Spiral Membrane Market by Polymer Type (Polyamide, PS & PES), Technology (RO, NF, UF, and MF), End-use Industry (Water & Wastewater Treatment, Food & Beverage, Pharmaceutical & Biotechnology, Oil & Gas), and Region - Global Forecast to 2023

Spiral Membrane Market Size And Forecast

The spiral membrane market was valued at USD 4.65 billion in 2017 and is projected to reach USD 8.20 billion by 2023, at a CAGR of 10.0% during the forecast period. In this study, 2017 has been considered as the base year while the forecast period that has been considered is from 2018 to 2023.

Market Dynamics

Driver

- Stringent regulatory and sustainability mandates for environmental safety

Restraint

- High operating cost for end users

Opportunities

- Growing population and rapid urbaniation in the emerging economies

Challenges

- High maintenance cost for increasing membrane lifespan

Stringent regulatory and sustainability mandates for environmental safety

Stringent regulatory and sustainability mandates have increased the demand for water purification and wastewater treatment. Environmental regulatory acts, such as Clean Water Act (CWA), Safe Drinking Water Act (SDWA), and related agencies, including Environmental Protection Agency (EPA), have enforced stringent rules and guidelines for eliminating the release of high amounts of toxic effluents into water sources. These regulations ensure that high-quality standards are followed for water & wastewater treatment. These factors increase the use of spiral membrane to meet the required standards. RO, UF, and NF technologies are expected to witness a high demand for reuse and recycling of water. Spiral membranes are mainly used in these technologies. Therefore, the increasing regulatory and sustainability mandates for environmental safety drives the spiral membrane market.

Objectives of the Study:

- To define, describe, and forecast the spiral membrane market on the basis of polymer type, technology, end-use industry, and region

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, future prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market shares and core competencies2

Note1: Micromarkets are the subsegments of the spiral membrane market included in the report

Note2: Core competencies of companies are determined in terms of their key developments, SWOT analysis, and key strategies adopted by them to sustain in the market

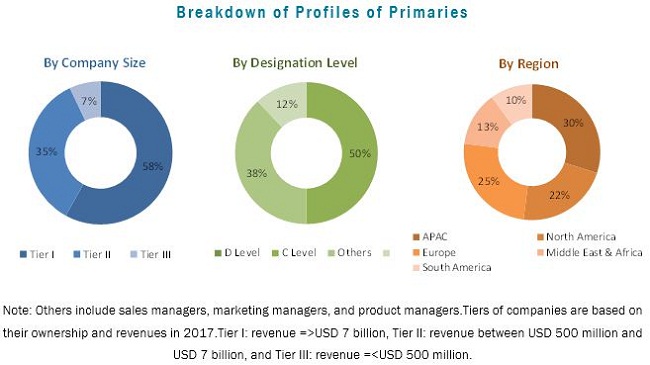

The top-down and bottom-up both approaches have been used to estimate and validate the size of the global spiral membrane market and to estimate the size of various other dependent submarkets. The research study involved the use of extensive secondary sources, directories, and databases such as Hoovers, Bloomberg, Chemical Weekly, Factiva, Commonwealth Scientific and Industrial Research Organization (CSIRO), Securities And Exchange Commission (SEC), American National Standards Institute (ANSI), Organization for Economic Co-operation and Development (OECD), and other government and private websites, to identify and collect information useful for the technical, market-oriented, and commercial study of the spiral membrane market. The figure below illustrates the breakdown of profiles of primaries.

To know about the assumptions considered for the study, download the pdf brochure

The spiral membrane market includes raw material suppliers, manufacturers of spiral membrane, and end users. DowDuPont Inc. (US), Toray Industries, Inc. (US), Hydranautics (US), LG Water Solutions (South Korea), SUEZ Water Technologies and Solutions (France), Merck Group (Germany), Pentair plc (US), Koch Membrane Systems (US), Pall Corporation (US), and Lanxess (Germany) are the leading players operating in the spiral membrane market.

