Starter Fertilizers Market by Nutrient Component (Nitrogen, Phosphorus, Potassium, and Micronutrients), Form (Dry and Liquid), Crop Type, Method of Application, and Region - Global Forecast to 2022

The starter fertilizers market is projected to grow at a CAGR of 4.04% from 2016 to 2022, to reach USD 8.33 Billion by 2022. The base year considered for the study is 2015 and the forecast years include 2016 to 2022. The basic objective of the report is to define, segment, and project the global market size for starter fertilizers on the basis of type, crop type, form, and region. It also helps to understand the structure of the starter fertilizers market by identifying its various subsegments. Other objectives are analyzing the opportunities in the market for stakeholders, providing a competitive landscape of market trends, and analyzing the macro and micro indicators of this market to provide factor analysis and to project the size of the market and its submarkets, in terms of value.

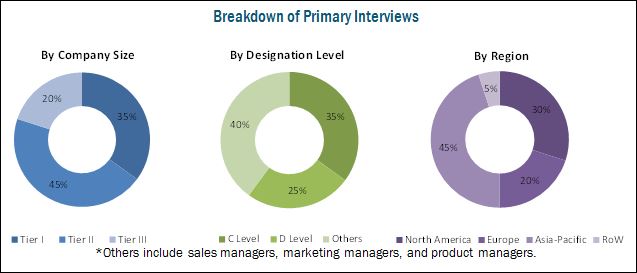

This report includes estimations of market sizes for value (USD million). Both, top-down and bottom-up approaches have been used to estimate and validate the size of the global starter fertilizers market and to estimate the size of various other dependent submarkets in the overall market. The key players in the market have been identified through secondary research, some of the sources are Press Releases, Paid Databases such as Factiva and Bloomberg, Annual Reports, and Financial Journals; their market share in respective regions have also been determined through primary and secondary research. All percentage shares, splits, and breakdown have been determined using secondary sources and were verified through primary sources. The figure below shows the breakdown of profiles of industry experts who participated in the primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

Key participants in the supply chain of the starter fertilizers market are starter fertilizer manufacturers, raw material manufacturers for starter fertilizers and distributors & retailers. The key players that are profiled in the report include The Scotts Miracle-Gro Company (U.S.), Yara International ASA (Norway), Agrium Inc. (U.S.), Stoller USA Inc. (U.S.), Helena Chemical Company (U.S.), Miller Seed Company (U.S.), and Nachurs Alpine Solution (U.S.).

This report is targeted at the existing players in the industry, which include the following:

- Manufacturers, importers & exporters, traders, distributors, and suppliers of fertilizers

- Agriculture research organizations

- Raw material suppliers

- Government authorities

“The study answers several questions for stakeholders, primarily which market segments to focus on in next two to five years for prioritizing efforts and investments”.

Scope of the Report

On the basis of Nutrient Component Type, the Starter Fertilizers Market has been segmented as follows:

-

Phosphorus

- Monoammonium phosphate

- Diammonium phosphate

- Ammonium phosphate

-

Nitrogen

- Ammonium nitrate

- Ammonium sulfate

-

Potassium

- Potassium chloride

- Potassium magnesium sulfate

- Potassium sulfate

-

Micronutrient

- Sulfur

- Zinc

- Boron

- Others

On the basis of Crop Type, the Starter Fertilizers Market has been segmented as follows:

- Cereals

- Fruits & vegetables

- Forage & turf grasses

On the basis of Method of Application, the Starter Fertilizers Market has been segmented as follows:

- In-furrow

- Fertigation

- Foliar

On the basis of Region, the Starter Fertilizers Market has been segmented as follows:

- North America

- Europe

- Asia-Pacific

- RoW

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the Starter Fertilizers Market report:

Regional Analysis

- Further country specific data and its market analysis

Company Information

- Detailed analysis and the profiling of additional market players (Up to five)

The starter fertilizers market is projected to grow at a CAGR of 4.04% from 2016 to 2022, to reach a projected value of USD 8.33 Billion by 2022. Starter fertilizers have become prominent in the recent years, due to the increase in the area under forage & turf grasses, growth in awareness regarding the types of crops that can benefit from the use of starter fertilizers, and increase in research activities regarding the importance of placement methods in fertilizer applications.

The method of application segment of the starter fertilizers market was led by in-furrow and followed by fertigation and foliar, respectively. Foliar is expected to have the highest growth rate as it is known to increase nutrient supply during early growth stages, when the root system is not well developed. Foliar application of nutrients though starter fertilizers on crops such as corn and soybean has proved to be helpful in overcoming possible limitations in crop nutrient uptake and increasing nutrient use efficiency and yields.

