coming years?

The Automated Tolling (E-Toll) segment is projected to grow at the highest CAGR during the forecast period. The growth of this segment can be attributed because automated tolling is rapidly becoming the most popular way for commuters to pass through tolls on highways and expressways. It is now a necessity and a daily part their lives. The working of these systems is very fast, along with an efficient mode for the collection of toll charges at the toll plazas. This saves a lot of time since vehicles passing through the toll plaza need not stop to pay the toll, and the payment is made automatically from the account of the vehicle.

How will COVID-19 impact on the penetration of traffic sensor market?

The impact of COVID-19 on the traffic sensor market and on consumer demand is currently unclear. However, it is estimated that there would be a short-term reduction in the production of traffic sensor as the transportation industry, which is the largest consumer of traffic sensor, is facing a shortage in demand for traffic sensor. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 28)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 33)

2.1 RESEARCH DATA

FIGURE 2 TRAFFIC SENSOR MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Major secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews with experts

2.1.2.2 Key data from primary sources

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primaries

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.2 MARKET SIZE ESTIMATION

FIGURE 3 RESEARCH FLOW OF MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): REVENUE FROM SALES OF TRAFFIC SENSOR PRODUCTS AND SOLUTIONS

2.2.1.1 Approach for capturing market size by bottom-up analysis (demand side)

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 6 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 RISK ASSESSMENT

TABLE 1 RISK FACTOR ANALYSIS

2.6 FORECASTING ASSUMPTIONS

2.7 COMPETITIVE LEADERSHIP MAPPING METHODOLOGY

TABLE 2 EVALUATION CRITERIA

2.7.1 VENDOR INCLUSION CRITERIA

2.8 STUDY LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 47)

FIGURE 8 TRAFFIC SENSOR MARKET, BY SENSOR TYPE, 2021 VS. 2026

FIGURE 1 MARKET, BY APPLICATION, 2021 VS. 2026

FIGURE 2 APAC TO EXHIBIT HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

3.1 IMPACT ANALYSIS OF COVID-19 ON MARKET

FIGURE 3 MARKET SIZE IN PRE-COVID-19 AND POST-COVID-19 SCENARIOS

3.1.1 PRE-COVID-19 SCENARIO

3.1.2 POST-COVID-19 SCENARIO

4 PREMIUM INSIGHTS (Page No. - 51)

4.1 ATTRACTIVE OPPORTUNITIES IN TRAFFIC SENSOR MARKET

FIGURE 4 INCREASED FOCUS ON PROMOTING ROAD SAFETY AWARENESS WITH RAPID URBANIZATION AND GROWING POPULATION FUEL MARKET GROWTH

4.2 MARKET, BY TECHNOLOGY

FIGURE 5 2D TRAFFIC SENSOR TECHNOLOGY TO HOLD LARGEST MARKET SHARE IN 2021

4.3 MARKET IN NORTH AMERICA, BY SENSOR TYPE AND COUNTRY

FIGURE 6 IMAGE SENSORS AND US TO CAPTURE LARGEST SHARE OF NORTH AMERICAN MARKET IN 2021

4.4 MARKET, BY SENSOR TYPE

FIGURE 7 IMAGE SENSORS TO CAPTURE LARGEST SHARE OF MARKET DURING FORECAST PERIOD

4.5 MARKET, BY KEY COUNTRY

FIGURE 8 US TO HOLD LARGEST SHARE OF MARKET IN 2021

5 MARKET OVERVIEW (Page No. - 54)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 9 TRAFFIC SENSOR MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

FIGURE 10 IMPACT OF DRIVERS ON MARKET

5.2.1.1 Increased focus on promoting road safety awareness with rapid urbanization and growing population

FIGURE 11 INCREASE IN GLOBAL TRAFFIC CONGESTION LEVEL WITH GROWING URBAN POPULATION FROM 2015 TO 2020

5.2.1.2 Strong focus of governments worldwide on building extensive and efficient transport infrastructure

5.2.1.3 Increased investments in building smart cities

TABLE 3 TOP 15 SMART CITIES IN WORLD, 2020 VS. 2021

TABLE 4 SMART CITY INITIATIVES AND INVESTMENTS

5.2.1.4 Urgent need to deploy real-time information systems in transport infrastructure

5.2.2 RESTRAINTS

FIGURE 12 IMPACT OF RESTRAINTS ON MARKET

5.2.2.1 High installation cost and indispensable prerequisites of non-intrusive sensors

5.2.2.2 Deterioration of road pavements and traffic disruptions during installation and maintenance of traffic sensors

5.2.3 OPPORTUNITIES

FIGURE 13 IMPACT OF OPPORTUNITIES ON THE MARKET

5.2.3.1 Growing importance of cycling infrastructure leading to higher adoption of bicycle counting sensors

FIGURE 14 PATENTS FOR BICYCLE COUNTER SENSORS BETWEEN 2010 AND 2020

5.2.3.2 Increasing focus on integrating ITS with loT and AI technologies

5.2.3.3 Rising adoption of electric and autonomous vehicles as new modes of transportation

5.2.4 CHALLENGES

FIGURE 15 IMPACT OF CHALLENGES ON TRAFFIC SENSOR MARKET

5.2.4.1 High amount of noise in raw and unfiltered floating cellular data

5.2.4.2 Challenges associated with data fusion due to deployment of multiple sensors

5.3 VALUE CHAIN ANALYSIS

FIGURE 16 VALUE CHAIN ANALYSIS OF TRAFFIC SENSORS ECOSYSTEM: MANUFACTURING, ASSEMBLY, AND SYSTEM INTEGRATION PHASES CONTRIBUTE MOST VALUE

