Top 10 Analytics Technologies – by Technology (Analytics-As-A-Service, Streaming Analytics, Edge Analytics, Data Lakes, Social Media Analytics, Predictive Analytics, Security Analytics, High-Performance Data Analytics, Content Analytics, and Video Analytics)

[186 Pages Report] The top 10 analytics technologies market is expected to grow at a significant rate during the forecast period. The base year used for this study is 2014/2015, and the forecast period considered is between 2015 and 2020/2016 and 2021.

Request for Customization to get the top 10 analytics technologies market forecasts to 2024

The objective of this study is to define, describe, and forecast the top 10 analytics technologies markets on the basis of various segments and subsegments. It provides a detailed information regarding the major factors influencing the growth of each market (drivers and restraints). It also includes the profiles of the key players and analysis of their recent developments for the specific analytics technology.

This research study involved extensive usage of secondary sources, directories, and databases such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource to identify and collect information useful for this technical, market-oriented, and commercial study of the top 10 analytics technologies markets. Along with that, a few other market-related sources such as CIOReview and white papers have also been considered while conducting extensive secondary research. The primary sources are mainly several industry experts from core and related industries and preferred system developers, service providers, system integrators, resellers, partners, standards, and certification organizations from companies and organizations related to various segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents that include key industry participants, subject matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information as well as to assess future prospects.

The major players in the market for top 10 analytics technologies include IBM Corporation (U.S.), Oracle Corporation (U.S.), SAS Institute (U.S.), SAP SE (Germany), Microsoft Corporation (U.S.), Dell Technologies, Inc. (U.S.), Cisco Systems (U.S.), Hewlett-Packard Enterprise (U.S.), GoodData Corporation (U.S.), and Informatica Corporation (U.S.). The end users of these analytics technologies are from BFSI, retail, government, healthcare & life sciences, manufacturing, telecommunications & IT, and other sectors.

The Target Audience:

- Analytics/Business Intelligence (BI) platform and software vendors

- Analytics/BI service providers

- Application design and software developers

- System integrators

- IT service providers

- Consulting service providers

- Managed service providers

- Telecom operators

- Government agencies

- Market research and consulting firms

- Cloud service providers

To know about the assumptions considered for the study, download the pdf brochure

Report Scope:

In this report, the Top 10 analytics technologies market has been segmented on the basis of the following categories:

- Analytics-as-a-Service Market

- By Solution

- By Service

- By Analytics Type

- By Vertical

- By Region

- Streaming Analytics Market

- By Type

- By Service

- By Application

- By Industry Vertical

- By Region

- Edge Analytics Market

- By Component

- By Service

- By Application

- By Industry Vertical

- By Region

- Data Lakes Market

- By Software

- By Service

- By Business Function

- By Industry Vertical

- By Region

- Social Media Analytics Market

- By Type

- By Service

- By Application

- By Vertical

- By Region

- Predictive Analytics Market

- By Business Function

- By Application

- By Vertical

- By Region

- Security Analytics Market

- By Application

- By Service

- By Vertical

- By Region

- High-Performance Data Analytics Market

- By Component

- By Data Type

- By Vertical

- By Region

- Content Analytics Market

- By Application

- By Vertical

- By Region

- Video Analytics Market

- By Type

- By Application

- By Vertical

- By Region

Company Profiles: Detailed analysis of the major companies present in the top 10 analytics technologies market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

- Geographic Analysis:

- Further breakdown of the North American markets into major countries

- Further breakdown of the European markets into major countries

- Further breakdown of the Asia-Pacific markets into major countries

- Further breakdown of the Middle East and Africa markets into major countries

- Further breakdown of the Latin American market into major countries

- Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

The top 10 analytics technologies market is expected to grow at a significant rate during the forecast period. The growth of this market is propelled by the advent of IoT and proliferation of massive amounts of data through connected devices, increasing focus on competitive insights, need for increased business agility and scalability, and growing volume and variety of business data across industry verticals. This report categorizes the top 10 analytics technologies market on the basis of software, service, data type, business function, application, industry vertical, and region.

The market for analytics as a service is expected to grow at the highest rate during the forecast period. The analytics as a service market is expected to be the next big thing in a few years. The analytics market evolution started with the digital support system and data warehouse, followed by the introduction of mainstream analytics, analytical tools, and finally, analytics as a service. Organizations adopted the analytics as a service solutions to save time and cost associated with the traditional on-premises analytical and BI platforms. An evolution from on-premises BI platforms to cloud-based BI is marked by the development of analytical tools and advantages, such as effective decision-making processes and enhanced Return on Investment (ROI), for all potential users.

