Terminal Management System Market by Offering (Software & Services (Professional & Managed Services)), Project Type (Brownfield & Greenfield), Vertical (Oil & Gas (Upstream, Midstream, Downstream), Chemicals), and Geography - Global Forecast to 2023

[156 Pages Report] The terminal management system market was valued at USD 725.5 Million in 2016 and is expected to reach USD 1,097.7 Million by 2023, at a CAGR of 5.94% during the forecast period. In this report, 2016 has been considered as the base year, and the market size forecast is for 2017–2023.

Objective of study:

- Define, describe, and forecast the TMS market—by offering, project type, vertical, and geography

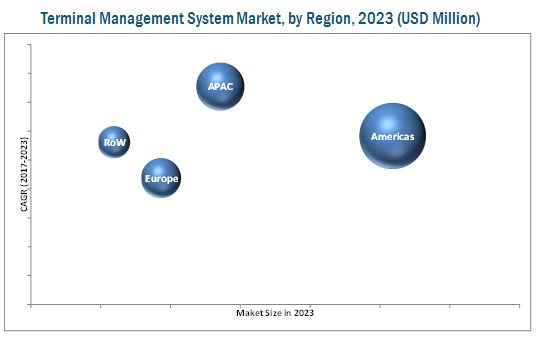

- Forecast the size of the market segments with respect to the Americas, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- Provide detailed information regarding major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

The terminal management system market was valued at USD 725.5 Million in 2016 and is expected to reach USD 1,097.7 Million by 2023, at a CAGR of 5.94% between 2017 and 2023. The increased use of integrated safety and security solutions, which enhance the level of automation at terminals, is a driving factor for this market.

The terminal management system market has been segmented by offering, project type, vertical, and geography. By offering, the market has been classified into software and services. The market for services is expected to grow at a higher CAGR during the forecast period. The major factor driving the growth of the services market is increasing awareness for installing automation solutions and the need for providing services, such as training and maintenance, to improve the operational efficiency of terminals.

The terminal management system market, by project type, has been segmented into brownfield and greenfield projects. The market for brownfield projects is expected to grow at a higher CAGR during the forecast period. The growing demand for automating existing terminals by integrating software will increase the overall productivity, and help conserve both time and energy.

The terminal management system market in APAC is expected to grow at the highest CAGR during the forecast period owing to the rise in the number of terminal automation projects in countries such as India, Malaysia, and the Philippines. For instance, the Governments of China and Japan are focusing on innovation and growth, and are taking steps to restructure the market. The value chain of the TMS market starts with R&D, which comprises planning and solution design, followed by software deployment, software solution providers, and system integrators. System integrators integrate the basic hardware components, such as programmable logic controllers and distributed control systems; software; and communication networks.

The major restraint for the terminal management system market is the lack of technical expertise. Global deployment of solutions is required for a company (distributor) to set up a standardized, common terminal management system (TMS) for terminal operations. Thus, sufficient technical knowledge and technical expertise is required to operate terminal management systems. Terminal upgrades and field operations require government approvals which is a major challenge for the market to promote exploration activities.

Key players in this market focus on strategic partnerships, acquisitions, agreements, contracts, new software, solution launches, and expansions to increase revenue. ABB Ltd. (Switzerland) is a leading player in the TMS market, followed by Honeywell International, Inc. (US) and Siemens AG (Germany). In 2017, ABB (Switzerland) signed an agreement for the safety and automation system with Statoil ASA (Norway) for new offshore oil field development in Norway. This agreement with Statoil ASA will enable ABB Ltd. to develop standard design solutions using the 800xA safety and automation system.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency & Pricing

