Sternal Closure Systems Market by Product (Closure Devices (Wires, Plate & Screw, Cable, Clips) Bone Cement), Procedure (Median Sternotomy, Hemisternotomy, Bilateral Thoracosternotomy), Material (Stainless Steel, PEEK, Titanum) & Region - Global Forecast to 2027

Market Growth Outlook Summary

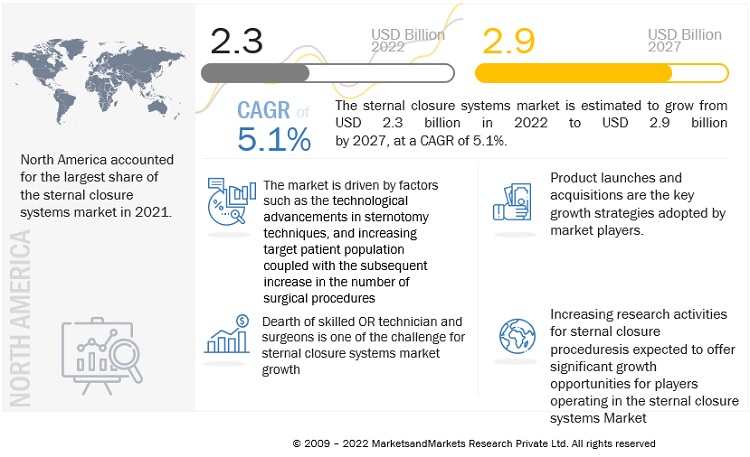

The global sternal closure systems market growth forecasted to transform from $2.3 billion in 2022 to $2.9 billion by 2027, driven by a CAGR of 5.1%. Market growth is driven by the high adoption of innovative sternal closure systems, and the rising number of cardiothoracic surgical procedures.

Sternal Closure Systems Market Trends

e- estimated, p-projected

To know about the assumptions considered for the study, Request for Free Sample Report

Sternal Closure Systems Market Growth Dynamics

Driver: Technological advancements in sternotomy techniques to drive the demand for sternal closure market

Median sternotomy procedures have been effectively used in surgical management since the early 1960s. They are considered the gold standard for surgical access to the heart and lungs in cardiothoracic and cardiopulmonary procedures.

The past decade has witnessed significant technological advancements in sternotomy techniques. For instance, the conventional approach for sternal bone closure involved using a thick braided suture, which was often associated with a high risk of local infection or sepsis. However, since 2010, there has been a significant increase in the adoption of advanced sternal closure devices and techniques. Surgical-grade stainless steel as well as titanium, are increasingly being used for manufacturing medical devices. Titanium and stainless steel-based sternal closure products are associated with several clinical advantages such as minimal pain, limited risk of sternal dehiscence, lower risk of sternal wound infections, and reduced mediastinitis.

Restraint: Procedural risks associated with sternal closure restrict the sternal closure systems market growth

Surgeons worldwide are increasingly utilizing technologically advanced and specialized surgical products for sternal closure after critical surgical procedures (such as cardiac bypass surgery, acute traumatic heart surgeries, and cardiac valve repair surgery).

However, sternal closure procedures are often associated with several postoperative complications such as sternal dehiscence, deep wound infections, and chronic pain. Similarly, geriatric, diabetic, and obese patients are more prone to post-operative sternal wound infections as compared to adult patients. Also, median sternotomy performed during cardiac surgeries is often associated with post-surgical complications such as myocardial injury, blood loss, atrial fibrillation, subxiphoid incisional hernias, and superficial incisional infections, among others

Challenge: Dearth of skilled OR technicians & surgeons a key challenging factor holding back market growth

According to the Association of American Medical Colleges (AAMC) (US), the demand for doctors is likely to grow twofold from 2013 to 2025. The shortage is divided nearly evenly between the need for more primary care physicians and the need for surgeons, cardiologists, oncologists, and other specialists. With the growing geriatric population, there is a need for skilled professionals to conduct interventional procedures. The proper usage of sternal closure devices requires expertise with relevant experience and knowledge.

