Specialty Breathable Membranes Market by Type (Polyurethane, PTFE, Thermoplastic Polyester, Thermoplastic Elastomers, Polyesther Block Amide, Copolyamide), Application (Healthcare/Medical, Textile), and Region - Global Forecast to 2026

Updated on : March 20, 2024

Specialty Breathable Membranes Market

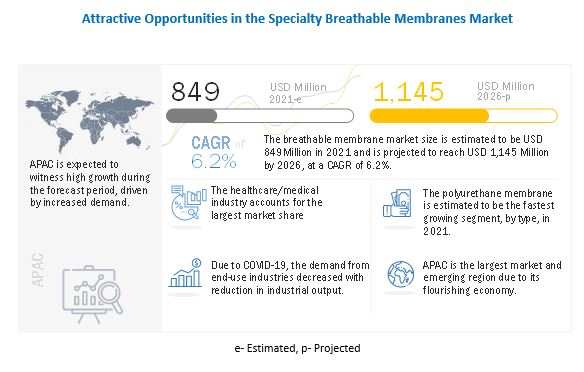

The global specialty breathable membranes market was valued at USD 849 million in 2021 and is projected to reach USD 1,145 million by 2026, growing at 6.2% cagr from 2021 to 2026. Breathability of a membranes is defined as the ability of a membranes to transmit moisture through it. Breathability of membranes is measured in terms of the Moisture Vapor Transmission Rate (MVTR), which measures the transmission of vapors through a material in a given period of time. It is an important requirement in many industries where moisture can cause damage. Industries such as hygiene, healthcare and medical, textile, food packaging, pharmaceuticals, building materials, and consumer goods use breathable membranes to control the amount of moisture. Breathable membranes are also termed as breathable films.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Pandemic Impact on the Global Specialty Breathable Membranes Market

Due to COVID-19 pandemic, the suspension of manufacturing operation, disruption of supply chain, and declining demand for industrial goods had significant impact on the market. However, due to COVID-19 pandemic, the demand for PPE kits, face mask, gown, and other products has grown massively, which, in turn, support for the growth of specialty breathable membranes market. At the same time, due to panic situation, people stock the hygiene products across the globe that drives the market. However, the end-use industries healthcare/medical, textile and others were affected by the pandemic.

Specialty Breathable Membranes Market Dynamics

Driver: Growing Awareness regarding health and hygiene in developing countries will support the market growth

The adoption of hygiene products in developing countries is low as compared to developed countries such as the US, Canada, Japan, and Western European countries such as Germany, France, the UK, and Italy. In APAC, Africa, and Eastern Europe, the adoption of health and hygiene was low due to cultural differences (affecting the consumers’ attitude towards these products), unaffordability due to high price and low per capita income but with the outbreak of COVID-19 and other infectious diseases, the adoption of hygiene products in developing countries has increased.

Polyethylene, Polypropylene and Polyurethane based breathable membranes are used as a main compound in the manufacturing of baby diapers. According to the European Chemical Agency, the global market for single-use baby diapers is expected to expand by 6.7% to USD 92.3 billion by 2024. The main players of the markets are Kao Corporation, Kimberly-Clark Corporation (Huggies, 26% of global market), The Procter & Gamble Company (Pampers, 36%), Unicharm Corporation, Hengan International Group Company Limited, and Essity AB, Bumkins AB, among other are investing continuously for expansion of the production capacity in the developing countries such as India, China, Mexico, Brazil, and ASEAN countries.

Restraint: Economic slowdown and impact of COVID-19 on manufacturing sector

Most of the North American and European countries, especially the US, Italy, Spain, the UK, France, and Germany, are severely impacted by the COVID-19 pandemic. The suspension of operations in several manufacturing sectors has resulted in a decline in the GDP of these countries. According to the IMF, the GDP of the European Union (EU) and North America reduced by 3.5% and 6.6% in 2020, respectively.

