Thermally Conductive Filler Dispersants Market by Dispersant Structure Type (Silicone-Based, Non-Silicone Based), Filler Material (Ceramic, Metal, Carbon-Based), Application (Thermal Insulation Glue), End-Use Industry, & Region - Global Forecast to 2028

Updated on : September 17, 2025

Thermally Conductive Filler Dispersants Market

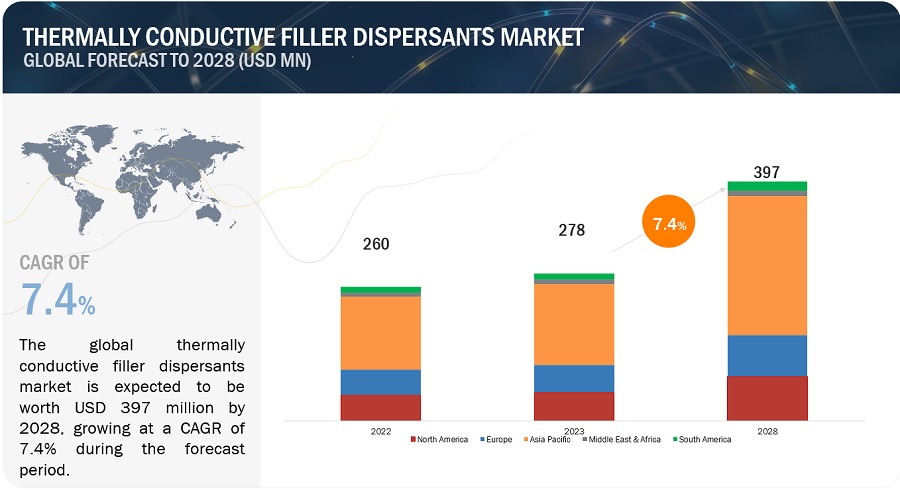

The thermally conductive filler dispersants market size is projected to reach USD 397 million by 2028 from USD 278 million in 2023, at a CAGR of 7.4% during the forecast period. The growth of the global thermally conductive filler dispersants market can be attributed to the increasing demand for high-performance and lightweight products. Thermally conductive filler dispersants play a crucial role in achieving the desired thermal properties in these high-performance products. Additionally, ongoing research and development activities aimed at improving the thermal conductivity of polymer composites drive the demand for thermally conductive filler dispersants.

Global Thermally Conductive Filler Dispersants Market Trend

To know about the assumptions considered for the study, Request for Free Sample Report

Thermally Conductive Filler Dispersants Market Dynamics

Driver: Increasing demand for consumer electronics products

Consumer electronics, such as smartphones, tablets, laptops, and gaming consoles, generate significant amounts of heat during operation. Efficient heat dissipation is crucial to ensure the optimal performance and longevity of these devices. Thermally conductive filler dispersants play a vital role in enhancing the thermal conductivity of polymer composites used in electronic components and heat sinks. Effective heat dissipation through the use of thermally conductive filler dispersants helps to prevent overheating, which can lead to performance degradation and reduced reliability of electronic components.

Restraint: Higher cost consideration

Cost is a significant factor that impacts on the thermally conductive filler dispersants market. The cost of thermally conductive filler dispersants can be a restraint for some applications. Certain high-performance fillers, such as silver or graphene, can be expensive, which can increase the overall cost of the thermally conductive polymer composites. The cost of high-performance fillers like silver or graphene is influenced by factors such as production methods, availability, and demand. These fillers often require specialized manufacturing processes and have limited availability, which can drive up their cost. Additionally, the demand for these high-performance fillers in various industries, including electronics and automotive, can further contribute to their higher price.

Opportunity: Increasing demand for fuel-efficient and high-end home appliance products

The demand for high-performance and lightweight products is driving the growth of the thermally conductive polymer composites market. Thermally conductive filler dispersants play a crucial role in achieving the desired thermal properties in these high-performance products. Polymer-based thermal interface materials consisting of polymer and thermally conductive fillers occupy the most commercial markets because of their thermal conductivity and mechanical properties. Thermally conductive filler dispersants play a crucial role in achieving optimal thermal conductivity in these materials. In addition, the demand for fuel-efficient products is driving the development of high-thermal-conductivity fillers such as aluminum nitride for use in polymer/ceramic composites. These fillers can be used in conjunction with thermally conductive filler dispersants to achieve optimal thermal conductivity.

Challenges: Compatibility with different polymers

Thermally conductive filler dispersants need to be compatible with a wide range of polymer matrices to ensure effective dispersion and interfacial interaction. Achieving compatibility with different polymers can be a challenge due to differences in chemical composition and processing conditions. The interfacial compatibility between fillers and the polymer matrix is crucial for effective dispersion and interfacial interaction, which ultimately affects the heat transfer efficiency of the composites. Surface modification techniques can be employed to improve the interface compatibility, but their effectiveness in improving overall thermal conductivity is limited. The thermal conductivity of polymer composites with dispersed fillers is influenced by several factors, including filler type, size, and aspect ratios. These factors need to be considered when selecting the appropriate thermally conductive filler dispersants for different polymer matrices. In addition, the quality of dispersion plays a significant role in achieving compatibility between fillers and polymers. For a single polymer, the dispersion quality may influence the outcome with the same filler.

Market Ecosystem

By dispersant type, non-silicone is the largest in thermally conductive filler dispersants market, in 2022.

The rising demand for non-silicone thermally conductive filler dispersants is driven by their compatibility with different polymers, form-in-place gap fillers, enhanced thermal conductivity, high thermal conductivity paste, and improved mechanical properties. These advantages make non-silicone thermally conductive filler dispersants a preferred choice for various industries, including electronics, automotive, healthcare, aerospace, and telecommunication.

By filler material, carbon-based are the second largest in thermally conductive filler dispersants market, in 2022.

Carbon-based fillers, such as carbon black, carbon fibers, synthetic graphite particles, and carbon nanotubes, exhibit high thermal conductivity. This makes them attractive for enhancing the thermal conductivity of polymer composites. Carbon-based fillers, particularly carbon fibers, offer a high strength-to-weight ratio, making them suitable for applications where weight reduction is important. In addition, surface modification techniques can be employed to enhance the interfacial compatibility between carbon-based fillers and the polymer matrix, improving dispersion and interfacial interaction. All these factors contribute to the growth of carbon-based filler materials in the thermally conductive filler dispersants market.