Major Market Developments

- In September 2016, DowDuPont Inc. launched a new product under its brand DOW Specialty Membrane, which strengthened the RO and NF portfolio of the company. This product is developed for effective liquid separation under severe conditions such as ultra-high pressure, extra-wide spacer filtration, and high-temperature. This development ultimately provided solutions to the then increasing challenges of chemical, sugar, and oil & gas industries.

- In October 2017, Toray Industries launched a new product named high-performance membrane bioreactor (MBR) module. This new product strengthened the product portfolio of the company.

- In May 2018, Hydranautics launched two new RO membranes (CPA7-LD and ESPA2-LD MAX) for industrial, municipal water, and re-use applications. This development strengthened the company’s product portfolio.

- In November 2017, LG Water Solutions introduced ultra-low pressure brackish water RO spiral membranes under its LG BW brand. These products will strengthen the product portfolio of the company.

Key Target Audience:

- Food and Beverage Manufacturers

- Government and Regional Agencies and Research Organizations

- Manufacturers of Membranes

- Chemical & Petrochemical Companies

- Pharmaceutical Companies

- Oil & Gas Companies

- Raw Material Producers and Manufacturers of Spiral Membranes

- Regional Manufacturers’ Associations and General Spiral Membrane Conferences

- Traders, Distributors, and Suppliers of Spiral Membranes

- Associations and Industrial Bodies

- R&D Institutions

- Environment Support Agencies

“This study answers several questions for the stakeholders, primarily which market segments they should focus upon during the next two to five years to prioritize their efforts and investments”.

Scope of the Report

This report forecasts the revenue growth of the spiral membrane market and provides an analysis of trends for each subsegment of the market. This research report categorizes the spiral membrane market as follows:

By Polymer Type:

- Polyamide

- PS & PES

- Fluoropolymers

By Technology:

- Reverse Osmosis (RO)

- Nanofiltration (NF)

- Ultrafiltration (UF)

- Microfiltration (MF)

By End-use Industry:

- Water & Wastewater Treatment

- Food & Beverage

- Chemical & Petrochemical

- Oil & Gas

- Pharmaceutical & Biotechnology

- Others

By Region:

- Europe

- North America

- Asia Pacific

- South America

- Middle East & Africa

Each region is further segmented into its key countries.

Critical questions which the report answers

- What are the upcoming trends for spiral membrane in developing nations?

- Which are the key players in the market and how intense is the competition?

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis:

- Country-level analysis of the spiral membrane market is provided by technology and end-use industry.

Company Information:

- Detailed analysis and profiles of additional market players.

The spiral membrane market is projected to grow from USD 5.10 billion in 2018 to USD 8.20 billion by 2023, at a CAGR of 10.0% from 2018 to 2023. Spiral membranes are used in a wide range of end-use industries, such as water & wastewater treatment, food & beverages, pharmaceutical & biotechnology, oil & gas, and chemical & petrochemical. They act as a selective barrier, allowing the passage of certain constituents while retaining others. These membranes are mainly termed as filtration elements and are widely used in commercial and industrial applications. With recent developments in spiral membrane materials and increasing demand for the reduction of energy consumption in the chemical processing industry, newer membranes and processes are being developed for new applications.

Based on polymer type, the polyamide segment is estimated to account for the largest share of the spiral membrane market during the forecast period (2018-2023). The expected large market share is due to the vast availability and cost-effectiveness of polyamide membranes when compared to other membrane materials.

Based on technology, the reverse osmosis segment is estimated to account for the largest share of the spiral membrane market during the forecast period. The expected large market share is due to the growing use of reverse osmosis in desalination and industrial effluent applications.

Based on end-use industry, the water & wastewater treatment segment is projected to lead the spiral membrane market during the forecast period. More than 50% of the global population resides in urban areas. China and India accounted for more than 30% of the global urban population. The rapidly growing population and urbanization have increased the demand for clean water. This, in turn, leads to the growing use of spiral membranes in the water & wastewater treatment industry.

