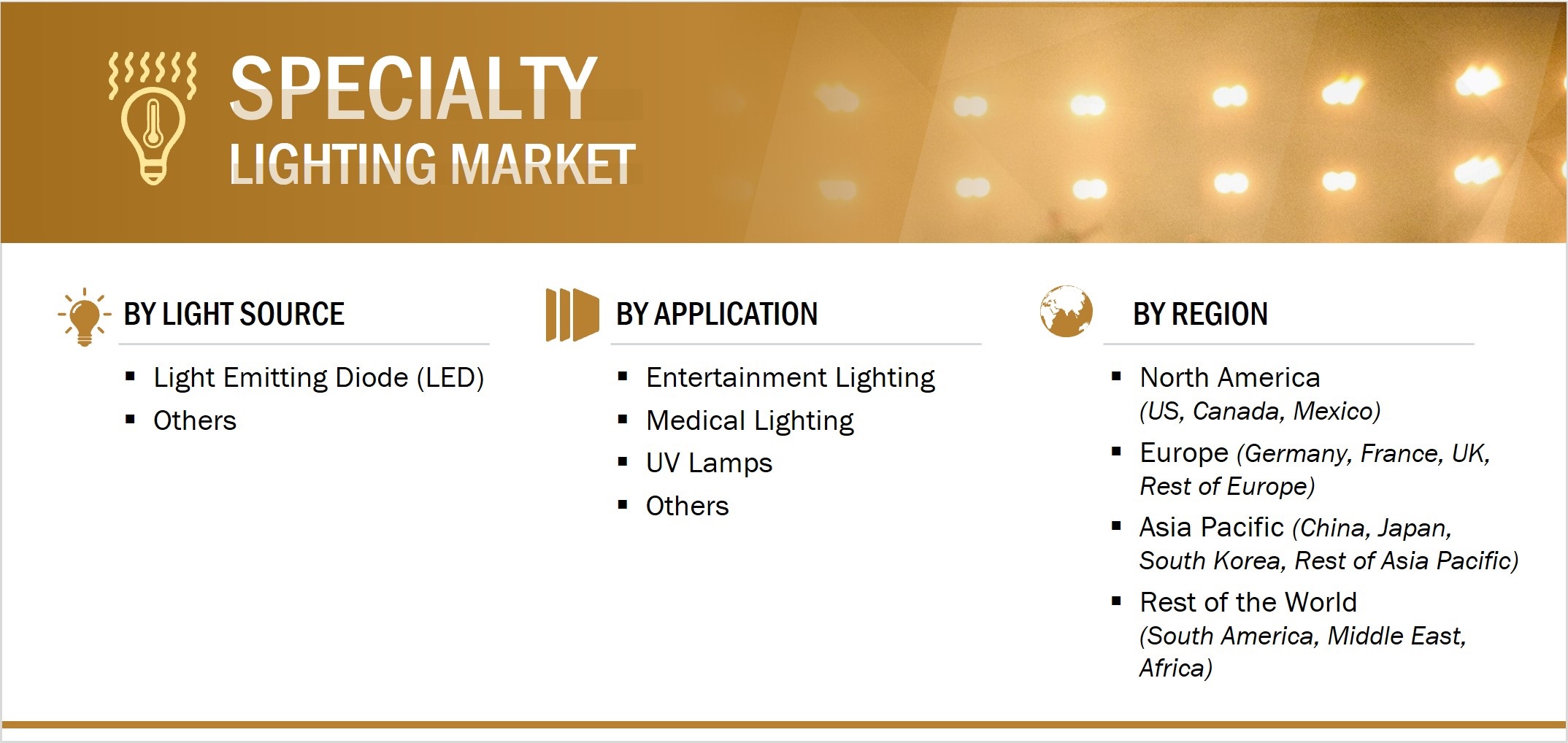

Specialty Lighting Market by Light Source (Light-Emitting Diode, Halogen Lamps, Xenon Bulbs, Incandescent Lamps, Metal Halide Lamps), Application (Entertainment, Medical, UV Lamps) and Region (North America, Europe, APAC, RoW) - Global Forecast to 2025-2036

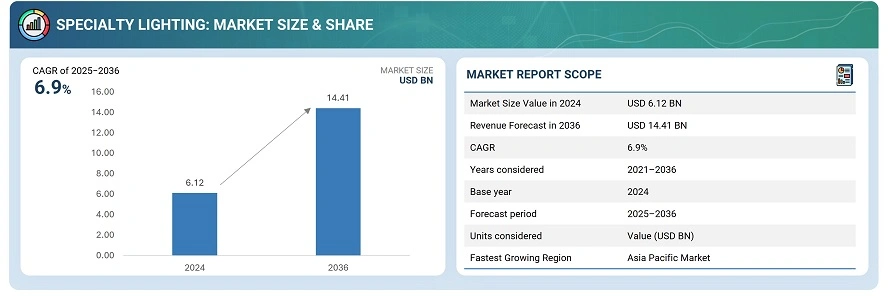

The global specialty lighting market was valued at USD 6.12 billion in 2024 and is estimated to reach USD 14.41 billion by 2036, at a CAGR of 6.9% between 2025 and 2036.

The specialty lighting market is primarily driven by the need for highly precise and focused illumination that standard lighting cannot provide, enabling critical tasks to be performed efficiently and safely. Increasing emphasis on hygiene and sanitation has fueled demand for UV-based solutions that effectively purify air, water, and surfaces. In professional environments, there is a growing requirement for consistent and controllable lighting to enhance performance, accuracy, and visual clarity. Moreover, the demand for lighting solutions that can address unique operational challenges, such as attracting insects or ensuring visibility in large-scale facilities, continues to propel market growth.

