Third-Party Risk Management Market by Component (Solution (Financial Control, Contract, Operational Risk, Audit, and Compliance) and Service (Professional & Managed)), Deployment Mode, Organization Size, Vertical, and Region - Global Forecast to 2035

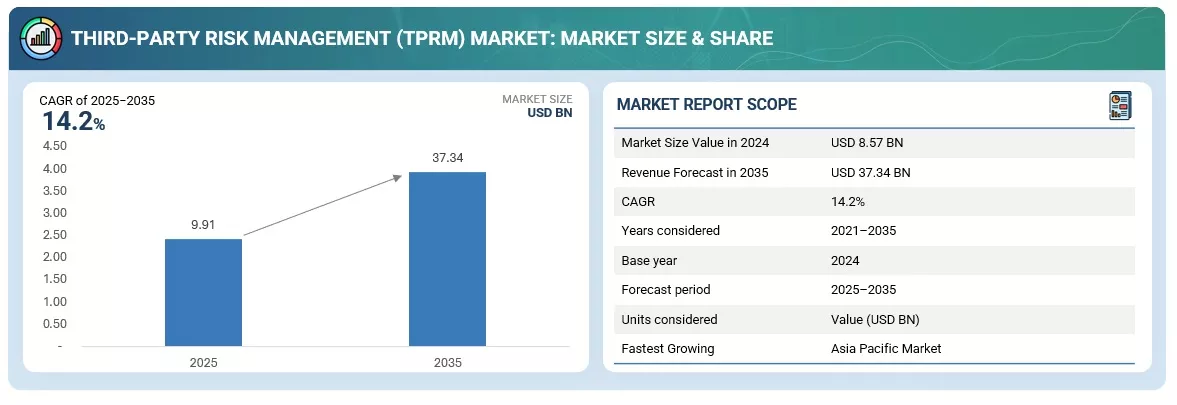

The global third-party risk management (TPRM) market was valued at USD 8.57 billion in 2024 and is projected to reach USD 37.34 billion by 2035, growing at a CAGR of 14.2% between 2025 and 2035.

The market growth is driven by rising regulatory compliance requirements, increasing dependence on external vendors, and growing cybersecurity threats across supply chains. As organizations expand outsourcing and digital transformation initiatives, transparency, accountability, and risk mitigation in third-party relationships have become critical. Integrating artificial intelligence (AI), machine learning (ML), and automation into TPRM solutions enables continuous monitoring and predictive risk analysis.

Third-Party Risk Management (TPRM) refers to identifying, assessing, and mitigating risks associated with external partners, vendors, and service providers accessing an organization’s systems, data, or operations. These risks include cybersecurity threats, compliance violations, financial instability, or operational failures. A typical TPRM framework involves multiple stages — vendor onboarding, due diligence, continuous monitoring, and remediation. Modern TPRM solutions use AI-based analytics, automation, and centralized dashboards to evaluate real-time supplier risk profiles. Continuous risk scoring, regulatory mapping, and integration with governance, risk, and compliance (GRC) systems allow organizations to manage vendor ecosystems efficiently while maintaining regulatory alignment.

Market by Application

BFSI (Banking, Financial Services, and Insurance)

The BFSI sector holds a significant share in the third-party risk management market due to its high dependency on external vendors for IT infrastructure, data processing, and customer-facing services. Financial institutions face stringent compliance obligations from regulators such as the FCA, FINRA, and the European Banking Authority, making vendor oversight critical. TPRM solutions in this segment enable banks and insurers to conduct due diligence, monitor data handling practices, and mitigate cybersecurity risks associated with outsourced functions. Additionally, adopting AI-driven continuous monitoring and automated risk scoring tools helps financial organizations reduce exposure to supply-chain attacks and maintain operational resilience. The growing integration of fintech ecosystems further amplifies the need for robust, scalable TPRM frameworks across the BFSI industry.

IT & Telecom

The IT and telecom industry plays a vital role in the third-party risk management market because of its extensive reliance on global suppliers, cloud service providers, and managed service partners. With increasing interconnectivity and network data exchange, any vendor compromise can disrupt critical operations and affect service continuity. TPRM solutions help organizations in this sector continuously assess vendor cybersecurity posture, ensure regulatory compliance with data protection laws, and strengthen supply-chain security. Furthermore, the rapid rollout of 5G, edge computing, and IoT infrastructure has intensified the need for proactive vendor risk identification and governance. As telecom operators expand collaborations with hyperscalers and SaaS providers, the demand for integrated, real-time third-party monitoring platforms continues to grow.

Healthcare

The healthcare application segment represents a significant opportunity in the third-party risk management market due to increasing digitalization of patient data and the rising use of third-party service providers for diagnostics, telemedicine, and health IT systems. Healthcare organizations are particularly vulnerable to vendor-induced data breaches and regulatory violations under laws such as HIPAA and GDPR. TPRM solutions enable hospitals and medical service providers to vet vendors, track compliance documentation, and monitor data security practices. Advanced analytics and automation help detect vulnerabilities and non-compliance issues early. The growing adoption of electronic health records (EHRs), connected medical devices, and cloud-based healthcare platforms is further driving the implementation of robust third-party risk frameworks across the industry.

