Power Grid System Market in Subsea by Component (Cables, Variable Speed Drives, Transformers, Switchgears), Application (Captive Generation, Wind Power), Depth (Shallow Water and Deepwater) and Region - Global Forecast to 2027

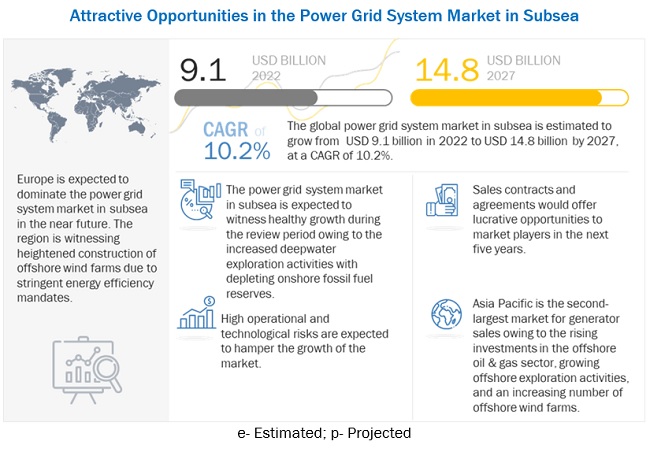

The global power grid system market in subsea in terms of revenue was estimated to be worth $9.1 billion in 2022 and is poised to reach $14.8 billion by 2027, growing at a CAGR of 10.2% from 2022 to 2027.

Beneficial government initiatives for offshore renewable power generation along with pressing urgency to reduce carbon emissions and improve grid reliability and efficiency is expected to propel the demand for subsea power grid systems. Furthermore, easy access to new wind turbine technology in offshore locations are expected to offer lucrative opportunities for the power grid system market in subsea during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Power grid system market in subsea

COVID-19 has unleashed a devastating blow to the global economy and the energy sector, disrupting supply chains while choking off demand. The COVID-19 pandemic has not only affected the healthcare sector worldwide but also impacted the global economy. It has had a substantial economic impact on various industrial sectors, such as manufacturing, power generation, renewables, nuclear, and oil & gas.

In August 2021, the US, Canada, and countries of Western Europe experienced relief from the pandemic. This progress was achieved by the continuous rollout of vaccines in these countries. Nevertheless, although vaccines have proved highly effective at preventing this severe disease in the West European countries, countries including the UK, Israel, and the US have been experiencing shortcomings in the ability of the vaccine to prevent infection from the new variants.

The outbreak and widespread of the COVID-19 pandemic have adversely affected power plant-related investments and construction globally. Also, the demand for subsea power grid systems has been reduced. Governments across the world have been compelled to reduce business activities to minimize the spread of COVID-19. Companies across different regions had to shut down their manufacturing facilities and services as partial or full lockdowns have been imposed in different countries to contain the spread of the virus. This resulted in increased procurement costs of raw materials owing to the shortage of raw material supply, which led to delays in order fulfillment. Thus, the pandemic has an adverse impact on the power grid system market in subsea in the short term.

Power grid system market in subsea Dynamics

Driver: Increased deepwater oil and gas exploration activities due to depleting onshore fossil fuel reserves

Unprecedented advancements in technologies used in deepwater exploration and production (E&P) activities, depleting onshore fossil fuel reserves, and the commercial viability of offshore projects are the major factors encouraging E&P operators for deepwater exploration. According to the Oil & Gas Journal, in February 2022, over the last 12 months, operators have disclosed deepwater finds in the Gulf of Mexico. Additionally, discoveries of offshore oil deposits such as the Liza field in Guyana, the Kutch Basin in India, and Tupi offshore oil field in Brazil signify the future oil production opportunities in offshore fields, thereby creating power grid requirement to transport electricity and supply power to subsea and offshore production facilities.

According to the BP Statistical Review of 2021, the top countries with the most untapped oil reserves include the US, Saudi Arabia, and Russia. Discoveries of such reserves will lead to increased well drilling and production activities. This will support the growth of the power grid system market in subsea. Moreover, regions that have high energy demand, such as Asia Pacific, are planning to augment their offshore production. Countries such as India and China, which have offshore oil and gas basins in the Indian Ocean and the South China Sea, respectively, have huge potential for offshore oil and gas exploration. Apart from the Asia Pacific region, major discoveries are being made in the offshore region of Africa, especially in western Africa. All these factors are likely to drive the market for power grid systems in subsea.

Moreover, Venezuela is the potential offshore market for oil exploration, with almost 300 billion barrels of oil reserves globally by the end of 2021. The list of potential oil reserves is mentioned below.

Restraint: High operational and technological risks

The high initial investment for commissioning a subsea power grid system and the associated maintenance costs are very high, preventing new players from entering the market. The cost of installing subsea components, including cables, transformers, and switchgears, also depends on factors such as the nature of the seabed, the depth of the site, the number of landings, as well as voltage requirements. For instance, the estimated cost for an undersea cable system could be around USD 2.0 million to 6.8 million per kilometer. The power grid system market in subsea has not only steep entry barriers but also stiff competition, excessive delays, and other difficulties, resulting in increased ownership and maintenance costs that small and medium-sized enterprises (SMEs) cannot afford. There are only a handful of players that hold a major share of the global market.

The high entry barrier is also attributed to the time involved in building these systems (3–4 years) and completion (average time to upgrade completion is 6–12 months). The investment required for new subsea power grid systems is significantly higher than upgrading the existing systems. All these factors are restraining the growth of the power grids system market in subsea.

Opportunities: Easy access of wind turbine technology to offshore locations

Unlike conventional offshore wind turbines, which have long towers sunk into the seabed and bolted into place in shallow seas 60–160 feet, floating turbines can access vast swaths of outlying ocean waters, up to half a mile deep, where the world's strongest and most consistent winds blow. For instance, Europe, where the density of onshore and near-shore wind turbines in places such as Germany, the United Kingdom, and Norway, has spurred rising opposition to new arrays, floating turbines can be deployed above the horizon, out of sight of coastal occupants.

