Swarm Robotics Market by Platform (UAV, UGV), Application (Security, Inspection & Monitoring, Mapping & Surveying, Search & Rescue and Disaster Relief, Supply Chain and Warehouse Management), End-Use Industry and Region - Global Forecast to 2028

Updated on : October 22, 2024

Swarm Robotics Market Size & Growth

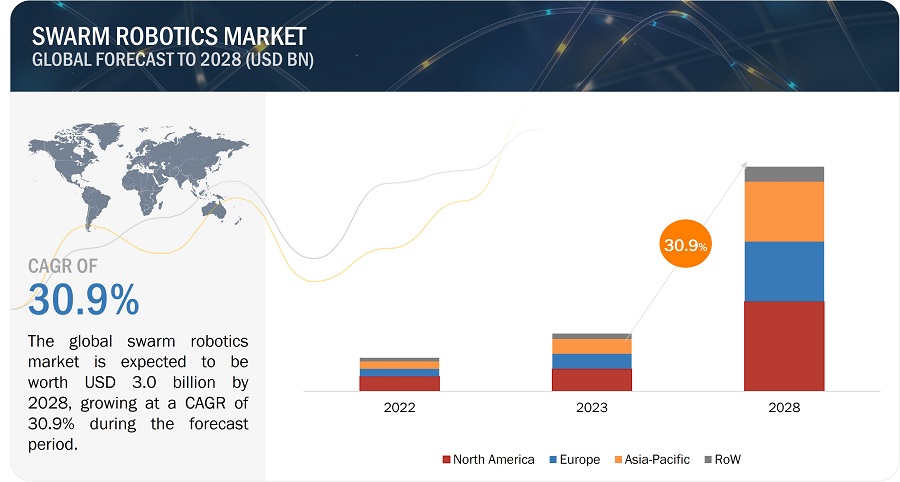

The swarm robotics market size is projected to grow from USD 0.8 billion in 2023 to USD 3.0 billion by 2028, growing at a CAGR of 30.9% during the forecast period from 2023 to 2028.

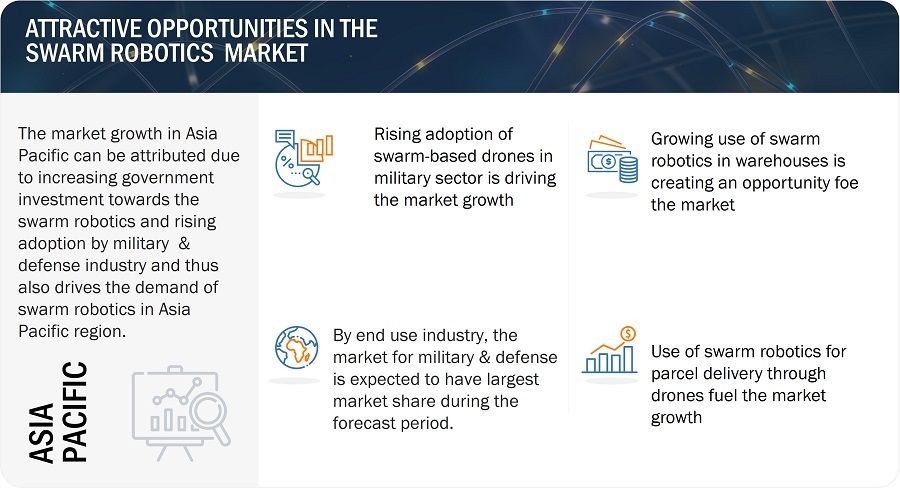

The growing use of swarm robotics in warehouses, the development of new technologies, such as artificial intelligence and machine learning, and the rising adoption of swarm-based drones in the military sector are expected to propel the market in the next five years. However, Low awareness about swarm intelligence, reluctance to accept new technology by key industries, and lack of skilled workforce are likely to pose challenges for industry players.

The objective of the report is to define, describe, and forecast the swarm robotics market based on platform, application, end-use industry, and region.

Swarm Robotics Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Swarm Robotics Market Dynamics:

Driver: Rising adoption of swarm-based drones in the military sector

Swarm-based drones can easily cover large areas at low costs, owing to which their adoption has been increasing for military operations. In addition, these swarm-based drones are used in times of natural calamities such as earthquakes, forest fires, and floods. UAVs are extensively used for various military operations, such as search and rescue, surveillance, traffic monitoring, weather monitoring, and firefighting. The increasing adoption of swarm drones in military sectors and growing research and development activities in this swarm technology is driving the swarm robotics market growth. For instance, in 2023, NewSpace Research, a Bengaluru-based start-up has delivered SWARM drones to Indian Army, which makes the Army the first major armed force in the world to operationalize these high-density SWARM drones.

The ongoing research and technological advancements continue to drive the adoption of swarm-based drones in the military sector, contributing to the evolution of modern warfare tactics.