Market by Technology

Cloud-Based Platforms

Cloud-based technology is among the dominant approaches in the third-party risk management (TPRM) market due to its scalability, flexibility, and cost efficiency. Cloud-based TPRM platforms enable organizations to centralize vendor data, automate workflows, and perform real-time monitoring across globally distributed suppliers. They offer seamless integration with governance, risk, and compliance (GRC) tools, allowing enterprises to dynamically manage regulatory updates and vendor risks. Additionally, adopting cloud-based TPRM solutions supports collaboration between internal teams and external partners, improving transparency and response time to risk incidents. The growing shift toward SaaS models and hybrid cloud environments, coupled with increasing cyberattacks on third-party ecosystems, is fueling substantial demand for these platforms. The market for cloud-based TPRM solutions is projected to expand significantly between 2025 and 2035, reflecting its role as a key enabler of continuous vendor risk assessment and global compliance management.

Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML technologies play a transformative role in the third-party risk management market by enhancing vendor assessments' precision, speed, and predictive capability. These technologies enable automated analysis of large datasets to identify emerging risks, anomalies, and compliance gaps before they escalate. AI-powered platforms can analyze vendor behavior patterns, assign dynamic risk scores, and even predict potential disruptions or cyber incidents through predictive analytics. Machine learning algorithms continuously improve, learning from new data to refine risk detection accuracy. Integrating AI and ML in TPRM helps reduce manual workload, improve decision-making, and accelerate risk mitigation. With organizations increasingly seeking intelligent, proactive solutions, the AI-driven TPRM segment is projected to register the fastest CAGR through 2035, positioning it as a cornerstone for next-generation third-party governance frameworks.

Market by Geography:

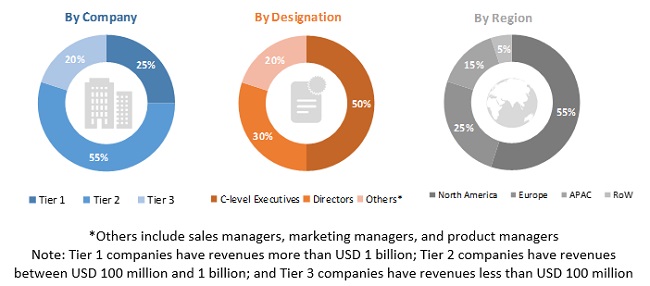

Geographically, the third-party risk management (TPRM) market is witnessing growing adoption across North America, Europe, Asia Pacific, and the Rest of the World. North America dominates the market, driven by strong regulatory frameworks such as OCC, FFIEC, and SOX compliance requirements, alongside mature enterprise governance practices in the United States and Canada. The region’s large base of financial institutions, technology firms, and managed service providers also fuels sustained TPRM demand for continuous vendor risk monitoring and cyber compliance.

Europe holds a significant global market share, supported by stringent data protection regulations such as GDPR and increasing emphasis on supply-chain transparency, particularly in financial services, critical infrastructure, and healthcare. Countries like the UK, Germany, and France are leading adopters due to rapid digital transformation and expanded outsourcing partnerships.

The Asia-Pacific region is emerging as the fastest-growing market, with expanding digital ecosystems, rapid cloud adoption, and growing awareness around third-party cybersecurity vulnerabilities. Nations such as India, Singapore, Japan, and Australia are witnessing strong uptake of TPRM solutions as local enterprises align with global compliance standards and manage complex vendor networks.

Market Dynamics

Driver: Increasing regulatory mandates and compliance requirements

The growing stringency of global regulatory frameworks is a key driver for the third-party risk management market. Organizations today face expanding compliance obligations under standards such as GDPR, CCPA, ISO 27001, and industry-specific laws like HIPAA and SOX. Regulators require enterprises to maintain oversight of vendors, assess data security practices, and ensure transparent reporting of risks. As a result, companies are increasingly investing in advanced TPRM platforms that automate due diligence, continuous monitoring, and documentation. This compliance-centric momentum is further amplified by the rise in cyber incidents and supply-chain vulnerabilities, compelling organizations to adopt integrated, technology-driven TPRM solutions. The market for compliance-enabled TPRM platforms is expected to witness robust growth through 2035, as enterprises prioritize regulatory alignment and operational resilience.

Restraint: High implementation cost and integration complexity

Despite growing awareness, many organizations face challenges in adopting TPRM solutions due to high setup costs, integration issues with legacy systems, and resource-intensive implementation processes. Building a centralized TPRM framework requires harmonizing data from procurement, IT, risk, and compliance teams, which can be complex and time-consuming. Additionally, smaller enterprises often struggle with limited budgets and skilled personnel to operate advanced systems. Integrating multiple existing governance, risk, and compliance (GRC) platforms or ERP systems can increase deployment time and costs. These operational and technical barriers limit adoption, particularly among mid-market organizations, restraining broader market expansion despite growing demand.

Opportunity: Rising adoption of AI-driven and predictive TPRM solutions

The increasing use of artificial intelligence (AI) and machine learning (ML) presents a significant opportunity in the TPRM market. AI-powered tools can automatically evaluate vast volumes of vendor data, perform risk scoring, and predict potential compliance breaches before they occur. These technologies also enable real-time monitoring, pattern recognition, and anomaly detection across complex supply chains. Demand for intelligent, automated platforms is accelerating as organizations seek more proactive and data-driven approaches to vendor management. The combination of predictive analytics, natural language processing (NLP), and risk intelligence feeds allows enterprises to reduce manual effort while enhancing accuracy. This shift toward AI-integrated TPRM systems is expected to fuel substantial growth, making predictive risk management a key differentiator among leading solution providers by 2035.

