Impact of Titanium Dioxide on Water Treatment Chemicals Industry Market - Current Industry Problem With Respect to Ferric Chloride (Coagulant In Water Treatment Chemicals), Shortage: A View From Titanium Dioxide Perspective

Current Industry Problem with Respect to Ferric Chloride (Coagulant in Water Treatment Chemicals), Shortage: A View From Titanium Dioxide Perspective

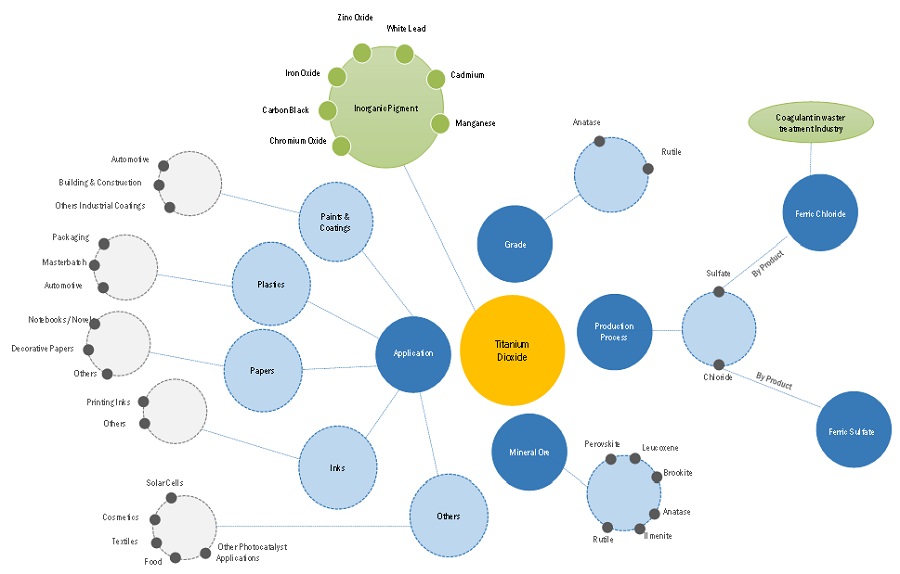

Titanium dioxide is a crucial component in the production of paints and coatings due to its excellent opacity, brightness, and UV-protective properties. The paint and coating industry is the largest consumer of titanium dioxide, accounting for around 50% of the total titanium dioxide market by volume. The ongoing Russia-Ukraine war has created a shortage of titanium dioxide (TiO2) raw material supplies. Ukraine alone has around 20% of the global reserves of titanium ores. This shortage has raised the concern of many Ferric Chloride manufactures as they are already facing lack of supply of metal scrap for the production. Many Steel making manufacturers are moving towards Electric Arc furnace as it uses 100% of Steel scrap and it produces 75% less carbon dioxide than traditional steelmaking. The market for Electric Arc furnace is estimated to grow rapidly in upcoming years and will aggravate the situation.

The global Titanium Dioxide market size is projected to grow from USD 24.8 billion in 2022 to USD 27.9 billion by 2026, at a CAGR of 5.9% between 2022 and 2026. The growth of the titanium dioxide market is mainly driven by the rising demand from the paints and coatings industry. Also, the growing production of plastic for packaging and automotive applications in APAC and increasing demand for printing inks across the world will support market growth.

Titanium Dioxide Market Dynamics

Driver: Increasing demand for Titanium dioxide in various end-use industries

The growth of various end-use industries, construction, Automotive and including cosmetic & personal care industries, particularly in emerging regions such as Asia Pacific, drives the growth. The paints & coatings industry accounts for more than 50% share of the global market for titanium dioxide. Apart from the construction industry, titanium dioxide has growing demand from sectors such as industrial and automotive & transportation. Titanium dioxide in the pigment form is one of the main constituents of decorative paints. Decorative paints and coatings are applied on the interior and exterior walls, wall paintings, wood flooring, sculpture, and furniture of all kinds of residential, commercial, industrial, and institutional buildings.

