Spices Market by Type (Pepper, Ginger, Cinnamon, Cumin, Turmeric, Cardamon, Coriander, cloves, and Other Spices), Form (Whole, Powder, and Chopped/Crushed), Application and Region - Global Forecast to 2027

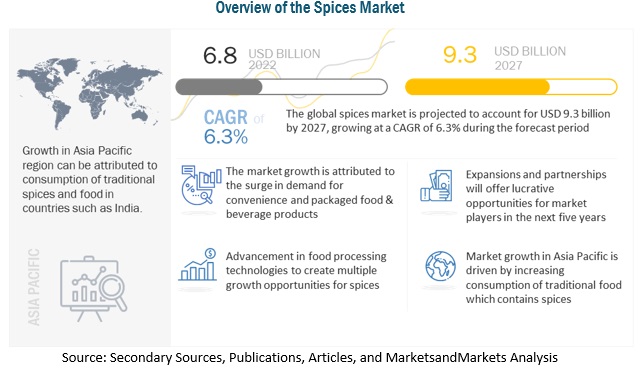

According to MarketsandMarkets, the global spices market is estimated to be valued at USD 6.8 billion in 2022 and is projected to reach USD 9.3 billion by 2027. The market is expected to grow with a CAGR of 6.3%, in terms of value between 2022 and 2027. Spices are the seeds, dried fruits, roots, and bark of specific plants which are used in various food & beverage application for enhancing the flavor and shelf life of products.

Spices Market Dynamics

Drivers: Increasing urbanization and changing lifestyles

This rise in urbanization is expected to drive the global spices market. Availability of spices has increased owing to growth of retail infrastructure. Spices are easily and widely available at supermarket and hypermarket, ultimately boosting the demand for spices.

Restraints: Adverse effects associated with excess spice consumption

Spices are used in various food & beverage applications. However, excess consumption of spices has negative effects on one’s health. One of the most common side effects associated is related to digestion system. Acidity can be triggered by spicy foods, which leads to slow digestion rate and increasing risk of heartburn.

Opportunities: Increasing usage in health and wellness products

As consumers are becoming more health conscious, they are demanding more healthy food & beverage products. Specific spices are used as a replacement of sugars, salts, and artificial additives. Rising demand for organic foods, natural flavouring, and safe dietary supplements are driving the demand for spices.

Challenges: Spices are prone to microbial contamination

Spices imported from developing countries has witnessed increasing incidences of microbial contamination. The key problem associated with importing spices is the difficulty of checking its composition. Test on composition is possible but it is not cost-effective.

By form, powder segment is expected to dominate the global spices market

Spices in powder form are preferred by consumers. Powdered spices are easy to handle, store, and have longer shelf life. These factors make powdered spices preferrable among consumers.

By type, pepper segment is likely to account for the largest market share

Pepper is used in the preparation of various food & beverage products. The growing food & beverage industry is expected to drive the demand for pepper. Black pepper has antioxidant and antibacterial properties which is expected to drive the growth for pepper segment in the forecasted period.

Asia Pacific region is expected to dominate the global spices market. According to FAO, factors such as economic development, urbanization and increasing income are leading to changes changing dietary patterns in Asia Pacific region. Consumers are increasing adopting traditional food items in their daily food intake. This is expected to drive the demand for spices in the region.

Key Market Players:

Key players in this market include McCormick & Company Inc. (US), Ajinomoto Co., Inc. (Japan), Associated British Food plc (UK), Kerry Group (Ireland), Döhler Group (Germany), Everest Spices (India), and ARIAKE JAPAN CO., LTD (Japan).

TABLE OF CONTENTS

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.4 REGIONAL SEGMENTATION

1.5 PERIODIZATION CONSIDERED

1.6 CURRENCY CONSIDERED

1.7 VOLUME UNITS CONSIDERED

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key Data from Secondary Sources

2.1.2 PRIMARY DATA

2.1.2.1 Key Data from Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 MARKET SIZE ESTIMATION - METHOD 1

2.2.2 MARKET SIZE ESTIMATION - METHOD 2

2.3 DATA TRIANGULATION

2.4 ASSUMPTIONS FOR THE STUDY

2.5 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.2 RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.4 CHALLENGES

