Spectroscopy IR Detector Market by Detector Technology (DTGS, MCT, InGaAs), Spectrum Sensitivity (NIR, Mid IR, and Far IR), Cooling Requirement (Cooled and Uncooled), Product Type (Benchtop, Portable, Hyphenated) - Global Forecast to 2022

The spectroscopy IR detector market is estimated to be worth USD 224.5 Million by 2022, growing at a CAGR of 6.9% during the forecast period; the market size, in terms of volume, is expected to grow at a CAGR of 7.7% during the same period. The objective of this report is to estimate the size, in terms of value and volume, and future growth potential of the IR detector market for IR spectroscopy across different segments such as detector technology, spectrum sensitivity, product type, cooling requirement, and geography. The base year considered for the study is 2015 and the forecast period is between 2016 and 2022. This report provides detailed information regarding the major factors influencing the growth of the IR detector market such as drivers, restraints, and opportunities. Along with this, the growth opportunities for the stakeholders have been analyzed by identifying the high-growth segments of the market.

The spectroscopy IR detector market is estimated to be worth USD 224.5 Million by 2022, growing at a CAGR of 6.9% during the forecast period. The market size, in terms of volume, is expected to grow at a CAGR of 7.7% during the forecast period.

The major drivers for the growth of the spectroscopy IR detector market include the increasing shipment of IR spectroscopy devices and the industry practice of upgrading old IR spectroscopy devices with new IR detector modules. Along with this, IR spectroscopy is used in the biological sector to identify various diseases. For instance, the Polish Academy of Sciences NaAAcZ Institute of Biocybernetics & Biomedical Engineering, (Warsaw, Poland) has developed an NIR spectroscopy instrument to monitor brain injuries. Such developments in techniques would drive the growth of the NIR detector market in the coming years.

The scope of this report covers the spectroscopy IR detector market segmented on the basis of detector technology, spectrum sensitivity, cooling requirement, product type, and geography. On the basis of spectrum sensitivity, the market has been segmented into NIR, Mid IR, and Far IR. Mid IR detectors are expected to hold the largest market share, during the forecast period.

The market has been segmented on the basis of detector technology into mercury cadmium telluride (MCT), deuterated triglycine sulfate (DTGS), indium gallium arsenide (InGaAs), and others. InGaAs-based IR detectors are expected to play a key role in the growth of the IR detector market because of the wide application of InGaAs-based IR detectors in NIR spectroscopy devices.

The spectroscopy IR detector market, on the basis of product type, has been segmented into benchtop spectroscopes, microspectroscopes, portable spectroscopes, and hyphenated spectroscopes. The portable IR spectroscopy device market is expected to grow in the near future and drive the IR detector market in this segment during the forecast period.

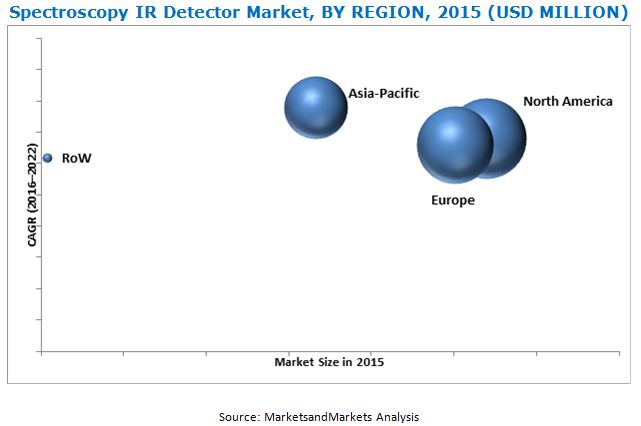

The market, on the basis of geography, has been segmented into four regions—North America, Europe, APAC, and RoW. North America held the largest market share in 2015; however, the market in APAC is expected to grow at the highest rate between 2016 and 2022 owing to the growing industrialization in this region.