Due to the COVID-19 pandemic, the demand from the industrial application had declined sharply in 2020. This impact was further intensified with the massive gap between supply and demand. Due to economic losses, several production activities were suspended until the recovery of the economy. This decline in the manufacturing industry across the globe, in turn, resulted in a decline in the demand for specialty breathable membranes.

Opportunities: Untapped markets in developing countries having low penetration rates of diapers

The penetration level of hygiene products in developing countries is still very low. Countries with large populations and high birth rates such as China, India, and Indonesia currently have a very low penetration rate. However, the demand is expected to grow significantly with the increase in per capita income, growing awareness regarding health and hygiene, and changing consumer preference. There is a big prospect for the growth of hygiene products as well as breathable membranes in emerging countries such as China, India, and Indonesia.

Opportunities: Cultural barriers

The hygiene market in the US and Europe is mature, with a high penetration rate. On the other hand, emerging markets provide an opportunity for growth in this area. Attractive as they may seem, the issue is to overcome the misconceptions surrounding use of baby and adult diapers, which is considered as a disease/taboo in developing countries.

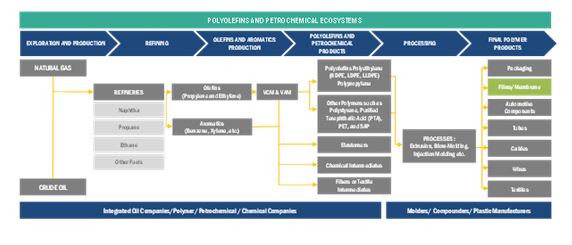

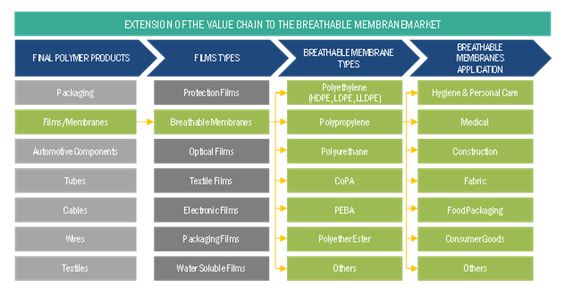

Ecosystem Diagram

Polyurethane-based breathable membranes segment accounted for the largest share in 2020

The polyurethane-based breathable membrane is the dominant segment in the overall specialty breathable membranes market. The major application of polyurethane breathable membrane is in hygiene products such as baby diapers, and medical and healthcare products, among others, footwear, sportswear and construction industry

Healthcare/medical application accounted for the largest share in 2020

Increasing use of hygiene products in emerging countries such as China, India, and Southeast Asian countries (including Thailand, Indonesia, Malaysia, the Philippines, and Vietnam) is driving the specialty breathable membranes market. Rise in awareness and growing per capita GDP are expected to drive the specialty breathable membranes market in these countries. An increase in the old age population is expected to drive the breathable membranes market in the adult incontinence sector in developed countries such as Japan, the US, Canada, Germany, and Italy. Moreover, due to COVID-19 pandemic, massive increase in the production of the facemask, surgical drapes, surgical gown, PPE kits and other goods supports for the growth of specialty breathable membranes market.

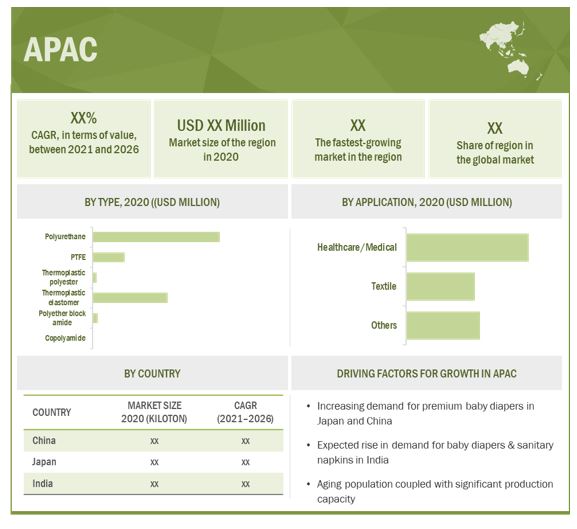

APAC is projected to account for the largest share of the specialty breathable membranes s market during the forecast period

