Structural Battery Market by Battery Capacity (Up To 50 Kwh, 50-100 Kwh, Above 100 Kwh), Architecture, Battery Form (Prismatic, Pouch, Cylindrical) Vehicle Type, Battery Type, Method (Laser, Wire Bonding) and Region - Global Forecast to 2027

Structural battery packs are multifunctional materials that serve both for energy storage and structure. Structural batteries offer “massless energy storage” because their effective weight is lower than the total weight of the cells. Also, they help save weight and are useful in transport applications such as electric vehicles and drones because of their potential to improve system efficiencies. Such batteries are hybrid and multifunctional composite materials that carry a load and store electrical energy like lithium-ion batteries.

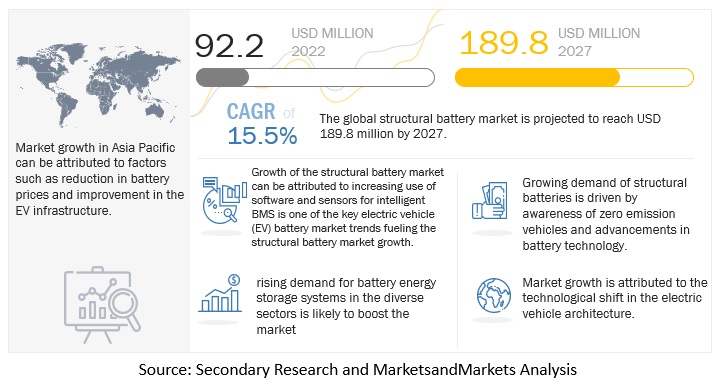

The global structural battery market will likely grow from USD 92.2 million in 2022 to USD 189.8 million by 2027. Structural batteries provide more power without adding extra weight, thus improving the efficiency of electric vehicles.

Drivers: Increasing adoption of electric vehicles and increasing new battery manufacturing facilities to drive the market

The structural battery market is growing due to the increasing adoption of electric vehicles and increasing investments by component manufacturers to set up new battery manufacturing and developing facilities. The government aims to reduce carbon dioxide emissions by providing subsidies and incentives that aid in the electric vehicle market growth. In July 2022, Tesla announced producing long-range structural batteries for its vehicles in US. These factors are the driving forces for the structural battery market growth. Also, factors driving the development of the structural battery market are shifting focus toward vehicle light-weighting and the increasing importance of thermal management and impact resistance of battery packs.

Restraints: Difficult cleaning process of the structural batteries

For better operational conditions of the structural batteries, cleaned battery surfaces are required by removing contaminants such as dusts, oxides, oils, battery electrolytes, and coatings. This improves the chemical properties of the battery. For a structural battery, the cleaning step represents a challenge because the total surface area that needs to be cleaned and bonded is extremely high compared to traditional batteries. This means that there is even less room for errors or inconsistencies in the cleaning and bonding processes, or else batteries will fail.

Challenges: Supply chain and geopolitical challenges in the structural battery market

Most of the battery manufacturers are in China and South Korea. The manufacturers continue to face supply chain constraints such as inflated air freight costs, the ongoing shortage of cargo ships, clogged seaports, shutdowns due to the pandemic, and so on. According to Hindustan Times in May-2022, the war in Ukraine will have economic consequences on Asian economies as Russian energy is the driver of the economic growth in the region. Chinese, South Korean, and other Asian suppliers control most natural resources and raw materials like nickel and cobalt for EV batteries.

Key players in the market:

Tesla (US), General Motors (US), BYD (China), LG Chem (South Korea), and CATL (China) are a few players in the Structural battery market

Recent Developments:

- In October-2022, researchers from Chalmers University of Technology announced to produce a structural battery that performs ten times better than all previous versions. It contains carbon fibre simultaneously as an electrode, conductor, and load-bearing material.

- In August-2022, Tesla announced to launch of a new Model Y variant with a BYD structural battery pack. It will be at the Giga Berlin facility in Germany.

- In October-2021, Tesla unveiled a new structural battery pack with 4680 cells during a Gigafactory Berlin tour

TABLE OF CONTENTS

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 INCLUSIONS & EXCLUSIONS

1.4 MARKET SCOPE

1.4.1 YEARS CONSIDERED FOR STUDY

1.5 CURRENCY

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 List of participating companies for primary research

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primary interview

2.2 MARKET ESTIMATION METHODOLOGY

2.3 MARKET SIZE ESTIMATION

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

2.5 FACTOR ANALYSIS

2.6 ASSUMPTIONS & ASSOCIATED RISKS

2.7 LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.2 RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.4 CHALLENGES