By application, heat dissipation accounts for the largest share in the thermally conductive filler dispersants market, in 2022.

In general, higher filler loadings are needed to achieve higher thermal conductivity in pastes used for heat transfer applications. This highlights the importance of thermally conductive filler dispersants in achieving efficient heat dissipation. High thermal conductivity pastes, which serve as heat transfer means for cooling electronic components like VLSI chips, rely on thermally conductive filler dispersants to enhance their thermal conductivity. Adding high thermal conductivity fillers into polymer matrices is an effective way to improve the heat transfer performance of polymer materials. Thermally conductive filler dispersants facilitate the dispersion and interaction of these fillers, contributing to enhanced heat dissipation.

By end-use industry, electronics is the largest in thermally conductive filler dispersants market, in 2022.

Electronics is the largest end-use segment. TIMs are commonly used for transferring thermal conductivity from the CPU or GPU to heat sink coolers. Electronic products such as CPUs, chipsets, graphics cards, and hard disk drives, are susceptible to failure in case of overheating. Thermally conductive filler dispersants for TIMs are used in computers to remove the excess heat to maintain the components operating temperature limits. They are used in computers to optimize performance and reliability for smooth functioning. They are used for improving the heat flow in computers by filling voids or irregularities between the heat sink and SSE base plate mounting surfaces. The increased demand for electronic products is driving the market for thermally conductive filler dispersants.

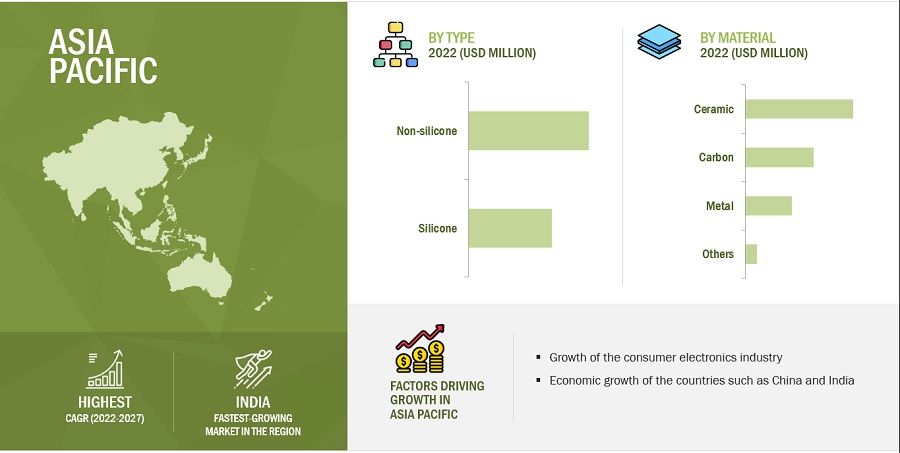

Asia Pacific is projected to be fastest growing amongst other regions in the thermally conductive filler dispersants market, in terms of value.

Based on the region, the thermally conductive filler dispersants market is segmented into Asia Pacific, North America, Europe, South America, and the Middle East & Africa. Currently, Asia Pacific is the fastest growing market for thermally conductive filler dispersants. The region has a large and growing population with increasing disposable income, a rising awareness of health and wellness, and the expanding middle-class population and changing lifestyles have led to a surge in demand for electronic products, and electric vehicles. Additionally, advancements in technologies and increased R&D activities in the thermally conductive filler dispersants market have further fueled the growth of the market in Asia Pacific.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Some of the key players operating in the thermally conductive filler dispersants market include BYK (Germany), Shin-Etsu Chemical (Japan), Dow Chemical Company (US), JNC Corporation (Japan), Momentive Performance Materials (US), Kusumoto Chemicals (Japan), Evonik (Germany), Croda International (UK), Lubrizol Corporation (US), and Wacker Chemie (Germany) among others.

These companies have adopted various organic as well as inorganic growth strategies between 2018 and 2022 to strengthen their positions in the market. The new product launch is the key growth strategy adopted by these leading players to enhance regional presence and develop product portfolios to meet the growing demand for thermally conductive filler dispersants from emerging economies.

Scope of the Report

|

Report Metric |

Details |

|

Years considered for the study |

2019-2028 |

|

Base Year |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Value (USD Million), Volume (Kiloton) |

|

Segments |

Dispersant Type, Filler Material, Application, End-use Industry, and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies |

BYK (Germany), Shin-Etsu Chemical (Japan), Dow Chemical Company (US), JNC Corporation (Japan), Momentive Performance Materials (US), Kusumoto Chemicals (Japan), Evonik (Germany), Croda International (UK), Lubrizol Corporation (US), and Wacker Chemie (Germany) among others. |

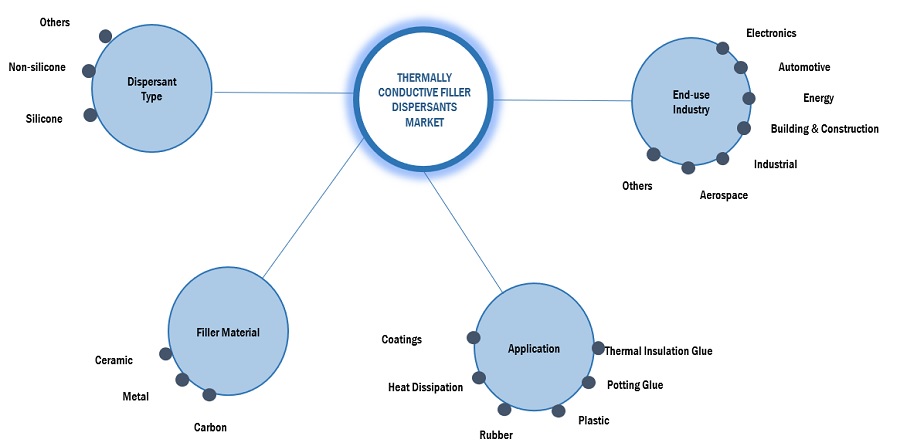

This report categorizes the global thermally conductive filler dispersants market based on dispersant type, filler material, application, end-use industry, and region.