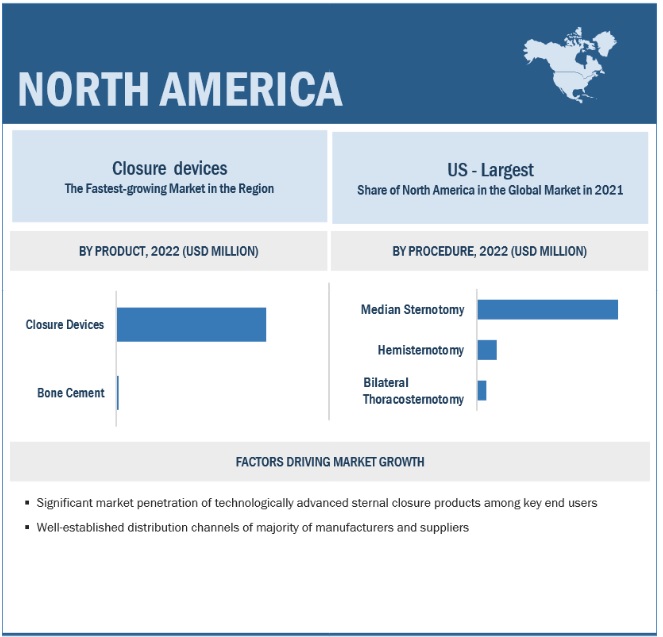

In 2021, closure devices segment accounted for the largest share of the sternal closure systems market, by product

The global sternal closure systems market is segmented into closure devices and bone cement based on product. Market growth for closure devices is largely driven by the clinical evidence present to support the therapeutic efficacy and availability of easy reimbursement across the developed market.

2021, median sternotomy segment accounted for the largest share in the sternal closure systems market, by procedure

The sternal closure systems market is segmented into median sternotomy, hemisternotomy, and bilateral thoracosternotomy by procedure. The median sternotomy segment accounted for the largest share owing to the rising number of critical patients suffering from cardiovascular diseases, and the significant availability of reimbursement for critical cardiac surgeries across developed markets (such as for CABG and valve replacement).

In 2021, titanium segment accounted for the largest share in the sternal closure systems market, by material

The sternal closure systems market is segmented into titanium, stainless steel, and polyether ether ketone (PEEK). In 2021, titanium accounted for the largest share of the sternal closure systems market. This can be attributed to the increased commercialization of titanium-based sternal closure systems across developed countries (especially in the US)

In 2021, North America accounted for the largest share of the sternal closure systems market

The global sternal closure systems market is segmented into four major regions namely, North America, Europe, the Asia Pacific, and Rest of the World. North America accounted for the largest share of the sternal closure systems market in 2021. Factors such as the increasing preference for advanced sternal closure products by surgeons, and the strong presence of device manufacturers in the region are contributing to the large share of this regional segment.

To know about the assumptions considered for the study, download the pdf brochure

The sternal closure systems market is dominated by players such as DePuy Synthes (US), Zimmer Biomet Holdings, Inc. (US), KLS Martin Group (US), B. Braun SE (Germany) and Stryker (US).

Scope of the Sternal Closure Systems Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2022 |

$2.3 billion |

|

Projected Revenue Size by 2027 |

$2.9 billion |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 5.1% |

|

Market Driver |

Technological advancements in sternotomy techniques to drive the demand for sternal closure market |

|

Market Opportunity |

Increasing research activities for sternal closure procedures |

This report categorizes the sternal closure systems market to forecast revenue and analyze trends in each of the following submarkets:

By Product

-

Closure Devices

- Wires

- Plates & Screws

- Cables

- Clips

- Bone Cement

By Procedure

- Median Sternotomy

- Hemisternotomy

- Bilateral Thoracosternotomy

By Material

- Titanium

- Stainless Steel

- Polyether ether Ketone (PEEK)

By Region

- North America

-

US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

- Rest of the World

Recent Developments

- In 2022, Evonik Venture Capital announced its investment in CircumFix Solutions which is a Tennessee-based startup that developed a sternal closure device to improve patient recovery after open chest surgery. The device used n implant-grade polyetheretherketone (PEEK) from Evonik for better results.

- In 2021, NEOS Surgery presented their implantable surgical device known as STERN Fix which is made of a Carbon Peek Matrix at the 35th European Association for CardioThoracic Surgery (EACTS) annual meeting held from 13 to 16 October in Barcelona.

- In 2020, Zimmer Biomet announced the acquisition of A&E Medical for USD 250 Million which enhances Zimmer Biomet’s Dental, Spine & Craniomaxillofacial, and Thoracic businesses.

Frequently Asked Questions (FAQ):

What is the size of Sternal Closure Systems Market?

The global sternal closure systems market size is projected to reach 2.9 billion by 2027, growing at a CAGR of 5.1%.

What are the major growth factors of Sternal Closure Systems Market?

Market growth is driven by the high adoption of innovative sternal closure systems, and the rising number of cardiothoracic surgical procedures.

Who all are the prominent players of Sternal Closure Systems Market?