Specialty lighting refers to lighting solutions designed for specific applications or environments where standard illumination is insufficient, requiring precise control, intensity, or wavelength. Unlike general-purpose lighting, specialty lighting caters to unique functional needs, such as enhancing visibility for detailed tasks, supporting hygiene through UV purification, or creating controlled lighting conditions in professional settings.

Market by Light Source

Light-emitting Diode (LED)

LED light sources are expected to capture the highest share and growth in the specialty lighting market due to their superior energy efficiency, long lifespan, and low maintenance requirements compared to traditional light sources. Their ability to provide precise, high-quality illumination makes them ideal for applications requiring accuracy and consistency. Additionally, the declining costs of LED technology and increasing demand for environmentally friendly lighting solutions are further accelerating their adoption across various specialty applications.

Other Light Sources

Other light sources, including halogen, xenon, incandescent, and metal halide, continue to hold a portion of the specialty lighting market due to their specific performance characteristics, such as high-intensity output, color rendering, and suitability for certain professional or industrial applications. These sources are often preferred in scenarios where precise spectral qualities or focused beams are required. However, their higher energy consumption and shorter lifespan compared to LEDs limit their overall market share and growth potential.

Market by Application

Entertainment Lighting

The entertainment lighting segment commands the highest market share due to the consistent demand for high-quality, visually impactful lighting in theaters, studios, concerts, and live events. These applications require precise, reliable, and customizable illumination to enhance audience experience and production quality. Additionally, frequent upgrades and replacements in the entertainment sector support sustained demand, reinforcing its dominance in the specialty lighting market.

UV Lamps

The UV lamps segment is poised for the highest growth owing to the increasing emphasis on hygiene and sanitation, particularly in air, water, and surface purification applications. Rising awareness of public health, coupled with regulatory support for clean environments in commercial, healthcare, and municipal facilities, is driving rapid adoption. Technological advancements improving efficiency and effectiveness of UV solutions further accelerate market expansion in this segment.

Market by Geography

Geographically, the specialty lighting market is experiencing widespread adoption across North America, Europe, Asia Pacific, and RoW (Middle East & Africa and South America). Asia Pacific is projected to witness the highest growth in the specialty lighting market over the coming years, driven by a combination of economic, industrial, and technological factors. Rapid industrialization and urbanization across countries such as China, India, and Southeast Asian nations are fueling demand for advanced lighting solutions in commercial, entertainment, and healthcare applications. Increasing investments in infrastructure development, public spaces, and industrial facilities are further boosting the need for specialty lighting that meets specific performance and safety standards. Moreover, the growing focus on hygiene and sanitation, particularly through UV-based air, water, and surface purification systems, is encouraging widespread adoption in hospitals, commercial buildings, and municipal facilities. The region also benefits from cost-effective manufacturing capabilities, a large consumer base, and favorable government policies that support technological adoption, collectively making Asia-Pacific the fastest-growing market for specialty lighting globally.

Market Dynamics

Driver: Rapid Adoption of Energy-Efficient Light Sources

The specialty lighting market is strongly driven by the increasing adoption of energy-efficient light sources, particularly LEDs, which offer longer lifespan, lower energy consumption, and reduced operational costs compared to traditional sources. Industries and professional sectors are seeking solutions that not only provide high-intensity and precise illumination but also help in sustainability and cost savings. This shift toward efficient lighting is encouraging replacements and upgrades, supporting consistent market growth across entertainment, medical, UV purification, and other applications.

Restraint: Limited Availability of Certain Light Sources

The market faces a restraint due to the limited availability of specialized light sources, such as xenon, metal halide, and certain high-intensity lamps. These sources are not produced at the same scale as LEDs, making them harder to source for specific applications. Supply constraints, combined with long lead times for custom or niche lighting products, can slow project execution and adoption in sectors requiring these specialized solutions.

Opportunity: Growing Use of UV Lamps for Hygiene

An emerging opportunity in the market is the expanding use of UV lamps for air, water, and surface purification, driven by heightened awareness of hygiene and sanitation standards. Hospitals, commercial buildings, and public facilities are increasingly adopting these solutions to mitigate health risks and meet regulatory requirements. Advances in UV technology, including improved efficiency and safety, are further encouraging adoption, making this segment one of the fastest-growing areas within the specialty lighting market.

Challenge: Regulatory and Compliance Constraints

A key challenge in the specialty lighting market is navigating stringent regulatory standards and compliance requirements for different applications. For example, UV lamps, medical lighting, and high-intensity sources must meet specific safety, environmental, and performance regulations. Ensuring compliance can increase development timelines, add operational complexity, and require rigorous testing, which may slow market adoption in certain regions or industries.

Future Outlook

The specialty lighting market is expected to experience steady growth from 2025 to 2036, driven by the continued adoption of energy-efficient light sources and the expanding demand for highly specialized illumination across diverse applications. UV-based solutions are projected to see rapid growth due to increasing focus on hygiene, sanitation, and regulatory compliance in healthcare, commercial, and public facilities. Technological advancements in light sources, such as higher intensity, longer lifespan, and improved spectral performance, will further enable the market to penetrate niche and high-performance applications. Additionally, regions like Asia Pacific are likely to lead in growth, fueled by industrialization, urbanization, and large-scale infrastructure projects, positioning the specialty lighting market as a dynamic and evolving sector with significant opportunities for innovation and expansion over the next decade.

