Specialty Polystyrene Resin Market by Function (Protection, Insulation, Cushioning & Others), Application (Protective Packaging, Building & Construction, Automotive & Transportation, Electronics, Healthcare), and Region - Global Forecast to 2023

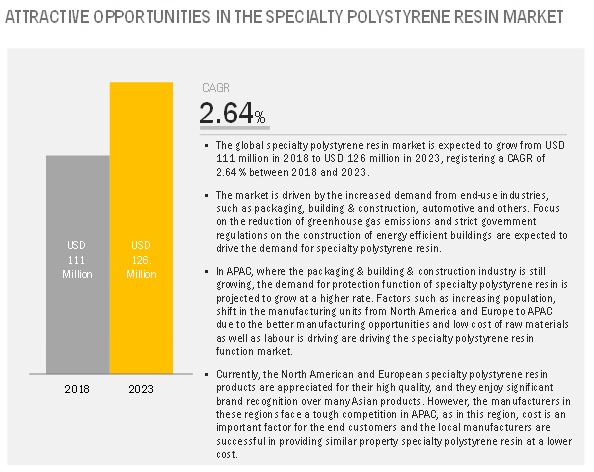

[152 Pages Report] The market for specialty polystyrene resin is estimated to grow from USD 111 million in 2018 to USD 126 million by 2023, at a CAGR of 2.64% during the forecast period. The demand for protection function from various applications is expected to drive the specialty polystyrene resin market. Focus on the reduction of greenhouse gas emissions and strict government regulations on the construction of energy-efficient buildings are expected to drive the demand for specialty polystyrene resin. The growth of the market is driven by increasing use of packaging for performance and environmental reasons in emerging economies such as India, China, Thailand, Indonesia, Brazil, and Argentina.

China continues to lead the market in APAC as well as globally. Increase in purchasing power parity and preference for packed and hygienic food are some of the major drivers responsible for the growth of the specialty polystyrene resin packaging industry. Currently, the North American and European specialty polystyrene resin products are appreciated for their high quality, and they enjoy significant brand recognition over many Asian products. However, the manufacturers in these regions face tough competition in APAC, as in this region, cost is an important factor for the end customers and the local manufacturers are successful in providing specialty polystyrene resin with similar properties at a lower cost.

The protection function segment is expected to account for the largest share of the specialty polystyrene resin market.

The protection function accounted for the largest market share in specialty polystyrene resin market in 2017 and is expected to remain the major function during the forecast period, as this function is mostly needed in applications such as healthcare, electrical & electronics, and packaging. In the packaging application, specialty polystyrene resin delivers physical and mechanical strength, and it is the most versatile type of polymer foam. It is lightweight, composed of individual cells of low-density polystyrene, and has a high strength-to-weight ratio because it is cross-linked nature. It is useful in the food service and protective packaging applications.

The specialty polystyrene resin market is projected to witness the highest growth in the healthcare application.

Specialty polystyrene resins are adopted widely across the healthcare industry with significant efforts to commercialize new medical polymers to meet the specification of high-end use. The demand for specialty polystyrene resin in the healthcare market is growing significantly owing to a significant upsurge in demand for medical labware, pharmaceutical products, vacutainer trays, components for medical devices, and packaging for essential medicines due to the increase in population. The demand for specialty polystyrene resin is witnessing significant growth in all the regions due to the rapid acceptance and adoption of polymers from product designing to final product manufacturing.

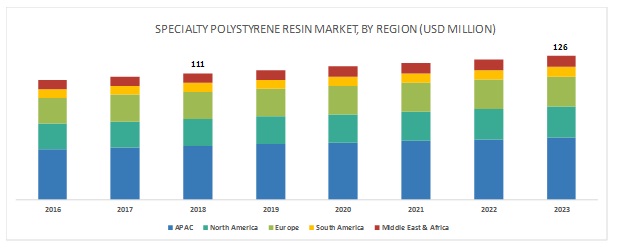

APAC is expected to account for the largest market share during the forecast period.