On the basis of dispersant type, the thermally conductive filler dispersants market has been segmented as follows:

- Silicone-based

- Non-silicone based

- Others

On the basis of filler material, the thermally conductive filler dispersants market has been segmented as follows:

- Ceramic

- Metal

- Carbon-based

- Others

On the basis of application, the thermally conductive filler dispersants market has been segmented as follows:

On the basis of the end-use industry, the thermally conductive filler dispersants market has been segmented as follows:

- Electronics

- Automotive

- Energy

- Building & Construction

- Industrial

- Aerospace

- Others

On the basis of region, the thermally conductive filler dispersants market has been segmented as follows:

- North America

- Asia Pacific

- Europe

- South America

- Middle East & Africa

The thermally conductive filler dispersants market has been further analyzed based on key countries in each of these regions.

Recent Developments

- In December 2019, the specialty chemicals group ALTANA acquired Schmid Rhyner AG, a Swiss overprint varnish specialist to generate value-creating growth through targeted acquisitions. The acquisition helped ALTANA ALTANA to expand its product portfolio and offer new solutions to its customers in various industries.

- In October 2022, BYK launched BYK-MAX CT 4275, is a specially developed additives that can be used in a wide variety of polyamides and thermoplastic. BYK-MAX CT 4275 is used to enhance the performance of thermal interface materials by improving the dispersion and incorporation of the additive into the thermoplastic matrix, resulting in improved thermal conductivity and mechanical properties.

- In April 2022, Shin-Etsu Co. Ltd. developed thermal interface silicone rubber sheet series (TC-BGI Series) for use in components of electric vehicles as the technology for high voltage devices advances. It is a hard, thermal-interface silicone rubber sheet that combines good levels of voltage resistance and heat dissipation.

- In January 2021, Momentive Performance Materials acquired KCC Corporation's Silicones business in Korea and the UK, as well as its sales operations in China. KCC Corporation offers silicone and silicone-based products. The acquisition strengthens Momentive's global capabilities in advanced silicones and enhances its ability to serve customers in the Asia-Pacific region.

- In February 2023, Evonik Industries invested USD 1 miilion into fumed aluminum oxide production plant expansion for battery applications in Yokkaichi, Japan. The investment helped Evonik Industries to meet the growing demand for fumed aluminum oxide in the battery industry and strengthen its position in the market. It also expanded Evonik's presence in Asia, where the demand for lithium-ion batteries was high.

Frequently Asked Questions (FAQ):

What is the current size of the global thermally conductive filler dispersants market?

Global thermally conductive filler dispersants market size is estimated to reach USD 397 million by 2028 from USD 278 billion in 2023, at a CAGR of 7.4% during the forecast period.

Who are the winners in the global thermally conductive filler dispersants market?

Companies such as include BYK (Germany), Shin-Etsu Chemical (Japan), Dow Chemical Company (US), JNC Corporation (Japan), Momentive Performance Materials (US), Kusumoto Chemicals (Japan), Evonik (Germany), Croda International (UK), Lubrizol Corporation (US), and Wacker Chemie (Germany) among others. They have the potential to broaden their product portfolio and compete with other key market players.

What are some of the drivers in the market?

Growing demand for consumer electronics products, Increasing demand from the automotive industry for electric vehicles.

What are the various dispersant types of thermally conductive filler dispersants?

Silicone and non-silicone are the major dispersant types of thermally conductive filler dispersants. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

- 5.2 RECESSION IMPACT

-

5.3 MARKET DYNAMICSDRIVERS- Rising demand for miniaturization of electronic devices- Rising demand from new applicationsRESTRAINTS- Stringent government regulations and environmental constraintsOPPORTUNITIES- Emergence of IoT and 5G technology- Rising advancements in nanotechnologyCHALLENGES- Selection and optimization of thermal interface materials

-

5.4 VALUE CHAIN ANALYSISRAW MATERIAL SUPPLIERSMANUFACTURERS OF DISPERSANTDISTRIBUTORSEND–USE INDUSTRIES

-

5.5 PORTER’S FIVE FORCES ANALYSISTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSTHREAT OF NEW ENTRANTSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.6 MACROECONOMIC INDICATORSGLOBAL GDP TRENDS

-

5.7 TARIFFS & REGULATIONSREGULATIONS- Europe- US- ChinaSTANDARDS

-

5.8 CASE STUDY ANALYSISENHANCING LED COOLING WITH THERMAL CONDUCTIVE FILLER DISPERSANTS BY THERMALTECH SOLUTIONSENHANCING EFFICIENCY IN HIGH–PERFORMANCE ELECTRONICS BY ELECTROTECH SOLUTIONS

-

5.9 TECHNOLOGY ANALYSISNEW TECHNOLOGIES: THERMALLY CONDUCTIVE FILLER DISPERSANTS

-

5.10 ECOSYSTEM MAPPING

- 5.11 KEY CONFERENCES & EVENTS IN 2023–2024

-

5.12 KEY FACTORS AFFECTING BUYING DECISIONQUALITYSERVICE

-

5.13 AVERAGE SELLING PRICE ANALYSISAVERAGE SELLING PRICE, BY REGIONAVERAGE SELLING PRICE, BY DISPERSANT TYPEAVERAGE SELLING PRICE, BY FILLER MATERIAL

-

5.14 PATENT ANALYSISINTRODUCTIONDOCUMENT TYPEPUBLICATION TRENDS – LAST 10 YEARSINSIGHTJURISDICTION ANALYSISTOP COMPANIES/APPLICANTS

- 6.1 INTRODUCTION

-

6.2 SILICONESUITABLE FOR WIDE RANGE OF APPLICATIONS

-

6.3 NON–SILICONEEASY OPERABILITY, SHATTER RESISTANCE, AND LIGHTWEIGHT PROPERTIESPOLYMERICCARBOXYLAMINE

- 6.4 OTHER DISPERSANT TYPES

- 7.1 INTRODUCTION

-

7.2 CERAMIC FILLERSEXCELLENT THERMAL CONDUCTIVITY AND ELECTRICAL INSULATION MAKE THEM SUITABLE FOR WIDE RANGE OF APPLICATIONSALUMINA (AL2O3)MAGNESIUM OXIDE (MGO)ALUMINUM HYDROXIDE (AL(OH)3)BORON NITRIDE (BN)

-

7.3 METAL FILLERSMETAL FILLERS SUITABLE FOR ENHANCING THERMAL CONDUCTIVITY OF POLYMER/CERAMIC COMPOSITESALUMINUM NITRIDE (ALN)OTHER METAL FILLERS

