Teleprotection Market - By Product Type (Teleprotection units, Communication Network Technology, Software, Services), Components (IED, Interface Device, SCADA), Applications (Power, Telecom) and Geography - Analysis & Forecast (2013 - 2018)

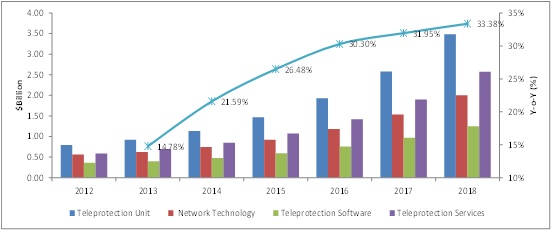

Teleprotection market is at its early growth stage; however, it has a high potential across various industry verticals like power, telecom, oil & gas, transportation, information technology, aerospace & defense and so on. The increasing demand for energy saving and seamless transmission will boost the market with the help of advanced communication and network technologies. The market is in its growth stage and penetrating very fast. The market is estimated to reach $9.31 billion in 2018 at a CAGR of 28.67% from 2013 to 2018.

Telecontrol market report based on an in-depth research study on the market and its related industries, focuses on the complete global market for all types of products which are available commercially and which are yet to commercialize in the near future (before 2018). The report presents a detailed insight on the current industry, and identifies key trends of various segments of the market with in-depth quantitative and qualitative information. The telecontrol market report segments the market on the basis of types of products, components, application, and geography. Further, it contains revenue forecasts, and trend analysis with respect to the marketís timeliness.

Major players in this telecontrol market include ABB Ltd. (Switzerland), Alcatel Lucent S.A. (France), Alstom S.A. (France), Cisco Systems (U.S.), DNV Kema (The Netherlands), GE Energy (U.S.), Nokia (Finland), Telco systems (U.S.), Siemens AG (Germany), Schweitzer Engineering Laboratories, Inc. (U.S.) and so on.

Following is the detailed explanation of each segment:

Market by types of Products:

The telecontrol product market can be divided into teleprotection unit, communication network technology, Telecontrol software and services. The telecontrol unit part can again be sub-divided into Directional electrical interface equipment, Optical interface equipment, Data terminal equipment (DTE), Data circuit terminating (communication) equipment (DCE), Multi-service access equipment and so on. The communication network technology can again be sub-segmented into conventional and advanced systems. The conventional methods consist of TDM (Time-division multiplexing); TDM over IP (time-division multiplexing over internet protocol) and PSN (Public switched network) while advanced methods consist of IP/MPLS (internet protocol/multi- protocol label switching) and SDH/SONET (synchronous digital hierarchy/synchronous optical network). The Telecontrol software consists of synchrophasors software, event analysis software, network management system software and so on.

Market by Components:

The telecontrol component market can be divided into four major parts: Intelligent electronic device (IED), Interface device, Communication network components and Teleprotection SCADA. The IED market can again be sub-divided into Switches, Relays, Connecters, Multiplexers, Transducers, Routers, Controllers and so on. The interface devices Serial data interface, Parallel data interface, Analog data interface and Digital data interface. The Communication network consist of In-band, Out-band and Ethernet components. In-band consists of PLC (Power line communication), Out-band consists of OFC (Optical fiber communication), Copper wire communication and Pilot-relay communication while Ethernet consists of System configuration and protection signaling, Telecontrol using TDM over Ethernet converters and Ethernet Teleprotection using IEC-61850GOOSE messaging. The telecontrol SCADA market comprises of Architecture, Requirement and Function components.

Market by Applications:

The telecontrol application market consists of different industry verticals such as Power, Telecom, Information technology (cyber security), Oil& Gas pipelines, Transportation, Aerospace & Defense and others. The power vertical can again be sub-segmented into phase comparison and substation automation while telecom vertical can be sub-divided into Analog systems, Digital systems and Universal systems.

Market by Geography:

The geography market can be divided into North America (the U.S, Canada and others), Europe (the U.K, Germany, Russia and others), the Asia Pacific (China, Japan, India and others) and Rest of the World (Latin America, The Middle East and others) with in-depth analysis of their market share and key player distribution in the ecosystem.