5.3.1 PLANNING AND REVISING FUNDS

5.3.2 RESEARCH AND DEVELOPMENT

5.3.3 MANUFACTURING AND ASSEMBLY & SYSTEM INTEGRATION

5.3.4 DISTRIBUTION AND AFTER-SALES SERVICES

5.4 ECOSYSTEM

FIGURE 17 TRAFFIC SENSORS ECOSYSTEM

TABLE 5 LIST OF COMPANIES AND THEIR ROLE IN TRAFFIC SENSORS ECOSYSTEM

5.5 TRENDS IMPACTING CUSTOMERS’ BUSINESS

FIGURE 18 REVENUE SHIFT IN MARKET

5.6 CASE STUDIES

5.6.1 EFKON IS WORKING WITH VARANASI SMART CITY LIMITED (INDIA) TO DEVELOP VARANASI SMART CITY INFORMATION AND COMMUNICATION TECHNOLOGY (ICT) SOLUTIONS

5.6.2 SMATS TRAFFIC SOLUTIONS (CANADA) OFFERS REAL-TIME QUEUE MONITORING AND SIGNAL TIMING SOLUTIONS FOR FLORIDA DEPARTMENT OF TRANSPORTATION (FDOT) BY UTILISING VEHICLE-TO-NETWORK (V2N) COMMUNICATION

5.6.3 AGD SYSTEMS (UK) OFFERS COMBINATION OF PEDESTRIAN DETECTOR SENSORS TO MANAGE TRAFFIC IN NEW SOUTH WALES, AUSTRALIA

5.6.4 SWARCO (AUSTRIA) COLLABORATED WITH ADG SYSTEMS (UK) TO DEVELOP ADVANCED WARNING SYSTEM FOR SAFETY OF CYCLISTS ON BEDFORDSHIRE'S COUNTRY LANES IN UK

5.6.5 KAPSCH TRAFFICCOM (AUSTRIA) UPGRADED TOLL COLLECTION EQUIPMENT ON MARYLAND ROADS IN US

5.7 PORTER’S FIVE FORCES ANALYSIS

FIGURE 19 PORTER’S FIVE FORCES ANALYSIS

TABLE 6 TRAFFIC SENSOR MARKET: PORTER’S FIVE FORCES ANALYSIS

5.7.1 THREAT OF NEW ENTRANTS

5.7.2 THREAT OF SUBSTITUTES

5.7.3 BARGAINING POWER OF BUYERS

5.7.4 BARGAINING POWER OF SUPPLIERS

5.7.5 INTENSITY OF COMPETITIVE RIVALRY

5.8 TECHNOLOGY TRENDS

5.8.1 KEY TECHNOLOGY

5.8.1.1 Advent of vehicle-to-everything (V2X) technology owing to its benefits and features

TABLE 7 V2X COMMUNICATION TECHNOLOGY

5.8.1.2 Rapid development of smart imaging sensors and powerful image processors

FIGURE 20 PATENTS FOR TRAFFIC IMAGE SENSORS BETWEEN 2010 AND 2020

5.8.2 COMPLEMENTARY TECHNOLOGY

5.8.2.1 Growing advancement in AI, IoT, and big data analytics

5.8.2.2 Edge computing and advent of 5G technology

5.9 TRADE ANALYSIS

5.9.1 IMPORT SCENARIO

5.9.1.1 Import scenario for market

TABLE 8 ELECTRIC SIGNAL, SAFETY & TRAFFIC CONTROLLER PARTS (INCLUDING TRAFFIC SENSORS) IMPORTS, BY KEY COUNTRY, 2011–2020 (USD MILLION)

FIGURE 21 IMPORT DATA FOR ELECTRIC SIGNAL, SAFETY & TRAFFIC CONTROLLER PARTS (INCLUDING TRAFFIC SENSORS) IN MARKET FOR TOP FIVE COUNTRIES, 2016–2020 (USD MILLION)

5.9.2 EXPORT SCENARIO

5.9.2.1 Export scenario for market

TABLE 9 ELECTRIC SIGNAL, SAFETY & TRAFFIC CONTROLLER PARTS (INCLUDING TRAFFIC SENSORS) EXPORTS, BY KEY COUNTRY, 2011–2020 (USD MILLION)

FIGURE 22 EXPORT DATA FOR ELECTRIC SIGNAL, SAFETY & TRAFFIC CONTROLLER PARTS (INCLUDING TRAFFIC SENSORS) IN MARKET FOR TOP FIVE COUNTRIES, 2016–2020 (USD MILLION)

