Street and Roadway Lighting Market by Lighting Type (Conventional, and Smart), Light Source (LEDs, Fluorescent Lights, and HID Lamps), Wattage Type (<50W, 50W – 150W, and >150w), End User, Offering, and Region - Global Forecast to 2022

The street and roadway lighting market is expected to grow at a CAGR of 6.03% during the forecast period to reach USD 10.94 Billion by 2022. The base year used for the study is 2015 and the forecast period is between 2016 and 2022. This report provides a detailed analysis of the market based on lighting type, light source, wattage type, end user, offering, and geography. It has been estimated that the LED light source would hold a large share of the market during the forecast period. However, the market for smart lighting is expected to grow at the highest CAGR between 2016 and 2022.

To estimate the size of the street lighting market, we have considered the top players and their share in the market. This research study involves the study of annual and financial reports of top players, presentations, press releases, journals, paid databases, and interviews with industry experts. The research methodology is explained below:

- Analyzing the overall size of the individual markets through the percentage split with the help of primary and secondary research

- Analyzing several market segments and subsegments

- Analyzing the supply and demand sides of the street and roadway lighting ecosystem

- Analyzing the market trends in various regions and countries, supported by the ongoing research and development (R&D) in these regions

- Finalizing the overall market size by triangulation with supply-side data, which includes product developments, supply chain, and estimated sales of the market.

According to the MarketsandMarkets forecast, the street and roadway lighting market is expected to be valued at USD 10.94 Billion by 2022, growing at a CAGR of 6.03% between 2016 and 2022. The growth of the market could be attributed to the modernization and development of infrastructure such as smart cities, need for energy-efficient street lighting systems, increasing penetration of LED lights and luminaires in street lighting applications, and stringent rules and regulations by governments. However, the high installation cost of smart lighting and lack of awareness about the payback period are the restraints for the market.

Of all the major hardware components, luminaires are expected to dominate the street and roadway lighting market during the forecast period. The services segment is expected to witness the highest growth from 2016 to 2022. The growth of the services segment is mainly propelled by the use of smart street lighting for energy conservation and high efficiency. Smart street lighting comprises pre-installation and post-installation services such as installation, design, maintenance, support, and monitoring services.

Among all the end users, street and roadways held the largest share of the street and roadway lighting market in 2015. The key reason for the growth of the street and roadways segment is rapid urbanization and expansion of cities around the globe. The market for the street and roadways segment in APAC is expected to grow at the highest CAGR between 2016 and 2022. The major reason driving the growth of this segment in the APAC region is need for improvement in visibility and safety of drivers, riders, and pedestrians, thereby minimizing road accidents. Moreover, modernization and development of infrastructure across various countries such as India, China, Japan, and South Korea is driving the demand for lighting in street and roadways applications in the APAC region.

The street and roadway lighting market based on lighting type comprises conventional lighting and smart lighting. The market for smart lighting is expected to grow at the highest rate between 2016 and 2022 as the adoption of smart lighting is growing rapidly with the growth of industries and cities. Until recently, illuminating the dark was the main task of street lighting. However, smart street lighting is expected to perform many more functions in the future. It would notify or register a change in traffic volume and feed that data into an intelligent transport system (ITS). Smart street lighting would be a part of a networked urban infrastructure. This acts as a driver for the growth of smart street lighting during the forecast period. The market for conventional lighting is expected to grow at a CAGR of 3.06% between 2016 and 2022 as in the APAC region, South Asian countries such as India, Maldives, Sri Lanka, Nepal, Bhutan, and Bangladesh would have larger share of conventional lighting than smart lighting.

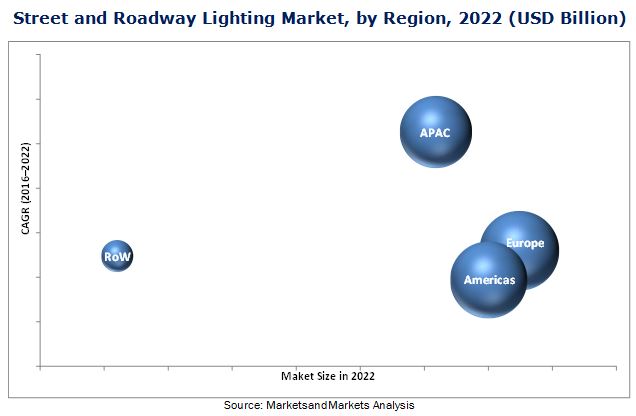

Of all the regions, Europe held the largest share of the market, and APAC is expected to grow at the highest CAGR between 2016 and 2022. In APAC, the growth is attributed to the modernization and development of infrastructure such as smart cities across the region. For instance, India came up with a list of 100 new smart cities in 2014; Union Budget of India allocated USD 1.0 billion for smart city projects. Furthermore, Europe is expected to dominate the global street and roadway lighting market due to stringent government regulations pertaining to lighting efficiency by European countries such as Germany, France, and Italy.