The Teleprotection Market report also identifies the drivers, restraints, opportunities, current market trends, winning imperatives, and burning issues of the telecontrol market. Apart from the market segmentation, the report also includes the critical market data and qualitative information for each product type along with qualitative analysis such as Porterís five force analysis, market timeline analysis, market investment analysis, industry breakdown analysis and value chain analysis.

Teleprotection is a new buzz around the power and telecom utilities. There is surge of teleprotected grids and utilities to employ in number of industry verticals. Thanks to the advancement in communication network technologies; it is now possible to leverage high end technologies for processing a heap of signals and information to access risk of failure and blackouts for both consumers and OEMs.

The key drivers of the teleprotection ecosystem are: Aging grid infrastructure in power industry, the influence of product marketers to provide multifunctional solutions that comply with strict communication protocols, Reduction in transmission and distribution loss, Mass-Revenue Contribution Sectors such as Aerospace & Defense to take the lead from Applications in the years to come, Huge rise in demand levels expected from diverse fields in power and telecom and huge demand of uninterrupted power supply from developing countries. Teleprotection, in spite of being a must use case with its exceptional demand, still has some restraints for its marketís growth. The key market restraints can be classified as; High Cost Factor, High Level of Expenditure, Investments to deploy the system, Lack of interoperability standards and protocols to use and install the telecontrol systems and differences between electricity regulations across the geographies. The opportunities of teleprotection ecosystem can be classified as: Diverse new product requirements in Military, Aerospace & Defense and information technology sectors and Integration with Intelligent and advanced communication technologies.

This telecontrol report focuses on giving a birdís eye-view of the complete teleprotection industry with regards to the products market, with detailed market segmentations, combined with qualitative analysis of each and every aspect of the classification on the basis of technology, principles, components, application verticals (sectors), sub-applications, and geography. All the numbers, both, revenue & volume, at every level of detail, are forecast till 2018, to give a glimpse of the potential revenue base in this market.

Major players in this Telecontrol market include ABB Ltd. (Switzerland), Alcatel Lucent S.A. (France), Alstom S.A. (France), Cisco Systems (U.S.), DNV Kema (The Netherlands), GE Energy (U.S.), Nokia (Finland), Telco systems (U.S.), Siemens AG (Germany), Schweitzer Engineering Laboratories, Inc. (U.S.) and so on.

TELEPROTECTION MARKET SEGMENTATION INFOGRAPH (2013-2018)

Source: MarketsandMarkets Analysis

The teleprotection market is currently in its initiation phase and is expected to transition to the growth phase scaling billions of revenues in the years to come. The total market value was $2.30 billion in 2012, which is likely to increase till $9.31 billion in 2018 with an estimated CAGR of 28.67%. The influence of product marketers to provide multifunctional solutions that comply with strict communication protocols drove the market to the upper limits of the overall ecosystem. Teleprotection software, service and communication network technology market are also going to do an excellent business across the forecast period.

Table Of Contents

1 Introduction - Teleprotection Market (Page No. - 26)

1.1 Key Take-Away

1.2 Report Description

1.3 Teleprotection Markets Covered

1.4 Stakeholders

1.5 Report Assumptions

1.5.1 General Assumptions & Glossary

1.5.2 Market Engineering Assumptions

1.6 Research Methodology

1.6.1 Teleprotection Market Size Estimation

1.6.2 Teleprotection Market Crackdown & Data Triangulation

1.6.3 Teleprotection Market Forecasting Model

1.6.4 Key Data Points Taken From Secondary Sources

1.6.5 Key Data Points Taken From Primary Sources

1.6.6 List Of Companies Covered During Study

2 Executive Summary (Page No. - 41)

3 Cover Story: Primary Research Interview (Page No. - 43)

3.1 Research Interview With President & Ceo, Amperion, Inc. (U.S.)

4 Premium Insights (Page No. - 47)

4.1 Competitive Profiling Of Elite Players

4.2 Geography Life-Cycle Of Teleprotection Market

4.3 Growth Strategy Matrix (ANSOFF MATRIX)

4.3.1 Market Development

4.3.1.1 Japan, Brazil, And India To Lead The Pecking Order Of The Markets Conducive For Investments In Aerospace, Information Technology And Oil & Gas Industry Vertical

