Torque Sensor Market Size, Share & Industry Growth Analysis Report by Type (Rotary Torque Sensors and Reaction Torque Sensors), Application (Automotive, Test & Measurement, Industrial, Aerospace & Defense), Technology, and Geography- Global Growth Driver and Industry Forecast to 2026

Updated on : Oct 23, 2024

Various types of torque sensors based on different technology are being deployed worldwide, from magnetoelastic to surface acoustic wave (SAW). They not only provide advantages over the widely used strain gauge technology but are also ideal for various niche applications. The objective of the report is to define, describe, and forecast the torque sensor industry based on type, technology, application, and region.

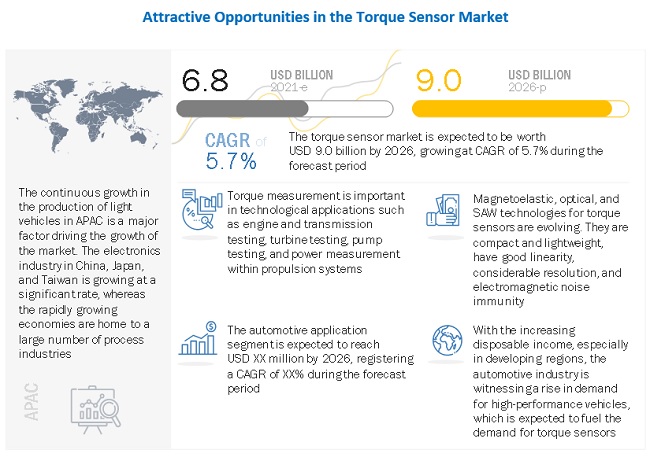

The global torque sensor market size is projected to grow from USD 6.8 billion in 2021 to USD 9.0 billion by 2026; it is expected to grow at a Compound Annual Growth Rate (CAGR) of 5.7% from 2021 to 2026.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19 on current torque sensor market size and forecast

The emergence of the COVID-19 pandemic, a deadly respiratory disease that originated in China, is now become a worldwide issue and has also affected the market. The COVID-19 pandemic will have a varying impact on different types of torque sensors. Most of the industrial equipment are stationary in nature and equipped with reaction torque sensors. Reaction torque sensors are majorly used in testing and measurement and industrial applications. Thus, the growth of these segments is expected to be less affected as compared to the other segments. On the other hand, the market for other torque sensor types used in the automotive and aerospace & defense applications could be affected to a higher degree due to the significant impact of the pandemic on the operations of these industries. The automotive and aerospace & defense industries are the major end users of rotary torque sensors. Both these industries have been adversely affected due to the decline in demand for motor vehicles and reduced number of aircraft orders due to travel restrictions and lack of consumer confidence.

Torque Sensor Industry Dynamics

Driver: Growing importance of torque measurement

Torque measurement is important in technological applications such as engine and transmission testing, turbine testing, pump testing, and power measurement within propulsion systems. Torque is one of the critical parameters in the development of combustion engines and industrial motors. In addition, torque measurement is required in almost every machine that attains angular momentum, including the screw caps on medicine bottles and engines to improve mechanical performance. Torque sensing is one of the methods used to increase the efficiency of machines, engines, and embedded systems. Further, torque sensors are also used as auditing tools for motors, power tools, turbines, and generators. Therefore, the demand for torque sensors is increasing over the past few years, and the trend is likely to remain the same in the coming years.

Restraint: Low reliability of available torque sensors in high-end applications

Some of the most demanding applications, such as aerospace, marine, and racing, require torque sensors with the highest accuracy and reliability for smooth and dependable measurements. However, resistive and piezo-resistive strain gauge techniques are known to introduce errors caused by temperature fluctuation induced by the shaft rotation, which is an area of concern. Sensors employed in aerospace applications should have high-temperature durability so that they can be integrated into close vicinity to the combustion chamber. Although the recent attempts to enhance the existing torque measurement technologies for improved accuracy have been successful, it still remains a concern in large-scale applications.

Opportunity: Evolution of new torque measurement technologies

A lot of new technologies for torque measurement have evolved over the past few years, primary ones are the magnetoelastic, optical, and SAW technologies. Apart from being compact and lightweight, the sensors based on these technologies have excellent linearity, considerable resolution, and fair electromagnetic noise immunity. The battery-less and wireless operations of SAW-based torque sensors allow for flexible package design and easy integration with existing system designs. Magnetoelastic torque sensors have a much higher frequency response and are resistant to environmental effects, making them ideal for automotive and aerospace applications. Such features are likely to enable the effective use of these torque sensors in many of the existing torque applications; they would also create new opportunities for these sensors in high-performance control, machinery prognostics, and vehicle monitoring and control.

