Termite Bait Systems Market by Termite Type (Subterranean, Dampwood, Drywood), Station Type (In-Ground, Above-Ground), Application (Commercial & Industrial, Residential, Agriculture & Livestock Farms), and Region - Global Forecast to 2023

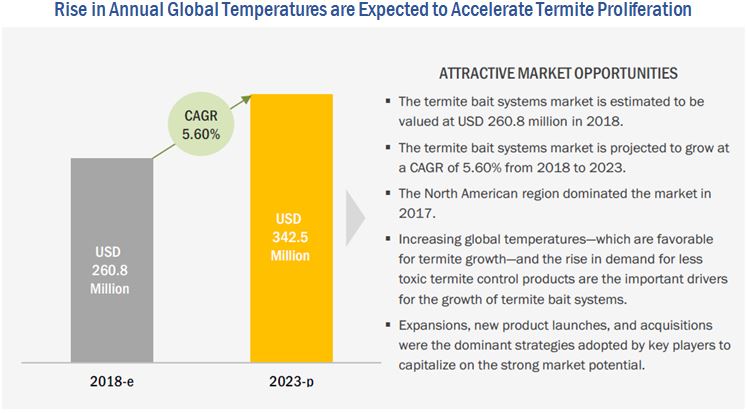

[130 Pages] Termite Bait Systems Market categorizes the global market by Application (Commercial & Industrial, Residential, Agriculture & Livestock Farms), Termite Type (Subterranean, Dampwood, Drywood), Station Type (In-Ground, Above-Ground), and Region. The market is estimated at USD 260.8 million in 2018 and is projected to reach USD 342.5 million by 2023, at a CAGR of 5.60% during the forecast period.

For more details on this research, Request Free Sample Report

The years considered for the study are as follows:

- Base year 2017

- Estimated year 2018

- Projected year 2023

- Forecast period 2018 to 2023

Objectives of the report

- Determining and projecting the size of the termite bait systems market with respect to termite type, station type, application, and regional markets, over a five-year period ranging from 2018 to 2023

- Identifying attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Analyzing the demand-side factors on the basis of the impact of macro- and micro-economic factors on the market and shifts in demand patterns across different subsegments and regions

Research Methodology:

- Major regions were identified, along with countries contributing the maximum share

- Secondary research was conducted to obtain the value of termite bait systems market for regions such as North America, Europe, Asia Pacific, South America, and RoW

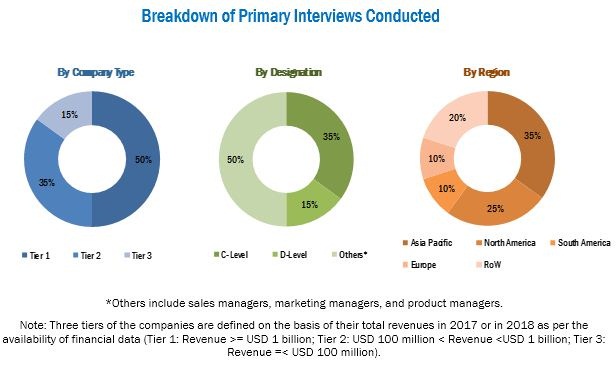

- The key players have been identified through secondary sources such as Bloomberg, Factiva, agricultural magazines, and companies annual reports while their market share in the respective regions has been determined through both, primary and secondary research. The research methodology includes the study of annual and financial reports of top market players as well as interviews with industry experts (such as CEOs, VPs, directors, and marketing executives) for key insights (both quantitative and qualitative) for the termite bait systems market.

To know about the assumptions considered for the study, download the pdf brochure

The various contributors involved in the value chain of the market include raw material suppliers, R&D institutes, termite bait system manufacturing companies such as DowDuPont (US), BASF (Germany), and Bayer (Germany), and government bodies & regulatory associations such as the US Environmental Protection Agency (US EPA), World Health Organization (WHO), Pest Management Regulatory Agency (PMRA), and Control of Pesticides Regulations (CoPR).