5.10 PATENT ANALYSIS

TABLE 10 TOP 10 PATENT OWNERS IN LAST 10 YEARS (2011–2020)

TABLE 11 PATENTS FILED FOR VARIOUS TYPES OF TRAFFIC SENSORS, 2020

FIGURE 23 TRAFFIC SENSOR PATENTS GRANTED BETWEEN 2011 AND 2020

FIGURE 24 TOP 10 COMPANIES WITH LARGEST NUMBER OF PATENT APPLICATIONS, 2011–2020

5.11 TARIFFS AND REGULATIONS

5.11.1 TARIFFS

TABLE 12 WORLD IMPORT TARIFFS FOR ELECTRIC SIGNAL, SAFETY & TRAFFIC CONTROLLER PARTS (SIMPLE AVERAGE) VIEW DATA SAVE IMAGE SHARE, BY KEY COUNTRY

5.11.1.1 Positive impact of tariffs on traffic sensors ecosystem

5.11.1.2 Negative impact of tariffs on traffic sensors ecosystem

5.11.2 REGULATIONS AND STANDARDS

FIGURE 25 VARIOUS STANDARDS FOR TRAFFIC SENSORS

5.11.2.1 ISO standards

5.11.2.1.1 ISO 17386:2010

5.11.2.1.2 ISO/TS 15624:2001

5.11.2.1.3 ISO/IEC 30128:2014

5.11.2.1.4 ISO 15638-21:2018

5.11.2.2 Federal Communications Commission (FCC) Regulations

5.11.2.3 Regulations for different regions

TABLE 13 REGULATIONS FOR DIFFERENT REGIONS

5.12 AVERAGE SELLING PRICE

TABLE 14 AVERAGE SELLING PRICE OF TRAFFIC SENSOR, BY TYPE (USD)

FIGURE 26 ASP TREND FOR TRAFFIC SENSORS BETWEEN 2018 AND 2026

FIGURE 27 ASP TREND FOR BENDING PLATE SENSORS FROM 2018 TO 2026

6 TRAFFIC SENSOR MARKET, BY SENSOR TYPE (Page No. - 98)

6.1 INTRODUCTION

FIGURE 28 MARKET, BY SENSOR TYPE

TABLE 15 MARKET, BY SENSOR TYPE, 2018–2020 (MILLION UNITS)

TABLE 16 MARKET, BY SENSOR TYPE, 2021–2026 (MILLION UNITS)

FIGURE 29 IMAGE SENSORS TO HOLD LARGEST SIZE OF MARKET IN 2026

TABLE 17 MARKET, BY SENSOR TYPE, 2018–2020 (USD MILLION)

TABLE 18 MARKET, BY SENSOR TYPE, 2021–2026 (USD MILLION)

6.2 PIEZOELECTRIC SENSORS

6.2.1 PIEZOELECTRIC SENSORS ARE USED FOR MEASURING GENERATED ELECTRIC CHARGE OR ANY MECHANICAL DEFORMATION

FIGURE 30 PIEZOELECTRIC MARKET, BY SENSOR TYPE

TABLE 19 MARKET FOR PIEZOELECTRIC SENSORS, BY REGION, 2018–2020 (USD MILLION)

TABLE 20 MARKET FOR PIEZOELECTRIC SENSORS, BY REGION, 2021–2026 (USD MILLION)

TABLE 21 MARKET FOR PIEZOELECTRIC SENSORS, BY TYPE, 2018–2020 (USD MILLION)

TABLE 22 MARKET FOR PIEZOELECTRIC SENSORS, BY TYPE, 2021–2026 (USD MILLION)

6.2.2 CERAMIC

6.2.2.1 Ceramic piezoelectric sensors offer fast response and highly accurate operation resonance in real time

6.2.3 QUARTZ

6.2.3.1 Quartz piezoelectric sensors are used to minimize effort needed to install sensors across highways

6.3 BENDING PLATE SENSORS

6.3.1 BENDING PLATE SENSORS ARE WIDELY USED IN WIM APPLICATIONS

TABLE 23 MARKET FOR BENDING PLATE SENSORS, BY REGION, 2018–2020 (USD MILLION)

TABLE 24 MARKET FOR BENDING PLATE SENSORS, BY REGION, 2021–2026 (USD MILLION)

6.4 INDUCTIVE LOOP SENSORS

6.4.1 INDUCTIVE LOOP SENSORS ARE USED TO DETECT AND COUNT NUMBER OF VEHICLES

TABLE 25 MARKET FOR INDUCTIVE LOOP SENSORS, BY REGION, 2018–2020 (USD MILLION)

TABLE 26 MARKET FOR INDUCTIVE LOOP SENSORS, BY REGION, 2021–2026 (USD MILLION)

6.5 MAGNETIC SENSORS

6.5.1 MAGNETIC SENSORS CAN BE USED AS CONTACTLESS DETECTION SENSORS

FIGURE 31 GLOBAL MARKET SIZE FOR AUTOMOTIVE MAGNETIC SENSORS, 2017 VS. 2030

TABLE 27 MARKET FOR MAGNETIC SENSORS, BY REGION, 2018–2020 (USD MILLION)