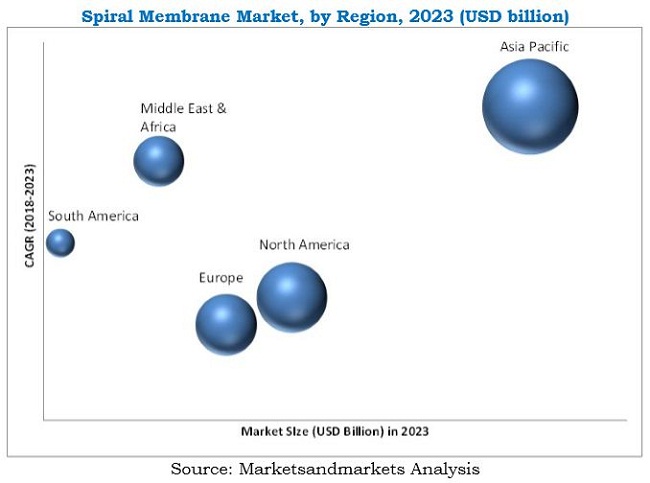

The APAC region is estimated to be the largest market for spiral membrane, globally. The growth of the APAC spiral membrane market can be attributed to the large industrial base and increased demand for spiral membrane from the water & wastewater treatment, chemical & petrochemical, oil & gas, pharmaceutical & biotechnology, and food & beverage industries of the region. Additionally, several initiatives by the region’s different governments to attract investments from various international companies are expected to propel the growth of the APAC spiral membrane market during the forecast period.

Spiral membrane is used in various end-use industries such as water & wastewater treatment, pharmaceutical & biotechnology, and food & beverage.

Water & Wastewater Treatment

Membranes separation technology in water & wastewater treatment plants are used for microbial removal, desalination of sea water, sewage treatment, wastewater treatment of water from industries, processing of natural mineral water, production of potable water, and treatment of brackish water. The two major membrane processes used for water & wastewater treatment include RO and NF. Knowing which membrane system solution suits the best for water treatment challenge helps to increase the plant efficiency, along with reduced operating & chemical costs, and compliance with increasingly stringent waste disposal regulations.

Food & Beverage

Despite being a relatively mature sector, there are still emerging and potential applications in protein isolation and other separations. An important trend for membranes in the food & beverage sector also relates to wastewater treatment. As disposal regulations have become stringent and sewage surcharges escalate, the industry is being forced to look for new cost-effective water treatment technologies using membranes. Major technologies used in food & beverage industry are RO, NF, UF, MF, along with some of the less used technologies such as pervaporation, gas transfer, and membrane distillation.

Critical questions the report answers:

- What are the upcoming hot bets for spiral membrane market?

- How market dynamics is changing for different types of technology in different end-use industries?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

High maintenance cost for increasing the membrane’s lifespan is expected to be the major challenge for the growth of the spiral membrane market during the forecast period. DowDuPont Inc. (US), Toray Industries, Inc. (US), Hydranautics (US), LG Water Solutions (South Korea), SUEZ Water Technologies and Solutions (France), Merck Group (Germany), Pentair plc (US), Koch Membrane Systems (US), Pall Corporation (US), and Lanxess (Germany) are the key players operating in the spiral membrane market. These companies have adopted various organic and inorganic growth strategies between 2015 and 2018 to strengthen their position in the spiral membrane market. New product/technology development, partnerships, agreements, and collaborations were the key growth strategies adopted by these leading players to enhance their regional presence and meet the growing demand for spiral membrane from emerging economies.