Moreover, the ocean region beyond the reach of conventional offshore turbines makes up 80% of the world's maritime waterways, allowing for floating arrays. This technology has grown in the last five years. The farms are expected to expand in size to demonstrate their viability and feasibility to governments and large-scale investors.

Challenges: Low cost of onshore electricity generation

Even without financial support and with declining oil prices, the cost of electricity generation from onshore wind power plants, geothermal and hydropower plants, and biomass power plants is equivalent to or lower than the cost of power generation from coal-, gas-, and diesel-powered plants. Moreover, the cost of electricity produced by land-based wind turbines and solar PVs has gone down, and it is more economical to generate electricity using solar and wind energy than other renewable sources across the world. Additionally, the cost of producing electricity from conventional resources, including coal, gas, and diesel, is quite lower than the power generation within offshore oil and gas production plants. All these factors are likely to negatively impact the offshore market and, subsequently, the power grid system market in subsea

The variable speed drives segment, by component, is expected to be the second-largest power grid system market in subsea during the forecast period

On the basis of component, the power grid system market in subsea been broadly classified not cables, transformers, switchgears, variable speed drives, and others. The variable speed drives segment, by component, is expected to be the second-largest market in subsea during the forecast period. Subsea VSDs can accommodate a wide variety of power and voltage demands such as high-power requirements for applications such as booster and injection pumps, wet and dry gas compressors, as well as smaller power applications, such as submersible and scrubber pumps. The installation of subsea VSD systems also helps reduce the cabling cost from the offshore platform to the oil & gas processing plant wherein equipment is placed. These factors are expected to fuel the demand for subsea variable speed drives during the forecast period.

The shallow water segment is expected to emerge as the largest marketduring the forecast period on based on depth

The power grid system market in subsea, by depth, has been segmented into shallow water and deep-water. The shallow water segment is expected to dominate the market in subsea as major oil and gas exploration and production activities are performed in shallow waters. Asia Pacific is estimated to lead the market in subsea for the shallow water segment during the review period, followed by the Middle East, as most offshore oil and gas production is limited to shallow water in these regions.

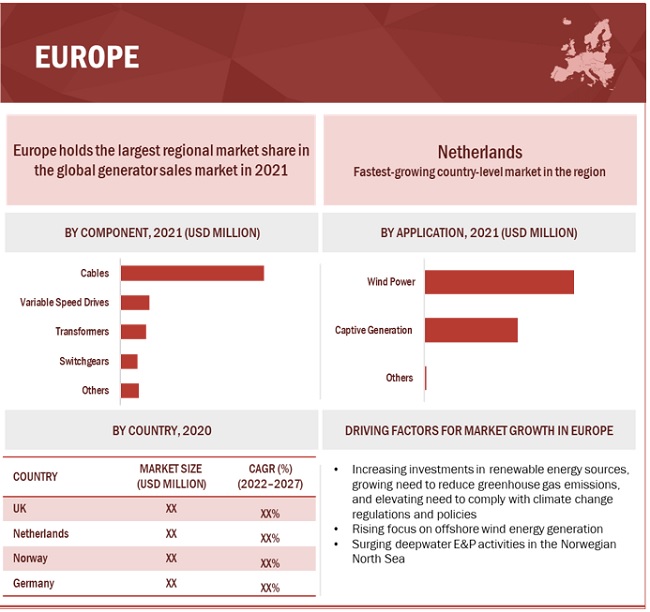

Europe is expected to account for the largest market size during the forecast period.

The power grid system market in subsea has been analyzed for 5 regions, namely Asia Pacific, North America, Europe, Middle East & Africa, South America. Europe is expected to dominate the global market in subsea between 2022–2027, followed by Asia Pacific and North America. Europe and Asia Pacific are the major contributors to the global market in subsea owing to the strong demand for renewable energy sources and favourable government policies in these regions. Most countries in Europe are mainly focusing on renewable energy capacity addition. Countries such as Germany, the UK, the Netherlands, and Norway are leading the renewable energy capacity addition. The growth of the market in subsea is supported by the European Wind Initiative (EWI), a wind energy R&D program developed to take the wind industry to the next level in Europe.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The power grid system market in subsea is dominated by a few major players that have a wide regional presence. The major players in the market in subsea are Prysmian Group (Italy), Nexans (France), TechnipFMC (UK), General Electric (US) Baker Hughes (US), ABB (Switzerland), and Siemens Energy (Germany). Between 2018 and 2022, the companies adopted growth strategies such as sales contracts and agreements to capture a larger share of the power grid system market in subsea. Some of the other major players include Schlumberger (US), Aker Solutions ASA (Norway), Hitachi Energy (Switzerland), Oceaneering International (US), NKT (Denmark), LS Cable & System (South Korea), ZTT (China), Sumitomo Electric Industries, Ltd. (Japan), TE Connectivity (Switzerland), Schneider Electric (France), Apar Industries (India) and Intertek Group (UK) among others.

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2020–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Component, Application, and Depth |

|

Geographies covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies covered |

ABB (Switzerland), TechnipFMC (UK), General Electric (US), Siemens Energy (Germany), Baker Hughes (US), Prysmian Group (Italy), Nexans (France), Schlumberger (US), Aker Solutions ASA (Norway), Hitachi Energy (Switzerland), DEME (Denmark), SSG Cable (China), Oceaneering International (US), NKT (Denmark), LS Cable & System (South Korea), ZTT (China), Sumitomo Electric Industries, Ltd. (Japan), TE Connectivity (Switzerland), Intertek Group (UK), Teledyne Marine (US), J+S Subsea (UK), Furukawa Electric Co., Ltd. (Japan), Schneider Electric (France), Deep C (Norway), and Apar Industries (India). |

This research report categorizes the power grid system market in subsea by component, application, depth and region

On the basis of component:

- Cables

- Variable Speed Drives

- Transformers

- Switchgears

- Others (connectors, actuators, sensors, and penetrators)

On the basis of application:

- Captive Generation

- Wind Power

- Others (tidal power, solar power and diesel & gas based floating power plants)

On the basis of by depth:

- Shallow Water

- Deepwater

On the basis of region:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In January 2022, TechnipFMC was awarded a subsea EPCI contract by Petrobras for its Búzios 6 field (module 7), greenfield development in the pre-salt area. The contract covered the provision of flexible and rigid pipes, umbilicals, pipeline end terminals, rigid jumpers, umbilical termination assemblies and a mooring system.