Challenge: Decline in demand in automotive industry impact of COVID-19

The COVID-19 pandemic has had a significant impact on the growth of the automotive industry. Large-scale automobile manufacturing has been interrupted in Europe, and many vehicle assembly plants in the US have been shut down. The increase in the number of COVID-19 cases and implementation of long-term lockdowns in Europe and the US had forced automobile manufacturers, such as General Motors (US) and Volkswagen (Germany), to temporarily shut down almost all the plants for about 1–2 months from March 2020. Between April and July 2020, Toyota (Japan) partially suspended the operations at specific plants and production lines, taking into consideration the supply–demand gap and surge in COVID-19 cases. Although countries are partially working through various lockdown measures, loss of consumer confidence is expected to continue to impact the sale of automobiles. On the other hand, though manufacturers have resumed their vehicle production in Q4 of 2020, the production volume is fluctuating. As automotive is one of the primary markets for torque sensors, the growth of the torque sensor market is expected to be significantly affected. According to the International Organization of Motor Vehicle Manufacturers (OICA), vehicle production in Q1, Q2, and Q3 of 2020 witnessed a decline of 23%, 32%, and 23%, respectively, compared to that of 2019. As torque sensors are widely used in electronic power steering systems and automatic transmission in vehicles, the decline in vehicle production is expected to hamper the demand for torque sensors and create a challenging situation for the market players.

To know about the assumptions considered for the study, download the pdf brochure

Market for rotary torque sensors to grow at higher CAGR during forecast period

The rotary torque sensors find a wide range of applications, such as in automobile engine testing, drivetrain measurement, dynamometer testing, electric motor testing, and gearbox testing. Hence, the market for rotary torque sensors is expected to register a higher CAGR as the increasing trend of improving fuel economy, efficiency, and electrification is expected to increase their demand during the forecast period.

Market for torque sensor based on strain gauge to grow at highest CAGR during forecast period

Signals produced by strain gauge torque sensors are compatible with a wide range of instruments, such as digital displays and analog and digital amplifiers. Besides, they are cost-effective compared to other torque sensors. Hence, the strain gauge torque sensors segment is expected to grow at the highest CAGR during the forecast period as improvements in modern strain gauge torque sensors are allowing for high precision measurements.

Market for automotive application to grow at highest CAGR during forecast period

Most automobile manufacturers use torque sensors for calibrating automatic transmissions and mapping engine torque. They are used for testing clutches and gearboxes, as well as measuring strain and determining the dynamic torque within an engine. Rotary torque sensors are used for strain measurement, testing of major components, including clutch and gearboxes, and dynamic torque within the engine. Stringent emission regulations, changing buyer preference, and electrification technology are expected to have a large impact on the demand and use of torque sensors for automotive applications which is contributing to the higher growth in this application.

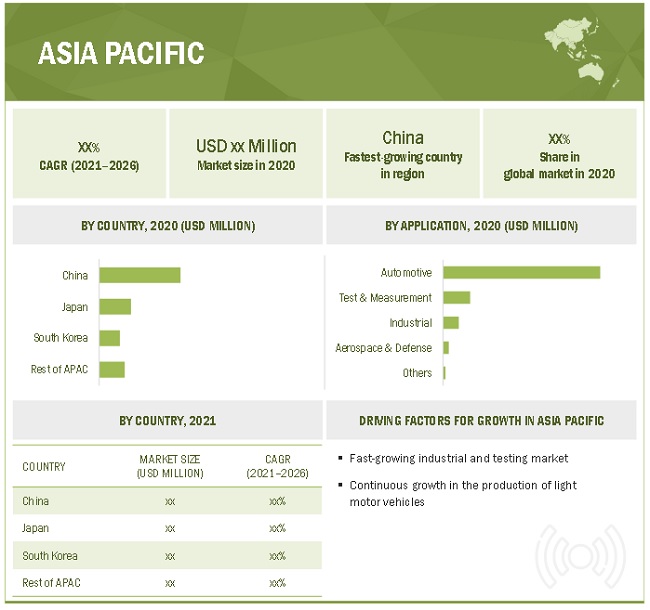

Market in APAC to grow at highest CAGR during the forecast period

APAC is expected to account for the highest growth of the torque sensor market for various types of torque sensors throughout the forecast period. China is the largest vehicle manufacturer in the world. Japan and South Korea are also the major exporters of motor vehicles globally. Due to large-scale manufacturing and significant investments in new vehicle technologies, the automotive industry is expected to play a vital role in the growth of the market in the region. APAC is also expected to be the largest market for industrial applications. The growing need for energy production and large-scale manufacturing of various types of goods for export are facilitating the market for torque sensors.

The APAC is expected to recover in 2021, with China being the first country to show signs of recovery in the region, especially in the automotive industry. Various automobile suppliers throughout China have now resumed production, slowly recovering from the disruptions caused in the supply chain as a result of the pandemic. The government is also continuing to focus on the development of electric vehicles. The automotive industry in Japan is facing significant disruptions as a result of the pandemic. However, Japanese automakers are continuing to spend on research and development, especially in electrification technology. Like China, South Korea is also witnessing recovery in the automotive industry. Although vehicle export from South Korea is currently facing headwinds, the domestic market is witnessing healthy growth. Most domestic car manufacturers in South Korea have announced an increase in domestic sales at the end of 2020. Availability of incentives on electric vehicles and research and testing on new vehicle modes is facilitating market recovery.

Top Torque Sensor Companies - Key Market Players

Major torque sensor comanies are include ABB (Switzerland), Crane Electronics (UK), FUTEK Advanced Sensor Technology (US), HBM (Germany), Applied Measurements (UK), Honeywell (US), Kistler Holding (Switzerland), Sensor Technology (UK), Norbar Torque Too (UK), Infineon Technologies (Germany), Teledyne Technologies (US), Datum Electronics (UK), MagCanica (US), Interface (US), AIMCO (US), TE Connectivity (Switzerland), Mountz (US), PCB Piezotronics (US), S. Himmelstein & Company (US), and Transense Technologies (UK).

