Telecom Order Management Market by Solution (Customer Order Management, Service Order Management, and Service Inventory Management), Service, Network Type (Wireline and Wireless), Deployment Type, and Region - Global Forecast to 2022

[111 Pages Report] The global telecom order management market accounted for USD 1.80 Billion in 2016 and is projected to reach USD 3.22 Billion by 2022, at a Compound Annual Growth Rate (CAGR) of 10.4% during the forecast period.

Request for Customization to get the global Telecom Order Management market forecasts to 2025

The report aims at estimating the market size and the growth potential of the telecom order management market across different segments: components (solutions and services), network types, deployment types, and regions. The primary objective of the report is to provide a detailed analysis of the major factors (drivers, restraints, opportunities, industry-specific challenges, and recent developments) influencing the market growth, analyze the market opportunities for stakeholders, and offer details of the competitive landscape to the market leaders.

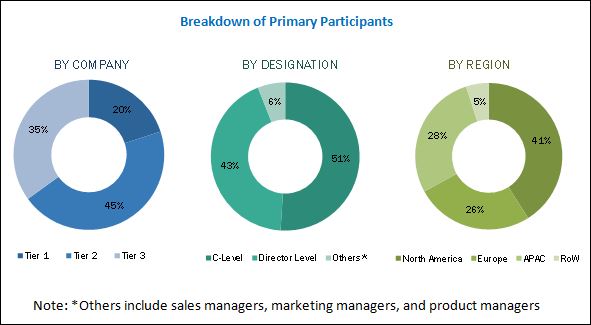

The research methodology used to estimate and forecast the telecom order management market began with capturing data on the key vendor revenues through secondary sources, such as annual reports, TM Forum, International Telecommunication Union (ITU), IEEE Xplore, press releases and investor presentations of companies, and white papers, certified publications, and articles from recognized associations and government publishing sources. Vendor offerings were also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the global telecom order management market from the revenues of the key market players. After arriving at the overall market size, the market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key industry personnel, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of the profiles of the primary discussion participants is depicted in the below figure:

To know about the assumptions considered for the study, download the pdf brochure

The telecom order management market includes companies such as Cerillion (UK), Cognizant (US), Ericsson (Sweden), IBM (US), Oracle (US), ChikPea (US), Comarch (Poland), Fujitsu (Japan), Intellibuzz (India), Mphasis (India), Neustar (US), and Pegasystems (US).

Key Target Audience

- Telecom order management vendors

- IT service providers

- System integrators

- Telecom equipment providers

- Mobile Network Operators (MNOs)

- Government telecom regulatory authorities

- Cloud service providers

- Communication Service Providers (CSPs)

- Consulting companies

- Communication equipment vendors

Scope of the Telecom Order Management Market Research Report

The research report categorizes the telecom order management market to forecast the revenues and analyze the trends in each of the following subsegments:

By Component

- Solutions

- Customer order management

- Service order management

- Service inventory management

- Services

- Integration and installation services

- Consulting services

- Support services

By Network Type

- Wireline

- Wireless

Telecom Order Management Market By Deployment Type

- On-premises

- Cloud

By Region

- North America

- Europe

- Asia Pacific (APAC)

- Middle East and Africa (MEA)

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific requirements. The following customization options are available for the report:

Product Analysis

- Product matrix provides detailed product information and comparison

Geographic Analysis

- Further breakdown of the North American telecom order management market

- Further breakdown of the European market

- Further breakdown of the APAC market

- Further breakdown of the MEA market

- Further breakdown of the Latin American market

Company Information

- Detailed analysis and profiling of additional market players

MarketsandMarkets forecasts the telecom order management market to grow from USD 1.96 Billion in 2017 to USD 3.22 Billion by 2022, at a Compound Annual Growth Rate (CAGR) of 10.4% during the forecast period. The major factors driving the market growth are the rapid growth in the number of of connected devices and subscribers, and consolidation of services offered by telecom service providers and network operators.

The objective of the report is to define, describe, and forecast the telecom order management market size on the basis of components (solutions and services), network types, deployment types, and regions. In the components, the solutions segment is expected to have the larger market share during the forecast period. The services segment is expected to grow at a higher CAGR during the forecast period.

