Thermoplastic Tapes Market by Fiber Type (Glass, Carbon), Resin Type (PAEK, PA, PPS, PP), Application (Aerospace & Defense, Automotive & Transportation, Oil & Gas, Sporting Goods, Medical & Healthcare), and Region - Global Forecasts to 2028

Thermoplastic Tape Market

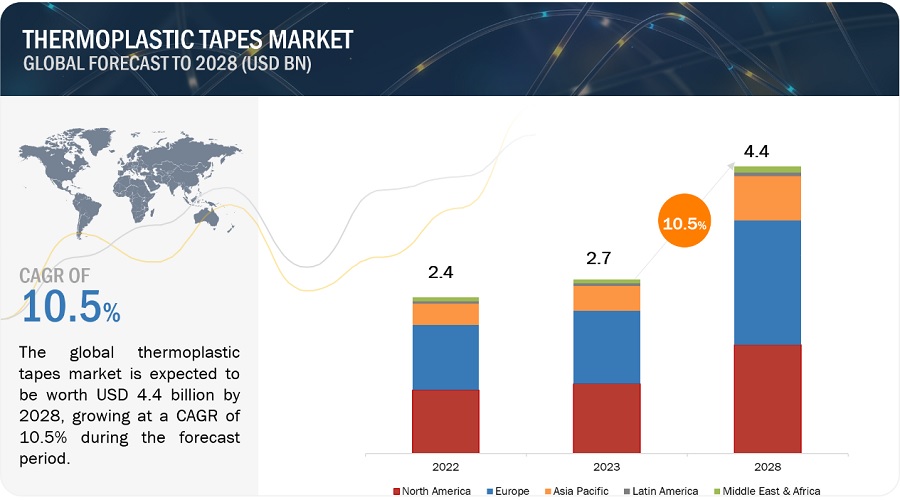

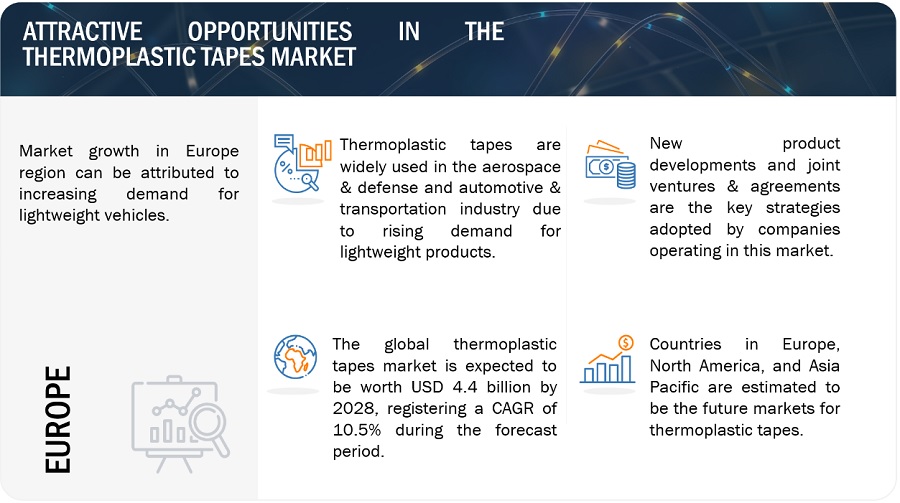

The global thermoplastic tape market is valued at USD 2.7 billion in 2023 and is projected to reach USD 4.4 billion by 2028, growing at a cagr 10.5% from 2023 to 2028. The market growth is driven by the aerospace & defense industry’s demand for weight reduction and increased fuel efficiency.

Thermoplastic tapes are made of multiple fibers bound together with a thermoplastic resin for optimal performance. They offer high strength, stiffness, abrasion resistance, and chemical resistance. The aerospace & defense, automotive & transportation, and sporting goods industries rely on these tapes for localized reinforcements, repairs, and seam taping.

In the aerospace & defense industry, thermoplastic tapes are used in both primary and secondary structures, mainly in fuselage skin, access panels, wing spars, wing skins, rib stiffeners, brackets, flooring and conduits. And in sporting goods, thermoplastic tapes are used in tennis rackets, skis/kiteboards, golf shafts, and bicycle frames.

Attractive Opportunities in Thermoplastic Tapes Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Thermoplastic Tapes Market Dynamics

Driver: Increasing demand for fuel-efficient vehicle

Vehicle weight plays a significant role in reducing fuel consumption in vehicles (Source: US Department of Energy). The weight reduction of a vehicle by 10% can result in enhanced fuel economy by 6–8%. Thermoplastic tape offers high strength, flexibility, and lightweight, making it suitable to replace traditional metal tapes in vehicle manufacturing. For instance, vehicle panels made with Sabic’s UDMAX tape offer good strength and impact resistance with lightweight features, which can result in a mass reduction of vehicle interior panels of up to 35% in comparison to metal parts. In the case of exterior panels, the composite material can help reduce mass by up to 50%.

Restraint: High manufacturing costs

Thermoplastic tapes reinforced with advanced fibers, such as carbon or aramid, can be relatively more expensive than traditional materials, such as thermoset tapes. High-performance thermoplastic resins and advanced fiber reinforcements used in thermoplastic tapes can be costly. Tape placement, consolidation, and welding require precise temperature, pressure, and cooling rates, making the product costlier. The production volume of thermoplastic tapes is lower than traditional materials, resulting in higher per-unit costs. However, this cost barrier can limit their widespread adoption, particularly in industries with stringent cost constraints.

Opportunity: Reduced carbon fiber cost

Carbon fiber thermoplastics are made through an energy-intensive process. According to MAI Carbon Cluster Management GmbH, a partner of BMW and Audi, the production costs of carbon fibers could be reduced. This project is backed by the German Federal Government and more than 70 business and research institutions and will have a huge impact on the automotive industry, which faces stringent environmental regulations in Europe and the US. Hence, developing low-cost and high-yield precursors for making commercial-grade carbon fibers would provide significant opportunities for the market players to expand their market share. The reduced carbon fiber cost will eventually decrease the cost of carbon fiber thermoplastic tapes.

