Infrared Thermography Market for Building Inspection by Product (Cameras, Scopes, Modules), Solution (Handheld Thermal Camera, Fixed Mount Camera, Unmanned Infrared System), Platform (IR lens, Uncooled IR detector), Building Type - Global Forecast to 2028

Updated on : October 23, 2024

Infrared Thermography Market Size & Growth

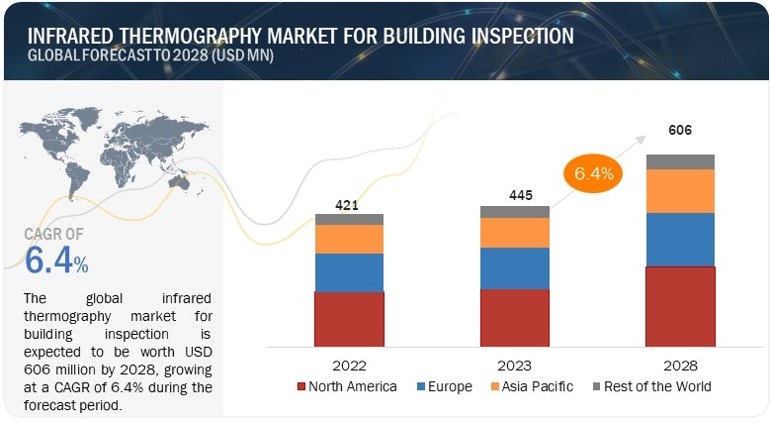

[224 Pages Report] The global infrared thermography market size for building inspection is estimated to be worth USD 445 million in 2023 and is projected to reach USD 606 million by 2028, growing at a CAGR of 6.4% during the forecast period 2023 to 2028 Growing demand for smart buildings is one of the major opportunities that lies ahead for market growth.

Infrared Thermography Market size Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Infrared Thermography Market Trends

Driver: Increasing emphasis on energy efficiency and sustainability

Infrared thermography enables precise identification of areas requiring repairs or retrofitting to improve energy efficiency. This targeted approach helps allocate resources more effectively and avoid unnecessary interventions, resulting in optimized energy consumption and reduced operational costs. Efforts to enhance energy efficiency through infrared thermography inspections lead to significant cost savings in the long run. By addressing energy-related issues promptly, building owners can cut down on energy bills and operational expenses.

Restraint: Initial investment and training costs

Adopting infrared thermography for building inspection necessitates an upfront investment in thermal imaging equipment, which includes high-quality infrared cameras and associated hardware and software. These initial costs can be significant, especially for small businesses or organizations with limited budgets. Maintaining thermal imaging equipment, ensuring its accuracy, and calibrating it periodically adds to the overall costs. Regular maintenance is crucial to preserving the quality of thermal images and ensuring reliable results during inspections.

Opportunity: Growing demand for smart buildings

Smart and green buildings prioritize energy efficiency and sustainable practices. Infrared thermography is a valuable tool for assessing the thermal performance of building envelopes, insulation systems, and HVAC systems. Integrating infrared thermography with building automation systems enhances overall building management. By regularly monitoring thermal conditions, smart buildings can trigger automated responses to rectify temperature anomalies or potential energy wastage, optimizing energy consumption and reducing operational costs.

Challenge: Data analysis and reporting complexity

Data analysis and reporting in infrared thermography for building inspection can be complex due to the nature of the data collected and the need to accurately interpret and communicate. Infrared inspections generate a significant number of thermal images, especially for larger buildings or complex structures. Managing and analyzing these large data sets can be challenging, requiring efficient data storage, organization, and retrieval systems. Interpreting thermal images requires a deep understanding of building materials, construction techniques, and heat transfer principles. Thermographers must be able to distinguish between normal temperature variations and anomalies that could indicate defects or issues.

Infrarred Thermography Market for Building Inspection: Ecosystem

The infrared thermography Industry for building inspection is marked by the presence of a few tier-1 companies, such as Teledyne FLIR LLC (US), Fluke Corporation (US), and Axis Communications AB (Sweden), and many more. These companies have created a competitive ecosystem by investing in research and development activities to launch highly efficient and reliable thermal imaging offerings.

Infrared Thermography Market Share

The market for thermal modules to hold second largest market share during the forecast period

The growth of thermal modules for thermal imaging has surged due to technological advancements, reduced costs, and diversified applications. These modules have become smaller, with higher resolution and better image quality, finding use in industries from defense to consumer electronics. Integration with IoT and connectivity has expanded real-time monitoring capabilities. Regulatory standards and increasing market competition have further fueled innovation and accessibility.

Unmanned segment by Solution type to hold highest CAGR during the forecast period

These cameras have become more sophisticated, offering higher resolution and improved image processing. They find applications in various sectors, including surveillance, industrial inspections, agriculture, and search and rescue. As automation and AI integration increase, unmanned thermal imaging cameras are poised to play a pivotal role in enhancing efficiency, safety, and data-driven decision-making.

Fire/Flare Detection application to hold second highest market share during the forecast period

Fire and flare detection using thermal imaging has gained significant importance due to its effectiveness in early detection and prevention. Thermal imaging technology detects heat signatures, making it ideal for identifying fires and flares, especially in challenging environments. These systems are crucial for industrial facilities, oil refineries, and hazardous areas.