In the network types segment, the wireline network type is expected to have the larger market size as compared to the wireless network type during the forecast period. Wired networks comprise copper cables, coaxial cables, and sometimes fiber optics to set up the connections. Wireline network is also known as the Ethernet network. These wired network connections are not prone to single point of failure, thus, they offer a much faster speed than dial-up connections. Presently, organizations with sensitive data, use wired networks, as they are considered to be highly secure connections. Though wireless networks have been widely adopted, many companies still prefer using wired networking solutions, along with wireless networks, to provide better connectivity and secured services.

In the deployment types segment, the cloud deployment type is expected to grow at a higher rate during the forecast period. Companies are shifting toward cloud-based services to avoid investments in the IT infrastructure and to experience scalability, faster deployment, and agility benefits. With cloud-based deployments, organizations can easily minimize their upfront costs, manage content quality, increase their Return on Investment (RoI), and expand their customer base. Therefore, it is expected that cloud deployments will witness an increase during the forecast period.

North America is expected to have the largest share in the telecom order management market during the forecast period. Driven by the expansion of Long-Term Evolution (LTE) networks in the region, Communication Service Providers (CSPs) are looking for new innovative solutions to standardize their 4G/LTE business models, provide better customer service, and measure the service quality and performance. These are the factors driving the growth of the North American region. APAC is expected to grow at the highest CAGR during the forecast period, as the region has the presence of creditable organizations that are gradually embracing the adoption of advanced technologies.

The rapid growth in the number of connected devices and subscribers is benefiting the growth of the telecom order management market. However, resistance to adopt structural changes in systems and new technologies, and the requirement for highly proficient specialists to manage the telecom orders may act as the restraining factors that can hamper business-critical functions in the market.

Major vendors in the telecom order management market are Cerillion (US), Cognizant (US), Ericsson (Sweden), IBM (US), Oracle (UK), ChikPea (US), Comarch (Poland), Fujitsu (Japan), Intellibuzz (India), Mphasis (India), Neustar (US), and Pegasystems (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Research Assumptions and Limitations

2.3.1 Assumptions

2.3.2 Limitations

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 27)

4.1 Attractive Market Opportunities in the Telecom Order Management Market

4.2 Market By Services

4.3 Telecom Order Management Market, Market Share of Top 3 Solutions and Regions

4.4 Market Investment Scenario

5 Market Overview and Industry Trends (Page No. - 29)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Cost-Effective Business Processes to Gain A Competitive Edge in the Industry

5.2.1.2 Rapid Increase in Connectivity Devices and Subscribers

5.2.1.3 Consolidation of Services By Telecom Service Providers and Network Operators

5.2.2 Restraints

5.2.2.1 Resistance to Adopt Structural Changes in Systems and New Technologies

5.2.2.2 Requirement of Highly Proficient Specialists to Manage the Telecom Order

5.2.3 Opportunities

5.2.3.1 Innovation in Next-Generation Telecom Order Management Tools

5.2.4 Challenges

5.2.4.1 Lack of Standardization and Compatibility Issues With the Existing Systems

5.3 Use Cases

5.3.1 Use Case 1: Intellibuzz

5.3.2 Use Case 2: Cerillion

5.3.3 Use Case 3: Pegasystems

5.3.4 Use Case 4: Comarch

6 Telecom Order Management Market, By Component (Page No. - 34)

6.1 Introduction

6.2 Solutions

6.2.1 Customer Order Management

6.2.2 Service Order Management

6.2.3 Service Inventory Management

6.3 Services

6.3.1 Integration and Installation Services

6.3.2 Consulting Services

6.3.3 Support Services

7 Telecom Order Management Market, By Network Type (Page No. - 44)

7.1 Introduction

7.2 Wireline

7.3 Wireless

8 Market By Deployment Type (Page No. - 48)

8.1 Introduction

8.2 On-Premises

8.3 Cloud

9 Telecom Order Management Market, By Region (Page No. - 52)

9.1 Introduction

9.2 North America

9.2.1 United States

9.2.2 Canada

9.3 Europe

9.3.1 United Kingdom

9.3.2 Germany

9.3.3 Others

9.4 Asia Pacific

9.5 Middle East and Africa

9.6 Latin America

10 Competitive Landscape (Page No. - 74)

10.1 Overview

10.2 Competitive Situations and Trends

10.2.1 Agreements, Partnerships, and Collaborations

10.2.2 New Product/Service Developments

10.2.3 Mergers and Acquisitions

10.2.4 Business Expansions

10.3 Market Standing, By Key Player

11 Company Profiles (Page No. - 79)

11.1 Introduction

11.2 Cerillion

11.3 Cognizant

11.4 Ericsson

11.5 IBM

11.6 Oracle

11.7 ChikPea

11.8 Comarch

11.9 Fujitsu

11.10 Intellibuzz

11.11 Mphasis

11.12 Neustar

11.13 Pegasystems

*Details on Business Overview, Products/Solutions Offered, Recent Developments, SWOT Analysis and MNM View might not be captured in case of unlisted companies.