Challenge: Limited use of carbon fiber tapes in high-temperature applications and challenges in the development of low-cost technologies.

Aircraft parts that are installed in high-temperature zones between 200 ºC and 400 ºC are metallic. Alloys based on aluminum, titanium, and steel are only used in these zones. The use of carbon fiber thermoplastic tapes is not possible due to the limited operating temperatures of conventional thermosets below 400 ºC.

Further, the high cost of the thermoplastic tapes manufacturing process is another major challenge. The high cost of thermoplastic tapes is associated with their penetration into structural applications of various industries. The real potential of thermoplastic tapes has not yet been realized due to the R&D cost incurred during design errors, high manufacturing costs, and increased cycle times. Many new applications of these tapes have been discovered, but due to high-cost constraints, the commercialization of these applications is yet to begin. High R&D costs may pose a challenge to developing low-cost technologies for all researchers and key manufacturers.

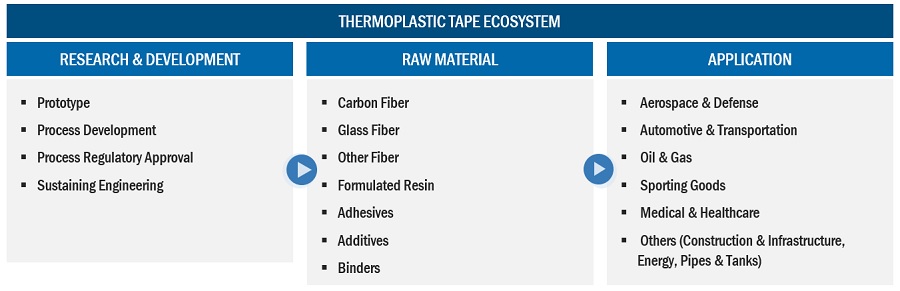

Thermoplastic Tapes Market Ecosystem

Based on the fiber type, the carbon fiber segment is estimated to account for the largest market share during the forecast period

Carbon fiber thermoplastic tapes dominated the overall thermoplastic tapes market in 2022. The growth of the carbon fiber thermoplastic tapes industry is mainly driven by the resins used in carbon fiber thermoplastic tapes as they enhance the physical and mechanical properties of these tapes. Increase fuel efficiency and low weight have been the foremost drivers for the use of carbon fiber-based composites in the aerospace industry. The greater strength-to-weight capability and excellent fatigue resistance of carbo fiber-based thermoplastic tapes allow for more structurally efficient and aerodynamic aircraft designs.

Based on resin type, the PP segment is anticipated to register a significant CAGR during the forecast period

Polypropylene (PP) exhibits chemical resistance, fatigue resistance, transmissivity, and toughness. PP resin-based thermoplastic composites provide a competitive advantage over PA-based thermoplastic composites due to their lower price, superior physical properties, and lesser specific gravity. PP can be reinforced with glass, carbon, and other fibers. Long carbon-fiber-reinforced polypropylene offers superior strength and increased stiffness, making PP resin-based thermoplastic tapes useful in the automotive application. The need to reduce weight to enhance fuel economy majorly drives high consumption of PP resin-based thermoplastic composites.

Based on end-use industry, aerospace & defense segment holds the highest market share in 2022, both in terms of value and volume

The aerospace & defense segment dominates the thermoplastic tapes market due to the increasing demand for lightweight aircraft from Boeing and Airbus, mainly due to the superior properties of thermoplastic tapes, which help reduce the overall weight of airplanes and provide corrosion resistance and high strength and abrasion. Thermoplastic tapes are extensively used for repairing aircraft wings and for building part thickness in aircraft. The entry of new aircraft manufacturers, such as Comac (China) and United Aircraft Corporation (Russia), is expected to boost the demand for thermoplastic tapes during the forecast period.

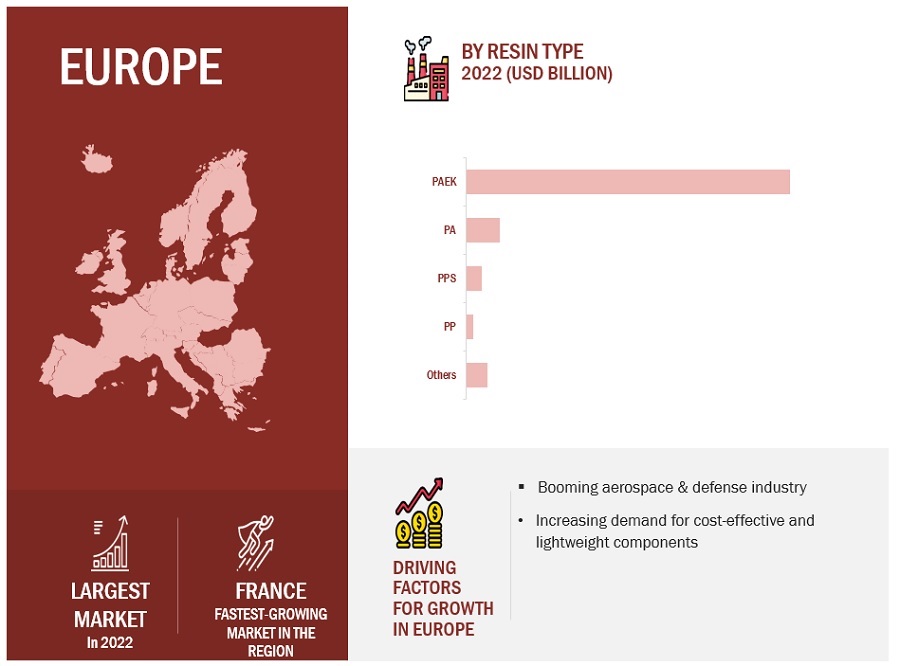

Europe to register the highest growth during the forecast period

Europe was the largest market for the thermoplastic tapes market by value in 2022. The growth of end-use industries such as aerospace & defense, automotive & transportation, oil & gas, sporting goods, and medical and healthcare is driving the thermoplastic tapes industry in the region. The region has a presence of several carbon fiber fiber-reinforced thermoplastic tapes manufacturers, such as SGL carbon and Evonik Industries AG, which are engaged in the production of high quality thermoplastic tapes, drives the thermoplastic tapes market in the region. For example, SGL Carbon, a European company provides carbon fiber fiber-reinforced thermoplastic tapes under the brand name, SIGRAFIL.