Among the nutrient component type such as nitrogen, phosphorus, potassium and micronutrients, phosphorus accounted for the largest market share in 2015. Phosphorus starter fertilizers are used to a large extent among farmers, globally. Phosphorus is a key nutrient required by roots at the germination stage of crop growth. Most starter fertilizers thus contain a higher proportion of phosphorus. The cereal crops segment dominated the starter fertilizers market in 2015, owing to phosphorus’s large-scale application to corn, sorghum, and wheat crops cultivated in the North American region.

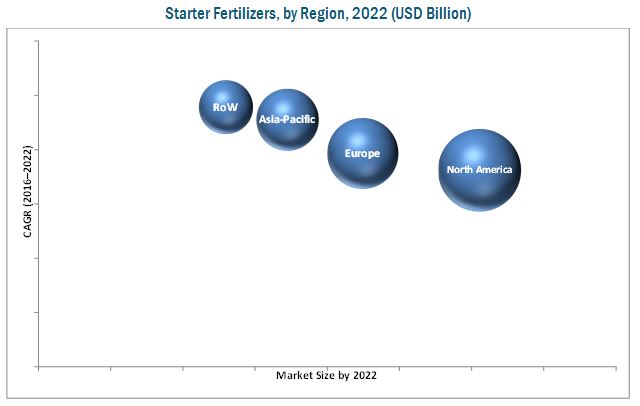

North America accounted for the largest market share for starter fertilizers, the U.S. being the fastest growing in the region, from 2016 to 2022. Asia Pacific is projected to be the fastest-growing market for the period considered for this study, due to the high adoption rate of starter fertilizer products and high level of exports of these products to the Asia-Pacific region.

Limited usage in field crop production is one of the restraints for starter fertilizers market. In the production of field crops, this limited usage is due to the availability of other suitable types of fertilizers.

Yara International ASA is one of the key players in the starter fertilizers market and focuses on strengthening its fertilizers product portfolio by acquiring companies that help in expanding its production capacity of different types of fertilizers. The company’s core competencies are strong product portfolio for fertilizers market and global footprint for fertilizer products. Recently, the company acquired Greenbelt Fertilizers (Zambia), a leading distributor of fertilizers in Zambia, Malawi and Mozambique, for USD 51 million.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Scope of the Study

1.4 Years Considered for the Study

1.5 Unit Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Demand-Side Analysis

2.2.2.1 Increase in Value Added to Gdp By Agriculture

2.2.2.2 Rising Consumption of Fertilizer Nutrients

2.2.3 Supply-Side Analysis

2.2.3.1 Novel Formulations of Existing Nutrients

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Breakdown & Data Triangulation

2.5 Research Assumptions & Limitation

2.5.1 Assumptions

2.5.2 Limitations

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities in this Market

4.2 Market For Starter Fertilizers, By Nutrient Component

4.3 North America Starter Fertilizers Market, By Country and By Component

4.4 Market For Starter Fertilizers : Major Countries

4.5 Market For Starter Fertilizers, By Crop Type

4.6 Starter Fertilizers Market Life Cycle Analysis, By Region

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Nutrient Component

5.2.2 By Crop Type

5.2.3 By Form

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increased Area Under Forage & Turf Grasses