Restraint: Technical Challenges and High Initial Investment

Several characteristics that make swarm robotics strategic for many future use cases (autonomous, decentralized, etc.) also limit the evolution of the technology from academic institutions to scalable industrial solutions. Swarm robots need to be able to communicate with each other in order to coordinate their actions. This can be a challenge in complex environments, such as those with a lot of noise or interference. In some cases, robot swarms are unable to complete a task if global communication is blocked. Although several existing wireless technologies are available, the protocols specialized for swarm robotics remain undiscovered.

Moreover, high initial investment costs linked with intelligence, expensive research costs, and so on are barriers to market growth. These challenges are making it difficult for the swarm robotics market to grow. However, as the technology for swarm robotics continues to develop, these challenges are likely to be addressed. This could lead to the widespread adoption of swarm robotics in various applications.

Opportunities: Integration of swarm intelligence technology with connected cars

The growing penetration of connected cars in the swarm robotics market is expected to positively impact the market. Connected cars are equipped with sensors and communication technologies that allow them to interact with each other and with the environment. This makes them ideal platforms for swarm robotics applications. Connected cars enable the driver to connect with online platforms and facilitate real-time communication. The growth of the swarm robotics market is driven by government mandates on telematics applications, the implementation of intelligent transportation systems (ITS), rapid urbanization, and increasing demand for usage-based insurance (UBI).

Challenges: Low awareness about swarm intelligence and reluctance to accept new technology by key industries

There is currently less information about swarm robotics in the market, although the situation is expected to change positively in the coming years. Due to less information, users are unaware of the advantages such as decentralization, robustness, flexibility, and scalability of swarm intelligence. Therefore, they are less willing to adopt this technology. There has been a gradual information wave elucidating and educating end users, which is expected to gain momentum in the coming years, leading to the increased adoption of swarm technology and robots.

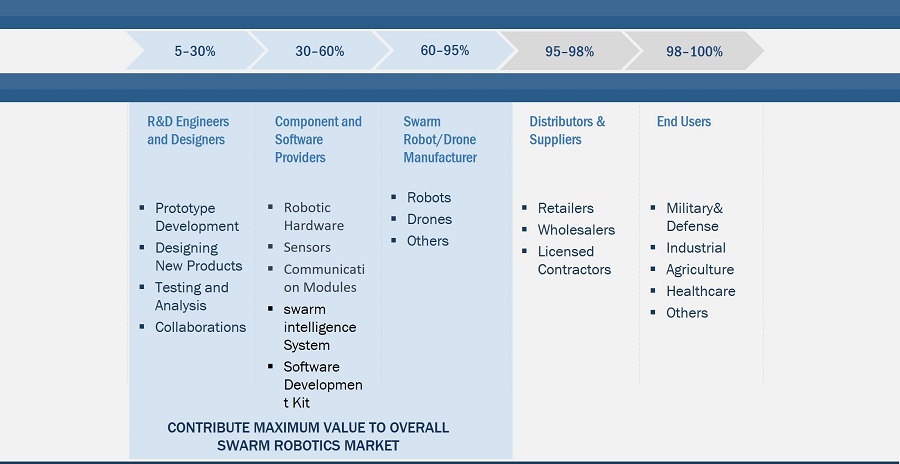

Market Map/Ecosystem

Swarm Robotics Market: Key Trends

The prominent players in the swarm robotics market are Hydromea (Switzerland), Boston Dynamic (US), SwarmFarm (Australia), Swarm Technology (US), Sentien Robotics (US), Berkeley Marine Robotics (US), Swisslog Holding AG (Switzerland), FARobot, Inc. (Taiwan), K-Team Corporation (Switzerland), KION Group AG (Germany), among others. These companies boast mixing trends with a comprehensive product portfolio and strong geographic footprint.

Swarm Robotics Market Segmentation

UAV to acquire a significant share in the swarm robotics market during the forecast period.

The UAV is expected to account for a significant share and grow at the highest CAGR during the forecast period. Rapid advancements in drone and robotics technology have made it possible to create smaller, more capable, and affordable drones. These advancements have enabled the development of UAV swarm robots with improved capabilities and better coordination.

Security, inspection & monitoring application expected to hold the largest share in the swarm robotics market in 2023.

The security,inspection, & monitoring segment expected to account for the largest market share in 2023. Inspection of critical infrastructure with drones is experiencing an increasing uptake in the industry driven by a demand for reduced cost, time, and risk for inspectors. Company such as Hydromea SA, Boston Dynamic, Berkeley Marine Robotics, and others are the major players providing swarm robotics for security, inspection & monitoring applications.