Challenge: Lack of standardized frameworks and inconsistent risk data

One of the key challenges hindering the third-party risk management market is the lack of globally standardized frameworks and consistent risk assessment methodologies. Different industries and regions follow diverse compliance protocols, resulting in fragmented vendor evaluation practices. This inconsistency complicates benchmarking and continuous monitoring across multi-country vendor ecosystems. Moreover, limited access to reliable, up-to-date vendor risk data—especially for small suppliers or offshore service providers—reduces assessment accuracy. The absence of unified reporting standards also hampers effective collaboration among compliance, IT security, and procurement teams. Addressing this challenge will require closer alignment between regulators, industry consortia, and solution vendors to develop harmonized standards that promote transparency and comparability in global TPRM practices.

Future Outlook

The third-party risk management (TPRM) market is projected to grow steadily from 2025 to 2035, driven by the rising complexity of global supply chains, increasing cybersecurity threats, and expanding regulatory scrutiny across industries. Organizations are shifting from periodic vendor assessments to continuous, real-time monitoring enabled by artificial intelligence, predictive analytics, and automation. These advancements are expected to redefine vendor governance, enhance resilience, and minimize operational disruptions.

North America will continue to dominate the market owing to mature compliance frameworks and strong adoption in the BFSI and technology sectors, while Europe maintains its momentum through stringent data protection regulations such as GDPR. The Asia-Pacific region, led by India, Singapore, and Japan, is anticipated to grow fastest as enterprises in these countries accelerate outsourcing and digital transformation initiatives.

Despite challenges like integration complexity, data inconsistency, and high implementation costs, the overall outlook remains positive. The growing demand for scalable, AI-driven, and cloud-based TPRM platforms will foster innovation and adoption across enterprises of all sizes. As organizations increasingly prioritize supply-chain transparency and risk intelligence, third-party risk management will evolve into a core pillar of enterprise security and compliance strategies through 2035.

Key Market Players

Key Third-Party Risk Management companies include RSA Security LLC (US), MetricStream, Inc. (US), BitSight Technologies (US), ProcessUnity, Inc. (US), Aravo Solutions, Inc. (US), Prevalent, Inc. (US), OneTrust, LLC (US), NAVEX Global, Inc. (US), SAI360 (Australia), and IBM Corporation (US), among others.

These players focus on expanding their risk intelligence capabilities through AI-driven analytics, real-time monitoring, and predictive modeling. Strategic partnerships, product innovations, and cloud-based platform enhancements remain the primary approaches to strengthening their global footprint and addressing evolving compliance and cybersecurity requirements.

Scope of the Third-Party Risk Management Report

|

Report Metrics |

Details |

|

Market size available for years |

2021–2035 |

|

Base year considered |

2024 |

|

Forecast period |

2025–2035 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

Component, Solution, Service, Deployment Mode, Organization Size, Vertical, And Region |

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

|

Companies covered |

20 major vendors, namely, include RSA (US), Genpact (US), MetricStream (US), Deloitte (US), KPMG (Netherlands), BitSight Technologies (US), Ernst & Young (UK), PwC (UK), ProcessUnity (US), Venminder (US), Resolver (Canada), NAVEX Global (US), Riskpro (India), SAI Global (US), RapidRatings (US), Optiv (US), Aravo (US), OneTrust (US and UK), Galvanize (Canada), and Prevalent (US) |

This research report categorizes the Third-Party Risk Management market to forecast revenues and analyze trends in each of the following submarkets:

Based on the Component:

- Solution

- Service

Based on the Solution:

- Financial Control Management

- Contract Management

- Operational Risk Management

- Audit Management

- Compliance Management

- Others (Includes Quality Assurance Management, Information Management, and Relationship Management)

Based on Service:

-

Professional

- Consulting

- Integration and Design

- Support and Maintenance

- Managed

Based on the Deployment Mode:

- Cloud

- On-premises

Based on Organization Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

Based on Verticals:

- BFSI

- IT and Telecom

- Healthcare and Life Sciences

- Government, Defense, and Aerospace

- Retail and Consumer Goods

- Manufacturing

- Energy and Utilities

- Others (Includes Education; Travel and Hospitality; Transportation and Logistics; and Media and Entertainment)

Based on the Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- Rest of Europe

-

APAC

- China

- Japan

- India

- Rest of APAC

-

MEA

- Middle East

- Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In October 2019, Genpact partnered with Tradeshift to focus on combining the company’s digital business platform called Genpact Cora with Business-to-Business (B2B) network technology. The combined solution is designed for customers that wish to link their procurement operations to a global network of buyers and sellers.

- In September 2019, BitSight Technologies partnered with ServiceNow, to launch 2 new certified ServiceNow applications, namely, BitSight for Vendor Risk Management and BitSight for Security Incident Response.

- In July 2019, KPMG was awarded by the US patent for technology to monitor and report third-party vulnerabilities. As a result, its offerings related to third-party intelligence that monitors and identifies threats to third-party networks in real time would gain a better competitive advantage as compared to its competitors in the TPRM space.

- In June 2019, EY acquired Pangea3 Legal Managed Services (LMS) business from Thomson Reuters. This acquisition would strengthen Pangea3 LMS’ capabilities in the areas of contract life cycle management, regulatory risk and compliance, and investigations.

- In March 2019, RSA introduced new enhancements to its integrated risk management , RSA Archer. Product enhancements, such as automated risk identification and assessment, modern platform for analysis and evaluation, and broad integrations for treatment of cyber risks, are collectively used to extend customers’ ability to efficiently and effectively identify, analyze, and treat critical elements of digital risk.

Key Questions addressed in this report:

- What are the global trends influencing the growth of the third-party risk management market?

- Which technologies and innovations will shape the market in the next decade?

- What are the most lucrative regional and industry-specific opportunities for TPRM vendors?

- What strategies are leading market players adopting to strengthen compliance automation and predictive risk intelligence?

