Test Strips Market by Product Type (Blood test strip, Urine Test Strip), Application (Diabetes, Infectious Disease, Cardiac Marker Testing), End-use (Hospitals, Home Care, Diagnostic Laboratories) - Global Forecast to 2027

Increasing prevalence of infectious diseases across the globe

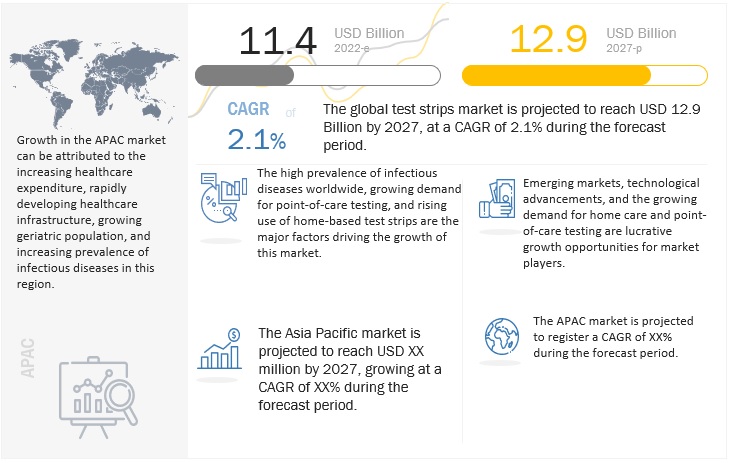

The global test strips market is projected to reach USD 12.9 billion by 2027 from USD 11.4 billion in 2021, at a CAGR of 2.1% during the forecast period . The growth of test strips market is owing to Increasing prevalence of diabetes across the globe, rising preference for point of care testing, and increasing technological advancements in test strips whereas the low accuracy of test strips are restraining this market up to certain extent.

To know about the assumptions considered for the study, Request for Free Sample Report

“Blood test strips accounted for the largest share in the test strips market”

The test strips market is segmented into blood test strips, urine test strips, and others (covid-19 & other test strips). In 2021, blood test strips accounted for the larger share of the global test strips market. The large share of this segment can be attributed to the increasing application of test strips for POC testing, during the forecast period.

“The hospitals & Clinics segment accounted for the largest share of test strips market in 2021”

Based on end users, the test strips market is segmented into hospitals & clinics, home care, diagnostic labs, and other end users. The hospitals & clinics segment accounted for the largest market share in 2021. Technological advancements, the increasing adoption of point-of-care testing and growing patient inclination toward fast and early diagnosis are driving the growth of the hospitals & clinics segment. The COVID-19 pandemic has also increased the demand for point-of-care testing in professional healthcare settings, further driving the growth of this market in the forecast period.

“North America accounted for the largest share of the test strips market in 2021”

The North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2021, North America accounted for the largest share of the test strips market, followed by Europe, the Asia Pacific, Latin America, and the Middle East & Africa. However, the APAC is expected to grow at the highest CAGR during the forecast period. The rapidly developing healthcare industry in China and India, growth in the aging population, rising life expectancy, rising per capita income, increasing investments in the region by key market players, the expansion of private-sector hospitals & clinics to rural areas, the availability of low-cost labor for manufacturing, the presence of a favorable regulatory environment, and growing demand for home and POC testing are supporting market growth in the APAC. The current COVID-19 scenario and its high impact in the Asia Pacific (especially India) have also resulted in a high growth rate in the test strips market in this region.

Competitive Landscape

Key Market Players to Propel Market Progress Due to Advanced Logistics

Primary players operating in the market utilize expansion and offering strengthening strategies. Due to its strong distribution channels, F. Hoffmann-La Roche Ltd. extended its diagnostic capabilities by its global access program which has raised funds for malaria, AIDS, and tuberculosis, which is anticipated to boost market growth. Increasing strategic initiatives and launches will strengthen their distribution channels in the market.

Key Industry Development:

- In August 2021, Becton, Dickinson and Company got approval for the OTC rapid antigen test using the Scanwell Health Mobile App.

- In April 2021, Becton, Dickinson and Company partnered with USA Track & Filed (USATF) (US) to provide rapid COVID-19 testing for athletes using the BD veritor plus system.

