Telecom Operations Management Market by Software (Billing & Revenue Management, Customer & Product Management, and Others), by Services (Planning & Consulting, Operations & Maintenance, and Others), by Deployment Type and by Geography - Global Forecast to 2019

[127 Pages Report] Telecom Operations Management market to grow from $44.69 billion in 2014 to $66.83 billion by 2019, at a Compound Annual Growth Rate (CAGR) of 8.38%.

Telecom operations have reached a high level of complexity owing to the ever increasing and fluctuating nature of the telecom business. This has led to the rising of operational costs related to these activities, which in turn reduce profitability. The telecom operations management market caters to the need for efficient operation management systems in the telecom market. The service and solution providers in this market offer end-to-end solutions and services along with point-to-point specific offerings to manage the operations.

The telecom operations management market has been rising since the last decade. Furthermore, technologies such as next generation Operations Support System (OSS), Business Support System (BSS), Over-the-Top (OTT), and Service Delivery Platform (SDP) are being developed which are expected to bring about a high revenue generation for this market. There is a speculation that various companies plan to invest multibillion dollars in this market in the next few year. The market consists of large players like Ericsson, Oracle, HP, Accenture, and others, which offer services and solutions in this market. The market has seen these players grab high amount of market share.

This research report is a comprehensive study of the global market for telecom operations management (TOM). This report analyzes global adoption trends, key drivers, restraints, opportunities, and best practices in the market. The research report also examines growth potential, market sizes, and revenue forecasts across different regions as well as industry verticals.

The report forecasts the market sizes and trends for telecom operations management in the following sub-markets:

On the basis of software type:

- Billing and revenue management

- Customer and product management

- Service fulfillment and assurance

- Resource inventory management

- Network management

- Service delivery platform

On the basis of service:

- Planning and consulting

- Operations and maintenance

- System integration

- Managed services

On the basis of deployment type:

- On-premises

- Cloud

On the basis of region:

- North America (NA)

- Europe

- Asia-Pacific (APAC)

- MiddleEast and Africa (MEA)

- Latin America (LA)

The global telecom sector has been on a rapid rise since the last few decades. High level of operational complexity in telecom operations management has brought high growth in the market. The market is surging because of the need for telecom companies to timely and effectively delivers diversified customer demands in highly competitive environment. The market players offer solutions and services which help in the smooth flow of operations with maximized profitability.

The major factors driving the telecom operations management industry have been analyzed to be increasing operational costs, high operational complexity, and large scale investments in OSS architecture, among others. However, the lack of system integrators is the hindering factor for growth in this market.

In this report, MarketsandMarkets provides an in-depth study of the market trends, market sizing, competitive mapping, and market dynamics of the market. The trends, drivers, and opportunities in the market distinctly indicate noteworthy growth in the coming years. The telecom operations management industry is segmented by software into billing and revenue management, customer and product management, service fulfillment and assurance, resource inventory management, network management, Service Delivery Platform (SDP), and others; by service into planning and consulting, operations and maintenance, managed services, and system integration; by deployment type into on-premises and cloud; by geographical region into North America, Europe, Asia-Pacific, Middle East and Africa, and Latin America.

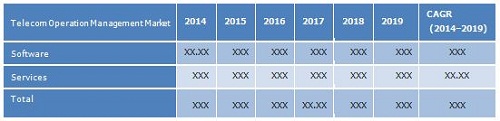

MarketsandMarkets forecasts the global telecom operations management market to grow from $44.69 billion in 2014 to $66.83 billion by 2019, at a Compound Annual Growth Rate (CAGR) of 8.38%. The table given below highlights the overall market size and Year-on-Year (Y-o-Y) growth during the forecast period of 2014–2019.

