Sports Nutrition Market by Product Type (Sports Supplements, Sports Drinks, Sports Foods, Meal Replacement Products), Formulation (Tablets, Capsules, Powder, Softgels, Liquid), End User (Athletes, Bodybuilders, Recreational users, lifestyle users) - Global Forecast to 2029

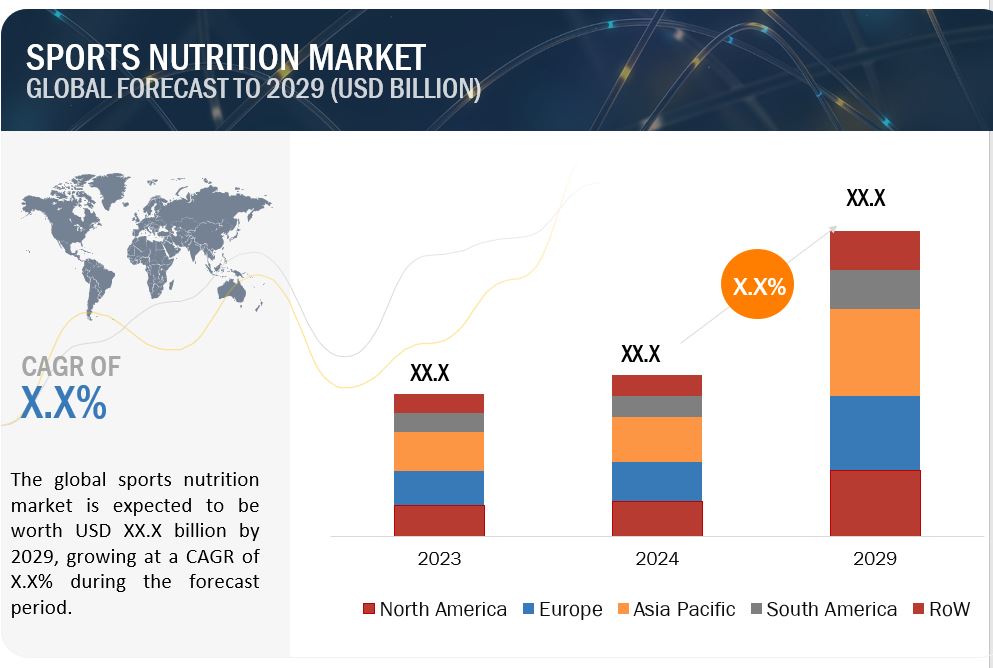

The global sports nutrition market is on a trajectory of significant expansion, with an estimated value projected to reach USD XX billion by 2029 from the 2024 valuation of USD XX billion, displaying a promising Compound Annual Growth Rate (CAGR) of 7.2%. In recent years, the sports nutrition industry has experienced a notable shift driven by the increasing demand from mainstream consumers adopting active lifestyles. Traditionally dominated by elite athletes and bodybuilders, the market now sees significant contributions from health-conscious individuals seeking products that support their fitness goals and overall well-being. This shift has prompted sports nutrition brands to evolve their product development and marketing strategies, emphasizing accessibility and appeal to broader consumer segments. Key trends shaping this transformation include the rise of personalized nutrition solutions. Consumers increasingly favor tailored approaches that address individual nutritional needs, leveraging advancements in health assessments, biomarkers, and genetic insights. This trend not only enhances consumer engagement but also enables brands to offer more targeted and effective nutritional solutions.