To know about the assumptions considered for the study, download the pdf brochure

Thermoplastic Tape Market Players

The thermoplastic tapes market is dominated by a few globally established players such as Toray Industries, Inc. (Japan), SABIC (Saudi Arabia), Mitsui Chemicals, Inc. (Japan), Evonik Industries AG (Germany), Hexcel Corporation (US), Teijin Limited (Japan), Arkema (Netherlands), and Solvay (Belgium), BASF SE (US), and SGL Carbon (Germany), among others, are the key manufacturers that secured major contracts in the last few years. Major focus was given to the contracts and new product development due to the changing requirements across the world.

These companies are pursuing a variety of inorganic and organic strategies in order to gain a foothold in the thermoplastic tapes market. The research includes a detailed competitive analysis of these key players in the thermoplastic tapes industry, including company profiles, recent developments, and key market strategies.

Read More: Thermoplastic Tape Companies

Thermoplastic Tape Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2023 |

USD 2.7 billion |

|

Revenue Forecast in 2028 |

USD 4.4 billion |

|

CAGR |

10.5% |

|

Market size available for years |

2021–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Value (USD million), Volume (Kiloton) |

|

Segments Covered |

By Fiber Type, By Resin Type, By End-use Type, Region |

|

Geographies covered |

Europe, North America, Asia Pacific, Latin America, the Middle East, and Africa |

|

Companies covered |

Toray Industries, Inc. (Japan), SABIC (Saudi Arabia), Mitsui Chemicals, Inc. (Japan), Evonik Industries AG (Germany), Hexcel Corporation (US), Teijin Limited (Japan), Arkema (Netherlands), and Solvay (Belgium), BASF SE (US), and SGL Carbon (Germany) |

The study categorizes the thermoplastic tapes market based on fiber type, resin type, end-use industry, and Region.

By Fiber Type:

- Carbon Fiber

- Glass Fiber

- Others (Aramid, Natural)

By Resin Type:

- PAEK

- PPS

- PA

- PP

- Others (PC, PET, TPU, PPA, PVDF, and PE)

By End-use Industry:

- Aerospace & Defense

- Automotive & Transportation

- Oil & Gas

- Sporting Goods

- Medical & Healthcare

- Other (Construction & Infrastructure, Energy, Pipes & Tanks)

By Region:

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Recent Developments

- In October 2022, Mitsui Chemicals, Inc. collaborated with JUNICHIRO YOKOTA STUDIO to exhibit its CFRTP TAFNEX at DESIGNART TOKYO 2022 event.

- In July 2022, Hexcel Corporation joined Spirit Aero Systems to develop sustainable aircraft technologies for manufacturing future aircrafts. Hexcel’s HiTape will be optimized for fully automated lay-up.

- In January 2022, Toray Industries developed a new analysis technology for multi-material structures comprising UD continuous fiber-reinforced tapes and injection molding materials. This breakthrough makes it possible to predict the properties of parts made up of multiple materials and develop high-performance components.

- In November 2021, Solvay developed carbon fiber-reinforced polyetheretherketone (CF/PEEK), CF-reinforced bio-based high-performance polyamides, and CF-reinforced polyphenylene sulfide (CF/PPS) composite materials. The partnership significantly expanded the types of neat and carbon fiber-reinforced materials portfolio that 9T Labs currently offers.

- In May 2021, Teijin Carbon Europe introduced a new carbon fiber thermoplastic unidirectional pre-impregnated tape (TPUD) based on PPS. The new Tenax TPUD with PPS matrix allows entry into new cost-sensitive markets while offering the typical TPUD advantages such as high resistance to chemicals and solvents, low flammability, storage or shipping at room temperatures, and recyclability.

Frequently Asked Questions (FAQ):

Which are the major companies in the thermoplastic tapes market? What are their major strategies to strengthen their market presence?

Toray Industries, Inc. (Japan), SABIC (Saudi Arabia), Mitsui Chemicals, Inc. (Japan), Evonik Industries AG (Germany), Hexcel Corporation (US), Teijin Limited (Japan), Arkema (Netherlands), and Solvay (Belgium), BASF SE (US), and SGL Carbon (Germany), among others, are the key manufacturers that secured contracts, deals in the last few years. Contracts and deals were the key strategies adopted by these companies to strengthen their position in the thermoplastic tapes market.

What are the drivers for the thermoplastic tapes market?

Wide application in primary and secondary aircraft structures and high durability and fatigue resistance are the major drivers of the market.

Which region is expected to hold the highest market share?

Europe will dominate the market share in 2022, showcasing strong demand for thermoplastic tapes from this region. Well-established and prominent manufacturers in this region driving market growth in the region.

What is the total CAGR expected to be recorded for the thermoplastic tapes market during 2023-2028?

The CAGR is expected to record a CAGR of 10.5% from 2023-2028.

How is the thermoplastic tapes market aligned?