4.3.2 Diversification

4.3.2.1 Forward Integration Dubbed To Be The Winning Strategy For Communication Technology Players

4.3.3 Telecontrol Market Penetration

4.3.3.1 Power And Telecom Sector Proving To Be The Most Sought Revenue Avenues For Existing Players To Grab The Lionís Share

4.3.4 Product Development

4.3.4.1 Product Development In New Markets Deemed To Be A Game-Changing Proposition For The New Entrants

4.4 Teleprotection Unit Shipment And Average Selling Price Dashboard

4.4.1 Teleprotection System Deployment To Amass 1 Billion Units Landmark By 2018

4.5 Telecontrol Market Investment Analysis

4.5.1 The Major Barriers For Investment In Teleprotection Ecosystem

4.5.2 The Major Pro-Factors For Investment In Teleprotection Ecosystem

5 Market Overview (Page No. - 61)

5.1 Introduction - Telecontrol Market

5.1.1 Definition

5.1.2 Wide Area Protection

5.1.3 Technology Advancements

5.1.3.1 Iec Standards For Teleprotection

5.1.3.2 Teleprotection Protocol And Security

5.2 History & Evolution

5.2.1 Evolution Based On Communication Network Technology And Components

5.2.2 Evolution Based On Applications

5.3 Teleprotection Schema & Operations

5.3.1 Transient Network Simulation

5.3.1.1 Advantages Of Transient Network Simulation

5.3.2 Teleprotection Schemes

5.3.2.1 Direct Inter Trip Scheme

5.3.2.2 Simplified Permissive Overreaching Transfer Trip Scheme

5.3.2.3 Simplified Directional Comparison Scheme

5.3.2.4 Simplified Blocking Scheme

5.3.2.5 Conventional Implementation Of Accelerated Scheme

5.3.3 Teleprotection Parameters

6 Teleprotection Market Analysis (Page No. - 79)

6.1 Introduction - Telecontrol Market

6.2 Teleprotection Market Dynamics

6.2.1 Telecontrol Market Drivers

6.2.1.1 Aging Grid Infrastructure In Power Industry

6.2.1.2 Reduction In Transmission And Distribution Loss

6.2.1.3 The Influence Of Product Marketers To Provide Multifunctional Solutions That Comply With Strict Communication Protocols

6.2.1.4 Mass-Revenue Contribution Sectors Such As Aerospace & Defence To Take The Lead From Applications In The Years To Come