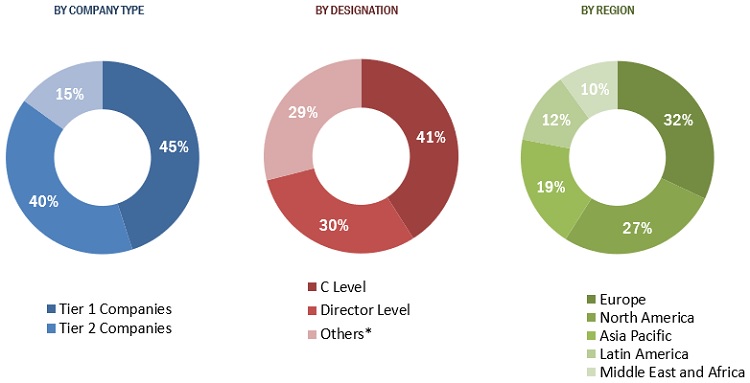

The primary interviews conducted for this report can be categorized as follows:

- By Company Type: Tier 1–35%, Tier 2–20%, and Tier 3–45%

- By Designation: C-level–45%, Director Level–25%, and Others–30%

- By Region: North America–36%, Europe–26%, Asia Pacific–21%, Latin America- 10%, and Middle East and Africa– 7%

Lits of Companies Profiled in the Report:

- Abbott Laboratories (US)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Quidel Corporation (US)

- Danaher Corporation (US)

- Siemens AG (Germany)

- Life Scan (US)

- Taidoc (Taiwan)

- B Braun (Germany)

- Hologic (US)

To know about the assumptions considered for the study, download the pdf brochure

Scope of the Report:

|

Report Metric |

Details |

|

Market Size Available for Years |

2020–2027 |

|

Base Year Considered |

2021 |

|

Forecast Period |

2022–2027 |

|

Forecast Unit |

Value (USD Million/Billion) |

|

Segments Covered |

By Product Type, Application, End User, And Region |

|

Countries Covered |

|

|

Companies covered |

The prominent players in the test strips market Abbott Laboratories (US), F. Hoffmann-La Roche Ltd. (Switzerland), Quidel Corporation (US), Danaher Corporation (US), Siemens AG (Germany), Life Scan (US), Taidoc (Taiwan), B Braun (Germany), and Hologic (US), and others. |

The research report categorizes closed system transfer device market into the following segments and sub-segments:

By Product Type

- Blood Test Strips

- Urine Test Strips

- Others (Covid-19 & Other Test Strips)

By Application

- Diabetes

- Infectious Disease

- Cardiac Marker Testing

- Pregnancy & Fertility Testing

- Others (Drug Of Abuse, Veterinary Testing, Lipid Testing, And Drug Development And Quality Testing)

By End User

- Hospitals & Clinics

- Homecare

- Diagnostic Labs

- Other End Users

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 CATEGORY-WISE INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.4 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 KEY DATA FROM SECONDARY SOURCES

2.1.2 PRIMARY DATA

2.1.2.1 KEY DATA FROM PRIMARY SOURCES

2.1.2.2 KEY INDUSTRY INSIGHTS

2.2 MARKET SIZE ESTIMATION

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

2.4 MARKET SHARE ESTIMATION

2.5 STUDY ASSUMPTIONS

2.6 LIMITATIONS

2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing prevalence of diabetes across the globe

