Subscription & Billing Management Market by Component (Software and Services), Organization Size (SMEs and Large Enterprises), Deployment Type (Cloud and On-premises), Vertical (IT, Telecom, and Media & Entertainment), and Region - Global Forecast to 2025

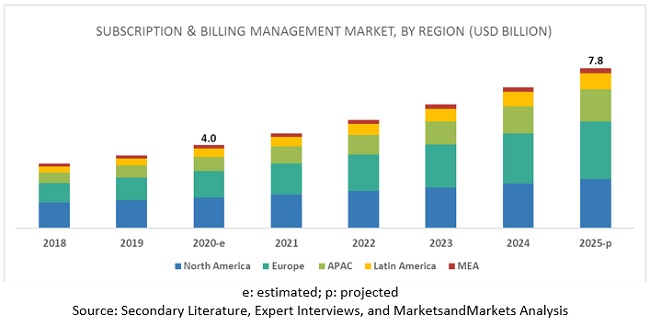

MarketsandMarkets forecasts the global subscription & billing management market size to grow from USD 4.0 billion in 2020 to USD 7.8 billion by 2025, at a Compound Annual Growth Rate (CAGR) of 14.0% during the forecast period. Major factors expected to drive the growth of the market include rising adoption of subscription business models, increasing demand for reducing subscriber churn and improving customer retention, growing need for adhering to compliances, and increasing need for upgrading legacy system.

Based on vertical, the IT vertical to hold the largest market size during the forecast period

The IT vertical is expected to hold the largest market size during the forecast period. This growth is attributed to the high transitions of traditional software and technology companies to a subscription-based model. During the last two years, there is an increase in the adoption and transition from the traditional license-based model toward a subscription model. Emerging tech startups are also practicing usage-based charging in the Business-to-Business (B2B) space for some time. This has resulted in the high adoption of especially the cloud-based subscription & billing management software.

Based on organization size, the SMEs segment to grow at a higher CAGR during the forecast period

Organizations with less than 1,000 employees are considered under the Small and Medium-sized Enterprises (SMEs). Companies without their own cloud services are partnering with other cloud service organizations to provide cloud-based subscription & billing management software to the SMEs. The availability of low-cost capabilities helps SMEs sustain and give stiff competition in the service market space. This enables SMEs to increase customer engagement by providing efficient services and benefits to increase their sales. The increasing focus on providing a better customer experience and the growing need to automate manual accounting and financial processes is increasing subscription & billing management software adoption. The low cost and high adoption of cloud-based software is boosting the market growth.

Based on region, North America to account for the largest chunk of the subscription & billing management market share during the forecast period

The subscription & billing management market in North America is expected to provide maximum revenue opportunities to vendors, due to the presence of the worlds leading telecom service providers and subscription & billing management vendors. With the rise in adoption of Bring Your Own Device (BYOD) and cloud-based services, there has been an upsurge in the automation of subscription processes. Thus, large enterprises in North America are ready to spend more on subscription & billing software. Countries such as the US and Canada have been expansively implementing subscription billing software with the increasing adoption of mobile devices. The most prominent driver for growth in this region is the considerable adoption of cloud-based solutions across large enterprises and SMEs, particularly in the US.

Key Market Players

Key and emerging subscription & billing management market players include 2Checkout (US), Apttus (US), Aria Systems (US), BillingPlatform (US), Chargebee (US), Chargify (US), cleverbridge (Germany), Gotransverse (US), Recurly (US), SaaSOptics (US), Sage Intacct (UK), Salesforce (US), SAP (Germany), Vindicia (US), Zuora (US), Digital River (US), NetSuite (US), FastSpring (US), JustOn (Germany), Zoho (US), and Fusebill (Canada). These players have adopted various strategies to grow in the market. The companies are focused on inorganic and organic growth strategies to strengthen their market position.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

20182025 |

|

Base year considered |

2019 |

|

Forecast period |

20202025 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Components (Software and Services), Deployment Types (Cloud and On-premises), Organization Size (SMEs and Large Enterprises), Verticals (BFSI, Retail and eCommerce, IT, Telecom, Media and Entertainment, Public Sector and Utilities, Transportation and Logistics, and Others), and Regions |

|

Geographies covered |

North America, Europe, APAC, Latin America, and MEA |

|

Companies covered |

2Checkout (US), Apttus (US), Aria Systems (US), BillingPlatform (US), Chargebee (US), Chargify (US), cleverbridge (Germany), Gotransverse (US), Recurly (US), SaaSOptics (US), Sage Intacct (UK), Salesforce (US), SAP (Germany), Vindicia (US), Zuora (US), Digital River (US), NetSuite (US), FastSpring (US), JustOn (Germany), Zoho (US), and Fusebill (Canada). |

