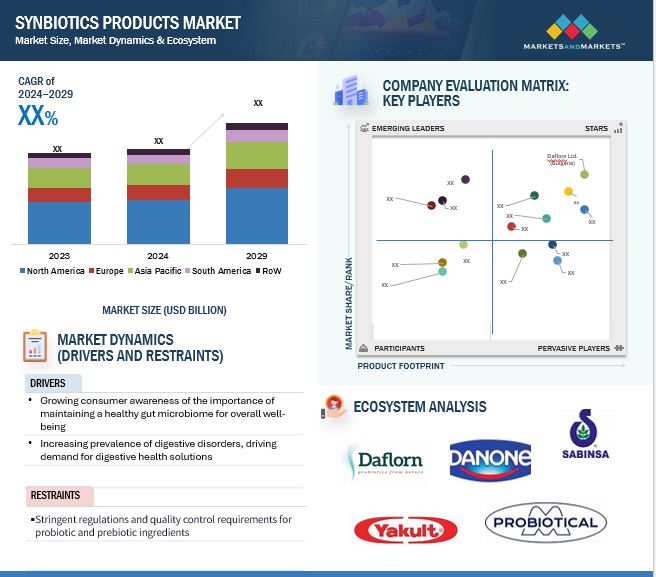

Synbiotic Products Market

The synbiotic products market is estimated at USD XX million in 2024; it is projected to grow at a CAGR of XX% to reach USD XX million by 2029. The rising popularity of functional foods and beverages is propelling synbiotic product market growth. Consumers increasingly seek nutritional products that offer health benefits beyond basic sustenance, targeting areas like immune support, digestive health, and inflammation reduction. Synbiotic products, combining probiotics and prebiotics, are particularly attractive to individuals aiming to improve gut wellness.

Market Dynamics

Drivers: Rising demand for probiotics and prebiotics as functional foods

The rising demand for probiotics and prebiotics in functional foods is fundamentally reshaping the synbiotics market by addressing contemporary health-conscious consumer preferences. Synbiotic products, which strategically combine probiotics and prebiotics, are experiencing accelerated market growth due to growing awareness about gut microbiome's critical role in overall health. Consumers are increasingly viewing these products as proactive health solutions rather than mere nutritional supplements, driving significant market expansion across multiple sectors.

The functional food segment represents a particularly dynamic area of synbiotics market development. Manufacturers are innovatively integrating synbiotic formulations into everyday food and beverage products like yogurts, fermented drinks, nutritional bars, and fortified dairy alternatives. This approach makes gut health support more accessible and appealing to mainstream consumers who seek convenient wellness solutions. The targeted health benefits extend beyond digestive support, encompassing immune system enhancement, metabolic regulation, and potential mental health improvements.

Restraints: challenges in maintaining the viability and stability of probiotics during formulation, storage, and delivery

Maintaining probiotic viability presents significant challenges across the synbiotic product development lifecycle. During formulation, probiotics are inherently sensitive microorganisms susceptible to environmental stressors like temperature, moisture, pH variations, and oxidative conditions. Manufacturers must develop sophisticated encapsulation technologies and protective matrices that shield live bacterial strains from degradation while ensuring their functional integrity.

Storage represents another critical challenge. Probiotics require precise environmental conditions to maintain cellular viability and metabolic activity. Temperature fluctuations, humidity exposure, and prolonged storage periods can dramatically reduce bacterial survival rates. Advanced microencapsulation techniques, utilizing protective coating materials like alginate, gelatin, and specialized polymers, help create microenvironments that stabilize and preserve probiotic microorganisms.

Opportunities: Development of targeted synbiotic formulations for specific health conditions and population segments

The development of targeted synbiotic formulations represents a sophisticated approach to personalized nutrition, addressing specific health conditions and population-specific needs. Researchers and manufacturers are increasingly focusing on precision-based synbiotic solutions that go beyond generic gut health support. For instance, specialized formulations are emerging for distinct demographic groups like infants, elderly populations, athletes, and individuals with specific health vulnerabilities.