Target Audience

The stakeholders for the report are as follows:

- Termiticide manufacturers, suppliers, and formulators

- Bait component manufacturers

- Professional pest control service providers

- Termiticide importers and exporters

- End users such as commercial establishments and government & archaeological building contractors

- Commercial research & development (R&D) institutions

- Pest management associations and industry bodies

- Government pesticide authorities and regulatory bodies

Drivers

Environmentally safe and convenient application process

There are different methods employed for controlling termite population, such as liquid chemical barriers and baiting stations. Liquid chemical barriers such as repellents are used to create a barrier around and under the buildings to block potential routes of termite entry. However, this method has certain drawbacks, as the barriers can be moved, replaced, or disturbed by pets and children or by adding a new garden bed. These drawbacks are noticed especially in developed countries with low population density and high household area per family. Additionally, the direct application of chemical to the soil is toxic to animal and human health, located in the surrounding area. Thus, it has been a reason for homeowners to prefer bait stations, which are safer to humans and pets. Whereas in developing countries with high population density, chemical barriers are mostly not an option at all.

Changing climatic conditions increase the need to avert termite invasion

Termites are prevalent in climatic regions with temperatures in the range of 22.9°C (75°F) to 35°C (95°F) for their survival. They would die if the surrounding temperature is below 25°F or above 100°F. Hence, termites are predominantly found in subtropical regions of almost all continents.

The changing climatic conditions are of significance for termite control as global warming leads to change in the population dynamics of termites and their ecosystems as they are found prominently in warmer climates. Warmer temperatures associated with climate changes affect the distribution and infestation of termite. Due to climate change, the termite population is expected to move rapidly from mid to high latitudes with higher chances of survival rate. To control the risks of termite infestation, bait systems are expected to provide long-term protection in and around homes, without being affected by the changing climatic conditions such as heavy rainfall or high summer temperatures.

Restraints

High initial investment and contract maintenance

In case of bait systems, the cost of installation and bait components is considered along with the cost of the active ingredient. Hence, baiting systems are more expensive as compared to conventional chemical treatments. Additionally, baiting systems require multiple visits to the structure to monitor termite presence and assess in case any additional baits are needed.

Lack of awareness & low adoption rate

Awareness about termite bait systems is low in developing regions such as Asia and Sub-Saharan Africa. Homeowners are less aware about the benefits of termite bait systems, and they are accustomed to the methods of usage of chemical liquid barriers, which helps in immediate knockdown of termites. The main reason for the low adoption rate of termite baits in these emerging regions is the established market for chemical termiticides, which are less expensive as compared to baits.

Scope of the Termite Bait Systems Market Report

This research report categorizes the termite bait systems market based on termite type, station type, application, and region.

Based on termite type, the market has been segmented as follows:

- Subterranean termites

- Dampwood termites

- Drywood termites

- Others (conehead termites and desert termites)

- Based on station type, the market has been segmented as follows:

- In-ground

- Above-ground

Based on application, the market has been segmented as follows:

- Commercial & industrial

- Residential

- Agriculture & livestock farms

- Others (forestry, storage, and transport facilities)

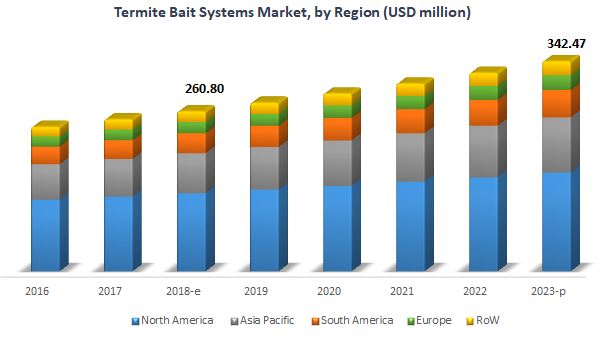

Based on region, the market has been segmented as follows:

- North America

- Asia Pacific

- Europe

- South America

- RoW (South Africa, Egypt, and other countries such as Israel, Turkey, and Morocco)

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the companys specific scientific needs.

The following customization options are available for the report:

Product Analysis:

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of European market for termite bait systems into Greece, Portugal, and the UK.

- Further breakdown of the Rest of Asia Pacific market for termite bait systems into India, Malaysia, Indonesia, and Thailand

- Further breakdown of the Rest of South American market for termite bait systems into Colombia, Uruguay, and Chile

- Further breakdown of others in RoW market for termite bait systems into Israel, Turkey, and Morocco.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

The termite bait systems market is estimated to be USD 260.8 million in 2018 and is projected to reach USD 342.5 million by 2023, at a CAGR of 5.60%. The environmental benefits associated with termite bait systems are a major factor contributing to the growth of this market, globally. Due to the growing housing market and increasing prevalence of termite population due to the poor building practices, the market for termite bait systems is projected to grow in the coming years.