Frequently Asked Questions (FAQ):

What does Third-Party Risk Management (TPRM) mean?

Third-Party Risk Management is a set of processes to monitor, analyze, and control several functional and operational risks pertaining to a company by any external business entity.

What is Third-Party Risk Management lifecycle?

According to the Office of the Comptroller of the Currency (OCC), Third-Party Risk Management lifecycle primarily includes 5 phases such as, Planning, Due diligence and selection of TPRM solution, Contract negotiation, Ongoing monitoring, and Termination.

What are the Third-Party Risk Management best practices?

Some of the best practices of the Third-Party Risk Management solutions are as follows:

- The company must have well-documented policies, programs, and procedures

- Organizations must deploy a rigorous set of practices that address each pillar of TPRM

- TPRM must ensure adequate credentialed staffing

- The company deploying Third-Party Risk Management should foster a supportive board and senior management team

What is the Third-Party Risk Management market size?

The global Third-Party Risk Management (TPRM) market size is projected to grow from USD 3.2 billion in 2019 to USD 6.8 billion by 2024, at a CAGR of 15.9% during the forecast period. Factors, such as the increasingly stringent compliance mandates to tackle third-party risks, lack of in-house competencies in the organization across several verticals, and the rising instances of cyberattacks, are expected to work in favor of the TPRM market growth in the near future.

Why is Third-Party Risk Management important?

Widespread use of mobile devices and penetration of the internet globally have encouraged greater number of operational and functional business processes to become the responsibility of third-party entities. As a result, mitigating third-party risks in an optimized way turn out to be imperative for all the organizations that depend largely on third-party relationships.

What is an example of a third party?

A few examples of third parties include vendors, suppliers, distribution partners, technology partners, customers, and fourth parties. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 20)

1.1 Objectives of the Study

1.2 Market Definition

1.2.1 Inclusions and Exclusions

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regions Covered

1.4 Years Considered for the Study

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 24)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Vendor Selection and Evaluation

2.1.1.2 Geographic Analysis

2.1.1.3 Analysis of Industry Trends

2.1.2 Primary Data

2.1.2.1 Key Industry Insights

2.1.2.2 Breakup of Primaries

2.2 Data Triangulation

2.3 Market Size Estimation

2.3.1 Revenue Estimates

2.3.2 Bottom-Up Approach

2.3.3 Top-Down Approach

2.4 Market Forecast

3 Executive Summary (Page No. - 36)

4 Premium Insights (Page No. - 40)

4.1 Attractive Market Opportunities in the Market

4.2 Third-Party Risk Management Market, By Solution, 2019

4.3 Market, By Deployment Mode, 2019–2024

4.4 Market, Top 3 Verticals and Regions, 2019

4.5 Market, By Organization Size, 2019–2024

4.6 Market Investment Scenario

5 Market Overview (Page No. - 44)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Need for Economic Management

5.2.1.2 Lack of In-House Competencies

5.2.1.3 Increasing Adoption of Virtual Applications

5.2.1.4 Rising Instances of Cyberattacks

5.2.2 Restraints

5.2.2.1 Dependence on Non-Formal and Manual Business Processes

5.2.2.2 Lack of Skilled Professionals

5.2.3 Opportunities

5.2.3.1 Increase in Stringent Regulations and Compliance Requirements

5.2.3.2 Increasing Demand for Hybrid Environment

5.2.3.3 Technological Advancements, Including Automation, Data Analytics, and Smart Contracts

5.2.4 Challenges

5.2.4.1 Compatibility Issues With Legacy Systems

5.2.4.2 Lack of Awareness of TPRM Solutions and Services

5.3 Use Cases

5.4 Best Practices in Third-Party Risk Management

6 Third-Party Risk Management Market, By Component (Page No. - 53)

6.1 Introduction

6.2 Solutions

6.2.1 Increasing Cyberattacks to Drive the Adoption of Third-Party Risk Management Solutions

6.3 Services

6.3.1 Need for Seamless Experience and Personalized Services to Contribute to the Demand of Third-Party Risk Management Services

7 Market, By Solution (Page No. - 57)

7.1 Introduction

7.2 Financial Control Management

7.2.1 Growing Need to Optimize Operational Efficiency and Meet Financial Expectations Driving the Demand for Financial Control Management Solutions

7.3 Contract Management

7.3.1 Increasing Need to Manage Various Attributes of Contracts to Boost the Adoption of Contract Management Solutions

7.4 Operational Risk Management

7.4.1 Advanced Capabilities of Operational Risk Management Solutions to Boost Their Growth

7.5 Audit Management

7.5.1 Increasing Complexity of Business Operations to Fuel the Adoption of Audit Management Solutions

7.6 Compliance Management

7.6.1 Increasing Focus Toward Achieving Financial Transparency to Drive the Adoption of Compliance Management Solutions

7.7 Others

8 Third-Party Risk Management Market, By Service (Page No. - 65)

8.1 Introduction

8.2 Professional Services

8.2.1 Consulting

8.2.1.1 Consulting Services to Play a Crucial Role in Helping Organizations Improve Their TPRM Program

8.2.2 Integration and Design

8.2.2.1 Integration and Design Services to Gain Traction for the Successful Implementation of TPRM Solutions

8.2.3 Support and Maintenance

8.2.3.1 Increasing Adoption of TPRM Solutions to Boost the Demand for Support and Maintenance Services

8.3 Managed Services

8.3.1 Managed Services Gaining Popularity as They Help Organizations Meet Compliance Needs

9 Market, By Deployment Mode (Page No. - 72)

9.1 Introduction

9.2 Cloud

9.2.1 Low Cost of Installation, Upgrade, and Maintenance to Boost the Adoption of Cloud-Based Third-Party Risk Management Solutions