TABLE 28 MARKET FOR MAGNETIC SENSORS, BY REGION, 2021–2026 (USD MILLION)

6.6 ACOUSTIC SENSORS

6.6.1 ACOUSTIC SENSORS ARE HELPFUL IN MEASURING SOUND LEVELS

TABLE 29 MARKET FOR ACOUSTIC SENSORS, BY REGION, 2018–2020 (USD MILLION)

TABLE 30 MARKET FOR ACOUSTIC SENSORS, BY REGION, 2021–2026 (USD MILLION)

6.7 INFRARED SENSORS

6.7.1 INFRARED SENSORS ARE USEFUL IN IDENTIFYING VEHICLES AND ESTIMATING THEIR SPEED

TABLE 31 MARKET FOR INFRARED SENSORS, BY REGION, 2018–2020 (USD MILLION)

TABLE 32 MARKET FOR INFRARED SENSORS, BY REGION, 2021–2026 (USD MILLION)

6.8 IMAGE SENSORS

6.8.1 IMAGE SENSORS ARE USED TO DETECT PARKED AND MOVING VEHICLES

TABLE 33 MARKET FOR IMAGE SENSORS, BY REGION, 2018–2020 (USD MILLION)

TABLE 34 MARKET FOR IMAGE SENSORS, BY REGION, 2021–2026 (USD MILLION)

6.9 RADAR SENSORS

6.9.1 RADAR SENSORS ARE USED TO FIND VELOCITY AND ACCURATE POSITION OF DISTANT OBJECTS

TABLE 35 MARKET FOR RADAR SENSORS, BY REGION, 2018–2020 (USD MILLION)

TABLE 36 MARKET FOR RADAR SENSORS, BY REGION, 2021–2026 (USD MILLION)

6.10 LIDAR SENSORS

6.10.1 LIDAR SENSORS ARE UTILIZED TO ACHIEVE REAL-TIME INFORMATION ABOUT VEHICLE COUNT, TYPE, POSITION, DIRECTION, AND SPEED

TABLE 37 MARKET FOR LIDAR SENSORS, BY REGION, 2018–2020 (USD MILLION)

TABLE 38 MARKET FOR LIDAR SENSORS, BY REGION, 2021–2026 (USD MILLION)

6.11 THERMAL SENSORS

6.11.1 THERMAL SENSORS ARE USED WHEN THERE IS LACK OF LIGHT TO CAPTURE VEHICLE IMAGES

TABLE 39 MARKET FOR THERMAL SENSORS, BY REGION, 2018–2020 (USD MILLION)

TABLE 40 MARKET FOR THERMAL SENSORS, BY REGION, 2021–2026 (USD MILLION)

7 TRAFFIC SENSOR MARKET, BY TECHNOLOGY (Page No. - 116)

7.1 INTRODUCTION

FIGURE 32 3D SENSOR TECHNOLOGY TO EXHIBIT HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

TABLE 41 MARKET, BY TECHNOLOGY, 2018–2020 (USD MILLION)

TABLE 42 MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

7.2 2D SENSOR

7.2.1 PROMINENT PRESENCE OF VENDORS, SMALL FORM FACTOR, AND LOW INVESTMENT PROPEL MARKET GROWTH FOR 2D SENSORS

7.3 3D SENSOR

7.3.1 3D SENSORS CAN CAPTURE REAL-TIME DATA FOR EASY IDENTIFICATION OF VEHICLES, DATA ACQUISITION, POINT CLOUD CLASSIFICATION, AND 3D VISUALIZATION

7.4 GLOBAL SYSTEM FOR MOBILE COMMUNICATION (GSM)

7.4.1 GSM TECHNOLOGY MANAGES TRAFFIC BY COLLECTING LOCATION DATA, SPEED, DIRECTION OF TRAVEL, AND TIME INFORMATION FROM MOBILE PHONES IN MOVING VEHICLES

7.5 RADIOFREQUENCY IDENTIFICATION (RFID)

7.5.1 V2X COLLISION DETECTION SYSTEM UTILIZES RFID TECHNOLOGY TO DETECT VEHICLE PRESENCE ON ROAD INTERSECTIONS

8 TRAFFIC SENSOR MARKET, BY APPLICATION (Page No. - 122)

8.1 INTRODUCTION

FIGURE 33 MARKET, BY APPLICATION

FIGURE 34 TRAFFIC MONITORING APPLICATION TO HOLD LARGEST SIZE OF MARKET BETWEEN 2021 AND 2026

TABLE 43 MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 44 MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

8.2 VEHICLE MEASUREMENT AND PROFILING

8.2.1 VEHICLE RECOGNITION, CLASSIFICATION, AND AXLE COUNTING ARE MAJOR APPLICATIONS OF TRAFFIC SENSORS

8.2.2 VEHICLE PROFILING

8.2.2.1 Vehicle profiling can be done through traffic sensors

8.2.3 AXLE COUNTING

8.2.3.1 Axle counter enables error-free detection and counting of vehicle axles in multi-lane roads and free-flowing traffic