Pediatric-specific synbiotic formulations are particularly promising, targeting early microbiome development and addressing conditions like allergies, immune system modulation, and metabolic programming. These targeted products incorporate carefully selected probiotic strains and prebiotic compounds that support optimal childhood growth and developmental processes. Similarly, geriatric-focused synbiotics address age-related microbiome changes, targeting immune function decline, cognitive health, and metabolic challenges associated with aging.

Challenges: Price sensitivity and affordability concerns particularly in emerging markets

Price sensitivity and affordability present significant challenges for synbiotic product market penetration in emerging economies. While consumers in these markets demonstrate growing health consciousness, economic constraints limit widespread adoption of premium synbiotic solutions. The high production costs associated with advanced probiotic and prebiotic formulations create substantial pricing barriers, particularly in regions with lower disposable incomes.

Manufacturers are responding through strategic product segmentation and innovative pricing models. They're developing more affordable product lines that maintain core health benefits while reducing production expenses. This approach involves using locally sourced ingredients, optimizing manufacturing processes, and creating smaller packaging formats that lower per-unit costs. Additionally, some companies are exploring partnerships with local producers to reduce logistics and distribution expenses.

SYNBIOTIC MARKET ECOSYSTEM

Prominent companies in this market include well-established, financially stable manufacturers of synbiotic products. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include Daflorn Ltd. (Bulgaria), Danone (France), Sabinsa Corporation (US), Yakult (Japan), Probiotical (Italy).

Based on product type, the sub-segment is projected to have a significant share in the market.

Food and beverages dominated the synbiotic product market, capturing 84.1% market share in 2019. Their potential to enhance immunity, cardiovascular health, and digestive wellness is expected to drive market expansion. Leading food manufacturers like Nestle and Pfizer are collaborating with academic institutions to deepen microbiome research.

For example, in November 2019, Nestlé partnered with the Center for Microbiome Innovation at the University of California San Diego to advance understanding of microbiome's impact on human health and develop targeted nutritional solutions promoting overall well-being.

The offline distribution channel is the fastest growing segment in the symbiotic products market and is projected to have a significant share.

Distribution channels for synbiotic products encompass online and offline platforms. In 2022, web channels significantly contributed to market revenue, driven by increasing internet and smartphone accessibility. Online stores offer shopping convenience, diverse product ranges, competitive pricing, and extensive customer reviews to aid purchasing decisions.

Offline channels, including traditional retailers, grocery stores, and hypermarkets, remain substantial. Physical stores provide consumers the opportunity to examine products directly and enjoy immediate product acquisition, maintaining their market relevance despite growing online sales.