Moreover, convenience has emerged as a pivotal factor influencing consumer choices, exacerbated by the pandemic-driven surge in e-commerce. Brands are increasingly leveraging alternative delivery methods such as nutrition bars and ready-to-drink supplements to meet the demand for on-the-go solutions. Simultaneously, there is a growing emphasis on transparency and clean labeling, reflecting consumers' increased awareness of product ingredients and health implications. This shift necessitates clear and informative messaging to build trust and loyalty among active lifestyle consumers who prioritize holistic health benefits and product integrity. As the market continues to expand, leveraging these trends will be crucial for brands seeking to capitalize on the burgeoning mainstream interest in sports nutrition.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Drivers: Increasing Awareness and Participation in Fitness Activities

The sports nutrition market continues to be driven by increasing awareness of the benefits of physical activity and healthy living. As more individuals engage in fitness activities, there is an increased demand for products that support performance enhancement, recovery, and overall health. The market growth is further propelled by innovations in product formulations, catering to diverse consumer needs from athletes to fitness enthusiasts. Key factors influencing market expansion include growing health consciousness, and expanding retail distribution channels. Additionally, collaborations with fitness centers, sporting events, and endorsements by athletes play pivotal roles in market visibility and consumer trust. This dynamic landscape presents opportunities for industry stakeholders to leverage consumer trends toward holistic health and wellness solutions, positioning themselves strategically in the competitive sports nutrition sector.

Restraints: Consumer sensitivity to highly priced products.

Premium pricing of sports nutrition products can present a significant barrier to market expansion, particularly in emerging regions such as Asia-Pacific, South America, and the Middle East. Consumer sensitivity to pricing, coupled with competitive pressures and varying economic conditions, can restrict uptake. Many potential consumers perceive high-priced products as unaffordable or insufficiently justified by perceived benefits compared to lower-cost alternatives. This dynamic challenges market penetration efforts and limits the potential customer base. Moreover, distribution challenges and the need for specialized retail channels further complicate market entry for premium brands. To overcome these barriers, companies must carefully balance pricing strategies with product differentiation and targeted marketing efforts to effectively address diverse consumer preferences and economic realities in these regions.

Opportunities: Increase in Demand for claim free products like natural & organic certified.

The demand for natural and organic sports nutrition products has surged significantly in recent years, driven by a global shift towards healthier lifestyles and heightened awareness among athletes regarding ingredient quality and product efficacy. This trend has been bolstered by consumer preferences for minimally processed supplements, which preserve the inherent benefits of plant-based ingredients without synthetic additives. Consumers, particularly in regions like the UK and North America, are increasingly skeptical about synthetic ingredients in traditional sports supplements, with a significant portion favoring cleaner labels and transparency in product formulations. This shift towards "clean label" products has driven companies to focus on sustainability, transparency, and ethical sourcing practices. Brands that emphasize organic ingredients and clear, understandable labeling are gaining trust and market share, as evidenced by consumer surveys indicating a preference for products perceived as safer and more nutritious.

Technological advancements have also played a crucial role in meeting this demand. Companies are leveraging new science-based technologies to enhance the effectiveness of organic ingredients, thereby improving both performance outcomes and consumer satisfaction. Strategic partnerships and expanded distribution channels, such as ProSource's collaboration with Pepsi-Cola Bottling Company for wider market reach, underscore the industry's commitment to meeting the growing demand for organic sports nutrition products.

Challenges: New entrants face substantial barriers.

The sports nutrition market is indeed fiercely competitive, characterized by a multitude of established brands and new entrants striving to capture market share. Key players such as Glanbia, Abbott Laboratories, and PepsiCo dominate with extensive product portfolios and strong distribution networks, bolstered by significant investments in research and development. New entrants face substantial barriers including high initial capital investment requirements for manufacturing facilities and marketing campaigns to establish brand recognition amidst established competitors. Moreover, regulatory hurdles, particularly in emerging markets like Asia-Pacific and Latin America, further complicate market entry strategies. To succeed, new players must differentiate through innovation, such as offering natural and organic products that appeal to health-conscious consumers, or by targeting niche segments like vegan athletes. Successful market penetration demands a blend of strategic partnerships, robust research and development capabilities, and agile marketing strategies to effectively navigate this dynamic and competitive environment.