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary and Primary Research

2.1.1.1 Key Industry Insights

2.1.2 Secondary Data

2.1.2.1 Key Data From Secondary Sources

2.1.3 Primary Data

2.1.3.1 Primary Interviews With Experts

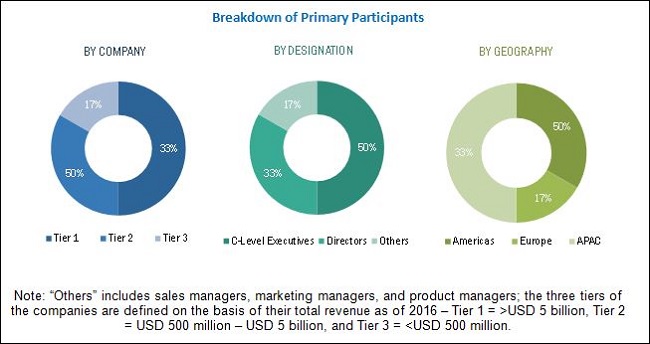

2.1.3.2 Breakdown of Primaries

2.1.3.3 Key Data From Primary Sources

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach for Capturing the Market Share By Bottom-Up Analysis (Demand Side)

2.2.2 Top-Down Approach

2.2.2.1 Approach for Capturing the Market Share By Top-Down Analysis (Supply Side)

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 29)

4 Premium Insight (Page No. - 34)

4.1 Increase in Retrofit Projects in the Terminal Management System Market

4.2 Terminal Management System (TMS) Market, By Managed Services

4.3 Americas is Expected to Hold the Largest Market Share in the Terminal Management System (TMS) Market in 2017

4.4 China Dominated the Terminal Management System (TMS) Market in APAC in 2017

4.5 Terminal Management System (TMS) Market, By Chemicals

5 Market Overview (Page No. - 37)

5.1 Market Dynamics

5.1.1 Drivers

5.1.1.1 Implementation of Terminal Management Solution in Brownfield Terminals Reduces Operational Cost

5.1.1.2 Increasing Needs for Safety and Environmental Norms in Various Verticals

5.1.1.3 Integrated Safety and Security Solutions Enhance the Levels of Automation in A Terminal

5.1.2 Restraints

5.1.2.1 Fluctuation in Crude Oil Prices Impacts the Installation of Terminal Management Software in Oil & Gas Industry

5.1.2.2 Lack of Technical Expertise

5.1.3 Opportunities

5.1.3.1 Establishment of Greenfield Terminals in Asia and Africa Bring Opportunities for Growth in Terminal Management System Market