- In January 2022, Nexans received a contract under the frame agreement to manufacture approximately 110 km of high-voltage subsea cables to South Fork Wind, a joint venture between Ørsted and Eversource. The three-phase 138 kV high-voltage alternative current (HVAC) subsea export cables will be integrated with two fiber-optic cables and transmit 132 MW of electricity to Long Island, New York.

- In February 2022, Prysmian Group plans on opening a new submarine power cable plant in Brayton Point site, Massachusetts, US. The new plant will allow the company to provide support to customers in US.

- In February 2022, ABB entered into an agreement with OneSubsea to support its subsea multiphase compression system for Shell’s Ormen Lange field. According to this agreement, ABB is expected to supply variable-speed drives and subsea transformers to power subsea compressors.

- In October 2021, Siemens Energy, together with Aker Solutions, won a contract for an offshore grid connection project in the US. The company will supply the high-voltage direct-current (HVDC) transmission system to bring green energy from Sunrise Wind, a utility-scale offshore wind project, to the mainland.

- In August 2021, GE Renewable Energy, a subsidiary of General Electric (GE), and PKN ORLEN signed an agreement to develop offshore wind projects in Poland jointly.

- In September 2019, Baker Hughes and Ocean Installer AS won a subsea contract for the engineering, procurement, construction, and installation (EPCI) of subsea systems and associated services by Vår Energi AS for the Balder X project on the Norwegian Continental Shelf (NCS). Under the contract, the companies delivered and installed 16 new subsea production systems (SPS), umbilicals, risers, and flowlines to the Jotun A floating production storage and offloading (FPSO) unit.

Frequently Asked Questions (FAQ):

What is the current size of the power grid system market in subsea?

The current market size of global power grid system market in subsea is USD 7.4 billion in 2021.

What is the major drivers for power grid system market in subsea?

The global power grid system market in subsea is driven by Increased deepwater oil and gas exploration activities due to depleting onshore fossil fuel reserves Favorable government policies for offshore renewable power production, especially using wind energy The rapidly expanding manufacturing sector is also fueling demand for subsea power grid system.

Which is the largest regional market during the forecasted period in power grid system market in subsea?

Europe is the largest regional market during the forecasted period. Countries such as Norway, the UK, and the Netherlands are witnessing heightened construction of offshore wind farms due to stringent energy efficiency mandates, and the strong focus of most European countries on utilizing renewable energy sources for power generation propels European market growth.

Which is the fastest-growing segment, by depth during the forecasted period in power grid system market in subsea?

The deepwater segment of the power grid system market in subsea is expected to witness the highest CAGR during the forecast period The depletion of shallow water reserves (maturing shallow water basins) has made E&P companies shift their focus on deepwater areas. Deepwater activities would continue to be a key avenue for oil production and, thus, it would generate substantial demand for power grid system market in subsea. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.2.1 POWER GRID SYSTEM MARKET IN SUBSEA, BY COMPONENT: INCLUSIONS & EXCLUSIONS

1.2.2 MARKET IN SUBSEA, BY APPLICATION: INCLUSIONS & EXCLUSIONS

1.2.3 MARKET IN SUBSEA, BY DEPTH: INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET IN SUBSEA SEGMENTATION

1.3.2 REGIONAL SCOPE

1.4 YEARS CONSIDERED

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

FIGURE 1 POWER GRID SYSTEM MARKET IN SUBSEA: RESEARCH DESIGN

2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION METHODOLOGY

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Key data from primary sources

2.2.2.2 Breakdown of primaries

FIGURE 3 BREAKDOWN OF PRIMARIES

2.3 IMPACT OF COVID-19

2.4 MARKET SIZE ESTIMATION

2.4.1 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.4.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4.3 DEMAND-SIDE ANALYSIS

FIGURE 6 MAIN METRICS CONSIDERED WHILE ANALYZING AND ASSESSING DEMAND FOR SUBSEA POWER GRID SYSTEMS

2.4.3.1 Demand-side calculation

2.4.3.2 Assumptions for demand-side analysis

2.4.4 SUPPLY-SIDE ANALYSIS

FIGURE 7 MAIN METRICS CONSIDERED IN ASSESSING SUPPLY FOR SUBSEA POWER GRID SYSTEMS

FIGURE 8 POWER GRID SYSTEM MARKET IN SUBSEA: SUPPLY-SIDE ANALYSIS

2.4.4.1 Supply-side calculation

2.4.4.2 Assumptions for supply side

2.4.5 FORECAST

3 EXECUTIVE SUMMARY (Page No. - 40)

TABLE 1 POWER GRID SYSTEM MARKET IN SUBSEA SNAPSHOT

FIGURE 9 EUROPE DOMINATED MARKET IN SUBSEA IN 2021

FIGURE 10 CABLES SEGMENT TO HOLD LARGEST SHARE OF MARKET IN SUBSEA, BY COMPONENT, DURING FORECAST PERIOD

FIGURE 11 CAPTIVE GENERATION SEGMENT TO ACCOUNT FOR LARGEST SHARE OF MARKET IN 2027

FIGURE 12 DEEPWATER SEGMENT TO WITNESS HIGHER GROWTH RATE IN MARKET IN SUBSEA, BY DEPTH, DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 44)