Scope of the Torque Sensor Market Report:

|

Report Metric |

Details |

|

Market size available for years |

2017—2026 |

|

Base year |

2020 |

|

Forecast period |

2021—2026 |

|

Units |

Value (USD Million/Thousand) |

|

Segments covered |

Type, Technology, Application, and Geography |

|

Geographic regions covered |

North America, Europe, APAC, and RoW |

|

Torque Sensor Companies covered |

ABB (Switzerland), Crane Electronics (UK), FUTEK Advanced Sensor Technology (US), HBM (Germany), Applied Measurements (UK), Honeywell (US), Kistler Holding (Switzerland), Sensor Technology (UK), Norbar Torque Too (UK), Infineon Technologies (Germany), Teledyne Technologies (US), Datum Electronics (UK), MagCanica (US), Interface (US), AIMCO (US), TE Connectivity (Switzerland), Mountz (US), PCB Piezotronics (US), S. Himmelstein & Company (US), Transense Technologies (UK), KONUX (Germany), Monad Electronics (India), Robotiq (Canada), HITEC Sensor Solutions (US), and Bota Systems (Switzerland) |

This report categorizes the torque market based on type, technology, application, and geography.

Torque Sensor Market Anslysis, by Type:

- Rotary Torque Sensors

- Reaction Torque Sensors

- COVID-19 impact on types of torque sensors

Torque Sensor Market, by Technology:

- Strain Gauge

- Surface Acoustic Wave (SAW)

- Optical

- Magnetoelastic

Torque Sensor Market, by Application:

- Automotive

- Test & Measurement

- Industrial

- Aerospace & Defense

- Others

- COVID-19 impact on diferent application areas of torque sensors

Torque Sensor Market Trends, by Region:

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- France

- UK

- Spain

- Rest of Europe

-

APAC

- China

- Japan

- South Korea

- Rest of APAC

-

RoW

- Middle East & Africa

- South America

- COVID-19 impact on torque sensor market in different regions

Recent Developments in Torque Sensor Industry

- In November 2020, HBM (Germany) launched a new torque transducer T40CB featuring a central bore hole that makes it ideal for testing automobile parts in confined spaces. It also features analog and digital interfaces, which ensure it integrates with many different test bench systems.

- In May 2020, Kistler Holding (Switzerland) announced a collaboration with Vehico (Germany), a manufacturer of driving robots and vehicle control systems for vehicle testing. As a result of this collaboration, an extensive package of sensor technologies and driving robots will now be available to Vehico from a single source.

- In March 2020, HBM (Germany) launched T21WN torque transducers based on the strain-gauge technology. It is ideal for laboratory, test shop, and testing applications as well as for use in production and process monitoring and quality assurance.

Frequently Asked Questions (FAQ):

What will be the dynamics for the adoption of torque sensors based on type?

Due to their maintenance-free operation and wide application areas, the market for noncontact-based torque sensors is expected to have a higher share. They can cover a wide range of torque forces and are hence suitable for general applications such as electric motor testing, pump torque testing, and gearbox testing.

Which torque sensor technology will contribute to the overall market growth by 2026?

The most common torque sensor measurement principle utilizes bonded strain gauge technology, where the strain gauges are bonded to a suitably designed shaft. Improvements in modern strain gauge torque sensors are allowing for high precision measurements and compatibility with a wide range of instruments, strain gauge technology is expected to be the dominant technology for torque sensors.

How will technological developments in new torque sensor technologies change the torque sensor landscape in the future?

A lot of new technologies for torque measurement have evolved over the past few years, primary ones are the magnetoelastic, optical, and SAW technologies. Apart from being compact and lightweight, the sensors based on these technologies have excellent linearity, considerable resolution, and fair electromagnetic noise immunity.

Which region is expected to adopt torque sensors at a fast rate?

APAC is expected to adopt torque at the fastest rate. China is the largest vehicle manufacturer in the world. Japan and South Korea are also the major exporters of motor vehicles globally. Due to large-scale manufacturing and significant investments in new vehicle technologies, the automotive industry is expected to play a vital role in the growth of the torque sensor market in the region.

What are the key market dynamics influencing market growth? How will they turn into strengths or weaknesses of companies operating in the market space?

Growing importance of torque measurement in technological applications such as engine and transmission testing, turbine testing, pump testing, and power measurement andIncreasing application of torque sensors for electric power steering (EPS) systems and advanced high-performance vehicles are expected to be the key market drivers influencing growth. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 22)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

FIGURE 1 SEGMENTATION OF TORQUE SENSOR MARKET

1.3.1 YEARS CONSIDERED

1.4 CURRENCY & PRICING

1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 25)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH FLOW

FIGURE 3 TORQUE SENSOR MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: (SUPPLY SIDE) — REVENUE GENERATED BY COMPANIES IN MARKET

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (SUPPLY SIDE) – IDENTIFICATION OF REVENUES GENERATED BY COMPANIES FROM MARKET

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

FIGURE 6 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 7 TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.4 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 35)

FIGURE 9 ROTARY TORQUE SENSORS SEGMENT TO ACCOUNT FOR LARGER SIZE OF MARKET IN 2021

FIGURE 10 STRAIN GAUGE TECHNOLOGY SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

FIGURE 11 AUTOMOTIVE APPLICATION TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 12 APAC TO HOLD LARGEST SHARE OF MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 39)