-

7.4 CARBON–BASED FILLERSEXCELLENT THERMAL CONDUCTIVITY PROPERTY MAKES THEM SUITABLE FOR ENHANCING HEAT TRANSFER WITHIN COMPOSITECARBON FIBERCARBON BLACKGRAPHITECARBON NANOTUBE

- 7.5 OTHER FILLER MATERIALS

- 8.1 INTRODUCTION

- 8.2 THERMAL INSULATION GLUE

- 8.3 POTTING GLUE

- 8.4 PLASTIC

- 8.5 RUBBER

- 8.6 HEAT DISSIPATION CERAMICS

- 8.7 COATINGS

- 8.8 OTHERS

- 9.1 INTRODUCTION

-

9.2 ELECTRONICSDISPERSANTS HELP MAINTAIN CONSISTENT THERMAL PROPERTIES ACROSS INTERFACE, ENSURING EFFICIENT HEAT FLOWLITHIUM–ION BATTERYSENSORSTHERMAL INTERFACE MATERIALS

-

9.3 AUTOMOTIVEELECTRIC VEHICLES UTILIZE LITHIUM–ION BATTERIES THAT GENERATE HEAT DURING CHARGING AND DISCHARGING

-

9.4 ENERGYEFFICIENT HEAT EXCHANGE CRUCIAL FOR OPTIMAL ENERGY CONVERSION IN CONVENTIONAL POWER PLANTS

-

9.5 BUILDING & CONSTRUCTIONINCORPORATION INTO INSULATION MATERIALS TO ENHANCE THERMAL CONDUCTIVITY

-

9.6 INDUSTRIALNUMEROUS BENEFITS RELATED TO HEAT MANAGEMENT, EQUIPMENT EFFICIENCY, AND OVERALL OPERATIONAL PERFORMANCE

- 9.7 AEROSPACE

- 9.8 OTHER END–USE INDUSTRIES

- 10.1 INTRODUCTION

-

10.2 ASIA PACIFICRECESSION IMPACTCHINA- Largest producer and exporter of consumer electronics globallyJAPAN- Nine fully operational nuclear power plants to drive marketINDIA- Rapid industrialization in energy and power generation end–use industries to boost demandSOUTH KOREA- Growth of construction industry in industrial and commercial infrastructural developmentREST OF ASIA PACIFIC

-

10.3 NORTH AMERICARECESSION IMPACTUS- Automotive industry to generate high demandCANADA- Manufacturing presence of major automotive companies to drive demandMEXICO- Leading manufacturing center for electronics

-

10.4 EUROPERECESSION IMPACTGERMANY- Export–driven economy and leading exporter of industrial machinery and automobilesFRANCE- Introduction of electro–drive vehicles to drive demandUK- Growing demand for home appliances and mobile phones to boost marketITALY- Commitment to sustainable climate and energy future to drive marketSPAIN- High demand of thermally conductive filler dispersants for effective heat dissipationREST OF EUROPE

-

10.5 MIDDLE EAST & AFRICARECESSION IMPACTSAUDI ARABIA- Growth of industrial sector to drive marketUAE- Focus on energy efficiency and sustainability to drive marketSOUTH AFRICA- Adoption of advanced technologies and electric vehicles to drive marketREST OF MIDDLE EAST & AFRICA

-

10.6 SOUTH AMERICARECESSION IMPACTBRAZIL- Growing industrialization to have positive impact on demandARGENTINA- Flourishing end–use industries to drive marketREST OF SOUTH AMERICA

- 11.1 OVERVIEW

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.3 REVENUE ANALYSIS

-

11.4 RANKING OF KEY PLAYERSTHE DOW CHEMICAL COMPANYHENKEL AG & CO. KGAABYKSHIN–ETSU CHEMICAL CO., LTD.EVONIK INDUSTRIES

- 11.5 MARKET SHARE ANALYSIS

-

11.6 COMPANY EVALUATION MATRIX (TIER 1)STARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTS

-

11.7 START–UPS AND SMES EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESSTARTING BLOCKSDYNAMIC COMPANIES

- 11.8 COMPETITIVE BENCHMARKING

-

11.9 COMPETITIVE SITUATIONS AND TRENDSPRODUCT LAUNCHES/DEVELOPMENTSDEALSOTHERS

-

12.1 KEY PLAYERSBYK- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTHE DOW CHEMICAL COMPANY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSHIN–ETSU CHEMICAL CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHENKEL AG & CO. KGAA- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMOMENTIVE PERFORMANCE MATERIALS, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewJNC CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewKUSUMOTO CHEMICALS, LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewEVONIK INDUSTRIES- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCRODA INTERNATIONAL- Business overview- Products/Solutions/Services offered- MnM viewTHE LUBRIZOL CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewWACKER CHEMIE AG- Business overview- Products/Solutions/Services offered- Recent developments- MnM view

-

12.2 OTHER PLAYERS3MPARKER HANNIFIN CORP. (LORD CORPORATION)DUPONT (LAIRD TECHNOLOGIES, INC.)H.B. FULLER COMPANYSANYO CHEMICAL INDUSTRIES, LTD.FUJIPOLY AMERICA CORPORATIONMASTER BOND INC.ELECTROLUBEWAKEFIELD THERMAL, INC.INDIUM CORPORATIONBYODAOS THERMAL COMPOUNDS LLCEPOXY TECHNOLOGY, INC.GELEST INC.