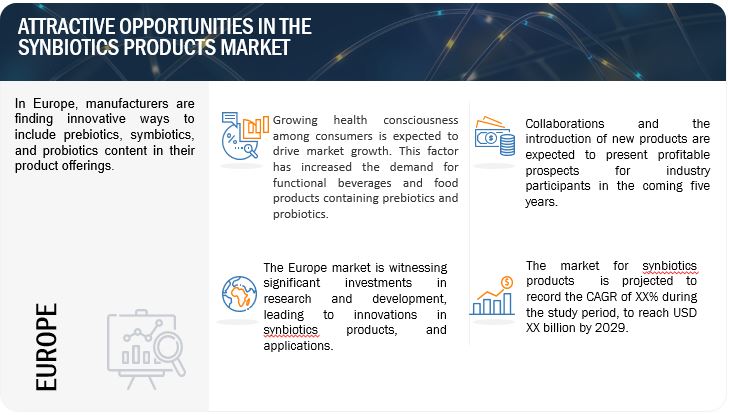

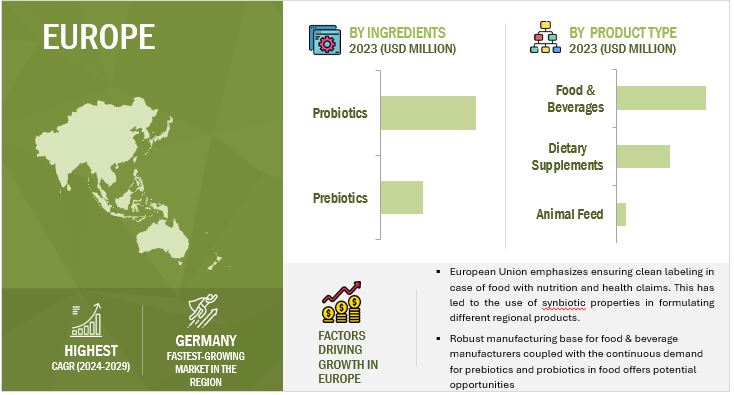

The Europe region is anticipated to experience rapid growth between 2024 and 2029.

Europe led the synbiotic products market, followed by North America and Asia-Pacific. Increasing awareness about functional foods and synbiotic products has driven market growth. The robust European food manufacturing base and continuous demand for prebiotics and probiotics create opportunities for synbiotic incorporation.

The European Union's emphasis on clean labeling and the European Food Safety Authority's Qualified Presumption of Safety (QPS) concept has facilitated synbiotic product development, providing additional safety assessment criteria for bacterial supplements in various food and beverage formulations.

Key Market Players

- Daflron Ltd. (Bulgaria)

- Danone (France)

- Sabinsa Corporation (US)

- Yakult (Japan)

- Probiotical (Italy)

- United Naturals (US)

- Synbiotic Health (US)

- Probi AB (Sweden)

- Nutech Ventures (US)

- Synbiotics Limited (India)

These market players are focusing on increasing their presence through agreements and collaborations. These companies have a strong presence in North America, Asia Pacific, South America and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

Recent Developments

- In 2021, Clasado Biosciences collaborated with Herbalife Nutrition to launch a new synbiotic product. Macrobiotic Max, a new supplement of Herbalife Nutrition, had Bimuno, a prebiotic ingredient prepared by Clasado, as its vital ingredient.

- In 2021, Ahava skincare launched a new synbiotic product line to strengthen the skin's barrier, resulting in healthy and hydrated skin. This product line combines prebiotic and probiotic properties, consisting of hand cream, body lotion, and foot cream blends of dead sea minerals to treat unbalanced skin microbiome.

- In 2020, Taiyo, a Japanese ingredient supplier, extended its product portfolio by pairing its prebiotic ingredient, Sunfiber, with probiotics. Alongside, the company launched a new women's health product, showing dual action benefits.

Frequently Asked Questions (FAQ):

What is the current size of the synbiotics products market?

The synbiotics products market is estimated at USD xx million in 2024 and is projected to reach USD xx million by 2029, at a CAGR of xx% during the same period.

Which are the key players in the market, and how intense is the competition?

Daflorn Ltd. (Bulgaria), Danone (France), Sabinsa Corporation (US), Yakult (Japan), Probiotical (Italy). The market for synbiotics products is expanding rapidly, with more mergers, acquisitions, and product launches. Companies in this sector are also heavily investing in research and development.

Which region is projected to account for the largest share of the synbiotics products market?

The Europe market is expected to dominate during the forecast period. The region currently stands as a formidable force in the synbiotics products market, boasting dominance fueled by a convergence of factors, including robust research and development initiatives and the presence of major key players with advanced manufacturing capabilities.

What kind of information is provided in the company profile section?

The provided company profiles deliver crucial details, including a thorough business summary that covers different segments, financial results, geographic presence, revenue distribution, and business revenue breakdown. They also offer insights into product lines, key achievements, and expert analyst opinions to better illustrate the company's potential.

What are the factors driving the synbiotics products market?

The rise in health issues of the growing population has increased the demand for functional foods. Therefore, demand, especially for probiotics and prebiotics in available food & beverages, is now witnessed to have significant growth.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Growth opportunities and latent adjacency in Synbiotic Products Market