The availability of substitute products for IR spectroscopy devices acts as a major restraining factor for the growth of the market. The major companies operating in the IR detector market include Hamamatsu Photonics K.K. (Japan), Excelitas Technologies Corp. (U.S.), LASER Components GmbH (Germany), UTC Aerospace Systems (U.S.), Newport Corporation (U.S.), and others. These players have adopted various strategies such as new product developments, expansions, mergers, partnerships, and collaborations to cater to the needs of the IR detector market for spectroscopy.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 10)

1.1 Study Objectives

1.2 Market Definition

1.3 Market Covered

1.4 Stakeholders

1.5 Currency & Pricing

2 Research Methodology (Page No. - 16)

2.1 Arriving at the Market Size

2.2 spectroscopy IR detector market Size Estimation

2.3 Forecasting Approach

2.4 Top – Down & Bottom – Up Approach

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Market Crackdown & Data Triangulations

2.5 Demand Side Approach

2.5 Key Data Points Taken From Secondary Research

2.5 Key Data Points Taken From Primary Research

2.5 Market Share Estimation

2.5 Report Assumptions

3 Executive Summary (Page No. - 30)

4 Market Overview (Page No. - 32)

4.1 Introduction

4.2 Parent Market Comparison

4.3 Market Dynamics

4.3.1 Drivers

4.3.1.1 Increasing Shipments of IR Spectroscopy Devices

4.3.1.2 Upgradation of IR Spectroscopy Devices Fostering the Growth of the IR Detector Market

4.3.2 Restraints

4.4.2.1 Availability of Substitutes for IR Spectroscopy in Various Industries

4.3.3 Opportunities

4.3.3.1 Adoption of NIR Spectroscopy Devices in Seed Quality Detection

4.3.3.2 Growing Product Development of IR Spectroscopy Devices for Biological Segment

4.4 Value Chain Analysis

4.5 Porter’s Five Forces Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Power of Buyers

4.5.3 Threat of New Entrants

4.5.4 Threat of Substitutes

4.5.5 Intensity of Competitive Rivalry

5 Global IR Detector Market for IR Spectroscopy, By Detector Technology (Page No. - 46)

5.1 Introduction

5.2 Market Overview, By Detector Technology

5.2.1 MCT IR Detector

5.2.1.1 MCT IR Detector Market, By Spectrum Sensitivity

5.2.2 DTGS IR Detector

5.2.2.1 DTGS IR Detector Market, By Spectrum Sensitivity

6 Global IR Detector Market for IR Spectroscopy, By Spectrum Sensitivity (Page No. - 51)

6.1 Introduction

6.2 Market Overview, By Spectrum Sensitivity

6.2.1 NIR Detector Market, By Detector Technology

6.2.1.1 NIR Detector Market, By Detector Technology

6.2.1.2 NIR Detector Market, By Product Type

6.2.2 Mid IR Detector Market, By Detector Technology

6.2.2.1 Mid IR Detector Market, By Detector Technology

6.2.2.2 Mid IR Detector Market, By Product Type

6.2.3 Far IR Detector Market, By Detector Technology

6.2.3.1 Far IR Detector Market, By Detector Technology

6.2.3.2 Far IR Detector Market, By Product Type

7 Global IR Detector Market for IR Spectroscopy, By Cooling Requirement (Page No. - 60)

7.1 Introduction

7.2 Market Overview, By Cooling Requirement

7.2.1 Cooled IR Detector

7.2.2 Uncooled IR Detector

8 Global IR Detector Market for IR Spectroscopy, By Product Type (Page No. - 63)

8.1 Introduction

8.2 spectroscopy IR detector market Overview, By Product Type

8.2.1 Benchtop IR Spectroscopes

8.2.1.1 IR Detector Market in Benchtop Spectroscopes, By Spectrum Sensitivity

8.2.2 Micro IR Spectroscopes

8.2.2.1 IR Detector Market in Microspectroscopes, By Spectrum Sensitivity

8.2.3 Portable IR Spectroscopes

8.2.3.1 IR Detector Market in Portable Spectroscopes, By Spectrum Sensitivity

8.2.4 Hyphenated IR Spectroscopes

8.2.4.1 IR Detector Market in Hyphenated Spectroscopes, By Spectrum Sensitivity

9 Geographic Analysis (Page No. - 70)

9.1 IR Detector Market for IR Spectroscopy, By Geography

9.2 North America

9.3 Europe

9.4 Asia-Pacific

10 Competitive Landscape (Page No. - 76)

9.1 Introduction

9.2 IR Detector Market Ranking Analysis, 2015

9.3 Competitive Scenario & Trends

9.4 Recent Developments

9.4.1 New Product Launches

9.4.2 Expansions

9.4.3 Mergers & Acqusitions

9.4.4 Partnerships, Agreements, Joint Ventures, & Collaborations

9.4.5 Others

11 Company Profiles (Page No. - 86)

11.1 Allied Vision Technologies GmbH

11.2 Bayspec, Inc.

11.3 Episensors, Inc.

11.4 Flir Systems, Inc..

11.5 Hamamatsu Photonics K.K.

11.6 Horiba, Ltd.

11.7 Newport Corporation

11.8 Sensors Unlimited

11.9 Sofradir

11.10 Teledyne Dalsa Inc.

11.11 Laser Components GmbH

11.12 Excelitas Technologies Corp.

List of Tables (45 Tables)