The market is growing at a significant pace. The market is a potential market, and many manufacturers are planning business strategies to expand their existing business. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Wide application in primary and secondary aircraft structures- High durability and fatigue resistance- Reduced fuel consumption and carbon emission- Increasing adoption of eco-friendly productsRESTRAINTS- High processing and manufacturing costsOPPORTUNITIES- Increased demand from various industries- Rising need for electric vehicles- Reduced carbon fiber costCHALLENGES- Development of low-cost technologies- Limited use of carbon fiber tapes in high-temperature applications

-

5.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.4 SUPPLY CHAIN ANALYSIS

-

5.5 PRICING ANALYSISAVERAGE SELLING PRICE, BY END-USE INDUSTRYAVERAGE SELLING PRICE, BY FIBER TYPEAVERAGE SELLING PRICE, BY RESIN TYPEAVERAGE SELLING PRICE, BY REGION

-

5.6 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.7 TECHNOLOGY ANALYSIS

- 5.8 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.9 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.10 ECOSYSTEM MAPPINGRAW MATERIAL ANALYSISMANUFACTURING PROCESS ANALYSISFINAL PRODUCT ANALYSIS

- 5.11 VALUE CHAIN ANALYSIS

-

5.12 IMPORT–EXPORT SCENARIOJAPANUSGERMANYFRANCECHINA

- 5.13 CASE STUDY ANALYSIS

- 5.14 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.15 PATENT ANALYSISMETHODOLOGYDOCUMENT TYPESINSIGHTSLEGAL STATUSJURISDICTION ANALYSISTOP APPLICANTS

- 6.1 INTRODUCTION

-

6.2 GLASS FIBERSUSED TO BUILD PARTS & MOLDS

-

6.3 CARBON FIBERSUSED IN SPORTING GOODS

- 6.4 OTHER FIBERS

- 7.1 INTRODUCTION

-

7.2 AEROSPACE & DEFENSENEED FOR FUEL-EFFICIENT AND ADVANCED AIRCRAFT TO DRIVE MARKET

-

7.3 AUTOMOTIVE & TRANSPORTATIONRISING DEMAND FOR LIGHTWEIGHT VEHICLES TO REDUCE FUEL CONSUMPTION

-

7.4 OIL & GASUSE OF THERMOPLASTIC TAPES IN DEEP-SEA OIL FACILITIES TO PROPEL MARKET

-

7.5 SPORTING GOODSUSE OF SMALL TOW CARBON FIBERS TO BOOST MARKET

-

7.6 MEDICAL & HEALTHCAREINCREASING INVESTMENT IN MEDICAL AND PHARMA INDUSTRIES TO PROPEL MARKET

-

7.7 OTHER END-USE INDUSTRIESCONSTRUCTION & INFRASTRUCTUREPIPES & TANKSENERGY

- 8.1 INTRODUCTION

-

8.2 POLYARYLETHERKETONEGOOD THERMAL STABILITY AND LOW FRICTION COEFFICIENT

-

8.3 POLYAMIDEHIGH RESISTANCE TO HEAT AND CHEMICAL ATTACK

-

8.4 POLYPHENYLENE SULFIDETHERMALLY STABLE AND CORROSION RESISTANT

-

8.5 POLYPROPYLENEOFFERS SUPERIOR STRENGTH AND CHEMICAL RESISTANCE

- 8.6 OTHER RESIN TYPES

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICAUS- Presence of well-established players to drive marketCANADA- Growth of manufacturing sector to propel market

-

9.3 EUROPEGERMANY- Strong manufacturing base and infrastructure to drive marketFRANCE- Increasing demand in aerospace & defense sector to propel marketUK- High demand for fuel-efficient and lightweight vehicles to boost marketITALY- Growth of automotive & transportation sector to fuel demand for thermoplastic tapesSPAIN- Use of composites in aircraft to boost marketREST OF EUROPE

-

9.4 ASIA PACIFICCHINA- Demand for sporting goods to drive marketJAPAN- Production of high-quality thermoplastic tapes to drive marketSOUTH KOREA- Presence of major automotive companies to boost marketAUSTRALIA- Increasing demand for electric vehicles to propel marketTAIWAN- Growth of sporting goods industry to drive marketREST OF ASIA PACIFIC

-

9.5 MIDDLE EAST & AFRICAUAE- Investment by leading players to fuel market growthSOUTH AFRICA- Growth of automotive & transportation sector to drive marketREST OF MIDDLE EAST & AFRICA

-

9.6 LATIN AMERICABRAZIL- Growth of aerospace & defense sector to boost marketMEXICO- Expansion of automotive & transportation sector to propel marketREST OF LATIN AMERICA

- 10.1 INTRODUCTION

- 10.2 MARKET SHARE ANALYSIS

- 10.3 RANKING OF KEY PLAYERS

- 10.4 REVENUE ANALYSIS OF TOP MARKET PLAYERS

-

10.5 COMPANY EVALUATION MATRIXSTARSPERVASIVE PLAYERSPARTICIPANTSEMERGING LEADERS

- 10.6 MARKET EVALUATION FRAMEWORK

- 10.7 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

-

10.8 SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

11.1 KEY PLAYERSEVONIK INDUSTRIES AG- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSOLVAY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTORAY INDUSTRIES, INC.- Business overview- Products offered- Recent developments- MnM viewMITSUI CHEMICALS, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSABIC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHEXCEL CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTEIJIN LIMITED- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewARKEMA- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSGL CARBON- Business overview- Products/Solutions/Services offered- MnM viewBASF SE- Business overview- Products/Solutions/Services offered- Recent developments- MnM view

-

11.2 OTHER PLAYERS3MPARK AEROSPACE CORP.CHOMARATSIGMATEXDSMCELANESE CORPORATIONAVIENTTCR COMPOSITES, INC.VICTREX PLCCOMPTAPEMITSUBISHI CHEMICAL GROUP

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 PORTER’S FIVE FORCES ANALYSIS OF THERMOPLASTIC TAPES MARKET

- TABLE 2 THERMOPLASTIC TAPES MARKET: SUPPLY CHAIN

- TABLE 3 AVERAGE SELLING PRICE OF THERMOPLASTIC TAPES BY REGION

- TABLE 4 IMPACT OF STAKEHOLDERS ON BUYING PROCESS

- TABLE 5 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 6 THERMOPLASTIC TAPES MARKET: KEY CONFERENCES AND EVENTS, 2023–2024