Streaming analytics is another analytics technology that promises huge opportunities for diverse business applications in the current era. Streaming analytics is used widely by major industry verticals such as BFSI, retail & e-commerce, telecommunications & IT, transportation & logistics, energy & utilities, government & defense, healthcare & life sciences, manufacturing, media & entertainment, and others (outsourcing services, education, and travel & hospitality), for different business needs. Some of the major applications of streaming analytics include fraud detection, sales & marketing management, predictive asset maintenance, risk management, network management & optimization, location intelligence, and operations management. The unexpected growth in the adoption of sources such as sensors, mobile devices, and networks has resulted into an exponential increase in data volume, which will increase the demand for streaming analytics across organizations.

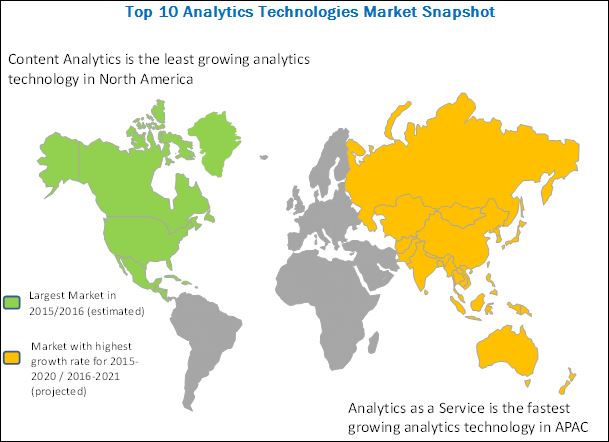

In 2015/2016, North America accounted for the largest share of the top 10 analytics technologies market. In addition, the presence of major industries and advancement in latest technologies are the factors that drive the demand for analytics technologies in this region. Europe accounted for the second-largest share of the top 10 analytics technologies market, while APAC is expected to have the highest growth rate in the top 10 analytics technologies market.

This report describes the drivers and restraints pertaining to each analytics technology in the top 10 analytics technologies market. In addition, it analyzes the current scenario and forecasts the market size till 2020/2021.

The major players in the market for top 10 analytics technologies include IBM Corporation (U.S.), Oracle Corporation (U.S.), SAS Institute (U.S.), SAP SE (Germany), Microsoft Corporation (U.S.), Dell Technologies, Inc. (U.S.), Cisco Systems (U.S.), Hewlett-Packard Enterprise (U.S.), GoodData Corporation (U.S.), and Informatica Corporation (U.S.).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Currency