5.2.1.2 Rising preference for point of care testing

5.2.1.3 Increasing technological advancements in test strips

5.2.2 RESTRAINTS

5.2.2.1 Lack of accuracy in test results

5.2.3 OPPORTUNITIES

5.2.3.1 Evolving application of test strips

5.2.4 CHALLENGES

5.2.4.1 Limited reimbursement for test strips

5.3 INDUSTRY TRENDS

5.4 REGULATORY ANALYSIS

5.5 ECOSYSTEM ANALYSIS

5.6 TECHNOLOGY ANALYSIS

5.7 TRADE ANALYSIS

5.8 VALUE CHAIN ANALYSIS

5.9 PORTER’S FIVE FORCES ANALYSIS

5.10 PATENT ANALYSIS

5.11 SUPPLY CHAIN ANALYSIS

5.12 PRICING ANALYSIS

5.13 KEY CONFERENCES AND EVENTS (2022-2023)

5.14 KEY STAKEHOLDERS & BUYING CRITERIA

6 TEST STRIPS MARKET, BY PRODUCT TYPE, 2020-2027 (USD MILLION)

6.1 INTRODUCTION

6.2 BLOOD TEST STRIPS

6.3 URINE TEST STRIPS

6.4 OTHERS (COVID-19 & OTHER TEST STRIPS)

7 TEST STRIPS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

7.1 INTRODUCTION

7.2 DIABETES

7.3 INFECTIOUS DISEASE

7.4 CARDIAC MARKER TESTING

7.5 PREGNANCY & FERTILITY TESTING

7.6 OTHERS (DRUG OF ABUSE, VETERINARY TESTING, LIPID TESTING, AND DRUG DEVELOPMENT AND QUALITY TESTING)

8 TEST STRIPS MARKET MARKET, BY END USER, 2020-2027 (USD MILLION)

8.1 INTRODUCTION

8.2 HOSPITALS & CLINICS

8.3 HOMECARE

8.4 DIAGNOSTIC LABS

8.5 OTHER END USERS

9 TEST STRIPS MARKET, BY REGION, 2020-2027 (USD MILLION)

9.1 INTRODUCTION

9.2 NORTH AMERICA

9.2.1 US

9.2.2 CANADA.

9.3 EUROPE

9.3.1 GERMANY

9.3.2 FRANCE

9.3.3 UK

9.3.4 ITALY

9.3.5 SPAIN

9.3.6 REST OF EUROPE (ROE)

9.4 ASIA PACIFIC

9.4.1 JAPAN

9.4.2 CHINA

9.4.3 INDIA

9.4.4 REST OF APAC (ROAPAC)

9.5 LATIN AMERICA

9.6 MIDDLE EAST & AFRICA

10 COMPETITIVE LANDSCAPE

10.1 INTRODUCTION

10.2 REVENUE SHARE ANALYSIS

10.2.1 REVENUE ANALYSIS FOR KEY PLAYERS IN THE TEST STRIPS MARKET

10.3 MARKET SHARE ANALYSIS OF KEY PLAYERS IN TEST STRIPS MARKET

10.4 COMETITIVE BENCHMARKING

10.5 COMPANY GEOGRAPHIC FOOTPRINT

10.6 COMPANY EVALUATION QUADRANT

10.6.1 STARS

10.6.2 PERVASIVE PLAYERS

10.6.3 EMERGING LEADERS

10.6.4 PARTICIPANTS

10.7 COMPETITIVE SITUATIONS AND TRENDS

10.7.1 PRODUCT/SERVICE LAUNCHES & APPROVALS

10.7.2 DEALS

11 COMPANY PROFILES

(Overview, Products, Financials, Strategy & Development)

11.1 KEY PLAYERS

11.1.1 ABBOTT LABORATORIES, INC.

11.1.2 F. HOFFMANN-LA ROCHE AG

11.1.3 QUIDEL CORPORATION

11.1.4 DANAHER CORPORATION

11.1.5 SIEMENS AG

11.1.6 LIFE SCAN

11.1.7 TAIDOC

11.1.8 ACON

11.1.9 B BRAUN

11.1.10 BAYER

11.2 OTHER PLAYERS

11.2.1 ARKRAY

11.2.2 BECTON, DICKINSON AND COMPANY

11.2.3 BIO-RAD LABORATORIES

11.2.4 ASCENSIA

11.2.5 THERMO FISHER SCIENTIFIC INC.

11.2.6 ARKRAY.

11.2.7 QIAGEN N.V

11.2.8 MERCK KGAA

11.2.9 HOLOGIC, INC.

11.2.10 HENRY SHEIN

11.2.11 CHEMBIO DIAGNOSTIC SYSTEMS, INC

12 APPENDIX

Note:

This ToC is tentative, and the segmentation given may change slightly depending on research findings.

Under the company profiles section Key 15 – 20 companies in the overall global market will be profiled. Details on business overview, products and services, financials, strategy & development might not be captured in case of unlisted companies.

Years considered for the study would be Historical year – 2020, Base Year – 2021, Estimated Year – 2022, Forecast Period – 2022 to 2027

The market tables would include value data in USD for the years 2020, 2021 and forecasted value for 2027 along with CAGR for the period 2022-2027

The market information will be provided in terms of value (USD million) only.

This study involved four major approaches in estimating the current test strips market size. Extensive research was conducted to collect information on the market as well as its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the value market. After that, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

This research study involved the extensive use of secondary sources; directories; databases such as Hoovers, Bloomberg Business, Factiva, and Avention; white papers; and annual reports, company house documents, and SEC filings of companies. Secondary research was used to identify and collect information useful for this extensive, technical, market-oriented, and commercial study of the test strips market. It was also used to obtain important information about top players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments related to market and technological perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing & sales directors, technology & innovation directors, and related key executives from various key companies and organizations operating in the test strips market market. Primary sources from the demand side include personnel from hospitals, clinics, pharma companies, and research labs. Primary research was conducted to identify segmentation types; industry trends; technology trends; key players; and key market dynamics such as drivers, restraints, opportunities, challenges, and key player strategies.

Market Size Estimation

The total size of the test strips market was arrived at after data triangulation from four different approaches, as mentioned below.

