Substation Monitoring System Market by Component (Hardware & Software), Communication Technology (Wired & Wireless), Sector (Transmission & Distribution), Industry (Utility, Oil & Gas, Mining, Steel, and Transportation) and Geography - Global Forecast to 2023

The substation monitoring system market is expected to grow from USD 3.32 Billion in 2017 to USD 5.21 Billion by 2023, at a CAGR of 7.8% between 2017 and 2023. The growth of this market is fueled by the growing demand for reduction in transmission and distribution losses, aging infrastructure, increasing investments (contracts) from the government, and improving IoT-based communication network. Moreover, the advantages of developing IEC 61850 standard to enable interoperability between IEDs and developments in the substation monitoring ecosystem through organic and inorganic growth strategies, such as product developments, expansions, partnerships, contracts and agreements, and acquisitions, would further drive the growth of this market.

Between hardware and software component, the market for software is expected to grow at a higher CAGR between 2017 and 2023. Despite the challenges such as cyber threat and harsh environmental conditions in the power industry, the market for software is expected to grow at the highest rate. The increasing use of electricity in the industrial sector and demand for uninterrupted power in emerging economies, such as China and India, are driving the growth of the market for software. Moreover, a growing need for reducing electricity losses through monitoring is driving the growth of the substation monitoring system market for software.

The substation monitoring system market for wireless communication technology is expected to grow at a high CAGR between 2017 and 2023, owing to the growing adoption of wireless communication technology over wired communication technology in remote electrical substations for online monitoring purposes.

The substation monitoring system market for the distribution sector is expected to grow at a high CAGR between 2017 and 2023, owing to the increasing demand for electricity, which would drive the need for upgrading aging infrastructure. The existing infrastructure cannot sustain bulk power movements. Hence, there is a need for substation monitoring systems to reduce the losses and maximize the electricity efficiency.

Among various industries, utility held the largest share of the overall substation monitoring system market in 2016. This is attributed to the growing use of substation monitoring system and services for reduction in transmission and distribution losses and aging infrastructure of electrical substations.

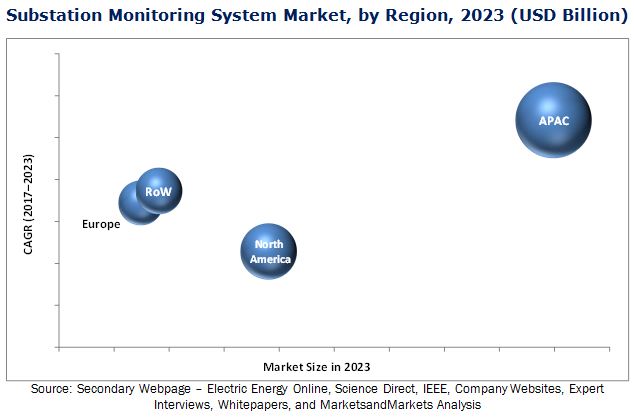

Asia Pacific (APAC) is expected to hold the largest share of the market during the forecast period. The substation monitoring system market in emerging economies, such as China, India, and South Korea, is expected to grow at the highest CAGR because of the rising need for reduction in transmission and distribution losses in these countries.

The key restraining factor for the growth of the substation monitoring system market is the high capital expenditure for installations of wireless sensor networks and increasing cost of installations of IEDs in substation. The consumers of substation monitoring systems are the key players in industries such as utility, oil & gas, mining, steel, and transportation. The major demand for substation monitoring system and services is from the utility and mining industries. While both these industries are growing rapidly, they face a stiff price competition in the market. Therefore, the players in these industries demand low-cost substation monitoring systems to bring down the price of the final product and services.

Key market players in the substation monitoring system market are ABB (Switzerland), Honeywell (US), Siemens (Germany), Schneider Electric (France), Emerson Electric (US), General Electric (US), Eaton (Ireland), Schweitzer Engineering Laboratories (US), NovaTech (UK), and Crompton Greaves (India). These companies focus on strategies such as product launches and developments, expansions, contracts and agreements, and acquisitions to enhance their service offerings and expand their business.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.3.3 Geographic Scope