1.4 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.2 Research Assumptions

3 Analytics-as-a-Service Market (Page No. - 19)

3.1 Executive Summary

3.2 Drivers and Restraints

3.3 Industry Trends

3.4 Analytics-as-a-Service Market Analysis, By Solution

3.5 Analytics-as-a-Service Market Analysis, By Service

3.6 Analytics-as-a-Service Market Analysis, By Analytics Type

3.7 Analytics-as-a-Service Market Analysis, By Vertical

3.8 Analytics-as-a-Service Market Analysis, By Region

4 Streaming Analytics Market (Page No. - 33)

4.1 Executive Summary

4.2 Drivers and Restraints

4.3 Streaming Analytics Market Analysis, By Type

4.4 Streaming Analytics Market Analysis, By Service

4.5 Streaming Analytics Market Analysis, By Application

4.6 Streaming Analytics Market Analysis, By Industry Vertical

4.7 Streaming Analytics Market Analysis, By Region

5 Edge Analytics Market (Page No. - 46)

5.1 Executive Summary

5.2 Drivers and Restraints

5.3 Industry Trends

5.4 Edge Analytics Market Analysis, By Component

5.5 Edge Analytics Market Analysis, By Service

5.6 Edge Analytics Market Analysis, By Application

5.7 Edge Analytics Market Analysis, By Industry Vertical

5.8 Edge Analytics Market Analysis, By Region

6 Data Lakes Market (Page No. - 62)

6.1 Executive Summary

6.2 Drivers and Restraints

6.3 Industry Trends

6.4 Data Lakes Market Analysis, By Software

6.5 Data Lakes Market Analysis, By Service

6.6 Data Lakes Market Analysis, By Business Function

6.7 Data Lakes Market Analysis, By Industry Vertical

6.8 Data Lakes Market Analysis, By Region

7 Social Media Analytics Market (Page No. - 76)

7.1 Executive Summary

7.2 Drivers and Restraints

7.3 Industry Trends

7.4 Social Media Analytics Market Analysis, By Type

7.5 Social Media Analytics Market Analysis, By Service

7.6 Social Media Analytics Market Analysis, By Application

7.7 Social Media Analytics Market Analysis, By Vertical

7.8 Social Media Analytics Market Analysis, By Region

8 Predictive Analytics Market (Page No. - 91)

8.1 Executive Summary

8.2 Drivers and Restraints

8.3 Predictive Analytics Market Analysis, By Business Function

8.4 Predictive Analytics Market Analysis, By Application

8.5 Predictive Analytics Market Analysis, By Vertical

8.6 Predictive Analytics Market Analysis, By Region

9 Security Analytics Market (Page No. - 101)

9.1 Executive Summary

9.2 Drivers and Restraints

9.3 Industry Trends

9.4 Security Analytics Market Analysis, By Application

9.5 Security Analytics Market Analysis, By Service

9.6 Security Analytics Market Analysis, By Vertical

9.7 Security Analytics Market Analysis, By Region

10 High-Performance Data Analytics Market (Page No. - 115)

10.1 Executive Summary

10.2 Drivers and Restraints

10.3 Industry Trends

10.4 High-Performance Data Analytics Market Analysis, By Component

10.5 High-Performance Data Analytics Market Analysis, By Data Type

10.6 High-Performance Data Analytics Market Analysis, By Vertical

10.7 High-Performance Data Analytics Market Analysis, By Region

11 Content Analytics Market (Page No. - 127)

11.1 Executive Summary

11.2 Drivers and Restraints

11.3 Industry Trends

11.4 Content Analytics Market Analysis, By Application

11.5 Content Analytics Market Analysis, By Vertical

11.6 Content Analytics Market Analysis, By Region

12 Video Analytics Market (Page No. - 137)

12.1 Executive Summary

12.2 Drivers and Restraints

12.3 Industry Trends

12.4 Video Analytics Market Analysis, By Type

12.5 Video Analytics Market Analysis, By Application

12.6 Video Analytics Market Analysis, By Vertical

12.7 Video Analytics Market Analysis, By Region

13 Company Profiles (Page No. - 151)

(Overview, Financials, Products & Services, Strategy, and Developments)*

13.1 IBM Corporation

13.2 Oracle Corporation

13.3 SAS Institute

13.4 SAP SE

13.5 Microsoft Corporation

13.6 Dell Technologies, Inc.

13.7 Cisco Systems, Inc.

13.8 Hewlett-Packard Enterprise (HPE)

13.9 Gooddata Corporation

13.10 Informatica Corporation

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 183)

14.1 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.2 Introducing RT: Real-Time Market Intelligence

14.3 Available Customization

14.4 Author Details

List of Tables (55 Tables)

Table 1 Analytics-as-a-Service Market Size and Growth, 2014–2021 (USD Billion, Y-O-Y %)

Table 2 Analytics-as-a-Service Market Size, By Solution, 2014–2021 (USD Million)

Table 3 Analytics-as-a-Service Market Size, By Service, 2014–2021 (USD Million)

Table 4 Analytics-as-a-Service Market Size, By Analytics Type, 2014–2021 (USD Million)

Table 5 Analytics-as-a-Service Market Size, By Vertical, 2014–2021 (USD Million)

Table 6 Analytics-as-a-Service Market Size, By Region, 2014–2021 (USD Million)

Table 7 Streaming Analytics Market Size and Growth, 2014–2021 (USD Billion, Y-O-Y %)

Table 8 Streaming Analytics Market Size, By Type, 2014–2021 (USD Million)

Table 9 Streaming Analytics Market Size, By Service, 2014–2021 (USD Million)

Table 10 Streaming Analytics Market Size, By Application, 2014–2021 (USD Million)

Table 11 Streaming Analytics Market Size, By Vertical, 2014–2021 (USD Million)

Table 12 Streaming Analytics Market Size, By Region, 2014–2021 (USD Million)

Table 13 Edge Analytics Market Size and Growth, 2014–2021 (USD Billion, Y-O-Y %)

Table 14 Edge Analytics Market Size, By Component, 2014–2021 (USD Billion)

Table 15 Edge Analytics Market Size, By Service, 2014–2021 (USD Billion)

Table 16 Edge Analytics Market Size, By Application, 2014–2021 (USD Billion)

Table 17 Edge Analytics Market Size, By Vertical, 2014–2021 (USD Billion)