The major players in the street and roadway lighting market are Koninklijke Philips N.V. (Netherlands), General Electric Company (U.S.), Cree, Inc. (U.S.), and Acuity Brands, Inc. (U.S.), OSRAM Licht AG (Germany), Eaton Corp Plc. (Ireland), and Hubbell Incorporated (U.S.), among others. These players have adopted various strategies such as product developments, partnerships, contracts, and business expansions to cater to the needs of the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Scope of the Study

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

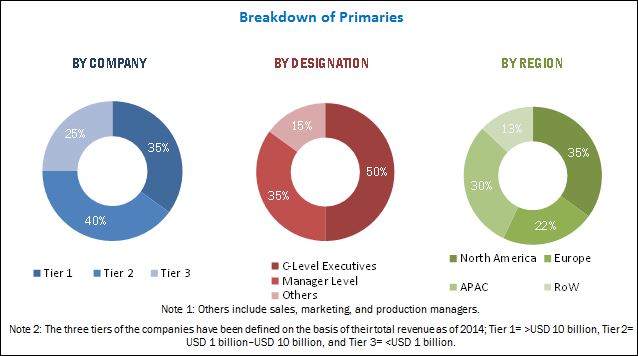

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 32)

4.1 Attractive Opportunities for the Global Street and Roadway Lighting Market

4.2 Market, By Lighting Type

4.3 Market, By Wattage Type

4.4 Market, By Offering

4.5 Market, By Geography

4.6 Life Cycle Analysis, By Light Source

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Segmentation

5.3 Market Dynamics: Street and Roadway Lighting Market

5.3.1 Drivers

5.3.1.1 Need for Improvement in Visibility and Safety of Drivers, Riders, and Pedestrians

5.3.1.2 Modernization and Development of Infrastructure Such as Smart Cities

5.3.1.3 Need for Energy-Efficient Lighting Systems

5.3.1.4 Increased Demand for Intelligent Solutions in Street Lighting Systems

5.3.1.5 Increasing Penetration of LED Lights and Luminaires in Outdoor Lighting

5.3.2 Restraints

5.3.2.1 Lack of Awareness About the Payback Period

5.3.2.2 High Installation Cost of Smart Lighting

5.3.3 Opportunities

5.3.3.1 Energy Efficiency in Developing Economies

5.3.3.2 Development of Wireless Technology for Street Lighting Systems

5.3.3.3 Iot Technology in Smart Street Lighting

5.3.4 Challenges

5.3.4.1 Lack of Common Open Standards

5.3.4.2 Rapidly Rising Product Testing Cost

5.3.4.3 Lack of Customer Ownership in Utility-Owned Street Lighting

6 Industry Trends (Page No. - 47)

6.1 Introduction

6.2 Value Chain Analysis

6.2.1 Research and Product Development

6.2.2 Raw Material/Component Suppliers

6.2.3 Manufacturers and Assemblers

6.2.4 Key Technology Providers/System Integrators

6.2.5 Distributors and Sellers

6.2.6 End Users

6.3 Key Industry Trends

6.4 Porter’s Five Forces

6.4.1 Bargaining Power of Suppliers

6.4.2 Bargaining Power of Buyers

6.4.3 Threat of New Entrants

6.4.4 Threat of Substitutes

6.4.5 Intensity of Competitive Rivalry

7 Street and Roadway Lighting Market, By Lighting Type (Page No. - 57)

7.1 Introduction

7.2 Conventional Lighting

7.3 Smart Lighting

7.3.1 Communication Technology

7.3.1.1 Wired Technology

7.3.1.2 Wireless Technology

8 Street and Roadway Lighting Market, By Light Source (Page No. - 61)

8.1 Introduction

8.2 LEDs

8.3 Fluorescent Lights

8.4 HID Lamps

8.4.1 Mercury Vapor Lamps (MVL)

8.4.2 High-Pressure Sodium (HPS) Lamps

8.4.3 Metal Halides and Induction Lamps

9 Street and Roadway Lighting Market, By Wattage Type (Page No. - 67)

9.1 Introduction

9.2 Less Than 50W

9.3 Between 50W and 150W

9.4 More Than 150W

10 Street and Roadway Lighting Market, By End User (Page No. - 72)

10.1 Introduction

10.2 Highways

10.3 Street and Roadways

10.4 Others (Bridges and Tunnels)

11 Street and Roadway Lighting Market, By Offering (Page No. - 77)