The research report categorizes the subscription & billing management market to forecast the revenues and analyze trends in each of the following subsegments:

By Component

- Software

- Services

- Consulting

- Implementation

- Support and Maintenance

By Deployment Type

- Cloud

- On-premises

By Organization Size

- SMEs

- Large Enterprises

By Vertical

- BFSI

- Retail and eCommerce

- IT

- Telecom

- Media and Entertainment

- Public Sector and Utilities

- Transportation and Logistics

- Others (Healthcare, education, and manufacturing)

By Region

- North America

- Europe

- APAC

- Latin America

- MEA

Recent Developments

- In January 2020, Zuora partnered with Radiuz, a global Mobility-as-a-Service (MaaS) platform provider, to replace Radiuzs home-grown billing system with Zuora Billing.

- In December, BillingPlatform enhanced its platform to optimize it and offer the most intuitive user experience to users.

- In November 2019, Aria Systems announced the availability of its Aria Crescendo Monetization Platform on Microsoft Azure.

- In November 2019, Sage Intacct launched its financial management platform, Sage Intacct, in the UK.

- In October 2019, Gotransverse announced the launch of a new multi-tenant production environment in Frankfurt, Germany.

Critical questions the report answers:

- Where will all these developments take the industry in the long term?

- What are the upcoming trends for the subscription & billing management market?

- Which segment provides the most opportunities for growth?

- Who are the leading vendors operating in this market?

- What are the opportunities for new market entrants?

Frequently Asked Questions (FAQ):

What is Subscription & billing management?

Subscription & billing management pertains to managing the entire billing life cycle for subscription revenue models. The subscription & billing management software offers definite capabilities to support subscription management, billing, invoicing and accounting, payment processing, fraud management, and third-party integrations for various recurring revenue models (per-user or usage-based). The software work on top of payment gateway(s) and can be integrated with the eCommerce platform and catalog/inventory management system.

What are the major verticals that deploy Subscription & billing management?

Subscription & billing management help enterprises across multiple verticals with an extensive set of capabilities for pricing and quote management, billing mediation, and financial management, enabling enterprises to acquire, maintain, and grow their customers and partners. Some of the verticals that are major adopters of Subscription & billing management technologies include Banking, Financial Services, and Insurance (BFSI), Retail & E-Commerce, Information Technology, Telecom, Transportation and logistics, and Media and Entertainment.

Which are the top industry players in Subscription & billing management market?

Apttus, Aria Systems, BillingPlatform, Gotransverse, Recurly, Sage Intacct, and Zuora, are some of the top industry players offering Subscription & billing management solutions and services.

What are the top trends in Subscription & billing management market?

Trends that are impacting the Subscription & billing management market includes:

- Rising adoption of subscription business models

- Increasing demand for reducing subscriber churn and improving customer retention

- Growing Need for adhering to compliances

- Increasing need for upgrading legacy systems

Opportunities for the Subscription & billing management market:

- Scalability of Saas business model

- Machine Learning (ML) to optimize subscription billing

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of the Study

1.2 Market Definition

1.2.1 Inclusions and Exclusions

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regions Covered

1.4 Years Considered for the Study

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakup of Primaries

2.2 Market Breakup and Data Triangulation

2.3 Key Industry Insights

2.4 Market Size Estimation

2.5 Market Forecast

2.6 Assumptions for the Study

3 Executive Summary (Page No. - 30)

4 Premium Insights (Page No. - 33)

4.1 Attractive Opportunities in Global Subscription & Billing Management Market

4.2 Market By Component, 2020 Vs. 2025

4.3 Market By Service, 2020 Vs. 2025

4.4 Market By Organization Size, 2020

4.5 Market By Deployment Type, 2020 Vs. 2025

4.6 Market By Vertical, 20182025

4.7 Market Investment Scenario (20202025)

5 Market Overview and Industry Trends (Page No. - 37)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rising Adoption of Subscription Business Models

