Tire Modeling Software Market - Global Forecast to 2029

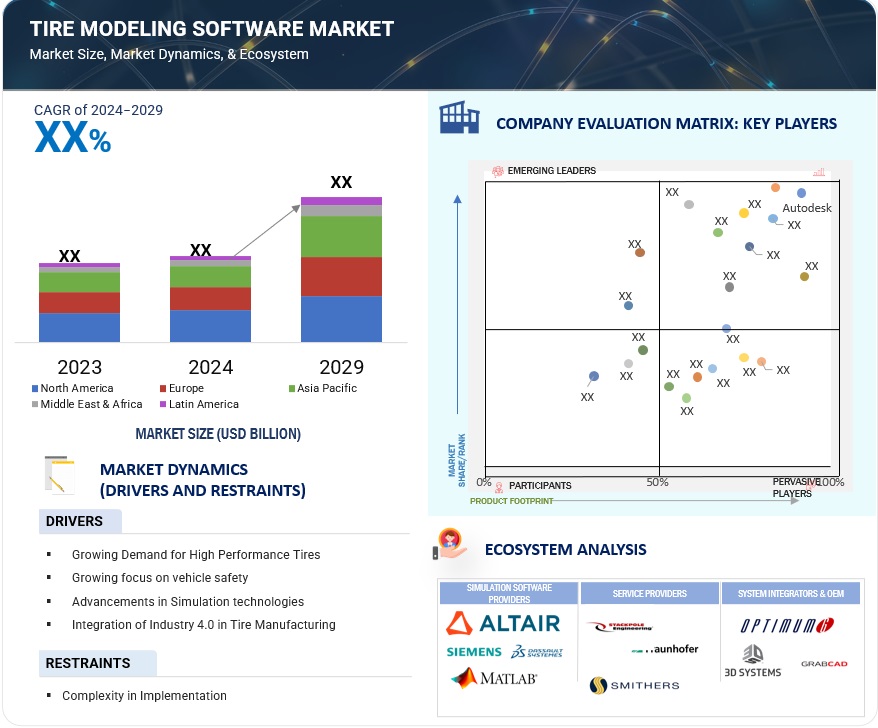

The Tire Modeling Software Market will grow from USD XX billion in 2024 to USD XX billion by 2029 at a compounded annual growth rate (CAGR) of XX% during the forecast period. Tire modeling software is a tool that supports tire manufacturers' design and optimization of tires for the more considerable demands of modern vehicles. Virtual prototyping, real-time simulation, and comprehensive performance assessment offer testing capabilities for such phenomena as rolling resistance, tread wear, and heat dissipation effects. This is made even better by the contributory advantages of artificial intelligence and machine learning, delivering predictive insights and adaptive design in developing novel and well-efficient tires. This technology serves the growing demand for tires devoted to electric vehicles (EVs), autonomous vehicles (AVs), and high-performance applications.

Additionally, tire modeling software ensures precise performance testing and promotes efficient material usage, enhancing safety and Sustainability in tire design. As consumer expectations evolve and regulatory standards become more stringent, this software allows manufacturers to innovate rapidly, better address diverse market needs, and align with emerging industry trends. Consequently, tire modeling software has become a driving force behind the growing tire demand and is pivotal in supporting the tire industry's expansion and modernization.

To know about the assumptions considered for the study, Request for Free Sample Report

