Supersonic Aircraft Market by Speed Range (Mach 1, Mach 2, Mach 3), Type (Light Jet, Medium Jet, Large Jet), System (Airframe, Engine, Avionics, Landing Gear Systems, Weapon System), Platform (Military, Commercial), Region - Global Forecast to 2030

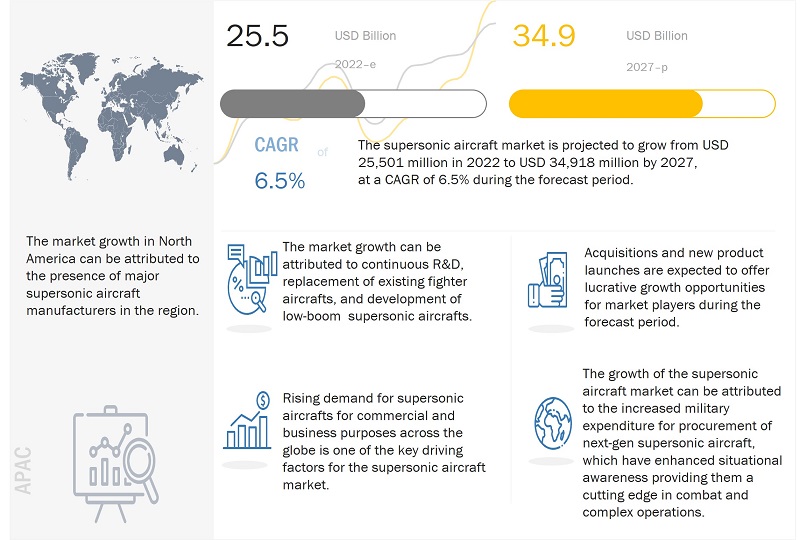

The supersonic aircraft market is estimated at USD 25.5 billion in 2024 and is projected to reach USD 34.9 billion by 2030, at a CAGR of 6.5% from 2024 to 2030. A supersonic aircraft is referred to as an aircraft that is able to fly supersonic, or faster than the speed of sound. Supersonic aircrafts have found extensive applications for research and combat missions since their inception in the late 1960s. The market saw an expansion into the commercial sector, with Concorde as the first aircraft to be used for civil purposes. The market saw a temporary halt owing to high levels of noise pollution, increased maintenance costs and poor fuel-efficiency. However, with the innovation in design and composite materials and the coming of sustainable aviation fuels, the market is witnessing a resurgence with increasing demand for supersonic aircraft from the civil and military aviation sectors. The development of low-boom or reduced boom supersonic aircrafts is one of the most significant factors driving the market growth.

The demand for commercial supersonic aircrafts is primarily driven by the fact that supersonic aircraft efficiently reduce journey time by half. Various supersonic aircraft manufacturers and start-ups are progressively working towards development of supersonic aircrafts for commercial and business jet applications in order to reduce the overall turnaround and flight time for business trips and international travel respectively, and humanitarian missions can save more lives owing to sustainable supersonic travel. With the development of low-boom supersonic aircrafts, the commercial segment is set to witness a significant growth in the upcoming years. The market will also gain popularity with the development in sustainable aviation fuels.

Component suppliers and manufacturers of supersonic aircraft market focus on development of light-weight aerospace components expanding the capabilities of these systems towards fuel-efficient supersonic aircrafts. Lockheed Martin (US) is an established player in the supersonic aircraft market and is engaged in developing commercial supersonic aircrafts, in collaboration with NASA to create the X-59 SuperSonic Technology (QueSST). The supersonic jet won't carry passengers, but it will lessen sonic booms over the land. Many aerospace OEMs such as Safran Group (France) are working on the development of advanced landing gears and other such components such as sustainable fuels, avionic systems and engines in order to support the high functional requirement of the supersonic aircrafts.