Restrain: Stringent environmental policies of governments regarding production of titanium dioxide

Several waste products are released during the production of titanium dioxide; therefore, several restrictions have been implemented by governments across the world to control the emission and ensure careful disposal of this waste. Titanium dioxide itself is acidic, and its improper disposable method creates numerous environmental problems. The dumping of sulfuric acid into the sea causes a sudden drop in the pH value of receiving water and reduces the oxygen levels in the water, thereby destroying marine life. Also, when dumped into the soil, sulfuric acid is released into the air, causing a harmful effect on the environment. The Government of China and the European government have enforced environmental policies to prohibit the discharge of the waste generated during the manufacturing of titanium dioxide into rivers or seawater and harmonize programs that limit discharge and wastewater.

Opportunity: Increased use of titanium dioxide as photocatalyst

A photocatalyst accelerates light-induced reactions without being consumed in the process. Titanium dioxide is utilized as a photocatalyst in various environmental and energy applications. Titanium dioxide is preferred as a photocatalyst due to its chemical stability, non-toxicity, eco-friendliness, optical and electronic properties. In the self-cleaning technology, the photocatalytic property of titanium dioxide provides resistance to dirt by starting an electrochemical reaction to break down the dirt particles. Free radicals formed from the electrochemical process can inactivate fungi, viruses, and bacteria. Free radicals also decompose pollutants before disappearing. Titanium oxide mixed with manganese compound works effectively to clean the surfaces from metals to fabrics in visual light.

Challenge: Volatility in cost of titanium dioxide

The fluctuation in the prices of raw materials required in the production of titanium dioxide directly impacts the growth of the titanium dioxide market. Factors impacting the prices of raw materials necessary to manufacture titanium dioxide are the constant changes in import and export policies and stringent government norms imposed for environmental safety. For example, in 2017, 73 Chinese feedstock plants failed to meet the requirements from the State Environmental Protection Administration of China over 12 months; therefore, these plants are closed permanently by the government. The closure of these production plants creates a sudden hike in the prices. In China, the sulfate process is used to produce titanium dioxide. Hence, the use of sulfur in the sulfuric acid industry in China mainly relies on export. Therefore, the change in the international market price of sulfur will directly affect the price of sulfuric acid, thereby affecting the price of titanium dioxide.

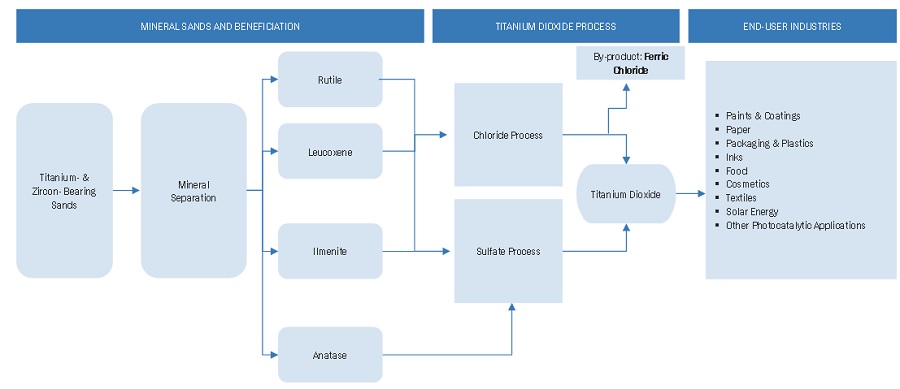

Based on Grade, rutile grade are projected to be the fastest-growing type for Titanium dioxide market.

Based on grade, the global titanium dioxide market has been classified into rutile and anatase. Rutile is the purest and most widespread form of titanium dioxide. It appears deep red in color. Rutile-grade titanium dioxide can be manufactured using sulfate and chloride processes. Anatase is a type of polymorph and is the rarest form of titanium dioxide. Anatase becomes rutile when exposed at about 915°C and becomes yellow when the temperature is higher than 400°C. It is only produced using the sulfate process. Rutile titanium dioxide is preferred in paints and coating to provide coverage because of better color strength and opacity than anatase-grade titanium dioxide. It is more suitable for outdoor and interface applications because of its high reflective index. Anatase-grade titanium dioxide is used as a colorant and photocatalyst in the printing inks, paper, and construction industries.

Based on Manufacturing process, chloride process is estimated to be the fastest-growing process for Titanium dioxide market.