4.1 ATTRACTIVE MARKET OPPORTUNITIES IN TORQUE SENSOR MARKET

FIGURE 13 INCREASING DEPLOYMENT OF TORQUE SENSORS IN AUTOMOTIVE APPLICATIONS IS DRIVING GROWTH OF MARKET

4.2 MARKET FOR NONCONTACT-BASED SENSORS, BY TYPE

FIGURE 14 NONCONTACT-BASED SENSOR MARKET FOR ROTARY TORQUE SENSORS TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

4.3 MARKET, BY TECHNOLOGY

FIGURE 15 STRAIN GAUGE TECHNOLOGY SEGMENT TO HOLD LARGEST SHARE OF MARKET IN 2021

4.4 MARKET IN APAC, BY APPLICATION & COUNTRY

FIGURE 16 AUTOMOTIVE APPLICATION AND CHINA TO HOLD LARGEST SHARES OF MARKET IN APAC IN 2021

4.5 MARKET, BY APPLICATION

FIGURE 17 AUTOMOTIVE APPLICATION TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 42)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 IMPACT OF DRIVERS AND OPPORTUNITIES ON MARKET

FIGURE 19 IMPACT OF RESTRAINTS AND CHALLENGES ON MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing demand for advanced high-performance vehicles

5.2.1.2 Growing importance of torque measurement

5.2.1.3 Increasing application of torque sensors for electric power steering (EPS) systems

5.2.2 RESTRAINTS

5.2.2.1 Low reliability of available torque sensors in high-end applications

5.2.3 OPPORTUNITIES

5.2.3.1 Evolution of new torque measurement technologies

5.2.3.2 Increase in use of torque sensors in robotics

5.2.4 CHALLENGES

5.2.4.1 Diversity of applications of torque sensors

5.2.4.2 Decline in demand in automotive industry—impact of COVID-19

FIGURE 20 GLOBAL VEHICLE PRODUCTION DATA FOR Q1, Q2, AND Q3 IN 2019 AND 2020

5.3 TORQUE SENSORS: VALUE CHAIN ANALYSIS

FIGURE 21 VALUE CHAIN ANALYSIS OF MARKET

6 TORQUE SENSOR MARKET, BY TYPE (Page No. - 49)

6.1 INTRODUCTION

FIGURE 22 ROTARY TORQUE SENSORS SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

TABLE 1 MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 2 MARKET, BY TYPE, 2021–2026 (USD MILLION)

6.2 ROTARY TORQUE SENSORS

TABLE 3 ROTARY TORQUE SENSOR MARKET, BY SENSING PROCESS, 2017–2020 (USD MILLION)

TABLE 4 ROTARY TORQUE SENSOR, BY SENSING PROCESS, 2021–2026 (USD MILLION)

6.2.1 CONTACT-BASED SENSING

6.2.1.1 High adoption of contact-based sensing rotary torque sensors in industrial applications

6.2.2 NONCONTACT-BASED SENSING

6.2.2.1 Increasing demand for noncontact-based sensing rotary torque sensors in automotive applications

6.3 REACTION TORQUE SENSORS

6.4 COVID-19 IMPACT ON TYPES OF MARKETS

7 TORQUE SENSOR MARKET, BY TECHNOLOGY (Page No. - 53)

7.1 INTRODUCTION

TABLE 5 MARKET, BY TECHNOLOGY, 2017–2020 (USD MILLION)

FIGURE 23 STRAIN GAUGE SEGMENT TO HOLD LARGEST SHARE DURING FORECAST PERIOD

TABLE 6 MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 7 MARKET FOR AUTOMOTIVE APPLICATION, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 8 TORQUE SENSOR MARKET FOR AUTOMOTIVE APPLICATION, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 9 MARKET FOR INDUSTRIAL APPLICATION, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 10 MARKET FOR INDUSTRIAL APPLICATION, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 11 MARKET FOR TEST & MEASUREMENT APPLICATION, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 12 MARKET FOR TEST & MEASUREMENT APPLICATION, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 13 MARKET FOR AEROSPACE & DEFENSE APPLICATION, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 14 MARKET FOR AEROSPACE & DEFENSE APPLICATION, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 15 MARKET FOR OTHER APPLICATIONS, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 16 MARKET FOR OTHER APPLICATIONS, BY TECHNOLOGY, 2021–2026 (USD MILLION)

7.2 STRAIN GAUGE

7.2.1 HIGH PRECISION MEASUREMENT TASKS HAVE INCREASED DEMAND FOR STARIN GAUGE TECHNOLOGY IN TORQUE SENSORS

TABLE 17 TORQUE SENSOR MARKET FOR STRAIN GAUGE TECHNOLOGY, BY APPLICATION, 2017–2020 (USD MILLION)

FIGURE 24 AUTOMOTIVE APPLICATION TO HOLD LARGEST SHARE OF STRAIN GAUGE SENSORS MARKET BY 2026

TABLE 18 MARKET FOR STRAIN GAUGE TECHNOLOGY, BY APPLICATION, 2021–2026 (USD MILLION)

7.3 MAGNETOELASTIC

7.3.1 AUTOMOTIVE IS MAJOR APPLICATION AREA FOR MAGNETOELASTIC TECHNOLOGY

TABLE 19 MARKET FOR MAGNETOELASTIC TECHNOLOGY, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 20 MARKET FOR MAGNETOELASTIC TECHNOLOGY, BY APPLICATION, 2021–2026 (USD MILLION)