5.3.1.2 Widening Applicability of Starter Fertilizers

5.3.2 Restraints

5.3.2.1 Limited Usage in Field Crop Production

5.3.2.2 High Cost of Developing New Products

5.3.3 Opportunities

5.3.3.1 Increasing Consumption Trend of Fertilizers

5.3.3.2 Improvement in Pasture Production

5.3.4 Challenges

5.3.4.1 Availability of Alternatives

5.3.4.2 Fluctuation in Raw Material Prices

6 Industry Trends (Page No. - 43)

6.1 Introduction

6.2 Supply Chain Analysis

6.3 Value Chain Analysis

6.4 Import-Export Analysis

6.5 Raw Material Price Trends

7 Starter Fertilizers Market, By Nutrient Component (Page No. - 47)

7.1 Introduction

7.2 Phosphorus

7.3 Nitrogen

7.4 Potassium

7.5 Micronutrients

8 Starter Fertilizers Market, By Crop Type (Page No. - 55)

8.1 Introduction

8.2 Cereals

8.3 Fruits & Vegetables

8.4 Forage & Turf Grasses

8.5 Others

9 Starter Fertilizers Market, By Method of Application (Page No. - 61)

9.1 Introduction

9.2 In-Furrow

9.3 Fertigation

9.4 Foliar

9.5 Other Methods

10 Starter Fertilizers Market, By Form (Page No. - 67)

10.1 Introduction

10.2 Liquid

10.3 Dry

11 Starter Fertilizers Market, By Region (Page No. - 71)

11.1 Introduction

11.2 North America

11.2.1 U.S.

11.2.2 Canada

11.2.3 Mexico

11.3 Europe

11.3.1 France

11.3.2 U.K.

11.3.3 Spain

11.3.4 Germany

11.3.5 Italy

11.3.6 Rest of Europe

11.4 Asia-Pacific

11.4.1 China

11.4.2 India

11.4.3 Australia

11.4.4 Japan

11.4.5 Rest of Asia-Pacific

11.5 Rest of the World (RoW)

11.5.1 Brazil

11.5.2 Argentina

11.5.3 Others in RoW

12 Competitive Landscape (Page No. - 103)

12.1 Introduction

12.2 Competitive Situations & Trends

12.2.1 Expansions & Investments

12.2.2 Agreements, Joint Ventures & Collaborations

12.2.3 Acquisitions

12.2.4 New Product Launches

13 Company Profiles (Page No. - 107)

(Company at A Glance, Business Overview, Products Offered, Key Strategy, Recent Developments, SWOT Analysis & MnM View)*

13.1 Introduction

13.2 Agrium Inc.

13.3 Yara International ASA

13.4 The Scotts Miracle-Gro Company

13.5 CHS Inc.

13.6 Stoller Usa Inc.

13.7 Nachurs Alpine Solutions Corp.

13.8 Conklin Company Partners Inc.

13.9 Helena Chemical Company

13.10 Miller Seed Company

13.11 Grassland Agro Ltd.

13.12 Agro-Culture Liquid Fertilizers

13.13 EC Grow

*Details on Company at A Glance, Recent Financials, Products Offered, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 127)

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.3 Introducing RT: Real-Time Market Intelligence

14.4 Available Customizations

14.5 Related Reports

List of Tables (80 Tables)

Table 1 Starter Fertilizers Market Size, By Nutrient Component, 2014–2022 (USD Million)

Table 2 Phosphorus Market Size, By Region, 2014–2022 (USD Million)

Table 3 Phosphorus Market Size, By Type, 2014–2022 (USD Million)

Table 4 Nitrogen Market Size, By Region, 2014–2022 (USD Million)

Table 5 Nitrogen Market Size, By Type, 2014–2022 (USD Million)

Table 6 Potassium Market Size, By Region, 2014–2022 (USD Million)

Table 7 Potassium Market Size, By Type, 2014–2022 (USD Million)

Table 8 Micronutrients Market Size, By Region, 2014–2021 (USD Million)

Table 9 Micronutrients Market Size, By Type, 2014–2022 (USD Million)

Table 10 Starter Fertilizers Market Size, By Crop Type, 2014–2022 ( USD Million)

Table 11 Cereals Market Size, By Region, 2014–2022 (USD Million)

Table 12 Fruits & Vegetables Market Size, By Region, 2014–2022 (USD Million)

Table 13 Forage & Turf Grasses Market Size, By Region, 2014–2022 (USD Million)

Table 14 Others Market Size, By Region, 2014–2022 (USD Million)

Table 15 Starter Fertilizers Market Size, By Method of Application, 2014–2022 (USD Million)

Table 16 In-Furrow Market Size, By Region, 2014–2022 (USD Million)

Table 17 Fertigation Market Size, By Region, 2014–2022 (USD Million)

Table 18 Foliar Market Size, By Region, 2014–2022 (USD Million)

Table 19 Other Methods Market Size, By Region, 2014–2022 (USD Million)

Table 20 Market Size For Starter Fertilizers, By Form, 2014–2022 (USD Million)

Table 21 Liquid Starter Fertilizers Market Size, By Region, 2014–2022 (USD Million)

Table 22 Dry Starter Fertilizers Market Size, By Region, 2014–2022 (USD Million)

Table 23 Market Size For Starter Fertilizers, By Region, 2014-2022 (USD Million)

Table 24 North America: Market Size, By Country, 2014-2022 (USD Million)

Table 25 North America: Market Size, By Nutrient Component, 2014-2022 (USD Million)

Table 26 North America: Phosphorus Market Size, By Country, 2014-2022 (USD Million)

Table 27 North America: Nitrogen Market Size, By Country, 2014-2022 (USD Million)

Table 28 North America: Potassium Market Size, By Country, 2014-2022 (USD Million)

Table 29 North America: Micronutrients Market Size, By Country, 2014-2022 (USD Million)

Table 30 North America: Starter Fertilizers Market Size, By Crop Type, 2014-2022 (USD Million)