The termite bait systems market is a relatively small sector in the termite control industry; however, the market has been growing at a significant rate due to the increasing need for effective termite management with less toxic methods in different sectors such as commercial and residential, in developed countries.

Subterranean termites occur in greater numbers in warm countries in the southern hemisphere. They infest homes from the ground level; it is easier to prevent subterranean termite infestations than drywood termite infestations. The most common control measures for subterranean termite infestations include placing bait stations around the house. Therefore, with respect to termite type, subterranean termites are estimated to dominate the market in 2018. This is due to the strong demand for these products & services in the North American and Asia Pacific regions.

The termite bait systems market, in terms of station type, is estimated to be dominated by in-ground bait stations in 2018. The main function of the in-ground station type is to monitor termite activities below the ground level of and around homes and apartments. Since subterranean termite species are predominantly found below the ground, consumers give high preference to in-ground termite bait stations. The convenience in the use of these products is a major reason supporting the acceptance of in-ground bait stations among consumers.

In this report, on the basis of application, the market has been segmented into commercial & industrial, residential, agriculture & livestock farms, and others that include forestry, storage, and transport facilities. The commercial & industrial segment is estimated to account for the largest share in 2018. This dominance can be attributed to the need to avoid heavy infrastructure losses from termite damage in the commercial & industrial sector.

For more details on this research, Request Free Sample Report

North America accounted for the largest share in 2017; followed by Asia Pacific, owing to the growing adoption of termite bait systems in countries such as the US, Canada, Australia, and China. Subterranean termites are widespread in North America and responsible for 90% of the management and damage costs in the US. In addition, the use of termite bait systems is high in the residential sector due to the presence of a large number of wooden houses, consumer awareness, and the strong presence & consumer reach of service providers in this region. Thus, the North American region dominated the termite bait systems market in 2017.

Factors driving the growth of the market are its environment-friendly nature, convenient application process, and changing climatic conditions that fuel the prevalence of termite attacks.

The major factors restraining the growth of the market are the high initial investment, renewal costs for contract maintenance, and lack of awareness. However, the market has strong prospects in the coming years, such as high consumer preference for innovative and sustainable products, and growing market opportunities in urban residential areas.

The global market for termite bait systems is dominated by large players such as DowDuPont (US), BASF (Germany), Bayer (Germany), Sumitomo Chemical (Japan), Syngenta (Switzerland), and Rentokil Initial (UK). Some emerging players in the termite bait systems market include Spectrum Brands (US) Ensystex (US), PCT International (Australia), Rollins (US), Terminix International (US), and Arrow Exterminators (US).

Opportunities

Higher preference of innovative and sustainable products among customers

Every bait system is composed of an active ingredient, which is either an insect growth regulator or chitin development inhibitor. These are a type of insecticides that are non-toxic and environmentally sustainable as they hold the growth of the larvae into an adult stage thereby reducing their chances of reproduction. Thus, there is an opportunity to develop bait systems using compounds that are completely sustainable, and in addition, make use of natural components that would function as attractants for termites.

Growing market opportunities in urban residential areas

The urban population of the world has grown rapidly from 746 million in 1950 to over 4 billion in 2016, according to United Nations Data. As a result, there has been an upsurge in housing, infrastructure, and hospitality sectors. Termites have been able to adapt to the growing urban establishments due to the usage of termiticide products at higher dosage levels without the introspection of a certified pest control service provider. This has led to increased resistance to chemical products. Customers from residential areas have also been proactive enough to take such preventive measures for structural protection of their households. To maintain public health and hygiene, pest management has been sought as an important tool in the urban cities of developed countries. Higher spending capacity of this demography has also been a factor for affording such services.

Challenges

Effects are relatively slow as compared to liquid chemical barriers

The drawback of baiting systems is the duration required for termite colony elimination. The effect of baits is slow as compared to the knockdown effects of liquid barriers. After the placement of bait stations, it might take several months for termites to find baits and share it with their nest mates. Also, there might be some degree of termite infestation occurred at some other location before the slow-acting baits come into effect. Hence, this process might take several months to a year for complete elimination of a termite colony. Furthermore, landlords having severe termite infestation around their homes would not prefer this method, as it takes more time.