The sternal closure systems market is dominated by players such as DePuy Synthes (US), Zimmer Biomet Holdings, Inc. (US), KLS Martin Group (US), B. Braun SE (Germany) and Stryker (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 22)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

TABLE 1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

FIGURE 1 STERNAL CLOSURE SYSTEMS MARKET SCOPE

1.3.1 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 26)

2.1 RESEARCH DATA

FIGURE 2 STERNAL CLOSURE SYSTEMS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 3 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primary interviews

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.1.3 KEY INDUSTRY INSIGHTS

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach 1: Company revenue estimation approach

FIGURE 5 BOTTOM-UP APPROACH: COMPANY REVENUE ESTIMATION APPROACH

2.2.1.2 Approach 2: Company presentations and primary interviews

2.2.1.3 Approach 3: Procedure-based approach

FIGURE 6 BOTTOM-UP APPROACH: PROCEDURE-BASED ANALYSIS

2.2.1.4 Growth forecast

2.2.1.5 Sternal closure systems market: CAGR analysis

FIGURE 7 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

2.2.2 TOP-DOWN APPROACH

FIGURE 8 STERNAL CLOSURE SYSTEMS MARKET: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 9 DATA TRIANGULATION METHODOLOGY

2.4 RESEARCH ASSUMPTIONS

2.5 LIMITATIONS AND RISK ASSESSMENT

TABLE 2 RISK ASSESSMENT: STERNAL CLOSURE SYSTEMS MARKET

3 EXECUTIVE SUMMARY (Page No. - 38)

FIGURE 10 STERNAL CLOSURE SYSTEMS MARKET, BY PRODUCT, 2022 VS. 2027 (USD MILLION)

FIGURE 11 STERNAL CLOSURE SYSTEMS MARKET, BY PROCEDURE, 2022 VS. 2027 (USD MILLION)

FIGURE 12 STERNAL CLOSURE SYSTEMS MARKET, BY MATERIAL, 2022 VS. 2027 (USD MILLION)

FIGURE 13 STERNAL CLOSURE SYSTEMS MARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

4 PREMIUM INSIGHTS (Page No. - 42)

4.1 STERNAL CLOSURE SYSTEMS MARKET OVERVIEW

FIGURE 14 TECHNOLOGICAL ADVANCEMENTS IN STERNOTOMY TECHNIQUES TO DRIVE MARKET

4.2 STERNAL CLOSURE SYSTEMS MARKET, BY PRODUCT (2022–2027)

FIGURE 15 CLOSURE DEVICES SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4.3 NORTH AMERICA: STERNAL CLOSURE SYSTEMS MARKET, BY PRODUCT AND COUNTRY (2021)

FIGURE 16 CLOSURE DEVICES SEGMENT ACCOUNTED FOR LARGEST SHARE OF NORTH AMERICAN STERNAL CLOSURE SYSTEMS MARKET IN 2021

4.4 STERNAL CLOSURE SYSTEMS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 17 ASIA PACIFIC COUNTRIES TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 45)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 STERNAL CLOSURE SYSTEMS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Technological advancements in sternotomy techniques

5.2.1.2 Increasing target patient population coupled with subsequent increase in number of surgical procedures

5.2.1.3 Growing availability of medical reimbursement across major markets

TABLE 3 KEY REIMBURSEMENT CODES FOR STERNAL CLOSURE (AS OF 2021)

5.2.2 RESTRAINTS

5.2.2.1 Procedural risks associated with sternal closure

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing research activities for sternal closure procedures