5.2.1.2 Increasing Demand for Reducing Subscriber Churn and Improving Customer Retention

5.2.1.3 Growing Need for Adhering to Compliances

5.2.1.4 Increasing Need for Upgrading Legacy Systems

5.2.2 Restraints

5.2.2.1 Data Synchronization Complexities

5.2.3 Opportunities

5.2.3.1 Scalability of Saas Business Model

5.2.3.2 ML to Optimize Subscription Billing

5.2.4 Challenges

5.2.4.1 Cloud Data Security and Privacy Concerns

5.2.4.2 In-House Subscription Billing Practice

5.2.4.3 Lack of Consistent Recurring Payment Infrastructure

5.3 Industry Trends

5.3.1 Industry use Cases

5.3.1.1 Use Case 1: Fusebill Enables Clearpathgps to Power High-Volume Billing With Fusebill Platform

5.3.1.2 Use Case 2: 2Checkout Improved Visicom Medias Ecommerce Revenue and Enabled Seamless Transition to Subscription-Based Model

5.3.1.3 Use Case 3: Zuora Helped the Seattle Times Migrate to Subscription Management System

6 Subscription & Billing Management Market, By Component (Page No. - 44)

6.1 Introduction

6.2 Software

6.2.1 Software: Market Drivers

6.3 Services

6.3.1 Consulting

6.3.1.1 Consulting: Market Drivers

6.3.2 Implementation

6.3.2.1 Implementation: Market Drivers

6.3.3 Support and Maintenance

6.3.3.1 Support and Maintenance: Market Drivers

7 Subscription & Billing Management Market, By Organization Size (Page No. - 51)

7.1 Introduction

7.2 Small and Medium-Sized Enterprises

7.2.1 Small and Medium-Sized Enterprises: Market Drivers

7.3 Large Enterprises

7.3.1 Large Enterprises: Market Drivers

8 Subscription & Billing Management Market By Deployment Type (Page No. - 55)

8.1 Introduction

8.2 Cloud

8.2.1 Cloud: Market Drivers

8.3 On-Premises

8.3.1 On-Premises: Market Drivers

9 Subscription & Billing Management Market By Vertical (Page No. - 60)

9.1 Introduction

9.2 Banking, Financial Services, and Insurance

9.2.1 Banking, Financial Services, and Insurance: Subscription & Billing Management Drivers

9.3 Retail and Ecommerce

9.3.1 Retail and Ecommerce: Market Drivers

9.4 Transportation and Logistics

9.4.1 Transportation and Logistics: Market Drivers

9.5 Information Technology

9.5.1 Information Technology: Market Drivers

9.6 Telecom

9.6.1 Telecom: Market Drivers

9.7 Media and Entertainment

9.7.1 Media and Entertainment: Market Drivers

9.8 Public Sector and Utilities

9.8.1 Public Sector and Utilities: Market Drivers

9.9 Others

10 Subscription & Billing Management Market By Region (Page No. - 71)

10.1 Introduction

10.2 North America

10.2.1 United States

10.2.1.1 United States: Market Drivers

10.2.2 Canada

10.2.2.1 Canada: Market Drivers

10.3 Europe

10.3.1 United Kingdom

10.3.1.1 United Kingdom: Market Drivers

10.3.2 Germany

10.3.2.1 Germany: Subscription & Billing Management Market Drivers

10.3.3 Rest of Europe

10.4 Asia Pacific

10.4.1 China

10.4.1.1 China: Market Drivers

10.4.2 Australia

10.4.2.1 Australia: Market Drivers

10.4.3 Rest of Asia Pacific

10.5 Latin America

10.5.1 Brazil

10.5.1.1 Brazil: Market Drivers

10.5.2 Mexico

10.5.2.1 Mexico: Market Drivers

10.5.3 Rest of Latin America

10.6 Middle East and Africa

10.6.1 United Arab Emirates

10.6.1.1 United Arab Emirates: Market Drivers

10.6.2 Kingdom of Saudi Arabia

10.6.2.1 Kingdom of Saudi Arabia: Market Drivers

10.6.3 Rest of Middle East and Africa

11 Competitive Landscape (Page No. - 112)

11.1 Introduction

11.2 Competitive Situation and Trends

11.2.1 New Product Launches and Product Enhancements

11.2.2 Agreements and Partnerships

11.2.3 Business Expansions

11.3 Market Ranking of Key Players

12 Company Profiles (Page No. - 120)

12.1 Introduction

(Business Overview, Platforms, Products, and Services Offered, Recent Developments & SWOT Analysis)*