Supersonic Aircraft Market Forecast to 2027

To know about the assumptions considered for the study, Request for Free Sample Report

Supersonic Aircraft Market Dynamics:

Driver: Design modifications enhance the fuel-efficiency and safety of the aircrafts

After the halt of supersonic aircrafts, such as the Concorde in2003, owing to safety and noise pollution concerns and high fuel and maintenance costs, manufacturers have partnered into the R&D and production of supersonic aircrafts which are cost-effective and environment-friendly. This venture has led into the evolution of supersonic aircrafts designs that are highly fuel-efficient and are less prone to operational hazards. These innovations have also resulted in supersonic aircrafts with a low sonic boom, thereby reducing the noise-pollution levels, which is a major concern in the operations of these aircrafts. One such example, is the Boom Supersonic’s (US) ‘Overture.’ It has design modifications in the form of Contoured fuselage- to optimize airflow in order to reduce drag, and increase fuel efficiency; Compound modified delta platform which improves supersonic performance and subsonic stability to maximize safety and efficiency; Gull wings that minimize aircraft drag and thus required, engine thrust; and a Four-engine design that delivers efficient supersonic performance, maintains standard temperature ranges, and flies without afterburners to minimize noise and fuel consumption.

Restraint: Strict government regulations on testing of Supersonic Aircrafts hamper the growth of the Market

Strict Government regulations can limit the market expansion of supersonic aircraft. Under the National Environmental Policy Act in the US, all applications for supersonic aircraft test flights must take environmental effects into account (NEPA). According to the rule, the FAA will decide this while assessing applications in compliance with the Council on Environmental Quality (CEQ) rules. Noise pollution is a hazard with test flights at supersonic speeds. The rules specify that a new clause added to the final rules will permit special test flight authorisation for determining an aircraft's noise characteristics for compliance with noise certification tests. Although there aren't any noise rules in place right now, the FAA said that this clause was forward-looking for when standards are eventually adopted. Even though there is an increasing amount of interest in and funding for commercial high-speed flight, current FAA regulations still forbid flying civil aircraft at supersonic speeds over American territory and from a certain distance offshore where a boom may reach American shores. A significant technical problem is presented by the requirement that supersonic aircraft adhere to the same airport noise standards as normal aircraft.

Opportunity: Increasing demand for supersonic aircraft for unmanned aerial systems

The growing need for unmanned supersonic systems for defense purposes will boost the demand for supersonic aircraft. Companies like Kelley Aerospace (Singapore) and Exosonic Inc. (US) are developing very complex unmanned supersonic aircraft that are. These drones, as opposed to older supersonic aircraft, will employ cutting-edge technologies that will significantly lessen the sonic boom while enhancing aerodynamics. The new drone will give fighter pilots hands-on flight training once it is ready for production. In addition to freeing up pilots and aircraft for other tasks, it will carry a range of payloads and sensors and lessen the wear and tear on combat aircraft. 100 pre-orders have reportedly already been placed for Singapore's Kelley Aerospace's new supersonic unmanned combat aircraft vehicle. Its carbon fibre monocoque is responsible for its styling (single-shell). With a maximum takeoff weight of 16,800 kg, it is reportedly light enough to travel more than 4,800 kilometres.

Challenge: Decrease in sonic boom

Reduced sonic boom, the loud sound wave created when an aircraft flies faster than the speed of sound, is the major challenge for the supersonic aircraft market. The Concorde, the only supersonic airliner that saw prolonged service, was limited to flying above oceans because it could break windows and result in injuries. Flying faster than the speed of sound is only permitted for military jets and only in circumstances when it is impossible to avoid it. In a vast number of nations these limits have been codified into law. The US Federal Aviation Administration (FAA) established a specific testing area for supersonic commercial aircraft over Kansas in 2020. The restriction might be lifted if the testing are successful and the new aircraft don't create harmful supersonic booms. Therefore, the efforts to create these silent supersonic jets will have a major impact. Although the technology hasn't been thoroughly tested yet, both for-profit businesses and governmental organisations like NASA have been trying to achieve this, and even one success might demonstrate the viability of the concept.