5.2.3.2 Emerging markets

5.2.3.3 Growth in number of hospitals and surgical centers

5.2.4 CHALLENGES

5.2.4.1 Dearth of skilled OR technicians and surgeons

5.2.4.2 Limited awareness among healthcare providers about novel sternal closure techniques

5.3 PRICING ANALYSIS

5.3.1 INDICATIVE PRICING MODEL ANALYSIS OF MARKET PLAYERS

TABLE 4 INDICATIVE PRICING FOR STERNAL CLOSURE SYSTEMS

5.3.2 AVERAGE SELLING PRICE OF STERNAL CLOSURE SYSTEMS, BY KEY PLAYER

TABLE 5 AVERAGE SELLING PRICE OF STERNAL CLOSURE SYSTEMS

5.4 VALUE CHAIN ANALYSIS

FIGURE 19 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDED DURING MANUFACTURING AND ASSEMBLY

5.5 SUPPLY CHAIN ANALYSIS

FIGURE 20 DIRECT DISTRIBUTION—PREFERRED STRATEGY OF PROMINENT COMPANIES

5.6 PORTER’S FIVE FORCES ANALYSIS

5.6.1 THREAT OF NEW ENTRANTS

5.6.2 THREAT OF SUBSTITUTES

5.6.3 BARGAINING POWER OF SUPPLIERS

5.6.4 BARGAINING POWER OF BUYERS

5.6.5 INTENSITY OF COMPETITIVE RIVALRY

5.7 ECOSYSTEM ANALYSIS

FIGURE 21 STERNAL CLOSURE SYSTEMS MARKET: ECOSYSTEM ANALYSIS

5.7.1 ROLE IN ECOSYSTEM

FIGURE 22 KEY PLAYERS IN STERNAL CLOSURE SYSTEMS MARKET ECOSYSTEM

5.8 REGULATORY ANALYSIS

TABLE 6 INDICATIVE LIST OF REGULATORY AUTHORITIES GOVERNING STERNAL CLOSURE SYSTEMS

5.8.1 NORTH AMERICA

5.8.1.1 US

TABLE 7 US: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

5.8.1.2 Canada

TABLE 8 CANADA: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

5.8.2 EUROPE

5.8.3 ASIA PACIFIC

5.8.3.1 Japan

TABLE 9 JAPAN: MEDICAL DEVICE CLASSIFICATION UNDER PMDA

5.8.3.2 China

TABLE 10 CHINA: CLASSIFICATION OF MEDICAL DEVICES

5.8.3.3 India

5.8.3.4 Australia

5.9 PATENT ANALYSIS

5.9.1 PATENT TRENDS FOR STERNAL CLOSURE SYSTEMS

FIGURE 23 PATENT TRENDS FOR STERNAL CLOSURE SYSTEMS, JANUARY 2011–OCTOBER 2022

5.9.2 JURISDICTION AND TOP APPLICANT ANALYSIS

FIGURE 24 TOP APPLICANTS AND OWNERS (COMPANIES/INSTITUTES) FOR STERNAL CLOSURE SYSTEM PATENTS, JANUARY 2011—OCTOBER 2022

5.10 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

5.10.1 REVENUE SHIFT AND REVENUE POCKETS FOR STERNAL CLOSURE SYSTEM MANUFACTURERS

FIGURE 25 REVENUE SHIFT FOR STERNAL CLOSURE SYSTEMS

5.11 KEY CONFERENCES AND EVENTS IN 2022–2023

TABLE 11 STERNAL CLOSURE SYSTEMS MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.12 TECHNOLOGY ANALYSIS

5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF STERNAL CLOSURE SYSTEMS

TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR STERNAL CLOSURE SYSTEMS (%)

5.13.2 BUYING CRITERIA

FIGURE 27 KEY BUYING CRITERIA FOR END USERS OF STERNAL CLOSURE SYSTEMS

TABLE 13 KEY BUYING CRITERIA FOR END USERS OF STERNAL CLOSURE SYSTEMS

5.14 TRADE ANALYSIS

TABLE 14 IMPORT DATA FOR HS CODE 902110, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 15 EXPORT DATA FOR HS CODE 902110, BY COUNTRY, 2017–2021 (USD MILLION)

6 STERNAL CLOSURE SYSTEMS MARKET, BY PRODUCT (Page No. - 68)

6.1 INTRODUCTION

TABLE 16 STERNAL CLOSURE SYSTEMS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

6.2 CLOSURE DEVICES

TABLE 17 CLOSURE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 18 CLOSURE DEVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.2.1 WIRES

6.2.1.1 Increasing number of complex and critical surgeries to drive market

TABLE 19 WIRES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.2.2 PLATES AND SCREWS

6.2.2.1 Plates and screws segment to witness high growth during forecast period

TABLE 20 PLATES AND SCREWS MARKET, BY REGION, 2020–2027 (USD MILLION)

6.2.3 CABLES

6.2.3.1 Less post-operative complications to boost demand for cables in sternal closure systems

TABLE 21 CABLES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.2.4 CLIPS

6.2.4.1 Elasticity and thermoreactive properties of clips to boost adoption in market

TABLE 22 CLIPS MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3 BONE CEMENT

6.3.1 KRYPTONITE MOST PREFERRED BONE CEMENT FOR MEDIAN STERNOTOMY PROCEDURES

TABLE 23 BONE CEMENT MARKET, BY REGION, 2020–2027 (USD MILLION)

7 STERNAL CLOSURE SYSTEMS MARKET, BY PROCEDURE (Page No. - 76)

7.1 INTRODUCTION

TABLE 24 STERNAL CLOSURE SYSTEMS MARKET, BY PROCEDURE, 2020–2027 (USD MILLION)