Commercially, titanium dioxide is extracted from natural rutile ore or slag. The extracted titanium dioxide used to synthesize the pigments exists in two crystalline forms, namely, anatase and rutile. The synthesis involves two processes—the chloride process and the sulfate process. Rutile-grade titanium dioxide is produced from chloride and sulfate processes, whereas anatase titanium dioxide is only produced from sulfate processes. Currently, the sulfate process dominates the production of titanium dioxide due to the lower production cost compared to the chloride process. China is the major player in the production and consumption of titanium dioxide. In China, due to environmental pollution, the government regulates the utilization of sulfate process technology in the industry. The global manufacturers are focused on shifting toward the chloride process due to environmental considerations and end-use requirements for high-quality titanium dioxide. The chloride process is expected to dominate the titanium dioxide market during the forecast period.

Based on Application, the paints & Coating segment is estimated to be the fastest-growing segment of the Titanium dioxide market.

Paints & Coating is estimated to be the largest and fastest-growing application of titanium dioxide. Titanium dioxide is utilized in paints and coatings to provide better coverage, brightness, whiteness, opacity, and durability. Titanium dioxide finds applications in different paints and coatings that include architectural coatings, automotive OEM coatings, general industrial finishes, powder coatings, waterborne paints, protective coatings, wood finishes, and other coatings. The rapidly growing housing and construction sector, increasing gross domestic product (GDP), ongoing rapid urbanization, and increasing disposable income propel the paints and coatings market.

Asia Pacific is projected to grow the fastest in the overall Titanium dioxide market during the forecast period.

Asia Pacific is projected to be the fastest-growing region for titanium dioxide market between 2022 and 2026. Increasing investments in infrastructure development projects, growing urbanization, improving standard of living, and thriving automotive sector, as well as high economic growth, are the key factors for the region's overall growth. Moreover, the growth is mainly attributed to the rising population in the region. With economic contraction and market saturation in Europe and North America, manufacturers are shifting to APAC. The strengthening economy of countries such as China and India attracts new investments from global manufacturers. APAC is the largest market for the paints and coating industry, driven by the ever-increasing population and rapid urbanization in China and India.

Key Market Players

Leading players in the titanium dioxide market are The Chemours Company (US), Tronox Holding PLC (US), Lomon Billions Group (China), Venator Materials PLC (UK), Kronos Worldwide Inc. (US), INEOS (UK), CINKARNA Celje d.d (Slovenia), TAYCA Corporation (Japan), ILUKA Resources (Australia), and Evonik Industries AG (Germany). These market players adopt key growth strategies such as expansions, partnerships, and acquisitions.

Recent Developments

- In May 2020, Tronox Holdings plc signed an agreement with Eramet S.A (France) to acquire the TiZir Titanium and Iron ("TTI") business.

- In July 2020, The company planned to invest USD 2 billion to expand mining operations in Panzhihua City, China, to produce ilmenite.

Titanium Dioxide Ecosystem

MnM has a specialized practice area named “Water Treatment” and Paint & Coating within its CnM domain, which extensively covers various chemicals (Titanium dioxide) value chain from raw materials to end-use industries.

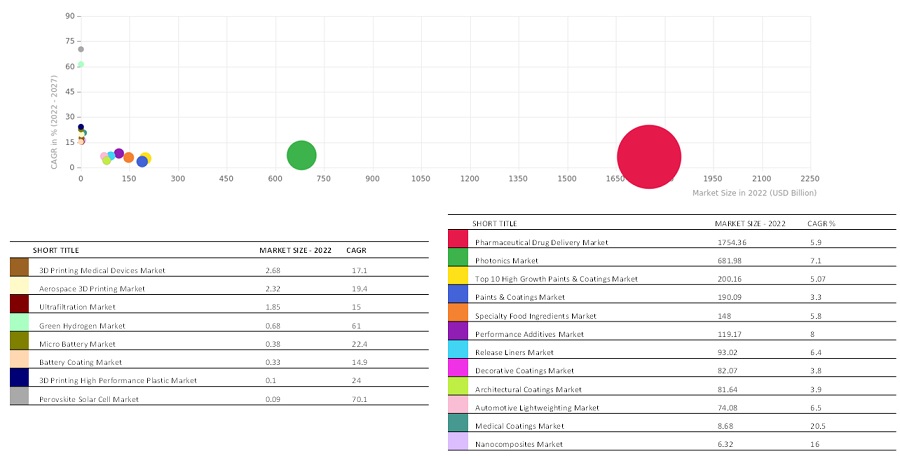

Marketsandmarkets’ coverage of high-growth niche markets relevant to Titanium dioxide

MnM has published research studies across the Titanium dioxide ecosystem covering paints & coating, inks, water treatment chemicals etc.