4.1 ATTRACTIVE OPPORTUNITIES IN POWER GRID SYSTEM MARKET IN SUBSEA

FIGURE 13 INCREASING DEEPWATER EXPLORATION DUE TO DEPLETING ONSHORE FOSSIL FUEL RESERVES TO DRIVE MARKET IN SUBSEA, 2022–2027

4.2 MARKET IN SUBSEA, BY REGION

FIGURE 14 NORTH AMERICAN MARKET IN SUBSEA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4.3 EUROPEAN MARKET IN SUBSEA, BY APPLICATION AND COUNTRY

FIGURE 15 WIND POWER SEGMENT AND UK DOMINATED MARKET IN SUBSEA, BY APPLICATION AND COUNTRY, RESPECTIVELY, IN 2021

4.4 MARKET IN SUBSEA, BY DEPTH

FIGURE 16 SHALLOW WATER SEGMENT TO ACCOUNT FOR LARGER SHARE THAN DEEPWATER SEGMENT IN 2027

4.5 MARKET IN SUBSEA, BY COMPONENT

FIGURE 17 CABLES SEGMENT TO ACCOUNT FOR LARGER SHARE IN 2027

4.6 MARKET IN SUBSEA, BY APPLICATION

FIGURE 18 CAPTIVE GENERATION SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2027

5 MARKET OVERVIEW (Page No. - 48)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 POWER GRID SYSTEM MARKET IN SUBSEA: MARKET DRIVERS

5.2.1 DRIVERS

5.2.1.1 Increased deepwater oil and gas exploration activities due to depleting onshore fossil fuel reserves

TABLE 2 OIL RESERVES (BILLION BARRELS), BY COUNTRY, 2021

5.2.1.2 Favorable government policies for offshore renewable power production, especially using wind energy

FIGURE 20 GLOBAL ENERGY SUPPLY INVESTMENT, BY SECTOR, 2019–2021

FIGURE 21 NEW WIND POWER INSTALLATIONS, 2020

FIGURE 22 GROWTH OF WIND POWER CAPACITY FROM 2021 TO 2025, BY REGION (MW)

5.2.1.3 Urgent need to reduce carbon emissions and improve grid reliability and efficiency

5.2.2 RESTRAINTS

5.2.2.1 High operational and technological risks

5.2.2.2 Greater energy losses witnessed during long-distance power transmission

5.2.3 OPPORTUNITIES

5.2.3.1 Potential of tidal energy to meet subsea power requirements

5.2.3.2 Easy access of wind turbine technology to offshore locations

5.2.4 CHALLENGES

5.2.4.1 Shortage of technical professionals in subsea industry

5.2.4.2 Low cost of onshore electricity generation

5.2.4.3 Climatic challenges pertaining to operations of offshore wind farms

5.3 SUPPLY CHAIN ANALYSIS

FIGURE 23 POWER GRID SYSTEM MARKET IN SUBSEA: SUPPLY CHAIN ANALYSIS

5.3.1 GRID MANUFACTURER

5.3.2 GRID INFRASTRUCTURE INSTALLER

5.3.3 END USER

5.4 PORTER’S FIVE FORCES ANALYSIS

FIGURE 24 MARKET IN SUBSEA: PORTER’S FIVE FORCES ANALYSIS

TABLE 3 MARKET IN SUBSEA: PORTER’S FIVE FORCES ANALYSIS

5.4.1 THREAT OF NEW ENTRANTS

5.4.2 BARGAINING POWER OF SUPPLIERS

5.4.3 BARGAINING POWER OF BUYERS

5.4.4 THREAT OF SUBSTITUTES

5.4.5 DEGREE OF COMPETITION

5.5 PATENT ANALYSIS

TABLE 4 PATENTS RELATED TO OFFSHORE WIND AND OIL & GAS

6 POWER GRID SYSTEM MARKET IN SUBSEA, BY COMPONENT (Page No. - 59)

6.1 INTRODUCTION

FIGURE 25 MARKET IN SUBSEA, BY COMPONENT, 2021

TABLE 5 MARKET IN SUBSEA, BY COMPONENT, 2020–2027 (USD MILLION)

6.2 CABLES

6.2.1 RISE IN DEMAND FROM OFFSHORE WIND AND OIL & GAS INDUSTRIES TO BOOST GROWTH OF MARKET FOR CABLES

TABLE 6 CABLES: MARKET IN SUBSEA, BY REGION, 2020–2027 (USD MILLION)

6.3 VARIABLE SPEED DRIVES

6.3.1 REDUCTION IN CABLING COST TO DRIVE GROWTH OF MARKET FOR VARIABLE SPEED DRIVES DURING FORECAST PERIOD

TABLE 7 VARIABLE SPEED DRIVES: MARKET IN SUBSEA, BY REGION, 2020–2027 (USD MILLION)

6.4 TRANSFORMERS

6.4.1 GROWTH IN OFFSHORE OIL & GAS EXPLORATION AND PRODUCTION ACTIVITIES TO BOOST MARKET GROWTH IN COMING YEARS

TABLE 8 TRANSFORMERS: MARKET IN SUBSEA, BY REGION, 2020–2027 (USD MILLION)

6.5 SWITCHGEARS

6.5.1 NEED FOR SAFE, EFFICIENT, AND RELIABLE POWER SUPPLY TO ACCELERATE CREATES DEMAND FOR SWITCHGEARS

TABLE 9 SWITCHGEARS: MARKET IN SUBSEA, BY REGION, 2020–2027 (USD MILLION)

6.6 OTHERS

TABLE 10 OTHERS: MARKET IN SUBSEA, BY REGION, 2020–2027 (USD MILLION)

7 POWER GRID SYSTEM MARKET IN SUBSEA, BY APPLICATION (Page No. - 66)

7.1 INTRODUCTION

FIGURE 26 MARKET IN SUBSEA, BY APPLICATION, 2021

TABLE 11 MARKET IN SUBSEA, BY APPLICATION, 2020–2027 (USD MILLION)