Swarm Robotics Industry Regional Analysis

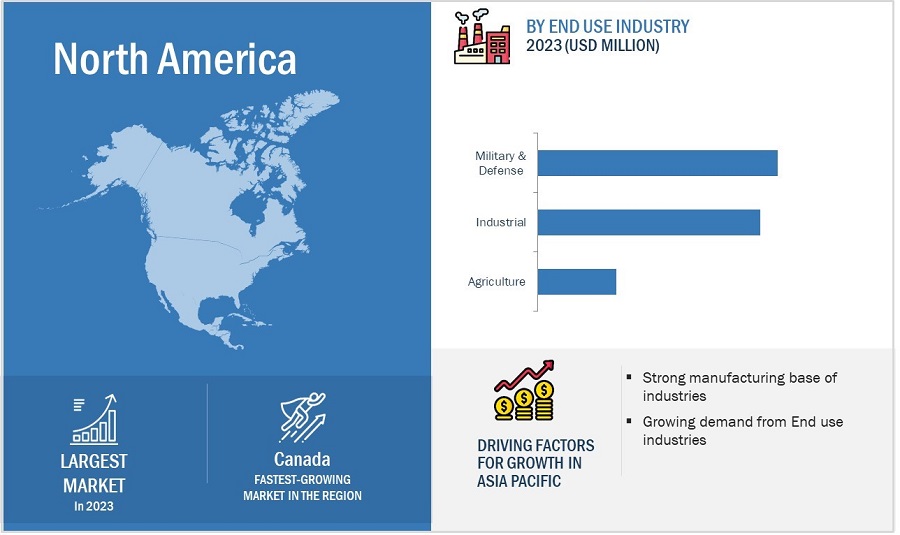

Swarm Robotics market to witness highest share from North Anerica during the forecast period.

The North America region continues to be a significant market for swarm robotics. This region is a key market as it is home to some of the major industry players, such as Boston Dynamic (US), Swarm Technology (US), and Sentien Robotics (US). Increased R&D activities in the field of swarm intelligence would drive the growth of the swarm robotics market in North America.

Further, the increasing demand for autonomous and semi-autonomous systems in the military, healthcare, and industrial sectors is driving the market growth. Moreover, the growing availability of advanced sensors and communication technologies is creating an opportunity for the swarm robotics market.

Swarm Robotics Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Swarm Robotics Companies - Key Market Players

- Hydromea (Switzerland),

- Boston Dynamic (US),

- SwarmFarm (Australia),

- Swarm Technology (US),

- Sentien Robotics (US),

- Berkeley Marine Robotics (US),

- Swisslog Holding AG (Switzerland),

- FARobot, Inc. (Taiwan),

- K-Team Corporation (Switzerland),

- KION Group AG (Germany).

Swarm Robotics Market Report Scope

|

Report Metric |

Details |

|

Estimated Value |

USD 0.8 billion in 2023 |

|

Expected Value |

USD 3.0 billion by 2028 |

|

Growth Rate |

CAGR of 30.9% |

|

Market Size Available for Years |

2019–2028 |

|

Base Year |

2022 |

|

Forecast Period |

2023–2028 |

|

Units |

Value (USD Million/USD Billion) |

|

Segments Covered |

Platform, Application, End Use Industry, and Region |

|

Regions Covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies Covered |

Hydromea (Switzerland), Boston Dynamic (US), SwarmFarm (Australia), Swarm Technology (US), Sentien Robotics (US), Berkeley Marine Robotics (US), Swisslog Holding AG (Switzerland), FARobot, Inc. (Taiwan), K-Team Corporation (Switzerland), KION Group AG (Germany), among others |

Swarm Robotics Market Highlights

This report categorizes the swarm robotics market based on platform, application, end-use industry, and region.

|

Segment |

Subsegment |

|

By Platform |

|

|

By Application |

|

|

By End Use Industry |

|

|

By Region |

|

Recent developments in Swarm Robotics Industry

- In February 2023, Exyn Technologies announced that they will be partnering with Easy Aerial to launch their new flagship airframe, the ExynAero™ EA6, integrated with ExynAI™ and optimized for Exyn’s diverse use cases.

- In May 2023, The Génération Robots group, which includes Génération Robots and Humarobotics, announced its first round of financing for a total of 3 million euros, secured by AQUITI Gestion and GT Logistics. This operation marks an important milestone in the group’s development and reflects the investors’ confidence in its potential.

Frequently Asked Questions (FAQs)

Which are the major companies in the swarm robotics market? What are their primary strategies to strengthen their market presence?

Hydromea (Switzerland), Boston Dynamic (US), SwarmFarm (Australia), K-Team Corporation (Switzerland), and Swarm Technology (US) are the leading players in the market. These companies have adopted organic and inorganic growth strategies such as product launches, partnerships and acquisitions, to gain a competitive advantage in the market.

Which is the potential market for the end-use industry?

Military & defense and agriculture are end-use industries with high growth opportunities owing to advancements in technology.

What are the opportunities for new swarm robotics market share entrants?

Factors such as the integration of swarm intelligence technology with connected cars and the rising use of swarm robotics in warehouses are creating opportunities for the players in the market.

Which platform is expected to drive swarm robotics market size growth in the next six years?

UGV is expected to remain the major platform driving swarm robotics demand.

What are the major strategies adopted by swarm robotics companies?