5.3 PORTER’S FIVE FORCES MODEL ANALYSIS

5.4 CASE STUDY ANALYSIS

5.5 PATENT ANALYSIS

5.6 VALUE CHAIN ANLYSIS

5.7 ECOSYSTEM ANALYSIS

5.8 TRADE ANALYSIS

5.9 AVERAGE SELLING PRICE

5.10 TECHNOLOGY ANALYSIS

5.11 REGULATORY OVERVIEW

5.12 DETAILED LIST OF CONFERENCES & EVENTS FOR THE STRUCTURAL BATTERY MARKET

5.13 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.14 SCENARIO ANALYSIS

5.14.1 MOST LIKELY SCENARIO

5.14.2 OPTIMISTIC SCENARIO

5.14.3 PESSIMISTIC SCENARIO

6 STRUCTURAL BATTERY MARKET, BY BATTERY CAPACITY

6.1 INTRODUCTION

6.1.1 OPERATIONAL DATA

6.1.2 ASSUMPTIONS

6.1.3 RESEARCH METHODOLOGY

6.2 UP TO 50 KWH

6.3 50-100 KWH

6.4 ABOVE 100 KWH

6.5 KEY INDUSTRY INSIGHTS

7 STRUCTURAL BATTERY MARKET, BY ARCHITECTURE

7.1 INTRODUCTION

7.1.1 OPERATIONAL DATA

7.1.2 ASSUMPTIONS

7.1.3 RESEARCH METHODOLOGY

7.2 EMBEDDED BATTERIES

7.3 LAMINATED STRUCTURAL ELECTRODES

7.4 KEY INDUSTRY INSIGHTS

8 STRUCTURAL BATTERY MARKET, BY BATTERY FORM

8.1 INTRODUCTION

8.1.1 OPERATIONAL DATA

8.1.2 ASSUMPTIONS

8.1.3 RESEARCH METHODOLOGY

8.2 PRISMATIC

8.3 POUCH

8.4 CYLINDRICAL

8.5 KEY INDUSTRY INSIGHTS

9 STRUCTURAL BATTERY MARKET, BY VEHICLE TYPE

9.1 INTRODUCTION

9.1.1 OPERATIONAL DATA

9.1.2 ASSUMPTIONS

9.1.3 RESEARCH METHODOLOGY

9.2 PASSENGER CAR

9.3 COMMERCIAL VEHICLE

9.4 KEY INDUSTRY INSIGHTS

10 STRUCTURAL BATTERY MARKET, BY BATTERY TYPE

10.1 INTRODUCTION

10.1.1 OPERATIONAL DATA

10.1.2 ASSUMPTIONS

10.1.3 RESEARCH METHODOLOGY

10.3 SOLID STATE

10.4 KEY INDUSTRY INSIGHTS

11 STRUCTURAL BATTERY MARKET, BY METHOD

11.1 INTRODUCTION

11.1.1 OPERATIONAL DATA

11.1.2 ASSUMPTIONS

11.1.3 RESEARCH METHODOLOGY

11.2 LASER

11.3 WIRE BONDING

11.4 KEY INDUSTRY INSIGHTS

12 STRUCTURAL BATTERY MARKET, BY REGION

12.1 INTRODUCTION

12.2 ASIA PACIFIC

12.2.1 CHINA

12.2.2 JAPAN

12.2.3 INDIA

12.2.4 SOUTH KOREA

12.3 EUROPE

12.3.1 FRANCE

12.3.2 GERMANY

12.3.3 SPAIN

12.3.4 UK

12.3.5 ITALY

12.4 NORTH AMERICA

12.4.1 US

12.4.2 CANADA

13 COMPETITIVE LANDSCAPE

13.1 OVERVIEW

13.2 MARKET EVALUATION FRAMEWORK

13.3 MARKET SHARE/RANKING ANALYSIS

13.4 TOP 5 PLAYERS REVENUE ANALYSIS

13.5 COMPETITIVE SCENARIO

13.5.1 NEW PRODUCT DEVELOPMENTS

13.5.2 DEALS

13.5.3 OTHERS

13.6 COMPETITIVE LEADERSHIP MAPPING

13.6.1 STARS

13.6.2 EMERGING LEADERS

13.6.3 PERVASISVE

13.6.4 PARTICIPANTS

13.7 START-UP/SME EVALUATION QUADRANT

13.7.1 PROGRESSIVE COMPANIES

13.7.2 RESPOSIVE COMPANIES

13.7.3 DYNAMIC COMPANIES

13.7.4 STARTING BLOCKS

13.8 WINNERS VS. TAIL-ENDERS

14 COMPANY PROFILES

(Business overview, Products offered, Recent Developments, SWOT analysis, MNM view)*

14.1 KEY PLAYERS

14.1.1 BYD

14.1.2 CATL

14.1.3 TESLA

14.1.4 GENERAL MOTORS

14.1.5 LG CHEM

14.1.6 ALKALINE BATTERY

14.1.7 SAMSUNG SDI

14.1.8 GOLDEN POWER GROUP

14.1.9 A 123 SYSTEMS

14.1.10 PANASONIC

14.2 OTHER PLAYERS

14.2.1 EXIDE INDUSTRIES

14.2.2 AMARA RAJA BATTERIES

14.2.3 FUTURE HI-TECH BATTERIES

14.2.4 EAST PENN MANUFACTURING COMPANY

15 RECOMMENDATIONS BY MARKETSANDMARKETS

16 APPENDIX

16.1 KEY INSIGHTS OF INDUSTRY EXPERTS

16.2 CURRENCY

16.3 DISCUSSION GUIDE

16.4 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

16.5 AVAILABLE CUSTOMIZATIONS

16.6 RELATED REPORTS

16.7 AUTHOR DETAILS

Growth opportunities and latent adjacency in Structural Battery Market