7.2 MEDIAN STERNOTOMY

7.2.1 LARGEST AND FASTEST-GROWING PROCEDURE SEGMENT IN MARKET

TABLE 25 STERNAL CLOSURE SYSTEMS MARKET FOR MEDIAN STERNOTOMY, BY REGION, 2020–2027 (USD MILLION)

7.3 HEMISTERNOTOMY

7.3.1 GROWING NUMBER OF CARDIAC SURGERIES TO SUPPORT MARKET GROWTH

TABLE 26 STERNAL CLOSURE SYSTEMS MARKET FOR HEMISTERNOTOMY, BY REGION, 2020–2027 (USD MILLION)

7.4 BILATERAL THORACOSTERNOTOMY

7.4.1 RISING NUMBER OF LUNG TRANSPLANTS TO DRIVE DEMAND FOR BILATERAL THORACOSTERNOTOMY

TABLE 27 STERNAL CLOSURE SYSTEMS MARKET FOR BILATERAL THORACOSTERNOTOMY, BY REGION, 2020–2027 (USD MILLION)

8 STERNAL CLOSURE SYSTEMS MARKET, BY MATERIAL (Page No. - 81)

8.1 INTRODUCTION

TABLE 28 STERNAL CLOSURE SYSTEMS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

8.2 TITANIUM

8.2.1 LARGEST MATERIAL SEGMENT IN STERNAL CLOSURE SYSTEMS MARKET

TABLE 29 TITANIUM STERNAL CLOSURE SYSTEMS MARKET, BY REGION, 2020–2027 (USD MILLION)

8.3 STAINLESS STEEL

8.3.1 HIGH ADOPTION OF STAINLESS-STEEL WIRES DURING STERNAL CLOSURE TO DRIVE MARKET

TABLE 30 STAINLESS STEEL STERNAL CLOSURE SYSTEMS MARKET, BY REGION, 2020–2027 (USD MILLION)

8.4 POLYETHERETHERKETONE (PEEK)

8.4.1 HIGH STABILITY OF PEEK TO DRIVE ADOPTION IN STERNAL CLOSURE SYSTEMS

TABLE 31 PEEK STERNAL CLOSURE SYSTEMS MARKET, BY REGION, 2020–2027 (USD MILLION)

9 STERNAL CLOSURE SYSTEMS MARKET, BY REGION (Page No. - 86)

9.1 INTRODUCTION

TABLE 32 STERNAL CLOSURE SYSTEMS MARKET, BY REGION, 2020–2027 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 28 NORTH AMERICA: STERNAL CLOSURE SYSTEMS MARKET SNAPSHOT

TABLE 33 NORTH AMERICA: STERNAL CLOSURE SYSTEMS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 34 NORTH AMERICA: STERNAL CLOSURE SYSTEMS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 35 NORTH AMERICA: CLOSURE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 36 NORTH AMERICA: STERNAL CLOSURE SYSTEMS MARKET, BY PROCEDURE, 2020–2027 (USD MILLION)

TABLE 37 NORTH AMERICA: STERNAL CLOSURE SYSTEMS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

9.2.1 US

9.2.1.1 US dominates North American sternal closure systems market

TABLE 38 KEY REIMBURSEMENT CODES FOR STERNAL CLOSURE IN US (AS OF 2021)

TABLE 39 US: STERNAL CLOSURE SYSTEMS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 40 US: CLOSURE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION

TABLE 41 US: STERNAL CLOSURE SYSTEMS MARKET, BY PROCEDURE, 2020–2027 (USD MILLION)

TABLE 42 US: STERNAL CLOSURE SYSTEMS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

9.2.2 CANADA

9.2.2.1 Rising number of cardiothoracic surgeries to propel market growth

TABLE 43 CANADA: STERNAL CLOSURE SYSTEMS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 44 CANADA: CLOSURE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 45 CANADA: STERNAL CLOSURE SYSTEMS MARKET, BY PROCEDURE, 2020–2027 (USD MILLION)

TABLE 46 CANADA: STERNAL CLOSURE SYSTEMS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

9.3 EUROPE

TABLE 47 EUROPE: STERNAL CLOSURE SYSTEMS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 48 EUROPE: STERNAL CLOSURE SYSTEMS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 49 EUROPE: CLOSURE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 50 EUROPE: STERNAL CLOSURE SYSTEMS MARKET, BY PROCEDURE, 2020–2027 (USD MILLION)

TABLE 51 EUROPE: STERNAL CLOSURE SYSTEMS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