Infrared Thermography Market Regional Analysis

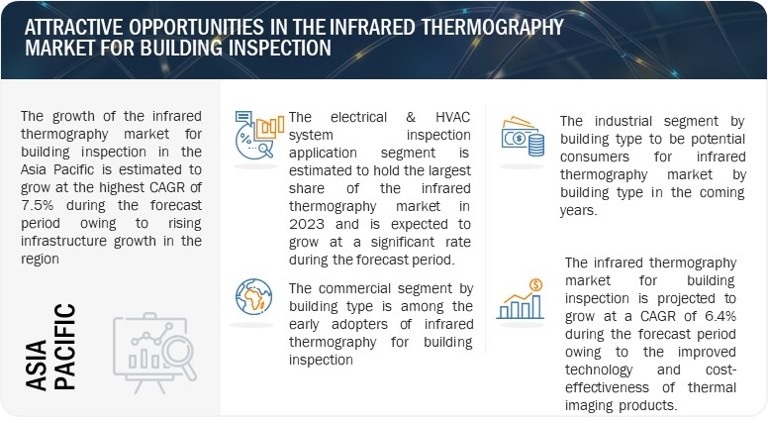

Asia Pacific held to register highest CAGR in the infrared thermography market for building inspection during forecast period

The Asia Pacific region has witnessed significant growth in thermal imaging, driven by robust infrastructure development. This technology plays a crucial role in construction quality control, power infrastructure maintenance, industrial predictive maintenance, and enhancing security across sectors. The technology continues to advance, and its applications are expanding to new areas, promoting safety, efficiency, and innovation in the region.

Infrared Thermography Market Size by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Infrared Thermography Companies - Key Market Players:

The overall Infrared Thermography companies is dominated by The key players in include

- Teledyne FLIR LLC (US),

- JENOPTIK AG (Germany),

- SKF (Sweden),

- Fluke Corporation (US),

- Raytheon Technologies Corporation (US),

- Axis Communications AB (Sweden), Inc,

- Xenics nv (Belgium),

- Zhejiang Dali Technology Co.,Ltd. (China),

- OPGAL Optronics Industries Ltd (Israel),

- InfraTec GmbH (Germany),

- Seek Thermal (US),

- Infrared Cameras Inc. (US) and

- Allied Vision Technologies GmbH (Germany). These companies have used both organic and inorganic growth strategies such as product launches, acquisitions, and partnerships to strengthen their position in the market.

Infrared Thermography Market Report Scope :

|

Report Metric |

Details |

| Estimated Market Size | USD 445 million in 2023 |

| Projected Market Size | USD 606 million by 2028 |

| Growth Rate | At a CAGR of 6.4% |

|

Infrared Thermography Market size available for years |

2019–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

|

|

Geographies covered |

|

|

Companies covered |

The major players in the infrared thermography market for building inspection are Teledyne FLIR LLC (US), JENOPTIK AG (Germany), SKF (Sweden), Fluke Corporation (US), Raytheon Technologies Corporation (US), Axis Communications AB (Sweden), Inc, Xenics nv (Belgium), Zhejiang Dali Technology Co.,Ltd. (China), OPGAL Optronics Industries Ltd (Israel), InfraTec GmbH (Germany), Seek Thermal (US), Infrared Cameras Inc. (US) and Allied Vision Technologies GmbH (Germany). |

Infrared Thermography Market Highlights

The study segments the infrared thermography market for building inspection based on By Application, By Product Type, By Building Type, By Solution and By Region

|

Segment |

Subsegment |

|

By Product Type |

|

|

By Solution Type |

|

|

Infrared Thermography Market Size , By Application |

|

|

Infrared Thermography Market Share, By Building Type |

|

|

Infrared Thermography Market Size , By Region |

|

Recent Developments In Infrared Thermography Industry

- In February 2023, Xenics nv (Belgium) launched Lynx R and XSL R series and expanding its linear SWIR camera portfolio. Linear SWIR cameras are available for demanding applications such as food sorting, machine vision, spectroscopy, optical fibre monitoring, semiconductor inspection, LIDAR sensing and spectral-domain optical coherence tomography.

- In November 2022, Teledyne FLIR launched FLIR ONE Edge Pro, a wireless thermal-visible camera for mobile devices. Unlike previous models, the reimagined FLIR ONE Edge Pro need not be physically connected to its companion mobile device, providing maximum thermal inspection flexibility.

- In May 2021, Teledyne Technologies acquired FLIR Systems, a leading provider of thermal imaging solutions. The acquisition allowed Teledyne to enhance its portfolio by integrating advanced thermal imaging technology and expanding its capabilities in the defense, industrial, and commercial markets.

Frequently Asked Questions (FAQs)

What is the current size of the global infrared thermography market for building inspection?

The infarred thermography market for building inpection is estimated to be worth USD 445 million in 2023 and is projected to reach USD 606 million by 2028, growing at a CAGR of 6.4% during the forecast period.

Who are the winners in the global infrared thermography market for building inspection?

Teledyne FLIR LLC (US), Axis Communications AB (Sweden), Fluke Corporation (US) are some of the global winners in infarred imaging market.

Which region is expected to hold the highest market share in infrared thermography market for building inspection?

North America is expected to dominate the infrared thermography market for building inspection during forecast period as region is home to many top market players such as Teledyne FLIR LLC (US), Fluke Corporation (US), IRCameras LLC (US) and OPGAL Optronics Industries Ltd. (US).

What are the major opportunities related to infrared thermography market for building inspection?

