Spoil Detection Based Smart Label Market by Type (Fish, Meat, Vegetables, Dairy Products), and Geography (North America, Europe, APAC, Row) - Global Forecast to 2020

The spoil detection based smart label market was worth USD 860.96 Million in 2014 and is expected to reach USD 1.68 Billion by 2020, at a CAGR of 11.8% between 2014 and 2020.

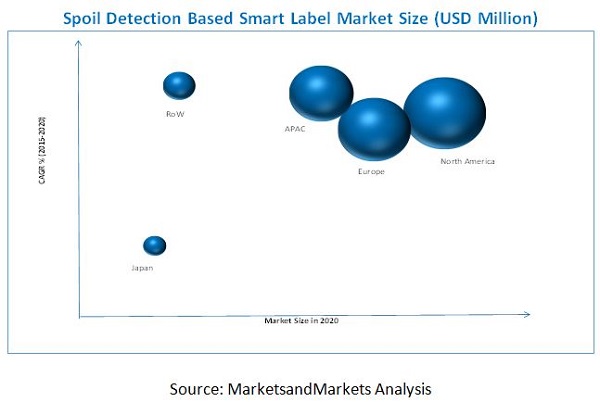

The global spoil detection based smart label market has been segmented on the basis of type and geography. The global spoil detection based smart label market based on type has been segmented into fish, meat, vegetables, dairy products, processed foods, and others. The others types include beverages and pulses. Geographically, the spoil detection based smart label market has been segmented into North America, Europe, Asia-Pacific (excluding Japan), Japan, and RoW. The base year considered for this report study is 2014 and the market forecast has been provided till 2020.

The global spoil detection based smart label market was valued at USD 860.96 Million in 2014, and is expected to grow at a CAGR of 11.8% from 2014 to 2020 to reach USD 1.68 Billion by 2020. Increasing government standards and rising customer preferences for hygiene of food material are expected to spur this market in the near future. Spoil detection based smart label is a GOOD alternative to detect the spoilage of food material.

The market based on type consists of materials on which labels are used. On the basis of type, the market has been segmented into fish, meat, vegetables, and dairy product, and processed foods among others. The smart label market used for fish related products is expected to grow at the highest CAGR between 2014 and 2020. Governing bodies of various countries have framed policies to encourage the use of labels in fishery products. For example, according to the E.U. relation no. 1169/2011, frozen meat including seafood should possess the label of date of freezing, date of expiry, frozen meat preparations methods along with the name and address of the manufacturer/packer. They also contain several other general rules which cover nutrition, country of origin, and health claims. Such supportive government regulation helps the spoil detection based smart label market in fishery industry to grow.

The market has been segmented into North America, Europe, Asia-Pacific (excluding Japan), Japan, and RoW. North America is expected to hold the largest share during the forecast period, followed by Europe and Asia-Pacific (excluding Japan). Increasing customer preference for hygienic food material and supportive norms by the Food and Drug Administration (FDA) and the U.S. Department of Agriculture (USDA) to reduce the wastage of food due to contamination of food material during distribution is expected to the boost market in North America, and it is expected to grow at a high rate.

Mechanical vulnerability of the smart labels is high. It creates chances of wear and tear in various industries such as logistics, manufacturing, and retail, which ultimately affects the performance of smart labels. Additional costs related to the software systems, physical environment of smart labels, and the lack of standardization and harmonization of frequency allocation are hampering the growth of the smart label market.

Some of the major companies operating in this market include Invengo Information Technology Co. Ltd. (China), Muhlbauer Holding Ag (Germany), SATO Holding Corporation (Japan), Smartrac N.V. (Netherland), Thin Film Electronics ASA (Norway), and Zebra Technologies (U.S.).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 8)