9.3.1 GERMANY

9.3.1.1 Germany dominates European sternal closure systems market

TABLE 52 GERMANY: STERNAL CLOSURE SYSTEMS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 53 GERMANY: CLOSURE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 54 GERMANY: STERNAL CLOSURE SYSTEMS MARKET, BY PROCEDURE, 2020–2027 (USD MILLION)

TABLE 55 GERMANY: STERNAL CLOSURE SYSTEMS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

9.3.2 UK

9.3.2.1 Rising number of target surgeries to drive demand for sternal closure systems

TABLE 56 UK: STERNAL CLOSURE SYSTEMS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 57 UK: CLOSURE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 58 UK: STERNAL CLOSURE SYSTEMS MARKET, BY PROCEDURE, 2020–2027 (USD MILLION)

TABLE 59 UK: STERNAL CLOSURE SYSTEMS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

9.3.3 FRANCE

9.3.3.1 Growing awareness of advanced sternal closure techniques to boost demand

TABLE 60 FRANCE: STERNAL CLOSURE SYSTEMS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 61 FRANCE: CLOSURE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 62 FRANCE: STERNAL CLOSURE SYSTEMS MARKET, BY PROCEDURE, 2020–2027 (USD MILLION)

TABLE 63 FRANCE: STERNAL CLOSURE SYSTEMS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

9.3.4 ITALY

9.3.4.1 Rising geriatric population to support market growth

TABLE 64 ITALY: STERNAL CLOSURE SYSTEMS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 65 ITALY: CLOSURE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 66 ITALY: STERNAL CLOSURE SYSTEMS MARKET, BY PROCEDURE, 2020–2027 (USD MILLION)

TABLE 67 ITALY: STERNAL CLOSURE SYSTEMS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

9.3.5 SPAIN

9.3.5.1 Rising CVD cases to drive demand for sternal closure systems

TABLE 68 SPAIN: STERNAL CLOSURE SYSTEMS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 69 SPAIN: CLOSURE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 70 SPAIN: STERNAL CLOSURE SYSTEMS MARKET, BY PROCEDURE, 2020–2027 (USD MILLION)

TABLE 71 SPAIN: STERNAL CLOSURE SYSTEMS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

9.3.6 REST OF EUROPE

TABLE 72 REST OF EUROPE: STERNAL CLOSURE SYSTEMS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 73 REST OF EUROPE: CLOSURE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 74 REST OF EUROPE: STERNAL CLOSURE SYSTEMS MARKET, BY PROCEDURE, 2020–2027 (USD MILLION)

TABLE 75 REST OF EUROPE: STERNAL CLOSURE SYSTEMS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

9.4 ASIA PACIFIC

FIGURE 29 ASIA PACIFIC: STERNAL CLOSURE SYSTEMS MARKET SNAPSHOT

TABLE 76 ASIA PACIFIC: STERNAL CLOSURE SYSTEMS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 77 ASIA PACIFIC: STERNAL CLOSURE SYSTEMS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 78 ASIA PACIFIC: CLOSURE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 79 ASIA PACIFIC: STERNAL CLOSURE SYSTEMS MARKET, BY PROCEDURE, 2020–2027 (USD MILLION)

TABLE 80 ASIA PACIFIC: STERNAL CLOSURE SYSTEMS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

9.4.1 JAPAN

9.4.1.1 Japan to dominate Asia Pacific sternal closure systems market

TABLE 81 JAPAN: STERNAL CLOSURE SYSTEMS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 82 JAPAN: CLOSURE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 83 JAPAN: STERNAL CLOSURE SYSTEMS MARKET, BY PROCEDURE, 2020–2027 (USD MILLION)

TABLE 84 JAPAN: STERNAL CLOSURE SYSTEMS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

9.4.2 CHINA

9.4.2.1 Increasing patient population to boost market growth

TABLE 85 CHINA: STERNAL CLOSURE SYSTEMS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 86 CHINA: CLOSURE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 87 CHINA: STERNAL CLOSURE SYSTEMS MARKET, BY PROCEDURE, 2020–2027 (USD MILLION)

TABLE 88 CHINA: STERNAL CLOSURE SYSTEMS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

9.4.3 INDIA

9.4.3.1 Expansion of health infrastructure to support market growth

TABLE 89 INDIA: STERNAL CLOSURE SYSTEMS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 90 INDIA: CLOSURE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 91 INDIA: STERNAL CLOSURE SYSTEMS MARKET, BY PROCEDURE, 2020–2027 (USD MILLION)

TABLE 92 INDIA: STERNAL CLOSURE SYSTEMS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

