Sustainable Agriculture Market by Type (Organic Farming, Agroecology, Regenerative Agriculture, Conservation Agriculture, and Precision Agriculture), Application (Food Production, Bioenergy, Environmental Services, and Water Management), and Region - Global Forecast to 2029

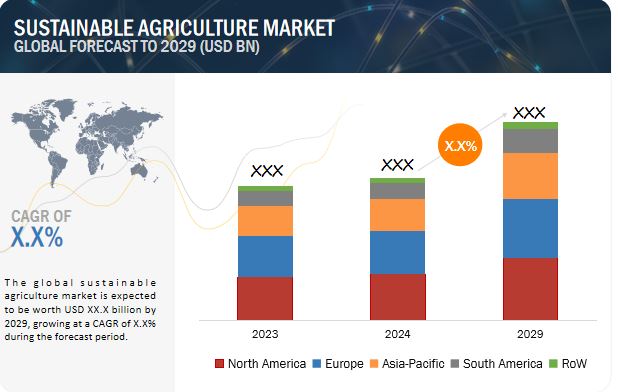

The global market for sustainable agriculture, estimated to be $XXX.X billion by 2024, has an impressive growth forecast, with growth expected to reach $XXX.X billion by 2029 at a compound annual growth rate (CAGR) of 6.1%. that is, within the forecast period.

Sustainable agriculture has become a cornerstone of modern food production, addressing the complex challenges of feeding a growing global population while preserving environmental integrity. This approach seeks to balance the immediate need for agricultural output with long-term ecological sustainability, recognizing that the health of our planet and the security of our food supply are inextricably linked. At its heart, sustainable agriculture embraces three fundamental pillars: environmental stewardship, economic viability, and social responsibility. These interconnected aspects form a holistic framework that guides farmers, researchers, and policymakers in developing resilient and productive agricultural systems.

The environmental dimension of sustainable agriculture focuses on preserving and enhancing natural resources. Soil health stands as a primary concern, with farmers employing techniques such as crop rotation, minimal tillage, and covering cropping to maintain soil structure and fertility. Water conservation plays an equally crucial role, driving the adoption of efficient irrigation methods and the cultivation of drought-resistant crops. Biodiversity promotion is another key strategy, encouraging the creation of habitats that support beneficial insects, pollinators, and other wildlife. These practices not only foster ecosystem health but also contribute to natural pest control, reducing the need for chemical interventions.

Technological innovations are rapidly changing the future of sustainable agriculture. Precision farming techniques using GPS-guided devices and drone technology allow for more efficient use of resources. Genetic modification results in crop varieties that are more resistant to pests, diseases, and environmental stresses. Big data analytics drive agricultural decisions, from planting dates to harvest time. Urban agriculture, including vertical agriculture, is expanding the possibilities for food production in space-constrained environments.

Despite its promise, sustainable agriculture faces significant challenges. Climate change poses a serious threat, with extreme weather and changing growing seasons disrupting established agricultural systems. Sustainable practices may appear less competitive in the short term due to economic pressures from traditional agricultural management and global market forces. The need for supportive government policies and consumer education remains essential to increase the adoption of sustainable practices.

Looking ahead, the sustainable agriculture strategy points to a more integrated approach, where biological principles, sophisticated technologies, and social considerations meet Time with global demand for food increasing, sustainable agriculture plays an increasingly significant role in food security while protecting the planet’s resources for future generations. This evolving paradigm represents not only a range of practices, but a fundamental shift in how we view the relationship between agriculture, the environment and human life.

Market Dynamics

Drivers: Consumer Awareness Drives Sustainable Agriculture Growth

The sustainable agriculture market is growing exponentially, driven primarily by increased consumer awareness and demand for environmentally friendly food products Modern consumers are becoming more informed about the impact of conventional agriculture is caused to the environment, resulting in a change in buying behavior. This trend is marked by a preference for organic products, locally sourced foods, and products with transparent supply chains.

The growth of the movement has been fueled by digital platforms and social media, which enable the rapid dissemination of information on sustainable agricultural practices. Consumers are now more likely to scrutinize food sources and production methods, putting pressure on food companies and retailers to have sustainable farms and detailed environmental data meeting will provide.

Health-conscious individuals also draw the connection between sustainable agricultural practices and nutrition, believing that products grown using organic or renewable methods can provide nutritional benefits a good benefit. This perception further increases the demand for processed foods.

