Supply Chain IoT Market by Component (Hardware, Software), Deployment Mode (On-Premises, Cloud), Organization Size, Vertical and Region - Global Forecast to 2027

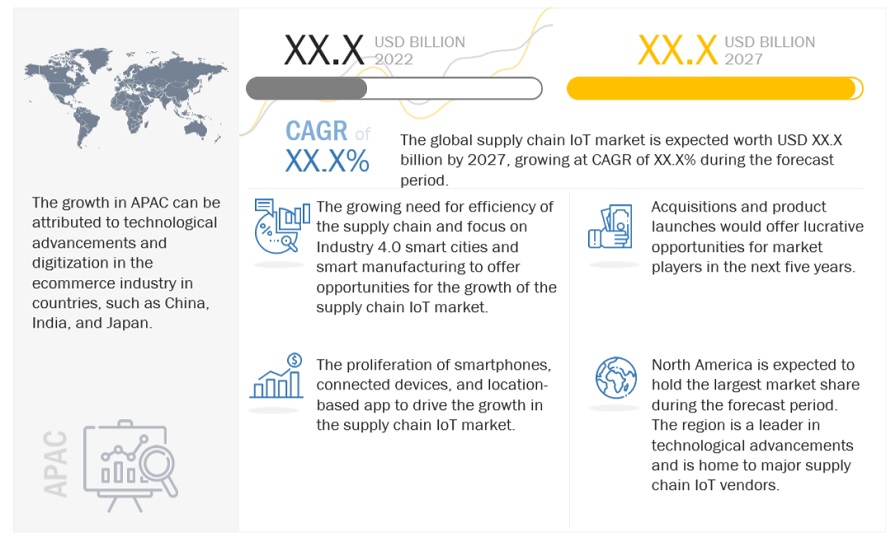

The global supply chain IoT market size to grow from USD XX.X billion in 2022 to USD XX.X billion by 2027, at a Compound Annual Growth Rate (CAGR) of XX.X% during the forecast period. Growing demand for ecommerce industry across the world, along with the increase in demand for an efficient supply chain management will drive the supply chain IoT market.

Market Dynamics

Driver: Proliferation of smartphones, connected devices, and location-based applications among customers

With the rising smartphone penetration and the changing consumer mobile buyer behavior, startups and established organizations are quickly looking for ways to improve their supply chain management through means of IoT devices. The deployment of IoT in supply chain has enabled eCommerce vendors to enhance their user experiences and provide proper navigation for objects or any locations. Supply chain IoT solutions provide an opportunity for organizations to engage customers in their supply chain with their brands, their products, their partners, or anything that helps them further increase customer relationships and sales.

Driver: Exponential rise of the eCommerce industry

The eCommerce industry is growing exponentially across the globe, and it holds a very large share in the retail market. eCommerce sales are expected to reach around 16% of the total retail sales, globally, by 2021. The main reason for such drastic increase in the demand for eCommerce services is the result of expectations and customer buying behavior. The customers now have various expectations such as fast and free shipping, competitive product pricing. This sudden change in the consumer behavior has prompted various companies to implement IoT services in their supply chain activities. Therefore, with the rise of eCommerce industry, the supply chain IoT market is also expected to grow.

Challenge: Lack of skills and technical expertise

The lack of knowledge with regard to IoT in supply chain and its benefits is becoming among the biggest challenges to this market, as it hinders customer adoption and acceptance. Implementing IoT in supply chain solutions and services offers various benefits, such as locating, tracking, and customer analytics, which most business owners are not aware of. Owing to this, business owners tend to avoid investing in deploying supply chain IoT solutions, as it becomes very difficult to predict which solution customers could accept in the future. Hence, the IoT technology needs a robust marketing plan for increasing the awareness and skills related to its usage.