ATTRACTIVE OPPORTUNITIES IN RAIL TRAFFIC MANAGEMENT MARKET

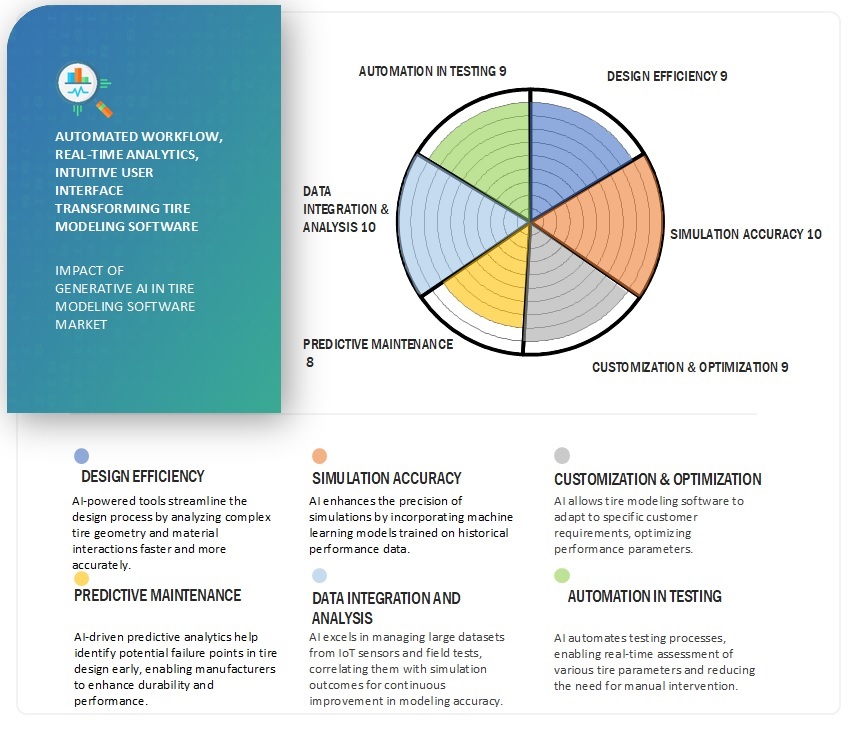

Impact of Gen AI on the Tire Modeling Software Market

Tire Modeling Software Market Dynamics

Driver: Growing Demand for High-Performance Tires

The rising demand for high-performance tires is expected to drive the demand for advanced tire modeling software. Many luxury, sports, and electric vehicles use performance tires that require engineering precision in durability, grip, efficiency, and environmental standards.

As a result, tire modeling software assists tire manufacturers in tracking various parameters when developing the tires without using a physical model, for instance, when the tire is in contact with different surface road types, in various weather conditions, or under load. This makes the design process more efficient, affordable, and quicker when launching the product to the market. It also helps to understand key characteristics such as traction stiffness, heat insulation, and surface abrasion, which are important for tries. Also, AI and ML features are now integrated into tire modeling applications as add-on technology, consequently providing foresight and re-optimizing tire structures during the design. As companies observe an increase in the requirement for high-performance tires, tire modeling software is an essential tool for design.

Restraint: Complexity in implementation

The complexity in implementation is a significant restraint for the tire modeling software market. These software solutions often require highly specialized knowledge and expertise to configure and integrate into existing systems, which can be barriers for many tire manufacturers. The process involves a steep learning curve, especially for users trying to understand the advanced algorithms and tire behavior models based on these tools. On top of that, integrating tire modeling software with other systems, such as design and manufacturing platforms, may technically prove demanding and time-consuming. Such complexities result in increased training costs, thereby taking longer implementation times and growing chances of mistakes or inefficiencies as these components are adopted. This, in turn, discourages the manufacturers from investing in such solutions and slows down overall market growth. It is a challenging situation frequently encountered by small and medium-sized enterprises without resources supporting such an intricate implementation process.

Opportunity: Growing Adoption of Autonomous and EV Vehicles

The rising adoption of electric vehicles (EVs) and autonomous vehicles (AVs) creates a substantial growth opportunity for tire modeling software. Electric cars need a specific type of tire capable of carrying more weight because of battery loads, low rolling resistance for energy savings, and minimizing the noise produced while driving. On the other hand, autonomous cars need tires that are much more durable, have specific performance requirements, and use materials that will be safe and reliable in all climates and situations.

These issues can be addressed in part through tire modeling software. It helps companies replicate the tires' physical performance without making too many processes that require mold making, and the actual tire costs a lot of production time. This technology facilitates understanding rolling resistance, tread wear, heat generation, and load distribution under various operational conditions. Such facilities are required to enhance our knowledge of tire performance on electric and autonomous vehicles.

The software's effectiveness in designing tires has improved. As the electric vehicle and autonomous vehicle markets expand and evolve, tire modeling software will be crucial in driving future expansion.

Challenge: Integration with other engineering systems for seamless operations.

Integration with other engineering systems remains a challenge for tire modeling software. It often has to interact seamlessly with CAD, CAE, and simulation tools to represent tire performance for various conditions accurately. It cannot be very easy because of differences in file formats, data structures, and computational standards since adapting all these different software packages into a common framework platform supports data exchange between them. This standardization deficiency complicates data exchange and causes inefficiencies and, worse, inaccuracies in simulation output. Modern designs of vehicles have increasingly advanced materials and technologies. Thus, tire modeling must be at the same level with multidisciplinary engineering processes such as aerodynamics and vehicle dynamics, intensifying the integration demands. These barriers will require considerable investments in interoperability solutions and the development of standard data protocols to increase software companies' costs and timelines, potentially stalling market growth.

The Tire Modeling Software Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

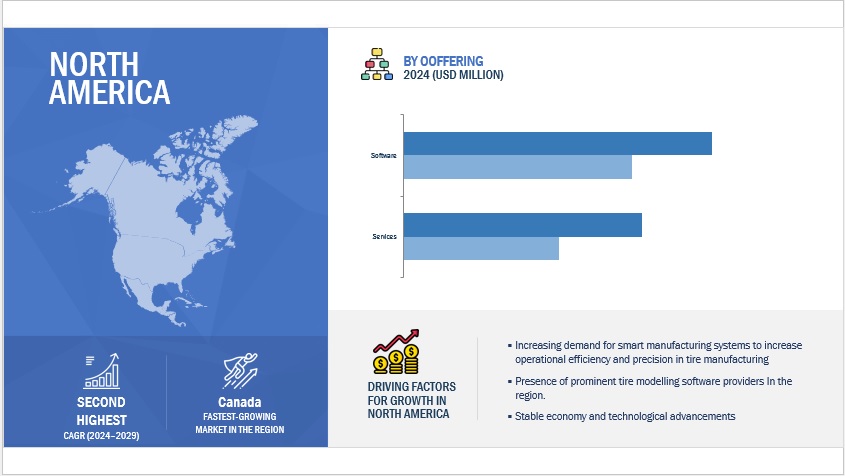

Based on the offering, the software segment holds the largest market share during the forecast period.