7.4 OPTICAL

7.4.1 OPTICAL TECHNOLOGY TO BE FAST-GROWING SEGMENT IN MARKET

TABLE 21 MARKET FOR OPTICAL TECHNOLOGY, BY APPLICATION, 2017–2020 (USD MILLION)

FIGURE 25 MARKET FOR OPTICAL SENSORS IN INDUSTRIAL APPLICATION TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 22 MARKET FOR OPTICAL TECHNOLOGY, BY APPLICATION, 2021–2026 (USD MILLION)

7.5 SURFACE ACOUSTIC WAVE

7.5.1 BENEFITS SUCH AS HIGH STABILITY AND HIGH SENSITIVITY ARE DRIVING ADOPTION OF SURFACE ACOUSTIC WAVE TECHNOLOGY IN TORQUE SENSING PROCESS

TABLE 23 MARKET FOR SAW TECHNOLOGY, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 24 MARKET FOR SAW TECHNOLOGY, BY APPLICATION, 2021–2026 (USD MILLION)

8 TORQUE SENSOR MARKET ANALYSIS, BY APPLICATION (Page No. - 64)

8.1 INTRODUCTION

TABLE 25 MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

FIGURE 26 AUTOMOTIVE APPLICATION TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

TABLE 26 MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 27 ROTARY TORQUE SENSOR MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 28 ROTARY TORQUE SENSOR, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 29 REACTION TORQUE SENSOR MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 30 REACTION TORQUE SENSOR, BY APPLICATION, 2021–2026 (USD MILLION)

8.2 AUTOMOTIVE

8.2.1 AUTOMOTIVE APPLICATION SEGMENT TO HOLD MAXIMUM SHARE OF MARKET

TABLE 31 MARKET FOR AUTOMOTIVE APPLICATION, BY TYPE, 2017–2020 (USD MILLION)

FIGURE 27 MARKET FOR ROTARY TORQUE SENSORS IN AUTOMOTIVE APPLICATION TO HOLD LARGER SHARE DURING FORECAST PERIOD

TABLE 32 MARKET FOR AUTOMOTIVE APPLICATION, BY TYPE, 2021–2026 (USD MILLION)

8.3 TEST & MEASUREMENT

8.3.1 TEST AND MEASUREMENT APPLICATION COVERS ANALYSIS, VALIDATION, AND VERIFICATION OF MECHANICAL AND ELECTRONIC SYSTEMS

TABLE 33 TORQUE SENSOR MARKET FOR TEST & MEASUREMENT APPLICATION, BY TYPE, 2017–2020 (USD MILLION)

TABLE 34 MARKET FOR TEST & MEASUREMENT APPLICATION, BY TYPE, 2021–2026 (USD MILLION)

8.4 INDUSTRIAL

8.4.1 HIGH IMPORTANCE OF TORQUE MEASUREMENT DURING MANUFACTURING PROCESS TO DRIVE MARKET GROWTH

TABLE 35 MARKET FOR INDUSTRIAL APPLICATION, BY TYPE, 2017–2020 (USD MILLION)

FIGURE 28 MARKET FOR ROTARY TORQUE SENSORS IN INDUSTRIAL APPLICATION TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 36 MARKET FOR INDUSTRIAL APPLICATION, BY TYPE, 2021–2026 (USD MILLION)

8.5 AEROSPACE & DEFENSE

8.5.1 GROWING USE OF TORQUE SENSORS IN CIVIL AND MILITARY AVIATION, AS WELL AS GOVERNMENTAL AND PRIVATE SPACEFLIGHT PROGRAMS

TABLE 37 MARKET FOR AEROSPACE & DEFENSE APPLICATION, BY TYPE, 2017–2020 (USD MILLION)

TABLE 38 MARKET FOR AEROSPACE & DEFENSE, BY TYPE, 2021–2026 (USD MILLION)

8.6 OTHERS

8.6.1 ROTARY TORQUE SENSORS ARE USED IN POULTRY FEEDERS TO MONITOR TORQUE OF MOTOR

TABLE 39 TORQUE SENSOR MARKET SHARE FOR OTHER APPLICATIONS, BY TYPE, 2017–2020 (USD MILLION)

TABLE 40 MARKET FOR OTHER APPLICATIONS, BY TYPE, 2021–2026 (USD MILLION)

8.7 COVID-19 IMPACT ON DIFFERENT APPLICATION AREAS OF TORQUE SENSORS

9 GEOGRAPHIC ANALYSIS OF TORQUE SENSOR MARKET (Page No. - 75)

9.1 INTRODUCTION

FIGURE 29 CHINA TO WITNESS HIGHEST GROWTH IN MARKET DURING FORECAST PERIOD

TABLE 41 MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 42 MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 43 MARKET FOR STRAIN GAUGE TECHNOLOGY, BY REGION, 2017–2020 (USD MILLION)

TABLE 44 MARKET FOR STRAIN GAUGE TECHNOLOGY, BY REGION, 2021–2026 (USD MILLION)

TABLE 45 MARKET FOR STRAIN GAUGE TECHNOLOGY FOR AUTOMOTIVE APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 46 TORQUE SENSOR MARKET FOR STRAIN GAUGE TECHNOLOGY FOR AUTOMOTIVE APPLICATION, BY REGION, 2021–2026 (USD MILLION)

