Trade Analytics Market by Component (Solutions, Services), Application (Transaction Cost Analysis, Workforce Management, and Sentiment Analysis), Trading Type, Deployment Mode (Cloud, On-premises), Organization Size, End User and Region - Global Forecast to 2027

In today’s rapidly changing financial environment, innovative quantitative analytics is critical to success. Market participants need a partner who understands the increasing complexities of the trade execution process and its impact on compliance reporting. Trade analytics software is specifically deployed to evaluate investments and to identify trading opportunities by analyzing the statistical trends and price variations gathered from the market. Trade analytics software processes data and delivers it in the form of statistical analysis to help traders make informed decisions when placing or managing a trade.

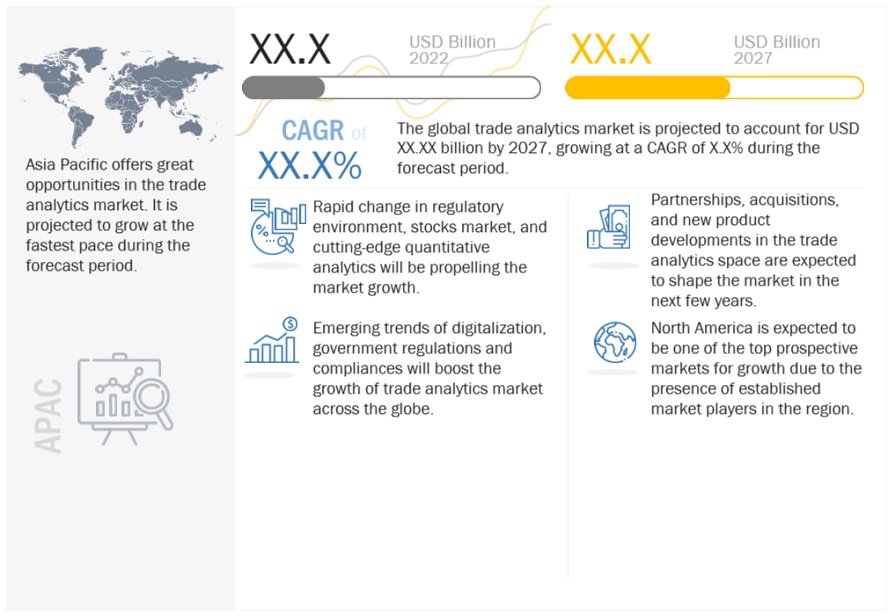

The global trade analytics market size is expected to grow from USD XX.X billion in 2022 to USD XX.X billion in 2027, at a Compound Annual Growth Rate (CAGR) of XX.X% during the forecast period.

Drivers: Rising need to evaluate and improve trading performance

Analytics enable traders with a formal framework for understanding the meaning of events and anticipating the ensuing market activity. This gives them context and places traders who use analytics at an advantage, helping them improve performance and reduce mistakes. Asset managers prefer analytics as it provides actionable insight to enhance and synchronize trading, quality, compliance, and other reporting capabilities. Implementation of trade analytics by different institutional investors, and individuals to focus on and analyze the risk involved in the portfolio is expected to drive market growth.

Rising importance of advanced technologies

Technological progress is offering opportunities to boost flexible ways of trading, reducing complex ways in which markets run. From trading software to tools for trading analysis, technology is at the heart of capital markets today. Financial institutions have enhanced the way they manage operations by adopting machine learning (ML) and artificial intelligence (AI). AI and ML are two emerging technologies with advanced analytics capabilities that can help traders to achieve their goals. This is expected to drive the adoption of trade analytics solutions across firms engaged in active trading activities.

Challenges:Lack of advanced analytical knowledge among the workforces

One of the major challenges encountered by firms has been the lack of technical expertise and firsthand experience in using the analytics and advanced trading algorithmic tools. As per data scientists across the world, the cause of apprehension of adopting advanced technology is the low level of skillsets among the workforce who are not adequate to utilize these advanced pervasive technologies. Enterprises breathing under a volatile, uncertain, complex, and ambiguous (VUCA) atmosphere need to adopt advanced analytical tools to help stay afloat in a disruptive world. To combat the current challenges of disruption, enterprises need to invest heavily in training and certification courses of using advanced technology to remain competitive and have a distinct place in the market.

Key Players in the Market

Global Trade Analytics LLC (US), Virtu Financial (US), Refinitiv (US), 63 Moon (India), AlgoTrader (Switzerland), FactSet (US), Vichara Technologies (US), MetaQuotes (Cyprus), Numerix (US), and One Market Data LLC (US) are few key players in the trade analytics market.

Recent Developments

- In September 2022, HDFC Bank signed long-term data and technology agreement with Refinitiv. HDFC Bank will empower its people and processes with Refinitiv’s enterprise data solutions to work smarter, faster, and under reduced operational risk with automated and reliable data across all business lines. Additionally, HDFC Bank will also enable its users with Refinitiv Workspace, Refinitiv’s highly customizable workflow solution for financial professionals provides access to real-time market data, news, fundamentals data, analytics, trading, and collaboration tools.