11.1 Introduction

11.2 Hardware

11.2.1 Lights and Bulbs

11.2.2 Luminaires

11.2.3 Control Systems

11.3 Software

11.4 Services

11.4.1 Pre-Installation

11.4.1.1 Design and Installation

11.4.2 Post-Installation

11.4.2.1 Maintenance and Support

12 Geographic Analysis (Page No. - 85)

12.1 Introduction

12.2 Americas

12.2.1 North America

12.2.1.1 U.S.

12.2.1.1.1 Adoption of LEDs Over Conventional Street and Roadway Lighting

12.2.1.2 Canada

12.2.1.2.1 Growing Adoption of LED Lighting Systems

12.2.2 Latin America

12.2.2.1 Brazil

12.2.2.2 Rest of Latin America

12.2.2.2.1 Mexico

12.2.2.2.1.1 Use of Energy-Efficient Street Lighting Solutions

12.3 Europe

12.3.1 Germany

12.3.1.1 Increasing Penetration of LED Lights and Luminaires in Outdoor Lighting

12.3.2 France

12.3.2.1 Focus on Energy-Efficient Street and Roadways Lighting Systems

12.3.3 U.K.

12.3.3.1 Government Regulations for Reducing Emissions and Adoption of Street and Roadways Lighting

12.3.4 Italy

12.3.4.1 LED Lights and Luminaires are the Major Drivers for the Street and Roadway Lighting Market

12.3.5 Rest of Europe

12.3.5.1 Spain

12.3.5.1.1 Growing Awareness About Energy Conservation

12.3.5.2 Netherlands

12.4 APAC

12.4.1 China

12.4.1.1 Graphene-Enhanced Street Lighting LED Fixtures

12.4.2 Japan

12.4.2.1 Increasing Penetration of LED Lighting

12.4.3 India

12.4.3.1 Implementation of LED Lights and Luminaires in Street Lighting

12.4.4 Rest of APAC

12.4.4.1 South Korea

12.4.4.2 Australia

12.4.4.2.1 Installation of Smart Street Lighting Systems

12.5 RoW

12.5.1 Middle East

12.5.2 Africa

12.5.2.1 Adoption of Renewable Energy Sources in Street and Roadway Lighting

13 Competitive Landscape (Page No. - 115)

13.1 Introduction

13.2 Ranking of Market Players, 2015

13.3 Competitive Situations and Trends

13.3.1 New Product Launches

13.3.2 Contracts and Agreements

13.3.3 Mergers & Acquisitions

14 Company Profiles (Page No. - 121)

14.1 Introduction

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, Ratio Analysis, MnM View)*

14.2 Koninklijke Philips N.V. (Royal Philips)

14.3 Cree, Inc.

14.4 General Electric Company (GE)

14.5 Eaton Corporation PLC

14.6 Osram Licht AG

14.7 Acuity Brands, Inc.

14.8 Hubbell Incorporated

14.9 Kingsun Optoelectronic Co., Ltd.

14.10 Thorn Lighting

14.11 LED Roadway Lighting Ltd.

14.12 Syska LED

14.13 Virtual Extension

14.14 Key Innovators

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 153)

15.1 Insights of Industry Experts

15.2 Discussion Guide

15.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

15.4 Introducing RT: Real-Time Market Intelligence

15.5 Available Customizations

15.6 Related Reports

15.7 Author Details

List of Tables (69 Tables)

Table 1 Street and Roadway Lighting Market, By Lighting Type

Table 2 Market: By Light Source

Table 3 Market: By Wattage Type

Table 4 Market: By End User

Table 5 Market: By Offering

Table 6 Some of the Successful Street Lighting Projects in the U.K. and Germany

Table 7 Energy-Efficient, Ecological, and Cost-Effective Street Lighting System—Leading Trend Among Key Market Players

Table 8 Market, By Lighting Type, 2013–2022 (USD Million)

Table 9 Market for Conventional Lighting, By Region, 2013–2022 (USD Million)