TABLE 47 MARKET FOR STRAIN GAUGE TECHNOLOGY FOR TEST & MEASUREMENT APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 48 MARKET FOR STRAIN GAUGE TECHNOLOGY FOR TEST & MEASUREMENT APPLICATION, BY REGION, 2021–2026 (USD MILLION)

TABLE 49 MARKET FOR STRAIN GAUGE TECHNOLOGY FOR INDUSTRIAL APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 50 MARKET FOR STRAIN GAUGE TECHNOLOGY FOR INDUSTRIAL APPLICATION, BY REGION, 2021–2026 (USD MILLION)

TABLE 51 MARKET FOR STRAIN GAUGE TECHNOLOGY FOR AEROSPACE & DEFENSE APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 52 MARKET FOR STRAIN GAUGE TECHNOLOGY FOR AEROSPACE & DEFENSE APPLICATION, BY REGION, 2021–2026 (USD MILLION)

TABLE 53 MARKET FOR STRAIN GAUGE TECHNOLOGY FOR OTHER APPLICATIONS, BY REGION, 2017–2020 (USD MILLION)

TABLE 54 MARKET FOR STRAIN GAUGE TECHNOLOGY FOR OTHER APPLICATIONS, BY REGION, 2021–2026 (USD MILLION)

TABLE 55 MARKET FOR MAGNETOELASTIC TECHNOLOGY, BY REGION, 2017–2020 (USD MILLION)

TABLE 56 MARKET FOR MAGNETOELASTIC TECHNOLOGY, BY REGION, 2021–2026 (USD MILLION)

TABLE 57 MARKET FOR MAGNETOELASTIC TECHNOLOGY FOR AUTOMOTIVE APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 58 MARKET FOR MAGNETOELASTIC TECHNOLOGY FOR AUTOMOTIVE APPLICATION, BY REGION, 2021–2026 (USD MILLION)

TABLE 59 MARKET FOR MAGNETOELASTIC TECHNOLOGY FOR TEST & MEASUREMENT APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 60 TORQUE SENSOR MARKET FOR MAGNETOELASTIC TECHNOLOGY FOR TEST & MEASUREMENT APPLICATION, BY REGION, 2021–2026 (USD MILLION)

TABLE 61 MARKET FOR MAGNETOELASTIC TECHNOLOGY FOR INDUSTRIAL APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 62 MARKET FOR MAGNETOELASTIC TECHNOLOGY FOR INDUSTRIAL APPLICATION, BY REGION, 2021–2026 (USD MILLION)

TABLE 63 MARKET FOR MAGNETOELASTIC TECHNOLOGY FOR AEROSPACE & DEFENSE APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 64 MARKET FOR MAGNETOELASTIC TECHNOLOGY FOR AEROSPACE & DEFENSE APPLICATION, BY REGION, 2021–2026 (USD MILLION)

TABLE 65 MARKET FOR MAGNETOELASTIC TECHNOLOGY FOR OTHER APPLICATIONS, BY REGION, 2017–2020 (USD MILLION)

TABLE 66 MARKET FOR MAGNETOELASTIC TECHNOLOGY FOR OTHER APPLICATIONS, BY REGION, 2021–2026 (USD MILLION)

TABLE 67 MARKET FOR OPTICAL TECHNOLOGY, BY REGION, 2017–2020 (USD MILLION)

TABLE 68 TORQUE SENSOR MARKET FOR OPTICAL TECHNOLOGY, BY REGION, 2021–2026 (USD MILLION)

TABLE 69 MARKET FOR OPTICAL TECHNOLOGY FOR AUTOMOTIVE APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 70 MARKET FOR OPTICAL TECHNOLOGY FOR AUTOMOTIVE APPLICATION, BY REGION, 2021–2026 (USD MILLION)

TABLE 71 MARKET FOR OPTICAL TECHNOLOGY FOR TEST & MEASUREMENT APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 72 MARKET FOR OPTICAL TECHNOLOGY FOR TEST & MEASUREMENT APPLICATION, BY REGION, 2021–2026 (USD MILLION)

TABLE 73 MARKET FOR OPTICAL TECHNOLOGY FOR INDUSTRIAL APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 74 MARKET FOR OPTICAL TECHNOLOGY FOR INDUSTRIAL APPLICATION, BY REGION, 2021–2026 (USD MILLION)

TABLE 75 MARKET FOR OPTICAL TECHNOLOGY FOR AEROSPACE & DEFENSE APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 76 MARKET FOR OPTICAL TECHNOLOGY FOR AEROSPACE & DEFENSE APPLICATION, BY REGION, 2021–2026 (USD MILLION)

TABLE 77 MARKET FOR OPTICAL TECHNOLOGY FOR OTHER APPLICATIONS, BY REGION, 2017–2020 (USD MILLION)

TABLE 78 MARKET FOR OPTICAL TECHNOLOGY FOR OTHER APPLICATIONS, BY REGION, 2021–2026 (USD MILLION)

TABLE 79 MARKET FOR SAW TECHNOLOGY, BY REGION, 2017–2020 (USD MILLION)

TABLE 80 MARKET FOR SAW TECHNOLOGY, BY REGION, 2021–2026 (USD MILLION)