APAC has emerged as the leading consumer and producer of specialty polystyrene resin. The easy availability of low-cost labor and economical & accessible raw materials are driving foreign investments, thereby increasing the production of specialty polystyrene resin in the region. APAC is also the fastest-growing specialty polystyrene resin market. The demand in APAC will further increase in the next five years because of the growing furniture, appliances, and automotive industries in the developing countries.

Key Market Players

The major vendors in the specialty polystyrene resin market are Sekisui Plastics Co., Ltd. (Japan), NOVA Chemicals Corporation (Canada), Synthos (Poland), BASF SE (Germany), SUNPOR KUNSTSTOFF GmbH (Austria), Atlas EPS (US), VERSALIS (Italy), SABIC (Saudi Arabia), LG Chem, Ltd. (South Korea), BEWiSynbra Group AB (publ) (Sweden), Samsung Fine Chemicals Co., Ltd (South Korea), Total S.A. (France), and Trinseo (US).

Sekisui Plastics Co., Ltd. (Japan), is one of the largest specialty polystyrene resin companies. This company has a strong global presence. It has a diversified product portfolio to cater to end-use industries according to their requirements. To sustain its dominating position, the company may enter into new industries and target new markets.

Scope of the report

|

Report Metric |

Details |

|

Years considered for the study |

2016–2023 |

|

Base year |

2017 |

|

Forecast period |

2018–2023 |

|

Units considered |

Value (USD) and Volume (Ton) |

|

Segments |

Function, Application, and Region |

|

Geographies |

APAC, North America, Europe, South America, and Middle East & Africa |

|

Companies |

Sekisui Plastics Co., Ltd. (Japan), NOVA Chemicals Corporation (Canada), Synthos (Poland), BASF SE (Germany), SUNPOR KUNSTSTOFF GmbH (Austria), Atlas EPS (US), VERSALIS (Italy), SABIC (Saudi Arabia), LG Chem, Ltd. (South Korea), BEWiSynbra Group AB (publ) (Sweden), Eastman Chemical Company (US), PACUR, LLC. (US), Styropek (US), StyroChem (Canada), Polysource, Inc. (US), RAPAC (US), Knauf Insulation (Germany), Taita Chemical Co., Ltd. (Taiwan), Jackon GmbH (Germany), Samsung Fine Chemicals Co., Ltd (South Korea), Total S.A. (France), and Trinseo (US) |

This research report categorizes the specialty polystyrene resin market based on function, application, and region.

On the basis of function, the specialty polystyrene resin market is segmented as follows:

- Protection

- Insulation

- Cushioning & others (rheological, multishock-proof)

On the basis of application, the specialty polystyrene resin market is segmented as follows:

- Protective Packaging

- Building & Construction

- Automotive & Transportation

- Electrical & Electronics

- Healthcare

- Others (Toys, Tapes, Films, Disposable and Non-disposable, Cassette cases, and Furniture & bedding)

On the basis of region, the specialty polystyrene resin market is segmented as follows:

- APAC

- North America

- Europe

- South America

- Middle East & Africa

Recent Developments

- In March 2018, Atlanta, GA acquired ACH Foam Technologies, which is a leading manufacturer of molded polystyrene solutions with manufacturing facilities across North America. ACH Foam Technologies has decades of experience, which will help Atlanta, GA expand its global reach and revenue. Also, with this acquisition, Atlanta, GA expanded its polystyrene foam business in North America and became one of the largest manufacturers of molded polystyrene in the region.

- In August 2016, Synthos acquired the EPS business of INEOS Styrenics European Holding BV (Switzerland). Through this, the company accelerated growth and delivered additional benefits to customers of both companies, giving them access to expanded technologies and an enhanced product portfolio.

- In June 2018, BASF announced plans to increase its global production capacity to 40,000 ton/year for Neopor, an expandable polystyrene containing graphite. BASF will increase the production in facilities in Ludwigshafen, Germany, and Ulsan in South Korea during the fourth quarter of this year.

Key Questions addressed by the report

- What are the mid-to-long-term impacts of the developments undertaken by the key players of the market?