The software segment dominates the tire modeling software market during the forecast period, driven by its essential role in designing, simulating, and optimizing tire assembly. Advanced software has become an integral part of tire manufacturers, helping them model complex tire structures that perform under diverse conditions, thus improving performance and safety. The demand for accurate tire modeling has increased due to electric and autonomous vehicles requiring unique performance specifications. Software solutions also provide scalability and compatibility with CAD and CAM systems and real-time data analysis that producers can use to optimize product development cycle time. The adaptability of software products to new technologies, such as artificial intelligence and machine learning, improves predictability and strengthens leadership in the market. The growing adoption of digital transformation by the automotive industry makes the software segment beneficial in terms of sustainability targets and regulatory compliance for continued leadership in the market for tire modeling software.

Based on end users, the aftermarket segment will grow at the highest CAGR during the forecast period.

In tire modeling markets, the aftermarket segment is projected to grow during the forecast period at the highest CAGR due to the increasing need for cost-effective and flexible tire solutions. In terms of market growth, it is expected that growing interest in making vehicles unique and improvements in the performance of cars will take the aftermarket provider to advanced modeling software, which focuses on safety and optimization of designs-the replacement segment will account for more tire upgrades and retrofit applications with the advent of electric and autonomous vehicles. Aftermarket offerings are typically considered more affordable than original equipment manufacturer offerings, making them within reach of a broader customer population, including small businesses and repair shops. Tires' Sustainability and longevity will be key priorities increasingly reflected in the aftermarket, where growth will most likely be witnessed in the market.

Based on the region, North America holds the largest market share during the forecast period.

North America is expected to hold the largest market share in the tire modeling software market during the period under consideration due to its strong automotive and transportation sectors. North America has some leading tire manufacturers and automotive companies heavily investing in advanced technology for better product design, performance, and safety standards. For instance, major players such as Michelin and Goodyear have encouraged using simulation tools to enhance the development processes significantly while reducing overall time-to-market. Additionally, EV or electric vehicle market growth and the advent of self-driving technology in North America will further boost the market since these segments need personalized designs for greater efficiency and more extended durability. Materially high R&D investments coupled with partnerships with software developers give further impetus to the region's stronghold, making North America an essential center for tire modeling technology innovation. The region's highly developed regulatory framework also strongly emphasizes tire performance and safety, which boosts requirements for precise modeling solutions.

Key Market Players

The tire modeling software market is dominated by a few globally established players such as Siemens (Germany), Calspin (US), Optimumg (US), Smithers (US), Cosin Scientific Software (Germany), Stackpole Engineering Services (US), Dassault Systems (French), Altair Engineering (US), MATLAB (US), Ansys (US), Fraunhofer (Germany), BETA CAE (Switzerland), Dufournier (France), GrabCAD (US), and 3D Systems (US) among others, are the key vendors that secured tire modeling software market in last few years. Customers are conducting experiments in the tire modeling software market because of their increased standard of living, ease of access to information, and quick adoption of technical items.

Recent Developments:

- In August 2024, Altair and Oasys announced a joint development agreement to create an integrated solution for crash and safety simulation in the automotive sector. The collaboration linked Altair's HyperWorks platform with Oasys Primer, providing a seamless workflow for crash safety analysis. This solution, powered by AI-augmented 3D modeling, aimed to enhance crash simulations with advanced pre- and post-processing tools for engineers.

- In May 2024, Smithers and Stackpole Engineering Services launched Virtual Tire Lab, a subscription-based platform offering a comprehensive toolset for analyzing and modifying tire models. The service provided ongoing updates to its library of tire models, including popular categories such as all-weather and EV-specific tires. It included Agile Tire software for in-depth analysis and simulation integration. This collaboration combined decades of expertise from both companies in tire testing and development.

- In March 2023, Siemens and Continental Tires announced a strategic supplier agreement to equip Continental's tire factories with advanced automation and drive technology. This collaboration aims to optimize global tire production, enhance machine efficiency, and drive standardization across production lines. Siemens will supply key automation systems and provide training while supporting sustainable production through long-lifecycle hardware and seamless software integration.

Frequently Asked Questions (FAQ):

What is tire modeling software?

What initiatives have tech giants implemented to enhance the development of tire modeling software?

Which are the key vendors exploring tire modeling software?

What is the total CAGR recorded for the tire modeling software market from 2024 to 2029?

Who are vital clients adopting tire modeling software?

Key clients adopting the tire modeling software include: -

- Tire Manufacturers

- Automotive OEMs (Original Equipment Manufacturers)

- Motorsport Teams

- Engineering and Design Consultancies

- Material Research Companies

- Simulation Software Developers

- R&D Centers in the Automotive Sector

- Universities and Academic Institutions

- Industrial Vehicle Manufacturers

- Aftermarket Performance Tuning Companies

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Growth opportunities and latent adjacency in Tire Modeling Software Market