Key Market Players

The supply chain IoT market vendors have implemented various types of organic and inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in the global market are Cisco (US), Robert Bosch GmbH (Germany), IBM (US), Microsoft (US), Qualcomm Inc (US), Intel (US), and Honeywell (US). The study includes an in-depth competitive analysis of these key players in the supply chain IoT market with their company profiles, recent developments, and key market strategies.

Recent Developments:

- In June 2021, SAP disclosed the first step in creating the world’s largest business network with SAP Business Network, this will bring together Ariba Network, SAP Logistics Business Network and SAP Asset Intelligence Network. SAP made new innovations which will companies in modernization and digitalization of their business processes.

TABLE OF CONTENTS

1 INTRODUCTION

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

2.4 MARKET FORECAST

2.5 ASSUMPTIONS

2.6 LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 ATTRACTIVE OPPORTUNITIES IN SUPPLY CHAIN IOT MARKET

4.2 MARKET, BY ORGANIZATION SIZE

4.3 NORTH AMERICAN MARKET, BY DEPLOYMENT MODE AND COUNTRY (2022)

4.4 ASIA PACIFIC MARKET, BY DEPLOYMENT MODE AND COUNTRY (2022)

4.5 SUPPLY CHAIN IOT MARKET, BY COUNTRY

5 MARKET OVERVIEW AND INDUSTRY TRENDS

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.2 RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.4 CHALLENGES

5.3 INDUSTRY TRENDS

5.3.1 VALUE CHAIN

5.3.2 ECOSYSTEM

5.3.3 PORTER’S FIVE FORCE MODEL

5.3.3.1 THREAT OF NEW ENTRANTS

5.3.3.2 THREAT OF SUBSTITUTES

5.3.3.3 BARGAINING POWER OF BUYERS

5.3.3.4 BARGAINING POWER OF SUPPLIER

5.3.3.5 COMPETITIVE RIVALRY

5.3.4 KEY STAKEHOLDERS AND BUYING CRITERIA

5.3.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

5.3.4.2 BUYING CRITERIA

5.3.5 TECHNOLOGY ANALYSIS

5.3.6 TRENDS AND DISRUPTIONS IMPACTING BUYERS

5.3.7 PATENT ANALYSIS

5.3.8 PRICING ANALYSIS

5.3.8.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY COMPONENT

5.3.9 USE CASES

5.3.10 KEY CONFERENCES & EVENTS IN 2022

5.3.11 TARIFF AND REGULATORY IMPACT

5.3.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES & OTHER ORGANIZATIONS