7.2 WIND POWER

7.2.1 SURGING USE OF SUBSEA POWER CABLES FOR LONG-DISTANCE POWER TRANSMISSION BY OFFSHORE WIND POWER GENERATION PLANTS

TABLE 12 WIND POWER: MARKET IN SUBSEA, BY REGION, 2020–2027 (USD MILLION)

7.3 CAPTIVE GENERATION

7.3.1 INCREASING SUBSEA OPERATIONS AND RISING NUMBER OF DEEPWATER DRILLING ACTIVITIES ACCELERATE DEMAND FOR SUBSEA POWER GRID SYSTEMS

TABLE 13 CAPTIVE GENERATION: MARKET IN SUBSEA, BY REGION, 2020–2027 (USD MILLION)

7.4 OTHERS

TABLE 14 OTHERS: MARKET IN SUBSEA, BY REGION, 2020–2027 (USD MILLION)

8 POWER GRID SYSTEM MARKET IN SUBSEA, BY DEPTH (Page No. - 72)

8.1 INTRODUCTION

FIGURE 27 MARKET IN SUBSEA, BY DEPTH, 2021

TABLE 15 MARKET IN SUBSEA, BY DEPTH, 2020–2027 (USD MILLION)

8.2 SHALLOW WATER

8.2.1 LOWER COSTS ASSOCIATED WITH SHALLOW WATER PROJECTS THAN DEEPWATER PROJECTS TO DRIVE MARKET GROWTH

TABLE 16 SHALLOW WATER: MARKET IN SUBSEA, BY REGION, 2020–2027 (USD MILLION)

8.3 DEEPWATER

8.3.1 INCREASING OFFSHORE OIL AND GAS EXPLORATION AND PRODUCTION ACTIVITIES IN DEEPWATER TO DRIVE MARKET GROWTH

TABLE 17 DEEPWATER: MARKET IN SUBSEA, BY REGION, 2020–2027 (USD MILLION)

9 POWER GRID SYSTEM MARKET IN SUBSEA, BY REGION (Page No. - 75)

9.1 INTRODUCTION

FIGURE 28 NORTH AMERICA TO REGISTER HIGHEST CAGR IN MARKET IN SUBSEA DURING FORECAST PERIOD

FIGURE 29 REGION-WISE SHARE ANALYSIS OF MARKET IN SUBSEA,2021

TABLE 18 MARKET IN SUBSEA, BY REGION, 2020–2027 (USD MILLION)

9.2 EUROPE

FIGURE 30 SNAPSHOT: MARKET IN SUBSEA IN EUROPE

9.2.1 BY COMPONENT

TABLE 19 EUROPE: MARKET IN SUBSEA, BY COMPONENT, 2020–2027 (USD MILLION)

9.2.2 BY APPLICATION

TABLE 20 EUROPE: MARKET IN SUBSEA, BY APPLICATION, 2020–2027 (USD MILLION)

9.2.3 BY DEPTH

TABLE 21 EUROPE: MARKET IN SUBSEA, BY DEPTH, 2020–2027 (USD MILLION)

9.2.4 BY COUNTRY

TABLE 22 EUROPE: MARKET IN SUBSEA, BY COUNTRY, 2020–2027 (USD MILLION)

9.2.4.1 Germany

9.2.4.1.1 Government initiatives to expand offshore wind power capacity to boost market growth

TABLE 23 GERMANY: MARKET IN SUBSEA, BY APPLICATION, 2020–2027 (USD MILLION)

9.2.4.2 Russia

9.2.4.2.1 New offshore drilling activities to accelerate market growth

TABLE 24 RUSSIA: MARKET IN SUBSEA, BY APPLICATION, 2020–2027 (USD MILLION)

9.2.4.3 Norway

9.2.4.3.1 Increase in deepwater oil & gas exploration activities in Norwegian Continental Shelf fuels market growth

TABLE 25 NORWAY: MARKET IN SUBSEA, BY APPLICATION, 2020–2027 (USD MILLION)

9.2.4.4 UK

9.2.4.4.1 Government focus on increasing offshore wind capacity to spur demand for subsea power grid systems

TABLE 26 UK: MARKET IN SUBSEA, BY APPLICATION, 2020–2027 (USD MILLION)

9.2.4.5 Netherlands

9.2.4.5.1 Huge investments in offshore wind projects to promote market growth

TABLE 27 NETHERLANDS: MARKET IN SUBSEA, BY APPLICATION, 2020–2027 (USD MILLION)

9.2.4.6 Denmark

9.2.4.6.1 Significant investments in offshore wind industry to push market growth

TABLE 28 DENMARK: MARKET IN SUBSEA, BY APPLICATION, 2020–2027 (USD MILLION)

9.2.4.7 Rest of Europe

TABLE 29 REST OF EUROPE: MARKET IN SUBSEA, BY APPLICATION, 2020–2027 (USD MILLION)

9.3 ASIA PACIFIC

FIGURE 31 SNAPSHOT: MARKET IN SUBSEA IN ASIA PACIFIC

9.3.1 BY COMPONENT

TABLE 30 ASIA PACIFIC: MARKET IN SUBSEA, BY COMPONENT, 2020–2027 (USD MILLION)

9.3.2 BY APPLICATION

TABLE 31 ASIA PACIFIC: MARKET IN SUBSEA, BY APPLICATION, 2020–2027 (USD MILLION)

9.3.3 BY DEPTH

TABLE 32 ASIA PACIFIC: MARKET IN SUBSEA, BY DEPTH, 2020–2027 (USD MILLION)

9.3.4 BY COUNTRY

TABLE 33 ASIA PACIFIC: MARKET IN SUBSEA, BY COUNTRY, 2020–2027 (USD MILLION)