9.3 On-Premises

9.3.1 Need to Secure In-House Applications, Platforms, and Systems Against Evolving Network-Based Attacks Driving the Adoption of On-Premises Third-Party Risk Management Solutions

10 Third-Party Risk Management Market, By Organization Size (Page No. - 76)

10.1 Introduction

10.2 Small and Medium-Sized Enterprises

10.2.1 Cost Effectiveness to Drive the Adoption of TPRM Solutions Among Small and Medium-Sized Enterprises

10.3 Large Enterprises

10.3.1 Growing Need for Securing Data From Vulnerabilities to Fuel the Adoption of Third-Party Risk Management Solutions in Large Enterprises

11 Market, By Vertical (Page No. - 80)

11.1 Introduction

11.2 Banking, Financial Services, and Insurance

11.2.1 Need to Keep Up With Changing Regulatory Environment Driving the Adoption of Third-Party Risk Management Solutions in the BFSI Vertical

11.3 IT and Telecom

11.3.1 Need to Effectively Manage Compliance and Risk Programs Driving the Adoption of Third-Party Risk Management Solutions in the IT and Telecom Vertical

11.4 Healthcare and Life Sciences

11.4.1 Need to Enhance Performance of Services Driving the Adoption of Third-Party Risk Management Solutions in the Healthcare and Life Sciences Vertical

11.5 Government, Aerospace, and Defense

11.5.1 Need to Comply With Federal Directives and Operational Mandates Driving the Adoption of Third-Party Risk Management Solutions in the Government, Aerospace, and Defense Sector

11.6 Retail and Consumer Goods

11.6.1 Need to Reduce Operational Cost and Enhance Profit Margins Driving the Adoption of Third-Party Risk Management Solutions in the Retail and Consumer Goods Vertical

11.7 Manufacturing

11.7.1 Need for Effective Risk Management to Drive the Adoption of Third-Party Risk Management Solutions in the Manufacturing Vertical

11.8 Energy and Utilities

11.8.1 Need to Set Up Proactive Policies to Comply With Directives Driving the Adoption of Third-Party Risk Management Solutions in the Energy and Utilities Vertical

11.9 Others

12 Third-Party Risk Management Market, By Region (Page No. - 90)

12.1 Introduction

12.2 North America

12.2.1 United States

12.2.1.1 Increasing Need for Secure and Comprehensive Partner Network to Boost the Adoption of TPRM Solutions in the US

12.2.2 Canada

12.2.2.1 Growing Data Security Concerns and Regulations to Fuel the Adoption of TPRM Solutions in Canada

12.3 Europe

12.3.1 United Kingdom

12.3.1.1 Growing Complexity of Regulations to Fuel the Adoption of TPRM Solutions in the UK

12.3.2 Germany

12.3.2.1 Advancement Toward Digitalization Approach to Boost the Growth of TPRM Market in Germany

12.3.3 Rest of Europe

12.4 Asia Pacific

12.4.1 China

12.4.1.1 Emergence of Mobile Technologies, Cloud Computing, and Increased Automation to Bolster the Growth of TPRM Market in China

12.4.2 Japan

12.4.2.1 Growing Trend of Industrialization and Modernization Driving the Growth of TPRM Market in Japan

12.4.3 India

12.4.3.1 High It Spending and Stable Government Support for Implementing the Latest Technologies to Fuel the Growth of TPRM Market in India

12.4.4 Rest of Asia Pacific

12.5 Middle East and Africa

12.5.1 Middle East

12.5.1.1 Growing Need to Provide Robust Third-Party Ecosystem Driving the Growth of TPRM Market in the Middle East

12.5.2 Africa

12.5.2.1 TPRM to be the Next Step of Advancement for Improving Operations and Services in Africa

12.6 Latin America

12.6.1 Brazil

12.6.1.1 Growing Focus of Financial Institutions on the Integration of TPRM Solutions to Drive the Market Growth in Brazil

12.6.2 Mexico

12.6.2.1 Increased Productivity By Using TPRM Solutions to Boost the Market Growth in Mexico

12.6.3 Rest of Latin America

13 Competitive Landscape (Page No. - 137)

13.1 Introduction

13.2 Competitive Leadership Mapping

13.2.1 Visionary Leaders

13.2.2 Dynamic Differentiators

13.2.3 Innovators

13.2.4 Emerging Companies

13.3 Competitive Scenario

13.3.1 New Product Launches and Product Enhancements

13.3.2 Partnerships and Collaborations

13.3.3 Mergers and Acquisitions

14 Company Profiles (Page No. - 144)

14.1 Introduction

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

14.2 RSA

14.3 Genpact

14.4 MetricStream

14.5 Deloitte

14.6 KPMG

14.7 BitSight

14.8 Ernst & Young

14.9 PwC

14.10 ProcessUnity

14.11 Venminder

14.12 Resolver

14.13 NAVEX Global

14.14 Riskpro

14.15 SAI Global

14.16 RapidRatings

14.17 Optiv

14.18 Aravo

14.19 OneTrust

14.20 Galvanize

14.21 Prevalent

14.22 Alyne

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 177)

15.1 Discussion Guide

15.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

15.3 Available Customizations

15.4 Related Reports

15.5 Author Details

List of Tables (126 Tables)

Table 1 Market Ecosystem: Vendor Selection and Evaluation Criteria

Table 2 Revenue and Share Estimates for Selected Vendors in the Market

Table 3 Third-Party Risk Management Market Size and Growth Rate, 2017–2024 (USD Million, Y-O-Y %)