Based on the speed range, the simulator market has been segmented into Mach 1, Mach 2 and Mach 3. Key players operating in the supersonic aircraft market are focused on developing advanced supersonic aircraft to explore new market opportunities with reduced time of travel, up to half of what the subsonic commercial airliners achieve. During the forecast period, the Mach 1 supersonic aircraft segment dominates the supersonic aircraft market with the largest market share and highest CAGR.

Based on the type, the supersonic aircraft market has been segmented into light jet, medium jet and large jet. The light jet segment is projected to register the highest CAGR of % during the forecast period. This is linked to an increase in demand for lighter jets' superior fuel economy, which is anticipated to drive demand in this market.

Based on the system, the supersonic aircraft market has been segmented into airframe, engine, avionics, landing gear systems and weapons systems. The airframe supersonic aircraft segment is projected to grow from USD million in 2022 to USD million by 2027, at a CAGR of % from 2022 to 2027, and accounts for the major supersonic aircraft market share. The advancements in composite airframes for supersonic aircraft enhance the operational efficiency for these aircrafts. The market for engines supersonic aircraft segment is anticipated to grow due to increased research and development by OEMs around the world.

Based on the platform, the supersonic aircraft market has been segmented into military and commercial aircraft. The growth of the supersonic aircraft market can be attributed to the increased use of supersonic aircraft in the military and commercial sectors. In the commercial sector, supersonic aircraft manufacturers are aiming to provide safe and comfortable flight experience with reduced travel time for the passengers. The growth for the military segment is spurred by the increasing global demand for first-generation supersonic aircraft for combat and rescue operations.

Supersonic Aircraft Market by Region

To know about the assumptions considered for the study, download the pdf brochure

The North American region held the major share of the supersonic aircraft market in 2021

The North-American region accounted for the largest market supersonic aircraft market share in 2021. It is one of the potential markets for commercial and military supersonic aircraft. An increase in international passenger traffic, especially for business and commercial purpose is the major reason for the increased demand for faster means of air-travel in countries such as the US and Canada. An increase in military expenditure, especially for the replacement of existing fighter aircrafts with modern generation combat aircrafts has driven the market.

According to Boom Technology Inc. (US), a supersonic aircraft manufacturer, there are more than 600 routes that can be flown by supersonic aircraft and can be completed in as little as half the time taken by the comercial subsonic airliners. There are several options, such as flying from Los Angeles to Honolulu in three hours or from Miami to London in under five hours.

The North American region is projected to Grow at the highest CAGR during the forecast period

The rising orders to replace the existing military fleet with new modern fighter aircraft from countries such as the US and Canada and with more commercial airliners such as the American Airlines opting for supersonic jets in their fleet, the region is set to witness a high CAGR amongst all the other regions . Supersonic jet demand in this region is anticipated to be driven by elements such the existence of major manufacturers, growing demand for air travel, expanding use of lightweight components in aircraft manufacturing, and growing R&D expenditures.

Key Market Players:

Some major players in the supersonic aircraft market are Boom Supersonic (US), Exosonic (US), Lockheed Martin (US), Eon Aerospace (US), Spike Aerospace (US) and Aerion Corp (US),. These players have adopted various growth strategies such as contracts, joint ventures, partnerships & agreements, acquisitions, and new product launches to expand their presence in the supersonic aircraft market.

Boom Technology Inc.

Boom Technology Inc., is an American corporation that deals in the design and manufacturing of supersonic commercial airliners with its headquarters in the Colorado, United States. Boom has conducted successful trials of its demonstrator aircraft XB-1, and their flagship aircraft, Overture, is a supersonic commercial jet that has a capacity of 88 people. Boom Technology Inc., also known as Boom Supersonic, recently entered into supplying supersonic aircrafts for various major airliners such as American Airlines, United Airlines, Japan Airlines and Northrupp Grumman to name a few.