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 THERMALLY CONDUCTIVE FILLER DISPERSANTS: VALUE CHAIN STAKEHOLDERS

- TABLE 3 THERMALLY CONDUCTIVE FILLER DISPERSANTS: PORTER’S FIVE FORCES ANALYSIS

- TABLE 4 TRENDS OF PER CAPITA GDP (USD) 2020–2022

- TABLE 5 GDP GROWTH ESTIMATE AND PROJECTION, BY KEY COUNTRY, 2023–2027

- TABLE 6 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- TABLE 7 AVERAGE SELLING PRICE, BY DISPERSANT TYPE (USD/KILOTON)

- TABLE 8 AVERAGE SELLING PRICE, BY FILLER MATERIAL (USD/KILOTON)

- TABLE 9 LIST OF PATENTS BY FUJIFILM CORPORATION

- TABLE 10 LIST OF PATENTS BY 3M INNOVATIVE PROPERTIES COMPANY

- TABLE 11 LIST OF PATENTS BY MITSUBISHI CHEMICAL CORPORATION

- TABLE 12 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

- TABLE 13 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY DISPERSANT TYPE, 2019–2022 (USD MILLION)

- TABLE 14 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY DISPERSANT TYPE, 2023–2028 (USD MILLION)

- TABLE 15 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY DISPERSANT TYPE, 2019–2022 (TON)

- TABLE 16 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY DISPERSANT TYPE, 2023–2028 (TON)

- TABLE 17 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY FILLER MATERIAL, 2019–2022 (USD MILLION)

- TABLE 18 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY FILLER MATERIAL, 2023–2028 (USD MILLION)

- TABLE 19 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY FILLER MATERIAL, 2019–2022 (TON)

- TABLE 20 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY FILLER MATERIAL, 2023–2028 (TON)

- TABLE 21 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 22 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 23 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 24 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 25 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 26 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 27 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 28 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 29 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 30 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY REGION, 2019–2022 (TON)

- TABLE 32 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY REGION, 2023–2028 (TON)

- TABLE 33 ASIA PACIFIC: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 34 ASIA PACIFIC: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 35 ASIA PACIFIC: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY COUNTRY, 2019–2022 (TON)

- TABLE 36 ASIA PACIFIC: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY COUNTRY, 2023–2028 (TON)

- TABLE 37 ASIA PACIFIC: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY DISPERSANT TYPE, 2019–2022 (USD MILLION)

- TABLE 38 ASIA PACIFIC: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY DISPERSANT TYPE, 2023–2028 (USD MILLION)

- TABLE 39 ASIA PACIFIC: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY DISPERSANT TYPE, 2019–2022 (TON)

- TABLE 40 ASIA PACIFIC: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY DISPERSANT TYPE, 2023–2028 (TON)

- TABLE 41 ASIA PACIFIC: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY FILLER MATERIAL, 2019–2022 (USD MILLION)

- TABLE 42 ASIA PACIFIC: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY FILLER MATERIAL, 2023–2028 (USD MILLION)

- TABLE 43 ASIA PACIFIC: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY FILLER MATERIAL, 2019–2022 (TON)

- TABLE 44 ASIA PACIFIC: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY FILLER MATERIAL, 2023–2028 (TON)

- TABLE 45 ASIA PACIFIC: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 46 ASIA PACIFIC: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 47 ASIA PACIFIC: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 48 ASIA PACIFIC: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 49 ASIA PACIFIC: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 50 ASIA PACIFIC: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 51 ASIA PACIFIC: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2019–2022 (TON)

- TABLE 52 ASIA PACIFIC: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2023–2028 (TON)

- TABLE 53 CHINA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 54 CHINA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 55 CHINA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2019–2022 (TON)

- TABLE 56 CHINA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2023–2028 (TON)

- TABLE 57 JAPAN: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 58 JAPAN: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 59 JAPAN: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2019–2022 (TON)

- TABLE 60 JAPAN: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2023–2028 (TON)

- TABLE 61 INDIA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 62 INDIA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 63 INDIA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2019–2022 (TON)

- TABLE 64 INDIA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2023–2028 (TON)

- TABLE 65 SOUTH KOREA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 66 SOUTH KOREA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 67 SOUTH KOREA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2019–2022 (TON)

- TABLE 68 SOUTH KOREA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2023–2028 (TON)

- TABLE 69 REST OF ASIA PACIFIC: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 70 REST OF ASIA PACIFIC: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 71 REST OF ASIA PACIFIC: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2019–2022 (TON)

- TABLE 72 REST OF ASIA PACIFIC: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2023–2028 (TON)

- TABLE 73 NORTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 74 NORTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 75 NORTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY COUNTRY, 2019–2022 (TON)

- TABLE 76 NORTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY COUNTRY, 2023–2028 (TON)

- TABLE 77 NORTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY DISPERSANT TYPE, 2019–2022 (USD MILLION)

- TABLE 78 NORTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY DISPERSANT TYPE, 2023–2028 (USD MILLION)

- TABLE 79 NORTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY DISPERSANT TYPE, 2019–2022 (TON)

- TABLE 80 NORTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY DISPERSANT TYPE, 2023–2028 (TON)

- TABLE 81 NORTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY FILLER MATERIAL, 2019–2022 (USD MILLION)

- TABLE 82 NORTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY FILLER MATERIAL, 2023–2028 (USD MILLION)

- TABLE 83 NORTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY FILLER MATERIAL, 2019–2022 (TON)

- TABLE 84 NORTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY FILLER MATERIAL, 2023–2028 (TON)

- TABLE 85 NORTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 86 NORTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 87 NORTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 88 NORTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 89 NORTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 90 NORTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 91 NORTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2019–2022 (TON)

- TABLE 92 NORTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2023–2028 (TON)

- TABLE 93 US: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 94 US: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 95 US: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2019–2022 (TON)

- TABLE 96 US: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2023–2028 (TON)

- TABLE 97 CANADA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 98 CANADA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 99 CANADA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2019–2022 (TON)

- TABLE 100 CANADA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2023–2028 (TON)

- TABLE 101 MEXICO: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 102 MEXICO: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 103 MEXICO: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2019–2022 (TON)

- TABLE 104 MEXICO: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2023–2028 (TON)

- TABLE 105 EUROPE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 106 EUROPE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 107 EUROPE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY COUNTRY, 2019–2022 (TON)

- TABLE 108 EUROPE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY COUNTRY, 2023–2028 (TON)

- TABLE 109 EUROPE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY DISPERSANT TYPE, 2019–2022 (USD MILLION)

- TABLE 110 EUROPE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY DISPERSANT TYPE, 2023–2028 (USD MILLION)

- TABLE 111 EUROPE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY DISPERSANT TYPE, 2019–2022 (TON)

- TABLE 112 EUROPE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY DISPERSANT TYPE, 2023–2028 (TON)

- TABLE 113 EUROPE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY FILLER MATERIAL, 2019–2022 (USD MILLION)

- TABLE 114 EUROPE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY FILLER MATERIAL, 2023–2028 (USD MILLION)

- TABLE 115 EUROPE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY FILLER MATERIAL, 2019–2022 (TON)