6.2.1.5 Significant Rise In Demand Levels Expected From Diverse Fields In Power And Telecom

6.2.1.6 Huge Demand Of Uninterrupted Power Supply From Developing Countries

6.2.2 Telecontrol Market Restraints

6.2.2.1 High Cost Factor, High Level Of Expenditure, Investments To Deploy The System

6.2.2.2 Lack Of Interoperability Standards And Protocols To Use And Install The Teleprotection Systems

6.2.2.3 Differences Between Electricity Regulations Across The Geographies

6.2.3 Telecontrol Market Opportunities

6.2.3.1 Diverse New Product Requirements In Military, Aerospace & Defence And Information Technology Sectors

6.2.3.2 Integration With Intelligent And Advanced Communication Technologies

6.2.4 Burning Issues

6.2.4.1 High Level Of Fragmentation, Diversity Among Key Players, Closed Pool Of Knowledge

6.2.4.2 Lack Of Required Level Of Investments, Capital Input And Support

6.2.5 Winning Imperatives

6.2.5.1 Strategic Mapping Of Communication Technologies For End-Use Applications

6.2.5.2 Industry Relations, Jvs, Collaborations With Other Players In The Value Chain

6.3 Industry Trends - Teleprotection Market

6.3.1 Industry Life Cycle

6.3.1.1 Industry Life Cycle Based On Communication Network Components

6.3.1.2 Industry Life Cycle Based On Application

6.4 Porterís Analysis

6.4.1 Threat From New Entrants

6.4.2 Threat From Substitutes

6.4.3 Bargaining Power Of Suppliers

6.4.4 Bargaining Power Of Buyers

6.4.5 Degree Of Competition

6.5 Value & Supply Chain Analysis

6.5.1 Business Models And Global Scaling Analysis

7 By Product Type (Page No. - 105)

7.1 Introduction - Teleprotection Market

7.2 Teleprotection Unit

7.2.1 Directional Electrical Interface Equipment

7.2.2 Optical Interface Equipment

7.2.3 Data Terminal Equipment (DTE)

7.2.3.1 Dte Pin Structure For Teleprotection

7.2.4 Data Circuit Terminating (Communication) Equipment (DCE)

7.2.4.1 Dce Pin Structure For Teleprotection

7.2.5 Multi-Service Access Equipment

7.2.5.1 Multi-Service Access Equipment To Be The Defining Market For The Teleprotection Industry

7.2.6 Others

7.3 Communication Network Technology

7.3.1 Conventional Methods

7.3.1.1 Tdm (Time-Division Multiplexing)

7.3.1.2 Tdm Over Ip (Time-Division Multiplexing Over Internet Protocol)

7.3.1.3 Psn (Public Switched Network)

7.3.2 New Advancements

7.3.2.1 Ip/Mpls (Internet Protocol/Multi Protocol Label Switching)

7.3.2.1.1 Ip/Mpls To Witness An Organic Upsurge In The Growth Rate In The Forthcoming Years

7.3.2.1.1.1 Ip/Mpls Challenges To Utility Networks

7.3.2.2 Sdh/Sonet (Synchronous Digital Hierarchy/Synchronous Optical Network)

7.4 Teleprotection Software

7.4.1 Synchrophasor Software

7.4.2 Event Analysis Software

7.4.3 Network Management System Software

7.4.4 Other Software

7.5 Teleprotection Services

7.5.1 North America Market Anticipated To Rejig The Services Domain In The Teleprotection Arena

8 By Components (Page No. - 132)

8.1 Introduction - Telecontrol Market

8.2 Intelligent Electronic Device (IED) Market

8.2.1 Apac To Be Serve As A Major Revenue Basket For The Ied Market After 2018

8.2.2 Switches

8.2.3 Relays

8.2.3.1 Major Relay Companies In 2012

8.2.3.2 Types Of Relay Protection Functions

8.2.3.3 Distance Relays

8.2.3.4 Directional Relays

8.2.4 Connecters

8.2.4.1 Voice And Teleprotection Card Connecter Ports

8.2.5 Multiplexers

8.2.6 Transducers

8.2.6.1 Major Transducers Players In 2012

8.2.7 Routers

8.2.8 Controllers

8.2.8.1 Programmable Logic Controller (PLC)

8.2.8.2 Major Plc Players In 2012

8.2.9 Displays

8.2.9.1 Displays With Tps (Teleprotection Signaling) Module

8.2.10 Others

8.3 Interface Device (Ieee C37.94, Rs-232 Etc.) Market

8.3.1 Serial Data Interface

8.3.2 Parallel Data Interface

8.3.3 Analog Data Interface

8.3.4 Digital Data Interface

8.4 Communication Network Components Market