The swarm robotics companies have adopted product launches, acquisitions, expansions, and contracts to strengthen their position in the swarm robotics market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising adoption of swarm-based drones in military sector- Breakthroughs in artificial intelligence and machine learning- Revolutionizing parcel delivery through dronesRESTRAINTS- Technical challenges and high initial investmentOPPORTUNITIES- Integrating swarm intelligence in connected cars- Growing use of swarm robotics in warehousesCHALLENGES- Lack of skilled workforce- Limited industrial awareness

- 5.3 VALUE CHAIN ANALYSIS

-

5.4 ECOSYSTEM MAPPING

-

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSES

-

5.6 PRICING ANALYSISAVERAGE SELLING PRICE (ASP) OF UAVS OFFERED BY KEY PLAYERS

-

5.7 TECHNOLOGY ANALYSISSWARM ROBOTS IN CONSTRUCTION INDUSTRYNANOROBOTS IN MEDICINEAI-CONTROLLED DRONE SWARM

-

5.8 CASE STUDY ANALYSISHYDROMEA SA DESIGNED AUV SYSTEM TO ADDRESS CHALLENGES RELATED TO MEASUREMENT, NAVIGATION, AND COMMUNICATIONWOODSIDE DEPLOYED BOSTON DYNAMICS’ SPOT ROBOT TO AUTOMATE ROUTINE INSPECTION AT NATURAL GAS FACILITY

-

5.9 PATENT ANALYSISLIST OF MAJOR PATENTS

- 5.10 TRADE ANALYSIS

-

5.11 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.12 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSTHREAT OF NEW ENTRANTS

- 5.13 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.14 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS RELATED TO SWARM ROBOTICSSTANDARDS AND REGULATIONS RELATED TO SWARM ROBOTICS

- 6.1 INTRODUCTION

-

6.2 UNMANNED GROUND VEHICLES (UGVS)INCREASING ADOPTION OF UGVS FOR AGRICULTURAL INSPECTIONS, DISASTER RESPONSE, AND LOGISTICS APPLICATIONS TO DRIVE MARKET

-

6.3 UNMANNED AERIAL VEHICLES (UAVS)GROWING USE OF UAVS FOR ENVIRONMENTAL MONITORING TO DRIVE SEGMENTAL GROWTH

- 6.4 OTHERS

- 7.1 INTRODUCTION

-

7.2 DRONESINCREASING USE OF DRONES FOR SEARCH AND RESCUE, ENVIRONMENTAL MONITORING, AND SURVEILLANCE APPLICATIONS TO DRIVE MARKET

-

7.3 ROBOTSRISING ADOPTION OF SWARM ROBOTS TO PERFORM LARGE, SCALABLE TASKS TO DRIVE MARKET

- 7.4 OTHERS

- 8.1 INTRODUCTION

-

8.2 SECURITY, INSPECTION, AND MONITORINGGROWING INSPECTION OF CRITICAL INFRASTRUCTURES WITH DRONES TO DRIVE MARKET

-

8.3 MAPPING AND SURVEYINGUSE OF SWARM ROBOTS TO MAP USAFE AND DIFFICULT ENVIRONMENTS TO SUPPORT SEGMENTAL GROWTH

-

8.4 SEARCH & RESCUE AND DISASTER RELIEFNEED FOR REAL-TIME SEARCH AND RESCUE TO FUEL ADOPTION OF SWARM ROBOTS

-

8.5 SUPPLY CHAIN AND WAREHOUSE MANAGEMENTUSE OF DRONES IN SHIPPING AND DELIVERY APPLICATIONS TO FOSTER MARKET GROWTH

- 8.6 OTHERS

- 9.1 INTRODUCTION

-

9.2 MILITARY & DEFENSEGROWING USE OF DRONES IN ANTI-AIRCRAFT DEFENSE APPLICATIONS TO DRIVE MARKET

-

9.3 INDUSTRIALINDUSTRY 4.0 REVOLUTION TO DRIVE MARKET GROWTH

-

9.4 AGRICULTUREINCREASING ADOPTION OF SWARM ROBOTS IN PRECISION FARMING APPLICATIONS TO SUPPORT MARKET GROWTH

-

9.5 HEALTHCAREGROWING USE OF SWARM ROBOTICS FOR REMOTE HEALTHCARE TO DRIVE MARKET

- 9.6 OTHERS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICAUS- Growing adoption of swarm robotics technology in military & defense to drive marketCANADA- Government-led initiatives to encourage adoption of robots to drive marketMEXICO- Increasing deployment of swarm robotics by military sector to augment market growthIMPACT OF RECESSION ON MARKET IN NORTH AMERICA

-

10.3 EUROPEUK- Growing use of swarm robotics for agricultural applications to fuel market growthGERMANY- Innovations in autonomous underwater vehicles to drive marketFRANCE- Increasing investments in development of smart factories to fuel demand for swarm roboticsITALY- Increasing demand for autonomous underwater vehicles in military applications to propel market growthREST OF EUROPEIMPACT OF RECESSION ON MARKET IN EUROPE