- TABLE 116 EUROPE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY FILLER MATERIAL, 2023–2028 (TON)

- TABLE 117 EUROPE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 118 EUROPE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 119 EUROPE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 120 EUROPE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 121 EUROPE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 122 EUROPE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 123 EUROPE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2019–2022 (TON)

- TABLE 124 EUROPE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2023–2028 (TON)

- TABLE 125 GERMANY: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 126 GERMANY: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 127 GERMANY: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2019–2022 (TON)

- TABLE 128 GERMANY: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2023–2028 (TON)

- TABLE 129 FRANCE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 130 FRANCE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 131 FRANCE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2019–2022 (TON)

- TABLE 132 FRANCE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2023–2028 (TON)

- TABLE 133 UK: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 134 UK: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 135 UK: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2019–2022 (TON)

- TABLE 136 UK: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2023–2028 (TON)

- TABLE 137 ITALY: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 138 ITALY: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 139 ITALY: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2019–2022 (TON)

- TABLE 140 ITALY: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2023–2028 (TON)

- TABLE 141 SPAIN: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 142 SPAIN: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 143 SPAIN: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2019–2022 (TON)

- TABLE 144 SPAIN: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2023–2028 (TON)

- TABLE 145 REST OF EUROPE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 146 REST OF EUROPE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 147 REST OF EUROPE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2019–2022 (TON)

- TABLE 148 REST OF EUROPE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2023–2028 (TON)

- TABLE 149 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 150 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 151 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY COUNTRY, 2019–2022 (TON)

- TABLE 152 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY COUNTRY, 2023–2028 (TON)

- TABLE 153 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY DISPERSANT TYPE, 2019–2022 (USD MILLION)

- TABLE 154 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY DISPERSANT TYPE, 2023–2028 (USD MILLION)

- TABLE 155 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY DISPERSANT TYPE, 2019–2022 (TON)

- TABLE 156 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY DISPERSANT TYPE, 2023–2028 (TON)

- TABLE 157 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY FILLER MATERIAL, 2019–2022 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY FILLER MATERIAL, 2023–2028 (USD MILLION)

- TABLE 159 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY FILLER MATERIAL, 2019–2022 (TON)

- TABLE 160 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY FILLER MATERIAL, 2023–2028 (TON)

- TABLE 161 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 162 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 163 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 164 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 165 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 166 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 167 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2019–2022 (TON)

- TABLE 168 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2023–2028 (TON)

- TABLE 169 SAUDI ARABIA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 170 SAUDI ARABIA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 171 SAUDI ARABIA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2019–2022 (TON)

- TABLE 172 SAUDI ARABIA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2023–2028 (TON)

- TABLE 173 UAE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 174 UAE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 175 UAE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2019–2022 (TON)

- TABLE 176 UAE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2023–2028 (TON)

- TABLE 177 SOUTH AFRICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 178 SOUTH AFRICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 179 SOUTH AFRICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2019–2022 (TON)

- TABLE 180 SOUTH AFRICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2023–2028 (TON)

- TABLE 181 REST OF MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 182 REST OF MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 183 REST OF MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2019–2022 (TON)

- TABLE 184 REST OF MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2023–2028 (TON)

- TABLE 185 SOUTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 186 SOUTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 187 SOUTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY COUNTRY, 2019–2022 (TON)

- TABLE 188 SOUTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY COUNTRY, 2023–2028 (TON)

- TABLE 189 SOUTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY DISPERSANT TYPE, 2019–2022 (USD MILLION)

- TABLE 190 SOUTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY DISPERSANT TYPE, 2023–2028 (USD MILLION)

- TABLE 191 SOUTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY DISPERSANT TYPE, 2019–2022 (TON)

- TABLE 192 SOUTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY DISPERSANT TYPE, 2023–2028 (TON)

- TABLE 193 SOUTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY FILLER MATERIAL, 2019–2022 (USD MILLION)

- TABLE 194 SOUTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY FILLER MATERIAL, 2023–2028 (USD MILLION)

- TABLE 195 SOUTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY FILLER MATERIAL, 2019–2022 (TON)

- TABLE 196 SOUTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY FILLER MATERIAL, 2023–2028 (TON)

- TABLE 197 SOUTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 198 SOUTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 199 SOUTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 200 SOUTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 201 SOUTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 202 SOUTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 203 SOUTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2019–2022 (TON)

- TABLE 204 SOUTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2023–2028 (TON)

- TABLE 205 BRAZIL: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 206 BRAZIL: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 207 BRAZIL: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2019–2022 (TON)

- TABLE 208 BRAZIL: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2023–2028 (TON)

- TABLE 209 ARGENTINA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 210 ARGENTINA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 211 ARGENTINA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2019–2022 (TON)

- TABLE 212 ARGENTINA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2023–2028 (TON)

- TABLE 213 REST OF SOUTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 214 REST OF SOUTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 215 REST OF SOUTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2019–2022 (TON)

- TABLE 216 REST OF SOUTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END–USE INDUSTRY, 2023–2028 (TON)

- TABLE 217 REVENUE ANALYSIS OF KEY COMPANIES, 2020–2022

- TABLE 218 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET: INTENSITY OF COMPETITIVE RIVALRY

- TABLE 219 DETAILED LIST OF COMPANIES

- TABLE 220 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS, BY DISPERSANT STRUCTURE

- TABLE 221 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS, BY FILLER MATERIAL

- TABLE 222 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS, BY END–USE INDUSTRY

- TABLE 223 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS, BY REGION

- TABLE 224 PRODUCT LAUNCHES/DEVELOPMENTS, 2018–2023

- TABLE 225 DEALS, 2018–2023

- TABLE 226 OTHERS, 2018–2023

- TABLE 227 BYK: COMPANY OVERVIEW

- TABLE 228 BYK: PRODUCT OFFERINGS

- TABLE 229 BYK: PRODUCT LAUNCHES

- TABLE 230 BYK: OTHER DEVELOPMENTS

- TABLE 231 THE DOW CHEMICAL COMPANY: COMPANY OVERVIEW

- TABLE 232 THE DOW CHEMICAL COMPANY: PRODUCT OFFERINGS

- TABLE 233 THE DOW CHEMICAL COMPANY: PRODUCT LAUNCHES

- TABLE 234 THE DOW CHEMICAL COMPANY: OTHER DEVELOPMENTS

- TABLE 235 SHIN–ETSU CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 236 SHIN–ETSU CHEMICAL CO., LTD.: PRODUCT OFFERINGS

