Touch Sensor Market - Global Forecast 2024 to 2030

A touch sensor, also known as tactile sensors is an electronic sensor used to detect and record physical touch. These sensors are economical miniature-sized alternatives to traditional mechanical switches. They are widely used for smartphones, displays, robotics, automotive, smart homes, and industrial applications.

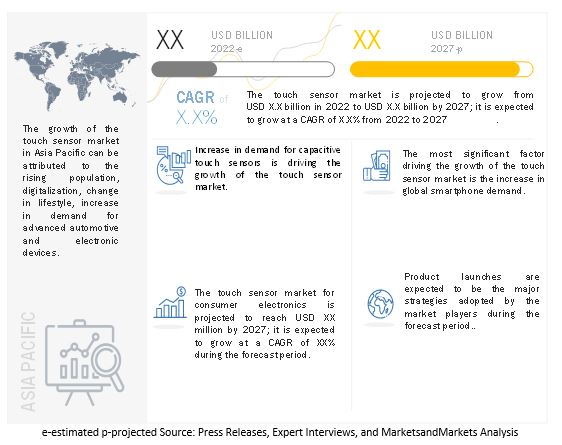

The global touch sensor market size is expected to grow from USD XX million in 2024 to USD XX million by 2030, at a CAGR of XX%. The increasing usage of touch sensors in portable electronics devices such as smartphones, smart TVs, and tablets and the growing demand for interactive digital signage in retail stores and malls are the key factors boosting the growth of the market.

To know about the assumptions considered for the study, Request for Free Sample Report

Drivers: Increase in use of touch sensors in portable electronic devices and automotive

Touch sensors are widely used in various portable electronic devices such as smartphones, wearables, tablets, laptop screens, and smart TVs. In automotive, they are used in infortainment systems to enhanced user experience. The increase in demand for the electronic devices and automotive is driving the growth of the touch sensors market.

Drivers:Increased integration of touch sensors in smart medical devices

Smart medical devices integrated with touch sensors are gaining traction now-a-days. They has advanced computing and communication technologies that aids in monitoring, collecting, and transmiting patient data to provide better diagnostics and treatment decisions. In addition, wearable devices transmit critical medical data in real time from hospital beds and private homes to physicians, which aids in accurate and on-time treatment. Moreover, adoption of touch sensors for therapeutic treatments is also increased driving the demand for touch sensors.

Challenges: Designing and testing challenges associated with touch sensors

The development of capacitive touch sensor face various designing and testing challenges such as grounding design, false touch, and EMI testing. Stable grounding design is critical to making sure that projected capacitive (PCAP) displays work properly. In addition, touch sensors are highly sensitive and touch screens ae prone to scratches. This may affect the functioning of the touch sensor and result in false touch.

Key players in the market

Infineon Technologies AG (Germany), Siemens (Germany), On Semiconductor (US), Texas Instruments Incorporated (US), Honeywell International (US), NXP Semiconductor N.V. (Netherlands), Qualcomm Inc. (US) STMicroelectronics N.V. (Switzerland), Microchip Technology Incorporated (US), and Banpil Photonics (US) are few key players in the touch sensor market globally.

Recent Developments

- In December 2021, Infineon Technologies AG launched the company’s fifth-generation CAPSENSE capacitive and inductive touch sensing human-machine interface (HMI) technology. It delivers higher performance and lower power consumption for demanding user interfaces in home appliance, industrial, consumer and IoT products.

- In December 2020, Renesas Electronics Corporation expanded its 32-bit RA2 Series microcontrollers (MCUs) with 20 new RA2L1 Group MCUs, increasing the RA Family to 66 MCUs. The RA2L1 MCUs are designed for ultra-low power consumption, with several integrated features to lower BOM costs, including capacitive touch sensing, embedded flash memory densities up to 256 KB, SRAM at 32 KB, analog, communications, and timing peripherals, and safety and security functions.