5.1.3.2 Cloud Computing Across All Verticals Enables Real-Time Reporting

5.1.4 Challenges

5.1.4.1 Technological Advancement Leads to Vulnerabilities Across All Verticals

5.1.4.2 Terminal Upgradations and Field Operations Require Government Approvals for Promoting Exploration Activities

6 Industry Trends (Page No. - 45)

6.1 Value Chain Analysis

6.2 Strategic Benchmarking

7 By Market, By Project Type (Page No. - 47)

7.1 Introduction

7.2 Brownfield Projects

7.3 Greenfield Projects

8 By Market, By Offering (Page No. - 53)

8.1 Introduction

8.2 Software

8.3 Services

8.3.1 Professional Services

8.3.2 Managed Services

9 By Market, By Vertical (Page No. - 62)

9.1 Introduction

9.2 Oil & Gas

9.2.1 Upstream

9.2.2 Midstream

9.2.3 Downstream

9.3 Chemicals

9.3.1 Petrochemicals

9.3.2 Others

9.4 Others

10 Geographic Analysis (Page No. - 79)

10.1 Introduction

10.2 Americas

10.2.1 Oil & Gas Industry Creates Job Opportunities in Americas

10.2.2 North America

10.2.2.1 Increase in Investment in the Oil & Gas Vertical Along With Rapid Expansion of Shale Gas

10.2.2.2 US

10.2.2.2.1 Liquefied Natural Gas Liquefaction Projects Provides Access to Large Markets

10.2.2.3 Canada

10.2.2.3.1 The Production Capacity of Crude Petroleum Products Experiences A Large Growth

10.2.2.4 Rest of North America

10.2.3 Latin America

10.2.3.1 Government Funding for Development of Semi-Automated Terminals

10.2.3.2 Mexico

10.2.3.2.1 Reforms in Energy Sector Helps to Increase the Overall Oil and Gas Production

10.2.3.3 Argentina

10.2.3.3.1 Oil & Gas Vertical Highly Dependent on Investments Made By Private Companies for Growth

10.2.3.4 Brazil

10.2.3.4.1 Brazil Not A Self-Sufficient Producer in the Chemicals Vertical

10.2.3.5 Rest of Latin America

10.3 Europe

10.3.1 Decline in Downstream Sector Due to the Drop in Global Oil Prices

10.3.2 Russia

10.3.2.1 Government Investments to Attain Growth in the Petrochemicals Industry

10.3.3 Germany

10.3.3.1 Net Exporter of Chemicals

10.3.4 Italy

10.3.4.1 Cheap Access to Land for Oil and Gas Exploration and Production Via Low Lease Rates in Italy

10.3.5 France

10.3.5.1 Union of Chemical Industry Establishing Partnerships to Drive Innovations in the Chemicals Vertical

10.3.6 Spain

10.3.6.1 Increasing Private Sector Participation With the Influx of Foreign Water Companies in Spain

10.3.7 Rest of Europe

10.4 APAC

10.4.1 Construction of Liquefied Natural Gas Facilities Leads to the Growth of the Lng Business

10.4.2 China

10.4.2.1 Reforms in Oil & Gas Vertical Leads to Changes in the National Policy

10.4.3 India

10.4.3.1 Government Incentives for Bio-Based Raw Materials to Reduce the Dependence on Crude Oil

10.4.4 Japan

10.4.4.1 Growth in the Petrochemicals Vertical Leads to Significant Improvement in Trading

10.4.5 Australia

10.4.5.1 More Investments in Large-Scale Gas Projects

10.4.6 Malaysia

10.4.6.1 Increasing Efforts to Improve the Amount of Hydrocarbon Reserves

10.4.7 Indonesia

10.4.7.1 Dependence on Foreign Investment and Collaboration for the Growth in the Petrochemicals Vertical

10.4.8 Rest of APAC

10.5 RoW

10.5.1 Government and Oil and Gas Companies Unite to Prioritize Creation of Skilled Workforce

10.5.2 Middle East

10.5.2.1 Decline in the Upstream Oil & Gas Vertical Due to Ongoing Turmoil in Syria and Libya

10.5.2.2 Iran

10.5.2.2.1 Opportunities to Potential Investors for the Growth and Development in Downstream Petrochemicals Vertical

10.5.2.3 Saudi Arabia

10.5.2.3.1 More Dependence on Oil and Petroleum Industries for Economic Growth

10.5.2.4 UAE

10.5.2.4.1 Petrochemicals Industry in UAE is Still in A Growth Stage

10.5.2.5 Rest of Middle East

10.5.3 Africa

10.5.3.1 Fluctuations in Economic and Political Environment Impacts the Growth of the Petrochemicals Vertical

10.5.3.2 South Africa

10.5.3.2.1 Crude Oil and Finished Products are Mainly Imported

10.5.3.3 Rest of Africa