Key Market Players

Top Specialty Lighting companies include Signify Holding (Netherlands), ams-OSRAM AG (Austria), STERIS (US), Ushio Inc. (Japan), and Zumtobel Group (Austria).

Key Questions addressed in this report:

- What are the global trends in demand for the market?

- What are the upcoming technologies/product areas that will have a significant impact on the market in the future?

- What will be the revenue pockets for the market players in the next 10 years?

- What are the prime strategies followed by key players in the market?

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 24)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 SPECIALTY LIGHTING MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 UNIT CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 28)

2.1 RESEARCH DATA

FIGURE 2 SPECIALTY LIGHTING MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.1.2 Key secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primary interviews

2.1.2.3 Key industry insights

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.2 MARKET SIZE ESTIMATION

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): REVENUE GENERATED BY KEY MARKET PLAYERS IN MARKET

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (SUPPLY SIDE): ILLUSTRATION OF REVENUE ESTIMATION OF KEY PLAYERS (SIGNIFY) IN MARKET

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 (DEMAND SIDE) —BOTTOM-UP ESTIMATION OF MARKET, BY GEOGRAPHY

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for capturing market size by bottom-up analysis

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing market size by top-down analysis

2.3 MARKET SHARE ESTIMATION

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.5 RISK ASSESSMENT

TABLE 1 RISK FACTOR ANALYSIS

2.5.1 RESEARCH ASSUMPTIONS

2.5.2 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 40)

FIGURE 9 SURGICAL SEGMENT OF MEDICAL APPLICATION TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

FIGURE 10 LED SEGMENT TO REGISTER HIGHER CAGR DURING 2022–2027

FIGURE 11 STAGE LIGHTING SEGMENT OF ENTERTAINMENT APPLICATION TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

FIGURE 12 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING 2022–2027

4 PREMIUM INSIGHTS (Page No. - 44)

4.1 GROWTH OPPORTUNITIES FOR PLAYERS IN SPECIALTY LIGHTING MARKET

FIGURE 13 ASIA PACIFIC TO OFFER LUCRATIVE GROWTH OPPORTUNITIES IN MARKET

4.2 MARKET, BY APPLICATION

FIGURE 14 ENTERTAINMENT SEGMENT TO LEAD MARKET FROM 2022 TO 2027

4.3 MARKET, BY LIGHT SOURCE

FIGURE 15 LED SEGMENT TO GROW AT HIGHER RATE DURING FORECAST PERIOD

4.4 MARKET IN ASIA PACIFIC, BY APPLICATION AND COUNTRY, 2027

FIGURE 16 ENTERTAINMENT SEGMENT AND CHINA TO ACCOUNT FOR LARGEST SHARES

4.5 MARKET, BY COUNTRY

FIGURE 17 MARKET TO RECORD HIGHEST CAGR IN INDIA DURING 2022–2027

5 MARKET OVERVIEW (Page No. - 47)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN SPECIALTY LIGHTING MARKET

5.2.1 DRIVERS

5.2.1.1 Stringent government regulations for air, water, and surface disinfection

5.2.1.2 Rising demand for UV LEDs across industries due to COVID-19

5.2.1.3 Increasing number of live music events and concerts

5.2.1.4 Growing adoption of surgical lighting for minor and major surgical procedures

5.2.1.5 Increasing penetration and decreasing cost of LEDs

FIGURE 19 DRIVERS: MARKET

5.2.2 RESTRAINTS

5.2.2.1 Perception of higher cost of installation and limited awareness about payback periods

FIGURE 20 RESTRAINTS: MARKET

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing demand for ultrapure water from end-use industries

5.2.3.2 High growth prospects in new applications

5.2.3.3 Geographical opportunities in Asia Pacific and RoW

FIGURE 21 OPPORTUNITIES: MARKET

5.2.4 CHALLENGES

5.2.4.1 Misconceptions regarding UV purification systems

FIGURE 22 CHALLENGES: MARKET

5.3 REVENUE SHIFT AND NEW REVENUE POCKETS FOR MARKET PLAYERS

FIGURE 23 REVENUE SHIFT IN MARKET

5.4 VALUE CHAIN ANALYSIS

FIGURE 24 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDITION DURING MANUFACTURING AND DISTRIBUTION PHASES

5.5 ECOSYSTEM/MARKET MAP

TABLE 2 MARKET: ECOSYSTEM

FIGURE 25 MARKET: PLAYER ECOSYSTEM

5.6 TECHNOLOGY ANALYSIS & TRENDS

FIGURE 26 MARKET: TECHNOLOGY ANALYSIS

5.7 PATENT ANALYSIS

5.7.1 DOCUMENT TYPE

TABLE 3 PATENTS FILED

FIGURE 27 PATENTS FILED FROM 2013 TO 2022

5.7.2 PUBLICATION TREND

FIGURE 28 NUMBER OF PATENTS FILED EACH YEAR, 2013–2022

5.7.3 JURISDICTION ANALYSIS

FIGURE 29 JURISDICTION ANALYSIS

5.7.4 TOP PATENT OWNERS

FIGURE 30 TOP 10 PATENT APPLICANTS, 2013–2022

TABLE 4 TOP 20 PATENT OWNERS IN LAST 10 YEARS

5.8 TRADE ANALYSIS

FIGURE 31 COUNTRY-WISE EXPORT DATA FOR PRODUCTS CLASSIFIED UNDER HS CODE: 9405, 2017–2021

TABLE 5 EXPORT SCENARIO FOR HS CODE: 9405-COMPLIANT PRODUCTS, BY COUNTRY, 2017–2021 (USD THOUSAND)