- TABLE 237 SHIN–ETSU CHEMICAL CO., LTD.: PRODUCT LAUNCHES

- TABLE 238 SHIN–ETSU CHEMICAL CO., LTD.: OTHER DEVELOPMENTS

- TABLE 239 HENKEL AG & CO. KGAA: COMPANY OVERVIEW

- TABLE 240 HENKEL AG & CO. KGAA: PRODUCT OFFERINGS

- TABLE 241 HENKEL AG & CO. KGAA: PRODUCT LAUNCHES

- TABLE 242 HENKEL AG & CO. KGAA: DEALS

- TABLE 243 MOMENTIVE PERFORMANCE MATERIALS, INC.: COMPANY OVERVIEW

- TABLE 244 MOMENTIVE PERFORMANCE MATERIALS, INC.: PRODUCT OFFERINGS

- TABLE 245 MOMENTIVE PERFORMANCE MATERIALS, INC.: DEALS

- TABLE 246 MOMENTIVE PERFORMANCE MATERIALS, INC.: PRODUCT LAUNCHES

- TABLE 247 MOMENTIVE PERFORMANCE MATERIALS, INC.: OTHER DEVELOPMENTS

- TABLE 248 JNC CORPORATION: COMPANY OVERVIEW

- TABLE 249 JNC CORPORATION: PRODUCT OFFERINGS

- TABLE 250 JNC CORPORATION: PRODUCT LAUNCHES

- TABLE 251 KUSUMOTO CHEMICALS, LTD.: COMPANY OVERVIEW

- TABLE 252 KUSUMOTO CHEMICALS, LTD.: PRODUCT OFFERINGS

- TABLE 253 KUSUMOTO CHEMICALS, LTD.: PRODUCT LAUNCHES

- TABLE 254 KUSUMOTO CHEMICALS, LTD.: OTHER DEVELOPMENTS

- TABLE 255 EVONIK INDUSTRIES: COMPANY OVERVIEW

- TABLE 256 EVONIK INDUSTRIES: PRODUCT OFFERINGS

- TABLE 257 EVONIK INDUSTRIES: DEALS

- TABLE 258 EVONIK INDUSTRIES: OTHER DEVELOPMENTS

- TABLE 259 CRODA INTERNATIONAL: COMPANY OVERVIEW

- TABLE 260 CRODA INTERNATIONAL: PRODUCT OFFERINGS

- TABLE 261 THE LUBRIZOL CORPORATION: COMPANY OVERVIEW

- TABLE 262 THE LUBRIZOL CORPORATION: PRODUCT OFFERINGS

- TABLE 263 THE LUBRIZOL CORPORATION: PRODUCT LAUNCHES

- TABLE 264 THE LUBRIZOL CORPORATION: OTHER DEVELOPMENTS

- TABLE 265 WACKER CHEMIE AG: COMPANY OVERVIEW

- TABLE 266 WACKER CHEMIE AG: PRODUCT OFFERINGS

- TABLE 267 WACKER CHEMIE AG: DEALS

- TABLE 268 WACKER CHEMIE AG: OTHER DEVELOPMENTS

- TABLE 269 3M: COMPANY OVERVIEW

- TABLE 270 PARKER HANNIFIN CORP. (LORD CORPORATION): COMPANY OVERVIEW

- TABLE 271 DUPONT (LAIRD TECHNOLOGIES, INC.): COMPANY OVERVIEW

- TABLE 272 H.B. FULLER COMPANY: COMPANY OVERVIEW

- TABLE 273 SANYO CHEMICAL INDUSTRIES, LTD.: COMPANY OVERVIEW

- TABLE 274 FUJIPOLY AMERICA CORPORATION: COMPANY OVERVIEW

- TABLE 275 MASTER BOND INC.: COMPANY OVERVIEW

- TABLE 276 ELECTROLUBE: COMPANY OVERVIEW

- TABLE 277 WAKEFIELD THERMAL, INC.: COMPANY OVERVIEW

- TABLE 278 INDIUM CORPORATION: COMPANY OVERVIEW

- TABLE 279 BYOD: COMPANY OVERVIEW

- TABLE 280 AOS THERMAL COMPOUNDS LLC: COMPANY OVERVIEW

- TABLE 281 EPOXY TECHNOLOGY, INC.: COMPANY OVERVIEW

- TABLE 282 GELEST INC.: COMPANY OVERVIEW

- FIGURE 1 THERMALLY CONDUCTIVE FILLER DISPERSANTS: MARKET SEGMENTATION

- FIGURE 2 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET: RESEARCH DESIGN

- FIGURE 3 DEMAND SIDE: MARKET SIZE ESTIMATION APPROACH

- FIGURE 4 BOTTOM–UP APPROACH

- FIGURE 5 TOP–DOWN APPROACH

- FIGURE 6 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET: DATA TRIANGULATION

- FIGURE 7 SILICONE SEGMENT TO REGISTER HIGHEST CAGR OF OVERALL THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET

- FIGURE 8 CERAMIC TO BE FASTEST–GROWING FILLER MATERIAL OF THERMALLY CONDUCTIVE FILLER DISPERSANTS DURING FORECAST PERIOD

- FIGURE 9 ASIA PACIFIC TO BE FASTEST–GROWING REGION DURING FORECAST PERIOD

- FIGURE 10 EMERGING ECONOMIES TO OFFER ATTRACTIVE OPPORTUNITIES IN THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET DURING FORECAST PERIOD

- FIGURE 11 NON–SILICONE SEGMENT TO LEAD THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET DURING FORECAST PERIOD

- FIGURE 12 CERAMIC SEGMENT TO WITNESS HIGHEST DEMAND IN THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET

- FIGURE 13 HEAT DISSIPATION CERAMIC SEGMENT TO WITNESS HIGHEST DEMAND IN THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET

- FIGURE 14 ELECTRONICS SEGMENT TO WITNESS HIGHEST DEMAND IN THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET

- FIGURE 15 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET IN INDIA TO GROW AT HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET

- FIGURE 17 OVERVIEW OF THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET VALUE CHAIN