11 Competitive Landscape (Page No. - 109)

11.1 Introduction

11.2 Market Ranking Analysis: Terminal Management System Market

11.3 Vendor Dive Overview

11.3.1 Vanguard

11.3.2 Dynamic

11.3.3 Innovator

11.3.4 Emerging

11.4 Competitive Benchmarking

11.4.1 Analysis of Product Portfolio of Major Players in the Terminal Management System Market (25 Companies)

11.4.2 Business Strategies Adopted By Major Players in the Terminal Management System Market (25 Players)

*Top 25 Companies Analyzed for This Study are - ABB Ltd. (Switzerland); Honeywell International Inc. (US); Siemens AG (Germany); Yokogawa Electric Corporation (Japan); Rockwell Automation, Inc. (US); Schneider Electric (France); Emerson Electric Co. (US); Endress+Hauser Management AG (Switzerland); General Atomics Corp. (California); Implico (Germany); Wipro Limited (India); Offspring International Limited (Uk); Eds Systems Oü (Estonia); Agidens International Nv (Belgium); Dearman Systems, Inc. (US); Triple Point Technology, Inc. (US); Pumpingsol (US); I.Dohmann GmbH (Germany); Tema Business Systems (India); and Quorum Business Solutions, Inc. (US).

12 Company Profiles (Page No. - 115)

(Overview, Financials, Products & Services, Strategy, and Developments)*

12.1 ABB Ltd.

12.2 Honeywell International Inc.

12.3 Siemens AG

12.4 Yokogawa Electric Corporation

12.5 Rockwell Automation, Inc.

12.6 Schneider Electric

12.7 Emerson Electric Co.

12.8 Endress+Hauser Management AG

12.9 General Atomics Corp.

12.10 Implico Group

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not Be Captured in Case of Unlisted Companies.

12.11 Key Innovators & Startups

12.11.1 Koninklijke Vopak N.V.

12.11.1.1 Business Overview

12.11.2 Offspring International Limited

12.11.2.1 Business Overview

12.11.3 Agidens International Nv

12.11.3.1 Business Overview

12.11.4 Toptech Systems, Inc.

12.11.4.1 Business Overview

12.11.5 Triple Point Technology, Inc.

12.11.5.1 Business Overview

13 Appendix (Page No. - 147)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (71 Tables)

Table 1 List of Major Secondary Sources

Table 2 Brownfield Terminal Automation Projects

Table 3 Terminal Management System Market: Safety and Regulatory Standards

Table 4 Global Terminal Management System Projects, 2016

Table 5 TMS Market, By Project Type, 2014–2023 (USD Million)

Table 6 Brownfield TMS Market, By Vertical, 2014–2023 (USD Million)

Table 7 Brownfield TMS Market, By Oil & Gas, 2014–2023 (USD Million)

Table 8 Brownfield TMS Market, By Chemicals, 2014–2023 (USD Million)

Table 9 Greenfield TMS Market, By Vertical, 2014–2023 (USD Million)

Table 10 Greenfield TMS Market, By Oil & Gas, 2014–2023 (USD Million)

Table 11 Greenfield TMS Market, By Chemicals, 2014–2023 (USD Million)

Table 12 TMS Market, By Offering, 2014–2023 (USD Million)

Table 13 TMS Market: Software

Table 14 Terminal Management System Software Market, By Vertical, 2014–2023 (USD Million)

Table 15 Terminal Management System Software Market, By Oil & Gas Vertical, 2014–2023 (USD Million)

Table 16 Terminal Management System Software Market, By Chemicals Vertical, 2014–2023 (USD Million)

Table 17 Terminal Management System Services Market, By Vertical, 2014–2023 (USD Million)

Table 18 Terminal Management System Services Market, By Oil & Gas Vertical, 2014–2023 (USD Million)

Table 19 Terminal Management System Services Market, By Chemicals Vertical, 2014–2023 (USD Million)

Table 20 TMS Market, By Services, 2014–2023 (USD Million)

Table 21 Professional Services: TMS Market, By Vertical, 2014–2023 (USD Million)

Table 22 Managed Services: TMS Market, By Vertical, 2014–2023 (USD Million)

Table 23 TMS Market, By Vertical, 2014–2023 (USD Million)

Table 24 Terminal Management System (TMS) Market for Oil & Gas Vertical, By Project Type, 2014–2023 (USD Million)

Table 25 Terminal Management System (TMS) Market for Oil & Gas Vertical, By Offering, 2014–2023 (USD Million)