APAC led the specialty breathable membranes market in terms of value in 2020. Increasing penetration of premium hygiene and medical & healthcare products in China, India, and Indonesia, along with the increase in per capita GDP, is expected to drive the breathable membranes market in the region. Moreover, growing production of the footwear, sportswear and athleisure in the region supports for the growth of market.

The demand for specialty breathable membrane mainly catered to by global players manufacturing these membranes for various end-use industries. Furthermore, the demand for specialty breathable membranes is mainly triggered by growing demand from building and construction, among other end-use industries are the key factors expected to drive the demand for specialty breathable membranes during the forecast period.

Key Market Players

The specialty breathable membranes market comprises major manufacturers such as Covestro AG (Germany), Arkema S.A. (France) Toray Industries (Japan),Berry Global Group (US) Schweitzer-Mauduit International, Inc. (US), and RKW Group, are the key players operating in the specialty breathable membranes s market. Expansions, acquisitions, joint ventures, and new product developments are some of the major strategies adopted by these key players to enhance their positions in the specialty breathable membranes s market.

Specialty Breathable Membranes Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 849 million |

|

Revenue Forecast in 2026 |

USD 1,145 million |

|

CAGR |

6.2% |

|

Market size available for years |

2019–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021–2026 |

|

Forecast units |

Value (USD Million) and Volume (Million Square Meter) |

|

Segments covered |

By Type, Application, and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, South America, and Middle East & Africa |

|

Companies covered |

Covestro AG (Germany), Arkema S.A. (France) Toray Industries (Japan),Berry Global Group (US) Schweitzer-Mauduit International, Inc. (US), and RKW Group, are the top 5 manufacturers are covered in the breathable membranes market. |

This research report categorizes the breathable membranes market based on resin type, backing material, a, and region.

Specialty Breathable Membranes Market, By Type

- Polyurethane

- PTFE

- Thermoplastic Polyester

- Thermoplastic Elastomers

- Polyether Block Amide

- Copolyamide

Specialty Breathable Membranes Market, By Application

-

Healthcare/Medical

- Baby Diapers

- Adult Diapers

- Sanitary Napkins

- PPE Kits

- Surgical Drapes

- Face Masks

- Surgicals Scrups & Gown

- Others

-

Textile

- Protective Clothing

- Athleisure

- Footwear

- Sportwear

- Others

Specialty Breathable Membranes Market, By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Recent Developments

- In April 2021, Schweitzer-Mauduit International has acquired Scapa group plc. The company is A UK based innovation, design, and manufacturing solution provider for healthcare and industrial market. The acquisition will offer a broader and best in class integrated product solutions to the customers globally.

- In 2020, Arkema acquired LIP (Bygningsartikler), a Danish firm specializing in tile adhesives, waterproofing systems, and floor preparation solutions. LIP is the first company in Scandinavian market. Bostik will be able to provide a wider choice of high-value-added solutions to its clients because of this initiative, while also expanding its position in the regional market. Arkema acquired Arrmaz (US), a surfactant for crop nutrition, mining, and infrastructure markets. The acquisition will help to further boost the group’s profile.

- Covestro acquired Resins & Functional Materials (RFM) business from Koninklijke DSM N.V., Heerlen (Netherlands) to strengthen their business in resins and chemicals worth USD 35 million.

Frequently Asked Questions (FAQ):

What are the major drivers influencing the growth of the specialty breathable membranes market?

The major drivers influencing the growth of specialty breathable membranes are increasing demand from the hygiene and healthcare/medical industry.