1.1 Objectives of the Study

1.2 Report Scope

1.2.1 Market Definition

1.2.2 Market Segmentation

1.3 Research Assumptions

2 Research Methodology (Page No. - 11)

2.1 Research Approach

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

3 Executive Summary (Page No. - 16)

4 Market Overview (Page No. - 18)

4.1 Introduction

4.2 History and Evolution of Spoil Detection Industry

4.3 Trends in the Smart Label Industry

4.4 Complementary Spoil Detection Products

5 Market Analysis (Page No. - 21)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1 Restraints

5.2.2 Opportunities

5.3 Burning Issue

5.3.1 Indirect Increase in Product Cost

5.4 Winning Imperative

5.4.1 Increasing Adoption of Sensing Labels in the Healthcare

and Pharmaceutical Industry 28

5.5 Product Positioning of Spoil Detection Based Smart Labels

5.6 Value Chain Analysis

6 Smart Label Market, By Type (Page No. - 31)

6.1 Introduction

6.2 Fish

6.3 Meat

6.4 Vegetables

6.5 Dairy Products

6.6 Others

7 Smart Label Market By Geography (Page No. - 40)

7.1 Introduction

7.2 North America

7.3 Europe

7.4 APAC (Excluding Japan)

7.5 Japan

7.6 RoW

8 Competitive Landscape (Page No. - 47)

8.1 Overview

8.2 Market Share Analysis, Spoil Detection Based Smart Label Market

8.3 New Product Launches

8.4 Acquisitions

8.5 Strategic Alliance/Collaboration/Agreements

8.6 Others

9 Company Profiles (Page No. - 52)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

9.1 Sato Holdings AG

9.2 Thin Film Electronics ASA

9.3 Zebra Technologies

9.4 Smartrac N.V.

9.5 Invengo Information Technology Co., Ltd.

9.6 Muhlbauer Holding AG & Co. KGAA.

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

10 Appendix (Page No. - 68)

10.1 Related Reports

List of Tables (17 Tables)

Table 1 Complementary Spoil Detection Products

Table 2 Spoil Detection Based Smart Labels, By Geography, 2013-2020

Table 3 Run Time Protection, Automated Spoilage Detection, and Increase in Demand Are Driving the Spoil Detection Based Smart Label Market

Table 4 Additional Cost Incurred Due to the Use of Smart Labels is Restraining the Growth of This Market

Table 5 Increasing Demand in the Supply Chain for Perishables Generating New Opportunities for Smart Label Market Players

Table 6 Spoil Detection Based Smart Labels and Their Position on the Lifecycle Curve of the Smart Label Industry

Table 7 Spoil Detection Based Smart Label Market, By Type, 2013-2020 (USD Million)

Table 8 Fish:Spoil Detection Based Smart Labels Market, By Geography, 2013-2020 (USD Million)

Table 9 Meat: Spoil Detection Based Smart Label, By Type, 2013-2020 (USD Million)

Table 10 Vegetables: Spoil Detection Based Smart Label Market, By Type, 2013-2020 (USD Million)

Table 11 Dairy Products: Spoil Detection Based Smart Label Market, By Type, 2013-2020 (USD Million)

Table 12 Processed Foods: Spoil Detection Based Smart Label Market, By Type, 2013-2020, USD Million

Table 13 Others: Spoil Detection Based Smart Label Market, By Type, 2013-2020 (USD Million)

Table 14 New Product Launches, 2012–2015

Table 15 Acquisitions, 2011–2014

Table 16 Strategic Alliace/Collaboration/Agreements: 2012–2014

Table 17 Others Recent Developments

List of Figures (27 Figures)

Figure 1 Research Methodology

Figure 2 Market Size Estimation Methodology: Bottom-Up Approach

Figure 3 Market Size Estimation Methodology: Top-Down Approach

Figure 4 Japan and Rest of APAC Are Expected to Drive Spoil Detection Based Smart Label Market in Forecast Period

Figure 5 Spoil Detection Based Smart Label Market, 2013-2020 (USD MN)

Figure 6 Major Factors Impacting the Smart Label Market

Figure 7 Product Positioning: Spoil Detection Based Smart Labels, 2015

Figure 8 Value Chain Analysis: Major Value is Added During the Raw Material Supply and Original Equipment Manufacturing Phase

Figure 9 Spoil Detection Based Smart Label Market, By Type

Figure 10 Increased Applications in Fishery Expected to Spearhead the Spoil Detection Based Label Market in Forecast Period