12.2 Zuora

12.3 Aria Systems

12.4 Gotransverse

12.5 Sage Intacct

12.6 BillingPlatform

12.7 2Checkout

12.8 Cleverbridge

12.9 Recurly

12.10 Digital River

12.11 Oracle NetSuite

12.12 FastSpring

12.13 Juston

12.14 Apttus

12.15 Vindicia

12.16 SaaSOptics

12.17 Fusebill

12.18 Zoho

12.19 Chargebee

12.20 Chargify

12.21 SAP

12.22 Salesforce

12.23 Right-To-Win

*Details on Business Overview, Platforms, Products, and Services Offered, Recent Developments & SWOT Analysis Might Not be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 157)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets Subscription Portal

13.3 Available Customization

13.4 Related Reports

13.5 Author Details

List of Tables (114 Tables)

Table 1 United States Dollar Exchange Rate, 20172019

Table 2 Factor Analysis

Table 3 Subscription & Billing Management Market Size, By Component, 20182025 (USD Million)

Table 4 Software: Market Size By Region, 20182025 (USD Million)

Table 5 Services: Market Size By Type, 20182025 (USD Million)

Table 6 Services: Market Size By Region, 20182025 (USD Million)

Table 7 Consulting Market Size, By Region, 20182025 (USD Million)

Table 8 Implementation Market Size, By Region, 20182025 (USD Million)

Table 9 Support and Maintenance Market Size, By Region, 20182025 (USD Million)

Table 10 Subscription & Billing Management Market Size, By Organization Size, 20182025 (USD Million)

Table 11 Small and Medium-Sized Enterprises: Market Size By Region, 20182025 (USD Million)

Table 12 Large Enterprises: Market Size By Region, 20182025 (USD Million)

Table 13 Subscription & Billing Management Market Size, By Deployment Type, 20182025 (USD Million)

Table 14 Cloud: Market Size By Region, 20182025 (USD Million)

Table 15 Cloud: Market Size By Vertical, 20182025 (USD Million)

Table 16 On-Premises: Subscription & Billing Management Market Size, By Region, 20182025 (USD Million)

Table 17 On-Premises: Market Size By Vertical, 20182025 (USD Million)

Table 18 Subscription & Billing Market Size, By Vertical, 20182025 (USD Million)

Table 19 Banking, Financial Services, and Insurance: Subscription & Billing Market Size, By Region, 20182025 (USD Million)

Table 20 Retail and Ecommerce: Subscription & Billing Market Size, By Region, 20182025 (USD Million)

Table 21 Transportation and Logistics: Subscription & Billing Market Size, By Region, 20182025 (USD Million)

Table 22 Information Technology: Subscription & Billing Market Size, By Region, 20182025 (USD Million)

Table 23 Telecom: Subscription & Billing Market Size, By Region, 20182025 (USD Million)

Table 24 Media and Entertainment: Subscription & Billing Market Size, By Region, 20182025 (USD Million)

Table 25 Public Sector and Utilities: Subscription & Billing Market Size, By Region, 20182025 (USD Million)

Table 26 Others: Subscription & Billing Market Size, By Region, 20182025 (USD Million)

Table 27 Subscription & Billing Management Market Size, By Region, 20182025 (USD Million)

Table 28 North America: Subscription & Billing Management Market Size, By Component, 20182025 (USD Million)

Table 29 North America: Market Size By Service, 20182025 (USD Million)

Table 30 North America: Market Size By Deployment Type, 20182025 (USD Million)

Table 31 North America: Market Size By Organization Size, 20182025 (USD Million)

Table 32 North America: Market Size By Vertical, 20182025 (USD Million)

Table 33 North America: Banking, Financial Services, and Insurance Market Size, By Deployment Type, 20182025 (USD Million)

Table 34 North America: Retail and Ecommerce Market Size, By Deployment Type, 20182025 (USD Million)

Table 35 North America: Transportation and Logistics Market Size, By Deployment Type, 20182025 (USD Million)

Table 36 North America: Information Technology Market Size, By Deployment Type, 20182025 (USD Million)

Table 37 North America: Telecom Market Size, By Deployment Type, 20182025 (USD Million)

Table 38 North America: Media and Entertainment Market Size, By Deployment Type, 20182025 (USD Million)