- Are the manufacturers of specialty polystyrene resin shutting down their plants because of the poor growth globally?

- Which function has the potential to register the highest market share and because of which application?

- What are the upcoming end-use industries for specialty polystyrene resin?

- What will be the future of the specialty polystyrene resin market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitation

1.7 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.3 Key Industry Insights

2.1.4 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions and Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities for Players in the Specialty Polystyrene Resin Market

4.2 Specialty Polystyrene Resin Market Size, By Function

4.3 Specialty Polystyrene Resin Market, By Application

4.4 Specialty Polystyrene Resin Market, By Region

4.5 APAC Specialty Polystyrene Resin Market, By Application and Key Countries

4.6 Specialty Polystyrene Resin Market Size, Developed vs. Developing Countries

4.7 Specialty Polystyrene Resin Market Attractiveness

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 High Growth of Automotive Application

5.2.1.2 Construction and Packaging Industries are the Major Markets for Specialty Polystyrene Resin.

5.2.2 Restraints

5.2.2.1 Volatility in Crude Oil & Raw Material Prices

5.2.2.2 Availability of High-Performance Substitutes

5.2.3 Opportunities

5.2.3.1 Polystyrene Products Can Be Recycled Easily

5.3 Challenges

5.3.1.1 Growing Preference Toward Molded Pulp Packaging

5.3.1.2 Ban on Eps in the Major Economies Threatens the Eps Manufacturers

5.4 Porter’s Five Forces Analysis

5.4.1 Threat of Substitutes

5.4.2 Bargaining Power of Buyers

5.4.3 Threat of New Entrants

5.4.4 Bargaining Power of Suppliers

5.4.5 Intensity of Competitive Rivalry

5.5 Macroeconomic Indicators

5.5.1 Introduction

5.5.2 Trends and Forecast of GDP Positively Driving the Packaging Industry

5.5.3 Trends in the Automotive Industry

5.5.4 Construction Industry Spending Worldwide, 2017–2025

5.5.5 Estimated Growth Rate of Consumer Electronics Industry, By Region, 2018–2022

6 Specialty Polystyrene Resin Market, By Function (Page No. - 52)

6.1 Introduction

6.1.1 Protection Function Accounted for the Largest Market Size, Globally

6.2 Protection

6.2.1 Increased Automobile Production and Healthcare Expenditure in APAC Drive the Specialty Polystyrene Resin Market in Protection Function

6.3 Insulation

6.3.1 Building & Construction Activities in APAC Drive the Specialty Polystyrene Resin Market in Insulation Function

6.4 Cushioning and Others

6.4.1 Growing Furniture & Bedding Industry in APAC Drives the Specialty Polystyrene Resin Market in Cushioning Function

7 Specialty Polystyrene Resin Market, By Application (Page No. - 59)

7.1 Introduction

7.1.1 Protective Packaging Application is Expected to Lead the Specialty Polystyrene Resin Market

7.2 Protective Packaging

7.2.1 APAC to Lead in the Protective Packaging Segment of the Specialty Polystyrene Resins Market

7.3 Building & Construction

7.3.1 APAC to Lead in the Building & Construction Segment of the Specialty Polystyrene Resins Market

7.4 Automotive & Transportation

7.4.1 APAC to Lead in the Automotive & Transportation Segment of the Specialty Polystyrene Resins Market

7.5 Healthcare

7.5.1 APAC to Lead in the Healthcare Application Segment of the Specialty Polystyrene Resins Market

7.6 Electrical & Electronics

7.6.1 APAC to Lead in the Electrical & Electronics Application of the Specialty Polystyrene Resins Market

7.7 Others

8 Specialty Polystyrene Resin Market, By Region (Page No. - 69)

8.1 Introduction

8.2 APAC

8.2.1 China

8.2.1.1 China Accounted for the Largest Market Size for Specialty Polystyrene Resin in APAC

8.2.2 India

8.2.2.1 Potential Customer Base and One of the Fastest Growing Consumers of Specialty Polystyrene Resin in APAC

8.2.3 Japan

8.2.3.1 Automotive & Transportation and Electronics & Semiconductors Applications are the Largest Markets for Specialty Polystyrene Resin in Japan