FIGURE 32 COUNTRY-WISE IMPORT DATA FOR PRODUCTS CLASSIFIED UNDER HS CODE: 9405, 2017–2021

TABLE 6 IMPORT SCENARIO FOR HS CODE: 9405-COMPLIANT PRODUCTS, BY COUNTRY, 2017–2021 (USD THOUSAND)

5.9 PORTER'S FIVE FORCES ANALYSIS

FIGURE 33 PORTER'S FIVE FORCES ANALYSIS OF MARKET

TABLE 7 PORTER'S FIVE FORCES ANALYSIS AND THEIR IMPACT

5.9.1 THREAT OF NEW ENTRANTS

5.9.2 THREAT OF SUBSTITUTES

5.9.3 BARGAINING POWER OF SUPPLIERS

5.9.4 BARGAINING POWER OF BUYERS

5.9.5 DEGREE OF COMPETITIVE RIVALRY

5.10 STANDARDS & REGULATIONS

5.10.1 REGULATORY LANDSCAPE

TABLE 8 REGULATIONS: LIGHTING ECOSYSTEM

6 SPECIALTY LIGHTING MARKET, BY LIGHT SOURCE (Page No. - 67)

6.1 INTRODUCTION

FIGURE 34 LED SEGMENT TO HOLD LARGER SHARE OF MARKET DURING FORECAST PERIOD

TABLE 9 MARKET, BY LIGHT SOURCE, 2018–2021 (USD MILLION)

TABLE 10 MARKET, BY LIGHT SOURCE, 2022–2027 (USD MILLION)

6.2 LIGHT-EMITTING DIODE (LED)

6.2.1 LED TO BE LEADING LIGHT SOURCE SEGMENT DURING FORECAST PERIOD

TABLE 11 MARKET FOR LED, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 12 MARKET FOR LED, BY APPLICATION, 2022–2027 (USD MILLION)

6.3 OTHER LIGHT SOURCES

TABLE 13 MARKET FOR OTHER LIGHT SOURCES, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 14 MARKET FOR OTHER LIGHT SOURCES, BY APPLICATION, 2022–2027 (USD MILLION)

7 SPECIALTY LIGHTING MARKET, BY APPLICATION (Page No. - 71)

7.1 INTRODUCTION

FIGURE 35 ENTERTAINMENT APPLICATION TO HOLD LARGEST SHARE OF MARKET DURING FORECAST PERIOD

TABLE 15 MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 16 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 17 MARKET, BY APPLICATION, 2018–2021 (THOUSAND UNIT)

TABLE 18 MARKET, BY APPLICATION, 2022–2027 (THOUSAND UNIT)

7.2 ENTERTAINMENT

TABLE 19 MARKET IN ENTERTAINMENT LIGHTING, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 20 MARKET IN ENTERTAINMENT LIGHTING, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 21 MARKET IN ENTERTAINMENT LIGHTING, BY LIGHT SOURCE, 2018–2021 (USD MILLION)

TABLE 22 MARKET IN ENTERTAINMENT LIGHTING, BY LIGHT SOURCE, 2022–2027 (USD MILLION)

TABLE 23 MARKET IN ENTERTAINMENT LIGHTING, BY REGION, 2018–2021 (USD MILLION)

TABLE 24 MARKET IN ENTERTAINMENT LIGHTING, BY REGION, 2022–2027 (USD MILLION)

TABLE 25 ENTERTAINMENT LIGHTING MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 26 ENTERTAINMENT LIGHTING MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 27 ENTERTAINMENT LIGHTING MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 28 ENTERTAINMENT LIGHTING MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 29 ENTERTAINMENT LIGHTING MARKET IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 30 ENTERTAINMENT LIGHTING MARKET IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 31 ENTERTAINMENT LIGHTING MARKET IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 32 ENTERTAINMENT LIGHTING MARKET IN ROW, BY REGION, 2022–2027 (USD MILLION)

7.2.1 STAGE LIGHTING

7.2.1.1 Increasing number of live performances & music events to positively impact market growth

TABLE 33 MARKET IN STAGE LIGHTING, BY REGION, 2018–2021 (USD MILLION)

TABLE 34 MARKET IN STAGE LIGHTING, BY REGION, 2022–2027 (USD MILLION)

7.2.2 STUDIO LIGHTING

7.2.2.1 Studio lighting produces desired ambience during shoot

TABLE 35 MARKET IN STUDIO LIGHTING, BY REGION, 2018–2021 (USD MILLION)

TABLE 36 MARKET IN STUDIO LIGHTING, BY REGION, 2022–2027 (USD MILLION)

7.2.3 OTHER ENTERTAINMENT LIGHTING

TABLE 37 MARKET IN OTHER ENTERTAINMENT LIGHTING, BY REGION, 2018–2021 (USD MILLION)

TABLE 38 MARKET IN OTHER ENTERTAINMENT LIGHTING, BY REGION, 2022–2027 (USD MILLION)

7.3 MEDICAL

TABLE 39 SPECIALTY LIGHTING MARKET IN MEDICAL LIGHTING, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 40 MARKET IN MEDICAL LIGHTING, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 41 MARKET IN MEDICAL LIGHTING, BY LIGHT SOURCE, 2018–2021 (USD MILLION)

