Sustainable Feedstock Market by Type, By Application (Energy, Chemicals & Petrochemicals, Pulp & Paper, Pharmaceuticals, Construction Materials) And Region – Global Forecast to 2029

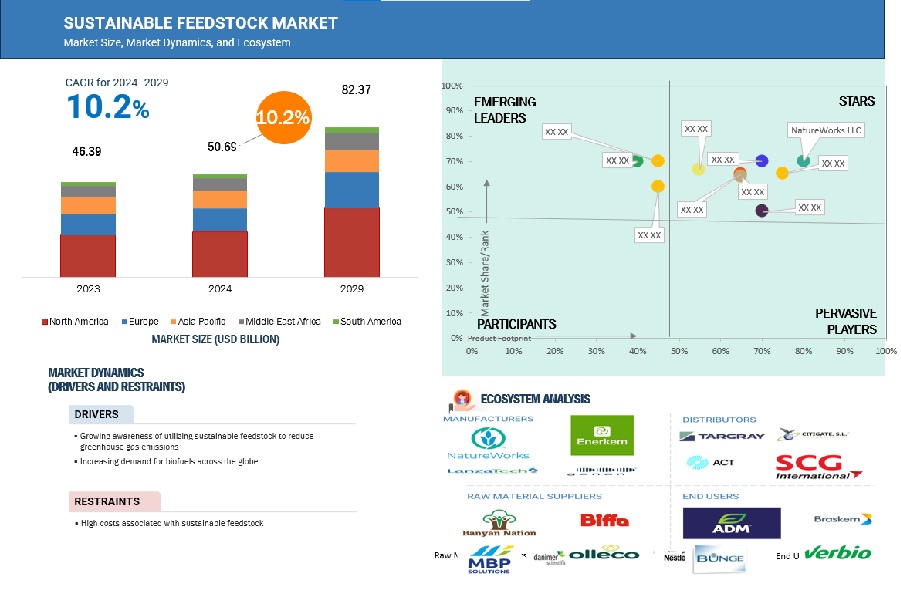

The global sustainable feedstock market is projected to grow from USD 50.69 billion in 2024 to USD 82.37 billion by 2029, at a CAGR of 10.2%. Increasing demand for biofuels across the globe is expected to drive demand for sustainable feedstock during the forecast period. According to International Energy Agency, global biofuel demand was pegged at 170,000 million litres surpassing the 2019 levels. According to same source, biofuels accounted for 3.5% of global transport fuel demand. Various governments are adopting policies to promote the adoption of biofuel which in turn will drive demand for sustainable feedstock. For instance, Brazil has announced to increase its biodiesel blending in fuel to 15% by 2026, up from 10% in 2022.

ATTRACTIVE OPPORTUNITIES IN THE SUSTAINABLE FEEDSTOCK MARKET

Source: Secondary Sources

To know about the assumptions considered for the study, Request for Free Sample Report

Source: Secondary Sources

Sustainable Feedstock Market Dynamics

Driver: Growing awareness of utilizing sustainable feedstock to reduce greenhouse gas emissions

Greenhouse gases traps the heat in atmosphere, causing the planet to warm. This warming leads to several problems, such as extreme weather events, rising sea levels, and melting glaciers. This has led to growing consumer awareness regarding the benefits of sustainable or eco-friendly products as people are becoming aware of the environmental and economic impacts of sustainable products. This has created a demand for sustainable feedstock and drove their adoption. Various governments are trying to move away from their dependence on fossil fuels. For instance, according to Renewable Energy Directive of European Union (EU), the EU has set a goal of meeting at least 42.5% of its energy demand through renewable sources by 2030. The directive has outlined measures to create energy efficient, circular & renewable energy system that will facilitate renewables-based electrification and will promote use of renewable fuels, including hydrogen. According to the directive, the share of renewable sources in EU energy consumption reached 23% in 2022.