8.4.1 In-Band

8.4.1.1 Plc (Power Line Communication)

8.4.1.1.1 B-Plc

8.4.2 Out-Band

8.4.2.1 Ofc (Optical Fiber Communication)

8.4.2.1.1 Ofc Advantages For Teleprotection

8.4.2.2 Copper Wire Communication

8.4.2.3 Pilot-Relay Communication

8.4.3 Ethernet

8.4.3.1 System Configuration And Protection Signaling

8.4.3.2 Teleprotection Using Tdm Over Ethernet Converters

8.4.3.3 Ethernet Teleprotection Using Iec-61850goose Messaging

8.4.4 Others

8.5 Scada Market

8.5.1 Architecture

8.5.1.1 Types Of Scada Architectures

8.5.2 Requirement

8.5.3 Functions

8.5.3.1 System Control

8.5.3.2 System Monitoring

8.5.3.3 Data Acquisition

9 By Application (Page No. - 163)

9.1 Introduction - Telecontrol Market

9.2 Power

9.2.1 Phase Comparison

9.2.1.1 Distance Protection

9.2.1.2 Differential Protection

9.2.2 Substation Automation

9.3 Telecom

9.3.1 Analog Systems

9.3.2 Digital Systems

9.3.3 Connectivity Factors

9.4 Information Technology (Cyber Security)

9.5 Oil & Gas Pipeline

9.5.1 Oil & Gas Pipeline Applications To Drive The Teleprotection Market With Exponential Growth Aspects In The Middle-East Region

9.6 Transportation

9.6.1 Transportation Application Sgmentation

9.7 Aerospace & Defense

9.8 Others

10 By Geography (Page No. - 185)

10.1 Teleprotection Market Introduction

10.2 Pest Analysis Of Teleprotection Market

10.2.1.1 Political

10.2.1.2 Economical

10.2.1.3 Social

10.2.1.4 Technological

10.3 North Americaís Revenue Contribution To Cross $3 Billion By 2018

10.3.1 U.S.: The Principal Torch-Bearer Of Teleprotection Ecosystem

10.3.2 Canada

10.3.3 Others

10.4 Europe

10.4.1 U.K.: The Top Bet In The Ivy-League Nations In The European Teleprotection Industry

10.4.2 U.K.

10.4.3 Germany: An Economy With Untapped Potential

10.4.4 Russia

10.4.5 Others

10.5 Asia-Pacific

10.5.1 Power And Telecom Sectors To Render The Activation Thrust For The Upsurge In The Apac Market

10.5.2 China

10.5.3 Japan

10.5.4 India

10.5.4.1 Fdiís To Rev-Up The Power Sector In The Indian Landscape

10.5.5 Others

10.6 Rest Of The World

10.6.1 Latin America

10.6.2 The Middle East

10.6.3 Others

11 Competitive Landscape (Page No. - 223)

11.1 Introduction - Teleprotection Market

11.2 Industry Key Players

11.2.1 Teleprotection Players

11.2.2 Teleprotection Market Share Analysis

11.3 Recent Industry Developments

11.3.1 New Product Developments & Announcements

11.3.2 Contracts And Agreements

11.3.3 Acquisitions, Collaborations, And Joint Ventures

11.3.4 Awards And Others

12 Company Profiles (Overview, Products And Services, Financials, Strategy & Development)* (Page No. - 239)

12.1 Abb Ltd

12.2 Alcatel-Lucent

12.3 Alstom Sa

12.4 Altalink

12.5 Ambient Corporation

12.6 Amperion, Inc.

12.7 Conolog Corporation

12.8 General Electric

12.9 Itron

12.10 Nokia Oyj

12.11 Plc Power

12.12 Rad Data Communications Ltd

12.13 Ruggedcom

12.14 Schneider Electric

12.15 Schweitzer Engineering Laboratories

12.16 Selta Spa

12.17 Tc Communication Inc.

12.18 Telco Systems

12.19 Texas Instruments

12.20 Transdyn Inc

12.21 Valiant Communications Limited

12.22 Ventyx *Details On Overview, Products And Services, Financials, Strategy & Development Might Not Be Captured In Case Of Unlisted Companies.

List Of Tables (96 Tables)

Table 1 General Assumptions

Table 2 Teleprotection Market Engineering Assumptions

Table 3 List Of Companies Covered During Study

Table 4 Teleprotection Market Revenue, By Product Type, 2012 - 2018 ($Billion)

Table 5 Products, Services And Component Mapping Of Elite Players

Table 6 IEC Standards For Teleprotection Market

Table 7 Teleprotection Protocol And Security

Table 8 Quantification Of Overall Porter Analysis

Table 9 Teleprotection Market, By Product Type, 2013 - 2018 ($Billion)

Table 10 Market, By Teleprotection Unit, 2013 - 2018 ($Million)