Market Ecosystem

Sports supplements are witnessing significant growth during the forecast period.

The sports supplements segment within the sports nutrition market is experiencing robust growth during the forecast period, driven by increasing consumer awareness regarding health and fitness. This growth is bolstered by the rising prevalence of fitness-centric lifestyles, particularly among millennials and Gen Z, who are increasingly prioritizing physical well-being and performance enhancement. Moreover, the proliferation of e-commerce platforms has expanded market accessibility, facilitating a wider consumer reach. Key players are capitalizing on this trend by innovating product formulations and focusing on natural, organic ingredients to meet the escalating demand for clean-label products. Strategic marketing initiatives, endorsements by high-profile athletes, and collaborations with fitness influencers further amplify market penetration, positioning sports supplements as a pivotal component in the broader health and wellness industry.

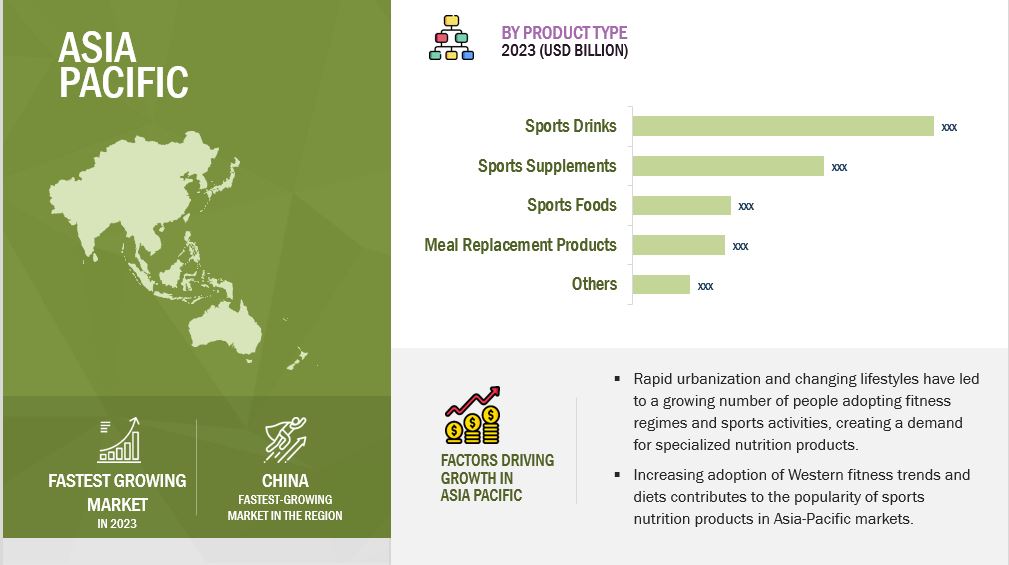

Asia pacific is the fastest-growing market for sports nutrition among the regions.

The sports nutrition market in the Asia Pacific region is experiencing robust growth, fueled by increasing health awareness and the influence of global events like the Tokyo Olympics. Key markets such as Japan, China, and India are leading this expansion, with Japan already being a significant player due to its high consumer engagement and interest in fitness and wellness. The demand for protein supplements, sports drinks, and ready-to-drink protein beverages is particularly strong, driven by an active lifestyle trend and heightened awareness of the benefits of sports nutrition. Additionally, the region is witnessing a shift towards natural and organic products, with consumers prioritizing clean labels and functional ingredients. Collaborations between local and international brands and endorsements by prominent athletes are further propelling market growth, making the Asia Pacific a lucrative landscape for sports nutrition businesses.

Key Market Players

The key players in this market include Abbott (US), Glanbia PLC (Ireland), PepsiCo (US), The Coca-Cola Company (US), Mondelez International (US), Quest Nutrition, LLC (US), GNC Holdings, LLC (US), Otsuka Holdings Co., Ltd. (Japan), POST HOLDINGS, INC. (US), and MusclePharm. (US).