Source: MarketsandMarkets Analysis

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Year

1.3.3 Currency

1.3.4 Package Size

1.4 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Market Size Estimation

2.2 Market Share Estimation

2.2.1 Key Data From Secondary Sources

2.2.2 Key Data From Primary Sources

2.2.2.1 Key Industry Insights

2.2.3 Assumptions

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 25)

4.1 Attractive Market Opportunities in TOM Market

4.2 TOM Market: Software Deployment Type

4.3 Global TOM Software Market

4.4 TOM Market Across Various Regions

4.5 Life Cycle Analysis, By Region, 2014

5 Market Overview (Page No. - 29)

5.1 Introduction

5.2 Evolution

5.3 Market Segmentation

5.3.1 TOM Market

5.3.2 TOM Market, By Deployment Type

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Increasing Operational Costs

5.4.1.2 High Operational Complexity

5.4.1.3 Rise in Demand for Outsourcing Telecom Operations

5.4.2 Restraint

5.4.2.1 Lack of Efficient System Integrators

5.4.3 Opportunity

5.4.3.1 Need for End-To-End Operations Management

6 Industry Trends (Page No. - 36)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porter’s Five Forces Analysis

6.3.1 Threat From New Entrants

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Competitive Rivalry

7 Global TOM Market Analysis, By Software (Page No. - 40)

7.1 Introduction

7.2 Billing and Revenue Management

7.3 Customer and Product Management

7.4 Service Fulfillment and Assurance

7.5 Resource Inventory Management

7.6 Network Management

7.7 Service Delivery Platform

8 Global TOM Market Analysis, By Service (Page No. - 57)

8.1 Introduction

8.2 Planning and Consulting Services

8.3 Operations and Maintenance Services

8.4 System Integration

8.5 Managed Services

9 Global TOM Market Analysis, By Deployment Type (Page No. - 62)

9.1 Introduction

9.2 Cloud

9.3 On-Premises

10 Geographic Analysis (Page No. - 66)

10.1 Introduction

10.2 NA

10.3 Europe

10.4 APAC

10.5 MEA

10.6 LA

11 Competitive Landscape (Page No. - 81)

11.1 Overview

11.2 Competitive Situation and Trends

11.2.1 New Product Launches

11.2.2 Agreements, Partnerships, and Collaborations

11.2.3 Mergers and Acquisitions

12 Company Profiles (Page No. - 89)

12.1 Introduction

12.2 Accenture

12.3 Ericsson

12.4 Huawei Technologies

12.5 NEC Corporation

12.6 Oracle Corporation

12.7 Alcatel-Lucent

12.8 Amdocs

12.9 CISCO Sytems

12.10 Hewlett-Packard

12.11 SAP AG

13 Appendix (Page No. - 119)

13.1 Discussion Guide

13.2 Introducing RT: Real Time Market Intelligence

13.3 Available Customizations

13.4 Related Reports

List of Tables (71 Tables)

Table 1 Global TOM Market Size, By Type, 2012-2019 ($Billion)

Table 2 Effort to Reduce Operational Costs is Propelling the Growth of Telecom Operation Management

Table 3 Inadequate System Integrators Hampering the Growth of the Telecom Operations Management Market

Table 4 End-To-End Operations Management Systems Are Yet an Unexplored Territory

Table 5 TOM Market Size, By Software, 2012-2019 ($Billion)

Table 6 TOM Billing and Revenue Management Market Size, By Region, 2012-2019 ($Million)

Table 7 TOM Billing and Revenue Management Market Size, By Deployment Type, 2012-2019 ($Billion)

Table 8 TOM Billing and Revenue Management Cloud Market Size, By Region, 2012-2019 ($Million)

Table 9 TOM Billing and Revenue Management On-Premises Market Size, By Region, 2012-2019 ($Million)

Table 10 TOM Customer and Product Management Market Size, By Region, 2012-2019 ($Million)

Table 11 TOM Customer and Product Management Market Size, By Deployment Type, 2012-2019 ($Million)

Table 12 TOM Customer and Product Management Cloud Market Size, By Region, 2012-2019 ($Million)

Table 13 TOM Customer and Product Management On-Premises Market Size, By Region, 2012-2019 ($Million)

Table 14 TOM Service Fulfillment and Assurance Market Size, By Region, 2012-2019 ($Million)

Table 15 TOM Service Fulfillment and Assurance Market Size, By Deployment Type, 2012-2019 ($Billion)

Table 16 TOM Service Fulfillment and Assurance Cloud Market Size, By Region, 2012-2019 ($Million)

Table 17 TOM Service Fulfillment and Assurance On-Premise Market Size, By Region, 2012-2019 ($Million)