Growing demand for smart buildings and integration of thermal imaging with building information modelling are some of the major opportunities in the infrared thermography market for building inpection.

What are the major strategies adopted by market players?

The key players have adopted product launches, acquisitions, and partnerships to strengthen their position in the global infrared thermography market for building inspection.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing adoption of non-destructive testing methods- Growing emphasis on energy efficiency and sustainability of buildings- Cost-effectiveness and time efficiency of infrared thermographyRESTRAINTS- Export restrictions imposed on thermal imaging products- High initial investment and training costs related to infrared thermographyOPPORTUNITIES- Integration with Building Information Modeling (BIM)- Growing demand for smart buildingsCHALLENGES- Data analysis and reporting complexities associated with infrared thermography for building inspection- Uneven enforcement of environmental and safety regulations in emerging economies

- 5.3 VALUE CHAIN ANALYSIS

-

5.4 ECOSYSTEM MAPPING

- 5.5 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.6 PRICING ANALYSISAVERAGE SELLING PRICE OF INFRARED THERMOGRAPHY PRODUCTS OFFERED BY KEY PLAYERSAVERAGE SELLING PRICE TREND

-

5.7 TECHNOLOGY ANALYSISUSE OF IR IMAGING TO ANALYZE ORGANIC COMPOSTSVIBRATIONAL SPECTROSCOPIC TECHNIQUES FOR TEA QUALITY AND SAFETY ANALYSESADVANCEMENTS IN AI-BASED INFRARED IMAGING

-

5.8 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.9 KEY STAKEHOLDERS IN BUYING PROCESS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.10 CASE STUDY ANALYSISROCKWOOL GROUP USED TELEDYNE FLIR’S THERMAL IMAGING TECHNOLOGY TO EVALUATE INSULATION EFFECTIVENESS AND PROVIDE COMPREHENSIVE BUILDING ANALYSIS- VICENZA COURT HIRED SERVICES OF THERMAL IMAGING EXPERTS FROM MULTITES SRL TO RESOLVE CONSTRUCTION DISPUTEHIGHLAND HELICOPTERS DEPLOYED THERMAL CAMERAS FROM INFRATEC TO COMBAT WILDFIRES

-

5.11 TRADE ANALYSISIMPORT SCENARIO OF MAGNETIC OR OPTICAL READERSEXPORT SCENARIO OF MAGNETIC OR OPTICAL READERS

-

5.12 PATENT ANALYSIS

- 5.13 KEY CONFERENCES AND EVENTS, 2023–2024

- 5.14 TARIFF ANALYSIS

-

5.15 STANDARDS AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSREGULATORY LANDSCAPEGOVERNMENT REGULATIONS- US- Europe- India

- 6.1 INTRODUCTION

-

6.2 SHORT-WAVE INFRARED (SWIR)INCREASED DEPLOYMENT OF SWIR FOR NON-DESTRUCTIVE TESTING IN SEMICONDUCTOR AND ELECTRONICS INDUSTRY TO DRIVE SEGMENT

-

6.3 MID-WAVE INFRARED (MWIR)BETTER IMAGE GENERATION CAPACITY OF MWIR TO DRIVE SEGMENTAL LANDSCAPE

-

6.4 LONG-WAVE INFRARED (LWIR)SIGNIFICANT USE OF LWIR CAMERAS IN FIREFIGHTING TO FUEL SEGMENT GROWTH

- 7.1 INTRODUCTION

-

7.2 HARDWAREIR LENS SYSTEMS- Precise inspections facilitated by enhanced optics and wider coverage of IR lens systems to drive segmentUNCOOLED IR DETECTORS- Need for energy conservation and predictive maintenance in building inspection to propel segmentOTHERS

-

7.3 SOFTWAREPREDICTIVE MAINTENANCE CAPABILITIES OF SOFTWARE USING AI ALGORITHMS AND MACHINE LEARNING TECHNOLOGIES TO FUEL MARKET GROWTH

- 8.1 INTRODUCTION

-

8.2 THERMAL CAMERASABILITY TO OPERATE IN DIFFERENT LIGHTING CONDITIONS TO FUEL MARKET

-

8.3 THERMAL SCOPESADOPTION IN VARIOUS APPLICATIONS TO BOOST MARKET

-

8.4 THERMAL MODULESADOPTION IN NON-CONTACT PATROL INSPECTIONS TO PROPEL MARKET

- 9.1 INTRODUCTION

-

9.2 UNMANNED INFRARED SYSTEMSREQUIREMENT FOR EFFICIENT AND COMPREHENSIVE BUILDING INSPECTIONS IN REMOTE OR HAZARDOUS AREAS TO DRIVE MARKET

-

9.3 HANDHELD THERMAL CAMERASEASE OF HANDLING AND PORTABILITY TO PROPEL MARKET

-

9.4 FIXED MOUNT CAMERASNEED FOR CONTINUOUS MONITORING AND AUTOMATION ACROSS INDUSTRIES TO FUEL SEGMENT GROWTH

- 10.1 INTRODUCTION

-

10.2 INDUSTRIALINCREASING NEED FOR PREDICTIVE MAINTENANCE TO DRIVE MARKET

-

10.3 COMMERCIALRISING AWARENESS OF ENERGY CONSERVATION TO PROPEL MARKET

-

10.4 RESIDENTIALINCREASING DEMAND FOR ENERGY-EFFICIENT HOMES AND SMART BUILDINGS TO FUEL MARKET GROWTH

- 11.1 INTRODUCTION

-

11.2 ENERGY AUDITINGINCREASING FOCUS ON SUSTAINABLE PRACTICES TO DRIVE DEMAND FOR ENERGY AUDITING

-

11.3 ELECTRICAL & HVAC SYSTEMS INSPECTIONNEED TO MAINTAIN SAFE AND RELIABLE ELECTRICAL INFRASTRUCTURE IN BUILDINGS TO FUEL SEGMENT GROWTH