Table 1 Country-Wise Trade of Spectrometers, Spectrophotometers, and Other Devices, 2015

Table 2 Key Data Taken From Secondary Sources

Table 3 Key Data Taken From Primary Sources

Table 4 General Assumptions

Table 5 Year-Wise & Forecast Assumptions

Table 6 Year-Wise & Forecast Assumptions

Table 7 Quantification of Porter’s Analysis

Table 8 Global IR Detector Market for IR Spectroscopy, By Detector Technology, 2014–2022 (Unit Shipment)

Table 9 MCT IR Detector Market for IR Spectroscopy, By Spectrum Sensitivity, 2014–2022 (Unit Shipment)

Table 10 DTGS IR Detector Market for IR Spectroscopy, By Spectrum Sensitivity, 2014–2022 (Unit Shipment)

Table 11 Global IR Detector Market for IR Spectroscopy, By Spectrum Sensitivity, 2014–2022 (Unit Shipment)

Table 12 NIR Detector Market for IR Spectroscopy, By Detector Technology, 2014–2022 (Unit Shipment)

Table 13 NIR Detector Market for IR Spectroscopy, By Product Type, 2014–2022 (Unit Shipment)

Table 14 Mid IR Detector Market for IR Spectroscopy, By Detector Technology, 2014–2022 (Unit Shipment)

Table 15 Mid IR Detector Market for IR Spectroscopy, By Product Type, 2014–2022 (Unit Shipment)

Table 16 Far IR Detector Market for IR Spectroscopy, By Detector Technology, 2014–2022 (Unit Shipment)

Table 17 Far IR Detector Market for IR Spectroscopy, By Product Type, 2014–2022 (Unit Shipment)

Table 18 Global IR Detector Market for IR Spectroscopy, By Cooling Requirement, 2014–2022 (Unit Shipment)

Table 19 Global IR Detector Market for IR Spectroscopy, By Product Type, 2014–2022 (Unit Shipment)

Table 20 IR Detector Market in Benchtop Spectroscopes, By Spectrum Sensitivity, 2014–2022 (Unit Shipment)

Table 21 IR Detector Market in Microspectroscopes, By Spectrum Sensitivity, 2014–2022 (Unit Shipment)

Table 22 IR Detector Market in Portable Spectroscopes, By Spectrum Sensitivity, 2014–2022 (Unit Shipment)

Table 23 IR Detector Market in Hyphenated Spectroscopes, By Spectrum Sensitivity, 2014–2022 (Unit Shipment)

Table 24 Global IR Detector Market for IR Spectroscopy, By Region, 2014–2022 (Unit Shipment)

Table 25 IR Detector Market for IR Spectroscopy in North America, By Country, 2014–2022 (Unit Shipment)

Table 26 IR Detector Market for IR Spectroscopy in Europe, By Country, 2014–2022 (Unit Shipment)

Table 27 IR Detector Market for IR Spectroscopy in APAC, By Country, 2014–2022 (Unit Shipment)

Table 28 Market Ranking Analysis of IR Detector Market

Table 29 List of New Product Development in the IR Detector Market for IR Spectroscopy

Table 30 List of Expansion in IR Detector Market for IR Spectroscopy

Table 31 List of Merger and Acquistions in IR Detector Market for IR Spectroscopy

Table 32 List of Agreements, Partnership, Joint Ventures, Contracts & Collabrations in spectroscopy IR detector market