12 Appendix (Page No. - 103)

12.1 Other Key Developments

12.1.1 Mergers and Acquisitions

12.1.2 Partnerships, Collaborations, and Agreements

12.2 Discussion Guide

12.3 Knowledge Store: MarketsandMarkets Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (66 Tables)

Table 1 United States Dollar Exchange Rate, 20142016

Table 2 Telecom Order Management Market Size, By Component, 20152022 (USD Million)

Table 3 Solutions: Market Size, By Type, 20152022 (USD Million)

Table 4 Solutions: Market Size, By Region, 20152022 (USD Million)

Table 5 Customer Order Management Market Size, By Region, 20152022 (USD Million)

Table 6 Service Order Management Market Size, By Region, 20152022 (USD Million)

Table 7 Service Inventory Management Market Size, By Region, 20152022 (USD Million)

Table 8 Services: Market Size, By Type, 20152022 (USD Million)

Table 9 Services: Market Size, By Region, 20152022 (USD Million)

Table 10 Integration and Installation Services Market Size, By Region, 20152022 (USD Million)

Table 11 Consulting Services Market Size, By Region, 20152022 (USD Million)

Table 12 Support Services Market Size, By Region, 20152022 (USD Million)

Table 13 Telecom Order Management Market Size, By Network Type, 20152022 (USD Million)

Table 14 Wireline: Market Size, By Region, 20152022 (USD Million)

Table 15 Wireless: Market Size, By Region, 20152022 (USD Million)

Table 16 Market Size, By Deployment Type, 20152022 (USD Million)

Table 17 On-Premises: Market Size, By Region, 20152022 (USD Million)

Table 18 Cloud: Market Size, By Region, 20152022 (USD Million)

Table 19 Market Size, By Region, 20152022 (USD Million)

Table 20 North America: Market Size, By Component, 20152022 (USD Million)

Table 21 North America: Market Size, By Solution, 20152022 (USD Million)

Table 22 North America: Market Size, By Service, 20152022 (USD Million)

Table 23 North America: Market Size, By Network Type, 20152022 (USD Million)

Table 24 North America: Market Size, By Deployment Type, 20152022 (USD Million)

Table 25 North America: Market Size, By Country, 20152022 (USD Million)

Table 26 United States: Telecom Order Management Market Size, By Component, 20152022 (USD Million)

Table 27 United States: Market Size, By Solution, 20152022 (USD Million)

Table 28 United States: Market Size, By Service, 20152022 (USD Million)

Table 29 United States: Market Size, By Network Type, 20152022 (USD Million)

Table 30 United States: Market Size, By Deployment Type, 20152022 (USD Million)

Table 31 Canada:Market Size, By Component, 20152022 (USD Million)

Table 32 Canada: Market Size, By Solution, 20152022 (USD Million)

Table 33 Canada: Market Size, By Service, 20152022 (USD Million)

Table 34 Canada: Market Size, By Network Type, 20152022 (USD Million)

Table 35 Canada: Market Size, By Deployment Type, 20152022 (USD Million)

Table 36 Europe: Telecom Order Management Market Size, By Component, 20152022 (USD Million)

Table 37 Europe: Market Size, By Solution, 20152022 (USD Million)

Table 38 Europe: Market Size, By Service, 20152022 (USD Million)

Table 39 Europe: Market Size, By Network Type, 20152022 (USD Million)

Table 40 Europe: Market Size, By Deployment Type, 20152022 (USD Million)

Table 41 Europe: Market Size, By Country, 20152022 (USD Million)

Table 42 United Kingdom: Market Size, By Component, 20152022 (USD Million)

Table 43 United Kingdom: Market Size, By Solution, 20152022 (USD Million)

Table 44 United Kingdom: Market Size, By Service, 20152022 (USD Million)