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Key Data From Secondary Sources

2.1.3 Primary Data

2.1.4 Key Data From Primary Sources

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Assumptions and Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 25)

3.1 Introduction

4 Premium Insights (Page No. - 28)

4.1 Attractive Opportunities In the Spiral Membrane Market

4.2 Spiral Membrane Market, By Technology

4.3 Spiral Membrane Market, By Polymer Type

4.4 Spiral Membrane Market, By Region

4.5 APAC Spiral Membrane Market, By End-Use Industry and Country

5 Market Overview (Page No. - 31)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Stringent Regulatory and Sustainability Mandates for Environmental Safety

5.2.2 Restraints

5.2.2.1 High Operating Cost for End Users

5.2.3 Opportunities

5.2.3.1 Growing Population and Rapid Urbanization In the Emerging Economies

5.2.4 Challenges

5.2.4.1 High Maintenance Cost for Increasing Membrane Lifespan

5.3 Porter’s Five Forces

5.3.1 Bargaining Power of Buyers

5.3.2 Bargaining Power of Suppliers

5.3.3 Threat of New Entrants

5.3.4 Threat of Substitutes

5.3.5 Intensity of Competitive Rivalry

6 Macroeconomic Indicators (Page No. - 37)

6.1 Introduction

6.2 Policy & Regulations

6.2.1 North America

6.2.1.1 Clean Water Act (CWA)

6.2.1.2 Safe Drinking Water Act (SDWA)

6.2.2 Europe

6.2.2.1 The Urban Wastewater Treatment Directive (1991)

6.2.2.2 The Drinking Water Directive (1998)

6.2.2.3 The Water Framework Directive (2000)

6.2.3 Asia

6.2.3.1 Environment Protection Law (EPL)

6.2.3.2 The Water Resource Law

6.2.3.3 Water Pollution Prevention & Control Law (WPL)

7 Spiral Membrane Market, By Polymer Type (Page No. - 41)

7.1 Introduction

7.2 Polyamide

7.3 Ps & Pes

7.4 Fluoropolymers

7.5 Others

8 Spiral Membrane Market, By Technology (Page No. - 44)

8.1 Introduction

8.2 Reverse Osmosis (RO)

8.3 Nanofiltration (NF)

8.4 Ultrafiltration (UF)

8.5 Microfiltration (MF)

9 Spiral Membrane Market, By End-Use Industry (Page No. - 47)

9.1 Introduction

9.2 Water & Wastewater Treatment

9.2.1 Desalination

9.2.2 Public Utility Water Treatment

9.2.3 Wastewater Recycle

9.3 Food & Beverage

9.4 Pharmaceutical & Biotechnology

9.5 Chemical & Petrochemical

9.6 Oil & Gas

9.7 Others

10 Spiral Membrane Market, By Region (Page No. - 52)

10.1 Introduction

10.2 APAC

10.2.1 China

10.2.2 Southeast Asia

10.2.3 India

10.2.4 Japan

10.2.5 Australia

10.2.6 Rest of APAC

10.3 North America

10.3.1 US

10.3.2 Canada

10.3.3 Mexico

10.4 Europe

10.4.1 Spain

10.4.2 Italy

10.4.3 Germany

10.4.4 UK

10.4.5 France

10.4.6 Netherlands

10.4.7 Rest of Europe

10.5 Middle East & Africa

10.5.1 Saudi Arabia

10.5.2 Qatar

10.5.3 OMAN

10.5.4 UAE

10.5.5 Rest of Middle East & Africa

10.6 South America

10.6.1 Brazil

10.6.2 Chile

10.6.3 Rest of South America

11 Competitive Landscape (Page No. - 88)

11.1 Overview

11.2 Market Ranking

11.2.1 Dowdupont

11.2.2 Toray

11.2.3 Hydranautics

11.2.4 LG Chem

11.2.5 Suez

11.3 Competitive Scenario

11.3.1 New Product & Technology Development

11.3.2 Investments & Expansions

11.3.3 Partnerships, Agreements, & Collaborations

11.3.4 Mergers, Acquisitions, & Joint Ventures

12 Company Profile (Page No. - 94)

(Business overview, Products offered, Recent Development, SWOT analysis, MNM view)*