New Product Launches

|

Date |

Company |

Description |

|

November 2017 |

BASF |

BASF introduced a non-repellent termite control product, Termidor HE, in Japan. With its application to the foundation soil of homes and commercial buildings, it prevents termites from infesting structural materials such as wood. |

|

April 2017 |

DowDuPont |

Dow AgroSciences (US) introduced Recruit AG FlexPack termite bait. This product can be used in food manufacturing and food service areas. This launch helped Dow AgroSciences to strengthen its market position in few states of the US. |

Expansions

|

Date |

Company |

Description |

|

January 2018 |

Rollins |

Orkin, a wholly owned subsidiary of Rollins, opened six new franchises in Northeast Brazil, Brasilia, Argentina, Kenya, the Netherlands, and Azerbaijan. This development has expanded the presence of Rollins in South America, Europe, and Africa. |

|

April 2016 |

Sumitomo Chemical |

Sumitomo Chemical established a new R&D facility in North America to provide unique and innovative solutions based on the two technological disciplines of health and crop science, namely, crop protection chemicals and biorationals. |

Mergers & Acquisitions

|

Date |

Company |

Description |

|

January 2018 |

Arrow Exterminators |

Arrow Exterminators acquired Moores Premium Termite and Pest Control LLC (US). This acquisition would facilitate Arrows ability to grow and serve more residential and commercial customers with a full line of services in Georgetown, South Carolina. |

|

May 2017 |

Arrow Exterminators |

Arrow Exterminators acquired Garys Quality Pest Control, Inc. (US). This acquisition would contribute to grow and serve more customers in Southwest Florida with a full line of services, including termite and mosquito services. |

Agreements, Collaborations, and Joint Ventures

|

Date |

Company |

Description |

|

December 2017 |

BASF |

BASF entered into a commercialization agreement with Mitsui Chemicals Agro, Inc. (MCAG) (Japan). Through this agreement, MCAG granted BASF an exclusive right to commercialize Broflanilide products in several markets worldwide, excluding Japan and certain Asian other countries. Broflanilide is used to control different pests such as caterpillars, beetles, termites, ants, and cockroaches. |

|

September 2017 |

Bayer |

Bayer and IMBB (Institute of Molecular Biology and Biotechnology) (Greece) entered into a research collaboration for a period of five years. This collaboration is expected to discover the key aspects of insect gut physiology and discover novel targets for the development of insect control solutions. |

Frequently Asked Questions (FAQ):

What is the leading application in the termite bait systems market?

The commercial & industrial segment was the highest revenue contributor to the market, with USD 125.8 million in 2017, and is estimated to reach USD 179.3 million by 2023, with a CAGR of 6.1%.

What is the estimated industry size of termite bait systems?

The global termite bait systems market was valued at USD 247.7 million in 2017, and is projected to reach USD 342.5 million by 2023, registering a CAGR of 5.6% from 2018 to 2023.

What is the leading termite type of termite bait systems market?

The subterranean termites segment was the highest revenue contributor to the market, with USD 213.6 million in 2017, and is estimated to reach USD 298.1 million by 2023, with a CAGR of 5.8%. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.4 Years Considered

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Key Industry Insights

2.1.2.2 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Research Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 29)

4.1 Attractive Opportunities in the Termite Bait Systems Market

4.2 Market For Termite Bait Systems, By Station Type & Region, 2018

4.3 Asia Pacific Termite Bait Systems Market, By Application & Country, 2017

4.4 Market For Termite Bait Systems, Top 10 Countries

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Environmentally Safe and Convenient Application Process