Table 26 Terminal Management System (TMS) Market for Oil & Gas Vertical, By Region, 2014–2023 (USD Million)

Table 27 Terminal Management System (TMS) Market for Oil & Gas Vertical, By Type 2014–2023 (USD Million)

Table 28 Terminal Management System (TMS) Market for Upstream Oil & Gas Vertical, By Project Type, 2014–2023 (USD Million)

Table 29 Terminal Management System (TMS) Market for Upstream Oil & Gas Vertical, By Offering, 2014–2023 (USD Million)

Table 30 Terminal Management System (TMS) Market for Upstream Oil & Gas Vertical, By Region, 2014–2023 (USD Million)

Table 31 Terminal Management System (TMS) Market for Midstream Oil & Gas Vertical, By Project Type, 2014–2023 (USD Million)

Table 32 Terminal Management System (TMS) Market for Midstream Oil & Gas Vertical, By Offering, 2014–2023 (USD Million)

Table 33 Terminal Management System (TMS) Market for Midstream Oil & Gas Vertical, By Region, 2014–2023 (USD Million)

Table 34 Terminal Management System (TMS) Market for Downstream Oil & Gas Vertical, By Project Type, 2014–2023 (USD Million)

Table 35 Terminal Management System (TMS) Market for Downstream Oil & Gas Vertical, By Offering, 2014–2023 (USD Million)

Table 36 Terminal Management System (TMS) Market for Downstream Oil & Gas Vertical, By Region, 2014–2023 (USD Million)

Table 37 Terminal Management System (TMS) Market for Chemicals Vertical, By Project Type, 2014–2023 (USD Million)

Table 38 Terminal Management System (TMS) Market for Chemicals Vertical, By Offering 2014–2023 (USD Million)

Table 39 Terminal Management System (TMS) Market for Chemicals Vertical, By Region 2014–2023 (USD Million)

Table 40 Terminal Management System (TMS) Market for Chemicals Vertical, By Type 2014–2023 (USD Million)

Table 41 Terminal Management System (TMS) Market for Petrochemicalsvertical, By Project Type, 2014–2023 (USD Million)

Table 42 Terminal Management System (TMS) Market for Petrochemicals Vertical, By Offering, 2014–2023 (USD Million)

Table 43 Terminal Management System (TMS) Market for Petrochemicals Vertical, By Region 2014–2023 (USD Million)

Table 44 Terminal Management System (TMS) Market for Other Chemicals Vertical, By Project Type, 2014–2023 (USD Million)

Table 45 Terminal Management System (TMS) Market for Other Chemicals Vertical, By Offering, 2014–2023 (USD Million)

Table 46 Terminal Management System (TMS) Market for Other Chemicals Vertical, By Region, 2014–2023 (USD Million)

Table 47 Terminal Management System (TMS) Market for Other Verticals, By Project Type, 2014–2023 (USD Million)

Table 48 Terminal Management System (TMS) Market for Other Verticals, By Offering, 2014–2023 (USD Million)

Table 49 Terminal Management System (TMS) Market for Other Verticals, By Region, 2014–2023 (USD Million)

Table 50 Terminal Management System Market, By Region, 2014–2023 (USD Million)

Table 51 By Market in Americas, By Vertical, 2014–2023 (USD Million)

Table 52 By Market for Oil & Gas in Americas , By Type, 2014–2023 (USD Million)

Table 53 By Market for Chemicals in Americas, By Type, 2014–2023 (USD Million)

Table 54 By Market in Americas, By Region, 2014–2023 (USD Million)

Table 55 By Market in North America, By Country, 2014–2023 (USD Million)

Table 56 By Market in Latin America, By Country, 2014–2023 (USD Million)

Table 57 By Market in Europe, By Vertical, 2014–2023 (USD Million)

Table 58 By Market for Oil & Gas in Europe, By Type, 2014–2023 (USD Million)

Table 59 By Market for Chemicals in Europe, By Type, 2014–2023 (USD Million)