Restraints: High costs associated with the sustainable feedstock

The high cost associated with developing sustainable feedstock is the main hindrance to the growth of the sustainable feedstock market. Consistent feedstock quality is required to achieve high production and longest possible production cycle. The sustainable feedstock needs to go through various pre-processes such as drying, densification to improve the efficiency of the feedstock. These processes are necessary, however, as they have high processing cost, processing complexity and low processing efficiency. Moreover, consistent supply of sustainable feedstock to production plants is not possible as the bio-based feedstock such as agricultural residues, forest residue, municipal waste etc. are collected accordingly with their growth cycles and their optimal harvesting times. This can lead to various logistical issues, feedstock losses due to microbial decomposition or fire, uneven feedstock quality due to variations in the properties of delivered feedstock. This factor leads to the increase in cost of feedstock.

Opportunity: Rising emphasis on waste management.

Waste management is becoming increasingly difficult owing to rapid growth in population, urbanization and industrialization. Traditional waste management methods such as open dumps, landfilling and stubble farming are often used, however, these practices contribute to environmental pollution. The excessive accumulation of waste materials harms the ecosystem and human health due to depleting water quality, air quality and biodiversity. United Nations Environment Programme had issued an article stating that globally, there are approximately 11.2 billion tons of solid wastes that are collected on yearly basis. Researchers have put efforts into recycling a variety of waste products as sources to produce different productive outcomes. This step in terms of waste will have benefits on both issues about the wastes and shifting energy usage to cleaner and renewable power generation sources. LanzaTech Global, Inc. (carbon recycling company) signed a license agreement in September 2024 with Sekisui Chemical (chemical manufacturing company) for the development of commercial-scale waste-to-ethanol facilities across Japan.

Challenges: Sourcing and storage issue of sustainable feedstock.

The major challenge for production of sustainable products is consistent and reliable supply of feedstock. The quality and composition of organic feedstock can vary significantly, affecting the efficiency and yield of sustainable products production. Some organic feedstock are perishable and have to be processed quickly to avoid degradation, creating logistical challenges. Adequate number of storage facilities are required to handle and store feedstocks, more specifically when dealing with large volumes of perishable feedstock. In case of bio-based feedstock, huge investments are required for proper storage of feedstock and to prevent seepage of leachate. Moreover, advanced pre-treatment technologies are required for efficient processing of feedstock, and lack of such technologies can hinder efficient production of sustainable products.

Sustainable Feedstock Market Ecosystem

The sustainable feedstock ecosystem comprises raw material suppliers providing raw materials, and equipment to manufacturers, manufacturers conducting research & development of the final products for use in various industries, and intermediaries/distributors providing a link between the manufacturer and end user by supplying the final products. They work together to supply final products to end users in different industries. It involves a series of processes, from raw material procurement to manufacturing end products and distributing them to end users for further use in various end-use industries.

Source: Secondary Sources

The bio-based feedstock segment is projected to be the largest feedstock type during the forecast period.

Bio-based feedstock include plant materials such as starch, cellulose, oils, lignin, polysaccharides among others. The majority of bio-based products currently manufactured are using starch as a feedstock. Many countries such as US, Canada and European countries are developing policies to boost the supply of bio-based feedstocks. For instance, in US, the Sustainable Aviation Grand Challenge Roadmap aims to reduce cost, enhance sustainability, and increase production 3 billion gallons per year of domestic sustainable aviation fuel which will help to reduce 50% of greenhouse gas emissions from aviation sector in the country by 2030. The country plans to produce or collect around 1 billion tons of biomass per year. The Canadian government in its 2021 budget, announced to invest US$ 1.1 billion over next five years to establish a Clean Fuels Fund, and to de-risk capital investment required for building a new or expansion of existing clean fuel production facilities. Support will also be available for establishment of biomass supply chains to improve logistics for collection, supply and distribution of biomass materials.