What are the major challenges in the specialty breathable membranes market?

The major challenges in breathable membranes market are implementation of stringent regulatory policies and intense competition in the market posing challenge to new entrant.

What are the different applications of specialty breathable membranes?

Specialty breathable membranes find their applications in various end-use industries such as, healthcare/medical, textile and building & construction, electronics are among others. The applications of these have been constantly increasing owing to constant innovation.

What is the impact of COVID-19 pandemic on the specialty breathable membranes market?

Owing to the COVID-19 pandemic, there has been a mixed impact on the specialty breathable membranes market across the globe. The demand from the healthcare and medical industry for the production of face mask, PPE kits, gown, and other products has grown massively whereas in textile and other industry the demand for specialty breathable membranes was declined.

What are the industry trends in specialty breathable membranes market?

In the recent past, several manufacturers have expanded their production facilities to cater to the rising demand for breathable membranes and enhance their presence in the target market. Along with this, to alleviate the competitive scenario, these key players are focusing on expanding their regional presence particularly in the Asia Pacific. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 38)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

TABLE 1 RESEARCH SCOPE: INCLUSIONS AND EXCLUSIONS

FIGURE 1 SPECIALTY BREATHABLE MEMBRANES MARKET SEGMENTATION

1.2.1 REGIONS COVERED

1.2.2 YEARS CONSIDERED IN THE STUDY

1.3 CURRENCY

1.4 UNIT CONSIDERED

1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 42)

2.1 RESEARCH DATA

FIGURE 2 SPECIALTY BREATHABLE MEMBRANES MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Critical secondary inputs

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Critical primary inputs

2.1.2.2 Key data from primary sources

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primary interviews

2.1.2.5 List of participated industry experts

2.2 MARKET SIZE ESTIMATION APPROACH

2.2.1 DEMAND SIDE: ASCERTAINING THE CONSUMPTION OF SPECIALTY BREATHABLE MEMBRANES IN THE HYGIENE APPLICATION

FIGURE 3 MARKET SIZE ESTIMATION – DEMAND SIDE

2.2.2 SUPPLY SIDE: FROM OVERALL CONSUMPTION OF POLYURETHANE BREATHABLE MEMBRANES

2.2.3 TOP-DOWN APPROACH: SPECIALTY BREATHABLE MEMBRANES MARKET

FIGURE 4 MARKET SIZE ESTIMATION – SUPPLY SIDE AND TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 5 SPECIALTY BREATHABLE MEMBRANES MARKET: DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 52)

FIGURE 6 POLYURETHANE TYPE SEGMENT ACCOUNTED FOR THE LARGEST SHARE IN 2020

FIGURE 7 HEALTHCARE/MEDICAL APPLICATION ACCOUNTED FOR THE LARGEST SHARE IN 2020

FIGURE 8 APAC TO WITNESS THE FASTEST GROWTH DURING THE FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 55)

4.1 ATTRACTIVE OPPORTUNITIES IN THE SPECIALTY BREATHABLE MEMBRANES MARKET

FIGURE 9 INCREASING USE OF HYGIENE AND HEALTHCARE PRODUCTS IN EMERGING ECONOMIES TO DRIVE THE DEMAND FOR SPECIALTY BREATHABLE MEMBRANES

4.2 SPECIALTY BREATHABLE MEMBRANES MARKET IN APAC, BY TYPE

FIGURE 10 POLYURETHANE TO LEAD THE SPECIALTY BREATHABLE MEMBRANES MARKET IN APAC

4.3 SPECIALTY BREATHABLE MEMBRANES MARKET, BY COUNTRY

FIGURE 11 INDIA TO GROW AT THE HIGHEST RATE DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 57)

5.1 INTRODUCTION

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR THE SPECIALTY BREATHABLE MEMBRANES MARKET

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Growing awareness regarding health and hygiene in developing countries