Table 60 By Market in Europe, By Country, 2014–2023 (USD Million)

Table 61 By Market in APAC, By Vertical, 2014–2023 (USD Million)

Table 62 By Market for Oil & Gas in APAC, By Type, 2014–2023 (USD Million)

Table 63 By Market for Chemicals in APAC, By Type, 2014–2023 (USD Million)

Table 64 By Market in APAC, By Country, 2014–2023 (USD Million)

Table 65 By Market in RoW, By Vertical, 2014–2023 (USD Million)

Table 66 By Market for Oil & Gas in RoW, By Type, 2014–2023 (USD Million)

Table 67 By Market for Chemicals in RoW, By Type, 2014–2023 (USD Million)

Table 68 By Market in RoW, By Region, 2014–2023 (USD Million)

Table 69 By Market in Middle East, By Country, 2014–2023 (USD Million)

Table 70 By Market in Africa, By Country, 2014–2023 (USD Million)

Table 71 Market Ranking of the Top 5 Players in the Terminal Management System Market, 2016

List of Figures (51 Figures)

Figure 1 Terminal Management System (TMS) Market: Research Design

Figure 2 Bottom-Up Approach to Arrive at the Market Size

Figure 3 Top-Down Approach to Arrive at the Market Size

Figure 4 Data Triangulation

Figure 5 Assumptions of the Research Study

Figure 6 Terminal Management System (TMS) Market for Services is Expected to Grow at A Higher Rate During the Forecast Period

Figure 7 Terminal Management System (TMS) Market for Managed Services is Expected to Grow at A Higher Rate During the Forecast Period

Figure 8 Terminal Management System (TMS) Market for Chemicals is Expected to Grow at the Highest Rate During the Forecast Period

Figure 9 Terminal Management System (TMS) Market for Brownfield Project is Expected to Grow at A Higher Rate During the Forecast Period

Figure 10 Terminal Management System (TMS) Market in APAC is Expected to Grow at the Highest Rate During the Forecast Period

Figure 11 Significant Rise in the Number of Brownfield Projects is Expected to Drive the Market During the Forecast Period

Figure 12 Chemicals is Expected to Grow at the Highest Rate in the Terminal Management System (TMS) Market for Managed Services During the Forecast Period

Figure 13 India is Expected to Witness the Highest Growth Rate During the Forecast Period

Figure 14 Chemicals Held the Largest Market Share in APAC in 2017

Figure 15 APAC is Estimated to Grow at the Highest CAGR Between 2017 and 2023

Figure 16 Cloud Computing Across All Verticals Enables Real-Time Reporting

Figure 17 Comparative Analysis of Crude Oil Prices

Figure 18 Major Value is Added During the Software Solution Providers Phase

Figure 19 Strategic Benchmarking: Key Players Largely Adopted the Strategy of Partnerships /Agreements/Contracts/ Launches

Figure 20 Terminal Management System Market, By Project Type

Figure 21 Chemicals is Expected to Grow at the Highest Rate in the Terminal Management System Market for Greenfield Projects

Figure 22 Terminal Management System (TMS) Market, By Offering

Figure 23 Terminal Management System (TMS) Market, By Service Type

Figure 24 Market for Managed Services is Expected to Grow at A Higher Rate During the Forecast Period

Figure 25 Terminal Management System (TMS) Market: By Vertical

Figure 26 Terminal Management System (TMS) Market: By Oil and Gas Vertical

Figure 27 Brownfield Projects to Lead the Terminal Management System Market for Downstream Oil & Gas Vertical During the Forecast Period

Figure 28 Terminal Management System (TMS) Market for Petrochemicals Vertical for Services to Grow at A Higher Rate During the Forecast Period

Figure 29 Terminal Management System (TMS) Market Segmentation: By Geography

Figure 30 Geographic Snapshot: TMS Market in APAC Expected to Grow at the Highest Rate During the Forecast Period