1.4 Currency

1.5 Limitations

1.6 Package Size

1.7 Market Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

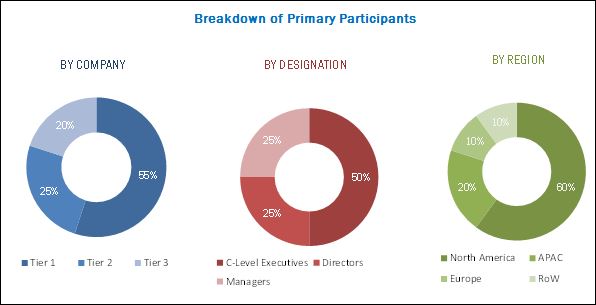

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.2.3 Market Share Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 32)

4.1 Attractive Market Opportunities in Overall Substation Monitoring System Market

4.2 Market, By Communication Technology

4.3 APAC Market, By Industry

4.4 Geographic Analysis of Market

4.5 Market in North America, By Country

4.6 Market, By Industry

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Demand for Reduction in Transmission and Distribution Losses

5.2.1.2 Aging Infrastructure

5.2.1.3 Increasing Investments (Contracts) From the Government

5.2.1.4 Developing Iec 61850 Standard to Enable Interoperability Between IEDs

5.2.1.5 Improving Iot-Based Communication Network

5.2.2 Restraints

5.2.2.1 High Capital Expenditure for Installations of Wireless Sensor Networks

5.2.2.2 Increasing Cost of Installations of IEDs in Substation

5.2.3 Opportunities

5.2.3.1 Growing Demand for Renewable Energy Projects

5.2.4 Challenges

5.2.4.1 Cyber-Risks in the Power Industry

5.2.4.2 Harsh Environmental Conditions

5.3 Value Chain Analysis

6 Market, By Component (Page No. - 45)

6.1 Introduction

6.2 Hardware

6.2.1 Intelligent Electronic Devices

6.2.1.1 Transformer

6.2.1.1.1 Voltage Instrument Transformer

6.2.1.1.2 Current Instrument Transformer

6.2.1.2 Relay Devices

6.2.1.3 Recloser Controllers

6.2.1.4 Circuit Breakers

6.2.1.5 Switches

6.2.2 Distribution Network Feeders

6.2.3 Others

6.2.3.1 Smart Sensors

6.2.3.2 Microcontrollers

6.2.3.3 Cameras

6.3 Software

6.3.1 Asset Management

6.3.2 Production Management

6.3.3 Performance Management

7 Market, By Communication Technology (Page No. - 59)

7.1 Introduction

7.2 Wired Communication Technology

7.2.1 Fiber Optic

7.2.2 Ethernet

7.2.3 PROFIBUS

7.2.4 Others

7.2.4.1 Fieldbus

7.2.4.2 HART

7.2.4.3 Modbus

7.3 Wireless Communication

7.3.1 Wireless LAN (Wi-Fi)

7.3.2 ZigBee

7.3.3 Cellular Technology

8 Market, By Sector (Page No. - 69)

8.1 Introduction

8.2 Transmission

8.3 Distribution

9 Market, By Industry (Page No. - 77)

9.1 Introduction

9.2 Oil & Gas

9.3 Steel

9.4 Utility

9.4.1 Non-Renewable

9.4.2 Renewable

9.5 Mining

9.6 Transportation

10 Geographic Analysis (Page No. - 88)

10.1 Introduction

10.2 Asia Pacific

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 Rest of APAC

10.3 North America

10.3.1 US

10.3.2 Canada

10.3.3 Mexico

10.4 Europe

10.4.1 UK

10.4.2 France

10.4.3 Germany

10.4.4 Rest of Europe

10.5 RoW

10.5.1 Middle East

10.5.2 Africa

10.5.3 South America

11 Competitive Landscape (Page No. - 112)

11.1 Overview

11.2 Market Share Analysis

11.3 Competitive Scenario

11.3.1 Product Launches/Product Developments

11.3.2 Partnerships, Acquisitions, Contracts, and Agreements

12 Company Profiles (Page No. - 119)

(Business Overview, Products Offered, Product Offering Scorecard, Business Strategy Scorecard, Recent Developments, Key Relationships)*