TABLE 42 MARKET IN MEDICAL LIGHTING, BY LIGHT SOURCE, 2022–2027 (USD MILLION)

TABLE 43 MARKET IN MEDICAL LIGHTING, BY REGION, 2018–2021 (USD MILLION)

TABLE 44 MARKET IN MEDICAL LIGHTING, BY REGION, 2022–2027 (USD MILLION)

TABLE 45 MEDICAL LIGHTING MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 46 MEDICAL LIGHTING MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 47 MEDICAL LIGHTING MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 48 MEDICAL LIGHTING MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 49 MEDICAL LIGHTING MARKET IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 50 MEDICAL LIGHTING MARKET IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 51 MEDICAL LIGHTING MARKET IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 52 MEDICAL LIGHTING MARKET IN ROW, BY REGION, 2022–2027 (USD MILLION)

7.3.1 SURGICAL LIGHTING

7.3.1.1 Asia Pacific to witness highest growth in surgical lighting market

TABLE 53 MARKET IN SURGICAL LIGHTING, BY REGION, 2018–2021 (USD MILLION)

TABLE 54 MARKET IN SURGICAL LIGHTING, BY REGION, 2022–2027 (USD MILLION)

7.3.2 EXAMINATION LIGHTING

7.3.2.1 North America leads market in this segment

TABLE 55 MARKET IN EXAMINATION LIGHTING, BY REGION, 2018–2021 (USD MILLION)

TABLE 56 MARKET IN EXAMINATION LIGHTING, BY REGION, 2022–2027 (USD MILLION)

7.4 UV LAMPS

TABLE 57 SPECIALTY LIGHTING MARKET IN UV LAMPS, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 58 MARKET IN UV LAMPS, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 59 MARKET IN UV LAMPS, BY LIGHT SOURCE, 2018–2021 (USD MILLION)

TABLE 60 MARKET IN UV LAMPS, BY LIGHT SOURCE, 2022–2027 (USD MILLION)

TABLE 61 MARKET IN MERCURY LAMPS, BY LAMP TYPE, 2018–2021 (USD MILLION)

TABLE 62 MARKET IN MERCURY LAMPS, BY LAMP TYPE, 2022–2027 (USD MILLION)

TABLE 63 MARKET IN UV LAMPS, BY REGION, 2018–2021 (USD MILLION)

TABLE 64 MARKET IN UV LAMPS, BY REGION, 2022–2027 (USD MILLION)

TABLE 65 UV LAMPS MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 66 UV LAMPS MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 67 UV LAMPS MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 68 UV LAMPS MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 69 UV LAMPS MARKET IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 70 UV LAMPS MARKET IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 71 UV LAMPS MARKET IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 72 UV LAMPS MARKET IN ROW, BY REGION, 2022–2027 (USD MILLION)

7.4.1 AIR PURIFICATION

7.4.1.1 UV disinfection of air is highly effective in destroying microorganisms

TABLE 73 MARKET IN AIR PURIFICATION, BY REGION, 2018–2021 (USD MILLION)

TABLE 74 MARKET IN AIR PURIFICATION, BY REGION, 2022–2027 (USD MILLION)

7.4.2 WATER PURIFICATION

7.4.2.1 Strict government regulations for wastewater disposal and treatment to boost market

TABLE 75 MARKET IN WATER PURIFICATION, BY REGION, 2018–2021 (USD MILLION)

TABLE 76 MARKET IN WATER PURIFICATION, BY REGION, 2022–2027 (USD MILLION)

7.4.3 SURFACE PURIFICATION

7.4.3.1 An important application of UV disinfection equipment

TABLE 77 MARKET IN SURFACE PURIFICATION, BY REGION, 2018–2021 (USD MILLION)

TABLE 78 MARKET IN SURFACE PURIFICATION, BY REGION, 2022–2027 (USD MILLION)

7.5 OTHER APPLICATIONS

TABLE 79 SPECIALTY LIGHTING MARKET IN OTHER APPLICATIONS, 2018–2021 (USD MILLION)

TABLE 80 MARKET IN OTHER APPLICATIONS, 2022–2027 (USD MILLION)

TABLE 81 MARKET IN OTHER APPLICATIONS, BY LIGHT SOURCE, 2018–2021 (USD MILLION)

TABLE 82 MARKET IN OTHER APPLICATIONS, BY LIGHT SOURCE, 2022–2027 (USD MILLION)

TABLE 83 MARKET IN OTHER APPLICATIONS, BY REGION, 2018–2021 (USD MILLION)

TABLE 84 MARKET IN OTHER APPLICATIONS, BY REGION, 2022–2027 (USD MILLION)

TABLE 85 MARKET IN OTHER APPLICATIONS IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 86 MARKET IN OTHER APPLICATIONS IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 87 MARKET IN OTHER APPLICATIONS IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 88 MARKET IN OTHER APPLICATIONS IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 89 MARKET IN OTHER APPLICATIONS IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 90 MARKET IN OTHER APPLICATIONS IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 91 MARKET IN OTHER APPLICATIONS IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 92 MARKET IN OTHER APPLICATIONS IN ROW, BY REGION, 2022–2027 (USD MILLION)

7.5.1 AIRPORT LIGHTING

TABLE 93 MARKET IN AIRPORT LIGHTING, BY REGION, 2018–2021 (USD MILLION)

TABLE 94 MARKET IN AIRPORT LIGHTING, BY REGION, 2022–2027 (USD MILLION)