Table 10 Market for Smart Lighting, By Region, 2013–2022 (USD Million)

Table 11 Market, By Light Source, 2013–2022 (USD Million)

Table 12 Market, By Light Source, 2013–2022 (Million Units)

Table 13 Market for LEDs, By Region, 2013–2022 (USD Million)

Table 14 Market for Fluorescent Lights, By Region, 2013–2022 (USD Million)

Table 15 Market for HID Lamps, By Region, 2013–2022 (USD Million)

Table 16 Market, By Wattage Type, 2013–2022 (USD Million)

Table 17 Market for Less Than 50W Type, By Region, 2013–2022 (USD Million)

Table 18 Street and Roadway Lighting Market for Between 50W and 150W Type, By Region, 2013–2022 (USD Million)

Table 19 Market for More Than 150W Type, By Region, 2013–2022 (USD Million)

Table 20 Market, By End User, 2013–2022 (USD Million)

Table 21 Street and Roadway Lighting Market for Highways, By Region, 2013–2022 (USD Million)

Table 22 Market for Street and Roadways, By Region, 2013–2022 (USD Million)

Table 23 Market for Other End Users, By Region, 2013–2022 (USD Million)

Table 24 Street and Roadway Lighting Market, By Offering, 2013–2022 (USD Million)

Table 25 Market, By Hardware, 2013–2022 (USD Million)

Table 26 Market for Hardware, By Region, 2013–2022 (USD Million)

Table 27 Market for Lights and Bulbs, By Region, 2013–2022 (USD Million)

Table 28 Market for Luminaires, By Region, 2013–2022 (USD Million)

Table 29 Market for Control Systems, By Region, 2013–2022 (USD Million)

Table 30 Street and Roadway Lighting Market for Software, By Region, 2013–2022 (USD Million)

Table 31 Market for Services, By Region, 2013–2022 (USD Million)

Table 32 Market, By Region, 2013–2022 (USD Million)

Table 33 Market in Americas, By Lighting Type, 2013–2022 (USD Million)

Table 34 Street and Roadway Lighting Market in Americas, By Light Source, 2013–2022 (USD Million)

Table 35 Market in Americas, By Light Source, 2013–2022 (Million Units)

Table 36 Market in Americas, By Wattage Type, 2013–2022 (USD Million)

Table 37 Market in Americas, By End User, 2013–2022 (USD Million)

Table 38 Market in Americas, By Offering, 2013–2022 (USD Million)

Table 39 Market in Americas, By Hardware, 2013–2022 (USD Million)

Table 40 Street and Roadway Lighting Market in Americas, By Region, 2013–2022 (USD Million)

Table 41 Market in North America, By Region, 2013–2022 (USD Million)

Table 42 Market in Latin America, By Region, 2013–2022 (USD Million)

Table 43 Street and Roadway Lighting Market in Europe, By Lighting Type, 2013–2022 (USD Million)

Table 44 Market in Europe, By Light Source, 2013–2022 (USD Million)

Table 45 Market in Europe, By Light Source, 2013–2022 (Million Units)

Table 46 Market in Europe, By Wattage Type, 2013–2022 (USD Million)

Table 47 Market in Europe, By End User, 2013–2022 (USD Million)

Table 48 Market in Europe, By Offering, 2013–2022 (USD Million)

Table 49 Market in Europe, By Hardware, 2013–2022 (USD Million)

Table 50 Market in Europe, By Country, 2013–2022 (USD Million)

Table 51 Market in APAC, By Lighting Type, 2013–2022 (USD Million)

Table 52 Street and Roadway Lighting Market in APAC, By Light Source, 2013–2022 (USD Million)

Table 53 Market in Americas, By Light Source, 2013–2022 (Million Units)

Table 54 Street and Roadway Lighting Market in APAC, By Wattage Type, 2013–2022 (USD Million)

Table 55 Market in APAC, By End User, 2013–2022 (USD Million)

Table 56 Market in APAC, By Offering, 2013–2022 (USD Million)

Table 57 Market in APAC, By Hardware, 2013–2022 (USD Million)

Table 58 Market in APAC, By Country, 2013–2022 (USD Million)

Table 59 Market in RoW, By Lighting Type, 2013–2022 (USD Million)

Table 60 Market in RoW, By Light Source, 2013–2022 (USD Million)

Table 61 Market in RoW, By Light Source, 2013–2022 (Million Units)

Table 62 Market in RoW, By Wattage Type, 2013–2022 (USD Million)