12.1 ABB

12.2 Siemens

12.3 General Electric

12.4 Schneider Electric

12.5 Cisco

12.6 Honeywell

12.7 Emerson Electric

12.8 Eaton

12.9 Crompton Greaves

12.10 Schweitzer Engineering Laboratories

12.11 Novatech

12.12 Key Innovators

12.12.1 Introduction

12.12.2 Igrid T&D

12.12.3 Sentient Energy

12.12.4 Cadillac Automation and Controls

12.12.5 Tekvel

12.12.6 I-TOR

*Details on Business Overview, Products Offered, Product Offering Scorecard, Business Strategy Scorecard, Recent Developments, Key Relationships Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 157)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (63 Tables)

Table 1 Substation Monitoring System Market, By Component, 2014–2023 (USD Million)

Table 2 Market for Transmission, By Component, 2014–2023 (USD Million)

Table 3 Market for Distribution, By Component, 2014–2023 (USD Million)

Table 4 Market, By Hardware, 2014–2023 (USD Million)

Table 5 Market for Transmission, By Hardware, 2014–2023 (USD Million)

Table 6 Market for Distribution, By Hardware, 2014–2023 (USD Million)

Table 7 Market, By Software, 2014–2023 (USD Million)

Table 8 Market for Transmission, By Software, 2014–2023 (USD Million)

Table 9 Market for Distribution, By Software, 2014–2023 (USD Million)

Table 10 Market, By Communication Technology, 2014–2023 (USD Million)

Table 11 Market for Communication Technology, By Wired, 2014–2023 (USD Million)

Table 12 Market for Communication Technology, By Fiber Optic, 2014–2023 (USD Million)

Table 13 Market for Communication Technology, By Ethernet, 2014–2023 (USD Million)

Table 14 Market for Communication Technology, By PROFIBUS, 2014–2023 (USD Million)

Table 15 Market for Communication Technology, By Others, 2014–2023 (USD Million)

Table 16 Market for Communication Technology, By Wireless, 2014–2023 (USD Million)

Table 17 Market for Communication Technology, By Wireless LAN, 2014–2023 (USD Million)

Table 18 Market for Communication Technology, By ZigBee, 2014–2023 (USD Million)

Table 19 Market for Communication Technology, By Cellular, 2014–2023 (USD Million)

Table 20 Market, By Sector, 2014–2023 (USD Million)

Table 21 Market for Transmission, By Industry, 2014–2023 (USD Million)

Table 22 Market for Transmission, By Communication Technology, 2014–2023 (USD Million)

Table 23 Market for Distribution, By Industry, 2014–2023 (USD Million)

Table 24 Market for Distribution, By Communication Technology, 2014–2023 (USD Million)

Table 25 Market, By Industry, 2014–2023 (USD Million)

Table 26 Market for Oil & Gas, By Communication Technology, 2014–2023 (USD Million)

Table 27 Market for Oil & Gas, By Sector, 2014–2023 (USD Million)

Table 28 Market for Steel, By Communication Technology, 2014–2023 (USD Million)

Table 29 Market for Steel, By Sector, 2014–2023 (USD Million)

Table 30 Market for Utility, By Communication Technology, 2014–2023 (USD Million)

Table 31 Market for Utility, By Sector, 2014–2023 (USD Million)

Table 32 Market for Utility, By Non-Renewable, 2014–2023 (USD Million)

Table 33 Market for Utility, By Renewable, 2014–2023 (USD Million)

Table 34 Market for Mining, By Communication Technology, 2014–2023 (USD Million)

Table 35 Market for Mining, By Sector, 2014–2023 (USD Million)

Table 36 Market for Transportation, By Communication Technology, 2014–2023 (USD Million)

Table 37 Market for Transportation, By Sector, 2014–2023 (USD Million)

Table 38 Market, By Region, 2014–2023 (USD Million)

Table 39 Market in APAC, By Country/Region, 2014–2023 (USD Million)

Table 40 Market in APAC, By Industry, 2014–2023 (USD Million)

Table 41 Market in China, By Industry, 2014–2023 (USD Million)

Table 42 Market in India, By Industry, 2014–2023 (USD Million)

Table 43 Market in Japan, By Industry, 2014–2023 (USD Million)

Table 44 Market in Rest of APAC, By Industry, 2014–2023 (USD Million)

Table 45 Market in North America, By Country, 2014–2023 (USD Million)

Table 46 Market in North America, By Industry, 2014–2023 (USD Million)

Table 47 Market in US, By Industry, 2014–2023 (USD Million)

Table 48 Market in Canada, By Industry, 2014–2023 (USD Million)

Table 49 Market in Mexico, By Industry, 2014–2023 (USD Million)