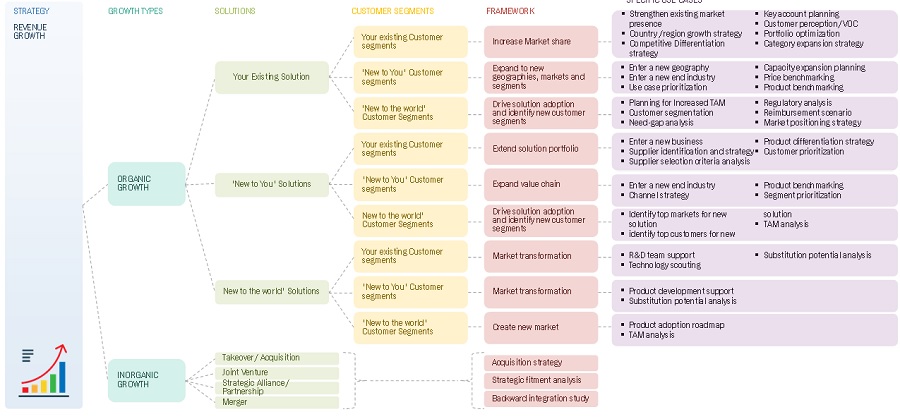

Client’s Problems Pertaining To ‘Titanium Dioxide’ Identified And Actionable Solutions Provided By Mnm

MnM has been working with titanium dioxide manufacturing companies to identify the pain points, unknowns, and adjacencies in the market and high-growth niche opportunities and provide actionable solutions. Various client problems, such as Customer Identification, Key Accounts Planning, Total Addressable Market Expansion, Product-Market Fit Assessment, M&A Intelligence, Strategic Planning, Competitive Strategy Planning, and Vendor Analysis, etc. have been identified and solved through various solutions offered by MnM.

Below are a few Revenue Impact stories on leading water treatment organizations.

MarketsandMarkets helped a Reputed Client to Penetrate in APAC Tio2 Market, With A Projected Revenue of Us$ 10 million in 5 Years.

Headline

MnM helped a top Mining Company identify Feedstock supplier and targeted countries to generate a revenue opportunity of ~USD 10 million over 5 years.

Client’s Problem statement

The client was keen to increase its market penetration in the APAC market and was looking out to develop an in-depth understanding of the current and future potential of Titanium dioxide. The key objectives of the study were to analyze the market potential in different applications and end-use industry, key customers, and leading suppliers, manufacturing and technologies. The client also wanted to identify raw material supplier and pricing analysis for raw material like ilmenite and rutile for titanium dioxide production as they were facing shortage of the raw material due to Russia Ukraine war. The client further wanted to identify new revenue pocket opportunities for Ferric chloride (By-product of Titanium Dioxide) in different geographies as market supply was low due to the shortage of the raw material (metal scrap) specially in north America. The shortage is expected to increase in future as more and more steel manufacturing are adapting Electric Arc furnace method to produce steel. In America alone 75% of the steel is produced using Electric Arc furnace technology.

MnM Approach

In the market analysis, MNM assisted the client in understanding the current potential of titanium dioxide in different types of applications and end-use industries. MnM also identified the top supplier for raw material, ilmenite, and rutile in APAC region to build a stronger supply chain for the client. Based on the given analysis client approached key customers in APAC to strengthen its business relationship.

Revenue Impact (RI)

Our findings helped the client to penetrate the market, with projected revenue of $10 million in 5 years. The client was able to establish and grow his Titanium dioxide business in APAC and strengthen its position as a ferric chloride supplier in different geographies.

MNM’s Offerings:

How MNM can assist to provide solutions pertaining to key challenges in the industry for Titanium dioxide.

Growth opportunities and latent adjacency in Impact of Titanium Dioxide on Water Treatment Chemicals Industry Market