TABLE 45 MARKET FOR VEHICLE MEASUREMENT AND PROFILING APPLICATION, BY REGION, 2018–2020 (USD MILLION)

TABLE 46 MARKET FOR VEHICLE MEASUREMENT AND PROFILING APPLICATION, BY REGION, 2021–2026 (USD MILLION)

TABLE 47 MARKET FOR VEHICLE MEASUREMENT AND PROFILING APPLICATION, BY TYPE, 2018–2020 (USD MILLION)

TABLE 48 MARKET FOR VEHICLE MEASUREMENT AND PROFILING APPLICATION, BY TYPE, 2021–2026 (USD MILLION)

8.3 WEIGH IN MOTION

8.3.1 TRAFFIC SENSORS PROVIDE ACCURATE DATA REGARDING GROSS WEIGHTS OF VEHICLES IN MOTION AND INDIVIDUAL AXLE LOADS WITHOUT DISTURBING TRAFFIC FLOW

FIGURE 35 MARKET FOR WEIGH IN MOTION APPLICATION IN APAC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 49 MARKET FOR WEIGH IN MOTION APPLICATION, BY REGION, 2018–2020 (USD MILLION)

TABLE 50 MARKET FOR WEIGH IN MOTION APPLICATION, BY REGION, 2021–2026 (USD MILLION)

TABLE 51 MARKET FOR WEIGHT IN MOTION APPLICATION, BY TYPE, 2018–2020 (USD MILLION)

TABLE 52 MARKET FOR WEIGHT IN MOTION APPLICATION, BY TYPE, 2021–2026 (USD MILLION)

8.3.2 WEIGHT ENFORCEMENT

8.3.2.1 Weight enforcement application ensures detection of overloaded vehicles in real time

8.3.3 WEIGHT-BASED TOLL COLLECTION

8.3.3.1 Weight-based toll collection systems present option to sanction loading limit violations or deny access to bridges roads

8.3.4 TRAFFIC DATA COLLECTION

8.3.4.1 Traffic data collection systems are used to get continuous, reliable, complete, and accurate traffic and weight-related data

8.4 TRAFFIC MONITORING

8.4.1 TRAFFIC MONITORING SYSTEMS ARE INTEGRATED WITH TRAFFIC SENSORS TO MONITOR ON-ROAD TRAFFIC IN REAL TIME

FIGURE 36 NORTH AMERICA TO HOLD LARGEST SIZE OF TRAFFIC SENSOR MARKET FOR TRAFFIC MONITORING APPLICATION THROUGHOUT FORECAST PERIOD

TABLE 53 MARKET FOR TRAFFIC MONITORING APPLICATION, BY REGION, 2018–2020 (USD MILLION)

TABLE 54 MARKET FOR TRAFFIC MONITORING APPLICATION, BY REGION, 2021–2026 (USD MILLION)

TABLE 55 MARKET FOR TRAFFIC MONITORING APPLICATION, BY TYPE, 2018–2020 (USD MILLION)

TABLE 56 MARKET FOR TRAFFIC MONITORING APPLICATION, BY TYPE, 2021–2026 (USD MILLION)

8.4.2 VEHICLE COUNTING

8.4.2.1 Vehicle counting systems are integrated with traffic sensors for continuous recording of vehicle counts

8.4.3 BICYCLE COUNTING

8.4.3.1 Bicycle counting systems record count of cyclists and pedestrians separately

8.4.4 VEHICLE MOTION TRACKING

8.4.4.1 Vehicle motion tracking systems are integrated with traffic sensors to detect vehicles with higher accuracy

8.5 AUTOMATED TOLLING (E-TOLL)

8.5.1 AUTOMATED TOLLING SOLUTIONS ARE DEPLOYED TO COLLECT TOLL FEES AT FASTER RATE

TABLE 57 MARKET FOR AUTOMATED TOLLING APPLICATION, BY REGION, 2018–2020 (USD MILLION)

TABLE 58 MARKET FOR AUTOMATED TOLLING APPLICATION, BY REGION, 2021–2026 (USD MILLION)

9 GEOGRAPHIC ANALYSIS (Page No. - 135)

9.1 INTRODUCTION

FIGURE 37 TRAFFIC SENSOR MARKET IN AUSTRALIA TO GROW AT HIGHEST CAGR BETWEEN 2021 AND 2026

FIGURE 38 APAC TO EXHIBIT HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

TABLE 59 MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 60 MARKET, BY REGION, 2021–2026 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 39 NORTH AMERICA: SNAPSHOT OF MARKET

TABLE 61 MARKET IN NORTH AMERICA, BY SENSOR TYPE, 2018–2020 (USD MILLION)

TABLE 62 MARKET IN NORTH AMERICA, BY SENSOR TYPE, 2021–2026 (USD MILLION)

TABLE 63 MARKET IN NORTH AMERICA, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 64 MARKET IN NORTH AMERICA, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 65 NORTH AMERICA: MARKET FOR VEHICLE MEASUREMENT AND PROFILING APPLICATION, BY TYPE, 2018–2020 (USD MILLION)