Table 50 Market in Europe, By Country/Region, 2014–2023 (USD Million)

Table 51 Market in Europe, By Industry, 2014–2023 (USD Million)

Table 52 Market in UK, By Industry, 2014–2023 (USD Million)

Table 53 Market in France, By Industry, 2014–2023 (USD Million)

Table 54 Market in Germany, By Industry, 2014–2023 (USD Million)

Table 55 Market in Rest of Europe, By Industry, 2014–2023 (USD Million)

Table 56 Market in RoW, By Region, 2014–2023 (USD Million)

Table 57 Market in RoW, By Industry, 2014–2023 (USD Million)

Table 58 Market in Middle East, By Industry, 2014–2023 (USD Million)

Table 59 Market in Africa, By Industry, 2014–2023 (USD Million)

Table 60 Market in South America, By Industry, 2014–2023 (USD Million)

Table 61 Top 5 Players in the Market, 2016

Table 62 10 Most Recent Product Launches and Developments in Market

Table 63 5 Most Recent Acquisitions, Partnerships, Agreements, and Contracts in Market

List of Figures (52 Figures)

Figure 1 Market Segmentation

Figure 2 Research Design

Figure 3 Research Flow of Market Size Estimation

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Assumptions of the Research Study

Figure 8 Utility Industry to Hold Largest Share of Substation Monitoring System Market During Forecast Period

Figure 9 Hardware to Hold Largest Share of Market During Forecast Period

Figure 10 Transmission to Hold Largest Share of Market During Forecast Period

Figure 11 Oil & Gas Expected to Be Fastest Growing Industry in Market During Forecast Period

Figure 12 APAC to Be Fastest-Growing Region in Market During Forecast Period

Figure 13 Growing Demand for Reduction in Transmission and Distribution Losses to Drive Growth of Market

Figure 14 Wired Communication Technology to Lead Market During Forecast Period

Figure 15 Utility and APAC Expected to Hold Largest Share of Market By 2023

Figure 16 China Expected to Witness Highest CAGR in Market in APAC By 2023

Figure 17 Market in Canada is Expected to Grow at Highest CAGR During Forecast Period

Figure 18 Utility Expected to Hold Largest Share in Market During Forecast Period

Figure 19 Value Chain Analysis: Major Value is Added During Manufacturing and Transmission Phases

Figure 20 Hardware Held Largest Share of Market for Component in 2016

Figure 21 IEDs Expected to Grow at Highest CAGR in Market for Hardware During Forecast Period

Figure 22 Distribution Network Feeders Application

Figure 23 Microcontrollers

Figure 24 Asset Management Expected to Grow at Highest Rate in Market for Software During Forecast Period

Figure 25 Substation Monitoring System Configuration, By Communication Technology

Figure 26 Market for Wireless Communication Technology Expected to Grow at Higher CAGR During Forecast Period

Figure 27 PROFIBUS Expected to Grow at A Higher CAGR in Market for Wired Communication Technology During Forecast Period

Figure 28 Wireless LAN Expected to Grow at Higher CAGR in Market for Wireless Communication Technology During Forecast Period

Figure 29 Market for Distribution Sector Expected to Grow at Higher CAGR During Forecast Period

Figure 30 Oil & Gas Industry Expected to Grow at Highest CAGR in Market for Transmission Between 2017 and 2023

Figure 31 Market for Oil & Gas Industry Based on Distribution Sector Expected to Grow at the Highest Rate During the Forecast Period

Figure 32 Market, By Industry

Figure 33 Oil & Gas Industry Expected to Grow at Highest CAGR in Market During Forecast Period

Figure 34 Coal Held Largest Share of Market for Utility Industry Based on Non-Renewable in 2016

Figure 35 Solar Expected to Grow at Highest CAGR in Market for Utility Industry Based on Renewable During Forecast Period

Figure 36 Market, By Geography

Figure 37 Snapshot of Market in APAC

Figure 38 Snapshot of Market in North America

Figure 39 Snapshot of Market in Europe

Figure 40 Snapshot of Market in RoW

Figure 41 Companies in Market Adopted Product Launches as Key Growth Strategy Between January 2013 and May 2017