Table 4 Top 10 Key Concerns of Third-Party Relationships

Table 5 Major Third-Party Risk Management-Associated Regulations and Guidelines

Table 6 Market: use Cases

Table 7 10 Best Practices to Reach Desired Maturity Levels in Third-Party Risk Management

Table 8 Market Size, By Component, 2017–2024 (USD Million)

Table 9 Solutions: Market Size, By Region, 2017–2024 (USD Million)

Table 10 Services: Market Size, By Region, 2017–2024 (USD Million)

Table 11 Third-Party Risk Management Market Size, By Solution, 2017–2024 (USD Million)

Table 12 Financial Control Management: Market Size, By Region, 2017–2024 (USD Million)

Table 13 Contract Management: Market Size, By Region, 2017–2024 (USD Million)

Table 14 Operational Risk Management: Market Size, By Region, 2017–2024 (USD Million)

Table 15 Audit Management: Market Size, By Region, 2017–2024 (USD Million)

Table 16 Compliance Management: Market Size, By Region, 2017–2024 (USD Million)

Table 17 Others: Market Size, By Region, 2017–2024 (USD Million)

Table 18 Market Size, By Service, 2017–2024 (USD Million)

Table 19 Professional Services: Third-Party Risk Management Market Size, By Type, 2017–2024 (USD Million)

Table 20 Professional Services: Market Size, By Region, 2017–2024 (USD Million)

Table 21 Consulting Market Size, By Region, 2017–2024 (USD Million)

Table 22 Integration and Design Market Size, By Region, 2017–2024 (USD Million)

Table 23 Support and Maintenance Market Size, By Region, 2017–2024 (USD Million)

Table 24 Managed Services: Market Size, By Region, 2017–2024 (USD Million)

Table 25 Market Size, By Deployment Mode, 2017–2024 (USD Million)

Table 26 Cloud: Market Size, By Region, 2017–2024 (USD Million)

Table 27 On-Premises: Market Size, By Region, 2017–2024 (USD Million)

Table 28 Third-Party Risk Management Market Size, By Organization Size, 2017–2024 (USD Million)

Table 29 Small and Medium-Sized Enterprises: Market Size, By Region, 2017–2024 (USD Million)

Table 30 Large Enterprises: Market Size, By Region, 2017–2024 (USD Million)

Table 31 Market Size, By Vertical, 2017–2024 (USD Million)

Table 32 Banking, Financial Services, and Insurance: Market Size, By Region, 2017–2024 (USD Million)

Table 33 IT and Telecom: Market Size, By Region, 2017–2024 (USD Million)

Table 34 Healthcare and Life Sciences: Market Size, By Region, 2017–2024 (USD Million)

Table 35 Government, Aerospace, and Defense: Market Size, By Region, 2017–2024 (USD Million)

Table 36 Retail and Consumer Goods: Market Size, By Region, 2017–2024 (USD Million)

Table 37 Manufacturing: Market Size, By Region, 2017–2024 (USD Million)

Table 38 Energy and Utilities: Third-Party Risk Management Market Size, By Region, 2017–2024 (USD Million)

Table 39 Others: Market Size, By Region, 2017–2024 (USD Million)

Table 40 Market Size, By Region, 2017–2024 (USD Million)

Table 41 North America: Market Size, By Component, 2017–2024 (USD Million)

Table 42 North America: Market Size, By Solution, 2017–2024 (USD Million)

Table 43 North America: Market Size, By Service, 2017–2024 (USD Million)

Table 44 North America: Market Size, By Professional Service, 2017–2024 (USD Million)

Table 45 North America: Market Size, By Deployment Mode, 2017–2024 (USD Million)

Table 46 North America: Market Size, By Organization Size, 2017–2024 (USD Million)

Table 47 North America: Market Size, By Vertical, 2017–2024 (USD Million)

Table 48 North America: Market Size, By Country, 2017–2024 (USD Million)

Table 49 United States: Third-Party Risk Management Market Size, By Component, 2017–2024 (USD Million)

Table 50 United States: Market Size, By Deployment Mode, 2017–2024 (USD Million)

Table 51 United States: Market Size, By Organization Size, 2017–2024 (USD Million)

Table 52 Canada: Market Size, By Component, 2017–2024 (USD Million)

Table 53 Canada: Market Size, By Deployment Mode, 2017–2024 (USD Million)

Table 54 Canada: Market Size, By Organization Size, 2017–2024 (USD Million)

Table 55 Europe: Market Size, By Component, 2017–2024 (USD Million)

Table 56 Europe: Market Size, By Solution, 2017–2024 (USD Million)

Table 57 Europe: Market Size, By Service, 2017–2024 (USD Million)

Table 58 Europe: Market Size, By Professional Service, 2017–2024 (USD Million)

Table 59 Europe: Third-Party Risk Management Market Size, By Deployment Mode, 2017–2024 (USD Million)

Table 60 Europe: Market Size, By Organization Size, 2017–2024 (USD Million)

Table 61 Europe: Market Size, By Vertical, 2017–2024 (USD Million)

Table 62 Europe: Market Size, By Country, 2017–2024 (USD Million)

Table 63 United Kingdom: Market Size, By Component, 2017–2024 (USD Million)

Table 64 United Kingdom: Market Size, By Deployment Mode, 2017–2024 (USD Million)

Table 65 United Kingdom: Market Size, By Organization Size, 2017–2024 (USD Million)

Table 66 Germany: Market Size, By Component, 2017–2024 (USD Million)