-

11.4 STRUCTURAL ANALYSISINCREASING EMPHASIS ON MAINTAINING SAFETY AND DURABILITY OF BUILDINGS TO PROPEL SEGMENT

-

11.5 INSULATION INSPECTIONRISING FOCUS ON DEVELOPING ENERGY-EFFICIENT BUILDINGS TO CREATE DEMAND FOR INSULATION INSPECTION

-

11.6 FLARE/FIRE DETECTIONNEED TO ENHANCE FIRE SAFETY MEASURES TO BOOST DEMAND FOR INFRARED THERMOGRAPHY

- 11.7 OTHERS

- 12.1 INTRODUCTION

-

12.2 NORTH AMERICAUS- Increased adoption of green building practices to fuel market growthCANADA- Rising investments by government in R&D of thermal imaging to drive marketMEXICO- Growing number of industrial and manufacturing facilities to boost marketRECESSION IMPACT ON INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN NORTH AMERICA

-

12.3 EUROPEUK- Increasing use of thermal cameras for HVAC system monitoring to propel marketGERMANY- Adoption in automotive and healthcare sectors to drive marketFRANCE- Growing urbanization to support market growthREST OF EUROPERECESSION IMPACT ON INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN EUROPE

-

12.4 ASIA PACIFICCHINA- Growing adoption of small and low-cost thermal imaging products to fuel market growthJAPAN- Extensive use of infrared thermography in disaster relief and recovery projects to propel marketINDIA- Favorable government initiatives and foreign direct investments to boost marketREST OF ASIA PACIFICRECESSION IMPACT ON INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN ASIA PACIFIC

-

12.5 REST OF THE WORLD (ROW)SOUTH AMERICA- Temperature variability in region to foster market growthMIDDLE EAST & AFRICA- Thriving oil & gas industry to contribute to market growthRECESSION IMPACT ON INFRARED THERMOGRAPHIC MARKET FOR BUILDING INSPECTION IN ROW

- 13.1 OVERVIEW

- 13.2 MARKET EVALUATION FRAMEWORK

- 13.3 MARKET SHARE ANALYSIS, 2022

- 13.4 REVENUE ANALYSIS OF KEY PLAYERS IN INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION

-

13.5 KEY COMPANY EVALUATION MATRIX, 2022STARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTS

-

13.6 COMPETITIVE BENCHMARKING OF KEY PLAYERSCOMPANY FOOTPRINT, BY PLATFORMCOMPANY FOOTPRINT, BY REGIONOVERALL COMPANY FOOTPRINT

-

13.7 STARTUPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 13.8 COMPETITIVE SCENARIOS AND TRENDS

- 14.1 INTRODUCTION

-

14.2 KEY PLAYERSTELEDYNE FLIR LLC- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewFLUKE CORPORATION- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewAXIS COMMUNICATIONS AB- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewSKF- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewJENOPTIK AG- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewKEYSIGHT TECHNOLOGIES- Business overview- Products/Services/Solutions offeredR. STAHL AG- Business overview- Products/Services/Solutions offeredOPGAL OPTRONIC INDUSTRIES LTD.- Business overview- Products/Services/Solutions offered- Recent developmentsRAYTEK DIRECT- Business overview- Products/Services/Solutions offeredXENICS NV.- Business overview- Products/Services/Solutions offered- Recent developmentsHANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.- Business overview- Products/Services/Solutions offered- Recent developments

-

14.3 OTHER PLAYERSAMETEK LAND (LAND INSTRUMENTS INTERNATIONAL LTD)INFRATEC GMBHSEEK THERMALINFRARED CAMERAS INC.TESTO SE & CO. KGAAC-THERMALSATIRTHERMOTEKNIX SYSTEMS LTD.COX CO., LTD.NEW IMAGING TECHNOLOGIES (NIT)ZHEJIANG DALI TECHNOLOGY CO., LTD.HGHSIERRA-OLYMPIA TECH.OPTOTHERM, INC.

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 RESEARCH ASSUMPTIONS

- TABLE 2 AVERAGE SELLING PRICE OF INFRARED THERMOGRAPHY PRODUCTS OFFERED BY TOP COMPANIES (USD)

- TABLE 3 INDICATIVE SELLING PRICE OF THERMAL IMAGING CAMERAS, BY REGION

- TABLE 4 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION: PORTER’S FIVE FORCES ANALYSIS, 2020

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY BUILDING TYPE

- TABLE 6 KEY BUYING CRITERIA, BY BUILDING TYPE

- TABLE 7 IMPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 902750, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 8 EXPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 902750, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 9 PATENTS PERTAINING TO INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, 2020–2022

- TABLE 10 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION: LIST OF CONFERENCES AND EVENTS