-

10.4 ASIA PACIFICCHINA- Increasing research and development activities to drive marketJAPAN- Increasing usage of multi-swarm robotics technology in various industrial applications to boost marketINDIA- Increasing adoption of swarm robotics in military sector to support market growthAUSTRALIA- Demand from agriculture and military industries to substantiate market growthREST OF ASIA PACIFICIMPACT OF RECESSION ON MARKET IN ASIA PACIFIC

-

10.5 REST OF THE WORLDMIDDLE EAST & AFRICA- Adoption of swarm robotics in mining industry to drive marketSOUTH AMERICA- Growing adoption of industrial robotics to drive market

- 11.1 OVERVIEW

-

11.2 STRATEGIES ADOPTED BY KEY PLAYERSPRODUCT PORTFOLIOREGIONAL FOCUSORGANIC/INORGANIC GROWTH STRATEGIES

- 11.3 MARKET SHARE ANALYSIS, 2022

- 11.4 REVENUE ANALYSIS OF KEY PLAYERS IN MARKET

-

11.5 SWARM ROBOTICS MARKET: EVALUATION MATRIX OF KEY COMPANIESSTARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTS

-

11.6 MARKET: EVALUATION MATRIX OF STARTUPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES)PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 11.7 COMPANY FOOTPRINT

-

11.8 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCHES AND DEVELOPMENTSDEALSOTHERS

-

12.1 KEY PLAYERSHYDROMEA- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewSWARMFARM- Business overview- Products/Services/Solutions offered- MnM viewK-TEAM CORPORATION- Business overview- Products/Services/Solutions offered- MnM viewBOSTON DYNAMICS- Business overview- Products/Services/Solutions offered- MnM viewSWARM TECHNOLOGY- Business overview- Products/Services/Solutions offered- MnM viewKION GROUP AG- Business overview- Products/Services/Solutions offeredSENTIEN ROBOTICS- Business overview- Products/Services/Solutions offeredSWISSLOG HOLDING AG- Business overview- Products/Services/Solutions offered- Recent developmentsBERKELEY MARINE ROBOTICS INC.- Business overview- Products/Services/Solutions offeredFAROBOT, INC.- Business overview- Products/Services/Solutions offered

-

12.2 OTHER PLAYERSUNBOX ROBOTICS PVT. LTD.BARNSTORM AGTECHAMBOTSAUTONOMOUS ROBOTICS LTDROBOTICS IND, INC.RESSON AEROSPACE INC.MOBILEYEROLLS-ROYCEGÉNÉRATION ROBOTSCAJAAPIUM INC.AGILOX SERVICES GMBHECA GROUPSRI INTERNATIONALEXYN TECHNOLOGIES

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 AVAILABLE CUSTOMIZATIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 SWARM ROBOTICS MARKET: ROLE OF KEY PLAYERS IN ECOSYSTEM