Table 39 North America: Public Sector and Utilities Market Size, By Deployment Type, 20182025 (USD Million)

Table 40 North America: Others Market Size, By Deployment Type, 20182025 (USD Million)

Table 41 North America: Market Size By Country, 20182025 (USD Million)

Table 42 United States: Subscription & Billing Management Market Size, By Component, 20182025 (USD Million)

Table 43 United States: Market Size By Service, 20182025 (USD Million)

Table 44 United States: Market Size By Deployment Type, 20182025 (USD Million)

Table 45 United States: Market Size By Organization Size, 20182025 (USD Million)

Table 46 United States: Market Size By Vertical, 20182025 (USD Million)

Table 47 United States: Banking, Financial Services, and Insurance Market Size, By Deployment Type, 20182025 (USD Million)

Table 48 United States: Retail and Ecommerce Market Size, By Deployment Type, 20182025 (USD Million)

Table 49 United States: Transportation and Logistics Market Size, By Deployment Type, 20182025 (USD Million)

Table 50 United States: Information Technology Market Size, By Deployment Type, 20182025 (USD Million)

Table 51 United States: Telecom Market Size, By Deployment Type, 20182025 (USD Million)

Table 52 United States: Media and Entertainment Market Size, By Deployment Type, 20182025 (USD Million)

Table 53 United States: Public Sector and Utilities Market Size, By Deployment Type, 20182025 (USD Million)

Table 54 United States: Others Market Size, By Deployment Type, 20182025 (USD Million)

Table 55 Europe: Subscription & Billing Management Market Size, By Component, 20182025 (USD Million)

Table 56 Europe: Market Size By Service, 20182025 (USD Million)

Table 57 Europe: Market Size By Deployment Type, 20182025 (USD Million)

Table 58 Europe: Market Size By Organization Size, 20182025 (USD Million)

Table 59 Europe: Market Size By Vertical, 20182025 (USD Million)

Table 60 Europe: Banking, Financial Services, and Insurance Market Size, By Deployment Type, 20182025 (USD Million)

Table 61 Europe: Retail and Ecommerce Market Size, By Deployment Type, 20182025 (USD Million)

Table 62 Europe: Transportation and Logistics Market Size, By Deployment Type, 20182025 (USD Million)

Table 63 Europe: Information Technology Market Size, By Deployment Type, 20182025 (USD Million)

Table 64 Europe: Telecom Market Size, By Deployment Type, 20182025 (USD Million)

Table 65 Europe: Media and Entertainment Market Size, By Deployment Type, 20182025 (USD Million)

Table 66 Europe: Public Sector and Utilities Market Size, By Deployment Type, 20182025 (USD Million)

Table 67 Europe: Others Market Size, By Deployment Type, 20182025 (USD Million)

Table 68 Europe: Market Size By Country, 20182025 (USD Million)

Table 69 Asia Pacific: Subscription & Billing Management Market Size, By Component, 20182025 (USD Million)

Table 70 Asia Pacific: Market Size By Service, 20182025 (USD Million)

Table 71 Asia Pacific: Market Size By Deployment Type, 20182025 (USD Million)

Table 72 Asia Pacific: Market Size By Organization Size, 20182025 (USD Million)

Table 73 Asia Pacific: Market Size By Vertical, 20182025 (USD Million)

Table 74 Asia Pacific: Banking, Financial Services, and Insurance Market Size, By Deployment Type, 20182025 (USD Million)

Table 75 Asia Pacific: Retail and Ecommerce Market Size, By Deployment Type, 20182025 (USD Million)

Table 76 Asia Pacific: Transportation and Logistics Market Size, By Deployment Type, 20182025 (USD Million)

Table 77 Asia Pacific: Information Technology Market Size, By Deployment Type, 20182025 (USD Million)

Table 78 Asia Pacific: Telecom Market Size, By Deployment Type, 20182025 (USD Million)

Table 79 Asia Pacific: Media and Entertainment Market Size, By Deployment Type, 20182025 (USD Million)

Table 80 Asia Pacific: Public Sector and Utilities Market Size, By Deployment Type, 20182025 (USD Million)

Table 81 Asia Pacific: Others Market Size, By Deployment Type, 20182025 (USD Million)

Table 82 Asia Pacific: Market Size By Country, 20182025 (USD Million)

Table 83 Latin America: Subscription & Billing Management Market Size, By Component, 20182025 (USD Million)