8.2.4 South Korea

8.2.4.1 Automotive & Transportation Application Drives the Market for Specialty Polystyrene Resin in South Korea

8.2.5 Rest of APAC

8.2.5.1 Building & Construction, Increase in Population, and Improving Economic Conditions are Expected to Drive the Specialty Polystyrene Resin APAC

8.3 North America

8.3.1 US

8.3.1.1 Growth in the Residential and Commercial Housing Sector to Drive the Specialty Polystyrene Resin Market in the Country

8.3.2 Canada

8.3.2.1 Growth in the Economy and Automotive Industry is Expected to Drive the Specialty Polystyrene Resin Market in the Country

8.3.3 Mexico

8.3.3.1 Strong Rebound in Exports and Improved Business Confidence to Strengthen the Mexican Specialty Polystyrene Resin Market

8.4 Europe

8.4.1 Germany

8.4.1.1 The German Construction Industry is Expected to Drive the Specialty Polystyrene Resin Market

8.4.2 Poland

8.4.2.1 Growth in the Chemical Manufacturing Industry is Expected to Drive the Specialty Polystyrene Resin Market

8.4.3 Russia

8.4.3.1 Building & Construction Industry is Expected to Drive the Specialty Polystyrene Resin Market

8.4.4 Italy

8.4.4.1 Building & Construction and Automobile Industries are Expected to Drive the Specialty Polystyrene Resin Market

8.4.5 Rest of Europe

8.4.5.1 Commercial & Residential Construction Industry is Expected to Drive the Specialty Polystyrene Resin Market

8.5 Middle East & Africa

8.5.1 Middle East

8.5.1.1 Building & Construction and Automobile & Transportation Application is Expected to Drive the Specialty Polystyrene Resin Market

8.5.2 Africa

8.5.2.1 Rising Demand From the Automotive, Electronics, Aerospace, Energy, and Construction Industries has Driven the Specialty Polystyrene Resin Market97