- TABLE 2 AVERAGE SELLING PRICE (ASP) OF ROBOTS AND HARDWARE COMPONENTS

- TABLE 3 AVERAGE SELLING PRICE (ASP) OF UAVS OFFERED BY KEY PLAYERS, BY APPLICATION

- TABLE 4 TOP 20 PATENT OWNERS IN LAST 10 YEARS

- TABLE 5 MARKET: LIST OF MAJOR PATENTS

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- TABLE 7 KEY BUYING CRITERIA FOR END-USE INDUSTRIES

- TABLE 8 MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 9 MARKET: LIST OF KEY CONFERENCES AND EVENTS

- TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 NORTH AMERICA: SAFETY STANDARDS FOR MARKET

- TABLE 15 EUROPE: SAFETY STANDARDS FOR MARKET

- TABLE 16 ASIA PACIFIC: SAFETY STANDARDS FOR MARKET

- TABLE 17 MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 18 MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 19 UGVS: SWARM ROBOTICS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 20 UGVS: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 21 UAVS: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 22 UAVS: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 23 OTHERS: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 24 OTHERS: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 25 MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 26 MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 27 SECURITY, INSPECTION, AND MONITORING: MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 28 SECURITY, INSPECTION, AND MONITORING: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 29 SECURITY, INSPECTION, AND MONITORING: MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 30 SECURITY, INSPECTION, AND MONITORING: MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 31 MAPPING AND SURVEYING: MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 32 MAPPING AND SURVEYING: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 33 MAPPING AND SURVEYING: MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 34 MAPPING AND SURVEYING: MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 35 SEARCH & RESCUE AND DISASTER RELIEF: MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 36 SEARCH & RESCUE AND DISASTER RELIEF: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 37 SEARCH & RESCUE AND DISASTER RELIEF: MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 38 SEARCH & RESCUE AND DISASTER RELIEF: MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 39 SUPPLY CHAIN AND WAREHOUSE MANAGEMENT: MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 40 SUPPLY CHAIN AND WAREHOUSE MANAGEMENT: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 41 SUPPLY CHAIN AND WAREHOUSE MANAGEMENT: MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 42 SUPPLY CHAIN AND WAREHOUSE MANAGEMENT: MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 43 OTHERS: SWARM ROBOTICS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 44 OTHERS: MARKET, BY END USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 45 OTHERS: MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 46 OTHERS: MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 47 MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 48 MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 49 MILITARY & DEFENSE: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 50 MILITARY & DEFENSE: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 51 MILITARY & DEFENSE: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 52 MILITARY & DEFENSE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 53 INDUSTRIAL: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 54 INDUSTRIAL: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 55 INDUSTRIAL: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 56 INDUSTRIAL: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 57 AGRICULTURE: SWARM ROBOTICS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 58 AGRICULTURE: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 59 AGRICULTURE: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 60 AGRICULTURE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 61 HEALTHCARE: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 62 HEALTHCARE: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 63 HEALTHCARE: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 64 HEALTHCARE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 65 OTHERS: ROBOTICS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 66 OTHERS: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 67 OTHERS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 68 OTHERS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 69 MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 70 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 71 NORTH AMERICA: SWARM ROBOTICS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 72 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 73 NORTH AMERICA: MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 74 NORTH AMERICA: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 75 EUROPE: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 76 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 77 EUROPE: MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 78 EUROPE: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 79 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 80 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 81 ASIA PACIFIC: MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 82 ASIA PACIFIC: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 83 ROW: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 84 ROW: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 85 ROW: MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 86 ROW: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 87 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN MARKET

- TABLE 88 SWARM ROBOTICS MARKET: DEGREE OF COMPETITION

- TABLE 89 COMPANY FOOTPRINT

- TABLE 90 APPLICATION FOOTPRINT OF COMPANIES

- TABLE 91 END-USE INDUSTRY FOOTPRINT OF COMPANIES

- TABLE 92 REGION FOOTPRINT OF COMPANIES

- TABLE 93 MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 94 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 95 MARKET: PRODUCT LAUNCHES AND DEVELOPMENTS, JANUARY 2019–JANUARY 2023

- TABLE 96 MARKET: DEALS, JANUARY 2019–JANUARY 2023

- TABLE 97 MARKET: OTHERS, JANUARY 2019–JANUARY 2023

- TABLE 98 HYDROMEA: COMPANY OVERVIEW

- TABLE 99 HYDROMEA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 100 HYDROMEA: PRODUCT LAUNCHES

- TABLE 101 HYDROMEA: DEALS

- TABLE 102 SWARMFARM: COMPANY OVERVIEW

- TABLE 103 SWARMFARM: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 104 K-TEAM CORPORATION: COMPANY OVERVIEW

- TABLE 105 K-TEAM CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 106 BOSTON DYNAMICS: COMPANY OVERVIEW

- TABLE 107 BOSTON DYNAMICS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 108 SWARM TECHNOLOGY: COMPANY OVERVIEW

- TABLE 109 SWARM TECHNOLOGY: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 110 KION GROUP AG: COMPANY OVERVIEW

- TABLE 111 KION GROUP AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 112 SENTIEN ROBOTICS: COMPANY OVERVIEW

- TABLE 113 SENTIEN ROBOTICS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 114 SWISSLOG HOLDING AG: COMPANY OVERVIEW

- TABLE 115 SWISSLOG HOLDING AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 116 SWISSLOG HOLDING AG: PRODUCT DEVELOPMENT

- TABLE 117 BERKELEY MARINE ROBOTICS INC.: COMPANY OVERVIEW

- TABLE 118 BERKELEY MARINE ROBOTICS INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 119 FAROBOT, INC.: COMPANY OVERVIEW

- TABLE 120 FAROBOT, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- FIGURE 1 SWARM ROBOTICS MARKET SEGMENT

- FIGURE 2 MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 UNMANNED AERIAL VEHICLES (UAVS) SEGMENT TO RECORD HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 8 SUPPLY CHAIN AND WAREHOUSE MANAGEMENT SEGMENT TO REGISTER HIGHEST CAGR BETWEEN 2023 AND 2028

- FIGURE 9 MILITARY & DEFENSE SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 10 NORTH AMERICA ACCOUNTED FOR LARGEST SHARE OF MARKET IN 2022

- FIGURE 11 INCREASING DEMAND FROM MILITARY & DEFENSE AND INDUSTRIAL VERTICALS TO FUEL MARKET GROWTH

- FIGURE 12 UNMANNED AERIAL VEHICLES SEGMENT TO EXHIBIT HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 13 MILITARY & DEFENSE AND CHINA DOMINATED ASIA PACIFIC MARKET IN 2022

- FIGURE 14 INDIA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 15 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 16 MARKET: IMPACT ANALYSIS OF DRIVERS