9.3.4.1 China

9.3.4.1.1 Considerable investments in renewable energy projects and strong commitment toward decarbonization to stimulate market growth

TABLE 34 CHINA: MARKET IN SUBSEA, BY APPLICATION, 2020–2027 (USD MILLION)

9.3.4.2 India

9.3.4.2.1 Upcoming projects for offshore wind production are likely to drive market growth

TABLE 35 INDIA: MARKET IN SUBSEA, BY APPLICATION, 2020–2027 (USD MILLION)

9.3.4.3 Japan

9.3.4.3.1 Active participation of government in offshore wind production and promoting wind farm developers

TABLE 36 JAPAN: MARKET IN SUBSEA, BY APPLICATION, 2020–2027 (USD MILLION)

9.3.4.4 South Korea

9.3.4.4.1 Rise in offshore wind installations in South Korea to support market growth

TABLE 37 SOUTH KOREA: MARKET IN SUBSEA, BY APPLICATION, 2020–2027 (USD MILLION)

9.3.4.5 Taiwan

9.3.4.5.1 Elevated offshore energy requirements and thriving renewable energy industry to fuel market growth

TABLE 38 TAIWAN: MARKET IN SUBSEA, BY APPLICATION, 2020–2027 (USD MILLION)

9.3.4.6 Rest of Asia Pacific

TABLE 39 REST OF ASIA PACIFIC: MARKET IN SUBSEA, BY APPLICATION, 2020–2027 (USD MILLION)

9.4 NORTH AMERICA

9.4.1 BY COMPONENT

TABLE 40 NORTH AMERICA: MARKET IN SUBSEA, BY COMPONENT, 2020–2027 (USD MILLION)

9.4.2 BY APPLICATION

TABLE 41 NORTH AMERICA: MARKET IN SUBSEA, BY APPLICATION, 2020–2027 (USD MILLION)

9.4.3 BY DEPTH

TABLE 42 NORTH AMERICA: MARKET IN SUBSEA, BY DEPTH, 2020–2027 (USD MILLION)

9.4.4 BY COUNTRY

TABLE 43 NORTH AMERICA: MARKET IN SUBSEA, BY COUNTRY, 2020–2027 (USD MILLION)

9.4.4.1 US

9.4.4.1.1 Increasing number of offshore wind projects and growing need to improve oil and gas production output to surge requirement for subsea power grid systems

TABLE 44 US: MARKET IN SUBSEA, BY APPLICATION, 2020–2027 (USD MILLION)

9.4.4.2 Canada

9.4.4.2.1 Rising focus and growing investments in offshore wind projects to provide lucrative opportunities

TABLE 45 CANADA: MARKET IN SUBSEA, BY APPLICATION, 2020–2027 (USD MILLION)

9.4.4.3 Mexico

9.4.4.3.1 increasing CAPEX and investments toward offshore E&P activities and elevating energy requirements to boost demand for subsea power grid systems

TABLE 46 MEXICO: MARKET IN SUBSEA, BY APPLICATION, 2020–2027 (USD MILLION)

9.5 MIDDLE EAST & AFRICA

9.5.1 BY COMPONENT

TABLE 47 MIDDLE EAST & AFRICA: MARKET IN SUBSEA, BY COMPONENT, 2020–2027 (USD MILLION)

9.5.2 BY APPLICATION

TABLE 48 MIDDLE EAST & AFRICA: MARKET IN SUBSEA, BY APPLICATION, 2020–2027 (USD MILLION)

9.5.3 BY DEPTH

TABLE 49 MIDDLE EAST & AFRICA: MARKET IN SUBSEA, BY DEPTH, 2020–2027 (USD MILLION)

9.5.4 BY COUNTRY

TABLE 50 MIDDLE EAST & AFRICA: MARKET IN SUBSEA, BY COUNTRY, 2020–2027 (USD MILLION)

9.5.4.1 Saudi Arabia

9.5.4.1.1 Saudi Arabia to be fastest-growing market in MEA during forecast period

TABLE 51 SAUDI ARABIA: MARKET IN SUBSEA, BY APPLICATION, 2020–2027 (USD MILLION)

9.5.4.2 UAE

9.5.4.2.1 UAE to account for largest share of Middle Eastern & African market throughout forecast period

TABLE 52 UAE: MARKET IN SUBSEA, BY APPLICATION, 2020–2027 (USD MILLION)

9.5.4.3 Qatar

9.5.4.3.1 Country’s focus on offshore drilling activities is likely to propel growth of market in subsea

TABLE 53 QATAR: MARKET IN SUBSEA, BY APPLICATION, 2020–2027 (USD MILLION)

9.5.4.4 Rest of Middle East & Africa

TABLE 54 REST OF MIDDLE EAST & AFRICA: MARKET IN SUBSEA, BY APPLICATION, 2020–2027 (USD MILLION)

9.6 SOUTH AMERICA

9.6.1 BY COMPONENT

TABLE 55 SOUTH AMERICA: MARKET IN SUBSEA, BY COMPONENT, 2020–2027 (USD MILLION)

9.6.2 BY APPLICATION

TABLE 56 SOUTH AMERICA: MARKET IN SUBSEA, BY APPLICATION, 2020–2027 (USD MILLION)

9.6.3 BY DEPTH

TABLE 57 SOUTH AMERICA: MARKET IN SUBSEA, BY DEPTH, 2020–2027 (USD MILLION)

9.6.4 BY COUNTRY

TABLE 58 SOUTH AMERICA: MARKET IN SUBSEA, BY COUNTRY, 2020–2027 (USD MILLION)

9.6.4.1 Brazil

9.6.4.1.1 Direct investments by foreign companies in oil & gas projects and growing deepwater exploration activities to foster market growth

TABLE 59 BRAZIL: MARKET IN SUBSEA, BY APPLICATION, 2020–2027 (USD MILLION)

9.6.4.2 Argentina

9.6.4.2.1 Prime focus on offshore gas exploration and production activities and favorable government policies to support market growth