Table 11 Teleprotection Unit Market, By Geography, 2013 - 2018 ($Million)

Table 12 Dte Pin Structure For Telecontrol

Table 13 Dce Pin Structure For Teleprotection

Table 14 Telecontrol Market, By Communication Network Technology, 2013 - 2018 ($Million)

Table 15 Communication Network Technology Market, By Geography, 2013 - 2018 ($Million)

Table 16 Communication Network Technology Market, By Conventional Method, 2013 - 2018 ($Million)

Table 17 Conventional Methods Market, By Geography, 2013 - 2018 ($Million)

Table 18 Communication Network Technology Market, By New Advancements, 2013 - 2018 ($Million)

Table 19 New Advancements Market, By Geography, 2013 - 2018 ($Million)

Table 20 Ip/Mpls: Challenges To Utility Networks

Table 21 Teleprotection Market, By Software Types, 2013 - 2018 ($Million)

Table 22 Telecontrol Software Market, By Geography, 2013 - 2018 ($Million)

Table 23 Teleprotection Service Market, By Geography, 2013 - 2018 ($Million)

Table 24 Telecontrol Market, By Components, 2013 - 2018 ($Billion)

Table 25 Telecontrol Components Market, By Geography, 2013 - 2018 ($Billion)

Table 26 Intelligent Electronic Device (IED) Market, By Geography, 2013 - 2018 ($Million)

Table 27 Major Relay Companies For Teleprotection In 2012

Table 28 Types Of Relay Protection Functions

Table 29 Voice And Telecontrol Card Connecter Ports

Table 30 Major Transducers Companies In Teleprotection

Table 31 Types Of Control

Table 32 Major Telecontrol Plc Companies In 2012

Table 33 Teleprotection Components Market, By Interfaces Device, 2013 - 2018 ($Million)

Table 34 Interfaces Device Market, By Geography, 2013 - 2018 ($Million)

Table 35 Telecontrol Components Market, By Communication Network Components, 2013 - 2018 ($Million)

Table 36 Communication Network Components Market, By Geography, 2013 - 2018 ($Million)

Table 37 Optical Fiber Communication Advantages For Teleprotection

Table 38 Goose Message Nominal Transmission Time

Table 39 Telecontrol Scada Market, By Geography, 2013 - 2018 ($Million)

Table 40 Types Of Scada Architectures

Table 41 Teleprotection Market, By Applications, 2013 - 2018 ($Billion)

Table 42 Telecontrol Applications Market, By Geography, 2013 - 2018 ($Billion)

Table 43 Teleprotection Applications In Power Industry

Table 44 Power Application Market, By Type, 2013 - 2018 ($Million)

Table 45 Power Applications Market, By Geography, 2013 - 2018 ($Million)

Table 46 Power Application Market, By Phase Comparison, 2013 - 2018 ($Million)

Table 47 Telecontrol Applications In Telecom Industry

Table 48 Telecom Application Market, By Telecom Systems, 2013 - 2018 ($Million)

Table 49 Telecom Applications Market, By Geography, 2013 - 2018 ($Million)

Table 50 Information Technology Applications Market, By Geography, 2013 - 2018 ($Million)

Table 51 Oil & Gas Pipeline Applications Market, By Geography, 2014 - 2018 ($Million)

Table 52 Transportation Application Segmentation

Table 53 Teleprotetcion Application In Transportation Industry

Table 54 Transportation Applications Market, By Geography, 2013 - 2018 ($Million)

Table 55 Aerospace & Defense Applications Of Teleprotection

Table 56 Aerospace & Defense Applications Market, By Geography, 2013 - 2018 ($Million)

Table 57 Other Applications Market, By Geography, 2013 - 2018 ($Million)

Table 58 Teleprotection Market, By Geography, 2013 - 2018 ($Billion)

Table 59 North America Market: Teleprotection Market, By Applications, 2013 - 2018 ($Million)

Table 60 North America Market: Teleprotection Market, By Country, 2013 - 2018 ($Million)

Table 61 North America Market: Teleprotection Market, By Product Type, 2013 - 2018 ($Million)