Figure 31 Terminal Management System (TMS) Market in India is Estimated to Grow at the Highest Rate Between 2017 and 2023

Figure 32 Segmentation: the Americas

Figure 33 Americas: Terminal Management System Market Snapshot

Figure 34 Segmentation: North America

Figure 35 Segmentation: Latin America

Figure 36 Segmentation: Europe

Figure 37 Segmentation: APAC

Figure 38 APAC: Terminal Management System Market Snapshot

Figure 39 Segmentation: RoW

Figure 40 Segmentation: Middle East

Figure 41 Segmentation: Africa

Figure 42 Key Growth Strategies Adopted By Top Companies, 2013–2017

Figure 43 Dive Chart

Figure 44 ABB Ltd.: Company Snapshot

Figure 45 Honeywell International Inc.: Company Snapshot

Figure 46 Siemens AG: Company Snapshot

Figure 47 Yokogawa Electric Corp.: Company Snapshot

Figure 48 Rockwell Automation, Inc.: Company Snapshot

Figure 49 Schneider Electric: Company Snapshot

Figure 50 Emerson Electric Co.: Company Snapshot

Figure 51 Endress+Hauser Management AG: Company Snapshot

The research methodology used to estimate and forecast the terminal management system market begins with obtaining data on revenues of key vendors through secondary research sources such as Oil and Gas Authority (UK) and International Energy Agency, Vendor offerings are taken into consideration to determine the market segmentation. Top-down approach has been employed to arrive at the overall market size of the global terminal management system market, including automating terminals by integrating software and determining the average project cost in USD. After arriving at the overall market size, the total market is split into several segments and subsegments. This is further verified through primary research by conducting extensive interviews with key people—such as CEOs, VPs, directors, and executives. Data triangulation and market breakdown procedures are employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments.

To know about the assumptions considered for the study, download the pdf brochure

This study also answers several questions, such as which market segments to focus on in the next 2–5 years for prioritizing efforts and investments, for stakeholders. The terminal management system market comprises software solution providers, turnkey contractors, service providers, system integrators, and end users.

- Software Solution Providers: Honeywell International Inc. (US), Emerson Electric Co. (US), Varec Inc. (US), Toptech Systems (US), Dearman Systems, Inc. (US), Rockwell Automation, Inc. (US), Triple Point Technology (US), Dearman Systems, Inc. (US), Pumping Sol (US), Wipro Limited (India)

- Turnkey Contractors: ABB Ltd. (Switzerland), Siemens AG (Germany), Implico Group (US), Yokogawa Electric Corporation (Japan), Schneider Electric (France), General Atomics Corp. (California)

- Services: AC2, Inc. (US), Koninklijke Vopak N.V. (Netherlands), Agidens International NV (Belgium), Endress+Hauser Management AG (Switzerland), i.Dohmann GmbH (Germany), Motorola Solutions, Inc. (US), Synel (Israel), Tema Business Systems (India), Toptech Systems, Inc. (US)

Target Audience:

- Raw material and equipment suppliers

- Terminal operators

- Automation providers

- Control system manufacturers

- Transportation providers

- Government agencies

Scope of the Report:

The global terminal management system market, in this research report, has been segmented by offering, project type, vertical, and geography.

Terminal Management System Market, by offering:

- Software

- Services

Terminal Management System Market, by Project type:

- Brownfield projects

- Greenfield projects

Terminal Management System Market, by Vertical:

- Oil & Gas

- Chemicals

- Others

Terminal Management System Market, by Region:

- Americas

- Europe

- APAC

- RoW

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

-

Geographic Analysis

- Comprehensive coverage of regulations followed in each region (Americas, Europe, APAC, and RoW)

-

Company Information

- Detailed analysis and profiling of additional market players (up to 10)

Growth opportunities and latent adjacency in Terminal Management System Market

We are looking for competitor analysis for major players in terminal management system in South America and Middle East Countries.