TABLE 81 MARKET FOR SAW TECHNOLOGY FOR AUTOMOTIVE APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 82 MARKET FOR SAW TECHNOLOGY FOR AUTOMOTIVE APPLICATION, BY REGION, 2021–2026 (USD MILLION)

TABLE 83 MARKET FOR SAW TECHNOLOGY FOR TEST & MEASUREMENT APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 84 MARKET FOR SAW TECHNOLOGY TEST & MEASUREMENT APPLICATION, BY REGION, 2021–2026 (USD MILLION)

TABLE 85 MARKET FOR SAW TECHNOLOGY FOR INDUSTRIAL APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 86 MARKET FOR SAW TECHNOLOGY FOR INDUSTRIAL APPLICATION, BY REGION, 2021–2026 (USD MILLION)

TABLE 87 MARKET FOR SAW TECHNOLOGY FOR AEROSPACE & DEFENSE APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 88 MARKET FOR SAW TECHNOLOGY FOR AEROSPACE & DEFENSE APPLICATION, BY REGION, 2021–2026 (USD MILLION)

TABLE 89 MARKET FOR SAW TECHNOLOGY FOR OTHER APPLICATIONS, BY REGION, 2017–2020 (USD MILLION)

TABLE 90 MARKET FOR SAW TECHNOLOGY FOR OTHER APPLICATIONS, BY REGION, 2021–2026 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 30 NORTH AMERICA: TORQUE SENSOR MARKET SNAPSHOT

TABLE 91 MARKET IN NORTH AMERICA, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 92 MARKET IN NORTH AMERICA, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 93 MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 94 MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

9.2.1 US

9.2.1.1 Increasing demand for low-cost sensor to boost growth of market in US

9.2.2 CANADA

9.2.2.1 Industrial and automotive application are driving growth of market in Canada

9.2.3 MEXICO

9.2.3.1 Expanding automotive industry is driving growth of market

9.3 EUROPE

FIGURE 31 EUROPE: TORQUE SENSOR MARKET SNAPSHOT

TABLE 95 MARKET IN EUROPE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 96 MARKET IN EUROPE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 97 MARKET IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 98 MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

9.3.1 GERMANY

9.3.1.1 Germany is expected to hold largest share of market in Europe

9.3.2 UK

9.3.2.1 Expanding automotive industry is driving growth of market in UK

9.3.3 FRANCE

9.3.3.1 Growing adoption of torque sensors in drive assistance systems to boost market growth in France

9.3.4 SPAIN

9.3.4.1 market in Spain to grow at a slower pace as compared to other European countries

9.3.5 REST OF EUROPE

9.4 ASIA PACIFIC

FIGURE 32 APAC: TORQUE SENSOR MARKET SNAPSHOT

TABLE 99 MARKET IN APAC, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 100 MARKET IN APAC, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 101 MARKET IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 102 MARKET IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

9.4.1 CHINA

9.4.1.1 China to hold largest share of market in APAC

9.4.2 JAPAN

9.4.2.1 Initiatives taken by government to increase use of intelligent machines are driving growth of market

9.4.3 SOUTH KOREA

9.4.3.1 market in South Korea is dominated by automotive and industrial applications

9.4.4 REST OF APAC

9.5 REST OF THE WORLD

FIGURE 33 SOUTH AMERICA TO DOMINATE ROW MARKET DURING FORECAST PERIOD

TABLE 103 TORQUE SENSOR MARKET IN ROW, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 104 MARKET IN ROW, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 105 MARKET IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 106 MARKET IN ROW, BY REGION, 2021–2026 (USD MILLION)

9.5.1 SOUTH AMERICA

9.5.1.1 South America to hold larger share of market in RoW

9.5.2 MIDDLE EAST AND AFRICA

9.5.2.1 Presence of prominent industries to drive growth of market in RoW

9.6 COVID-19 IMPACT ON MARKET IN DIFFERENT REGIONS

10 COMPETITIVE LANDSCAPE (Page No. - 107)

10.1 OVERVIEW

10.2 RANKING ANALYSIS OF PLAYERS IN MARKET

FIGURE 34 RANKING OF KEY PLAYERS IN MARKET (2020)

10.3 COMPANY EVALUATION MATRIX

10.3.1 STAR

10.3.2 EMERGING LEADER

10.3.3 PERVASIVE

10.3.4 PARTICIPANT

TABLE 107 LIST OF START-UPS IN MARKET

FIGURE 35 COMPANY EVALUATION MATRIX, 2020

FIGURE 36 PRODUCT AND BUSINESS FOOTPRINT ANALYSIS OF TOP PLAYERS

10.4 KEY MARKET DEVELOPMENTS

10.4.1 PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 108 PRODUCT LAUNCHES, 2018–2020

10.4.2 PARTNERSHIPS AND COLLABORATIONS

TABLE 109 PARTNERSHIPS AND CONTRACTS, 2018–2020

10.4.3 MERGERS AND ACQUISITIONS

TABLE 110 MERGERS AND ACQUISITIONS, 2018–2020

10.4.4 EXPANSION

TABLE 111 EXPANSION, 2018–2020

11 COMPANY PROFILES (Page No. - 114)

11.1 INTRODUCTION

11.2 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, COVID-19-related Developments, and MnM View)*