TABLE 60 ARGENTINA: MARKET IN SUBSEA, BY APPLICATION, 2020–2027 (USD MILLION)

9.6.4.3 Rest of South America

TABLE 61 REST OF SOUTH AMERICA: MARKET IN SUBSEA, BY APPLICATION, 2020–2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 111)

10.1 KEY PLAYERS STRATEGIES

TABLE 62 OVERVIEW OF KEY STRATEGIES ADOPTED BY TOP PLAYERS, JANUARY 2018–MARCH 2022

10.2 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS

TABLE 63 MARKET IN SUBSEA: DEGREE OF COMPETITION

FIGURE 32 MARKET IN SUBSEA: MARKET SHARE ANALYSIS, 2021

10.3 REVENUE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 33 REVENUE OF TOP PLAYERS IN MARKET IN SUBSEA FROM 2016 TO 2021

10.4 COMPANY EVALUATION QUADRANT

10.4.1 STAR

10.4.2 PERVASIVE

10.4.3 EMERGING LEADER

10.4.4 PARTICIPANT

FIGURE 34 COMPETITIVE LEADERSHIP MAPPING: MARKET IN SUBSEA, 2021

10.5 POWER GRID SYSTEM MARKET IN SUBSEA: COMPANY FOOTPRINT

TABLE 64 BY COMPONENT: COMPANY FOOTPRINT

TABLE 65 BY APPLICATION: COMPANY FOOTPRINT

TABLE 66 BY REGION: COMPANY FOOTPRINT

TABLE 67 COMPANY FOOTPRINT

10.6 COMPETITIVE SCENARIO

TABLE 68 MARKET IN SUBSEA: DEALS, MARCH 2021–FEBRUARY 2022

TABLE 69 MARKET IN SUBSEA: OTHERS, SEPTEMBER 2019–MARCH 2022

11 COMPANY PROFILES (Page No. - 127)

11.1 KEY PLAYERS

(Business and financial overview, Products/services offered, Recent Developments, Deals, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats)*