- TABLE 7 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 THERMOPLASTIC TAPES MARKET: GLOBAL PATENTS

- TABLE 11 PATENT ANALYSIS

- TABLE 12 THERMOPLASTIC TAPES MARKET, BY FIBER TYPE, 2021–2028 (USD MILLION)

- TABLE 13 THERMOPLASTIC TAPES MARKET, BY FIBER TYPE, 2021–2028 (KILOTON)

- TABLE 14 GLASS FIBER: THERMOPLASTIC TAPES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 15 GLASS FIBER: THERMOPLASTIC TAPES MARKET, BY REGION, 2021–2028 (KILOTON)

- TABLE 16 CARBON FIBER: THERMOPLASTIC TAPES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 17 CARBON FIBER: THERMOPLASTIC TAPES MARKET, BY REGION, 2021–2028 (KILOTON)

- TABLE 18 OTHER FIBERS: THERMOPLASTIC TAPES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 19 OTHER FIBERS: THERMOPLASTIC TAPES MARKET, BY REGION, 2021–2028 (KILOTON)

- TABLE 20 THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 21 THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021–2028 (KILOTON)

- TABLE 22 AEROSPACE & DEFENSE: THERMOPLASTIC TAPES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 23 AEROSPACE & DEFENSE: THERMOPLASTIC TAPES MARKET, BY REGION, 2021–2028 (KILOTON)

- TABLE 24 AUTOMOTIVE & TRANSPORTATION: THERMOPLASTIC TAPES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 25 AUTOMOTIVE & TRANSPORTATION: THERMOPLASTIC TAPES MARKET, BY REGION, 2021–2028 (KILOTON)

- TABLE 26 OIL & GAS: THERMOPLASTIC TAPES MARKET, REGION, 2021–2028 (USD MILLION)

- TABLE 27 OIL & GAS: THERMOPLASTIC TAPES MARKET, BY REGION, 2021–2028 (KILOTON)

- TABLE 28 SPORTING GOODS: THERMOPLASTIC TAPES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 29 SPORTING GOODS: THERMOPLASTIC TAPES MARKET, BY REGION, 2021–2028 (KILOTON)

- TABLE 30 MEDICAL & HEALTHCARE: THERMOPLASTIC TAPES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 31 MEDICAL & HEALTHCARE: THERMOPLASTIC TAPES MARKET, BY REGION, 2021–2028 (KILOTON)

- TABLE 32 OTHER END-USE INDUSTRIES: THERMOPLASTIC TAPES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 33 OTHER END-USE INDUSTRIES: THERMOPLASTIC TAPES MARKET, BY REGION, 2021–2028 (KILOTON)

- TABLE 34 THERMOPLASTIC TAPES MARKET, BY RESIN TYPE, 2021–2028 (USD MILLION)

- TABLE 35 THERMOPLASTIC TAPES MARKET, BY RESIN TYPE, 2021–2028 (KILOTON)

- TABLE 36 PAEK: THERMOPLASTIC TAPES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 37 PAEK: THERMOPLASTIC TAPES MARKET, BY REGION, 2021–2028 (KILOTON)

- TABLE 38 PA: THERMOPLASTIC TAPES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 39 PA: THERMOPLASTIC TAPES MARKET, BY REGION, 2021–2028 (KILOTON)

- TABLE 40 PPS: THERMOPLASTIC TAPES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 41 PPS: THERMOPLASTIC TAPES MARKET, BY REGION, 2021–2028 (KILOTON)

- TABLE 42 PP: THERMOPLASTIC TAPES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 43 PP: THERMOPLASTIC TAPES MARKET, BY REGION, 2021–2028 (KILOTON)

- TABLE 44 OTHER RESINS: THERMOPLASTIC TAPES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 45 OTHER RESINS: THERMOPLASTIC TAPES MARKET, BY REGION, 2021–2028 (KILOTON)

- TABLE 46 THERMOPLASTIC TAPES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 47 THERMOPLASTIC TAPES MARKET, BY REGION, 2021–2028 (KILOTON)

- TABLE 48 NORTH AMERICA: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 49 NORTH AMERICA: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021–2028 (KILOTON)

- TABLE 50 NORTH AMERICA: THERMOPLASTIC TAPES MARKET, BY RESIN TYPE, 2021–2028 (USD MILLION)

- TABLE 51 NORTH AMERICA: THERMOPLASTIC TAPES MARKET, BY RESIN TYPE, 2021–2028 (KILOTON)

- TABLE 52 NORTH AMERICA: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 53 NORTH AMERICA: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021–2028 (KILOTON)

- TABLE 54 NORTH AMERICA: THERMOPLASTIC TAPES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 55 NORTH AMERICA: THERMOPLASTIC TAPES MARKET, BY COUNTRY, 2021–2028 (KILOTON)

- TABLE 56 US: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 57 US: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021–2028 (KILOTON)

- TABLE 58 CANADA: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 59 CANADA: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021–2028 (KILOTON)

- TABLE 60 EUROPE: THERMOPLASTIC TAPES MARKET, BY FIBER TYPE, 2021–2028 (USD MILLION)

- TABLE 61 EUROPE: THERMOPLASTIC TAPES MARKET, BY FIBER TYPE, 2021–2028 (KILOTON)

- TABLE 62 EUROPE: THERMOPLASTIC TAPES MARKET, BY RESIN TYPE, 2021–2028 (USD MILLION)

- TABLE 63 EUROPE: THERMOPLASTIC TAPES MARKET, BY RESIN TYPE, 2021–2028 (KILOTON)

- TABLE 64 EUROPE: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 65 EUROPE: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021–2028 (KILOTON)