- TABLE 11 MFN TARIFF FOR HS CODE 902750-COMPLIANT PRODUCTS EXPORTED BY US

- TABLE 12 MFN TARIFF FOR HS CODE 902750-COMPLIANT PRODUCTS EXPORTED BY CHINA

- TABLE 13 MFN TARIFF FOR HS CODE 902750-COMPLIANT PRODUCTS EXPORTED BY INDIA

- TABLE 14 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY PRODUCT TYPE, 2019–2022 (USD MILLION)

- TABLE 19 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 20 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY SOLUTION TYPE, 2019–2022 (USD MILLION)

- TABLE 21 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY SOLUTION TYPE, 2023–2028 (USD MILLION)

- TABLE 22 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY BUILDING TYPE, 2019–2022 (USD MILLION)

- TABLE 23 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY BUILDING TYPE, 2023–2028 (USD MILLION)

- TABLE 24 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 25 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 26 BENEFITS OF ENERGY AUDITING

- TABLE 27 ENERGY AUDITING: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY BUILDING TYPE, 2019–2022 (USD MILLION)

- TABLE 28 ENERGY AUDITING: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY BUILDING TYPE, 2023–2028 (USD MILLION)

- TABLE 29 ENERGY AUDITING: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY REGION, 2019–2022 (USD MILLION)

- TABLE 30 ENERGY AUDITING: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 ENERGY AUDITING: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN NORTH AMERICA, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 32 ENERGY AUDITING: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN NORTH AMERICA, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 33 ENERGY AUDITING: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN EUROPE, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 34 ENERGY AUDITING: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN EUROPE, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 35 ENERGY AUDITING: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN ASIA PACIFIC, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 36 ENERGY AUDITING: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN ASIA PACIFIC, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 37 ENERGY AUDITING: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN ROW, BY REGION, 2019–2022 (USD THOUSAND)

- TABLE 38 ENERGY AUDITING: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN ROW, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 39 BENEFITS OF ELECTRICAL & HVAC SYSTEMS INSPECTION

- TABLE 40 ELECTRICAL & HVAC SYSTEMS INSPECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY BUILDING TYPE, 2019–2022 (USD MILLION)

- TABLE 41 ELECTRICAL & HVAC SYSTEMS INSPECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY BUILDING TYPE, 2023–2028 (USD MILLION)

- TABLE 42 ELECTRICAL & HVAC SYSTEMS INSPECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY REGION, 2019–2022 (USD MILLION)

- TABLE 43 ELECTRICAL & HVAC SYSTEMS INSPECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY REGION, 2023–2028 (USD MILLION)

- TABLE 44 ELECTRICAL & HVAC SYSTEMS INSPECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN NORTH AMERICA, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 45 ELECTRICAL & HVAC SYSTEMS INSPECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN NORTH AMERICA, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 46 ELECTRICAL & HVAC SYSTEMS INSPECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN EUROPE, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 47 ELECTRICAL & HVAC SYSTEMS INSPECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN EUROPE, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 48 ELECTRICAL & HVAC SYSTEMS INSPECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN ASIA PACIFIC, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 49 ELECTRICAL & HVAC SYSTEMS INSPECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN ASIA PACIFIC, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 50 ELECTRICAL & HVAC SYSTEMS INSPECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN ROW, BY REGION, 2019–2022 (USD THOUSAND)

- TABLE 51 ELECTRICAL & HVAC SYSTEMS INSPECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN ROW, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 52 STRUCTURAL ANALYSIS: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY BUILDING TYPE, 2019–2022 (USD MILLION)

- TABLE 53 STRUCTURAL ANALYSIS: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY BUILDING TYPE, 2023–2028 (USD MILLION)

- TABLE 54 STRUCTURAL ANALYSIS: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY REGION, 2019–2022 (USD MILLION)

- TABLE 55 STRUCTURAL ANALYSIS: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY REGION, 2023–2028 (USD MILLION)

- TABLE 56 STRUCTURAL ANALYSIS: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN NORTH AMERICA, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 57 STRUCTURAL ANALYSIS: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN NORTH AMERICA, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 58 STRUCTURAL ANALYSIS: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN EUROPE, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 59 STRUCTURAL ANALYSIS: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN EUROPE, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 60 STRUCTURAL ANALYSIS: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN ASIA PACIFIC, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 61 STRUCTURAL ANALYSIS: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN ASIA PACIFIC, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 62 STRUCTURAL ANALYSIS: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN ROW, BY REGION, 2019–2022 (USD THOUSAND)

- TABLE 63 STRUCTURAL ANALYSIS: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN ROW, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 64 INSULATION INSPECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY BUILDING TYPE, 2019–2022 (USD MILLION)

- TABLE 65 INSULATION INSPECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY BUILDING TYPE, 2023–2028 (USD MILLION)

- TABLE 66 INSULATION INSPECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY REGION, 2019–2022 (USD MILLION)

- TABLE 67 INSULATION INSPECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY REGION, 2023–2028 (USD MILLION)

- TABLE 68 INSULATION INSPECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN NORTH AMERICA, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 69 INSULATION INSPECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN NORTH AMERICA, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 70 INSULATION INSPECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN EUROPE, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 71 INSULATION INSPECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN EUROPE, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 72 INSULATION INSPECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN ASIA PACIFIC, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 73 INSULATION INSPECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN ASIA PACIFIC, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 74 INSULATION INSPECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN ROW, BY REGION, 2019–2022 (USD THOUSAND)