Table 18 TOM Resource Inventory Management Market Size, By Region, 2012-2019 ($Million)

Table 19 TOM Resource Inventory Management Market Size, By Deployment Type, 2012-2019 ($Million)

Table 20 TOM Resource Inventory Management Cloud Market Size, By Region, 2012-2019 ($Million)

Table 21 TOM Resource Inventory Management On-Premises Market Size, By Region, 2012-2019 ($Million)

Table 22 TOM Network Management Market Size, By Region, 2012-2019 ($Million)

Table 23 Network Management Market Size, By Deployment Type, 2012-2019 ($Billion)

Table 24 TOM Network Management Cloud Market Size, By Region, 2012-2019 ($Million)

Table 25 TOM Network Management On-Premises Market Size, By Region, 2012-2019 ($Million)

Table 26 TOM Service Delivery Platform Market Size, By Region, 2012-2019 ($Million)

Table 27 TOM Service Delivery Platform Market Size, By Deployment Type, 2012-2019 ($Billion)

Table 28 TOM Service Delivery Platform Cloud Market Size, By Region, 2012-2019 ($Million)

Table 29 TOM Service Delivery Platform On-Premises Market Size, By Region, 2012-2019 ($Million)

Table 30 TOM Market Size, By Service, 2012-2019 ($Billion)

Table 31 TOM Planning & Consulting Market Size, By Region, 2012-2019 ($Million)

Table 32 TOM Operations and Maintenance Market Size, By Region, 2012-2019 ($Million)

Table 33 TOM System Integration Market Size, By Region, 2012-2019 ($Million)

Table 34 TOM Managed Services Market Size, By Region, 2012-2019 ($Million)

Table 35 TOM Software Market Size, By Deployment Type, 2012-2019 ($Billion)

Table 36 TOM Cloud Market Size, By Region, 2012-2019 ($Billion)

Table 37 TOM On-Premises Market Size, By Region, 2012-2019 ($Billion)

Table 38 TOM Market Size, By Region, 2012-2019 ($Billion)

Table 39 North America: TOM Market Size, By Type, 2012-2019 ($Billion)

Table 40 North America: TOM Market Size, By Software, 2012-2019 ($Million)

Table 41 North America: TOM Market Size, By Service, 2012-2019 ($Million)

Table 42 North America: TOM Software Market Size, By Deployment Type, 2012-2019 ($Billion)

Table 43 North America: TOM Cloud Market Size, By Software, 2012-2019 ($Million)

Table 44 North America: TOM On-Premises Market Size, By Software, 2012-2019 ($Million)

Table 45 Europe: TOM Market Size, By Type, 2012-2019 ($Billion)

Table 46 Europe: TOM Market Size, By Software, 2012-2019 ($Million)

Table 47 Europe: TOM Market Size, By Service, 2012-2019 ($Million)

Table 48 Europe: TOM Software Market Size, By Deployment Type, 2012-2019 ($Billion)

Table 49 Europe: TOM Cloud Market Size, By Software, 2012-2019 ($Million)

Table 50 Europe: TOM On-Premises Market Size, By Software, 2012-2019 ($Million)

Table 51 Asia-Pacific: TOM Market Size, By Type, 2012-2019 ($Billion)

Table 52 Asia-Pacific: TOM Market Size, By Software, 2012-2019 ($Million)

Table 53 Asia-Pacific: TOM Market Size, By Service, 2012-2019 ($Million)

Table 54 Asia-Pacific: TOM Software Market Size, By Deployment Type, 2012-2019 ($Billion)

Table 55 Asia-Pacific: TOM Cloud Market Size, By Software, 2012-2019 ($Million)

Table 56 Asia-Pacific: TOM On-Premise Market Size, By Software, 2012-2019 ($Million)

Table 57 Middle East and Africa: TOM Market Size, By Type, 2012-2019 ($Billion)

Table 58 Middle East and Africa: TOM Market Size, By Software, 2012-2019 ($Million)

Table 59 Middle East and Africa: TOM Market Size, By Service, 2012-2019 ($Million)

Table 60 Middle East and Africa: TOM Software Market Size, By Deployment Type, 2012-2019 ($Billion)