Figure 42 Market: Evaluation Framework

Figure 43 Battle for Market Share

Figure 44 ABB: Company Snapshot

Figure 45 Siemens: Company Snapshot

Figure 46 General Electric: Company Snapshot

Figure 47 Schneider Electric: Company Snapshot

Figure 48 Cisco: Company Snapshot

Figure 49 Honeywell : Company Snapshot

Figure 50 Emerson Electric: Company Snapshot

Figure 51 Eaton: Company Snapshot

Figure 52 Crompton Greaves: Company Snapshot

The substation monitoring system market is likely to witness high growth in the coming years, owing to the growing demand for reduction in transmission and distribution losses, aging infrastructure, Increasing investments (contracts) from the government, developing IEC 61850 standard to enable interoperability between IEDs, and improving IoT-based communication network. The substation monitoring system market was valued at USD 3.03 Billion in 2016 and is expected to reach USD 5.21 Billion by 2023, at a growing CAGR of 7.8% during the forecast period. The base year considered for the study is 2016 and the forecast period is between 2017 and 2023. The objective of the report is to provide a detailed analysis of the market based on component, communication technology, sector, industry, and region. The report provides detailed information on the major factors influencing the growth of the market. Moreover, the report provides a detailed overview of the value chain of the substation monitoring system market.

The research methodology used to estimate and forecast the substation monitoring system market begins with obtaining data through secondary research such as Automation World, Electric Energy Online, IEEE, and the newsletters and whitepapers of the leading players in this market. Moreover, the offerings of the substation monitoring system providers have been taken into consideration to determine the market segmentation. The bottom-up procedure has been employed to arrive at the overall size of the substation monitoring system market from the revenue of key players. After arriving at the overall market size, the total market has been split into several segments and subsegments, which have then been verified through primary research by conducting extensive interviews with officials holding key positions in this market, such as CEOs, VPs, directors, and executives. The market breakdown and data triangulation procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The breakdown of the profiles of primaries has been depicted in the following figure:

To know about the assumptions considered for the study, download the pdf brochure

The players offering substation monitoring system are ABB (Switzerland), Honeywell (US), Siemens (Germany), Schneider Electric (France), Emerson Electric (US), General Electric (US), Eaton (Ireland), Schweitzer Engineering Laboratories (US), NovaTech (UK), and Crompton Greaves (India).

Target Audience of the Report:

- Raw material and manufacturing equipment suppliers

- Electronic design automation (EDA) and design tool vendors

- Component manufacturers

- Original equipment manufacturers (OEMs)

- Integrated device manufacturers (IDMs)

- Original design manufacturers (ODMs)

- Technology, service, and solution providers

- Suppliers and distributors

- System integrators

- Government and other regulatory bodies

- Technology investors

- Research institutes and organizations

- Market research and consulting firms

This study answers several questions for the stakeholders, primarily regarding the market segments to focus on in the next two to five years for prioritizing efforts and investments.

Scope of the Report:

This research report categorizes the overall substation monitoring system market, based on component, communication technology, sector, industry, and region.

Substation Monitoring System Market, by Component

-

Hardware

- Distribution Network Feeders

- Smart Sensors

- Microcontrollers

- Cameras

-

Intelligent Electronic Devices (IEDs)

- Transformers

- Relay Devices

- Controllers

- Circuit Breakers

- Switches

-

Software

- Asset Management

- Production Management

- Performance Management

Substation Monitoring System Market, by Communication Technology

-

Wired

- Fiber Optic

- Ethernet

- PROFIBUS

- Others (Fieldbus, HART, Modbus)

-

Wireless

- Wireless LAN

- Cellular

- ZigBee

Substation Monitoring System Market, by Sector

- Transmission

- Distribution

Substation Monitoring System Market, by Industry

- Oil & Gas

- Steel

-

Utility

-

Non-Renewable

- Coal

- Crude Oil

- Natural Gas

- Nuclear

-

Renewable

- Solar

- Wind

- Water

- Others (Biofuels and Geothermal)

-

Non-Renewable

- Mining

- Transportation

Substation Monitoring System Market, by Geography

- Asia Pacific (APAC)

- North America

- Europe

- Rest of the World (ROW)

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the companies’ specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players on the basis of various blocks of the value chain

Maintenance and Repairing Services

- Further breakdown of market by maintenance and repairing services

Country-wise Breakup in RoW

- Country-wise split of RoW in the substation monitoring system market

Growth opportunities and latent adjacency in Substation Monitoring System Market