7.5.2 INSECT TRAP LIGHTING

TABLE 95 MARKET IN INSECT TRAP LIGHTING, BY REGION, 2018–2021 (USD MILLION)

TABLE 96 MARKET IN INSECT TRAP LIGHTING, BY REGION, 2022–2027 (USD MILLION)

8 SPECIALTY LIGHTING MARKET, BY REGION (Page No. - 100)

8.1 INTRODUCTION

FIGURE 36 MARKET, BY GEOGRAPHY

FIGURE 37 MARKET IN ASIA PACIFIC TO REGISTER HIGHEST CAGR FROM 2022 TO 2027

TABLE 97 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 98 MARKET, BY REGION, 2022–2027 (USD MILLION)

8.2 NORTH AMERICA

FIGURE 38 NORTH AMERICA: MARKET SNAPSHOT

TABLE 99 MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 100 MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 101 MARKET IN NORTH AMERICA, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 102 MARKET IN NORTH AMERICA, BY APPLICATION, 2022–2027 (USD MILLION)

8.2.1 US

8.2.1.1 Largest market for specialty lighting in region

8.2.2 CANADA

8.2.2.1 Market to grow at highest rate in region

8.2.3 MEXICO

8.2.3.1 Market to grow at stable rate during forecast period

8.3 EUROPE

FIGURE 39 EUROPE: SPECIALTY LIGHTING MARKET SNAPSHOT

TABLE 103 MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 104 MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 105 MARKET IN EUROPE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 106 MARKET IN EUROPE, BY APPLICATION, 2022–2027 (USD MILLION)

8.3.1 GERMANY

8.3.1.1 A major consumer of specialty lighting in region

8.3.2 UK

8.3.2.1 UV disinfection equipment market to continue to grow at strong rate

8.3.3 FRANCE

8.3.3.1 Accounts for significant market share in region

8.3.4 REST OF EUROPE

8.4 ASIA PACIFIC

FIGURE 40 ASIA PACIFIC: SPECIALTY LIGHTING MARKET SNAPSHOT

TABLE 107 MARKET IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 108 MARKET IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 109 MARKET IN ASIA PACIFIC, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 110 MARKET IN ASIA PACIFIC, BY APPLICATION, 2022–2027 (USD MILLION)

8.4.1 CHINA

8.4.1.1 A leading market for specialty lighting in region

8.4.2 JAPAN

8.4.2.1 Booming hospitality sector to contribute to market growth

8.4.3 INDIA

8.4.3.1 Growth of industrial sector favorable for market growth

8.4.4 SOUTH KOREA

8.4.4.1 Need for clean and safe water to drive UV disinfection equipment market

8.4.5 REST OF ASIA PACIFIC

8.5 ROW

FIGURE 41 ROW: SPECIALTY LIGHTING MARKET SNAPSHOT

TABLE 111 MARKET IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 112 MARKET IN ROW, BY REGION, 2022–2027 (USD MILLION)

TABLE 113 MARKET IN ROW, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 114 MARKET IN ROW, BY APPLICATION, 2022–2027 (USD MILLION)

8.5.1 MIDDLE EAST & AFRICA

8.5.1.1 Increasing installation of UV disinfection equipment to drive market

TABLE 115 MARKET IN MIDDLE EAST & AFRICA, BY REGION, 2018–2021 (USD MILLION)

TABLE 116 MARKET IN MIDDLE EAST & AFRICA, BY REGION, 2022–2027 (USD MILLION)

8.5.2 SOUTH AMERICA

8.5.2.1 Brazil, Argentina, and Chile–Key contributors to market growth

TABLE 117 MARKET IN SOUTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 118 MARKET IN SOUTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

9 COMPETITIVE LANDSCAPE (Page No. - 116)

9.1 OVERVIEW

FIGURE 42 KEY DEVELOPMENTS UNDERTAKEN BY LEADING PLAYERS IN SPECIALTY LIGHTING MARKET FROM 2019 TO 2022

9.2 MARKET SHARE AND RANKING ANALYSIS

TABLE 119 DEGREE OF COMPETITION

FIGURE 43 RANKING ANALYSIS OF TOP FIVE PLAYERS IN MARKET

9.3 FIVE-YEAR COMPANY REVENUE ANALYSIS

FIGURE 44 FIVE-YEAR REVENUE ANALYSIS OF KEY COMPANIES

9.4 COMPANY EVALUATION QUADRANT, 2021

9.4.1 STARS

9.4.2 EMERGING LEADERS

9.4.3 PERVASIVE PLAYERS

9.4.4 PARTICIPANTS

FIGURE 45 GLOBAL MARKET: COMPANY EVALUATION QUADRANT, 2021

9.5 COMPETITIVE BENCHMARKING

TABLE 120 COMPANY FOOTPRINT (25 COMPANIES)

TABLE 121 APPLICATION FOOTPRINT (25 COMPANIES)

TABLE 122 REGIONAL FOOTPRINT (25 COMPANIES)