The trend is driving farmers to adopt more sustainable practices to meet market demand, while food companies are investing in sustainable supply chains and developing a supply chain they want the environment. These changes extend beyond individual choice, influence policy decisions, and fill government incentives for sustainable agricultural practices.

As consumer awareness continues to grow, it is poised to become a key driver of innovation and expansion in sustainable agriculture, challenging the industry to meet growing demand while ensuring that farmers can be economically viable.

Restraints: Economic Barriers Hinder Widespread Adoption of Sustainable Agriculture

One of the most important constraints on sustainable agricultural markets is the economic challenge of transitioning from conventional agricultural practices to sustainable agriculture. This restriction affects farmers in a variety of ways, from small, family-owned enterprises to large commercial enterprises.

The initial cost of adopting sustainable practices can be high. Farmers often must invest in new equipment, change land management practices, and sacrifice short-term crops in the transition. Transitioning to organic farming, for example, requires a certification process that can take years, during which time farmers can achieve reduced yields without imposing soaring prices certified organic products are not included.

Furthermore, despite the lingering benefits to soil health and ecological stability from sustainable practices such as crop rotation, cover cropping and reduced tillage, this delayed satisfaction may be a particular obstacle for farmers operating in complex ways or experiencing financial pressures.

The capital available for this investment may be limited. Traditional lenders may be reluctant to finance a transition to more sustainable options due to perceived risk and uncertain returns. While some government programs provide subsidies, they cannot cover all costs or reach all potential beneficiary farmers. The market system itself can present challenges. Established supply chains and distribution channels are often based on conventional agriculture, making it difficult for quality products to effectively reach consumers This can provide sustainable products prices have risen, potentially restricting their market appeal.

Furthermore, competing with the economies of scale enjoyed by conventional farming can be difficult for professional farmers, especially in a global market where price often drives purchasing decisions This competition can squeeze profits a will be available to continuous manufacturers, making it difficult to estimate additional costs and due diligence.

Knowledge gaps and the need for specialized skills in sustainable agricultural practices can also be barriers. Farmers may need to invest time and energy in learning new techniques, which can be challenging with the day-to-day demands of farming. Addressing these economic constraints will be crucial to increase the adoption of sustainable agriculture. A combination of policy interventions, financial incentives, consumer education and market development may need to create an environment where sustainable agriculture is not only beneficial to the environment but also an economic advantage for farmers of all sizes.

Opportunities: Technological Innovation Drives Sustainable Agriculture Forward

The sustainable agriculture market is experiencing a giant opportunity through the fast advancement of generation. Precision agriculture, powered by data analytics and IoT gadgets, is revolutionizing farming practices. Farmers now use sensors, drones, and satellite imagery to monitor plants and soil situations with exceptional accuracy, optimizing aid use and decreasing waste.

Artificial intelligence and system mastering are improving choice-making methods, supporting expected climate styles, pest outbreaks, and top-quality planting instances. This fact-driven method permits farmers to make knowledgeable picks that enhance yields while minimizing environmental effect.

Robotics and automation are addressing challenging work shortages and improving performance. Autonomous tractors and AI-powered weeding machines perform precise area operations, decreasing the want for chemical inputs. Biotechnology improvements are growing crops more resilient to pests, illnesses, and climate stresses. Gene modifying techniques like CRISPR display promise for developing flora that require fewer inputs and can thrive in challenging environments. Blockchain era is enhancing supply chain transparency, assisting verify sustainable practices and construct customer accept as true with. Meanwhile, vertical farming and managed environment agriculture are increasing sustainable food manufacturing into urban areas, reducing water utilization and transportation emissions.

This technological convergence is attracting funding from agricultural organizations and tech giants alike, fostering a brand-new wave of Agri-tech startups. As these innovations turn out to be greater on hand and price-effective, they have the potential to force great adoption of sustainable farming practices, making them greater economically possible and appealing to farmers global.

Challenges: Climate Change Poses Major Challenge to Sustainable Agriculture

Climate change provides an impressive undertaking to the sustainable agriculture market. Extreme weather events, which includes excessive droughts, heatwaves, and storms, are becoming extra common and unpredictable, jeopardizing crop yields and soil fitness. These activities can undermine sustainable farming efforts, which often require long-term balance to expose consequences.

Shifting temperature styles are changing developing seasons and crop viability across regions. Farmers face new demanding situations in pest and disease control as hotter temperatures allow sure organisms to thrive in new regions, potentially conflicting with sustainable agriculture's aim to reduce chemical use. Water shortage, exacerbated with the aid of converting precipitation patterns and increased evaporation, puts extra stress on irrigation structures and water conservation efforts. Rising sea stages threaten coastal farmlands, forcing edition to salt-tolerant plants or relocation of farming sports.