Table 63 Market in RoW, By End User, 2013–2022 (USD Million)

Table 64 Market in RoW, By Offering, 2013–2022 (USD Million)

Table 65 Market in RoW, By Hardware, 2013–2022 (USD Million)

Table 66 Market in RoW, By Region, 2013–2022 (USD Million)

Table 67 New Product Launches in the Street and Roadway Lighting Market, 2015–2016

Table 68 Contracts and Agreements in the Market, 2015–2016

Table 69 Mergers & Acquisitions in the Market, 2015–2016

List of Figures (67 Figures)

Figure 1 Street and Roadway Lighting Market Segmentation

Figure 2 Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation Methodology

Figure 6 Conventional Lighting Currently Holds the Largest Share of the Market

Figure 7 LEDs Expected to Hold the Largest Size of the Market By 2022

Figure 8 50W–150W Wattage Type Expected to Grow at the Highest Rate During the Forecast Period

Figure 9 Street and Roadways Expected to Hold the Largest Share of the Market During the Forecast Period

Figure 10 Services Expected to Be the Fastest-Growing Segment in the Market During the Forecast Period

Figure 11 Americas Held the Largest Share of the Market in 2016

Figure 12 Decreasing Prices of LEDs Expected to Drive the Global Market During the Forecast Period

Figure 13 Market for Smart Lighting Expected to Grow at the Highest Rate During the Forecast Period

Figure 14 50W–150W Wattage Type Expected to Dominate the Global Market During the Forecast Period

Figure 15 Market for Services Expected to Grow at the Highest Rate During the Forecast Period

Figure 16 Americas Expected to Lead the Market During the Forecast Period

Figure 17 China Held the Largest Share of the Market in APAC in 2015

Figure 18 LEDs Expected to Be in the Growth Phase During the Forecast Period in the Market

Figure 19 Market, By Geography

Figure 20 Energy-Efficient Street Lighting Project Cycle

Figure 21 Reduction in LED Prices

Figure 22 Market: Value Chain Analysis

Figure 23 Porter’s Five Forces Analysis for the Market

Figure 24 Porter’s Five Forces Analysis: Threat of New Entrants Likely to Have A Medium Impact on the Overall Market

Figure 25 Porter’s Five Forces: Impact Analysis

Figure 26 Bargaining Power of Suppliers in the Street and Roadway Lighting Market, 2016

Figure 27 Bargaining Power of Buyers in the Market, 2016

Figure 28 Threat of New Entrants in the Market, 2016

Figure 29 Threat of Substitutes in the Market, 2016

Figure 30 Intensity of Competitive Rivalry in the Market, 2016

Figure 31 Market, By Lighting Type

Figure 32 Street and Roadway Lighting Market, By Light Source

Figure 33 Market for LEDs in APAC Expected to Grow at the Highest Rate During the Forecast Period

Figure 34 Market, By Wattage Type

Figure 35 Market, By End User

Figure 36 Market for Street and Roadways in APAC Expected to Grow at the Highest Rate During the Forecast Period

Figure 37 Street and Roadway Lighting Market, By Offering

Figure 38 Hardware Segment Expected to Hold the Largest Share of the Market During the Forecast Period

Figure 39 Luminaires Expected to Hold the Largest Share of the Market During the Forecast Period

Figure 40 Market, By Region

Figure 41 Geographic Snapshot: APAC Expected to Emerge as A Key Growth Region in the Street Market During the Forecast Period

Figure 42 Americas: Market Snapshot

Figure 43 LEDs Expected to Hold the Largest Share of the Market in Americas During the Forecast Period

Figure 44 Europe: Market Snapshot

Figure 45 Hardware Component Expected to Hold the Largest Size of the Market in Europe During the Forecast Period

Figure 46 APAC: Market Snapshot

Figure 47 Market in India Expected to Grow at the Highest Rate During the Forecast Period

Figure 48 Conventional Lighting Presently Holds the Largest Share of the Market in RoW

Figure 49 Companies Adopted New Product Launches as the Key Growth Strategy Between 2014 and 2016

Figure 50 Ranking of Top Players in the Market, 2015

Figure 51 Market Evaluation Framework: New Product Launches Fueled Growth and Innovation Between 2014 and 2016

Figure 52 Battle for Market Share: New Product Launches Was the Key Strategy Adopted Between 2014 and 2016