Table 84 Latin America: Market Size By Service, 20182025 (USD Million)

Table 85 Latin America: Market Size By Deployment Type, 20182025 (USD Million)

Table 86 Latin America: Market Size By Organization Size, 20182025 (USD Million)

Table 87 Latin America: Market Size By Vertical, 20182025 (USD Million)

Table 88 Latin America: Banking, Financial Services, and Insurance Market Size, By Deployment Type, 20182025 (USD Million)

Table 89 Latin America: Retail and Ecommerce Market Size, By Deployment Type, 20182025 (USD Million)

Table 90 Latin America: Transportation and Logistics Market Size, By Deployment Type, 20182025 (USD Million)

Table 91 Latin America: Information Technology Market Size, By Deployment Type, 20182025 (USD Million)

Table 92 Latin America: Telecom Market Size, By Deployment Type, 20182025 (USD Million)

Table 93 Latin America: Media and Entertainment Market Size, By Deployment Type, 20182025 (USD Million)

Table 94 Latin America: Public Sector and Utilities Market Size, By Deployment Type, 20182025 (USD Million)

Table 95 Latin America: Others Market Size, By Deployment Type, 20182025 (USD Million)

Table 96 Latin America: Market Size By Country, 20182025 (USD Million)

Table 97 Middle East and Africa: Subscription & Billing Management Market Size, By Component, 20182025 (USD Million)

Table 98 Middle East and Africa: Market Size By Service, 20182025 (USD Million)

Table 99 Middle East and Africa: Market Size By Deployment Type, 20182025 (USD Million)

Table 100 Middle East and Africa: Market Size By Organization Size, 20182025 (USD Million)

Table 101 Middle East and Africa: Market Size By Vertical, 20182025 (USD Million)

Table 102 Middle East and Africa: Banking, Financial Services, and Insurance Market Size, By Deployment Type, 20182025 (USD Million)

Table 103 Middle East and Africa: Retail and Ecommerce Market Size, By Deployment Type, 20182025 (USD Million)

Table 104 Middle East and Africa: Transportation and Logistics Market Size, By Deployment Type, 20182025 (USD Million)

Table 105 Middle East and Africa: Information Technology Market Size, By Deployment Type, 20182025 (USD Million)

Table 106 Middle East and Africa: Telecom Market Size, By Deployment Type, 20182025 (USD Million)

Table 107 Middle East and Africa: Media and Entertainment Market Size, By Deployment Type, 20182025 (USD Million)

Table 108 Middle East and Africa: Public Sector and Utilities Market Size, By Deployment Type, 20182025 (USD Million)

Table 109 Middle East and Africa: Others Market Size, By Deployment Type, 20182025 (USD Million)

Table 110 Middle East and Africa: Subscription & Billing Management Market Size, By Country, 20182025 (USD Million)

Table 111 Market Evaluation Framework

Table 112 New Product Launches and Product Enhancements, August 2019December 2019

Table 113 Agreements and Partnerships, September 2019January 2020

Table 114 Business Expansions, October 2018October 2019

List of Figures (36 Figures)

Figure 1 Subscription & Billing Management Market: Research Design

Figure 2 Data Triangulation

Figure 3 Market Size Estimation Methodology: Approach 1 (Supply Side) Revenue of Software/Services of Subscription & Billing Management Vendors

Figure 4 Market Size Estimation Methodology: Approach 2 Top-Down (Demand Side) Share of Subscription & Billing Management

Figure 5 Subscription & Billing Management Market to Witness Significant Growth During the Forecast Period

Figure 6 Fastest Growing Segments in the Global Market During the Forecast Period

Figure 7 Subscription & Billing Management: Regional Market Scenario

Figure 8 Rising Subscription Box Models Driving Global Subscription & Billing Management Market Growth

Figure 9 Software Segment to Hold a Higher Market Share During the Forecast Period

Figure 10 Support and Maintenance Segment to Lead in Terms of Market Share in 2020

Figure 11 Large Enterprises Segment to Hold a Higher Market Share in 2020

Figure 12 Cloud Segment to Hold a Higher Market Share in 2020

Figure 13 IT Vertical to Lead the Subscription & Billing Management Market in Terms of Market Share During the Forecast Period

Figure 14 Australia to Emerge as the Best Market for Investment During 20202025

Figure 15 Subscription & Billing Management Market: Drivers, Restraints, Opportunities, and Challenges