8.6 South America

8.6.1 Brazil

8.6.2 Rest of South America

9 Competitive Landscape (Page No. - 103)

9.1 Introduction

9.2 Competitive Scenario

9.2.1 Merger & Acqusition

9.2.2 New Product Launch

9.2.3 Investment & Expansion

9.2.4 Distribution & Agreement

10 Company Profiles (Page No. - 106)

10.1 Synthos S.A.

10.1.1 Business Overview

10.1.2 Products Offered

10.1.3 Recent Developments

10.1.4 SWOT Analysis

10.1.5 MnM View

10.2 BASF SE

10.2.1 Business Overview

10.2.2 Products Offered

10.2.3 Recent Developments

10.2.4 SWOT Analysis

10.2.5 MnM View

10.3 Versalis S.P.A.

10.3.1 Business Overview

10.3.2 Products Offered

10.3.3 SWOT Analysis

10.3.4 MnM View

10.4 Sekisui Plastics Co., Ltd.

10.4.1 Business Overview

10.4.2 Products Offered

10.4.3 SWOT Analysis

10.4.4 MnM View

10.5 LG Chem Ltd.

10.5.1 Business Overview

10.5.2 Products Offered

10.5.3 SWOT Analysis

10.5.4 MnM View

10.6 Sunpor Kunststoff GmbH

10.6.1 Business Overview

10.6.2 Products Offered

10.7 Eastman Chemical Company

10.7.1 Business Overview

10.8 Nova Chemicals Corporation

10.8.1 Business Overview

10.8.2 Products Offered

10.8.3 Recent Developments

10.9 Styropek

10.9.1 Business Overview

10.9.2 Products Offered

10.10 Styrochem

10.10.1 Business Overview

10.10.2 Products Offered

10.11 Polysource

10.11.1 Business Overview

10.11.2 Products Offered

10.12 RAPAC

10.12.1 Business Overview

10.12.2 Products Offered

10.13 Knauf Insulation

10.13.1 Business Overview

10.13.2 Products Offered

10.14 Taita Chemical Co., Ltd.

10.14.1 Business Overview

10.14.2 Products Offered

10.15 Jackon GmbH

10.15.1 Business Overview

10.15.2 Products Offered

10.16 Innova

10.16.1 Business Overview

10.16.2 Products Offered

10.17 SABIC

10.17.1 Business Overview

10.17.2 Products Offered

10.18 Atlas Roofing

10.18.1 Business Overview

10.18.2 Products Offered

10.19 Ineos Styrolution Group GmbH

10.19.1 Business Overview

10.19.2 Products Offered

10.20 Trinseo

10.20.1 Business Overview

10.20.2 Products Offered

10.21 Total S.A.

10.21.1 Business Overview

10.21.2 Products Offered

10.22 Pacur, Llc.

10.22.1 Business Overview

10.23 Samsung Fine Chemicals Co. Ltd.

10.23.1 Business Overview

10.23.2 Recent Developments

11 Appendix (Page No. - 146)

11.1 Insights From Industry Experts

11.2 Discussion Guide

11.3 Knowledge Store: Marketsandmarkets Subscription Portal

11.4 Introducing Rt: Real Time Market Intelligence

11.5 Available Customizations

11.6 Related Reports

11.7 Authors Details

List of Tables (73 Tables)

Table 1 Specialty Polystyrene Resin Market Snapshot (2018 vs. 2023)

Table 1 Major Players Profiled in This Report

Table 2 Major Planned Construction Projects in China

Table 3 Competitive Analysis of Specialty Polystyrene Resin Eps vs. Polyurethane Foams

Table 4 Specialty Polystyrene Resin Based Eps vs. Molded Pulp

Table 5 Competitive Analysis of Specialty Polystyrene Resin and Polyurethane Foams

Table 6 GDP Percentage Change of Key Country, 2018–2023

Table 7 Automotive Production in Key Countries, 2016–2017 (Unit)

Table 8 Specialty Polystyrene Resin Market Size, By Function, 2016–2023 (USD Million)

Table 9 Market Size, By Function, 2016–2023 (Ton)

Table 10 Protection Segment Size in Specialty Polystyrene Resin Market, By Region, 2016–2023 (USD Million)

Table 11 Protection Segment Size in Market, By Region, 2016–2023 (Ton)

Table 12 Insulation Segment Size in Market, By Region, 2016–2023 (USD Million)

Table 13 Insulation Segment Size in Market, By Region, 2016–2023 (Ton)

Table 14 Cushioning and Others Segment Size in Specialty Polystyrene Resin Market, By Region, 2016–2023 (USD Million)

Table 15 Cushioning and Others Segment Size in Market, By Region, 2016–2023 (Ton)

Table 16 By Market Size, By Application, 2016–2023 (USD Million)

Table 17 By Market Size, By Application, 2016–2023 (Ton)

Table 18 By Market Size in Protective Packaging Application, By Region, 2016–2023 (USD Million)

Table 19 By Market Size in Protective Packaging Application, By Region, 2016-2023 (Ton)

Table 20 By Market Size in Building & Construction Application, By Region, 2016–2023 (USD Million)

Table 21 By Market Size in Building & Construction Application, By Region, 2016–2023 (Ton)

Table 22 By Market Size in Automotive & Transportation Application, By Region, 2016–2023 (USD Million)

Table 23 By Market Size in Automotive & Transportation Application, By Region, 2016–2023 (Ton)

Table 24 By Market Size in Medical Application, By Region, 2016–2023 (USD Million)

Table 25 By Market Size in Healthcare Application, By Region, 2016-2023 (Ton)

Table 26 By Market Size in Electrical & Electronics Application, By Region, 2016–2023 (USD Million)

Table 27 By Market Size in Electrical & Electronics Application, By Region, 2016-2023 (Ton)

Table 28 By Market Size in Other Applications, By Region, 2016–2023 (USD Million)