Figure 53 Geographic Revenue Mix of Major Players in the Market, 2015

Figure 54 Koninklijke Philips N.V.: Company Snapshot

Figure 55 Koninklijke Philips N.V.: SWOT Analysis

Figure 56 Cree, Inc.: Company Snapshot

Figure 57 Cree, Inc.: SWOT Analysis

Figure 58 General Electric Company: Company Snapshot

Figure 59 General Electric Company: SWOT Analysis

Figure 60 Eaton Corporation PLC: Company Snapshot

Figure 61 Eaton Corporation PLC: SWOT Analysis

Figure 62 Osram Licht AG: Company Snapshot

Figure 63 Osram Licht AG: SWOT Analysis

Figure 64 Acuity Brands, Inc.: Company Snapshot

Figure 65 Acuity Brands, Inc.: SWOT Analysis

Figure 66 Hubbell Incorporated: Company Snapshot

Figure 67 Thorn Lighting: Company Snapshot

After arriving at the overall market size, the total market has been split into several segments and subsegments and confirmed with the key industry experts. The following figure depicts the breakdown of primaries on the basis of company, designation, and region.

To know about the assumptions considered for the study, download the pdf brochure

Market Ecosystem

The street and roadway lighting market ecosystem includes component suppliers such as ClaroLux Landscape Lighting (U.S.), Forus Electric Private Limited (India), Shenzhen GHC Co., Ltd. (China), and Shenzhen HXD Lighting Co., Ltd. (China); lighting manufacturers such as Cree, Inc. (U.S.), Acuity Brands Lighting, Inc. (U.S.), Koninklijke Philips N.V. (Netherlands), and OSRAM Licht GmbH (Germany); and system integrators such as WS Atkins plc (U.K.), MMA Lighting Consultancy Ltd. (U.K.), Lighting Reality Ltd (U.K.), and General Electric Company (U.S.).

Scope of the Report:

|

Report Metric |

Details |

|

Base year |

2015 |

|

Forecast period |

2016–2022 |

|

Units |

Value (USD) |

|

Segments covered |

Type, End User, Offerings, and Region |

|

Geographic regions covered |

North America, APAC, Europe, and RoW |

|

Companies covered |

Koninklijke Philips N.V. (Netherlands), General Electric Company (U.S.), Cree, Inc. (U.S.), and Acuity Brands, Inc. (U.S.), OSRAM Licht AG (Germany), Eaton Corp Plc. (Ireland), and Hubbell Incorporated (U.S.), |

Target Audience:

- Technology providers

- Construction firms

- Research organizations

- Government organizations

- Technology investors

- Technology standards organizations

- Forums, alliances, associations, and government bodies

- Venture capitalists

- Private equity firms, analysts, and strategic business planners

Scope of the Report:

This research report categorizes the overall market on the basis of lighting type, light source, wattage type, end user, offering, and region.

Street and Roadway Lighting Market, By Lighting Type

- Conventional Lighting

- Smart Lighting

Street and Roadway Lighting Market, By Light Source

- LEDs

- Fluorescent Lights

- HID Lamps

Street and Roadway Lighting Market, By Wattage Type

- Less than 50W

- Between 50W and 150W

- More than 150W

Street and Roadway Lighting Market, By End User

- Highways

- Street and Roadways

- Others

Street and Roadway Lighting Market, By Offering

- Hardware

- Software

- Services

Street and Roadway Lighting Market, By Region

-

Americas

-

North America

- U.S.

- Rest of North America

-

Latin America

- Brazil

- Rest of Latin America

-

North America

-

Europe

- Germany

- U.K.

- France

- Italy

- Rest of Europe

-

APAC

- China

- Japan

- India

- Rest of APAC

-

RoW

- Middle East

- Africa

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

Further breakdown of region-/country-specific analysis

Company Information

Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Street and Roadway Lighting Market

I am writing a PhD thesis on the smart lightning market and the diffusion of IoT technologies in smart cities, and Id like to see your report in order to find correct data about the smart lightning market. What would be the best price for this?

Hi, Id like to know if your market assessment includes market size of services business around street lighting. From my understanding, this services business includes: the conception and engineering, installation and maintenance and operation of these street lights for cities. I have the impression that your market sizing only takes into acccount the sales of hardware (street lighting hardware: bulbs, lamps, drivers, controllers...) but not the services business around needed to implement, operate and maintain the hardware. Is it right? I am looking for a global market sizing and forecast of street lighting business per region which includes hardware sales + services sales as I understand it (services=engineering and concepetion + installation + maintenance and operation).