5.2.1.2 Changing Climatic Conditions Increase the Need to Avert Termite Invasion

5.2.2 Restraints

5.2.2.1 High Initial Investment and Contract Maintenance

5.2.2.2 Lack of Awareness & Low Adoption Rate

5.2.3 Opportunities

5.2.3.1 Higher Preference of Innovative and Sustainable Products Among Customers

5.2.3.2 Growing Market Opportunities in Urban Residential Areas

5.2.3.3 Growing Market Consolidation Activities Would Improve Customer Reach and Service Quality

5.2.4 Challenges

5.2.4.1 Effects are Relatively Slow as Compared to Liquid Chemical Barriers

5.3 Regulatory Framework

5.3.1 Introduction

5.3.2 Us

5.3.3 Canada

5.3.4 European Union

5.3.5 UK

5.3.6 Australia

6 Termite Bait Systems Market, By Termite Type (Page No. - 41)

6.1 Introduction

6.2 Subterranean Termites

6.3 Dampwood Termites

6.4 Drywood Termites

6.5 Other Termite Types

7 Termite Bait Systems Market, By Station Type (Page No. - 47)

7.1 Introduction 7.2 In-Ground

7.3 Above-Ground

8 Termite Bait Systems Market, By Application (Page No. - 51)

8.1 Introduction 8.2 Commercial & Industrial

8.3 Residential

8.4 Agriculture & Livestock Farms

8.5 Other Applications

9 Termite Bait Systems Market, By Region (Page No. - 57)

9.1 Introduction 9.2 North America

9.2.1 US

9.2.2 Canada

9.2.3 Mexico

9.3 Asia Pacific

9.3.1 Australia

9.3.2 China

9.3.3 Japan

9.3.4 Rest of Asia Pacific

9.4 South America

9.4.1 Brazil

9.4.2 Argentina

9.4.3 Rest of South America

9.5 Europe

9.5.1 France

9.5.2 Italy

9.5.3 Spain

9.5.4 Rest of Europe

9.6 Rest of the World (RoW)

9.6.1 South Africa

9.6.2 Egypt

9.6.3 Others in RoW

10 Competitive Landscape (Page No. - 92)

10.1 Overview

10.2 Company Rankings

10.2.1 Termiticide (Bait) Manufacturers

10.2.2 Termite Control Service Providers

10.3 Competitive Scenario

10.3.1 New Product Launches

10.3.2 Expansions

10.3.3 Mergers & Acquisitions

10.3.4 Agreements, Collaborations, and Joint Ventures

11 Company Profiles (Page No. - 98)

11.1 Termite Bait Manufacturers

11.1.1 Dowdupont

11.1.2 BASF

11.1.3 Bayer AG

11.1.4 Sumitomo Chemical Co., Ltd.

11.1.5 Syngenta

11.1.6 Spectrum Brands, Inc.

11.1.7 Ensystex

11.1.8 Pct International

11.2 Termite Control Service Providers

11.2.1 Rentokil Initial Plc

11.2.2 Rollins, Inc.

11.2.3 The Terminix International Company LP

11.2.4 Arrow Exterminators, Inc.

12 Appendix (Page No. - 124)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

List of Tables (76 Tables)

Table 1 USD Exchange Rate, 20132017

Table 2 Price Comparison Between Termite Bait and Liquid Termiticide, 2017

Table 3 Termite Bait Systems Market Size, By Termite Type, 20162023 (USD Million)

Table 4 Market Size For Subterranean Termite Bait Systems, By Region, 20162023 (USD Million)

Table 5 Market Size For Dampwood Termite Bait Systems, By Region, 20162023 (USD Million)

Table 6 Market Size For Drywood Termite Bait Systems, By Region, 20162023 (USD Million)

Table 7 Termite Bait Systems Market Size for Other Termite Types, By Region, 20162023 (USD Million)

Table 8 Market Size For Termite Bait Systems, By Station Type, 20162023 (USD Million)

Table 9 Market Size For In-Ground Termite Bait Systems, By Region, 20162023 (USD Million)

Table 10 Market Size For Above-Ground Termite Bait Systems, By Region, 20162023 (USD Million)

Table 11 Market Size For Termite Bait Systems, By Application, 20162023 (USD Million)

Table 12 Termite Bait Systems Market Size for Commercial & Industrial Applications, By Region, 20162023 (USD Million)

Table 13 Termite Bait Systems Market Size for Residential Applications, By Region, 20162023 (USD Million)

Table 14 Termite Bait Systems Market Size for Agriculture & Livestock Farm Applications, By Region, 20162023 (USD Million)

Table 15 Termite Bait Systems Market Size for Other Applications, By Region, 20162023 (USD Million)

Table 16 Termite Bait Systems Market Size, By Region, 20162023 (USD Million)

Table 17 North America: Market Size For Termite Bait Systems, By Country, 20162023 (USD Million)