Table 33 List of Other Activities in IR Detector Market for IR Spectroscopy

Table 34 Allied Vision Technologies GmbH: Developments

Table 35 Bayspec, Inc.: Developments

Table 36 Episensors, Inc.: Developments

Table 37 Flir Systems, Inc.: Developments

Table 38 Hamamatsu Photonics K.K.: Developments

Table 39 Horiba, Ltd.: Developments

Table 40 Newport Corporation: Developments

Table 41 Sensors Unlimited: Developments

Table 42 Sofradir: Developments

Table 43 Teledyne Dalsa Inc.: Developments

Table 44 Laser Components GmbH: Developments

Table 45 Excelitas Technologies Corp.: Developments

List of Figures (69 Figures)

Figure 1 IR Spectrum Range (Wavelength)

Figure 2 Spectroscopy IR Detector Market Covered

Figure 3 Spectroscopy IR Detector Market Size Estimation

Figure 4 Top – Down & Bottom – Up Approach

Figure 5 Market Crackdown & Data Triangulation

Figure 6 Key Insights From Primary Respondent

Figure 7 Executive Summary of IR Detector Market for IR Spectroscopy in 2015

Figure 8 Parent Market Comparison of IR Detector Market for IR Spectroscopy

Figure 9 Market Dynamics of IR Detector Market for IR Spectroscopy Application

Figure 10 ISpectroscopy IR Detector Market Driver Impact Analysis

Figure 11 Spectroscopy IR Detector Market Restain Impact Analysis

Figure 12 Value Chain Analysis of IR Detector Market in IR Spectroscopy

Figure 13 Impact Analysis in 2015

Figure 14 Impact Analysis in 2015 & 2022

Figure 15 Bargaining Power of Supplier

Figure 16 Bargaining Power of Buyer

Figure 17 Threat From New Entrant

Figure 18 Threat From Substitute

Figure 19 Intensity of Competitive Rivalry

Figure 20 Spectroscopy IR Detector Market, By Detector Technology

Figure 21 Global ISpectroscopy IR Detector Market, By Detector Technology, 2014–2022 (USD Million)

Figure 22 MCT IR Detector Market for IR Spectroscopy, By Spectrum Sensitivity, 2014–2022 (USD Million)

Figure 23 DTGS IR Detector Market for IR Spectroscopy, By Spectrum Sensitivity, 2014–2022 (USD Million)

Figure 24 Spectroscopy IR Detector Market, By Spectrum Sensitivity

Figure 25 Global Spectroscopy IR Detector Market, By Spectrum Sensitivity, 2014–2022 (USD Million)

Figure 26 NIR Detector Market for IR Spectroscopy, By Detector Technology, 2014–2022 (USD Million)

Figure 27 NIR Detector Market for IR Spectroscopy, By Product Type, 2014–2022 (USD Million)

Figure 28 Mid IR Detector Market for IR Spectroscopy, By Detector Technology, 2014–2022 (USD Million)

Figure 29 Mid IR Detector Market for IR Spectroscopy, By Product Type, 2014–2022 (USD Million)

Figure 30 Far IR Detector Market for IR Spectroscopy, By Detector Technology, 2014–2022 (USD Million)

Figure 31 Far IR Detector Market for IR Spectroscopy, By Product Type, 2014–2022 (USD Million)

Figure 32 Spectroscopy IR Detector Market, By Cooling Requirement

Figure 33 Global Spectroscopy IR Detector Market, By Cooling Requirement, 2014–2022 (USD Million)

Figure 34 IR Detector Market for IR Spectroscopy, By Product Type

Figure 35 Global Spectroscopy IR Detector Market, By Product Type, 2014–2022 (USD Million)

Figure 36 IR Detector Market in Benchtop Spectroscopes, By Spectrum Sensitivity, 2014–2022 (USD Million)

Figure 37 IR Detector Market in Microspectroscopes, By Spectrum Sensitivity, 2014–2022 (USD Million)

Figure 38 IR Detector Market in Portable Spectroscopes, By Spectrum Sensitivity, 2014–2022 (USD Million)

Figure 39 IR Detector Market in Hyphenated Spectroscopes, By Spectrum Sensitivity, 2014–2022 (USD Million)

Figure 40 Geography Snapshot: Global IR Detector Market for IR Spectroscopy

Figure 41 Global IR Detector Market for IR Spectroscopy, By Region, 2014–2022 (USD Million)

Figure 42 Spectroscopy IR Detector Market in North America, By Country, 2014–2022 (USD Million)

Figure 43 Spectroscopy IR Detector Market in Europe, By Country, 2014–2022 (USD Million)