The unpredictability introduced with the aid of weather change complicates long-time period planning for farmers. There is a threat that a few may revert to traditional, high-input farming techniques to keep yields in challenging conditions, potentially undermining development in sustainable agriculture adoption.

Addressing this undertaking calls for developing climate-resilient crop sorts and farming strategies, improving weather forecasting equipment, and increasing coverage help for weather variation in agriculture. The sustainable agriculture quarter needs to evolve unexpectedly to preserve productiveness at the same time as adhering to environmentally pleasant practices inside the face of changing climate conditions.

Market Ecosystem

Organic farming Segment Dominates Sustainable Agriculture Market

Organic agriculture has emerged as a pacesetter inside the sustainable agriculture market, shooting the most important market percentage throughout kind segments via 2023. This dominance can be attributed to several key drivers’ consumer oriented and in keeping with sustainable agricultural ideas.

First, organic farming prioritizes soil fitness and biodiversity. By averting insecticides and fertilizers, organic farmers domesticate healthful soil ecosystems, which in turn helps the production of strong, nutrient-dense plants that this focus on soil fitness now not most effective produces healthier ingredients but helps conserve carbon dioxide via addressing the issues of climate alternate.

Second, animal welfare is emphasized in farm animals farming inside the manufacturing of natural ingredients. Organic requirements commonly require animals to move exterior and pasture, prohibit using increase promoters and antibiotics, and mandate using organic So these practices appeal to moral consumers who placed animal welfare first. Thirdly, the natural sector has set up rigorous certification strategies, presenting clients with transparent and honest product labelling. This certification facilitates construct consumer confidence and justifies premium pricing, contributing to the section's marketplace share. The organic grocery store has also benefited from growing health focus amongst consumers. Many perceive organic merchandise as healthier because of the absence of synthetic pesticides and genetically changed organisms (GMOs). This perception has driven call for, amongst fitness-centered demographics.

Furthermore, the organic zone has shown remarkable innovation in product development and advertising. Organic versions of popular merchandise now are widely available, from toddler food to snacks and drinks, expanding the market reach.

Several leading groups include Organic Valley, Nature's Path Foods, The Hain Celestial Group etc. Have capitalized at the growth of the organic food segment. These groups have no longer simplest contributed to the boom of the organic meals segment but have also performed essential roles in advancing sustainable agriculture practices. Their success demonstrates the marketplace's sturdy urge for food for natural products and the potential for further expansion in this region of sustainable agriculture.

Food Production Segment Leads Sustainable Agriculture Applications

Food processing has emerged as a key force in the consumption segment of the sustainable agriculture market, claiming a significant market share. This top designation can be attributed to factors that emphasize the critical role that sustainable practices play in reducing environmental footprint and meeting global food demand.

The leadership of the food processing segment is driven by the rising global population, and the subsequent rise in food demand. Sustainable agriculture in food production provides solutions to increase yields without destroying natural resources, making them crucial for the long-term stability of the food supply chain.

Consumer demand for transparently sourced, environmentally friendly food has contributed significantly to the growth of this segment. Increased consumers are demanding processed foods, which is pushing food companies to embrace and promote such practices throughout their supply chains.

Technological progress plays a key role in the rise of conventional food production. Precision farming techniques, vertical agriculture, and AI-powered crop management have made sustainable practices more efficient and economical, encouraging their adoption plays little role in food production with an emphasis on reducing food waste. The production side also became a strength. Sustainable practices are improved storage and distribution methods, helping to reduce losses and increase the efficiency of food production systems.

Several essential food organizations like Unilever, Nestlé, PepsiCo, Danone, and Kellogg's have made extensive strides in enforcing sustainable meals manufacturing practices:

These industry leaders reveal how sustainable food production is turning into fundamental to big-scale meals production. Their initiatives not only contribute to environmental conservation however also ensure long-time period business sustainability by securing destiny supply chains.

The dominance of the food production phase in sustainable agriculture programs displays a broader shift toward accountable food structures.

North America Leads Sustainable Agriculture Market

North America has emerged because it is the dominant participant within the sustainable agriculture market, pushed by means of numerous key elements. Advanced technological infrastructure, together with widespread adoption of precision agriculture and IoT gadgets, has enabled extra efficient and sustainable farming practices across the vicinity.