5.2.1.2 Increasing usage in the production of healthcare and medical personal protective kit and surgical items

5.2.1.3 Steady growth in demand from the sportswear and footwear applications will support the market growth

FIGURE 13 GLOBAL SPORTSWEAR MARKET, 2019 - 2025

FIGURE 14 GLOBAL FOOTWEAR PRODUCTION SHARE, BY REGION, 2020

5.2.1.4 Growing usage of specialty breathable membranes in the construction industry

5.2.2 RESTRAINTS

5.2.2.1 Economic slowdown and impact of COVID-19 on the manufacturing sector

5.2.2.2 Stagnant growth in baby diapers market in developed countries

5.2.3 OPPORTUNITIES

5.2.3.1 Untapped markets in developing countries having low penetration rates of diapers

5.2.4 CHALLENGES

5.2.4.1 Cultural barriers

5.2.4.2 Costlier than conventional membranes

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 15 SPECIALTY BREATHABLE MEMBRANES MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 THREAT OF NEW ENTRANTS

5.3.3 THREAT OF SUBSTITUTES

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITION

TABLE 2 SPECIALTY BREATHABLE MEMBRANES MARKET: PORTER’S FIVE FORCES ANALYSIS

5.4 REGULATORY LANDSCAPE

TABLE 3 REGULATORY STANDARDS APPLICABLE TO BREATHABLE MEMBRANES

5.5 YC, YCC DRIVERS

FIGURE 16 GROWING HEALTH & HYGIENE SEGMENT WILL BRING IN CHANGE IN FUTURE REVENUE MIX

5.6 TECHNOLOGY ANALYSIS

5.7 ECOSYSTEM

FIGURE 17 POLYOLEFINS AND PETROCHEMICAL ECOSYSTEM

FIGURE 18 EXTENSION OF THE ECOSYSTEM TO BREATHABLE MEMBRANES MARKET

TABLE 4 SPECIALTY BREATHABLE MEMBRANES MARKET: ECOSYSTEM

5.8 VALUE CHAIN ANALYSIS

FIGURE 19 VALUE CHAIN ANALYSIS OF SPECIALTY BREATHABLE MEMBRANES MARKET

5.8.1 DISRUPTION DUE TO COVID-19

5.9 AVERAGE PRICE & COST STRUCTURE ANALYSIS

FIGURE 20 WEIGHTED AVERAGE PRICE ANALYSIS (USD/SQUARE METER) OF SPECIALTY BREATHABLE MEMBRANES, BY REGION (2020)

5.10 RANGE SCENARIOS OF SPECIALTY BREATHABLE MEMBRANES MARKET

FIGURE 21 PRE- AND POST-COVID-19 ANALYSIS OF SPECIALTY BREATHABLE MEMBRANE DEMAND

5.11 FORECAST FACTORS AND COVID-19 IMPACT

5.12 PATENT ANALYSIS

FIGURE 22 GRANTED PATENTS ON SPECIALTY BREATHABLE MEMBRANES, 2010 – AUGUST 2020

FIGURE 23 SHARE OF THE JURISDICTION OF GRANTED PATENTS

TABLE 5 GRANTED PATENTS BY KEY PLAYERS (TILL DATE)

TABLE 6 LIST OF KIMBERLY CLARK’S PATENTS

5.13 TRADE SCENARIO: KEY EXPORTING AND IMPORTING COUNTRIES

TABLE 7 INTENSITY OF TRADE, BY KEY COUNTRY

5.14 CASE STUDY

5.15 MACROECONOMIC OVERVIEW

5.15.1 GLOBAL GDP OUTLOOK

TABLE 8 WORLD GDP GROWTH PROJECTION

TABLE 9 INDUSTRIAL PRODUCTION INDEX, BY COUNTRY/REGION

5.16 ADJACENT MARKETS

5.16.1 INDUSTRIAL FILMS MARKET

5.16.1.1 Market definition

5.16.1.2 Market overview

5.16.1.3 Industrial films market, by film type

TABLE 10 INDUSTRIAL FILMS MARKET SIZE, BY FILM TYPE, 2018–2025 (USD MILLION)