Bottom-up Approach: Revenues of individual companies were gathered from public sources and databases. Shares of the test strips businesses of leading players were gathered from secondary sources to the extent available. In certain cases, the share of the business unit was ascertained after a detailed analysis of various parameters, including product portfolio, market positioning, selling price, and geographic reach and strength. Individual shares or revenue estimates were validated through expert interviews.

Country level Analysis: The size of the test strips market was obtained from the annual presentations of leading players and secondary data available in the public domain. The share of test strips products in the overall test strips market was obtained from secondary data and validated by primary participants to arrive at the total test strips market. Primary participants further validated the numbers.

Primary Interviews: As a part of the primary research process, individual respondent insights on the market size and growth were taken during the interview (regional and global, as applicable). All the responses were collated, and a weighted average was taken to derive a probabilistic estimate of the market size and growth rate.

Geographic market assessment (by region & country): The geographic assessment was done using the following approaches:

Approach 1: Geographic revenue contributions/splits of leading players in the market (wherever available) and respective growth trends

Approach 2: Geographic adoption trends for individual product segments by end users and growth prospects for each of the segments (assumptions and indicative estimates validated from primary interviews)

At each point, the assumptions and approaches were validated through industry experts contacted during primary research. Considering the limitations of data available from secondary research, revenue estimates for individual companies (for the overall test strips market and geographic market assessment) were ascertained based on a detailed analysis of their respective product offerings, geographic reach/strength (direct or through distributors or suppliers), and the shares of the leading players in a particular region or country.

After complete market engineering with calculations for market statistics, market size estimations, market forecasting, market breakdown, and data triangulation, extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. In the complete market engineering process, both top-down and bottom-up approaches were extensively used, along with several data triangulation methods to perform market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and further quantitative analysis was also done from all the numbers arrived at in the complete market engineering process to list key information throughout the report.

Breakdown of Primary Interviews (Supply Side): by Company Type, Designation, and Region

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Tiers are defined based on a company’s total revenue. As of 2020, Tier 1 = >USD 1 billion, Tier 2 = ~USD 505 million, and Tier 3 = >USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

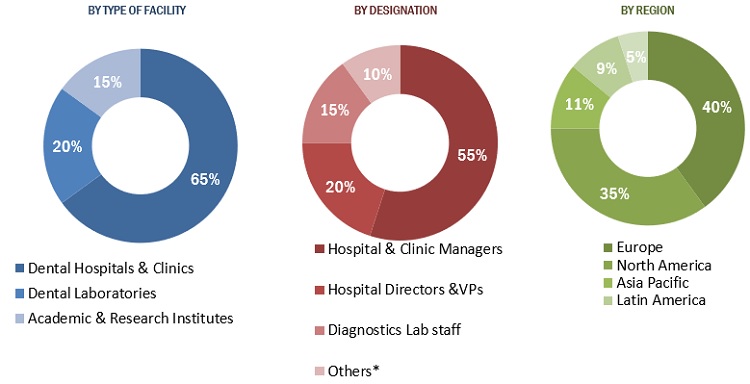

Breakdown of Primary Interviews (Demand Side): By End User Type, Designation, and Region

Note 1: Other end users segment includes research institutes.

Note 2: Other designation includes type-c executives of hospitals and clinics.

Data Triangulation

After arriving at the market size, the total market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed wherever applicable.

Approach to derive the market size and estimate market growth

The market rankings for leading players were ascertained after a detailed assessment of their revenues from the test strips business using secondary data available through paid and unpaid sources. Owing to data limitations, in certain cases, the revenue share was arrived at after a detailed assessment of the product portfolios of major companies and their respective sales performance. At each point, this data was validated through primary interviews with industry experts.

Objectives of the Study

- To define, describe, segment, and forecast the test strips market by Product Type, Application, End User, and region

- To provide detailed information about the factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall test strips market

- To analyze market opportunities for stakeholders and provide details of the market’s competitive landscape

- To forecast the size of the test strips market in five main regions, namely,

North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa, along with their respective key countries - To profile key players in the market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments, such as acquisitions; new product launches; expansions; collaborations, agreements, and partnerships; and R&D activities of the leading market players

- To benchmark players in the market using the "Competitive Leadership Mapping" framework, which analyzes market players on various parameters within the broad categories of business and product strategy.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Product Analysis

- Further segmentation of individual product segments by application

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific test strips market into South Korea, Australia, New Zealand, and others

- Further breakdown of the Rest of Europe test strips market into Belgium, Russia, the Netherlands, Switzerland, and others

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

Growth opportunities and latent adjacency in Test Strips Market