Table 67 Germany: Market Size, By Deployment Mode, 2017–2024 (USD Million)

Table 68 Germany: Third-Party Risk Management Market Size, By Organization Size, 2017–2024 (USD Million)

Table 69 Rest of Europe: Market Size, By Component, 2017–2024 (USD Million)

Table 70 Rest of Europe: Market Size, By Deployment Mode, 2017–2024 (USD Million)

Table 71 Rest of Europe: Market Size, By Organization Size, 2017–2024 (USD Million)

Table 72 Asia Pacific: Market Size, By Component, 2017–2024 (USD Million)

Table 73 Asia Pacific: Market Size, By Solution, 2017–2024 (USD Million)

Table 74 Asia Pacific: Market Size, By Service, 2017–2024 (USD Million)

Table 75 Asia Pacific: Market Size, By Professional Service, 2017–2024 (USD Million)

Table 76 Asia Pacific: Third-Party Risk Management Market Size, By Deployment Mode, 2017–2024 (USD Million)

Table 77 Asia Pacific: Market Size, By Organization Size, 2017–2024 (USD Million)

Table 78 Asia Pacific: Market Size, By Vertical, 2017–2024 (USD Million)

Table 79 Asia Pacific: Market Size, By Country, 2017–2024 (USD Million)

Table 80 China: Market Size, By Component, 2017–2024 (USD Million)

Table 81 China: Market Size, By Deployment Mode, 2017–2024 (USD Million)

Table 82 China: Market Size, By Organization Size, 2017–2024 (USD Million)

Table 83 Japan: Market Size, By Component, 2017–2024 (USD Million)

Table 84 Japan: Market Size, By Deployment Mode, 2017–2024 (USD Million)

Table 85 Japan: Third-Party Risk Management Market Size, By Organization Size, 2017–2024 (USD Million)

Table 86 India: Market Size, By Component, 2017–2024 (USD Million)

Table 87 India: Market Size, By Deployment Mode, 2017–2024 (USD Million)

Table 88 India: Market Size, By Organization Size, 2017–2024 (USD Million)

Table 89 Rest of Asia Pacific: Market Size, By Component, 2017–2024 (USD Million)

Table 90 Rest of Asia Pacific: Market Size, By Deployment Mode, 2017–2024 (USD Million)

Table 91 Rest of Asia Pacific: Third-Party Risk Management Market Size, By Organization Size, 2017–2024 (USD Million)

Table 92 Middle East and Africa: Market Size, By Component, 2017–2024 (USD Million)

Table 93 Middle East and Africa: Market Size, By Solution, 2017–2024 (USD Million)

Table 94 Middle East and Africa: Market Size, By Service, 2017–2024 (USD Million)

Table 95 Middle East and Africa: Market Size, By Professional Service, 2017–2024 (USD Million)

Table 96 Middle East and Africa: Market Size, By Deployment Mode, 2017–2024 (USD Million)

Table 97 Middle East and Africa: Market Size, By Organization Size, 2017–2024 (USD Million)

Table 98 Middle East and Africa: Market Size, By Vertical, 2017–2024 (USD Million)

Table 99 Middle East and Africa: Third-Party Risk Management Market Size, By Sub-Region, 2017–2024 (USD Million)

Table 100 Middle East: Market Size, By Component, 2017–2024 (USD Million)

Table 101 Middle East: Market Size, By Deployment Mode, 2017–2024 (USD Million)

Table 102 Middle East: Market Size, By Organization Size, 2017–2024 (USD Million)

Table 103 Africa: Market Size, By Component, 2017–2024 (USD Million)

Table 104 Africa: Market Size, By Deployment Mode, 2017–2024 (USD Million)

Table 105 Africa: Market Size, By Organization Size, 2017–2024 (USD Million)

Table 106 Latin America: Third-Party Risk Management Market Size, By Component, 2017–2024 (USD Million)

Table 107 Latin America: Market Size, By Solution, 2017–2024 (USD Million)

Table 108 Latin America: Market Size, By Service, 2017–2024 (USD Million)

Table 109 Latin America: Market Size, By Professional Service, 2017–2024 (USD Million)

Table 110 Latin America: Market Size, By Deployment Mode, 2017–2024 (USD Million)

Table 111 Latin America: Third-Party Risk Management Market Size, By Organization Size, 2017–2024 (USD Million)

Table 112 Latin America: Market Size, By Vertical, 2017–2024 (USD Million)

Table 113 Latin America: Market Size, By Country, 2017–2024 (USD Million)

Table 114 Brazil: Market Size, By Component, 2017–2024 (USD Million)

Table 115 Brazil: Market Size, By Deployment Mode, 2017–2024 (USD Million)

Table 116 Brazil: Third-Party Risk Management Market Size, By Organization Size, 2017–2024 (USD Million)

Table 117 Mexico: Market Size, By Component, 2017–2024 (USD Million)

Table 118 Mexico: Market Size, By Deployment Mode, 2017–2024 (USD Million)

Table 119 Mexico: Market Size, By Organization Size, 2017–2024 (USD Million)

Table 120 Rest of Latin America: Market Size, By Component, 2017–2024 (USD Million)

Table 121 Rest of Latin America: Market Size, By Deployment Mode, 2017–2024 (USD Million)

Table 122 Rest of Latin America: Third-Party Risk Management Market Size, By Organization Size, 2017–2024 (USD Million)

Table 123 Evaluation Criteria

Table 124 New Product Launches and Product Enhancements, 2018–2019

Table 125 Partnerships and Collaborations, 2018–2019

Table 126 Mergers and Acquisitions, 2018–2019

List of Figures (46 Figures)