- FIGURE 17 MARKET: IMPACT ANALYSIS OF RESTRAINTS

- FIGURE 18 MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 19 MARKET: IMPACT ANALYSIS OF CHALLENGES

- FIGURE 20 MARKET: VALUE CHAIN ANALYSIS

- FIGURE 21 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR MARKET PLAYERS

- FIGURE 22 AVERAGE SELLING PRICE (ASP) OF UAVS OFFERED BY KEY PLAYERS, BY APPLICATION

- FIGURE 23 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

- FIGURE 24 NUMBER OF PATENTS GRANTED PER YEAR, 2012–2023

- FIGURE 25 IMPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 854140, BY COUNTRY, 2018–2022 (USD THOUSAND)

- FIGURE 26 EXPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 854140, BY COUNTRY, 2018–2022 (USD THOUSAND)

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- FIGURE 28 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 29 MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 30 UNMANNED AERIAL VEHICLES SEGMENT TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- FIGURE 31 MARKET, BY TYPE

- FIGURE 32 MARKET, BY APPLICATION

- FIGURE 33 SECURITY, INSPECTION, AND MONITORING SEGMENT TO COMMAND LARGEST SHARE OF MARKET IN 2023

- FIGURE 34 SWARM ROBOTICS MARKET, BY END-USE INDUSTRY

- FIGURE 35 MILITARY & DEFENSE SEGMENT TO ACCOUNT FOR LARGEST SHARE OF MARKET IN 2023

- FIGURE 36 INDIA TO REGISTER HIGHEST CAGR IN GLOBAL MARKET DURING 2023–2028

- FIGURE 37 NORTH AMERICA TO REGISTER HIGHEST CAGR IN MARKET IN NORTH AMERICA DURING FORECAST PERIOD

- FIGURE 38 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 39 EUROPE: MARKET SNAPSHOT

- FIGURE 40 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 41 ROW: MARKET SNAPSHOT

- FIGURE 42 REVENUE ANALYSIS OF KEY PLAYERS IN SWARM ROBOTICS MARKET IN 2022

- FIGURE 43 MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 44 MARKET: STARTUPS/SMES EVALUATION MATRIX, 2022

- FIGURE 45 KION GROUP AG: COMPANY SNAPSHOT

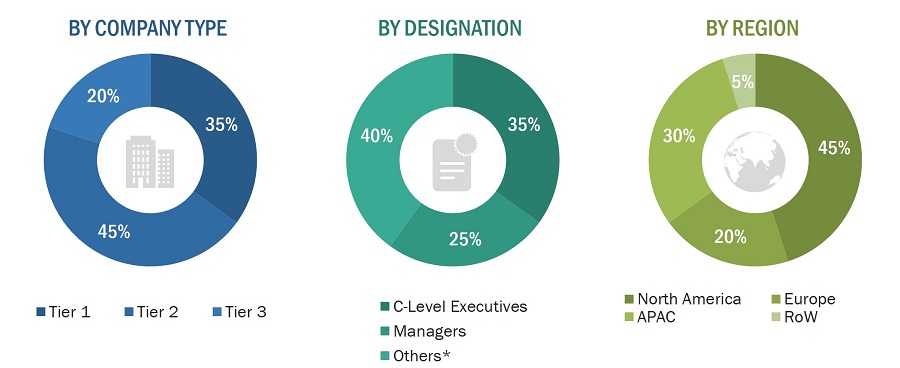

The research process for this study included systematic gathering, recording, and analysis of data about customers and companies operating in the swarm robotics market. This process involved the extensive use of secondary sources, directories, and databases (Factiva, Oanda, and OneSource) for identifying and collecting valuable information for the comprehensive, technical, market-oriented, and commercial study of the swarm robotics market. In-depth interviews were conducted with primary respondents, including experts from core and related industries and preferred manufacturers, to obtain and verify critical qualitative and quantitative information as well as to assess growth prospects. Key players in the swarm robotics market were identified through secondary research, and their market rankings were determined through primary and secondary research. This research included studying annual reports of top players and interviewing key industry experts such as CEOs, directors, and marketing executives.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information important for this study. Secondary sources included corporate filings, such as annual reports, investor presentations, and financial statements; trade, business, and professional associations; white papers, swarm robotics products-related journals, certified publications; articles by recognized authors; directories; and databases.

Secondary research was conducted to obtain key information about the industry supply chain, market value chain, key players, market classification and segmentation as per industry trends to the bottom-most level, geographic markets, and key developments from both market- and technology-oriented perspectives. Data from secondary research was collected and analyzed to determine the overall market size, which was further validated by primary research.

Primary Research

In the primary research process, various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts such as CEOs, VPs, marketing directors, technology & innovation directors, and key executives from major companies in the swarm robotics market.

After going through market engineering (which includes calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers obtained. Primary research was conducted to identify segmentation types, industry trends, key players, competitive landscape, and key market dynamics such as drivers, restraints, opportunities, and challenges, along with the key strategies adopted by players operating in the market.