Table 29 By Market Size in Other Applications, By Region, 2016-2023 (Ton)

Table 30 By Market Size, By Region, 2016–2023 (USD Million)

Table 31 By Market Size, By Region, 2016–2023 (Ton)

Table 32 APAC: By Market Size, By Country, 2016–2023 (USD Million)

Table 33 APAC: By Market Size, By Country, 2016–2023 (Ton)

Table 34 APAC: By Market Size, By Function, 2016–2023 (USD Million)

Table 35 APAC: By Market Size, By Function, 2016–2023 (Ton)

Table 36 APAC: By Market Size, By Application, 2016–2023 (USD Million)

Table 37 APAC: By Market Size, By Application, 2016–2023 (Ton)

Table 38 China: By Market Size, By Application, 2016–2023 (USD Million)

Table 39 APAC: By Resin Market Size, By Application, 2016–2023 (Ton)

Table 40 India: By Market Size, By Application, 2016–2023 (USD Million)

Table 41 India: By Market Size, By Application, 2016–2023 (Ton)

Table 42 North America: By Market Size, By Country, 2016–2023 (USD Million)

Table 43 North America: By Market Size, By Country, 2016–2023 (Ton)

Table 44 North America: By Market Size, By Product Type, 2016–2023 (USD Million)

Table 45 North America: By Market Size, By Product Type, 2016–2023 (Ton)

Table 46 North America: By Market Size, By Application, 2016–2023 (USD Million)

Table 47 North America: By Market Size, By Application, 2016–2023 (Ton)

Table 48 US: By Market Size, By Function, 2016–2023 (USD Million)

Table 49 US: By Market Size, By Function, 2016–2023 (Ton)

Table 50 Europe: By Market Size, By Country, 2016–2023 (USD Million)

Table 51 Europe: By Market Size, By Country, 2016–2023 (Ton)

Table 52 Europe: By Market Size, By Function, 2016–2023 (USD Million)

Table 53 Europe: By Market Size, By Function, 2016–2023 (Ton)

Table 54 Europe: By Market Size, By Application, 2016–2023 (USD Million)

Table 55 Europe: By Market Size, By Application, 2016–2023 (Ton)

Table 56 Germany: By Market Size, By Application, 2016–2023 (USD Million)

Table 57 Germany: By Resin Market Size, By Application, 2016–2023 (Ton)

Table 58 Middle East & Africa: By Resin Market Size, By Country, 2016–2023 (USD Million)

Table 59 Middle East & Africa: By Resin Market Size, By Country, 2016–2023 (Ton)

Table 60 Middle East & Africa: By Market Size, By Function, 2016–2023 (USD Million)

Table 61 Middle East & Africa: By Market Size, By Function, 2016–2023 (Ton)

Table 62 Middle East & Africa: By Market Size, By Application, 2016–2023 (USD Million)

Table 63 Middle East & Africa: By Market Size, By Application, 2016–2023 (Ton)

Table 64 South America: By Resin Market Size, By Country, 2016–2023 (USD Million)

Table 65 South America: By Resin Market Size, By Country, 2016–2023 (Ton)

Table 66 South America: By Market Size, By Function, 2016–2023 (USD Million)

Table 67 South America: By Market Size, By Function, 2016–2023 (Ton)

Table 68 South America: By Market Size, By Application, 2016–2023 (USD Million)

Table 69 South America: By Market Size, By Application, 2016–2023 (Ton)

Table 70 Merger & Acqusition, 2015–2018

Table 71 New Product Launch, 2015–2018

Table 72 Investment & Expansion, 2015–2018

Table 73 Distribution & Agreement, 2015–2018

List of Figures (33 Figures)

Figure 1 Specialty Polystyrene Resin Market Segmentation

Figure 2 Specialty Polystyrene Resin Market: Research Design

Figure 3 Market Size Estimation: Bottom-Up Approach

Figure 4 Market Size Estimation: Top-Down Approach

Figure 5 Specialty Polystyrene Resin: Data Triangulation

Figure 6 APAC to Dominate the Specialty Polystyrene Resin Market Between 2018 and 2023