- TABLE 75 INSULATION INSPECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN ROW, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 76 BENEFITS OF FIRE/FLARE DETECTION

- TABLE 77 FIRE/FLARE DETECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY BUILDING TYPE, 2019–2022 (USD MILLION)

- TABLE 78 FIRE/FLARE DETECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY BUILDING TYPE, 2023–2028 (USD MILLION)

- TABLE 79 FIRE/FLARE DETECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY REGION, 2019–2022 (USD MILLION)

- TABLE 80 FIRE/FLARE DETECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY REGION, 2023–2028 (USD MILLION)

- TABLE 81 FIRE/FLARE DETECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN NORTH AMERICA, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 82 FIRE/FLARE DETECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN NORTH AMERICA, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 83 FIRE/FLARE DETECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN EUROPE, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 84 FIRE/FLARE DETECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN EUROPE, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 85 FIRE/FLARE DETECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN ASIA PACIFIC, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 86 FIRE/FLARE DETECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN ASIA PACIFIC, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 87 FIRE/FLARE DETECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN ROW, BY REGION, 2019–2022 (USD THOUSAND)

- TABLE 88 FIRE/FLARE DETECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN ROW, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 89 OTHERS: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY BUILDING TYPE, 2019–2022 (USD MILLION)

- TABLE 90 OTHERS: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY BUILDING TYPE, 2023–2028 (USD MILLION)

- TABLE 91 OTHERS: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY REGION, 2019–2022 (USD MILLION)

- TABLE 92 OTHERS: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY REGION, 2023–2028 (USD MILLION)

- TABLE 93 OTHERS: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN NORTH AMERICA, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 94 OTHERS: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN NORTH AMERICA, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 95 OTHERS: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN EUROPE, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 96 OTHERS: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN EUROPE, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 97 OTHERS: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN ASIA PACIFIC, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 98 OTHERS: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN ASIA PACIFIC, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 99 OTHERS: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN ROW, BY REGION, 2019–2022 (USD THOUSAND)

- TABLE 100 OTHERS: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN ROW, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 101 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY REGION, 2019–2022 (USD MILLION)

- TABLE 102 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY REGION, 2023–2028 (USD MILLION)

- TABLE 103 NORTH AMERICA: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 104 NORTH AMERICA INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 105 NORTH AMERICA: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 106 NORTH AMERICA: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 107 EUROPE: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 108 EUROPE: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 109 EUROPE: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 110 EUROPE: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 111 ASIA PACIFIC: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 112 ASIA PACIFIC: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 113 ASIA PACIFIC: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 114 ASIA PACIFIC: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 115 ROW: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY REGION, 2019–2022 (USD MILLION)

- TABLE 116 ROW: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY REGION, 2023–2028 (USD MILLION)

- TABLE 117 ROW: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 118 ROW: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 119 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION

- TABLE 120 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION: MARKET SHARE ANALYSIS (2022)

- TABLE 121 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION: LIST OF KEY STARTUPS/SMES

- TABLE 122 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (PLATFORM FOOTPRINT)

- TABLE 123 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (REGION FOOTPRINT)

- TABLE 124 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION: PRODUCT LAUNCHES, 2021–2023

- TABLE 125 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION: DEALS, 2021–2023

- TABLE 126 TELEDYNE FLIR LLC: BUSINESS OVERVIEW

- TABLE 127 TELEDYNE FLIR LLC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 128 TELEDYNE FLIR LLC: PRODUCT LAUNCHES

- TABLE 129 TELEDYNE FLIR LLC: DEALS

- TABLE 130 FLUKE CORPORATION: BUSINESS OVERVIEW

- TABLE 131 FLUKE CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 132 FLUKE CORPORATION: PRODUCT LAUNCHES

- TABLE 133 AXIS COMMUNICATIONS AB: BUSINESS OVERVIEW

- TABLE 134 AXIS COMMUNICATIONS AB: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 135 AXIS COMMUNICATIONS AB: PRODUCT LAUNCHES

- TABLE 136 SKF: BUSINESS OVERVIEW

- TABLE 137 SKF: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 138 SKF: DEALS

- TABLE 139 JENOPTIK AG: BUSINESS OVERVIEW

- TABLE 140 JENOPTIK AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 141 JENOPTIK AG: DEALS

- TABLE 142 KEYSIGHT TECHNOLOGIES: BUSINESS OVERVIEW

- TABLE 143 KEYSIGHT TECHNOLOGIES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 144 R. STAHL AG: BUSINESS OVERVIEW

- TABLE 145 R. STAHL AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 146 OPGAL OPTRONIC INDUSTRIES LTD.: BUSINESS OVERVIEW

- TABLE 147 OPGAL OPTRONIC INDUSTRIES LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 148 OPGAL OPTRONIC INDUSTRIES LTD.: PRODUCT LAUNCHES

- TABLE 149 RAYTEK DIRECT: BUSINESS OVERVIEW

- TABLE 150 RAYTEK DIRECT: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 151 XENICS NV.: BUSINESS OVERVIEW

- TABLE 152 XENICS NV.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 153 XENICS NV.: PRODUCT LAUNCHES

- TABLE 154 XENICS NV.: DEALS

- TABLE 155 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.: BUSINESS OVERVIEW