Consumer cognizance and the call for sustainably produced food is specifically excessive in North America. This has brought on retailers and food organizations to prioritize sustainable sourcing, in addition riding marketplace boom. Robust regulatory frameworks and government guides, inclusive of organic certification packages and conservation incentives, have additionally played an essential function.

The region's robust awareness of agricultural research and development has contributed to its market leadership. North American institutions are at the vanguard of growing modern sustainable farming techniques and environmentally friendly solutions.

Well-evolved delivery chains and distribution networks for sustainable foods have made these merchandise extra reachable to consumers. The presence of several farmers' markets, organic meals shops, and mainstream stores supplying sustainable alternatives has facilitated market enlargement.

Several North American agencies have become worldwide leaders in sustainable agriculture, including Whole Foods Market, Cascadian Farm, Earthbound Farm, Stonyfield Farm, and Nature's Path Foods. These businesses had been instrumental in mainstreaming organic and sustainably produced meals.

The location's colorful challenge capital surroundings have additionally contributed through investment several agtech startups targeted on sustainable agriculture answers, accelerating innovation in regions which include vertical farming and regenerative agriculture.

North America's function as the largest sustainable agriculture marketplace displays a broader shift towards environmentally friendly and fitness-conscious practices within the location's food machine. This trend is likely to pressure further increase and innovation within the region, increasing North America's effect on worldwide sustainable farming practices.

Key Market Players

The key players in this market include Whole Foods (US), Organic Valley (US), Nature's Path Foods (US), Eden Foods, Inc. (US), Deere & Company (US), Trimble Inc. (US), AGCO Corporation (US), AgJunction LLC (US), Raven Industries, Inc. (US), AG Leader Technology (US), Teejet Technologies (US), Topcon (US), Taranis (Israel), and others

Recent Developments

- In December 2023, Organic Valley, the largest cooperative of organic farmers within the state, is in search of more milk and actively welcoming greater farmers. The cooperative brought eighty-four family farms into its fold in 2023, demonstrating a sturdy response to farm loss and agricultural consolidation.

- In January 2024, John Deere announced a new Factory installation of AI-enabled See & Spray Premium weed sensing technology on the Hagie STS sprayer.

- In September 2023, Trimble and AGCO introduced that both the groups to Form Joint Venture to Better Serve Farmers Worldwide with Mixed Fleet Precision Agriculture Solutions

Frequently Asked Questions (FAQ):

What is the current size of the Sustainable Agriculture market?

The Global market for sustainable agriculture, estimated to be $XXX.X billion by 2024, has an impressive growth forecast, with growth expected to reach $XXX.X billion by 2029 at a compound annual growth rate (CAGR) of 6.1%. that is, within the forecast period.

Which are the key players in the market, and how intense is the competition?

The key players in this market include Whole Foods (US), Organic Valley (US), Nature's Path Foods (US), Eden Foods, Inc. (US), Deere & Company (US), Trimble Inc. (US), AGCO Corporation (US), AgJunction LLC (US), Raven Industries, Inc. (US), AG Leader Technology (US), Teejet Technologies (US), Topcon (US), Taranis (Israel), and others

The Sustainable Agriculture market witnesses increased scope for growth. The market is seeing an increase in the number of joint ventures, acquisitions, and new expansions. Moreover, the companies involved in manufacturing Sustainable Agriculture products are investing a considerable proportion of their revenues in research and development activities.

Which region is projected to account for the largest share of the Sustainable Agriculture market?

North America is poised to establish its leadership in the sustainable agriculture market throughout the forecast period. This dominance is driven by strong consumer awareness and widespread adoption of sustainable agricultural practices. Strong statistics support organic farming in North America.

What kind of information is provided in the company profile section?

The company profiles mentioned above offer valuable information such as a comprehensive business overview, including details on the company's various business segments, financial performance, geographical reach, revenue composition, and the breakdown of their business revenue. Additionally, these profiles offer insights into the company's product offerings, significant milestones, and expert analyst perspectives to further explain the company's potential.

What are the factors driving the Sustainable Agriculture market?

The change in basic assumptions towards holistic health practices has driven the consumption of organic foods beyond mere sustenance. Consumers increasingly seek products that offer comprehensive health benefits, extending to both internal well-being and external appearance. One of the main drivers of the sustainable agriculture market is the growing consumer awareness of environmental sustainability and health. The effects of the food choices they make on the environment and their own health are becoming increasingly apparent to consumers. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Growth opportunities and latent adjacency in Sustainable Agriculture Market