TABLE 66 NORTH AMERICA: MARKET FOR VEHICLE MEASUREMENT AND PROFILING APPLICATION, BY TYPE, 2021–2026 (USD MILLION)

TABLE 67 NORTH AMERICA: MARKET FOR WEIGH IN MOTION APPLICATION, BY TYPE, 2018–2020 (USD MILLION)

TABLE 68 NORTH AMERICA: MARKET FOR WEIGH IN MOTION APPLICATION, BY TYPE, 2021–2026 (USD MILLION)

TABLE 69 NORTH AMERICA: MARKET FOR TRAFFIC MONITORING APPLICATION, BY TYPE, 2018–2020 (USD MILLION)

TABLE 70 NORTH AMERICA: MARKET FOR TRAFFIC MONITORING APPLICATION, BY TYPE, 2021–2026 (USD MILLION)

TABLE 71 MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 72 MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

9.2.1 US

9.2.1.1 US holds first rank in global market at present

9.2.2 CANADA

9.2.2.1 Government initiatives for development of smart cities and managing urban traffic congestion boost market growth in Canada

9.2.3 MEXICO

9.2.3.1 Strong inclination of country toward development and adoption of automated tolling systems to drive market growth in Mexico

9.3 EUROPE

FIGURE 40 EUROPE: SNAPSHOT OF TRAFFIC SENSOR MARKET

TABLE 73 MARKET IN EUROPE, BY SENSOR TYPE, 2018–2020 (USD MILLION)

TABLE 74 MARKET IN EUROPE, BY SENSOR TYPE, 2021–2026 (USD MILLION)

TABLE 75 MARKET IN EUROPE, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 76 MARKET IN EUROPE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 77 EUROPE: MARKET FOR VEHICLE MEASUREMENT AND PROFILING APPLICATION, BY TYPE, 2018–2020 (USD MILLION)

TABLE 78 EUROPE: MARKET FOR VEHICLE MEASUREMENT AND PROFILING APPLICATION, BY TYPE, 2021–2026 (USD MILLION)

TABLE 79 EUROPE: MARKET FOR WEIGH IN MOTION APPLICATION, BY TYPE, 2018–2020 (USD MILLION)

TABLE 80 EUROPE: MARKET FOR WEIGH IN MOTION APPLICATION, BY TYPE, 2021–2026 (USD MILLION)

TABLE 81 EUROPE: MARKET FOR TRAFFIC MONITORING APPLICATION, BY TYPE, 2018–2020 (USD MILLION)

TABLE 82 EUROPE: MARKET FOR TRAFFIC MONITORING APPLICATION, BY TYPE, 2021–2026 (USD MILLION)

TABLE 83 MARKET IN EUROPE, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 84 MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

9.3.1 GERMANY

9.3.1.1 Collaboration of German government with companies offering smarter transport solutions stimulate market growth

9.3.2 UK

9.3.2.1 Investments in development and deployment of ITS encourage adoption of traffic sensors in UK

9.3.3 FRANCE

9.3.3.1 Technological advancements in transportation industry for accessing real-time information spur demand for traffic sensors in France

9.3.4 RUSSIA

9.3.4.1 Approval of funds by Russian government for implementation of ITS in country supports market growth

9.3.5 ITALY

9.3.5.1 Research and development activities and initiatives by local authorities to implement smart mobility systems foster market growth in Italy

9.3.6 SPAIN

9.3.6.1 Initiatives of local authorities to implement smart mobility systems fuel market in Spain

9.3.7 REST OF EUROPE

9.4 ASIA PACIFIC

FIGURE 41 ASIA PACIFIC: SNAPSHOT OF TRAFFIC SENSOR MARKET

TABLE 85 MARKET IN APAC, BY SENSOR TYPE, 2018–2020 (USD MILLION)

TABLE 86 MARKET IN APAC, BY SENSOR TYPE, 2021–2026 (USD MILLION)

TABLE 87 MARKET IN APAC, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 88 MARKET IN APAC, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 89 APAC: MARKET FOR VEHICLE MEASUREMENT AND PROFILING APPLICATION, BY TYPE, 2018–2020 (USD MILLION)

TABLE 90 APAC: MARKET FOR VEHICLE MEASUREMENT AND PROFILING APPLICATION, BY TYPE, 2021–2026 (USD MILLION)

TABLE 91 APAC: MARKET FOR WEIGH IN MOTION APPLICATION, BY TYPE, 2018–2020 (USD MILLION)

TABLE 92 APAC: MARKET FOR WEIGH IN MOTION APPLICATION, BY TYPE, 2021–2026 (USD MILLION)

TABLE 93 APAC: MARKET FOR TRAFFIC MONITORING APPLICATION, BY TYPE, 2018–2020 (USD MILLION)

TABLE 94 APAC: MARKET FOR TRAFFIC MONITORING APPLICATION, BY TYPE, 2021–2026 (USD MILLION)

TABLE 95 MARKET IN APAC, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 96 MARKET IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

9.4.1 CHINA

9.4.1.1 Robust transportation infrastructure, increasing investments in smart city projects, and faster economic development to drive market growth in China