- TABLE 66 EUROPE: THERMOPLASTIC TAPES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 67 EUROPE: THERMOPLASTIC TAPES MARKET, BY COUNTRY, 2021–2028 (KILOTON)

- TABLE 68 GERMANY: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 69 GERMANY: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021–2028 (KILOTON)

- TABLE 70 FRANCE: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 71 FRANCE: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021–2028 (KILOTON)

- TABLE 72 UK: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 73 UK: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021–2028 (KILOTON)

- TABLE 74 ITALY: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 75 ITALY: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021–2028 (KILOTON)

- TABLE 76 SPAIN: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 77 SPAIN: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021–2028 (KILOTON)

- TABLE 78 REST OF EUROPE: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 79 REST OF EUROPE: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021–2028 (KILOTON)

- TABLE 80 ASIA PACIFIC: THERMOPLASTIC TAPES MARKET, BY FIBER TYPE, 2021–2028 (USD MILLION)

- TABLE 81 ASIA PACIFIC: THERMOPLASTIC TAPES MARKET, BY FIBER TYPE, 2021–2028 (KILOTON)

- TABLE 82 ASIA PACIFIC: THERMOPLASTIC TAPES MARKET, BY RESIN TYPE, 2021–2028 (USD MILLION)

- TABLE 83 ASIA PACIFIC: THERMOPLASTIC TAPES MARKET, BY RESIN TYPE, 2021–2028 (KILOTON)

- TABLE 84 ASIA PACIFIC: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 85 ASIA PACIFIC: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021–2028 (KILOTON)

- TABLE 86 ASIA PACIFIC: THERMOPLASTIC TAPES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 87 ASIA PACIFIC: THERMOPLASTIC TAPES MARKET, BY COUNTRY, 2021–2028 (KILOTON)

- TABLE 88 CHINA: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 89 CHINA: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021–2028 (KILOTON)

- TABLE 90 JAPAN: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 91 JAPAN: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021–2028 (KILOTON)

- TABLE 92 SOUTH KOREA: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 93 SOUTH KOREA: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021–2028 (KILOTON)

- TABLE 94 AUSTRALIA: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 95 AUSTRALIA: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021–2028 (KILOTON)

- TABLE 96 TAIWAN: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 97 TAIWAN: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021–2028 (KILOTON)

- TABLE 98 REST OF ASIA PACIFIC: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 99 REST OF ASIA PACIFIC: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021–2028 (KILOTON)

- TABLE 100 MIDDLE EAST & AFRICA: THERMOPLASTIC TAPES MARKET, BY FIBER TYPE, 2021–2028 (USD MILLION)

- TABLE 101 MIDDLE EAST & AFRICA: THERMOPLASTIC TAPES MARKET, BY FIBER TYPE, 2021–2028 (KILOTON)

- TABLE 102 MIDDLE EAST & AFRICA: THERMOPLASTIC TAPES MARKET, BY RESIN TYPE, 2021–2028 (USD MILLION)

- TABLE 103 MIDDLE EAST & AFRICA: THERMOPLASTIC TAPES MARKET, BY RESIN TYPE, 2021–2028 (KILOTON)

- TABLE 104 MIDDLE EAST & AFRICA: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 105 MIDDLE EAST & AFRICA: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021–2028 (KILOTON)

- TABLE 106 MIDDLE EAST & AFRICA: THERMOPLASTIC TAPES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 107 MIDDLE EAST & AFRICA: THERMOPLASTIC TAPES MARKET, BY COUNTRY, 2021–2028 (KILOTON)

- TABLE 108 UAE: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 109 UAE: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021–2028 (KILOTON)

- TABLE 110 SOUTH AFRICA: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 111 SOUTH AFRICA: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021–2028 (KILOTON)

- TABLE 112 REST OF MIDDLE EAST & AFRICA: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 113 REST OF MIDDLE EAST & AFRICA: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021–2028 (KILOTON)

- TABLE 114 LATIN AMERICA: THERMOPLASTIC TAPES MARKET, BY FIBER TYPE, 2021–2028 (USD MILLION)

- TABLE 115 LATIN AMERICA: THERMOPLASTIC TAPES MARKET, BY FIBER TYPE, 2021–2028 (KILOTON)

- TABLE 116 LATIN AMERICA: THERMOPLASTIC TAPES MARKET, BY RESIN TYPE, 2021–2028 (USD MILLION)

- TABLE 117 LATIN AMERICA: THERMOPLASTIC TAPES MARKET, BY RESIN TYPE, 2021–2028 (KILOTON)

- TABLE 118 LATIN AMERICA: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 119 LATIN AMERICA: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021–2028 (KILOTON)

- TABLE 120 LATIN AMERICA: THERMOPLASTIC TAPES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 121 LATIN AMERICA: THERMOPLASTIC TAPES MARKET, BY COUNTRY, 2021–2028 (KILOTON)

- TABLE 122 BRAZIL: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 123 BRAZIL: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021–2028 (KILOTON)

- TABLE 124 MEXICO: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 125 MEXICO: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021–2028 (KILOTON)

- TABLE 126 REST OF LATIN AMERICA: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 127 REST OF LATIN AMERICA: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021–2028 (KILOTON)

- TABLE 128 DEGREE OF COMPETITION: THERMOPLASTIC TAPES MARKET

- TABLE 129 COMPANY PRODUCT FOOTPRINT

- TABLE 130 COMPANY END-USE INDUSTRY FOOTPRINT

- TABLE 131 COMPANY REGION FOOTPRINT

- TABLE 132 THERMOPLASTIC TAPES MARKET: PRODUCT DEVELOPMENTS, 2018–2023

- TABLE 133 THERMOPLASTIC TAPES MARKET: DEALS, 2018–2023

- TABLE 134 THERMOPLASTIC TAPES MARKET: OTHER DEVELOPMENTS, 2018–2023

- TABLE 135 THERMOPLASTIC TAPES MARKET: KEY STARTUPS/SMES

- TABLE 136 THERMOPLASTIC TAPES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 137 EVONIK INDUSTRIES AG: COMPANY OVERVIEW