Table 61 Middle East and Africa: TOM Cloud Market Size, By Software, 2012-2019 ($Million)

Table 62 Middle East and Africa: TOM On-Premises Market Size, By Software, 2012-2019 ($Million)

Table 63 Latin America: TOM Market Size, By Type, 2012-2019 ($Billion)

Table 64 Latin America: TOM Market Size, By Software, 2012-2019 ($Million)

Table 65 Latin America: TOM Market Size, By Service, 2012-2019 ($Million)

Table 66 Latin America: TOM Software Market Size, By Deployment Type, 2012-2019 ($Million)

Table 67 Latin America: TOM Cloud Market Size, By Software, 2012-2019 ($Million)

Table 68 Latin America: TOM On-Premise Market Size, By Software, 2012-2019 ($Million)

Table 69 New Product Launches, 2012-2014

Table 70 Agreements, Partnerships, and Collaborations 2012-2014

Table 71 Mergers and Acquisitions, 2012-2014

List of Figures (47 Figures)

Figure 1 TOM Market: Stakeholders

Figure 2 TOM: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 TOM Market: Assumptions

Figure 6 Global TOM Market: By Software and Service, 2014

Figure 7 Billing and Revenue Management Market is Expected to Increase Almost Two Times in the Next 5 Years

Figure 8 Large Scale Implementation of BRM Systems Will Act as an Attractive Market Opportunity

Figure 9 Cloud Deployment is Expected to Grow at A Higher Rate Than On-Premises Deployment

Figure 10 Billing and Revenue Management Captures Lion Share of the TOM Market

Figure 11 NA Stands With the Largest TBRM Market Share in the Global Outlook, 2014

Figure 12 Latin American Market Soon to Enter Exponential Growth Phase in Coming Years

Figure 13 Evolution of TOM Market

Figure 14 TOM Market Segmentation

Figure 15 Telecom Operations Management Market Segmentation, By Deployment Type

Figure 16 The Need for Reduction in Operational Costs Provides an Impetus for the Telecom Operations Management Market

Figure 17 Value Chain Analysis

Figure 18 Porter’s Five Force Analysis (2014)

Figure 19 BRM and Customer and Product Management Show Greater Demand in Global TOM Market

Figure 20 Europe Set to Be the Largest Market for Billing and Revenue Management

Figure 21 APAC to Witness the Fastest Growth Rate in the Customer and Product Management Software

Figure 22 NA to Show Escalated Demand for Service Fulfilment and Assurance

Figure 23 MEA Would Be the Fastest Growing Market for Resource Inventory Management Software

Figure 24 Large Network Infrastructure in NA to Drive Higher Demand for Network Management Software

Figure 25 NA Posts the Fastest Market Growth Rate for SDP Software Market

Figure 26 Managed Services Hold Greater Future Scope Among the TOM Service Segments

Figure 27 Cloud Deployment Shows Faster Adoption Rate in the TOM Market During the Forecast

Figure 28 Rapid Expansion of Telecom Operators in APAC Set to Drive Greater Demand for TOM Market

Figure 29 Companies Adopted Agreements as the Key Growth Strategies Over the Last 3 Years

Figure 30 Market Evaluation Framework

Figure 31 Battle for Market Share: Customer Agreement Was the Key Strategy

Figure 32 Geographic Revenue Mix of Top 5 Market Players

Figure 33 Accenture: Business Overview

Figure 34 Accenture: SWOT Analysis

Figure 35 Ericsson: Business Overview

Figure 36 Ericsson: SWOT Analysis

Figure 37 Huawei Technologies: Business Overview

Figure 38 SWOT Analysis

Figure 39 NEC Corporation: Business Overview

Figure 40 SWOT Analysis

Figure 41 Oracle Corporation: Business Overview

Figure 42 Oracle: SWOT Analysis

Figure 43 Alcatel-Lucent: Business Overview

Figure 44 Amdocs: Business Overview

Figure 45 CISCO Systems: Business Overview

Figure 46 Hewlett-Packard: Business Overview

Figure 47 SAP AG: Business Overview

Growth opportunities and latent adjacency in Telecom Operations Management Market