TABLE 11 INDUSTRIAL FILMS MARKET SIZE, BY FILM TYPE, 2018–2025 (MILLION SQUARE METER)

5.16.2 TEXTILE FILMS MARKET

5.16.2.1 Market definition

5.16.2.2 Market overview

5.16.2.3 Textile films market, by type

TABLE 12 TEXTILE FILMS MARKET SIZE, BY TYPE, 2016–2023 (KILOTON)

TABLE 13 TEXTILE FILMS MARKET SIZE, BY TYPE, 2016–2023 (USD MILLION)

5.16.2.4 Textile films market, by region

TABLE 14 TEXTILE FILMS MARKET SIZE, BY REGION, 2016–2023 (KILOTON)

TABLE 15 TEXTILE FILMS MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

5.16.3 BOPP FILMS MARKET

5.16.3.1 Market definition

5.16.3.2 Market overview

5.16.3.3 BOPP films market, by packaging type

TABLE 16 BOPP FILMS MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

TABLE 17 BOPP FILMS MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (KILOTON)

5.16.4 BIODEGRADABLE FILMS MARKET

5.16.4.1 Market definition

5.16.4.2 Market overview

5.16.4.3 Biodegradable films market, by type

TABLE 18 BIODEGRADABLE FILMS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 19 BIODEGRADABLE FILMS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

6 SPECIALTY BREATHABLE MEMBRANES MARKET, BY TYPE (Page No. - 91)

6.1 INTRODUCTION

FIGURE 24 POLYURETHANE-BASED SPECIALTY BREATHABLE MEMBRANES LEAD THE MARKET

TABLE 20 SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 21 SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

6.2 POLYURETHANE

6.2.1 POLYURETHANE IS WIDELY USED IN PRODUCTION OF MONOLITHIC BREATHABLE MEMBRANES

TABLE 22 POLYURETHANE-BASED SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY REGION, 2019–2026 (MILLION SQUARE METER)

TABLE 23 POLYURETHANE-BASED SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.3 PTFE

6.3.1 GROWING ADOPTION OF MEMBRANES IN SEVERAL APPLICATIONS WILL SUPPORT THE MARKET GROWTH

TABLE 24 PTFE-BASED SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY REGION, 2019–2026 (MILLION SQUARE METER)

TABLE 25 PTFE-BASED SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.4 THERMOPLASTIC POLYESTER

6.4.1 APAC IS THE LARGEST AND FASTEST-GROWING MARKET FOR THIS SEGMENT

TABLE 26 THERMOPLASTIC POLYESTER-BASED SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY REGION, 2019–2026 (MILLION SQUARE METER)

TABLE 27 THERMOPLASTIC POLYESTER-BASED SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.5 THERMOPLASTIC ELASTOMER

6.5.1 GROWTH OF MEDICAL & PROTECTIVE CLOTHING SECTOR IS A MARKET DRIVER

TABLE 28 THERMOPLASTIC ELASTOMER-BASED SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY REGION, 2019–2026 (MILLION SQUARE METER)

TABLE 29 THERMOPLASTIC ELASTOMER-BASED SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.6 POLYETHER BLOCK AMIDE

6.6.1 MARKET IN THE POLYETHER BLOCK AMIDE SEGMENT IS DRIVEN BY GROWING DEMAND FOR PROTECTIVE WEAR AND SPORTING GOODS

TABLE 30 POLYETHER BLOCK AMIDE -BASED SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY REGION, 2019–2026 (MILLION SQUARE METER)