- TABLE 138 EVONIK INDUSTRIES AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 139 EVONIK INDUSTRIES AG: OTHER DEVELOPMENTS

- TABLE 140 SOLVAY: COMPANY OVERVIEW

- TABLE 141 SOLVAY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 142 SOLVAY: DEALS

- TABLE 143 SOLVAY: OTHER DEVELOPMENTS

- TABLE 144 TORAY INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 145 TORAY INDUSTRIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 146 TORAY INDUSTRIES, INC.: DEALS

- TABLE 147 TORAY INDUSTRIES, INC.: OTHER DEVELOPMENTS

- TABLE 148 MITSUI CHEMICALS, INC.: COMPANY OVERVIEW

- TABLE 149 MITSUI CHEMICALS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 150 MITSUI CHEMICALS, INC.: DEALS

- TABLE 151 SABIC: COMPANY OVERVIEW

- TABLE 152 SABIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 153 SABIC: OTHER DEVELOPMENTS

- TABLE 154 HEXCEL CORPORATION: COMPANY OVERVIEW

- TABLE 155 HEXCEL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 156 HEXCEL CORPORATION: DEALS

- TABLE 157 TEIJIN LIMITED: COMPANY OVERVIEW

- TABLE 158 TEIJIN LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 159 TEIJIN LIMITED: DEALS

- TABLE 160 TEIJIN LIMITED: OTHER DEVELOPMENTS

- TABLE 161 ARKEMA: COMPANY OVERVIEW

- TABLE 162 ARKEMA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 163 ARKEMA: DEALS

- TABLE 164 SGL CARBON: COMPANY OVERVIEW

- TABLE 165 SGL CARBON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 166 BASF SE: COMPANY OVERVIEW

- TABLE 167 BASF SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 168 BASF SE: DEALS

- FIGURE 1 THERMOPLASTIC TAPES MARKET SEGMENTATION

- FIGURE 2 THERMOPLASTIC TAPES MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 5 THERMOPLASTIC TAPES MARKET: DATA TRIANGULATION

- FIGURE 6 AEROSPACE & DEFENSE END-USE INDUSTRY TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 7 CARBON FIBER ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 8 PAEK RESIN DOMINATED MARKET IN 2022

- FIGURE 9 EUROPE TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 10 HIGH DEMAND FOR THERMOPLASTIC TAPES FROM AEROSPACE & DEFENSE SECTOR TO DRIVE MARKET

- FIGURE 11 PAEK ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 12 CARBON FIBER DOMINATED MARKET IN 2022

- FIGURE 13 AUTOMOTIVE & TRANSPORTATION RECORDED HIGHEST GROWTH DURING FORECAST PERIOD 2023-2028

- FIGURE 14 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 16 PORTER’S FIVE FORCES ANALYSIS: THERMOPLASTIC TAPES MARKET

- FIGURE 17 AVERAGE SELLING PRICE OF KEY PLAYERS BY TOP THREE END-USE INDUSTRIES (USD/KG)

- FIGURE 18 AVERAGE SELLING PRICE BY FIBER TYPE (USD/KG)

- FIGURE 19 AVERAGE SELLING PRICE BY RESIN TYPE (USD/KG)

- FIGURE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- FIGURE 21 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- FIGURE 22 THERMOPLASTIC TAPES MARKET: ECOSYSTEM MAP

- FIGURE 23 VALUE CHAIN ANALYSIS: THERMOPLASTIC TAPES MARKET

- FIGURE 24 REVENUE SHIFT OF THERMOPLASTIC TAPES MARKET

- FIGURE 25 GLOBAL PATENT ANALYSIS, BY DOCUMENT TYPE

- FIGURE 26 GLOBAL PATENT PUBLICATION TRENDS, 2012–2022

- FIGURE 27 THERMOPLASTIC TAPES MARKET: LEGAL STATUS OF PATENTS

- FIGURE 28 GLOBAL JURISDICTION ANALYSIS

- FIGURE 29 ZHEJIANG UNIVERSITY REGISTERED HIGHEST NUMBER OF PATENTS

- FIGURE 30 CARBON FIBER SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 31 AEROSPACE & DEFENSE TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 32 EUROPE TO LEAD MARKET IN AEROSPACE & DEFENSE SEGMENT