- In April 2020, Infineon Technologies AG had acquired Cypress Semiconductor Corporation. The acquisition will broaden their application range as well as improve their product offerings such as sensors and others.

TABLE OF CONTENTS

1 Introduction

1.1. Study Objectives

1.2. Market Definition

1.2.1. Inclusions and Exclusions

1.3. Study Scope

1.3.1. Markets Covered

1.3.2. Geographic Scope

1.3.3. Years Considered

1.4. Currency

1.5. Limitations

1.6. Stakeholders

2 Research Methodology

2.1. Introduction

2.2. Research Data

2.2.1. Secondary Data

2.2.2. Primary Data

2.2.2.1. Breakdown Of Primary Interviews

2.2.2.2. Primary Interviews With Experts

2.2.2.3. Key Data From Primary Source

2.2.2.4. Key Industry Insights

2.3. Market Size Estimation

2.3.1. Bottom-UP Approach

2.3.2. Top-Down Approach

2.4. Market Breakdown and Data Triangulation

2.5. Research Assumptions

3 Executive Summary

4 Premium Insights

5 Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.2.4. Challenges

5.3. Value Chain Analysis

5.4. Case Study

5.5. Average Selling Price (ASP) Analysis

6 Touch Sensor Market, By Technology

6.1. Introduction

6.2. Resistive

6.3. Capacitive

6.4. Infrared

6.5. Others

7 Touch Sensor Market, By Product

7.1. Introduction

7.2. Smartphones

7.3. Tablets

7.4. Monitors & Laptops

7.5. Interactive Screens

7.6. Others

8 Touch Sensor Market, By Application

8.1. Introduction

8.2. Consumer Electronics

8.3. Retail

8.4. Education

8.5. Others

9 Touch Sensor Market, By Region

9.1. Introduction

9.2. North America

9.2.1. US

9.2.2. Canada

9.2.3. Mexico

9.3. Europe

9.3.1. Germany

9.3.2. France

9.3.3. UK

9.3.4. Rest of the Europe

9.4. Asia Pacific

9.4.1. China

9.4.2. Japan

9.4.3. India

9.4.4. South Korea

9.4.5. Rest of Asia Pacific

9.5. Rest of World (RoW)

9.5.1. South America

9.5.2. Middle East

9.5.3. Africa

10 Competitive Landscape

10.1. Overview

10.2. Market Evaluation Framework

10.2.1. Product Portfolio

10.2.2. Regional Focus

10.2.3. Manufacturing Footprint

10.2.4. Organic/Inorganic Strategies

10.3. Market Share Analysis (Top 5 Players)

10.4. 5-Year Company Revenue Analysis

10.5. Company Evaluation Quadrant

10.5.1. Stars

10.5.2. Emerging Leaders

10.5.3. Pervasive

10.5.4. Participants

10.5.5. Competitive Benchmarking

10.6. Company Footprint

10.6.1. Company Technology Footprint

10.6.2. Company Product Footprint

10.6.3. Company Region Footprint

10.7. Competitive Situation and Trends

10.7.1. Product Launches

10.7.2. Deals

11 Company Profiles

11.1. Introduction

11.2. Key Players

11.2.1. Infineon

11.2.2. Siemens

11.2.3. On Semiconductor

11.2.4. Texas Instruments

11.2.5. Honeywell

11.2.6. Atmel

11.2.7. NXP Semiconductor

11.2.8. Qualcomm Inc

11.2.9. STMicroelectronics

11.2.10. Microchip Technology

11.3. Other Key Players

11.3.1. Banpil Photonics

11.3.2. 3M Touch Systems

11.3.3. Cypress Semiconductor

11.3.4. Samsung Electronics

11.3.5. TPK Holding

11.3.6. Fujitsu

11.3.7. Freescale Semiconductor

11.3.8. Neonode

11.3.9. Corning Incorporated

11.3.10. Immersion Corporation

12 Appendix

Growth opportunities and latent adjacency in Touch Sensor Market