Table 18 North America: Market Size For Termite Bait Systems, By Station Type, 20162023 (USD Million)

Table 19 North America: Market Size For Termite Bait Systems, By Termite Type, 20162023 (USD Million)

Table 20 North America: Market Size For Termite Bait Systems, By Application, 20162023 (USD Million)

Table 21 US: Market Size For Termite Bait Systems, By Station Type, 20162023 (USD Million)

Table 22 US: Market Size For Termite Bait Systems, By Application, 20162023 (USD Million)

Table 23 Canada: Market Size For Termite Bait Systems, By Station Type, 20162023 (USD Million)

Table 24 Canada: Market Size For Termite Bait Systems, By Application, 20162023 (USD Million)

Table 25 Mexico: Market Size For Termite Bait Systems, By Station Type, 20162023 (USD Million)

Table 26 Mexico: Termite Bait Systems Market Size, By Application, 20162023 (USD Million)

Table 27 Asia Pacific: Market Size For Termite Bait Systems, By Country, 20162023 (USD Million)

Table 28 Asia Pacific: Market Size For Termite Bait Systems, By Station Type, 20162023 (USD Million)

Table 29 Asia Pacific: Market Size For Termite Bait Systems, By Termite Type, 20162023 (USD Million)

Table 30 Asia Pacific: Termite Control Market Size, By Application, 20162023 (USD Million)

Table 31 Australia: Market Size For Termite Bait Systems, By Station Type, 20162023 (USD Million)

Table 32 Australia: Market Size For Termite Bait Systems, By Application, 20162023 (USD Million)

Table 33 China: Market Size For Termite Bait Systems, By Station Type, 20162023 (USD Million)

Table 34 China: Market Size For Termite Bait Systems, By Application, 20162023 (USD Million)

Table 35 Japan: Market Size For Termite Bait Systems, By Station Type, 20162023 (USD Million)

Table 36 Japan: Termite Bait Systems Market Size, By Application, 20162023 (USD Million)

Table 37 Rest of Asia Pacific: Market Size For Termite Bait Systems, By Station Type, 20162023 (USD Million)

Table 38 Rest of Asia Pacific: Market Size For Termite Bait Systems, By Application, 20162023 (USD Million)

Table 39 South America: Market Size For Termite Bait Systems, By Country, 20162023 (USD Million)

Table 40 South America: Market Size For Termite Bait Systems, By Station Type, 20162023 (USD Million)

Table 41 South America: Market Size For Termite Bait Systems, By Termite Type, 20162023 (USD Million)

Table 42 South America: Market Size For Termite Bait Systems, By Application, 20162023 (USD Million)

Table 43 Brazil: Market Size For Termite Bait Systems, By Station Type, 20162023 (USD Million)

Table 44 Brazil: Market Size For Termite Bait Systems, By Application, 20162023 (USD Million)

Table 45 Argentina: Market Size For Termite Bait Systems, By Station Type, 20162023 (USD Million)

Table 46 Argentina: Termite Bait Systems Market Size, By Application, 20162023 (USD Million)

Table 47 Rest of South America: Market Size For Termite Bait Systems, By Station Type, 20162023 (USD Million)

Table 48 Rest of South America: Market Size For Termite Bait Systems, By Application, 20162023 (USD Million)

Table 49 Europe: Market Size For Termite Bait Systems, By Country, 20162023 (USD Million)

Table 50 Europe: Market Size For Termite Bait Systems, By Station Type, 20162023 (USD Million)

Table 51 Europe: Market Size For Termite Bait Systems, By Termite Type, 20162023 (USD Million)

Table 52 Europe: Market Size For Termite Bait Systems, By Application, 20162023 (USD Million)

Table 53 France: Market Size For Termite Bait Systems, By Station Type, 20162023 (USD Million)

Table 54 France: Market Size For Termite Bait Systems, By Application, 20162023 (USD Million)

Table 55 Italy: Market Size For Termite Bait Systems, By Station Type, 20162023 (USD Million)

Table 56 Italy: Termite Bait Systems Market Size, By Application, 20162023 (USD Million)

Table 57 Spain: Market Size For Termite Bait Systems, By Station Type, 20162023 (USD Million)

Table 58 Spain: Market Size For Termite Bait Systems, By Application, 20162023 (USD Million)