9.6 STARTUP/SME EVALUATION QUADRANT, 2021

9.6.1 PROGRESSIVE COMPANIES

9.6.2 RESPONSIVE COMPANIES

9.6.3 DYNAMIC COMPANIES

9.6.4 STARTING BLOCKS

FIGURE 46 GLOBAL MARKET: STARTUP/SME EVALUATION QUADRANT, 2021

9.7 COMPETITIVE SCENARIO AND TRENDS

9.7.1 PRODUCT LAUNCHES

TABLE 123 PRODUCTS LAUNCHES, JANUARY 2019 TO OCTOBER 2021

9.7.2 DEALS

TABLE 124 DEALS, MARCH 2021 TO MAY 2022

10 COMPANY PROFILES (Page No. - 129)

10.1 INTRODUCTION

10.2 KEY PLAYERS

(Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)*

10.2.1 SIGNIFY

TABLE 125 SIGNIFY: COMPANY OVERVIEW

FIGURE 47 SIGNIFY: COMPANY SNAPSHOT

TABLE 126 SIGNIFY: PRODUCT LAUNCHES

TABLE 127 SIGNIFY: DEALS

10.2.2 OSRAM

TABLE 128 OSRAM: COMPANY OVERVIEW

FIGURE 48 OSRAM: COMPANY SNAPSHOT

10.2.3 SMART GLOBAL HOLDINGS (CREE LED)

TABLE 129 SMART GLOBAL HOLDINGS (CREE LED): COMPANY OVERVIEW

FIGURE 49 SMART GLOBAL HOLDINGS (CREE LED): COMPANY SNAPSHOT

TABLE 130 SMART GLOBAL HOLDINGS (CREE LED): PRODUCT LAUNCHES

TABLE 131 SMART GLOBAL HOLDINGS (CREE LED): DEALS

10.2.4 USHIO

TABLE 132 USHIO: COMPANY OVERVIEW

FIGURE 50 USHIO: COMPANY SNAPSHOT

TABLE 133 USHIO: PRODUCT LAUNCHES

10.2.5 ADVANCED SPECIALTY LIGHTING

TABLE 134 ADVANCED SPECIALTY LIGHTING: COMPANY OVERVIEW

10.2.6 GETINGE AB

TABLE 135 GETINGE AB: COMPANY OVERVIEW

FIGURE 51 GETINGE AB: COMPANY SNAPSHOT

10.2.7 HERBERT WALDMANN

TABLE 136 HERBERT WALDMANN: COMPANY OVERVIEW

TABLE 137 HERBERT WALDMANN: PRODUCT LAUNCHES

10.2.8 BRANDON MEDICAL

TABLE 138 BRANDON MEDICAL: COMPANY OVERVIEW

10.2.9 INTEGRA LIFESCIENCES

TABLE 139 INTEGRA LIFESCIENCES: COMPANY OVERVIEW

FIGURE 52 INTEGRA LIFESCIENCES: COMPANY SNAPSHOT

10.2.10 STERIS PLC

TABLE 140 STERIS PLC: COMPANY OVERVIEW

FIGURE 53 STERIS PLC: COMPANY SNAPSHOT

*Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

10.3 OTHER KEY PLAYERS

10.3.1 HALMA

10.3.2 ATLANTIC ULTRAVIOLET

10.3.3 XYLEM

10.3.4 ADVANCED UV

10.3.5 AMERICAN ULTRAVIOLET

10.3.6 MARTIN PROFESSIONAL

10.3.7 ALTMAN LIGHTING

10.3.8 CHAUVET & SONS

10.3.9 GUANGZHOU YAJIANG PHOTOELECTRIC EQUIPMENT CO.

10.3.10 DARAY MEDICAL

10.3.11 COLOR IMAGINATION LED LIGHTING

10.3.12 ADVANCED STAGE LIGHTS

10.3.13 TECHNOMED INDIA

10.3.14 SIMEON MEDICAL

10.3.15 CRYSTAL IS

11 APPENDIX (Page No. - 166)

11.1 INSIGHTS OF INDUSTRY EXPERTS

11.2 QUESTIONNAIRE FOR SPECIALTY LIGHTING MARKET

11.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

11.4 CUSTOMIZATION OPTIONS

11.5 RELATED REPORTS

11.6 AUTHOR DETAILS

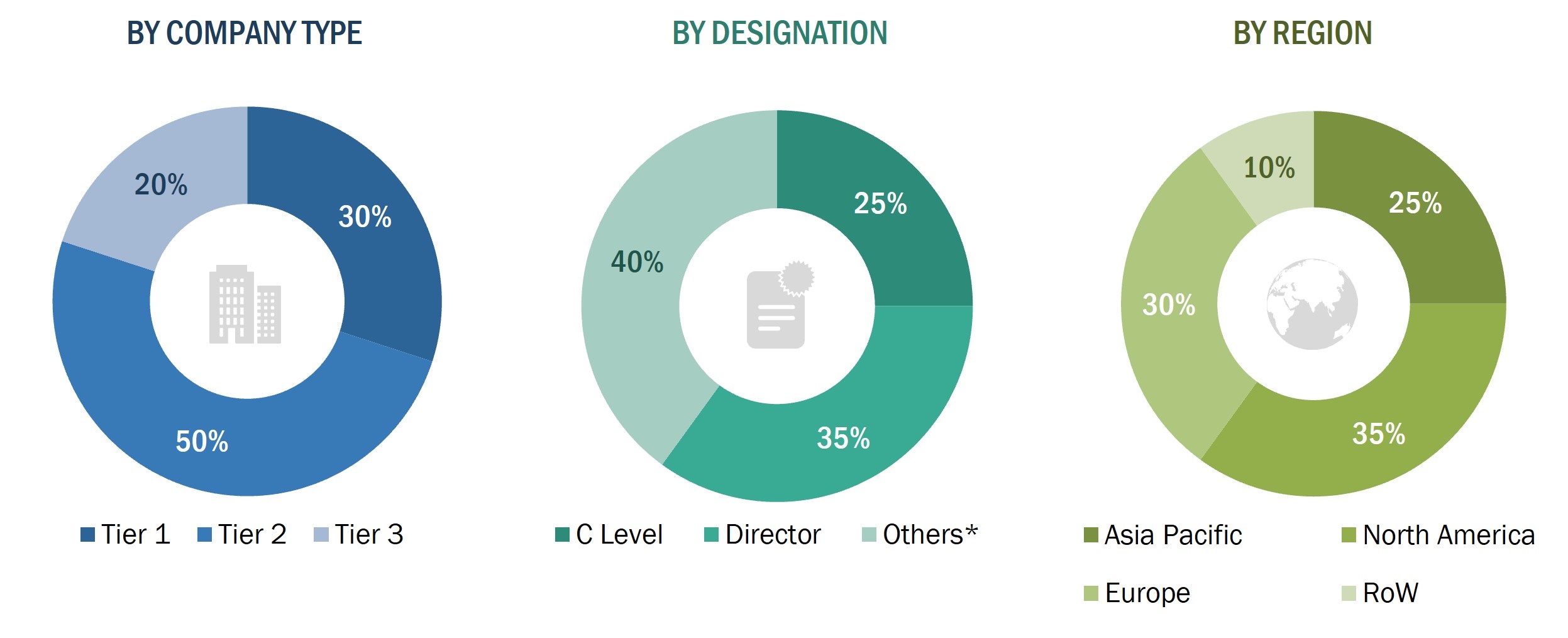

There are 2 basic sources of information: secondary sources and primary sources, which have been used to identify and collect information for an extensive, technical, and commercial study of the specialty lighting market. Secondary sources include company websites, magazines, associations, and databases (OneSource, Factiva, and Bloomberg). Primary sources such as key opinion leaders from various sectors that include experts from various government or lighting associations, preferred suppliers, manufacturers, distributors, service providers, technology developers, subject matter experts (SMEs), C-level executives of key market players, and industry consultants have been interviewed to understand, obtain, and verify critical information as well as to assess future trends in the market and the growth prospects of the market. Key players in the specialty lighting market have been identified through secondary research, and their market share has been determined through primary and secondary research. This research includes the study of the annual reports of the market players to identify the top players in the specialty lighting market. The following illustrative figure shows the market research methodology applied for developing this report on the specialty lighting market.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information relevant to this study on the specialty lighting market. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles by recognized authors; directories; and databases.

The global size of the specialty lighting market has been obtained from the secondary data made available through paid and unpaid sources. It has also been determined by analyzing the product portfolios of the leading companies and rating them based on the quality of their offerings.