11.2.1 ABB

FIGURE 37 ABB: COMPANY SNAPSHOT

11.2.2 CRANE ELECTRONICS

11.2.3 FUTEK ADVANCED SENSOR TECHNOLOGY

11.2.4 HBM

11.2.5 APPLIED MEASUREMENTS

11.2.6 TELEDYNE TECHNOLOGIES

FIGURE 38 TELEDYNE TECHNOLOGIES: COMPANY SNAPSHOT

11.2.7 TE CONNECTIVITY

FIGURE 39 TE CONNECTIVITY: COMPANY SNAPSHOT

11.2.8 HONEYWELL

FIGURE 40 HONEYWELL: COMPANY SNAPSHOT

11.2.9 INFINEON TECHNOLOGIES

FIGURE 41 INFINEON TECHNOLOGIES: COMPANY SNAPSHOT

11.2.10 KISTLER HOLDING

11.2.11 SENSOR TECHNOLOGY

11.2.12 NORBAR TORQUE TOOLS

* Business Overview, Products Offered, Recent Developments, COVID-19-related Developments, and MnM View might not be captured in case of unlisted Torque Sensor companies.

11.3 OTHER KEY PLAYERS

11.3.1 DATUM ELECTRONICS

11.3.2 MAGCANICA

11.3.3 INTERFACE

11.3.4 AIMCO

11.3.5 MOUNTZ

11.3.6 PCB PIEZOTRONICS

11.3.7 S. HIMMELSTEIN AND COMPANY

11.3.8 TRANSENSE TECHNOLOGIES

12 APPENDIX (Page No. - 149)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

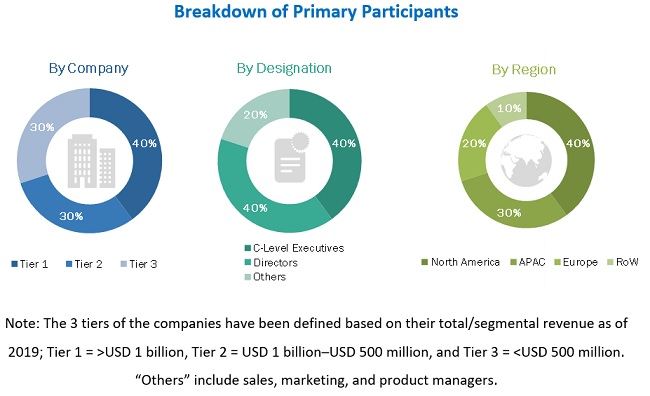

The study involved four major activities in estimating the size for torque sensor market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with torque sensor industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information important for this study. Secondary sources include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers, torque sensor-related journals, and certified publications; articles by recognized authors; gold and silver standard websites; directories; and databases like Factiva.

Secondary research was mainly conducted to obtain key information about the torque sensor industry supply chain, the market value chain, the total pool of key players, market classification and segmentation according to torque sensor industry trends to the bottom-most level, and key developments from both market- and technology-oriented perspectives. Data from secondary research was collected and analyzed to arrive at the overall market size, which was further validated by primary research.

Primary Research

In the primary research process, various primary sources from the supply and demand sides were interviewed to obtain the qualitative and quantitative information for this report. Primary sources from the supply side include torque sensor industry experts such as CEOs, VPs, marketing directors, technology and innovation directors, and related key executives from major companies and organizations operating in the torque sensor market.

Extensive primary research was conducted after obtaining information about the torque sensor market through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides. Primary data has been mainly collected through telephonic interviews, which constitute approximately 80% of the overall primary interviews. Moreover, questionnaires and emails were also used to collect the data.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches were used, along with several data triangulation methods, to estimate and forecast the size of the market and its segments and subsegments listed in the report. Extensive qualitative and quantitative analyses were carried out on the complete market engineering process to list the key information/insights pertaining to the torque sensor market.

Key players in the market were identified through secondary research, and their rankings in the respective regions were determined through primary and secondary research. This entire procedure involves the study of the annual and financial reports, Factiva data of top players, as well as interviews with torque sensor industry experts, such as chief executive officers, vice presidents, directors, and marketing executives, for both quantitative and qualitative key insights. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets and presented in this report.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall size of the torque sensor market from the estimation process explained above, the total market was split into several segments and subsegments. The market breakdown and data triangulation procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Report Objectives

- To describe and forecast the torque sensor market, in terms of value, based on type, technology, application, and geography

- To describe and forecast the market size of torque sensor market, in terms of value, with regards to 4 main regions: North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for various stakeholders by identifying high-growth segments of the torque sensor market

- To benchmark players within the market using the proprietary “Competitive Leadership Mapping” framework, which analyzes market players on various parameters within the broad categories of business strategy excellence and strength of product portfolio

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies2, along with detailing the competitive landscape of the market

- To analyze competitive developments such as acquisitions, product launches and developments, expansion, mergers, and acquisitions in the torque sensor market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Torque Sensor Market

Electric power steering system is one of the major application in automotive sector. Does your report describe what are the other application area of torque sensor in automotive?

On the basis of nature, torque can be measured through different ways. I would like to know the different types of torque sensors. Does your report cover different types of torque sensors and their market size in each application?

Torque sensors are used in various applications. I would like to understand what are the major application of torque sensor and what technologies of torque sensor are used in each application. Could you provide me related data ?

What are the upcoming application and trends f torque sensors?

I am writing the research paper on Torque Sensor. How does your report help me in my study?