- TABLE 156 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- FIGURE 1 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION: SEGMENTATION

- FIGURE 2 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION: RESEARCH DESIGN

- FIGURE 3 PROCESS FLOW OF MARKET SIZE ESTIMATION

- FIGURE 4 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION: BOTTOM-UP APPROACH

- FIGURE 5 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION: TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH (SUPPLY SIDE)—REVENUE GENERATED FROM SALES OF INFRARED THERMOGRAPHY PRODUCTS FOR BUILDING INSPECTION

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 THERMAL CAMERAS SEGMENT, BY PRODUCT TYPE, TO HOLD MAJORITY MARKET SHARE IN 2028

- FIGURE 9 HANDHELD THERMAL CAMERAS SEGMENT, BY SOLUTION TYPE, HELD LARGEST MARKET SHARE IN 2023

- FIGURE 10 COMMERCIAL SEGMENT, BY BUILDING TYPE, TO DOMINATE MARKET IN 2023

- FIGURE 11 ELECTRICAL & HVAC SYSTEMS INSPECTION SEGMENT, BY APPLICATION, TO HOLD LARGEST MARKET SHARE IN 2028

- FIGURE 12 ASIA PACIFIC TO BE FASTEST-GROWING INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION DURING FORECAST PERIOD

- FIGURE 13 INCREASING ADOPTION OF INFRARED THERMOGRAPHY TECHNOLOGY IN ASIA PACIFIC TO DRIVE MARKET

- FIGURE 14 UNMANNED INFRARED SYSTEMS TO REGISTER HIGHEST CAGR IN INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION DURING FORECAST PERIOD

- FIGURE 15 THERMAL CAMERAS SEGMENT TO DOMINATE INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN 2028

- FIGURE 16 US AND ELECTRICAL & HVAC SYSTEMS INSPECTION APPLICATION TO HOLD LARGEST SHARES OF MARKET IN NORTH AMERICA IN 2028

- FIGURE 17 INDUSTRIAL SEGMENT TO RECORD HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 18 CHINA TO REGISTER HIGHEST CAGR IN INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION DURING FORECAST PERIOD

- FIGURE 19 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 DRIVERS AND THEIR IMPACT ON INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION

- FIGURE 21 RESTRAINTS AND THEIR IMPACT ON INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION

- FIGURE 22 OPPORTUNITIES AND THEIR IMPACT ON INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION

- FIGURE 23 CHALLENGES AND THEIR IMPACT ON INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION

- FIGURE 24 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION: VALUE CHAIN ANALYSIS

- FIGURE 25 ECOSYSTEM ANALYSIS

- FIGURE 26 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION: KEY PLAYERS IN ECOSYSTEM

- FIGURE 27 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR MARKET PLAYERS

- FIGURE 28 AVERAGE SELLING PRICE OF UNCOOLED CAMERAS, BY KEY PLAYER

- FIGURE 29 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION: PORTER’S FIVE FORCES ANALYSIS, 2022

- FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY BUILDING TYPE

- FIGURE 31 KEY BUYING CRITERIA, BY BUILDING TYPE

- FIGURE 32 NUMBER OF PATENTS GRANTED FROM 2013 TO 2022

- FIGURE 33 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY WAVELENGTH

- FIGURE 34 THERMAL CAMERAS SEGMENT, BY PRODUCT TYPE, TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 35 HANDHELD THERMAL CAMERAS SEGMENT, BY SOLUTION TYPE, TO DOMINATE MARKET IN 2028

- FIGURE 36 COMMERCIAL SEGMENT, BY BUILDING TYPE, TO LEAD MARKET IN 2028

- FIGURE 37 ENERGY AUDITING SEGMENT, BY APPLICATION, TO RECORD HIGHEST CAGR IN INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION DURING FORECAST PERIOD

- FIGURE 38 ASIA PACIFIC TO WITNESS HIGHEST CAGR IN INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION DURING FORECAST PERIOD

- FIGURE 39 NORTH AMERICA: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION SNAPSHOT

- FIGURE 40 EUROPE: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION SNAPSHOT

- FIGURE 41 ASIA PACIFIC: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION SNAPSHOT

- FIGURE 42 FIVE-YEAR REVENUE ANALYSIS OF KEY PLAYERS IN INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION

- FIGURE 43 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION (GLOBAL): KEY COMPANY EVALUATION MATRIX, 2022

- FIGURE 44 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION (GLOBAL): STARTUPS/SMES EVALUATION MATRIX, 2022

- FIGURE 45 TELEDYNE FLIR LLC: COMPANY SNAPSHOT

- FIGURE 46 FLUKE CORPORATION: COMPANY SNAPSHOT

- FIGURE 47 AXIS COMMUNICATIONS AB: COMPANY SNAPSHOT

- FIGURE 48 SKF: COMPANY SNAPSHOT

- FIGURE 49 JENOPTIK AG: COMPANY SNAPSHOT

- FIGURE 50 KEYSIGHT TECHNOLOGIES: COMPANY SNAPSHOT

- FIGURE 51 R. STAHL AG: COMPANY SNAPSHOT

- FIGURE 52 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.: COMPANY SNAPSHOT