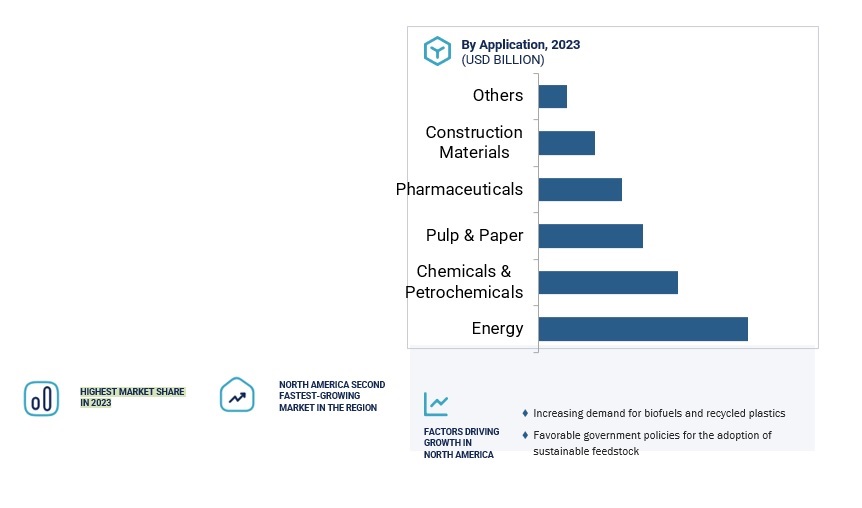

Energy application segment is anticipated to have the largest market share in terms of value, during the forecast period.

Energy is estimated to have largest share in application segment in terms of value. Sustainable feedstock are majorly used in production of biodiesel/biofuels which finds application in transportation fuel, heating oil, power generation among others. Biofuels has a major role in decarbonizing transport sector by providing a low-carbon solution for existing technologies. Increasing demand for biodiesel is expected to drive the demand for sustainable feedstock during the forecast period. According to IEA, demand for biodiesel, renewable diesel, and biojet fuel is expected to increase by 44% between 2022-2027.

Biofuels companies have taken up different strategies of growth in response to increased demand for biofuels. In October 2024, Brazilian biofuel producer Grupo Potential announced that it would add capacity at one of the biodiesel plants it owned in the state of Parana. The company is to invest US$ 108 and is expected to expand the plant production capacity to 1.62 billion litres from 900 million litres and will be completed by 2026.

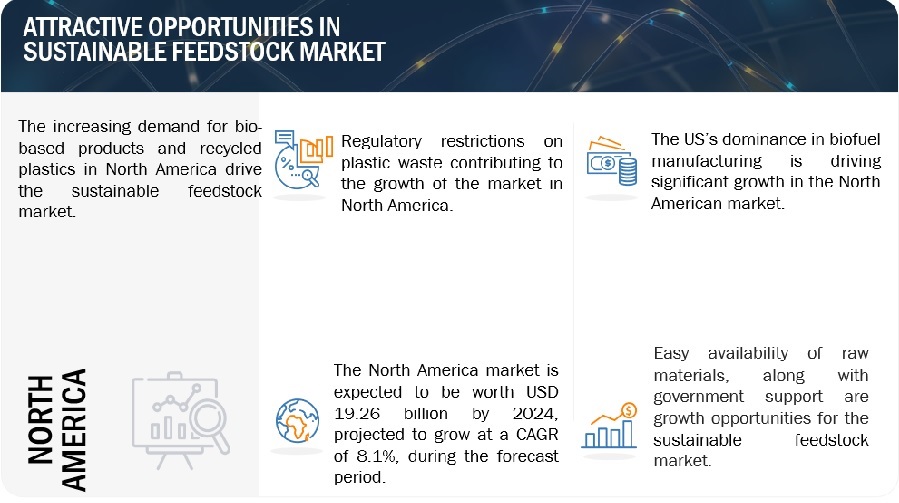

North America is projected to account for the largest market share during the forecast period.