9.4.2 JAPAN

9.4.2.1 High emphasis of Japan on improving road safety and traffic congestion creates lucrative opportunities for market

9.4.3 AUSTRALIA

9.4.3.1 Huge investments in traffic management systems and smart city projects to drive market in Australia

9.4.4 REST OF APAC

9.5 ROW

FIGURE 42 ROW: SNAPSHOT OF TRAFFIC SENSOR MARKET

TABLE 97 MARKET IN ROW, BY SENSOR TYPE, 2018–2020 (USD MILLION)

TABLE 98 MARKET IN ROW, BY SENSOR TYPE, 2021–2026 (USD MILLION)

TABLE 99 MARKET IN ROW, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 100 MARKET IN ROW, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 101 ROW: MARKET FOR VEHICLE MEASUREMENT AND PROFILING APPLICATION, BY TYPE, 2018–2020 (USD MILLION)

TABLE 102 ROW: MARKET FOR VEHICLE MEASUREMENT AND PROFILING APPLICATION, BY TYPE, 2021–2026 (USD MILLION)

TABLE 103 ROW: MARKET FOR WEIGH IN MOTION APPLICATION, BY TYPE, 2018–2020 (USD MILLION)

TABLE 104 ROW: MARKET FOR WEIGH IN MOTION APPLICATION, BY TYPE, 2021–2026 (USD MILLION)

TABLE 105 ROW: MARKET FOR TRAFFIC MONITORING APPLICATION, BY TYPE, 2018–2020 (USD MILLION)

TABLE 106 ROW: MARKET FOR TRAFFIC MONITORING APPLICATION, BY TYPE, 2021–2026 (USD MILLION)

TABLE 107 MARKET IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 108 MARKET IN ROW, BY REGION, 2021–2026 (USD MILLION)

9.5.1 SOUTH AMERICA

9.5.1.1 Integration of IoT and GSM technologies in traffic management solutions to fuel need for traffic sensors

9.5.2 MIDDLE EAST & AFRICA

9.5.2.1 Implementation of sustainable traffic management systems to reduce traffic congestion supports growth of market in MEA

10 COMPETITIVE LANDSCAPE (Page No. - 175)

10.1 OVERVIEW

10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

10.2.1 OVERVIEW OF STRATEGIES DEPLOYED BY ORIGINAL EQUIPMENT MANUFACTURERS OF TRAFFIC SENSORS

10.3 COMPANY REVENUE ANALYSIS, 2020

TABLE 109 REVENUE ANALYSIS OF FIVE PLAYERS IN TRAFFIC SENSOR MARKET, 2016–2020 (USD MILLION)

FIGURE 43 FIVE-YEAR REVENUE ANALYSIS OF KEY PLAYERS, 2016–2020

10.4 MARKET SHARE ANALYSIS, 2020

FIGURE 44 SHARES OF MAJOR PLAYERS IN MARKET, 2020

TABLE 110 MARKET: DEGREE OF COMPETITION

10.5 RANKING OF KEY PLAYERS IN MARKET

FIGURE 45 MARKET: RANKING OF KEY PLAYERS, 2020

10.6 COMPANY EVALUATION QUADRANT

10.6.1 STAR

10.6.2 PERVASIVE PLAYER

10.6.3 EMERGING LEADER

10.6.4 PARTICIPANT

FIGURE 46 MARKET: COMPANY EVALUATION QUADRANT, 2020

10.7 STARTUP/SME EVALUATION QUADRANT

10.7.1 PROGRESSIVE COMPANY

10.7.2 RESPONSIVE COMPANY

10.7.3 DYNAMIC COMPANY

10.7.4 STARTING BLOCK

FIGURE 47 MARKET: STARTUP/SME EVALUATION QUADRANT, 2020

10.8 TRAFFIC SENSOR MARKET: COMPANY FOOTPRINT

TABLE 111 FOOTPRINT OF COMPANIES

TABLE 112 APPLICATION FOOTPRINT OF COMPANIES

TABLE 113 TECHNOLOGY FOOTPRINT OF COMPANIES

TABLE 114 REGIONAL FOOTPRINT OF COMPANIES

10.9 COMPETITIVE SCENARIO AND TRENDS

FIGURE 48 MARKET EVALUATION FRAMEWORK: PRODUCT LAUNCHES AND DEVELOPMENTS, PARTNERSHIPS, COLLABORATIONS, AND ACQUISITIONS WERE MOST COMMONLY ADOPTED STRATEGIES BY MARKET PLAYERS FROM 2017 TO 2021