Secondary research has been used to gather key information about the industry’s supply chain, the market’s monetary chain, the total number of key players, and market segmentation according to the industry trends to the bottom-most level, geographic markets, and key developments from both the market- and technology-oriented perspectives. It has also been conducted to identify and analyze the industry trends in the market and key developments that have been undertaken from both the market- and technology perspectives.

Primary Research

In the primary research process, various primary sources have been interviewed to obtain the qualitative and quantitative information related to the market across 4 main regions-Asia Pacific, North America, Europe, and RoW (the Middle East, Africa, and South America). Primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing directors, technology directors, and some other related key executives from major companies and organizations operating in the specialty lighting market or related markets.

After the completion of market engineering, primary research has been conducted to gather information and verify and validate critical numbers obtained from other sources. Primary research has also been conducted to identify various market segments; industry trends; key players; competitive landscape; and key market dynamics, such as drivers, restraints, opportunities, and challenges, along with key strategies adopted by market players. Most of the primary interviews have been conducted with the supply side of the market. This primary data has been collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches have been used extensively in the market engineering process. Several data triangulation methods have also been used to perform the market forecasting and market estimation for the overall market segments and sub-segments in the report. Multiple qualitative and quantitative analyses have been performed on the market engineering process to gain key insights throughout the report.

Secondary research has been used to identify the key players of the specialty lighting market. The revenues of those key players have been determined through both primary and secondary research. The revenues have been identified geographically as well as market segment-wise, using financial statements and analyzing annual reports of the key market players. Interviews with CEOs, VPs, directors, and marketing executives were also conducted to gain insights on the key players and the specialty lighting market. All the market shares have been estimated using secondary and primary research. This data has been consolidated, supplemented with detailed inputs and analysis from MarketsandMarkets, and presented in this report.

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market has been then split into several segments and sub-segments. The data triangulation procedure has been employed to complete the market engineering process and arrive at the exact statistics for all segments and sub-segments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Study Objectives

- To define, describe, and forecast the size of the specialty lighting market, in terms of value, based on light source, application1, and region

- To define, describe, and forecast the size of the specialty lighting market, in terms of volume, based on application

- To forecast the size of the market and its segments with respect to 4 main regions, namely, North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding the major factors such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze micromarkets2 with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape of the market

- To strategically profile the key players in the market and comprehensively analyze their market ranking and core competencies3

- To analyze competitive developments such as mergers & acquisitions, new product launches/developments, collaborations, and Research & Development (R&D) activities carried out by players in the specialty lighting market

Report Scope

The report covers the demand- and supply-side segmentation of the specialty lighting market. The supply-side market light source, whereas the demand-side market segmentation includes application, and region.

The following are the years considered:

Available Customizations

With the given market data, MarketsandMarkets offers customizations based on the specific requirements of companies. The following customization options are available for the report:

Company Information

- Market size based on different subsegments of the specialty lighting market

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Specialty Lighting Market