Table 59 Rest of Europe: Market Size For Termite Bait Systems, By Station Type, 20162023 (USD Million)

Table 60 Rest of Europe: Market Size For Termite Bait Systems, By Application, 20162023 (USD Million)

Table 61 RoW: Market Size For Termite Bait Systems, By Country, 20162023 (USD Million)

Table 62 RoW: Market Size For Termite Bait Systems, By Station Type, 20162023 (USD Million)

Table 63 RoW: Market Size For Termite Bait Systems, By Termite Type, 20162023 (USD Million)

Table 64 RoW: Market Size For Termite Bait Systems, By Application, 20162023 (USD Million)

Table 65 South Africa: Market Size For Termite Bait Systems, By Station Type, 20162023 (USD Million)

Table 66 South Africa: Termite Bait Systems Market Size, By Application, 20162023 (USD Million)

Table 67 Egypt: Market Size For Termite Bait Systems, By Station Type, 20162023 (USD Million)

Table 68 Egypt: Market Size For Termite Bait Systems, By Application, 20162023 (USD Million)

Table 69 Others in RoW: Market Size For Termite Bait Systems, By Station Type, 20162023 (USD Million)

Table 70 Others in RoW: Market Size For Termite Bait Systems, By Application, 20162023 (USD Million)

Table 71 Company Rankings for Termiticide (Bait) Manufacturers

Table 72 Company Rankings for Termite Control Service Providers

Table 73 New Product Launches, 20142017

Table 74 Expansions, 20132018

Table 75 Mergers & Acquisitions, 20152018

Table 76 Agreements, Collaborations, and Joint Ventures, 20142017

List of Figures (39 Figures)

Figure 1 Termite Bait Systems Market Segmentation

Figure 2 Regional Segmentation

Figure 3 Termite Bait Systems: Research Design

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Market Size Estimation Methodology: Bottom-Up Approach

Figure 7 Data Triangulation Methodology

Figure 8 Market For Termite Bait Systems, By Station Type, 2018 vs. 2023

Figure 9 Termite Bait Systems Market, By Application, 2018 vs. 2023

Figure 10 Market For Termite Bait Systems, By Termite Type, 2018 vs. 2023

Figure 11 Termite Bait Systems Market: Regional Snapshot

Figure 12 Rise in Annual Global Temperatures are Expected to Accelerate Termite Proliferation

Figure 13 Strong Demand Witnessed for In-Ground Termite Bait Systems in North America, 2018

Figure 14 Asia Pacific: Commercial & Industrial Segment Witnessed High Demand in 2017

Figure 15 US and Australia: Important Markets for Termite Bait Systems, 2017

Figure 16 Termite Bait Systems Market: Drivers, Restraints, Opportunities, and Challenges

Figure 17 Rise in Global Temperature Influences Termite Proliferation

Figure 18 Market Size For Termite Bait Systems, By Termite Type, 2018 vs. 2023 (USD Million)

Figure 19 Market Size For Termite Bait Systems, By Station Type, 2018 vs. 2023 (USD Million)

Figure 20 Termite Bait Systems Market Size, By Application, 2018 vs. 2023 (USD Million)

Figure 21 Brazil is Projected to Be the Fastest-Growing Market, 20182023

Figure 22 North America: Market Snapshot

Figure 24 Key Developments By Leading Players in the Market For Termite Bait Systems, 20132018

Figure 25 Dowdupont: Company Snapshot

Figure 26 Dowdupont: SWOT Analysis

Figure 27 BASF: Company Snapshot

Figure 28 BASF: SWOT Analysis

Figure 29 Bayer AG: Company Snapshot

Figure 30 Bayer AG: SWOT Analysis

Figure 31 Sumitomo Chemical Co., Ltd.: Company Snapshot

Figure 32 Sumitomo Chemical Co., Ltd.: SWOT Analysis

Figure 33 Syngenta: Company Snapshot

Figure 34 Syngenta: SWOT Analysis

Figure 35 Spectrum Brands, Inc.: Company Snapshot

Figure 36 Rentokil Initial Plc.: Company Snapshot

Figure 37 Rentokil Initial Plc.: SWOT Analysis

Figure 38 Rollins, Inc.: Company Snapshot

Figure 39 The Terminix International Company LP: Company Snapshot

Growth opportunities and latent adjacency in Termite Bait Systems Market