6 INDUSTRY TRENDS

6.1 INTRODUCTION

6.2 VALUE CHAIN/SUPPLY CHAIN ANALYSIS

6.3 TECHNOLOGY ANALYSIS

6.4 PRICING ANALYSIS

6.5 ECOSYSTEM/ MARKET MAP

6.6 TRENDS/ DISRUPTION IMPACTING THE CUSTOMER’S BUSINESS

6.7 PATENT ANALYSIS

6.8 TRADE ANALYSIS

6.9 KEY CONFERENCES AND EVENTS IN 2022-2023

6.1 TARIFF AND REGULATORY LANDSCAPE

6.11 PORTER’S FIVE FORCES ANALYSIS

6.12 KEY STAKEHOLDERS & BUYING CRITERIA

6.13 CASE STUDY ANALYSIS

7 SPICES MARKET, BY FORM

7.1 INTRODUCTION

7.2 WHOLE

7.3 POWDER

7.3 CHOPPED/CRUSHED

8 SPICES MARKET, BY TYPE

8.1 INTRODUCTION

8.2 CINNAMON

8.3 PEPPER

8.4 CUMIN

8.5 CARDAMON

8.6 TURMERIC

8.7 GINGER

8.8 CORIANDER

8.9 CLOVES

8.1 OTHER SPICES

9 SPICES MARKET, BY APPLICATION

9.1 INTRODUCTION

9.2 MEAT & POULTRY

9.3 SNACK & CONVENIENCE FOOD

9.4 SOUPS, SAUCES, AND DRESSINGS

9.5 BAKERY & CONFECTIONERY

9.6 BEVERAGES

9.7 OTHER APPLICATIONS

10 SPICES MARKET, BY REGION

10.1 INTRODUCTION

10.2 NORTH AMERICA

10.2.1 US

10.2.2 CANADA

10.2.3 MEXICO

10.3 EUROPE

10.3.1 GERMANY

10.3.2 FRANCE

10.3.3 UK

10.3.4 ITALY

10.3.5 SPAIN

10.3.6 REST OF EUROPE

10.4 ASIA PACIFIC

10.4.1 CHINA

10.4.2 INDIA

10.4.3 JAPAN

10.4.4 AUSTRALIA & NEW ZEALAND

10.4.5 REST OF ASIA PACIFIC

10.5 SOUTH AMERICA

10.5.1 BRAZIL

10.5.2 ARGENTINA

10.5.3 REST OF SOUTH AMERICA

10.6 REST OF THE WORLD

10.6.1 AFRICA

10.6.2 MIDDLE EAST

11 COMPETITIVE LANDSCAPE

11.1 OVERVIEW

11.2 MARKET SHARE ANALYSIS*

11.3 KEY PLAYERS STRATEGIES

11.4 COMPANY REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS

11.5 COMPANY EVALUATION QUADRANT

11.5.1 STARS

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE PLAYERS

11.5.4 PARTICIPANTS

11.5.5 COMPETITIVE BENCHMARKING

11.6 PRODUCT FOOTPRINTS

11.7 STARTUP/SME EVALUATION QUADRANT

11.7.1 PROGRESSIVE COMPANIES

11.7.2 STARTING BLOCKS

11.7.3 RESPONSIVE COMPANIES

11.7.4 DYNAMIC COMPANIES

11.8 PRODUCT LAUNCHES, DEALS, AND OTHER DEVELOPMENTS

11.8.1 NEW PRODUCT LAUNCHES

11.8.2 DEALS

11.8.3 OTHER DEVELOPMENTS

11.8.4 PARTNERSHIPS, COLLABORATIONS, AND JOINT VENTURES

12 COMPANY PROFILES

12.1 AJINOMOTO CO., INC.

12.2 ASSOCIATED BRITISH FOODS PLC

12.3 ARIAKE JAPAN CO., LTD.

12.4 BARIA PEPPER

12.5 KERRY GROUP

12.6 THE BART INGREDIENTS CO. LTD.

12.7 DS GROUP

12.8 EVEREST SPICES

12.9 DOHLER GROUP

12.10 MCCORMICK & COMPANY INC.

Note: Currently, list of only 10 companies have been provided. However, this section covers 12-15 key company profiles which include business overview, recent financials, product offerings, key strategies, and swot analysis. recent financials can be provided based on data/information availability in public domain. The list of companies mentioned above can be altered depending upon client’s interest

13 APPENDIX

Note: The TOC prepared above is tentative and may subject to change, based on the research progress

Growth opportunities and latent adjacency in Spices Market