Figure 11 Geographic Snapshot : Spoil Detection Based Smart Label Market

Figure 12 North American Market for Spoil Detection Labels Expected to Register A Double Digit Growth in Forecast Period

Figure 13 Government Regulations Are Expected to Drive Europe Spoil Detection Based Smart Label Market in Forecast Period

Figure 14 APAC Region Expected to Grow Exponentially in Spoil Detection Label Market in the Next Five Years

Figure 15 Japanese Market for Spoil Detection Based Smart Labels, 2013-2020 (USD MN)

Figure 16 RoW Market for Spoil Detection Based Smart Labels, 2013-2020 (USD MN)

Figure 17 Spoil Detection Based Smart Label Market Players Prefer New Product Launches and Strategic Alliances As A Key Strategy for Business Expansion

Figure 18 Spoil Detection Based Smart Label Market Share, By Key Player, 2013

Figure 19 Battle for Market Share: Strategicalliances /Collborations/ Agreements Was A Key Strategy

Figure 20 Sato Holdings AG : Revenue Mix, 2013

Figure 21 Thinfilm Electronics ASA : Company Overview

Figure 22 Zebra Technologies: Company Overview

Figure 23 Zebra Technologies:SWOT Analysis

Figure 24 Smartrac N.V.: Company Overview

Figure 25 Smartrac N.V.: SWOT Analysis

Figure 26 Invengo Information Technology Co., Ltd.: Company Overview

Figure 27 Muhlbauer Holding AG & Co. KGAA.: Company Overview

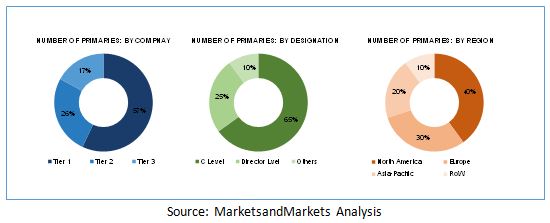

Major players operational in the spoil detection based smart label market have been identified across region, along with their offerings, distribution channel, and regional presence. Furthermore, the average revenues generated by these companies, segmented on the basis of region, were used to arrive at the overall market size. This overall market size was used in the top-down procedure to estimate the sizes of subsegments of markets via percentage splits from secondary and primary research. The entire procedure includes the study of the annual and financial reports of the top market players and extensive interview of key industry leaders such as CEOs, VPs, directors, marketing executives, subject matter experts (SMEs), and C-level executives of key market players to obtain and verify critical qualitative and quantitative information as well as to assess future prospects.

To know about the assumptions considered for the study, download the pdf brochure

This report provides valuable insights regarding the integrated ecosystem of the spoil detection based smart label market, which gives the holistic view of the current demand-side and vendor-side of this market. This study answers several questions for the stakeholders, primarily which market segments to focus on in next two to five years for prioritizing their efforts and investments. The value chain of smart label consists of product-based and service-based providers, with value being added at each stage, thereby producing end products and services comprising smart labels. Original equipment manufacturers (OEMs) and smart label manufacturers are the key contributor to the ecosystem of spoil detection based smart label market.

Target Audience

- Original Equipment Manufacturers (OEMs)

- Suppliers and Distributors

- Smart label manufactures

- Processed Food Manufactures

- Research Organizations and Institutes

- Market research and Consulting Firms

- Technology Standards Organizations, Forums, Alliances, and Associations

- Technology Investors

- Raw Material Supplier

- Base Material Manufacturing

- Third party Logistics

- Prototype Designing Firms

- Analysts and Strategic Business Planners

- End users interested to know more about the spoil detection based smart label and the latest technological developments in this market

- Government and Other Regulatory Bodies

Spoil Detection Based Smart Label Market Scope:

By Type:

- Fish

- Meat

- Vegetables

- Dairy Products

- Processed Foods

- Others

By Region:

- North America

- Europe

- Asia-Pacific (Excluding Japan)

- Japan

- Rest of the World

Available Customizations:

Along with the market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of region/country-specific analysis

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

Growth opportunities and latent adjacency in Spoil Detection Based Smart Label Market