Aerion Corp

Aerion Corp is an American civil aircraft manufacturing organization that specializes in the production of supersonic business jets and aircrafts. It is headquartered in Florida, US. Since its establishment in 2003, Aerion has made consistent investments in research and development, much of it carried out in collaboration with NASA and other esteemed aerospace research groups, to create designs for a family of effective supersonic jets. Aerion Corp has partnered with various organizations such as NASA, Washington Aeronautical Lab and the European Transonic Wind Tunnel for the design and development of supersonic jets. Its prominent product includes the Mach 1.2 AS 2 supersonic business jet.

Lockheed Martin Corp.

Lockheed Martin Corp., is a multinational aerospace and security organisation that deals in the research, design, development, production, integration, and maintenance of technological systems, products, and services for the aerospace and defense industry. It operates through the Aeronautics, Missiles and Fire Control (MFC), Rotary and Mission Systems (RMS), and Space are the segments. Advanced military aircraft, including as combat and air mobility aircraft, unmanned air vehicles, and related technologies, are researched, designed, developed, manufactured, integrated, maintained, supported, and upgraded by the Aeronautics segment. The Lockheed Martin Corporation is creating the X-59 supersonic aircraft in association with NASA's Quesst Mission in order to gather information on how the public will react to the aircraft's unusually mild sonic boom.

Exosonic Inc.

Exosonic Inc., is an American startup company that deals in the development of supersonic transport aircrafts. The proposed projects from Exosonic include a supersonic Mach 1.8 airliner with 70 passengers capacity and a supersonic unmanned aerial vehicle to be developed for the United States Army. Exosonic is using curved sonic boom technology to create a low boom, quiet supersonic passenger aircraft. It is also engaged in the development of Supersonic UAVs, that will enhance the training of air forces against potential threats. It is headquartered in California, US.

Supersonic aircraft Market Highlights:

What is new?

- Major developments that can change the business landscape as well as market forecasts.

-

Emerging Technology Trends

- Advanced composite materials

- Light-weight airframes

- Increased situational awareness through sensors and avionics

- Sustainable Aviation Fuel

- Low-boom supersonic aircrafts

- Design modifications through contoured fuselage to reduce drag

- Delta Planform wing shapes

- Gull wings to reduce air drag

- Addition/refinement in segmentation–Increase the depth or width of market segmentation. ((If Revamped))

-

Supersonic aircraft Market, By Speed Range

- Upto Mach 1

- Upto Mach 2

- Upto Mach 3

-

Supersonic aircraft Market, By Type

- Light Jet

- Medium Jet

- Large Jet

-

Supersonic aircraft Market, By System

- Airframe

- Engine

- Avionics

- Landing Gear System

- Weapons System

-

Supersonic aircraft Market, By Platform

- Military Aircraft

- Commercial Aircraft

- Coverage of new market players and change in the market share of existing aviation lubricants market players. ((If Revamped))

Company profiles: The company profiles offer details on major supersonic aircraft manufacturers. The companies present in this market ecosystem were initially identified and analyzed. Then, major players were shortlisted based on company product portfolio, revenue, recent developments, R&D, geographic presence, and export potential, among other factors. Also, suppliers to countries with significant demand were considered a key selection criterion. The above approach resulted in the selection of the final set of companies. Each company profile provides a business overview, product offerings, and recent developments. In the new edition of the report, we have players (20 major, 5 Startups/SME). Moreover, the share of companies operating in the supersonic aircraft market and start-up matrix have also been provided in the report.

- Updated financial information and product portfolios of players operating in the supersonic aircraft market. ((If Revamped))

Newer and improved representation of financial information: The new edition of the report contains updated financial information for each listed firm in the context of the supersonic aircraft market till 2021/2022 in the form of a single diagram (instead of multiple tables). This will make it easier to assess the current state of the firms featured in terms of their financial health, product portfolio strength, major revenue-producing region/country, business segment focus in the largest revenue-generating sector, and investment in R&D activities.