Figure 16 Subscription vs Perpetual Model

Figure 17 Churn Rate: B2B vs B2C

Figure 18 Software Segment to Hold a Higher Market Share During the Forecast Period

Figure 19 Support and Maintenance Segment to Hold the Largest Market Size During the Forecast Period

Figure 20 Small and Medium-Sized Enterprises Segment to Grow at a Higher CAGR During the Forecast Period

Figure 21 Cloud Segment to Hold a Larger Market Size During the Forecast Period

Figure 22 Media and Entertainment Vertical to Grow at the Highest Rate During the Forecast Period

Figure 23 Europe to Hold the Largest Market Size By 2025

Figure 24 Asia Pacific to Grow at the Highest CAGR During the Forecast Period

Figure 25 North America: Market Snapshot

Figure 26 Subscription Site Visits

Figure 27 Asia Pacific: Market Snapshot

Figure 28 Companies Adopted New Product Launches and Product Enhancements as Key Growth Strategies Between January 2018 and January 2020

Figure 29 Market Ranking of Key Players in the Subscription & Billing Management Market, 2020

Figure 30 Zuora: Company Snapshot

Figure 31 Zuora: SWOT Analysis

Figure 32 Aria Systems: SWOT Analysis

Figure 33 Gotransverse: SWOT Analysis

Figure 34 Sage Intacct: Company Snapshot

Figure 35 Sage Intacct: SWOT Analysis

Figure 36 BillingPlatform: SWOT Analysis

The study involved four major activities in estimating the current size of the subscription & billing management market. Extensive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of segments and subsegments of the subscription & billing management market.

Secondary Research

In the secondary research process, various secondary sources, including D&B Hoovers, Bloomberg BusinessWeek, and Factiva, have been referred to identify and collect information for this study. These secondary sources included annual reports; press releases and investor presentations of companies; whitepapers, articles by recognized authors; gold standard and silver standard websites; Research and Development (R&D) organizations; and regulatory bodies. The data was also collected from secondary sources, such as The American Marketing Association (AMA), The Information Technology Association of Canada (ITAC), European Business Association (EBA), European Mobile Payment Systems Association (EMPSA), and Africa and Middle East Depositories Association (AMEDA).

Primary Research

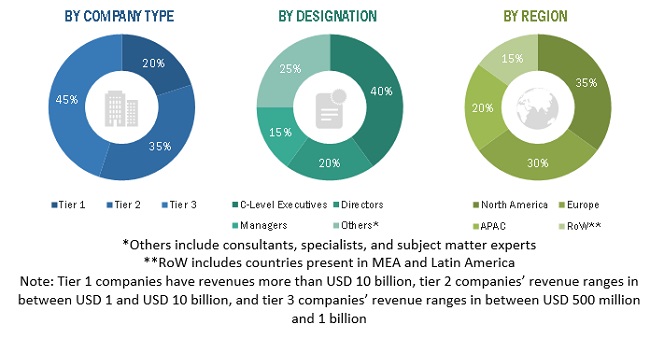

Various primary sources from both the supply and demand sides of the subscription & billing management market ecosystem were interviewed to obtain qualitative and quantitative information for this study. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various vendors providing subscription & billing management in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The following is the breakup of the primary respondents profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

To make market estimations and forecast the subscription & billing management market and other dependent submarkets, the top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall size of the global market using the revenues and offerings of the key companies in the market. The research methodology used to estimate the market size included the following:

- The key players in the market were identified through extensive secondary research.

- The market size, in terms of value, was determined through primary and secondary research processes.

- All percentage shares, splits, and breakups were determined using secondary sources and verified through primary sources.

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and forecast the subscription & billing management market by component (software and services), deployment type, organization size, vertical, and region

- To provide detailed information about the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze the opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of the segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To profile the key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as business expansions, new product developments, and Research and Development (R&D) activities, in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific requirements. The following customization options are available for the report:

Product Analysis

- Product matrix provides detailed product information and comparisons

Geographic Analysis

- Further breakup of the Canada subscription & billing management market

- Further breakup of the European market

- Further breakup of the APAC market

- Further breakup of the Latin American market

- Further breakup of the MEA market

Company Information

- Detailed analysis and profiling of additional market players

Growth opportunities and latent adjacency in Subscription & Billing Management Market