Figure 44 Spectroscopy IR Detector Market in APAC, By Country, 2014–2022 (USD Million)

Figure 45 Spectroscopy IR Detector Market: Competitive Situation & Trends, 2016–2012

Figure 46 Twentsche Kabelfabriek (TKF) Group NV: Business Overview

Figure 47 Allied Vision Technologies GmbH: Products Offred

Figure 48 Bayspec, Inc.: Business Overview

Figure 49 Bayspec, Inc.: Products Offered

Figure 50 Episensors, Inc.: Business Overview

Figure 51 Episensors, Inc.: Products Offered

Figure 52 Flir Systems, Inc.: Business Overview

Figure 53 Flir Systems, Inc.: Products Offered

Figure 54 Hamamatsu Photonics K.K.: Business Overview

Figure 55 Hamamatsu Photonics K.K.: Products Offered

Figure 56 Horiba, Ltd.: Business Overview

Figure 57 Horiba, Ltd.: Products Offered

Figure 58 Newport Corporation: Business Overview

Figure 59 Newport Corporation: Products Offered

Figure 60 United Technologies Corporation: Business Overview

Figure 61 Sensors Unlimited: Products Offered

Figure 62 Sofradir: Business Overview

Figure 63 Sofradir: Products Offered

Figure 64 Teledyne Technologies Inc.: Business Overview

Figure 65 Teledyne Dalsa Inc.: Products Offered

Figure 66 Laser Components GmbH: Business Overview

Figure 67 Laser Components GmbH: Products Offered

Figure 68 Excelitas Technologies Corp.: Business Overview

Figure 69 Excelitas Technologies Corp.: Products Offered

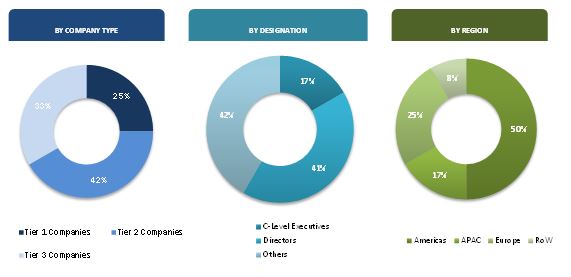

The research methodology used to estimate and forecast the spectroscopy IR detector market begins with obtaining data on key vendor revenues through company’s annual reports, SEC filings, Factiva, Bloomberg Business, and other secondary resources. The vendor offerings have also been taken into consideration to determine the market segmentation. The bottom-up procedure has been employed to arrive at the overall market size of the global IR detector market from the ASPs of IR detectors and the shipment of IR spectroscopy devices market. After arriving at the overall market size, the total market has been split into several segments and sub-segments, which are then verified through primary research by conducting extensive interviews with CEOs, VPs, directors, and executives. The market breakdown and data triangulation procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of the profiles of the primaries is depicted in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The IR detector ecosystem comprises IR sensor/detector component manufacturers such as Hamamatsu Photonics K.K. (Japan), Excelitas Technologies Corp. (U.S.), LASER Components GmbH (Germany) and others; and IR spectroscopy device manufacturers such as Thermo Fisher Scientific (U.S.), PerkinElmer (U.S.), Bruker Corporation (U.S.), and Agilent Technologies (U.S.) among others.

Key Target Audience

- IR Detector Manufacturers

- IR Spectroscopy Manufacturers

- IR Sensor & Spectroscopy Suppliers

- Government and Research Organizations

- Distribution Network Service Providers/Operators

- Banks, Venture Capitalists, Financial Institutions, and Other Investors

Scope of the Report

The research report segments the spectroscopy IR detector market into the following submarkets:

By Detector Technology

- Mercury Cadmium Telluride (MCT)

- Deuterated Triglycine Sulfate (DTGS)

- Indium Gallium Arsenide (InGaAs)

- Others

By Spectrum Sensitivity

- NIR

- Mid IR

- Far IR

By Cooling Requirement:

- Cooled

- Uncooled

By Product Type

- Benchtop Spectroscopes

- Microspectroscopes

- Portable Spectroscopes

- Hyphenated Spectroscopes

By Geography:

- North Americas

- Europe

- APAC

- RoW

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the IR detector market in North America

- Further breakdown of the IR detector market in Europe

- Further breakdown of the IR detector market in APAC

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Spectroscopy IR Detector Market