Table 18 Edge Analytics Market Size, By Region, 2014–2021 (USD Billion)

Table 19 Data Lakes Market Size and Growth, 2014–2021 (USD Billion, Y-O-Y %)

Table 20 Data Lakes Market Size, By Software, 2014–2021 (USD Million)

Table 21 Data Lakes Market Size, By Service, 2014–2021 (USD Million)

Table 22 Data Lakes Market Size, By Business Function, 2014–2021 (USD Million)

Table 23 Data Lakes Market Size, By Vertical, 2014–2021 (USD Million)

Table 24 Data Lakes Market Size, By Region, 2014–2021 (USD Million)

Table 25 Social Media Analytics Market Size and Growth, 2013-2020, (USD Million, Y-O-Y%)

Table 26 Social Media Analytics Market Size, By Type, 2013–2020 (USD Million)

Table 27 Social Media Analytics Market Size, By Service, 2013–2020 (USD Million)

Table 28 Social Media Analytics Market Size, By Application, 2013–2020 (USD Million)

Table 29 Social Media Analytics Market Size, By Vertical, 2013–2020 (USD Million)

Table 30 Social Media Analytics Market Size, By Region, 2013–2020 (USD Million)

Table 31 Predictive Analytics Market Size and Growth, 2013-2020, (USD Million, Y-O-Y %)

Table 32 Predictive Analytics Market Size, By Business Function, 2013–2020 (USD Million)

Table 33 Predictive Analytics Market Size, By Application, 2013–2020 (USD Million)

Table 34 Predictive Analytics Market Size, By Vertical, 2013–2020 (USD Million)

Table 35 Predictive Analytics Market Size, By Region, 2013–2020 (USD Million)

Table 36 Security Analytics Market Size and Growth, 2014–2021 (USD Million, Y-O-Y %)

Table 37 Security Analytics Market Size, By Component, 2014–2021 (USD Million)

Table 38 Innovation Spotlight: Latest Security Analytics Innovations

Table 39 Security Analytics Market Size, By Application, 2014–2021 (USD Million)

Table 40 Security Analytics Market Size, By Service, 2014–2021 (USD Million)

Table 41 Security Analytics Market Size, By Vertical, 2014–2021 (USD Million)

Table 42 Security Analytics Market Size, By Region, 2014–2021 (USD Million)

Table 43 High-Performance Data Analytics Market Size and Growth Rate, 2014–2021 (USD Billion, Y-O-Y %)

Table 44 High-Performance Data Analytics Market Size, By Component, 2014–2021 (USD Billion)

Table 45 High-Performance Data Analytics Market Size, By Data Type, 2014–2021 (USD Billion)

Table 46 High-Performance Data Analytics Market Size, By Vertical, 2014–2021 (USD Billion)

Table 47 High-Performance Data Analytics Market Size, By Region, 2014–2021 (USD Billion)

Table 48 Content Analytics Market Size, By Application, 2014–2021 (USD Million)

Table 49 Content Analytics Market Size, By Vertical, 2014–2021 (USD Million)

Table 50 Content Analytics Market Size, By Region, 2014–2021 (USD Million)

Table 51 Global Video Analytics Market Size and Growth, 2014–2021 (USD Million, Y-O-Y %)

Table 52 Video Analytics Market Size, By Type, 2014–2021 (USD Million)

Table 53 Video Analytics Market Size, By Application, 2014–2021 (USD Million)

Table 54 Video Analytics Market Size, By Vertical, 2014–2021 (USD Million)

Table 55 Video Analytics Market Size, By Region, 2014–2021 (USD Million)

List of Figures (59 Figures)

Figure 1 Analytics-as-a-Service Market: Value Chain Analysis

Figure 2 Financial Analytics Solution Estimated to Have Largest Market Size in 2016 (USD Million)

Figure 3 Managed Services to Record Highest Growth During 2016–2021 (USD Million)

Figure 4 Predictive Analytics to Record Highest Growth During 2016–2021 (USD Million)

Figure 5 Transportation and Logistics Vertical to Record Highest Growth During 2016–2021 (USD Million)

Figure 6 North America to Have Largest Market Size During 2016–2021 (USD Million)

Figure 7 Services Segment to Record Highest Growth During 2016-2021 (USD Million)

Figure 8 Managed Services to Record Highest Growth During 2016-2021 (USD Million)

Figure 9 Operations Management Application to Record Highest Growth During 2016-2021 (USD Million)

Figure 10 Media and Entertainment Vertical to Record Highest Growth During 2016-2021 (USD Million)