9.4.4 REST OF ASIA PACIFIC

TABLE 93 REST OF ASIA PACIFIC: STERNAL CLOSURE SYSTEMS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 94 REST OF ASIA PACIFIC: CLOSURE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 95 REST OF ASIA PACIFIC: STERNAL CLOSURE SYSTEMS MARKET, BY PROCEDURE, 2020–2027 (USD MILLION)

TABLE 96 REST OF ASIA PACIFIC: STERNAL CLOSURE SYSTEMS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

9.5 REST OF THE WORLD

TABLE 97 REST OF THE WORLD: STERNAL CLOSURE SYSTEMS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 98 REST OF THE WORLD: CLOSURE DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 99 REST OF THE WORLD: STERNAL CLOSURE SYSTEMS MARKET, BY PROCEDURE, 2020–2027 (USD MILLION)

TABLE 100 REST OF THE WORLD: STERNAL CLOSURE SYSTEMS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 124)

10.1 OVERVIEW

10.2 STRATEGIES ADOPTED BY KEY PLAYERS/RIGHT TO WIN

TABLE 101 OVERVIEW OF STRATEGIES ADOPTED BY KEY STERNAL CLOSURE SYSTEM MANUFACTURERS

10.3 REVENUE ANALYSIS

FIGURE 30 REVENUE ANALYSIS OF KEY PLAYERS

10.4 MARKET SHARE ANALYSIS

TABLE 102 STERNAL CLOSURE SYSTEMS MARKET: DEGREE OF COMPETITION

FIGURE 31 STERNAL CLOSURE SYSTEMS MARKET SHARE ANALYSIS, BY KEY PLAYER, 2021

10.5 COMPANY EVALUATION MATRIX

10.5.1 STARS

10.5.2 EMERGING LEADERS

10.5.3 PERVASIVE PLAYERS

10.5.4 PARTICIPANTS

FIGURE 32 STERNAL CLOSURE SYSTEMS MARKET: COMPANY EVALUATION QUADRANT (2021)

10.6 COMPANY EVALUATION QUADRANT (SMES/STARTUPS)

10.6.1 PROGRESSIVE COMPANIES

10.6.2 STARTING BLOCKS

10.6.3 RESPONSIVE COMPANIES

10.6.4 DYNAMIC COMPANIES

FIGURE 33 STERNAL CLOSURE SYSTEMS MARKET: COMPANY EVALUATION QUADRANT FOR STARTUPS/SMES (2021)

10.7 COMPANY FOOTPRINT ANALYSIS

TABLE 103 FOOTPRINT OF COMPANIES IN STERNAL CLOSURE SYSTEMS MARKET

TABLE 104 PRODUCT FOOTPRINT OF COMPANIES

TABLE 105 REGIONAL FOOTPRINT OF COMPANIES

10.8 COMPETITIVE BENCHMARKING

TABLE 106 STERNAL CLOSURE SYSTEMS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

10.9 COMPETITIVE SCENARIO

10.9.1 DEALS

TABLE 107 STERNAL CLOSURE SYSTEMS MARKET: DEALS, 2019–2022

10.9.2 PRODUCT LAUNCHES AND APPROVALS

TABLE 108 STERNAL CLOSURE SYSTEMS MARKET: PRODUCT LAUNCHES AND APPROVALS, 2019–2022

10.9.3 OTHER DEVELOPMENTS

TABLE 109 STERNAL CLOSURE SYSTEMS MARKET: OTHER DEVELOPMENTS, 2019–2022

11 COMPANY PROFILES (Page No. - 137)

(Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) *

11.1 KEY PLAYERS

11.1.1 DEPUY SYNTHES (PART OF JOHNSON & JOHNSON)

TABLE 110 JOHNSON & JOHNSON SERVICES, INC.: BUSINESS OVERVIEW

FIGURE 34 JOHNSON & JOHNSON SERVICES, INC: COMPANY SNAPSHOT (2021)

11.1.2 ZIMMER BIOMET HOLDINGS, INC

TABLE 111 ZIMMER BIOMET HOLDINGS, INC.: BUSINESS OVERVIEW

FIGURE 35 ZIMMER BIOMET HOLDINGS, INC.: COMPANY SNAPSHOT (2021)

11.1.3 B. BRAUN SE

TABLE 112 B. BRAUN SE: BUSINESS OVERVIEW

FIGURE 36 B. BRAUN SE: COMPANY SNAPSHOT (2021)

11.1.4 KLS MARTIN GROUP

TABLE 113 KLS MARTIN GROUP: BUSINESS OVERVIEW

11.1.5 STRYKER

TABLE 114 STRYKER: BUSINESS OVERVIEW

FIGURE 37 STRYKER: COMPANY SNAPSHOT (2021)