10.9.1 RECENT DEVELOPMENT

TABLE 115 MARKET: PRODUCT LAUNCHES AND DEVELOPMENTS

10.9.2 DEALS

TABLE 116 MARKET: DEALS

11 COMPANY PROFILES (Page No. - 192)

(Business overview, Products offered, Recent Developments, MNM view)*

11.1 KEY PLAYERS

11.1.1 EFKON AG

TABLE 117 EFKON AG: BUSINESS OVERVIEW

11.1.2 KAPSCH TRAFFICCOM AG

TABLE 118 KAPSCH TRAFFICCOM AG: BUSINESS OVERVIEW

FIGURE 49 KAPSCH TRAFFICCOM AG: COMPANY SNAPSHOT

11.1.3 TRANSCORE

TABLE 119 TRANSCORE: BUSINESS OVERVIEW

11.1.4 INTERNATIONAL ROAD DYNAMICS INC.

TABLE 120 INTERNATIONAL ROAD DYNAMICS INC.: BUSINESS OVERVIEW

11.1.5 KISTLER GROUP

TABLE 121 KISTLER GROUP: BUSINESS OVERVIEW

11.1.6 FLIR SYSTEMS

TABLE 122 FLIR SYSTEMS: BUSINESS OVERVIEW

FIGURE 50 FLIR SYSTEMS: COMPANY SNAPSHOT

11.1.7 TE CONNECTIVITY LTD.

TABLE 123 TE CONNECTIVITY LTD.: BUSINESS OVERVIEW

FIGURE 51 TE CONNECTIVITY LTD.: COMPANY SNAPSHOT

11.1.8 SWARCO AG

TABLE 124 SWARCO AG: BUSINESS OVERVIEW

11.1.9 Q-FREE ASA

TABLE 125 Q-FREE ASA: BUSINESS OVERVIEW

FIGURE 52 Q-FREE ASA: COMPANY SNAPSHOT

11.1.10 SICK AG

TABLE 126 SICK AG: BUSINESS OVERVIEW

FIGURE 53 SICK AG: COMPANY SNAPSHOT

11.1.11 AXIS COMMUNICATIONS AB

TABLE 127 AXIS COMMUNICATIONS AB: BUSINESS OVERVIEW

FIGURE 54 AXIS COMMUNICATIONS AB: COMPANY SNAPSHOT

11.1.12 RAYTHEON COMPANY

TABLE 128 RAYTHEON COMPANY: BUSINESS OVERVIEW

FIGURE 55 RAYTHEON COMPANY: COMPANY SNAPSHOT

11.1.13 SIEMENS

TABLE 129 SIEMENS: BUSINESS OVERVIEW

FIGURE 56 SIEMENS: COMPANY SNAPSHOT

11.2 OTHER KEY PLAYERS

11.2.1 SENSYS NETWORKS

11.2.2 LEDDARTECH

11.2.3 IMAGE SENSING SYSTEMS (ISS)

11.2.4 AGD SYSTEMS

11.2.5 JENOPTIK

11.2.6 MIOVISION

11.2.7 DIABLO CONTROLS

*Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 247)

12.1 POINTS TO BE DISCUSSED:

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORT

12.5 AUTHOR DETAILS

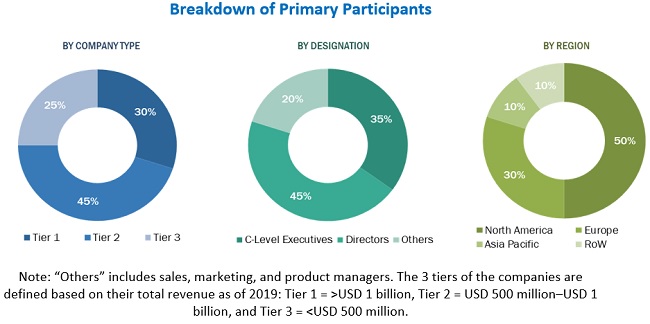

The study involved 4 major activities in estimating the current size of traffic sensor market. Exhaustive secondary research has been conducted to collect information about the market, the peer market, and the parent market. Validating findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments.

Secondary Research

The research methodology used to estimate and forecast the traffic sensor market begins with capturing the data on revenues of the key vendors in the market through secondary research. This study involves the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource, to identify and collect information useful for the technical and commercial study of the traffic sensor market. Secondary sources also include annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles from recognized authors; directories; and databases. Secondary research has been mainly done to obtain key information about the industry’s supply chain, market’s value chain, the total pool of key players, market classification and segmentation according to industry trends, geographic markets, and key developments from both market- and technology oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain the qualitative and quantitative information relevant to the traffic sensor market. Primary sources from the supply side include experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, application developers, application users, and related executives from various key companies and organizations operating in the ecosystem of the traffic sensor market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the overall size of the traffic sensor market. These methods have also been used extensively to estimate the size of various market subsegments. The research methodology used to estimate the market size includes the following:

- Key players in major applications and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the traffic sensor market on the basis of sensor type, technology, application, and Geography.

- To forecast the size of the market segments for four major regions—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To study the complete value chain and allied industry segments and perform a value chain analysis of the market

- To strategically profile key players and comprehensively analyze their market shares and core competencies2

- To analyze the opportunities in the market for stakeholders and describe the competitive landscape of the market

- To analyze competitive developments such as joint ventures, collaborations, agreements, contracts, partnerships, mergers & acquisitions, new product developments, and research & development (R&D) in the market

- To analyze the impact of COVID-19 on the traffic sensor market and provide market estimates for both pre- and post-COVID-19 scenarios

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Traffic Sensor Market