Figure 11 North America to Be the World’s Largest Streaming Analytics Market During 2016-2021 (USD Million)

Figure 12 Edge Analytics Market: Value Chain Analysis

Figure 13 Services Segment to Record Highest Growth During 2016-2021 (USD Billion)

Figure 14 Managed Services to Record Highest Growth During 2016–2021 (USD Billion)

Figure 15 Human Resources Application to Record Highest Growth During 2016–2021 (USD Billion)

Figure 16 IT and Telecom Vertical to Record Highest Growth During 2016–2021 (USD Billion)

Figure 17 North America to Be the World’s Largest Edge Analytics Market During 2016-2021 (USD Billion)

Figure 18 Data Visualization Software to Record Highest Growth During 2016-2021 (USD Million)

Figure 19 Managed Services to Record Highest Growth During 2016–2021 (USD Million)

Figure 20 Operations Business Function to Record Highest Growth During 2016–2021 (USD Million)

Figure 21 Healthcare and Life Sciences Vertical to Record Highest Growth During 2016–2021 (USD Million)

Figure 22 North America Estimated to Hold Largest Share of Global Data Lakes Market in 2016 (USD Million)

Figure 23 Social Media Analytics Market: Value Chain Analysis

Figure 24 Social Media Analytics Market: Porter’s Five Forces Analysis

Figure 25 Services Segment to Record Highest Growth During 2015-2020 (USD Million)

Figure 26 Consulting Services to Record Highest Growth During 2015–2020 (USD Million)

Figure 27 Customer Behavioral Analysis to Hold Largest Share Among All Applications During 2015–2020 (USD Million)

Figure 28 Retail Vertical to Have Largest Market Size in 2015 (USD Million)

Figure 29 North America to Be the World’s Largest Social Media Analytics Market During 2015-2020 (USD Million)

Figure 30 HR Business Function to Record Highest Growth During 2015-2020 (USD Million)

Figure 31 Network Management Application to Record Highest Growth During 2015-2020 (USD Million)

Figure 32 Manufacturing Vertical to Record Highest Growth During 2015-2020 (USD Million)

Figure 33 North America to Be the World’s Largest Predictive Analytics Market During 2015-2020 (USD Million)

Figure 34 Security Analytics Demand: Number of Cyberattacks, By Top Vertical, March 2015–March 2016

Figure 35 Endpoint Security Analytics to Record Highest Growth During 2016-2021 (USD Million)

Figure 36 Managed Services to Record Highest Growth During 2016–2021 (USD Million)

Figure 37 BFSI Vertical to Record Highest Growth During 2016-2021 (USD Million)

Figure 38 North America to Be the World’s Largest Security Analytics Market During 2016-2021 (USD Million)

Figure 39 High-Performance Data Analytics Market: Value Chain Analysis

Figure 40 Storage Segment to Record Highest Growth During 2016-2021 (USD Million)

Figure 41 Unstructured Data Type to Dominate Hdpa Market During 2016-2021 (USD Billion)

Figure 42 Healthcare & Life Sciences Vertical to Record Highest Growth in Hpda Market During 2016-2021 (USD Billion)

Figure 43 North America to Be the World’s Largest Hpda Market During 2016-2021 (USD Billion)

Figure 44 Social Media Analytics to Record Highest Growth During 2016-2021 (USD Million)

Figure 45 Travel and Hospitality Vertical to Record Highest Growth During 2016–2021 (USD Million)

Figure 46 North America to Be the World’s Largest Content Analytics Market During 2016-2021 (USD Million)

Figure 47 Server-Based Architecture Implementation

Figure 48 Edge-Based Architecture Implementation

Figure 49 Services Segment to Record Highest Growth During 2016-2021 (USD Million)

Figure 50 Counting and Crowd Management Application to Record Highest Growth During 2016-2021 (USD Million)

Figure 51 Retail Vertical to Record Highest Growth During 2016-2021 (USD Million)

Figure 52 North America to Be the World’s Largest Video Analytics Market During 2016-2021 (USD Million)

Figure 53 IBM Corporation: Company Snapshot

Figure 54 Oracle Corporation: Company Snapshot

Figure 55 SAS Institute: Company Snapshot

Figure 56 SAP SE: Company Snapshot

Figure 57 Microsoft Corporation: Company Snapshot

Figure 58 Cisco System, Inc.: Company Snapshot

Figure 59 Hewlett-Packard Enterprise: Company Snapshot

Growth opportunities and latent adjacency in Top 10 Analytics Technologies