Table 62 North America Market: Teleprotection Market, By Components, 2013 - 2018 ($Million)

Table 63 Europe Market: Teleprotection Market, By Applications, 2013 - 2018 ($Million)

Table 64 Europe Market: Teleprotection Market, By Country, 2013 - 2018 ($Million)

Table 65 Europe Market: Teleprotection Market, By Product Type, 2013 - 2018 ($Million)

Table 66 Europe Market: Teleprotection Market, By Components, 2013 - 2018 ($Million)

Table 67 Asia-Pacific Market: Teleprotection Market, By Applications, 2013 - 2018 ($Million)

Table 68 Asia-Pacific Market: Teleprotection Market, By Country, 2013 - 2018 ($Million)

Table 69 Asia-Pacific Market: Teleprotection Market, By Product Type, 2013 - 2018 ($Million)

Table 70 Asia-Pacific Market: Teleprotection Market, By Components, 2013 - 2018 ($Million)

Table 71 Asia-Pacific: Plc Market, By Country, 2013 - 2018 ($Million)

Table 72 Row Market: Teleprotection Market, By Applications, 2013 - 2018 ($Million)

Table 73 Row Market: Teleprotection Market, By Country, 2013 - 2018 ($Million)

Table 74 Row Market: Teleprotection Market, By Product Type, 2013 - 2018 ($Million)

Table 75 Row Market: Teleprotection Market, By Components, 2013 - 2018 ($Million)

Table 76 New Product Developments And Announcements In Teleprotection Ecosystem

Table 77 Teleprotection Ecosystem

Table 78 Acquisitions, Collaborations, And Joint Ventures Teleprotection Ecosystem

Table 79 Awards, Expansions And Presentations In Telecontrol Ecosystem

Table 80 ABB: Overall Revenue, 2011 - 2012 ($Billion)

Table 81 ABB: Market Revenue, By Product Segments, 2011 - 2012 ($Billion)

Table 82 Alcatel-Lucent: Overall Revenue, 2011 - 2012 ($Million)

Table 83 Overall Financials Of Alstom Sa, 2011 - 2012 ($Million)

Table 84 Alstom Market Revenue, By Geography, 2011 - 2012 ($Million)

Table 85 Ambient Corporation: Overall Revenue, 2011 - 2012 ($Million)

Table 86 Conolog Overall Revenue, 2011 - 2012 ($Million)

Table 87 Ge Overall Revenue, 2011 - 2012 ($Billion)

Table 88 Ge, Market Revenue, By Operating Segments, 2011 - 2012 ($Billion)

Table 89 Ge, Market Revenue, By Geography, 2011 - 2012 ($Billion)

Table 90 Itron: Overall Revenue, 2011 - 2012 ($Million)

Table 91 Schneider Electric: Overall Revenue, 2011 - 2012 ($Billion)

Table 92 Schneider Electric: Revenue, By Geography, 2011 - 2012 ($Billion)

Table 93 Texas Instruments: Market Revenue, 2011 - 2012 ($Million)

Table 94 Texas Instruments: Sales, By Business Segments, 2011 - 2012 ($Million)

Table 95 Texas Instruments: Market Revenue, By Geography, 2011 - 2012 ($Million)

Table 96 Valiant Communications: Overall Revenue, 2012 - 2013 ($Million)

List Of Figures (80 Figures)

Figure 1 Teleprotection Markets Covered

Figure 2 Teleprotection Market Research Methodology

Figure 3 Teleprotection Market Size Estimation Methodology

Figure 4 Data Triangulation Methodology

Figure 5 Teleprotection Market Forecasting Model

Figure 6 Geography Life Cycle Of Teleprotection

Figure 7 Growth Strategy Matrix For Telecontrol Market

Figure 8 Overall Teleprotection Unit Shipment (Million Units) And Asp ($) Trends (2012 - 2018)