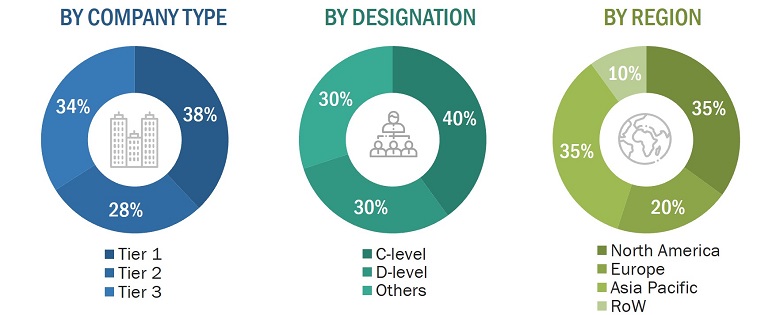

The research study involved 4 major activities in estimating the size of the infrared thermography market for building inspection. Exhaustive secondary research has been done to collect important information about the market and peer markets. The validation of these findings, assumptions, and sizing with the help of primary research with industry experts across the value chain has been the next step. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information required for this study. The secondary sources include annual reports, press releases, and investor presentations of companies, white papers, and articles from recognized authors. Secondary research was mainly done to obtain key information about the market’s value chain, the pool of key market players, market segmentation according to industry trends, and regional outlook and developments from both market and technology perspectives.

Primary Research

In the primary research, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative insights required for this report. Primary sources from the supply side include experts such as CEOs, vice presidents, marketing directors, equipment manufacturers, technology and innovation directors, end users, and related executives from multiple key companies and organizations operating in the infrared thermography market ecosystem.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

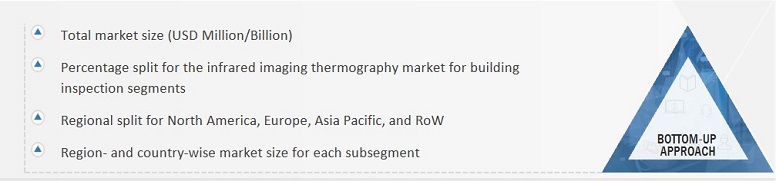

In the complete market engineering process, both top-down and bottom-up approaches were used along with several data triangulation methods to estimate and forecast the overall market segments and subsegments listed in this report.

Estimating market size by bottom-up approach (demand side)

The bottom-up approach has been used to arrive at the overall size of the infrared thermography market from the revenues of key players and their shares in the market. Key players have been identified on the basis of several parameters, such as product portfolio analysis, revenue, R&D expenditure, geographic presence, and recent activities. The overall market size has been calculated based on the revenues of the key players identified in the market.

Market Size Estimation Methodology-Bottom-up Approach

Data Triangulation

After arriving at the overall market size through the process explained earlier, the total market has been split into several segments. The market breakdown and data triangulation procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both the top-down and bottom-up approaches.

Market Definition

Infrared thermography is a method to study thermal images created by infrared cameras for detection of various properties and features in buildings such as heat loss, electrical faults, HVAC performance, insulation, and moisture detection among many others. Thermographic Inspection is a non-destructive testing method for objects by studying the thermal patterns emanating out of an objects surface. Infrared thermography is a non-contact, non- destructive, and non-intrusive method of mapping of thermograms on the surface of objects through detecting incident infrared radiation with the help of an infrared detector. The infrared energy emitted from object converts it to temperature and displays image of temperature distribution. Infrared thermography has various applications ranging from conditional monitoring in industries to night vision and intrusion detection for security and safety. In building inspection, infrared thermography has been widely used to study the heat patterns of the building to detect various defects related with structure, electrical & HVAC systems, materials, moisture, insulation and also to measure the heat and energy consumption patterns of the building.

Stakeholders

- Thermal imaging product manufacturers

- Thermal imaging product traders/suppliers

- Raw material suppliers and distributors

- Research organizations and consulting companies

- Associations, organizations, forums, and alliances related to infrared technology

- Government bodies such as regulatory authorities and policy-makers

- Venture capitalists, private equity firms, and start-up companies

- Companies in the thermal imaging market

- Electronics and semiconductor companies

- Technical standards organizations

- Investment communities in the market

- Research institutes and organizations

- Government and financial institutions

- Venture capitalists

- Private equity firms

- Analysts and strategic business planners

The main objectives of this study are as follows:

- To identify and segment the infrared thermography market in building inspection based on infrared detector type, application, spectral range, building type, platform, and geography.

- To analyze the composition of market by identifying subsegments of the infrared thermography market in building inspection.

- To estimate the size of infrared thermography market in building inspection and its subsegments on the basis of major geographies, namely, North America, Asia-Pacific, Europe, and Rest of the World.

- To derive key market trends driving or holding back the growth of the building thermography market and its subsegments.

- To study Porter’s five forces in detail along with value chain analysis of the building thermography market.

- To provide the details of each submarket per the applications growth trends and their contribution to the global building thermography market.

- To analyze opportunities in market for stakeholders, by identifying high-growth segments.

- To identify and profile key players in the market and a detailed analysis of their contribution to the overall market size and core competencies1 in each segment.

- To track and analyze important competitive developments such as mergers & acquisitions, partnerships, joint ventures, and many others in the building thermography market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Country-wise Information:

- Analysis for additional countries (up to five)

Company Information:

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Infrared Thermography Market

I am writing my bachelor thesis exactly about this topic. Is there any possibility to get access to the single report for a lower price? Could you please forward the sample with a quotation? Thank you in advance!