12.1 Dowdupont

12.2 Toray Industries

12.3 Hydranautics (Nitto Denko Corporation)

12.4 LG Water Solutions

12.5 Suez Water Technologies and Solutions

12.6 Koch Membrane Systems

12.7 Lanxess

12.8 Merck Group

12.9 Pall Corporation

12.10 Pentair

12.11 Other Companies

12.11.1 Alfa Laval

12.11.2 Applied Membranes

12.11.3 Aquabio

12.11.4 Aquatech International

12.11.5 Axeon Water Technologies

12.11.6 Fileder

12.11.7 GEA Group

12.11.8 Hyflux Ltd.

12.11.9 Membranium

12.11.10 Microdyn-Nadir Gmbh

12.11.11 Parker Hannifin Corporation

12.11.12 Prominent

12.11.13 Synder Filtration

12.11.14 Toyobo

12.11.15 Uniqflux Membranes

*Details on Business overview, Products offered, Recent Development, SWOT analysis, MNM view might not be captured in case of unlisted companies.

13 Appendix (Page No. - 116)

13.1 Insights From Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (72 Tables)

Table 1 Trends and Forecast of GDP Per Capita (USD)

Table 2 Spiral Membrane Market Size, By Polymer Type, 2016–2023 (USD Million)

Table 3 Spiral Membrane Market Size, By Technology, 2016–2023 (USD Million)

Table 4 Spiral Membrane Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 5 Spiral Membrane Market Size, By Region, 2016–2023 (USD Million)

Table 6 APAC: Spiral Membrane Market Size, By Country, 2016–2023 (USD Million)

Table 7 APAC: By Market Size, By Technology, 2016–2023 (USD Million)

Table 8 APAC: By Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 9 China: By Market Size, By Technology, 2016–2023 (USD Million)

Table 10 China: By Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 11 Southeast Asia: By Market Size, By Technology, 2016–2023 (USD Million)

Table 12 Southeast Asia: By Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 13 India: By Market Size, By Technology, 2016–2023 (USD Million)

Table 14 India: By Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 15 Japan: By Market Size, By Technology, 2016–2023 (USD Million)

Table 16 Japan: By Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 17 Australia: By Market Size, By Technology, 2016–2023 (USD Million)

Table 18 Australia: By Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 19 Rest of APAC: By Market Size, By Technology, 2016–2023 (USD Million)

Table 20 Rest of APAC: By Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 21 North America: By Market Size, By Country, 2016–2023 (USD Million)

Table 22 North America: By Market Size, By Technology, 2016–2023 (USD Million)

Table 23 North America: By Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 24 US: By Market Size, By Technology, 2016–2023 (USD Million)

Table 25 US: By Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 26 Canada: By Market Size, By Technology, 2016–2023 (USD Million)

Table 27 Canada: By Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 28 Mexico: By Market Size, By Technology, 2016–2023 (USD Million)

Table 29 Mexico: By Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 30 Europe: By Market Size, By Country, 2016–2023 (USD Million)

Table 31 Europe: By Market Size, By Technology, 2016–2023 (USD Million)

Table 32 Europe: By Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 33 Spain: By Market Size, By Technology, 2016–2023 (USD Million)

Table 34 Spain: By Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 35 Italy: By Market Size, By Technology, 2016–2023 (USD Million)

Table 36 Italy: By Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 37 Germany: By Market Size, By Technology, 2016–2023 (USD Million)

Table 38 Germany: By Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 39 UK: By Market Size, By Technology, 2016–2023 (USD Million)

Table 40 UK: By Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 41 France: By Market Size, By Technology, 2016–2023 (USD Million)

Table 42 France: By Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 43 Netherlands: By Market Size, By Technology, 2016–2023 (USD Million)

Table 44 Netherlands: By Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 45 Rest of Europe: By Market Size, By Technology, 2016–2023 (USD Million)

Table 46 Rest of Europe: By Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 47 Middle East & Africa: By Market Size, By Country, 2016–2023 (USD Million)

Table 48 Middle East & Africa: By Market Size, By Technology, 2016–2023 (USD Million)