Figure 1 Global Third-Party Risk Management Market: Research Design

Figure 2 Sample Secondary Data: Geographic Analysis

Figure 3 Sample Secondary Data: Europe

Figure 4 Sample Secondary Data: Industry Analysis

Figure 5 Sample Secondary Data: Top Areas of Third-Party Engagement Risk

Figure 6 Market Size Estimation Methodology: Approach 1

Figure 7 Market Size Estimation Methodology: Approach 2

Figure 8 Factor Analysis for Market Trend and Forecast

Figure 9 Services Segment to Witness a Higher Growth During the Forecast Period

Figure 10 North America to Account for the Highest Market Share in 2019

Figure 11 Fastest-Growing Segments of the Third-Party Risk Management Market

Figure 12 Increasing Demand for TPRM Solutions and Services and Growing Adoption By Small and Medium-Sized Enterprises to Fuel the Growth of Market

Figure 13 Financial Control Management Segment to Account for the Highest Market Share in 2019

Figure 14 On-Premises Segment to Account for a Higher Market Share During the Forecast Period

Figure 15 Banking, Financial Services, and Insurance Vertical and North America Region to Account for the Highest Market Shares in 2019

Figure 16 Small and Medium-Sized Enterprises Segment to Grow at a Higher CAGR During the Forecast Period

Figure 17 Asia Pacific to Emerge as the Best Market for Investments in the Next 5 Years

Figure 18 Drivers, Restraints, Opportunities, and Challenges: Third-Party Risk Management Market

Figure 19 Services Segment to Grow at a Higher CAGR During the Forecast Period

Figure 20 Compliance Management Segment to Record the Highest CAGR During the Forecast Period

Figure 21 Managed Services Segment to Record a Higher CAGR During the Forecast Period

Figure 22 Consulting Services Segment to Record the Highest CAGR During the Forecast Period

Figure 23 Cloud Deployment Mode to Grow at a Higher CAGR During the Forecast Period

Figure 24 Small and Medium-Sized Enterprises Segment to Grow at a Higher CAGR During the Forecast Period

Figure 25 Healthcare and Life Sciences Vertical to Register the Highest CAGR During the Forecast Period

Figure 26 North America to Account for the Largest Market Size During the Forecast Period

Figure 27 Asia Pacific to be an Attractive Market for Investments

Figure 28 North America: Third-Party Risk Management Market Snapshot

Figure 29 Solutions Segment to Account for a Larger Market Size in North America During the Forecast Period

Figure 30 Compliance Management Segment to Grow at the Highest CAGR in Europe During the Forecast Period

Figure 31 Asia Pacific: Market Snapshot

Figure 32 Consulting Segment to Have the Largest Market Size in Asia Pacific During the Forecast Period

Figure 33 Cloud Segment to Grow at a Higher CAGR in Middle East and Africa During the Forecast Period

Figure 34 Services Segment to Grow at a Higher CAGR in Latin America During the Forecast Period

Figure 35 Third-Party Risk Management Market (Global), Competitive Leadership Mapping, 2018

Figure 36 Key Developments By the Leading Players in the Third-Party Risk Management Market During 2018–2019

Figure 37 RSA: SWOT Analysis

Figure 38 Genpact: Company Snapshot

Figure 39 Genpact: SWOT Analysis

Figure 40 MetricStream: SWOT Analysis

Figure 41 Deloitte: Company Snapshot

Figure 42 Deloitte: SWOT Analysis

Figure 43 KPMG: Company Snapshot

Figure 44 KPMG: SWOT Analysis

Figure 45 Ernst & Young: Company Snapshot

Figure 46 PwC: Company Snapshot

The study involved 4 major activities in estimating the current size of the Third-Party Risk Management (TPRM) market. Exhaustive secondary research was done to collect information on the TPRM market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the size of the segments and subsegments of the market.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, have been referred to identify and collect information for this study. These secondary sources included annual reports, press releases and investor presentations of companies, whitepapers, certified publications and articles by recognized authors, gold standard and silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The TPRM market comprises several stakeholders, Managed Service Providers (MSPs), System Integrators (SIs), government organizations, legal agencies, distribution partners, fourth parties, Value-Added Resellers (VARs), chief compliance officers, procurement managers, risk officers, ethics directors, procurement directors, purchasing managers, third-party managers, vendor managers, oversight officers, operations officers, anti-corruption and anti-bribery heads, supply chain managers, auditors, due diligence heads, training staff, Enterprise Risk Management (ERM), privacy specialists, financial controllers, audit officers, and business resiliency specialists. The demand side of the market consists of financial institutions, investors, and insurance companies. The supply side includes TPRM solutions providers. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Third-Party Risk Management Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the TPRM market. These methods were also used extensively to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the TPRM market have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall TPRM market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To determine and forecast the global TPRM market by component, solution, service, deployment mode, organization size, vertical, and region from 2019 to 2024, and analyze the various macroeconomic and microeconomic factors that affect the market growth

- To forecast the size of the market segments with respect to 5 main regions, namely, North America; Europe; Asia Pacific (APAC); Middle East and Africa (MEA); and Latin America

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall TPRM market

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the TPRM market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the Europe Third-Party Risk Management market includes the Rest of Europe includes France, Nordic countries, and Benelux.

- Further breakdown of the Asia Pacific TPRM market includes South Korea, Australia, Philippines, Indonesia, and Singapore.

- Further breakdown of the Latin America TPRM market includes Colombia, Chile, and Argentina.

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Third-Party Risk Management Market