- In July 2021, Refinitiv enhanced its post-trade regulatory reporting capabilities through a partnership with Xinthesys LLC that enables sell-side traders to potentially save costs with a single and fully integrated platform for trade reporting.

TABLE OF CONTENTS

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY CONSIDERED

1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.3 BREAKUP OF PRIMARY PROFILES

2.1.4 KEY INDUSTRY INSIGHTS

2.2 MARKET BREAKUP AND DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

2.4 MARKET FORECAST

2.5 COMPETITIVE EVALUATION QUADRANT METHODOLOGY

2.6 STARTUP/SME EVALUATION QUADRANT METHODOLOGY

2.7 ASSUMPTIONS FOR THE STUDY

2.8 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 ATTRACTIVE OPPORTUNITIES IN THE TRADE ANALYTICS MARKET

4.2 MARKET, BY COMPONENT

4.3 MARKET, BY APPLICATION

4.4 MARKET, BY DEPLOYMENT MODE

4.5 MARKET, BY ORGANIZATION SIZE

4.6 MARKET, BY END USER

4.7 MARKET INVESTMENT SCENARIO

5 MARKET OVERVIEW

5.1 MARKET DYNAMICS

5.1.1 DRIVERS

5.1.2 RESTRAINTS

5.1.3 OPPORTUNITIES

5.1.4 CHALLENGES

5.2 CASE STUDIES

5.2.1 USE CASE 1

5.2.2 USE CASE 2

5.2.3 USE CASE 3

5.2.4 USE CASE 4

5.2.5 USE CASE 5

5.3 INVESTMENTS IN TRADE ANALYTICS

5.4 PATENT ANALYSIS

5.4.1 METHODOLOGY

5.4.2 DOCUMENT TYPE

5.4.3 INNOVATION AND PATENT APPLICATIONS

5.4.3.1 Top applicants

5.5 ECOSYSTEM OF THE TRADE ANALYTICS MARKET

5.6 SUPPLY CHAIN ANALYSIS

5.7 VALUE CHAIN ANALYSIS

5.8 TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS OF MARKET

5.9 TECHNOLOGY ANALYSIS

5.1 REGULATORY IMPLICATIONS

5.11 TARIFF AND REGULATORY LANDSCAPE

5.12 PRICING ANALYSIS

5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

5.14 PORTER’S FIVE FORCES ANALYSIS

5.14.1 THREAT OF NEW ENTRANTS

5.14.2 THREAT OF SUBSTITUTES

5.14.3 BARGAINING POWER OF SUPPLIERS

5.14.4 BARGAINING POWER OF BUYERS

5.14.5 INTENSITY OF COMPETITIVE RIVALRY

6 TRADE ANALYTICS MARKET, BY COMPONENT

6.1 INTRODUCTION

6.3 SOLUTION

6.3.1 SOLUTION: MARKET DRIVERS

6.4 SERVICES

6.4.1 SERVICES: MARKET DRIVERS

6.4.2 PROFESSIONAL SERVICES

6.4.2.1 Consulting

6.4.2.2 System Integration and Implementation

6.4.2.3 Support and Maintenance

6.4.3 MANAGED SERVICES

7 TRADE ANALYTICS MARKET, BY APPLICATION

7.1 INTRODUCTION

7.2 HIGH-FREQUENCY TRADING

7.2.1 HIGH-FREQUENCY TRADING: MARKET DRIVERS

7.3 TRANSACTION COST ANALYSIS

7.3.1 TRANSACTION COST ANALYSIS: MARKET DRIVERS

7.4 RISK AND COMPLIANCE MANAGEMENT

7.4.1 RISK AND COMPLIANCE MANAGEMENT: MARKET DRIVERS

7.5 SENTIMENT ANALYSIS

7.5.1 SENTIMENT ANALYSIS: MARKET DRIVERS

7.6 WORKFORCE MANAGEMENT

7.6.1 WORKFORCE MANAGEMENT: MARKET DRIVERS

7.7 OTHER APPLICATIONS (QUALITY MANAGEMENT AND BUSINESS INTELLIGENCE & REPORTING)

8 TRADE ANALYTICS MARKET, BY TRADING TYPE

8.1 INTRODUCTION

8.2 TECHNICAL TRADING

8.2.1 TECHNICAL TRADING: MARKET DRIVERS

8.3 FUNDAMENTAL TRADING

8.3.1 FUNDAMENTAL TRADING: MARKET DRIVERS

8.4 MOMENTUM TRADING

8.4.1 MOMENTUM TRADING: MARKET DRIVERS

8.5 COMMODITIES TRADING