Table 45 United Kingdom: Market Size, By Network Type, 20152022 (USD Million)

Table 46 United Kingdom: Market Size, By Deployment Type, 20152022 (USD Million)

Table 47 Asia Pacific: Telecom Order Management Market Size, By Component, 20152022 (USD Million)

Table 48 Asia Pacific: Market Size, By Solution, 20152022 (USD Million)

Table 49 Asia Pacific: Market Size, By Service, 20152022 (USD Million)

Table 50 Asia Pacific: Market Size, By Network Type, 20152022 (USD Million)

Table 51 Asia Pacific: Market Size, By Deployment Type, 20152022 (USD Million)

Table 52 Middle East and Africa: Market Size, By Component, 20152022 (USD Million)

Table 53 Middle East and Africa: Market Size, By Solution, 20152022 (USD Million)

Table 54 Middle East and Africa: Market Size, By Service, 20152022 (USD Million)

Table 55 Middle East and Africa: Market Size, By Network Type, 20152022 (USD Million)

Table 56 Middle East and Africa: Market Size, By Deployment Type, 20152022 (USD Million)

Table 57 Latin America: Telecom Order Management Market Size, By Component, 20152022 (USD Million)

Table 58 Latin America: Market Size, By Solution, 20152022 (USD Million)

Table 59 Latin America: Market Size, By Service, 20152022 (USD Million)

Table 60 Latin America: Market Size, By Network Type, 20152022 (USD Million)

Table 61 Latin America: Market Size, By Deployment Type, 20152022 (USD Million)

Table 62 Agreements, Partnerships, and Collaborations, 20162017

Table 63 New Product/Service Developments, 20152016

Table 64 Mergers and Acquisitions, 20152017

Table 65 Business Expansions, 20152017

Table 66 Telecom Order Management Market: Market Standing, 2017

List of Figures (41 Figures)

Figure 1 Telecom Order Management Market: Market Segmentation

Figure 2 Market: Research Design

Figure 3 Data Triangulation

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Market Size, By Component (2017 vs 2022)

Figure 7 Market Size, By Solution (2017 vs 2022)

Figure 8 Market Size, By Network Type (2017 vs 2022)

Figure 9 Market Size, By Deployment Type (2017 vs 2022)

Figure 10 Market: Regional Snapshot

Figure 11 Rapidly Growing Number of Connectivity Devices and Subscribers is Expected to Drive the Market

Figure 12 Consulting Services Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 13 Customer Order Management and North America are Estimated to Have the Largest Market Shares in 2017

Figure 14 Asia Pacific is Expected to Emerge as the Best Market for Investment Over the Next 5 Years

Figure 15 Telecom Order Management Market: Drivers, Restraints, Opportunities, and Challenges

Figure 16 Services Component is Expected to Exhibit A Higher CAGR During the Forecast Period

Figure 17 Service Order Management Segment is Expected to Exhibit the Highest CAGR During the Forecast Period

Figure 18 Consulting Services Segment is Expected to Exhibit the Highest CAGR During the Forecast Period

Figure 19 Wireless Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 20 Cloud Deployment Type is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 21 Asia Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 22 Regional Snapshot: Asia Pacific is Expected to Exhibit the Highest CAGR During the Forecast Period

Figure 23 North America: Market Snapshot

Figure 24 Asia Pacific: Market Snapshot

Figure 25 Companies Adopted New Product Launches as the Key Growth Strategy During 20152017

Figure 26 Market Evaluation Framework

Figure 27 Geographic Revenue Mix: Top 5 Market Players

Figure 28 Cerillion: Company Snapshot

Figure 29 Cerillion: SWOT Analysis

Figure 30 Cognizant: Company Snapshot

Figure 31 Cognizant: SWOT Analysis

Figure 32 Ericsson: Company Snapshot

Figure 33 Ericsson: SWOT Analysis

Figure 34 IBM: Company Snapshot

Figure 35 IBM: SWOT Analysis

Figure 36 Oracle: Company Snapshot

Figure 37 Oracle: SWOT Analysis

Figure 38 Comarch: Company Snapshot

Figure 39 Fujitsu: Company Snapshot

Figure 40 Mphasis: Company Snapshot

Figure 41 Pegasystems: Company Snapshot

Growth opportunities and latent adjacency in Telecom Order Management Market