- Updated market developments of the profiled players.

Recent Developments: Updated market developments such as contracts, joint ventures, partnerships & agreements, acquisitions, new service launches, new product launches, investments, funding, and certification have been mapped for the years 2018 to 2022. For instance, in August 2022, Boom Technology Inc., was granted a contract by the American Airlines, (US), for the supply of 20 Overture Supersonic aircrafts. The first aircraft is expected to launch in 2025 and transport its first customers in 2029 after fulfilling FAA and aviation regulations.

- Any new data points/analysis (frameworks) which was not present in the previous version of the report

- Competitive benchmarking of startups /SMEs covers financial status, the latest funding round, and total funding.

- Inclusion of the impact of megatrends on the supersonic aircraft market that includes a shift in global climate change, rapid urbanization, greater customization, and disruptive technologies

- Technology analysis and case studies are added in this edition of the report to give the technological perspective and the significance of the advancements in the supersonic aircraft market

- Inclusion of patent registrations to overview R&D activities in the supersonic aircraft market.

- The startup evaluation matrix is added in this report, covering supersonic aircraft startups.

- The new edition of the report consists of trends/disruptions in customer business, tariff & regulatory landscape, pricing analysis, and a market ecosystem map to better understand simulator market dynamics.

Recent Developments

- Boom Supersonic and American Airlines announced their deal to buy up to 20 Overture aircraft, with an option to buy a further 40, in August. At twice the speed of the current fastest commercial aircraft, Overture is anticipated to transport passengers. With a range of 4,250 nautical miles, Overture is planned to have a capacity of 65 to 80 passengers and travel at a top speed of Mach 1.7 over water. This is twice as fast as the current fastest commercial aircraft.

- Start-up Exosonic recently received a contract from the US Air Force (USAF) to create a low-boom supersonic executive transport that could replace "Air Force One" in the future. A silent, Mach 1.8, 70-seat supersonic passenger aircraft that can fly over land and water at supersonic speeds while producing a barely audible sonic boom is what Exosonic claims to be creating. The corporation is also working to transform the plane into a supersonic commercial airliner, which it intends to release in the middle of the 2030s.

- As part of the Tempest programme, BAE Systems will start developing the first supersonic fighter jet prototype in nearly 40 years. To replace the Eurofighter Typhoon, the defence industry behemoth will create a sixth-generation warplane. A joint initiative of BAE and the Ministry of Defense, the flying prototype is a part of the larger Tempest programme that also includes Leonardo of Italy.

Key Benefits of the Report/Reason to Buy:

Target Audience:

Frequently Asked Questions (FAQs):

What is the current size of the simulator market?

The supersonic aircraft market is estimated at USD 25.5 billion in 2022 and is projected to reach USD 34.9 billion by 2027, at a CAGR of 6.5% from 2022 to 2027.

Who are the winners in the simulator market?

Boom Supersonic (US), Aerion Corp (US), Lockheed Martin (US), Eon Aerospace (US), Exosonic (US).

What are some of the technological advancements in the market?

Increased emphasis on manufacturing lightweight airframe parts using composite materials such as carbon-fibre to enhance performance and fuel economy

Manufacturers of aircraft have been emphasising sustainability in recent years. OEMs have made noise reduction their top priority by implementing the most recent noise-reducing technologies into the engine and airframes, in addition to minimising carbon emissions and fuel consumption.

What are the factors driving the growth of the market?

Supersonic jet market revenue growth is anticipated to be positively impacted by factors such as rising air passenger traffic, technological developments in the aviation industry, high demand for lightweight components to increase fuel and performance efficiency, and rising need to shorten overall flight times. An average commercial jet's in-flight duration is about half that of a supersonic flight. Second-generation supersonic planes are now being developed, and they will be 30% more efficient and capable of reaching high speeds of over 2 Mach, which will continue the market's expansion.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Growth opportunities and latent adjacency in Supersonic Aircraft Market