Due to an increase in the demand for bio-based products and recycled plastics, the primary need for sustainable feedstock arises in North America. According to U.S. Energy Information Administration, around 18.7 billion gallons of biofuels were produced in the US during the year 2022, and 17.6 billion gallons were consumed. There has been the development of regulations on the regulation of plastic waste or pollution in all the countries of this region through the encouragement of recycled plastic consumption. In November 2024, United States Environmental Protection Agency published the National Strategy to Prevent Plastic Pollution focuses particularly in protecting the US population on the impact of plastic wastes. The policy will, therefore, aim at the decrease of single-use plastics in production and use, thereby increasing the supply of recycled plastics.

Source: Secondary Sources

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

- NatureWorks LLC (US)

- Aker Carbon Capture ASA (Norway)

- Darling Ingredients Inc. (US)

- Drax Group plc (UK)

- Enerkem (Canada)

- Genan Holding A/S (Denmark)

- Neste Oyj (Finland)

- POET,LLC (US)

- ResourceCo (Australia)

- Sustainable Feedstocks Group (UK)

Recent Developments in Sustainable Feedstock Market

- In November 2024, Corteva Inc. (agrochemical and seed company) announced partnership with BP plc (multinational oil & gas company) with an intent to form a joint venture to develop crop-based biofuel feedstock to meet the increasing demand for sustainable aviation fuel.

- In April 2024, Origin Materials (US based manufacturer of sustainable materials) announced the conversion of wood reside feedstock into sustainable feedstock at its Ontario (Canada) plant. The sustainable feedstock can be used for manufacturing of apparels & textiles, plastics, tires & automotive components, fuel and high performance polymers.

- In February 2022, BP Products North America Inc. entered into a long-term strategic offtake and market development agreement with Nuseed (global agriculture company). Under this agreement BP or its affiliate companies will purchase Nuseed’s Carinata oil to process or sell into markets for production of biofuels.

- In February 2022, Honeywell UOP (international supplier and licensor of process technology, catalysts, adsorbents, equipment, and consulting services to the petroleum refining, petrochemical, and gas processing industries) announced that it has developed a new solution for producing renewable naphtha using its Honeywell UOP Ecofining technology. The new solution can produce renewable naphtha from sustainable feedstock such as used cooking oils and animal fats.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Frequently Asked Questions (FAQs):

Which are the major companies in the sustainable feedstock market?

Some of the key players in the sustainable feedstock market include NatureWorks LLC (US), Aker Carbon Capture ASA (Norway), Darling Ingredients Inc. (US), Drax Group plc (UK), Enerkem (Canada), Genan Holding A/S (Denmark), Neste Oyj (Finland), POET, LLC (US), ResourceCo (Australia), and Sustainable Feedstocks Group (UK).

What are the drivers and opportunities for the sustainable feedstock market?

Growing awareness of utilizing sustainable feedstock to reduce greenhouse gas emissions is expected to boost this market, and the rising emphasis on waste management is expected to create an opportunity for the market to grow.

Which region is expected to hold the highest market growth rate?

North America's sustainable feedstock market, which has been experiencing growth and significant industry demand, is expected to account for the highest market growth rate during the forecast period. It is driven by the increasing demand for biofuels and recycled plastics in the region. Moreover, favorable government policies for the promotion of sustainability are driving the demand for sustainable feedstock in the region.

What is the total CAGR expected to be recorded for the sustainable feedstock market during 2024–2029?

The market is expected to record a CAGR of 10.2% during 2024–2029.

How is the sustainable feedstock market aligned?

The market is currently fragmented, with many new and established players entering this market. This has prompted existing market players to plan various growth strategies such as investment and expansion, partnerships, and the launch of new products to maintain their market presence.

Sustainable Feedstock Market

Growth opportunities and latent adjacency in Sustainable Feedstock Market