Figure 7 Protection Function of Specialty Polystyrene Resin to Dominate the Market Between 2018 and 2023

Figure 8 Healthcare to Be the Fastest-Growing Application Between 2018 and 2023

Figure 9 Emerging Economies to Offer Lucrative Growth Opportunities for Market Players

Figure 10 Protective Packaging Application to Drive the Specialty Polystyrene Resin Market

Figure 11 India: an Emerging Market for Specialty Polystyrene Resin

Figure 12 APAC: Specialty Polystyrene Resin Market Snapshot

Figure 13 North America: Specialty Polystyrene Resin Market Snapshot

Figure 14 Rise in Demand for Packaging Products to Drive the Specialty Polystyrene Resin Market in Europe

Figure 15 Middle East & Africa Market Snapshot: Protective Packaging is the Largest Market for Specialty Polystyrene Resin in the Region in 2017

Figure 16 Rise in Building & Construction Activities to Drive the Specialty Polystyrene Resin Market in South America

Figure 17 Key Growth Strategies Adopted By Companies Between 2015 and 2018

Figure 18 Synthos S.A: Company Snapshot

Figure 19 Synthos: SWOT Analysis

Figure 20 BASF SE: Company Snapshot

Figure 21 BASF SE: SWOT Analysis

Figure 22 Versalis S.P.A: Company Snapshot

Figure 23 Versalis S.P.A: SWOT Analysis

Figure 24 Sekisui Plastics Co., Ltd.: Company Snapshot

Figure 25 Sekisui Plastics Co., Ltd.: SWOT Analysis

Figure 26 LG Chem Ltd.: Company Snapshot

Figure 27 LG Chem Ltd.: SWOT Analysis

Figure 28 Eastmen Chemical Company: Company Snapshot

Figure 29 Nova Checmical Corporation: Company Snapshot

Figure 30 Innova: Company Snapshot

Figure 31 SABIC: Company Snapshot

Figure 32 Trinseo: Company Snapshot

Figure 33 Total S.A.: Company Snapshot

The study involved four major activities in estimating the current market size for specialty polystyrene resin. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and the subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg, and BusinessWeek were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; gold standard & silver standard websites; regulatory bodies; trade directories; and databases.

Primary Research

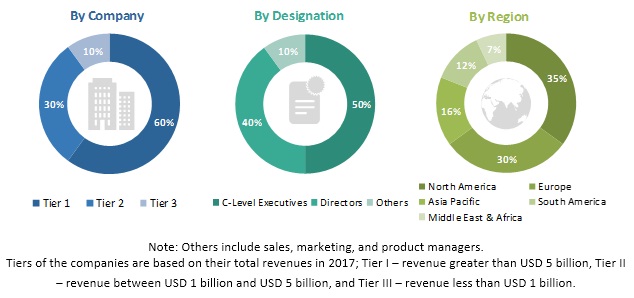

The specialty polystyrene resin market comprises several stakeholders such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations. The demand side for this market is characterized by the development of packaging, building & construction, automotive & transportation, electrical & electronics, and healthcare industries and the growth in population. The supply side is characterized by advancements in functions, resin chemistries, and diverse end-use industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the overall size of the specialty polystyrene resin market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides of the automotive, construction, electronics, and medical industries.

Report Objectives

- To define, describe, and forecast the global market size of specialty polystyrene resin

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market

- To understand the structure of the specialty polystyrene resin market by identifying its various subsegments

- To project the size of the market and its submarkets, in terms of value, with respect to the five regions (along with their respective key countries)

- To profile key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify major growth strategies adopted by players across key regions

- To analyze the competitive developments such as distribution agreements, investments & expansions, mergers & acquisitions, and new product launches in the specialty polystyrene resin market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Product Analysis:

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis:

- Further breakdown of a specific country based on application

Company Information:

- Detailed analysis and profiling of additional market players (up to twenty three)

Growth opportunities and latent adjacency in Specialty Polystyrene Resin Market