To know about the assumptions considered for the study, download the pdf brochure

Market size estimation

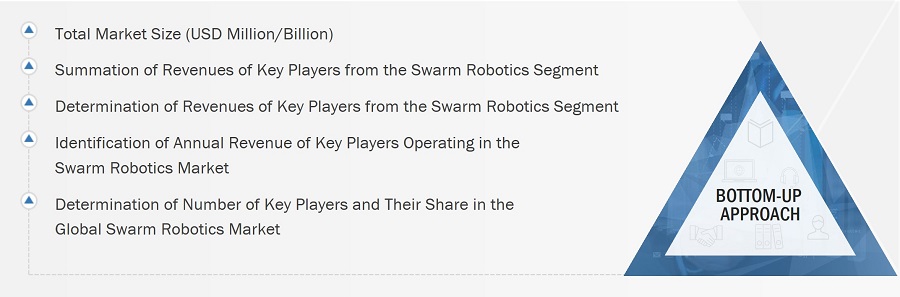

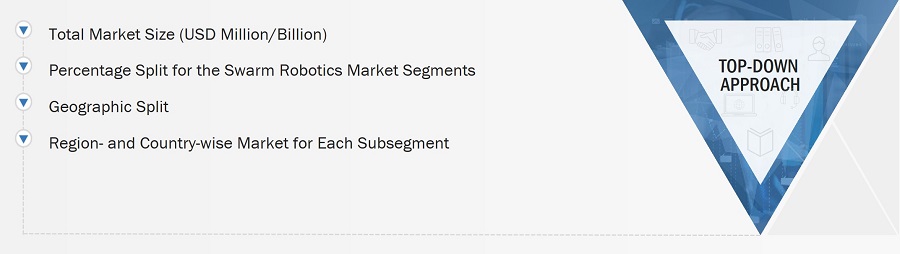

In the complete market engineering process, both top-down and bottom-up approaches were used, along with several data triangulation methods, to estimate and forecast the size of the market and its segments and subsegments listed in the report. Extensive qualitative and quantitative analyses were carried out on the complete market engineering process to list the key information/insights pertaining to the swarm robotics market.

The key players in the market were identified through secondary research, and their rankings in the respective regions were determined through primary and secondary research. This entire procedure involved the study of the annual and financial reports of top players, as well as interviews with industry experts such as chief executive officers, vice presidents, directors, and marketing executives for quantitative and qualitative key insights. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Swarm robotics market: Bottom-up Approach

Swarm robotics market: Top-Down Approach

Data triangulation

After arriving at the overall size of the swarm robotics market from the market size estimation process explained above, the total market was split into several segments and subsegments. Where applicable, the market breakdown and data triangulation procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using top-down and bottom-up approaches.

Market Definition

Swarm robotics is a field of robotics that studies the behavior of large groups of robots. Swarm robotics is an approach to coordinating multiple robots as a system consisting of large numbers of mostly simple physical robots. The swarm robotics market is expected to grow rapidly in the coming years. This is due to the increasing demand for swarm robots in various applications, such as search and rescue, inspection and monitoring, security, mapping, surveying, and many more.

Further, the swarm robotics market continues to evolve and expand, driven by ongoing research and development efforts, cost reduction initiatives, and increasing demand for solar energy solutions. The market is expected to grow further as technology advancements and economies of scale continue to improve the efficiency and cost-effectiveness of thin film PV modules.

Key Stakeholders

- Swarm robot component manufacturers

- Original equipment manufacturers (OEMs) of swarm intelligence

- Research organizations

- Swarm-Algorithm providers

- Drone manufacturers

- Robot manufacturers

- Technology providers

- Automotive companies

- Organizations, forums, alliances, and associations related to swarm intelligence

- Technology investors

Report Objectives

- To define, describe, estimate, and forecast the global swarm robotics market on the basis of platform, application, end-use industry, and geography

- To describe and forecast the swarm robotics market, in terms of value, by region—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges that influence the market growth.

- To provide a detailed overview of the swarm robotics market value chain

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To profile key players and comprehensively analyze their ranking based on their revenues and core competencies2, along with detailing the competitive landscape for market leaders.

- To analyze competitive developments such as expansions, agreements, partnerships, acquisitions, product developments, and research and development (R&D) in the swarm robotics market.

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the swarm robotics market.

- To analyze opportunities in the market for various stakeholders by identifying the high-growth segments of the market

- To benchmark the market players using the proprietary company evaluation matrix framework, which analyzes the market players on various parameters within the broad categories of business strategy excellence and strength of product portfolios.

- To strategically profile the key players and comprehensively analyze their market positions in terms of ranking and core competencies2, along with a detailed competitive landscape of the market.

- To analyze competitive developments such as acquisitions, product launches, partnerships, expansions, and collaborations undertaken in the swarm robotics market.

Available customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies.

Product analysis

- Detailed analysis and profiling of additional market players

The following customization options are available for the report:

- Market sizing and forecast for additional countries

- Additional five companies profiling

Growth opportunities and latent adjacency in Swarm Robotics Market