Recent Developments

- In January 2024, Abbott Laboratories has introduced a new protein shake under its new brand Protality, aimed at adults seeking weight loss while preserving muscle mass. This launch aligns with Abbott's strategy to tap into the growing demand for GLP-1 class weight-loss drugs. CEO Robert Ford emphasized the company's nutrition business initiative to counter muscle loss associated with GLP-1 medications like Wegovy, Ozempic, Mounjaro, and Zepbound, which have experienced substantial demand recently. Analysts project the GLP-1 drug class to exceed USD 100 billion in annual sales by the decade's end.

- In March 2023, PepsiCo launched Gatorade Fast Twitch, an innovative non-carbonated energy drink tailored for athletes. This product marks a strategic shift within PepsiCo's sports nutrition portfolio, integrating elements from its acquisition of CytoSport, known for Muscle Milk. Positioned in the performance energy drink category, Gatorade Fast Twitch includes 200mg of caffeine, B vitamins, and electrolytes, appealing to consumers seeking pre-workout solutions without carbonation. This move reflects PepsiCo's strategy to expand its "All G" portfolio, aimed at enhancing Gatorade's presence in sports nutrition while potentially merging brands like Evolve and Muscle Milk for broader market appeal.

- In November 2021, Coca-Cola has completed the acquisition of BODYARMOR, a sports performance and hydration beverage brand, by purchasing the remaining 85% stake for USD 5.6 billion in cash. Initially acquiring a 15% stake in 2018, Coca-Cola facilitated BODYARMOR's growth within its North American unit, headquartered in New York. The brand will operate independently, led by its current executive team, and continue its strategic growth plan under Coca-Cola's ownership. BODYARMOR, now the second-largest sports drink in measured retail channels, aims to leverage Coca-Cola's distribution network for further expansion in the health and wellness beverage market.

Frequently Asked Questions (FAQ):

What is the current size of the sports nutrition market?

The sports nutrition market is estimated at USD XX billion in 2024 and is projected to reach USD XX billion by 2029, at a CAGR of 7.2% from 2024 to 2029.

Which are the key players in the market, and how intense is the competition?

The key players in the sports nutrition market Abbott (US), Glanbia PLC (Ireland), PepsiCo (US), The Coca-Cola Company (US), Mondelez International US), Quest Nutrition, LLC (US), GNC Holdings, LLC (US), Otsuka Holdings Co., Ltd. (Japan), POST HOLDINGS, INC. (US), and MusclePharm. (US).

The sports nutrition market witnesses increased scope for growth. The market is seeing an increase in the number of joint ventures, acquisitions, and new expansions. Moreover, the companies involved in manufacturing sports nutrition products are investing a considerable proportion of their revenues in research and development activities.

Which region is projected to account for the largest share of the sports nutrition market?

The North America market is expected to dominate during the forecast period. In North America, particularly in the United States and Canada, there is a high level of awareness about health and fitness. This awareness drives demand for sports nutrition products among a wide demographic, from professional athletes to recreational gym-goers.

What kind of information is provided in the company profile section?

The company profiles mentioned above offer valuable information such as a comprehensive business overview, including details on the company's various business segments, financial performance, geographical reach, revenue composition, and the breakdown of their business revenue. Additionally, these profiles offer insights into the company's product offerings, significant milestones, and expert analyst perspectives to further explain the company's potential.

What are the factors driving the sports nutrition market?

The Sports nutrition market is driven by several key factors, including the rising awareness of health and fitness among consumers, coupled with an increasing inclination towards preventive healthcare, is significantly boosting the demand for sports nutrition products. Additionally, the proliferation of e-commerce platforms has enhanced product accessibility, further fueling market expansion. Innovations in product formulations, such as plant-based and organic ingredients, cater to the growing consumer preference for natural and clean-label products. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Growth opportunities and latent adjacency in Sports Nutrition Market