- FIGURE 18 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 19 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET ECOSYSTEM

- FIGURE 20 SUPPLIER SELECTION CRITERION

- FIGURE 21 AVERAGE SELLING PRICE, BY REGION (USD/KILOTON)

- FIGURE 22 PATENTS REGISTERED, 2012–2022

- FIGURE 23 NUMBER OF PATENTS IN LAST 10 YEARS

- FIGURE 24 TOP JURISDICTIONS

- FIGURE 25 TOP APPLICANTS’ ANALYSIS

- FIGURE 26 NON–SILICONE TO BE LARGEST DISPERSANT TYPE SEGMENT DURING FORECAST PERIOD

- FIGURE 27 CERAMIC FILLER MATERIAL TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 28 THERMAL INSULATION GLUE TO BE LARGEST APPLICATION SEGMENT DURING FORECAST PERIOD

- FIGURE 29 ELECTRONICS TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 30 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET IN INDIA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 31 ASIA PACIFIC: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET SNAPSHOT

- FIGURE 32 NORTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET SNAPSHOT

- FIGURE 33 ELECTRONICS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 34 COMPANIES ADOPTED INVESTMENTS & EXPANSIONS AS KEY GROWTH STRATEGY BETWEEN 2018 AND 2023

- FIGURE 35 RANKING OF TOP FIVE PLAYERS IN THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET

- FIGURE 36 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET SHARE, BY COMPANY (2022)

- FIGURE 37 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET: COMPANY EVALUATION MATRIX FOR TIER 1 COMPANIES, 2022

- FIGURE 38 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET: COMPANY EVALUATION MATRIX FOR START–UPS AND SMES, 2022

- FIGURE 39 BYK: COMPANY SNAPSHOT

- FIGURE 40 THE DOW CHEMICAL COMPANY: COMPANY SNAPSHOT

- FIGURE 41 SHIN–ETSU CHEMICAL CO., LTD.: COMPANY SNAPSHOT

- FIGURE 42 HENKEL AG & CO. KGAA: COMPANY SNAPSHOT

- FIGURE 43 EVONIK INDUSTRIES: COMPANY SNAPSHOT

- FIGURE 44 CRODA INTERNATIONAL: COMPANY SNAPSHOT

- FIGURE 45 WACKER CHEMIE AG: COMPANY SNAPSHOT

The study involved four major activities in estimating the current market size for thermally conductive filler dispersants. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methodologies were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Factiva, Zauba, Hoovers, and Bloomberg BusinessWeek were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gap fillers world, regulatory bodies, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

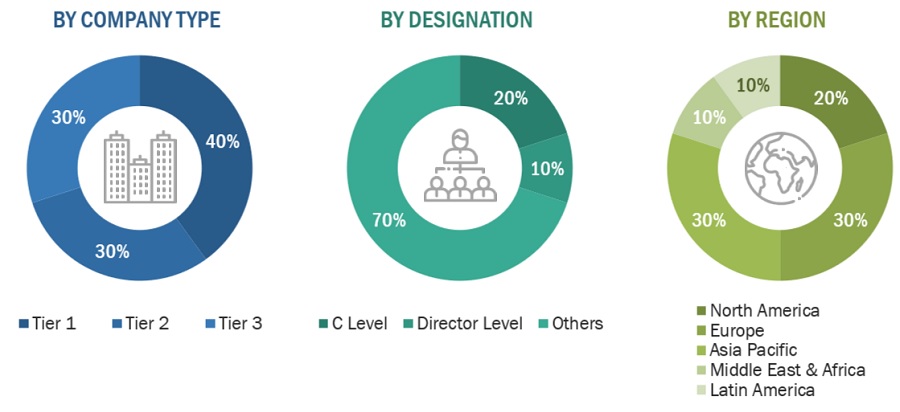

The thermally conductive filler dispersants market comprises several stakeholders, such as dispersant suppliers, filler material suppliers, distributors of thermally conductive filler dispersants, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market consists of various industries such as electronics, automotive, energy, building & construction, industrial, aerospace, and others. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to this market. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of thermally conductive filler dispersants and future outlook of their business which will affect the overall market.

Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the thermally conductive filler dispersants market. These methods were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value and volume, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Thermally Conductive Filler Dispersants Market: Bottum-Up Approach

Note: All the shares are based on the global market size.

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Thermally Conductive Filler Dispersants Market: Top-Down Approach

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

Data Triangulation

After arriving at the overall market size—using the market size estimation process explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply of thermally conductive filler dispersants and their applications.

Market Definition

Thermally conductive filler dispersants are materials that are used to enhance the thermal conductivity of polymer composites. They are used to disperse thermally conductive fillers in the polymer matrix to achieve efficient heat dissipation in various industries such as electronics, automotive, healthcare, aerospace, and telecommunication. The properties of fillers, such as particle size, morphology, dispersion, and orientation, and the interfacial compatibility between fillers and the polymer matrix affect the heat transfer efficiency of composites. Thermally conductive gap fillers are a type of thermally conductive filler dispersant that is compressible, soft, and can fill irregular gaps and surfaces between heat-generating components and heat sinks. They possess specific properties such as high thermal conductivity, low total thermal resistance, compressibility, conformability, good surface wetting, mechanical compliance, and flame retardancy, which make them suitable for addressing the heat dissipation requirements of the automotive industry. The development of new and improved fillers, advancements in modeling and simulation techniques, increasing demand for thermally conductive polymers, growing demand for electric vehicles, increasing demand for fuel-efficient and high-end home appliance products, and emerging markets present opportunities for the thermally conductive filler dispersants market.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Objectives of the Study:

- To define, describe, and forecast the thermally conductive filler dispersants market, in terms of value and volume.

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To analyze and forecast the market by dispersant type, filler material, application, and end-use industry.

- To forecast the size of the market for five regions, namely, Asia Pacific, Europe, North America, South America, and the Middle East & Africa along with their key countries

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders.

- To analyze competitive developments, such as new product launches, acquisitions, and expansion undertaken in the market

- To strategically profile key players and comprehensively analyze their market ranking and core competencies.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Regional Analysis:

- Country-level analysis of the thermally conductive filler dispersants market

Company Information:

- Detailed analysis and profiling of additional market players

Growth opportunities and latent adjacency in Thermally Conductive Filler Dispersants Market