6 SUPPLY CHAIN IOT MARKET, BY COMPONENT

6.1 INTRODUCTION

6.1.1 MARKET, BY COMPONENT: DRIVERS

6.2 HARDWARE

6.2.1 BARCODES AND BARCODE SCANNERS

6.2.2 RFID TAGS AND READERS

6.2.3 GPS TRACKING DEVICES

6.3 SOFTWARE

6.3.1 RESOURCE MONITORING

6.3.2 TRAFFIC AND FLEET MANAGEMENT

6.3.3 SAFETY AND SECURITY

6.3.4 OTHERS

7 SUPPLY CHAIN IOT MARKET, BY DEPLOYMENT MODE

7.1 INTRODUCTION

7.1.1 MARKET, BY DEPLOYMENT MODE: DRIVERS

7.2 ON-PREMISES

7.3 CLOUD

8 MARKET, BY ORGANIZATION SIZE

8.1 INTRODUCTION

8.1.1 MARKET, BY ORGANIZATION TYPE: DRIVERS

8.2 LARGE ENTERPRISES

8.3 SMALL AND MEDIUM-SIZED ENTERPRISES

9 SUPPLY CHAIN IOT MARKET, BY VERTICAL

9.1 INTRODUCTION

9.1.1 MARKET, BY VERTICAL: DRIVERS

9.2 FAST-MOVING CONSUMER GOODS

9.3 RETAIL AND ECOMMERCE

9.4 HEALTHCARE

9.5 MANUFACTURING

9.6 AUTOMOTIVE

9.7 TRANSPORTATION AND LOGISTICS

9.8 OTHER VERTICALS

10 SUPPLY CHAIN IOT MARKET, BY REGION

10.1 INTRODUCTION

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: PESTLE ANALYSIS

10.2.2 UNITED STATES

10.2.3 CANADA

10.3 EUROPE

10.3.1 EUROPE: PESTLE ANALYSIS

10.3.2 UNITED KINGDOM

10.3.3 GERMANY

10.3.4 FRANCE

10.3.5 ITALY

10.3.6 SPAIN

10.3.7 NORDICS

10.3.8 REST OF EUROPE

10.4 ASIA PACIFIC

10.4.1 ASIA PACIFIC: PESTLE ANALYSIS

10.4.2 CHINA

10.4.3 JAPAN

10.4.4 INDIA

10.4.5 AUSTRALIA AND NEW ZEALAND

10.4.6 SOUTH EAST ASIA

10.4.7 REST OF ASIA PACIFIC

10.5 MIDDLE EAST AND AFRICA

10.5.1 MIDDLE EAST AND AFRICA: PESTLE ANALYSIS

10.5.2 MIDDLE EAST

10.5.2.1 UNITED ARAB EMIRATES

10.5.2.2 KINGDOM OF SAUDI ARABIA

10.5.2.3 REST OF MIDDLE EAST

10.5.3 AFRICA

10.5.3.1 SOUTH AFRICA

10.5.3.2 EGYPT

10.5.3.3 NIGERIA

10.5.3.4 REST OF AFRICA

10.6 LATIN AMERICA

10.5.1 LATIN AMERICA: PESTLE ANALYSIS

10.5.2 BRAZIL

10.5.3 MEXICO

10.5.4 REST OF LATIN AMERICA

11 COMPETITIVE LANDSCAPE

11.1 OVERVIEW

11.2 MARKET EVALUATION FRAMEWORK

11.3 COMPETITIVE SCENARIO AND TRENDS

11.3.1 PRODUCT LAUNCHES

11.3.2 DEALS

11.3.3 OTHERS

11.4 MARKET SHARE ANALYSIS OF TOP PLAYERS

11.5 HISTORICAL REVENUE ANALYSIS

11.6 COMPANY EVALUATION MATRIX OVERVIEW

11.7 COMPANY EVALUATION QUADRANT

11.7.1 STARS

11.7.2 EMERGING LEADERS

11.7.3 PERVASIVE PLAYERS

11.7.4 PARTICIPANTS

11.8 PRODUCT FOOTPRINT ANALYSIS OF COMPANIES

11.9 MARKET RANKING ANALYSIS OF COMPANIES

11.10 STARTUP/SME EVALUATION QUADRANT

11.10.1 PROGRESSIVE COMPANIES

11.10.2 RESPONSIVE COMPANIES

11.10.3 DYNAMIC COMPANIES

11.10.4 STARTING BLOCKS

11.11 COMPETITIVE BENCHMARKING FOR SMES/STARTUPS

12 COMPANY PROFILES

12.1 KEY PLAYERS

12.1.1 CISCO

12.1.2 ROBERT BOSCH

12.1.3 IBM

12.1.4 MICROSOFT

12.1.5 QUALCOMM INC

12.1.6 INTEL

12.1.7 HONEYWELL

12.1.8 SAP

13 APPENDIX AND ADJACENT MARKETS

13.1 ADJACENT/RELATED MARKETS

13.1.1 INTRODUCTION

13.1.2 LIMITATIONS

13.2 SUPPLY CHAIN MARKET

13.3 CLOUD SUPPLY CHAIN MANAGEMENT MARKET

13.4 DISCUSSION GUIDE

13.5 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

13.6 AVAILABLE CUSTOMIZATIONS

13.7 RELATED REPORTS

13.8 AUTHOR DETAILS

Growth opportunities and latent adjacency in Supply Chain IoT Market