Table 31 North America: Market Size For Starter Fertilizers, By Method of Application, 2014-2022 (USD Million)

Table 32 North America: Market Size For Starter Fertilizers, By Form, 2014-2022 (USD Million)

Table 33 U.S.: Starter Fertilizers Market Size, By Nutrient Component, 2014-2022 (USD Million)

Table 34 Canada: Market Size For Starter Fertilizers, By Nutrient Component, 2014-2022 (USD Million)

Table 35 Mexico: Market Size, By Nutrient Component, 2014-2022 (USD Million)

Table 36 Europe: Market Size For Starter Fertilizers, By Country, 2014-2022 (USD Million)

Table 37 Europe: Market Size For Starter Fertilizers, By Nutrient Component, 2014-2022 (USD Million)

Table 38 Europe: Phosphorus Market Size, By Country, 2014-2022 (USD Million)

Table 39 Europe: Nitrogen Market Size, By Country, 2014-2022 (USD Million)

Table 40 Europe: Potassium Market Size, By Country, 2014-2022 (USD Million)

Table 41 Europe: Micronutrients Market Size, By Country, 2014-2022 (USD Million)

Table 42 Europe: Starter Fertilizers Market Size, By Crop Type, 2014-2022 (USD Million)

Table 43 Europe: Market Size For Starter Fertilizers, By Method of Application, 2014-2022 (USD Million)

Table 44 Europe: Market Size For Starter Fertilizers, By Form, 2014-2022 (USD Million)

Table 45 France: Market Size For Starter Fertilizers, By Nutrient Component, 2014-2022 (USD Million)

Table 46 U.K.: Market Size For Starter Fertilizers, By Nutrient Component, 2014-2022 (USD Million)

Table 47 Spain: Market Size, By Nutrient Component, 2014-2022 (USD Million)

Table 48 Germany: Market Size, By Nutrient Component, 2014-2022 (USD Million)

Table 49 Italy: Market Size For Starter Fertilizers, By Nutrient Component, 2014-2022 (USD Million)

Table 50 Rest of Europe: Market Size For Starter Fertilizers, By Nutrient Component, 2014-2022 (USD Million)

Table 51 Asia-Pacific: Starter Fertilizers Market Size, By Country, 2014-2022 (USD Million)

Table 52 Asia-Pacific: Market Size For Starter Fertilizers, By Nutrient Component, 2014-2022 (USD Million)

Table 53 Asia-Pacific: Phosphorus Market Size, By Country, 2014-2022 (USD Million)

Table 54 Asia-Pacific: Nitrogen Market Size, By Country, 2014-2022 (USD Million)

Table 55 Asia-Pacific: Potassium Market Size, By Country, 2014-2022 (USD Million)

Table 56 Asia-Pacific: Micronutrients Market Size, By Country, 2014-2022 (USD Million)

Table 57 Asia-Pacific: Market Size For Starter Fertilizers, By Crop Type, 2014-2022 (USD Million)

Table 58 Asia-Pacific: Market Size For Starter Fertilizers, By Method of Application, 2014-2022 (USD Million)

Table 59 Asia-Pacific: Starter Fertilizers Market Size, By Form, 2014-2022 (USD Million)

Table 60 China: Market Size, By Nutrient Component, 2014-2022 (USD Million)

Table 61 India: Market Size For Starter Fertilizers, By Nutrient Component, 2014-2022 (USD Million)

Table 62 Australia: Market Size For Starter Fertilizers, By Nutrient Component, 2014-2022 (USD Million)

Table 63 Japan: Market Size For Starter Fertilizers, By Nutrient Component, 2014-2022 (USD Million)

Table 64 Rest of Asia-Pacific: Market Size For Starter Fertilizers, By Nutrient Component, 2014-2022 (USD Million)

Table 65 RoW: Starter Fertilizers Market Size, By Country, 2014-2022 (USD Million)

Table 66 RoW: Market Size For Starter Fertilizers, By Nutrient Component, 2014-2022 (USD Million)

Table 67 RoW: Phosphorus Market Size, By Country, 2014-2022 (USD Million)

Table 68 RoW: Nitrogen Market Size, By Country, 2014-2022 (USD Million)

Table 69 RoW: Potassium Market Size, By Country, 2014-2022 (USD Million)

Table 70 RoW: Micronutrients Market Size, By Country, 2014-2022 (USD Million)

Table 71 RoW: Market Size For Starter Fertilizers, By Crop Type, 2014-2022 (USD Million)

Table 72 RoW: Market Size For Starter Fertilizers, By Method of Application, 2014-2022 (USD Million)