Table 49 Middle East & Africa: By Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 50 Saudi Arabia: By Market Size, By Technology, 2016–2023 (USD Million)

Table 51 Saudi Arabia: By Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 52 Qatar: By Market Size, By Technology, 2016–2023 (USD Million)

Table 53 Qatar: By Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 54 OMAN: By Market Size, By Technology, 2016–2023 (USD Million)

Table 55 OMAN: By Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 56 UAE: By Market Size, By Technology, 2016–2023 (USD Million)

Table 57 UAE: By Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 58 Rest of Middle East & Africa: Spiral Membrane Market Size, By Technology, 2016–2023 (USD Million)

Table 59 Rest of Middle East & Africa: By Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 60 South America: By Market Size, By Country, 2016–2023 (USD Million)

Table 61 South America: By Market Size, By Technology, 2016–2023 (USD Million)

Table 62 South America: By Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 63 Brazil: By Market Size, By Technology, 2016–2023 (USD Million)

Table 64 Brazil: By Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 65 Chile: By Market Size, By Technology, 2016–2023 (USD Million)

Table 66 Chile: By Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 67 Rest of South America: By Market Size, By Technology, 2016–2023 (USD Million)

Table 68 Rest of South America: By Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 69 New Product & Technology Development, 2015-2018

Table 70 Investment & Expansion, 2015-2018

Table 71 Partnership, Agreement, & Collaboration, 2015-2018

Table 72 Merger, Acquisition, & Joint Ventures, 2015-2018

List of Figures (35 Figures)

Figure 1 Spiral Membrane Market: Research Design

Figure 2 Key Industry Insights

Figure 3 Breakdown of Primary Interviews

Figure 4 Bottom-Up Approach

Figure 5 Top-Down Approach

Figure 6 Spiral Membrane Market : Data Triangulation

Figure 7 Water & Wastewater Treatment to Be The Leading End-Use Industry of Spiral Membrane

Figure 8 Reverse Osmosis to Be The Dominating Technology for Spiral Membrane

Figure 9 Polyamide to Be The Dominating Polymer Type for Spiral Membrane

Figure 10 APAC Spiral Membrane Market to Register The Highest Cagr

Figure 11 Emerging Economies Offer High Growth Opportunities for The Spiral Membrane Market

Figure 12 Nanofiltration to Be The Fastest-Growing Technology

Figure 13 Polyamide to Be The Largest and Fastest-Growing Polymer Type

Figure 14 APAC Accounted for The Largest Market Share In 2017

Figure 15 Water & Wastewater Treatment Was The Largest End-Use Industry of Spiral Membrane In APAC

Figure 16 Overview of Factors Governing The Spiral Membrane Market

Figure 17 Spiral Membrane Market: Porter’s Five Forces Analysis

Figure 18 Polyamide to Be The Largest Polymer Type for Spiral Membrane

Figure 19 Nanofiltration to Be The Fastest-Growing Technology for Spiral Membrane

Figure 20 Water & Wastewater Treatment to Be The Largest End-Use Industry of Spiral Membrane

Figure 21 Spiral Membrane Market In China to Witness The Highest Growth

Figure 22 APAC Spiral Membrane Market Snapshot

Figure 23 North American Spiral Membrane Market Snapshot

Figure 24 Companies Adopted Partnerships, Agreements, and Collaborations as The Key Growth Strategy Between 2015 and 2018

Figure 25 Dowdupont to Lead the Global Spiral Membrane Market

Figure 26 Dowdupont: Company Snapshot

Figure 27 Dowdupont: SWOT Analysis

Figure 28 Toray Industries: Company Snapshot

Figure 29 Toray Industries: SWOT Analysis

Figure 30 Hydranautics: SWOT Analysis

Figure 31 LG Water Solutions: SWOT Analysis

Figure 32 Suez Water Technologies and Solutions

Figure 33 Lanxess: Company Snapshot

Figure 34 Merck Group: Company Snapshot

Figure 35 Pentair: Company Snapshot

Growth opportunities and latent adjacency in Spiral Membrane Market