11.1.6 TELEFLEX INCORPORATED

TABLE 115 TELEFLEX INCORPORATED: BUSINESS OVERVIEW

FIGURE 38 TELEFLEX INCORPORATED: COMPANY SNAPSHOT (2021)

11.1.7 ACUMED LLC

TABLE 116 ACUMED LLC: BUSINESS OVERVIEW

11.1.8 IDEAR S.R.L

TABLE 117 IDEAR S.R.L: BUSINESS OVERVIEW

11.1.9 KINAMED INCORPORATED

TABLE 118 KINAMED INCORPORATED: BUSINESS OVERVIEW

11.1.10 ABLE MEDICAL DEVICES

TABLE 119 ABLE MEDICAL DEVICES: BUSINESS OVERVIEW

11.2 OTHER PLAYERS

11.2.1 PRAESIDIA

11.2.1.1 Products offered

11.2.2 ABYRX, INC.

11.2.2.1 Products offered

11.2.3 DISPOMEDICA

11.2.3.1 Products offered

11.2.4 JEIL MEDICAL CORPORATION

11.2.4.1 Products offered

11.2.5 CHANGZHOU WASTON MEDICAL APPLIANCE CO., LTD.

11.2.5.1 Products offered

11.2.6 NEOS SURGERY

11.2.6.1 Products offered

11.2.7 ORTOLOG MEDICAL

11.2.7.1 Products offered

11.2.8 MEDICON EG

11.2.8.1 Products offered

11.2.9 MEDXPERT GMBH

11.2.9.1 Products offered

11.2.10 CIRCUMFIX SOLUTIONS

11.2.10.1 Products offered

11.2.11 INVIBIO LTD.

11.2.11.1 Products offered

11.2.12 ARTHREX, INC.

11.2.12.1 Products offered

11.2.13 TTK HEALTHCARE LTD.

11.2.13.1 Products offered

11.2.14 LOTUS SURGICALS

11.2.14.1 Products offered

11.2.15 PETERS SURGICAL

11.2.15.1 Products offered

*Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 166)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 CUSTOMIZATION OPTIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

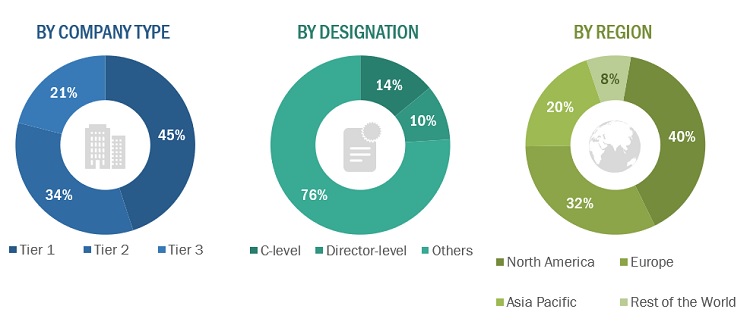

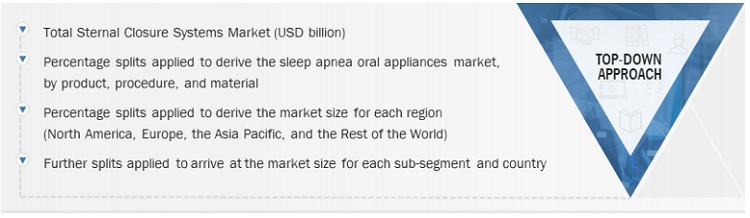

This study involved four major activities in estimating the current size of the sternal closure systems market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate segments and subsegments' market size.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to identify and collect information for this study.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources were mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify the critical qualitative and quantitative information as well as assess future prospects.

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the sternal closure systems market's total size. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research

- The revenues generated by leading players operating in the sternal closure systems market have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Global Sternal closure systems market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size by applying the process mentioned above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, segment, and forecast the global sternal closure systems market by product, procedure, material, and region

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, challenges, and trends)

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall sternal closure systems market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments with respect to four regions—North America, Europe, the Asia Pacific, and the Rest of the World

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To benchmark players within the market using the proprietary Competitive Leadership Mapping framework, which analyzes market players on various parameters within the broad categories of business and product excellence

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Country Information

Sternal closure systems market size and growth rate estimates for countries in the Rest of Europe, the Rest of Asia Pacific, and Rest of the World

Company profiles

Additional five company profiles of players operating in the sternal closure systems market.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Sternal Closure Systems Market