Table 73 RoW: Market Size For Starter Fertilizers, By Form, 2014-2022 (USD Million)

Table 74 Brazil: Starter Fertilizers Market Size, By Nutrient Component, 2014-2022 (USD Million)

Table 75 Argentina: Market Size For Starter Fertilizers, By Nutrient Component, 2014-2022 (USD Million)

Table 76 Others in RoW: Starter Fertilizers Market Size, By Nutrient Component, 2014-2022 (USD Million)

Table 77 Expansions & Investments, 2013-2016

Table 78 Agreements, Joint Ventures & Collaborations 2011-2016

Table 79 Acquisitions, 2014-2015

Table 80 New Product Launches, 2013

List of Figures (46 Figures)

Figure 1 Market Segmentation

Figure 2 Research Design

Figure 3 World Consumption of Nutrients

Figure 4 Bottom-Up Approach

Figure 5 Top-Down Approach

Figure 6 Data Triangulation

Figure 7 North America is Expected to Dominate this Market From 2016 to 2022

Figure 8 Starter Fertilizers Market Size, By Nutrient Component, 2016 vs 2022 (USD Million)

Figure 9 Cereals Segment is Estimated to Hold the Largest Market Share in 2016

Figure 10 Market Players Preferred Expansions & Investments as the Key Strategy From 2011 to 2016

Figure 11 Rising Applicability of Starter Fertilizers Provides Opportunities for This Market

Figure 12 Phosphorus Nutrient Segment to Grow at the Highest Rate

Figure 13 North America Was the Largest Market for Starter Fertilizers in 2015

Figure 14 Brazil is Projected to Be the Fastest-Growing Country-Level Market for Starter Fertilizers From 2016 to 2022

Figure 15 North America Dominated the Starter Fertilizers Market Across All Crop Types in 2015

Figure 16 Asia-Pacific Starter Fertilizers Market is Experiencing High Growth

Figure 17 Starter Fertilizers Market Segmentation, By Nutrient Component

Figure 18 Market Segmentation For Starter Fertilizers, By Crop Type

Figure 19 Market Segmentation For Starter Fertilizers, By Form

Figure 20 Starter Fertilizers Market: Drivers, Restraints, Opportunities and Challenges

Figure 21 Global Fertilizer Consumption Trend, 2002-2012

Figure 22 Supply Chain Analysis: Market For Starter Fertilizers

Figure 23 Value Chain Analysis: Market For Starter Fertilizers

Figure 24 Fertilizer Mixtures: Import-Export, By Country (2015)

Figure 25 Starter Fertilizer Raw Material Price Trends (2012-2015)

Figure 26 Phosphorus is Projected to Dominate the Market During the Forecast Period

Figure 27 North America to Remain the Largest Market Through 2022 (USD Million)

Figure 28 Cereals Segment is Projected to Dominate the Starter Fertilizers Market Through 2022 (USD Million)

Figure 29 The Asia-Pacific Cereals Market for Starter Fertilizers is Projected to Grow at the Highest Rate in Terms of Value From 2016 to 2022

Figure 30 In-Furrow Segment to Dominate the Market Throughout the Forecast Period

Figure 31 North America & Europe to Dominate the Market From 2016 Through 2022

Figure 32 Liquid Form of Starter Fertilizers is Projected to Dominate Through 2022

Figure 33 North America to Dominate the Liquid Starter Fertilizers Market Throughout the Forecast Period

Figure 34 Regional Snapshot: Markets in Brazil and Japan are Emerging as New Hot Spots

Figure 35 North American Starter Fertilizers Market Snapshot: U.S. is Projected to Grow at A High Rate Between 2016 & 2022

Figure 36 Market Snapshot For Asia Pacific Starter Fertilizers: Japan is Projected to Grow at Highest Rate Between 2016 & 2022

Figure 37 Key Companies Preferred Strategies Such as Expansions & Agreements From 2011 to 2016

Figure 38 Battle for Market Share: Expansion &Investment Were the Key Growth Strategies From (2011-2016)

Figure 39 Agrium Inc.: Company Snapshot

Figure 40 Agrium Inc.: SWOT Analysis

Figure 41 Yara International ASA: Company Snapshot

Figure 42 Yara International ASA: SWOT Analysis

Figure 43 The Scotts Miracle-GRO Company: Company Snapshot

Figure 44 The Scotts Miracle-GRO Company: SWOT Analysis

Figure 45 CHS Inc.: Company Snapshot

Figure 46 CHS Inc.: SWOT Analysis

Growth opportunities and latent adjacency in Starter Fertilizers Market