8.5.1 COMMODITIES TRADING: MARKET DRIVERS

8.6 OTHER TRADING TYPES (SCALPING TRADING, ARBITRAGE TRADING, SELL-SIDE TRADING, EQUITIES TRADING, AND SWING TRADING)

9 TRADE ANALYTICS MARKET, BY DEPLOYMENT MODE

9.1 INTRODUCTION

9.2 ON-PREMISES

9.2.1 ON-PREMISES: MARKET DRIVERS

9.3 CLOUD

9.3.1 CLOUD: MARKET DRIVERS

10 MARKET, BY ORGANIZATION SIZE

10.1 INTRODUCTION

10.2 SMES

10.2.1 SMES: MARKET DRIVERS

10.3 LARGE ENTERPRISES

10.3.1 LARGE ENTERPRISES: MARKET DRIVERS

11 TRADE ANALYTICS MARKET, BY END USER

11.1 INTRODUCTION

11.2 ASSET MANAGERS

11.2.1 ASSET MANAGERS: MARKET DRIVERS

11.3 HEDGE FUND MANAGER

11.3.1 HEDGE FUND MANAGER: MARKET DRIVERS

11.4 BROKER-DEALERS

11.4.1 BROKER-DEALERS: MARKET DRIVERS

11.5 INVESTMENT BANKS

11.5.1 INVESTMENT BANKS: MARKET DRIVERS

11.6 OTHER END USERS (RESEARCH PROVIDERS, RETAIL INVESTORS, AND ACADEMIA)

12 TRADE ANALYTICS MARKET BY REGION

12.1 INTRODUCTION

12.2 REGION: MARKET DRIVERS

12.3 NORTH AMERICA

12.3.1 NORTH AMERICA: REGULATORY LANDSCAPE

12.3.2 UNITED STATES

12.3.3 CANADA

12.4 EUROPE

12.4.1 EUROPE: REGULATORY LANDSCAPE

12.4.2 UNITED KINGDOM

12.4.3 GERMANY

12.4.4 FRANCE

12.4.5 REST OF EUROPE ( SPAIN, ITALY, SWITZERLAND, AND OTHERS)

12.5 ASIA PACIFIC

12.5.1 ASIA PACIFIC: REGULATORY LANDSCAPE

12.5.2 CHINA

12.5.3 JAPAN

12.5.4 INDIA

12.5.5 REST OF APAC (SINGAPORE, MALAYSIA, SOUTH KOREA, AND INDONESIA)

12.6 MIDDLE EAST AND AFRICA

12.6.1 MIDDLE EAST AND AFRICA: REGULATORY LANDSCAPE

12.6.2 UAE

12.6.3 KSA

12.6.4 SOUTH AFRICA

12.6.5 REST OF MEA (ISRAEL, QATAR, KUWAIT, AND TURKEY)

12.7 LATIN AMERICA

12.7.1 LATIN AMERICA: REGULATORY LANDSCAPE

12.7.2 BRAZIL

12.7.3 MEXICO

12.7.4 REST OF LATIN AMERICA (ARGENTINA, CHILE, PERU, AND COLOMBIA)

13 ADJACENT MARKET

13.1 INTRODUCTION

13.2 MARKET DEFINITION

13.3 ALGORITHMIC TRADING MARKET

13.4 ADVANCED ANALYTICS MARKET

14 COMPETITIVE LANDSCAPE

14.1 OVERVIEW

14.2 KEY PLAYER STRATEGIES

14.3 REVENUE ANALYSIS

14.4 MARKET SHARE ANALYSIS

14.5 MARKET EVALUATION FRAMEWORK

14.6 COMPANY EVALUATION QUADRANT

14.6.1 COMPANY EVALUATION MATRIX: DEFINITIONS AND METHODOLOGY

14.6.2 STARS

14.6.3 EMERGING LEADERS

14.6.4 PERVASIVE PLAYERS

14.6.5 PARTICIPANTS

14.7 COMPETITIVE BENCHMARKING

14.8 STARTUP/SME EVALUATION MATRIX

14.8.1 PROGRESSIVE COMPANIES

14.8.2 RESPONSIVE COMPANIES

14.8.3 DYNAMIC COMPANIES

14.8.4 STARTING BLOCKS

14.9 STARTUP/SME COMPETITIVE BENCHMARKING

14.9 COMPETITIVE SCENARIO AND TRENDS

14.9.1 PRODUCT LAUNCHES AND PRODUCT ENHANCEMENTS

14.9.2 DEALS

14.9.3 OTHERS

15 COMPANY PROFILES

15.1 KEY PLAYERS

15.1.1 GLOBAL TRADING ANALYTICS

15.1.2 VIRTU FINANCIAL

15.1.3 REFINITIV

15.1.4 63 MOONS

15.1.5 METAQUOTES

15.1.6 ALGOTRADERS

15.1.7 THOMSON REUTERS

15.1.8 SOFTWARE AG

15.1.9 NUMERIX

15.1.10 ABEL NOSER

15.2 STARTUP/SME COMPANY PROFILES

16 APPENDIX

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.3 AVAILABLE CUSTOMIZATIONS

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS

Growth opportunities and latent adjacency in Trade Analytics Market