Figure 9 Teleprotection Market Investment Analysis

Figure 10 Teleprotection Market Overview Of Teleprotection Ecosystem

Figure 11 Teleconrol System Architecture

Figure 12 Teleprotection Market Segmentation

Figure 13 Evolution Based On Communication Network Technology And Components

Figure 14 Evolution Based On Applications

Figure 15 Teleprotection Schemes

Figure 16 Teleprotection Performance Testing And Monitoring

Figure 17 Latency Sources In Teleprotection

Figure 18 Teleprotection Market Analysis

Figure 19 Teleprotection Market Drivers And Restraints

Figure 20 Teleprotection Market Drivers Impact Analysis

Figure 21 Teleprotection Market Restraints Impact Analysis

Figure 22 Teleprotection Market Opportunities Impact Analysis

Figure 23 Telecontrol Industry Life Cycle Based On Communication Network Components

Figure 24 Teleprotection Industry Life Cycle Based On Applications

Figure 25 Telecontrol Market: Porterís Five Forces Analysis

Figure 26 Teleprotection Market: Threat From New Entrants

Figure 27 Telecontrol Market: Threat From Substitutes

Figure 28 Teleprotection Market: Bargaining Power Of Suppliers

Figure 29 Telecontrol Market: Bargaining Power Of Buyers

Figure 30 Teleprotection Market: Degree Of Competition

Figure 31 Value Chain Analysis Of Teleprotection Market Ecosystem

Figure 32 Business Model Of Teleprotection Ecosystem

Figure 33 Market By Product Type

Figure 34 Market Segmentation Infograph (2013 - 2018)

Figure 35 Communication Network Technology Segmentation

Figure 36 Teleprotection Over IP/MPLS

Figure 37 Teleprotection Synchrophasor System

Figure 38 Teleprotection Market By Components

Figure 39 Teleprotection Market Segmentation, By Communication Network Components

Figure 40 Telecontrol Market By Application

Figure 41 Distance Protection Of Utilities

Figure 42 Telecom Applications: Network Services

Figure 43 Teleprotection Market, By Geography

Figure 44 Telecontrol Market: Geographic Snapshot

Figure 45 Graphical Purview Of Teleprotection Market, By Geography ($Million)

Figure 46 Pest Analysis Of Geographies For Teleprotection Market

Figure 47 U.S.: Teleprotection Market ($Million)

Figure 48 Canada: Teleprotection Market ($Million)

Figure 49 North America Others: Teleprotection Market ($Million)

Figure 50 U.K.: Teleprotection Market ($Million)

Figure 51 Germany: Telecontrol Market ($Million)

Figure 52 Russia: Teleprotection Market ($Million)

Figure 53 Europe Others: Teleprotection Market ($Million)

Figure 54 China: Teleprotection Market ($Million)

Figure 55 Japan: Teleprotection Market ($Million)

Figure 56 India: Teleprotection Market ($Million)

Figure 57 Apac Others: Teleprotection Market ($Million)

Figure 58 Latin America: Teleprotection Market ($Million)

Figure 59 The Middle East: Teleprotection Market ($Million)

Figure 60 Row Others: Teleprotection Market ($Million)

Figure 61 Competitive Landscape Segmentation Of Teleprotection Ecosystem

Figure 62 Market Share Analysis Of Telecontrol Top Players In 2012

Figure 63 Abb: Swot Analysis

Figure 64 Alcatel-Lucent: Product Offerings

Figure 65 Alstom Sa: Swot Analysis

Figure 66 Amperion: Swot Analysis

Figure 67 Major Operating Segments

Figure 68 Ge: Swot Analysis

Figure 69 Nokia: Products Offerings

Figure 70 Nokia: Overall Market Revenue, 2011 - 2012 ($Million)

Figure 71 Swot Analysis Of Nokia

Figure 72 Plc Power: Product Offerings

Figure 73 Products & Services Offered By Schneider Electric

Figure 74 Schneider Swot

Figure 75 Sel: Swot Analysis

Figure 76 Selta: Product Offerings

Figure 77 Tc Communication Inc. Product Offerings

Figure 78 Texas Instruments: Product Offerings

Figure 79 Texas Instruments: Swot

Figure 80 Ventyx: Product Offerings

Growth opportunities and latent adjacency in Teleprotection Market