- FIGURE 33 PAEK SEGMENT TO DOMINATE THERMOPLASTIC TAPES MARKET

- FIGURE 34 CHINA TO RECORD FASTEST GROWTH IN CARBON FIBER MARKET DURING FORECAST PERIOD

- FIGURE 35 NORTH AMERICA: THERMOPLASTIC TAPES MARKET SNAPSHOT

- FIGURE 36 EUROPE: THERMOPLASTIC TAPES MARKET SNAPSHOT

- FIGURE 37 ASIA PACIFIC: THERMOPLASTIC TAPES MARKET SNAPSHOT

- FIGURE 38 MARKET SHARE ANALYSIS OF TOP COMPANIES IN THERMOPLASTIC TAPES MARKET, 2022

- FIGURE 39 RANKING OF TOP FIVE PLAYERS IN THERMOPLASTIC TAPES MARKET

- FIGURE 40 REVENUE ANALYSIS OF TOP PLAYERS IN THERMOPLASTIC TAPES MARKET

- FIGURE 41 THERMOPLASTIC TAPES MARKET (GLOBAL): COMPANY EVALUATION MATRIX, 2022

- FIGURE 42 THERMOPLASTIC TAPES MARKET: SME EVALUATION MATRIX, 2022

- FIGURE 43 EVONIK INDUSTRIES AG: COMPANY SNAPSHOT

- FIGURE 44 SOLVAY: COMPANY SNAPSHOT

- FIGURE 45 TORAY INDUSTRIES, INC.: COMPANY SNAPSHOT

- FIGURE 46 MITSUI CHEMICALS, INC.: COMPANY SNAPSHOT

- FIGURE 47 SABIC: COMPANY SNAPSHOT

- FIGURE 48 HEXCEL CORPORATION: COMPANY SNAPSHOT

- FIGURE 49 TEIJIN LIMITED: COMPANY SNAPSHOT

- FIGURE 50 ARKEMA: COMPANY SNAPSHOT

- FIGURE 51 SGL CARBON: COMPANY SNAPSHOT

- FIGURE 52 BASF SE: COMPANY SNAPSHOT

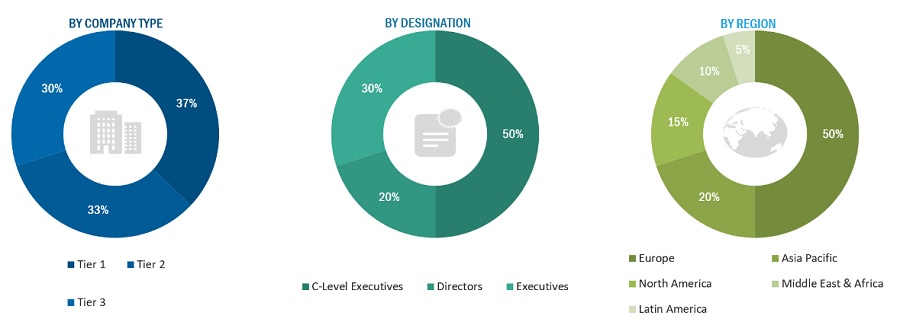

The study involves two major activities in estimating the current market size for the thermoplastic tapes market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering thermoplastic tapes and information from various trade, business, and professional associations. Secondary research was used to obtain key information about the supply chain of the thermoplastic tapes industry, the market’s monetary chain, the total pool of key players, market classification & segmentation according to industry trends to the bottom-most level and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective. The secondary data was collected and analyzed to arrive at the overall size of the thermoplastic tapes market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information regarding the thermoplastic tapes market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, product development/innovation teams, and related key executives from thermoplastic tapes industry vendors; system integrators; component providers; distributors; and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, vertical, and region. Stakeholders from the demand side, such as CIOs, CTOs, CSOs, and installation teams of the customer/end users who are using the thermoplastic tapes industry, were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of thermoplastic tapes and future outlook of their business which will affect the overall market.

The Breakup of Primary Research :

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

Details |

|

Teijin Limited |

Product Development Head |

|

Toray Industries, Inc. |

Sales Director |

|

Solvay |

Thermoplastic Tapes Consultant |

|

Hexcel Corporation |

Sales Head |

Market Size Estimation

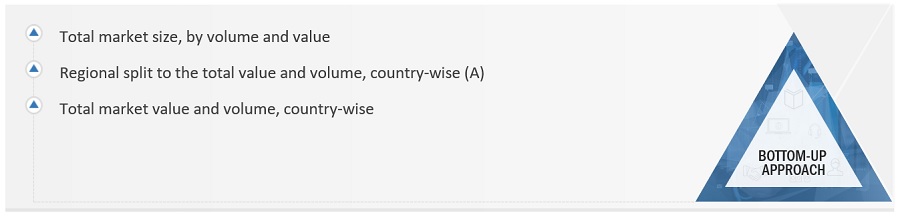

The research methodology used to estimate the size of the thermoplastic tapes market includes the following details. The market sizing of the market was undertaken from the demand side. The market was upsized based on procurements and modernizations in thermoplastic tapes in different applications of the thermoplastic tapes industry at a regional level. Such procurements provide information on the demand aspects of the thermoplastic tapes industry for each application. For each application, all possible segments of the thermoplastic tapes market were integrated and mapped.

Thermoplastic Tapes Market Size: Bottom Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

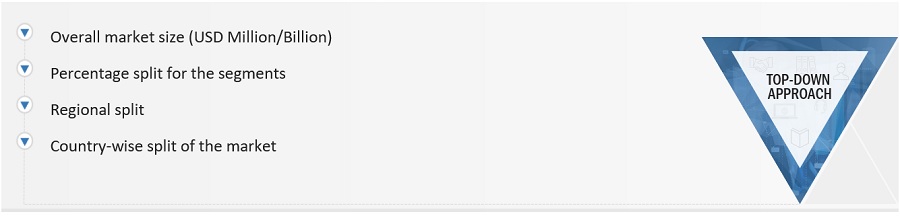

Thermoplastic Tapes Market Size: Top Down Approach

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Thermoplastic tape is a composite comprising properties of fibers and plastics (resins). These tapes are impregnated with various thermoplastic resins, including PAEK, PPS, PC, PA, PET, TPU, and others. Thermoplastic tapes are highly flexible at average temperatures but harden when the material is heated and cooled again. They offer high mechanical strength, flexibility, rigidity, chemical resistance, recyclability, and other properties. The demand for these tapes will likely grow with the increasing need for high-strength and lightweight parts in aerospace & defense, automotive & transportation, sporting goods, and other sectors.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Report Objectives

- To define, describe, and forecast the global thermoplastic tapes market based on fiber type, resin type, end-use industry, and region.

- To provide detailed information about key factors (drivers, restraints, opportunities, and challenges) influencing market growth.

- To predict the market size for North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

- To strategically analyze micromarkets concerning individual growth trends, growth prospects, and contribution to the total market.

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape.

- Analyze competitive market developments, such as new product launches/ developments, expansions, mergers & acquisitions, agreements, and partnerships.

- To profile key players and comprehensively analyze their market shares and core competencies.

Available Customizations

MarketsandMarkets offers following customizations for this market report:

- Additional country-level analysis of the thermoplastic tapes market

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company's market

Growth opportunities and latent adjacency in Thermoplastic Tapes Market