11.1.1 ABB

TABLE 70 ABB: BUSINESS OVERVIEW

FIGURE 35 ABB: COMPANY SNAPSHOT, 2021

TABLE 71 ABB: PRODUCTS/SERVICES OFFERED

TABLE 72 ABB: DEALS

TABLE 73 ABB: OTHERS

11.1.2 SIEMENS ENERGY

TABLE 74 SIEMENS ENERGY: BUSINESS OVERVIEW

FIGURE 36 SIEMENS ENERGY: COMPANY SNAPSHOT, 2021

TABLE 75 SIEMENS ENERGY: PRODUCTS/SERVICES OFFERED

TABLE 76 SIEMENS ENERGY: OTHERS

11.1.3 GENERAL ELECTRIC

TABLE 77 GENERAL ELECTRIC: BUSINESS OVERVIEW

FIGURE 37 GENERAL ELECTRIC: COMPANY SNAPSHOT, 2021

TABLE 78 GENERAL ELECTRIC: PRODUCTS/SERVICES OFFERED

TABLE 79 GENERAL ELECTRIC: DEALS

TABLE 80 GENERAL ELECTRIC: OTHERS

11.1.4 PRYSMIAN GROUP

TABLE 81 PRYSMIAN GROUP: BUSINESS OVERVIEW

FIGURE 38 PRYSMIAN GROUP: COMPANY SNAPSHOT, 2020

TABLE 82 PRYSMIAN GROUP: PRODUCTS/SERVICES OFFERED

TABLE 83 PRYSMIAN GROUP: DEALS

TABLE 84 PRYSMIAN GROUP: OTHERS

11.1.5 NEXANS

TABLE 85 NEXANS: BUSINESS OVERVIEW

FIGURE 39 NEXANS: COMPANY SNAPSHOT, 2020

TABLE 86 NEXANS: PRODUCTS/SERVICES OFFERED

TABLE 87 NEXANS: DEALS

TABLE 88 NEXANS: OTHERS

11.1.6 BAKER HUGHES

TABLE 89 BAKER HUGHES: BUSINESS OVERVIEW

FIGURE 40 BAKER HUGHES: COMPANY SNAPSHOT, 2021

TABLE 90 BAKER HUGHES: PRODUCTS/SERVICES OFFERED

TABLE 91 BAKER HUGHES: OTHERS

11.1.7 SCHLUMBERGER

TABLE 92 SCHLUMBERGER: BUSINESS OVERVIEW

FIGURE 41 SCHLUMBERGER: COMPANY SNAPSHOT, 2021

TABLE 93 SCHLUMBERGER: PRODUCTS/SERVICES OFFERED

TABLE 94 SCHLUMBERGER: OTHERS

11.1.8 TECHNIPFMC

TABLE 95 TECHNIPFMC: BUSINESS OVERVIEW

FIGURE 42 TECHNIPFMC: COMPANY SNAPSHOT, 2021

TABLE 96 TECHNIPFMC: PRODUCTS/SERVICES OFFERED

TABLE 97 TECHNIPFMC: DEALS

TABLE 98 TECHNIPFMC: OTHERS

11.1.9 AKER SOLUTIONS ASA

TABLE 99 AKER SOLUTIONS ASA: BUSINESS OVERVIEW

FIGURE 43 AKER SOLUTIONS ASA: COMPANY SNAPSHOT, 2020

TABLE 100 AKER SOLUTIONS ASA: PRODUCTS/SERVICES OFFERED

TABLE 101 AKER SOLUTIONS ASA: DEALS

TABLE 102 AKER SOLUTIONS ASA: OTHERS

11.1.10 NKT

TABLE 103 NKT: BUSINESS OVERVIEW

FIGURE 44 NKT: COMPANY SNAPSHOT, 2021

TABLE 104 NKT: PRODUCTS/SERVICES OFFERED

TABLE 105 NKT: DEALS

TABLE 106 NKT: OTHERS

11.1.11 OCEANEERING INTERNATIONAL

TABLE 107 OCEANEERING INTERNATIONAL: BUSINESS OVERVIEW

FIGURE 45 OCEANEERING INTERNATIONAL: COMPANY SNAPSHOT, 2021

TABLE 108 OCEANEERING INTERNATIONAL: PRODUCTS/SERVICES OFFERED

TABLE 109 OCEANEERING INTERNATIONAL: OTHERS

11.1.12 HITACHI ENERGY

TABLE 110 HITACHI ENERGY: BUSINESS OVERVIEW

TABLE 111 HITACHI ENERGY: PRODUCTS/SERVICES OFFERED

TABLE 112 HITACHI ENERGY: DEALS

TABLE 113 HITACHI ENERGY: OTHERS

11.1.13 SUMITOMO ELECTRIC INDUSTRIES, LTD.

TABLE 114 SUMITOMO ELECTRIC INDUSTRIES, LTD.: BUSINESS OVERVIEW

FIGURE 46 SUMITOMO ELECTRIC INDUSTRIES, LTD.: COMPANY SNAPSHOT, 2020

TABLE 115 SUMITOMO ELECTRIC INDUSTRIES, LTD.: PRODUCTS/SERVICES OFFERED

TABLE 116 SUMITOMO ELECTRIC INDUSTRIES, LTD.: OTHERS

11.1.14 TE CONNECTIVITY

TABLE 117 TE CONNECTIVITY: BUSINESS OVERVIEW

FIGURE 47 TE CONNECTIVITY: COMPANY SNAPSHOT, 2021

TABLE 118 TE CONNECTIVITY: PRODUCTS/SERVICES OFFERED

11.1.15 TELEDYNE MARINE

TABLE 119 TELEDYNE MARINE: BUSINESS OVERVIEW

TABLE 120 TELEDYNE MARINE: PRODUCTS/SERVICES OFFERED

11.2 OTHER PLAYERS

11.2.1 ZTT

11.2.2 SCHNEIDER ELECTRIC

11.2.3 APAR INDUSTRIES LTD.

11.2.4 LS CABLE & SYSTEM LTD.

11.2.5 SSG CABLE

*Details on Business Overview, Products Offered, Recent Developments, Deals, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 206)

12.1 INSIGHTS OF INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

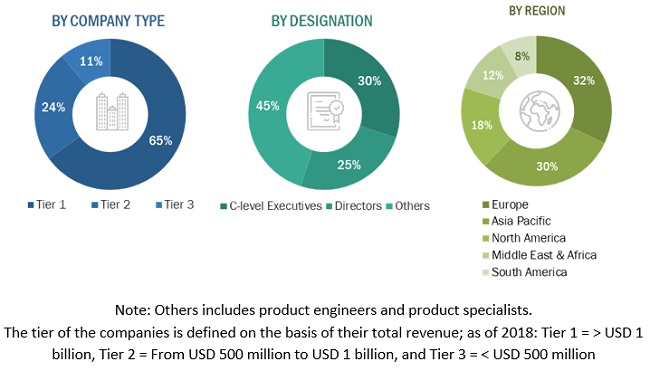

The study involved major activities in estimating the current size of the power grid system market in subsea. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study on the power grid system market in subsea involved the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg, Businessweek, Factiva, International Energy Agency, IRENA, GWEC, and BP Statistical Review of World Energy, to identify and collect information useful for a technical, market-oriented, and commercial study of the global market in subsea. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The power grid system market in subsea comprises several stakeholders such as subsea power grid system manufacturers, service providers and integrators, manufacturers of subcomponents of subsea power grid system, manufacturing technology providers, and technology support providers in the supply chain. The increased deepwater oil and gas exploration activities due to depleting onshore fossil fuel reserves and favorable government policies for offshore renewable power production, especially using wind energy is expected to drive the demand for global market in subsea. Moreover, the demand is also driven by the urgent need to reduce carbon emissions and improve grid reliability and efficiency. The supply side is characterized by rising demand for contracts from the industrial sector, and agreements among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

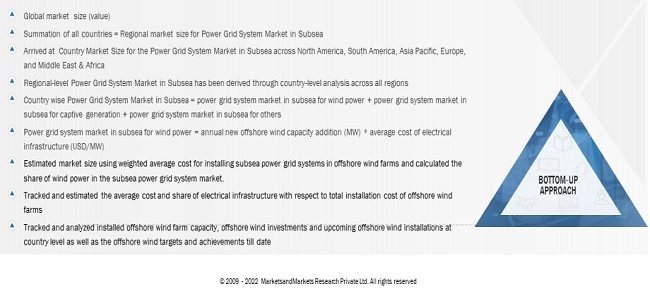

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the power grid system market in subsea. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions have been determined through both primary and secondary research.

- The industry’s value chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Power grid system market in subsea Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, the data triangulation and market breakdown processes have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand- and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Objectives of the Study

- To define, describe, segment, and forecast the power grid system market in subsea based on component, application, and depth, in terms of value

- To describe and forecast the market for various segments with respect to five main regions (along with respective countries), namely, North America, South America, Europe, Asia Pacific, and the Middle East & Africa, in terms of value

- To provide detailed information regarding drivers, restraints, opportunities, and challenges pertaining to the market in subsea

- To provide a detailed overview of the supply chain, patent analysis, and Porter’s five forces in the market in subsea

- To strategically analyze the market in subsea with respect to individual growth trends, prospects, and contribution of each segment to the market

- To analyze market opportunities for stakeholders by identifying high-growth segments and detail the competitive landscape in the market in subsea

- To strategically profile the key players and comprehensively analyze their market ranking and core competencies

- To track and analyze competitive developments such as sales contracts, acquisitions, collaborations, partnerships, agreements, and expansions in the power grid system market in subsea

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Geographic Analysis

- Further breakdown of region or country-specific analysis

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Power Grid System Market