TABLE 31 POLYETHER BLOCK AMIDE -BASED SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.7 COPOLYAMIDE

6.7.1 COPOLYAMIDE BREATHABLE MEMBRANES MAJORLY USED IN THE PRODUCTION OF FOOTWEAR AND APPAREL

TABLE 32 COPOLYAMIDE-BASED SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY REGION, 2019–2026 (MILLION SQUARE METER)

TABLE 33 COPOLYAMIDE -BASED SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

7 SPECIALTY BREATHABLE MEMBRANES MARKET, BY APPLICATION (Page No. - 100)

7.1 INTRODUCTION

FIGURE 25 HEALTHCARE/MEDICAL LEADS THE BREATHABLE MEMBRANES MARKET

TABLE 34 SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 35 SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

7.2 HEALTHCARE/MEDICAL

7.2.1 TECHNOLOGICAL INNOVATION IN HEALTHCARE/MEDICAL IS INCREASING THE DEMAND FOR BREATHABLE MEMBRANES

TABLE 36 SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN HEALTHCARE/ MEDICAL APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 37 SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN HEALTHCARE/ MEDICAL APPLICATION, 2019–2026 (USD MILLION)

TABLE 38 SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN HEALTHCARE/MEDICAL, BY REGION, 2019–2026 (MILLION SQUARE METER)

TABLE 39 SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN HEALTHCARE/MEDICAL, BY REGION, 2019–2026 (USD MILLION)

7.3 TEXTILE

7.3.1 RISING SPORTS ACTIVITY AND FITNESS DRIVING THE MARKET IN TEXTILE APPLICATION

TABLE 40 SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN TEXTILE APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 41 SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN TEXTILE APPLICATION, 2019–2026 (USD MILLION)

TABLE 42 SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN TEXTILE APPLICATION, BY REGION, 2019–2026 (MILLION SQUARE METER)

TABLE 43 SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN TEXTILE APPLICATION, BY REGION, 2019–2026 (USD MILLION)

7.4 OTHERS

TABLE 44 SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2019–2026 (MILLION SQUARE METER)

TABLE 45 SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2019–2026 (USD MILLION)

8 SPECIALTY BREATHABLE MEMBRANES MARKET, BY REGION (Page No. - 111)

8.1 INTRODUCTION

FIGURE 26 INDIA TO WITNESS THE HIGHEST GROWTH DURING THE FORECAST PERIOD

TABLE 46 SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY REGION, 2019–2026 (MILLION SQUARE METER)

TABLE 47 SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

8.2 NORTH AMERICA

FIGURE 27 NORTH AMERICA: SPECIALTY BREATHABLE MEMBRANES MARKET SNAPSHOT

TABLE 48 NORTH AMERICA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION SQUARE METER)

TABLE 49 NORTH AMERICA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 50 NORTH AMERICA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 51 NORTH AMERICA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 52 NORTH AMERICA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 53 NORTH AMERICA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 54 NORTH AMERICA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN HEALTHCARE/ MEDICAL APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 55 NORTH AMERICA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN HEALTHCARE/ MEDICAL APPLICATION, 2019–2026 (USD MILLION)

TABLE 56 NORTH AMERICA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN TEXTILE APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 57 NORTH AMERICA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN TEXTILE APPLICATION, 2019–2026 (USD MILLION)

8.2.1 US

8.2.1.1 Demand from the hygiene & healthcare application to support market growth

TABLE 58 US CONSTRUCTION SPENDING (USD BILLION), BY TYPE, 2015–2020

TABLE 59 US: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 60 US: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 61 US: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 62 US: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 63 US: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN HEALTHCARE/ MEDICAL APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 64 US: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN HEALTHCARE/ MEDICAL APPLICATION, 2019–2026 (USD MILLION)

TABLE 65 US: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN TEXTILE APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 66 US: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN TEXTILE APPLICATION, 2019–2026 (USD MILLION)

8.2.2 CANADA

8.2.2.1 The market will be driven by premium diapers and healthcare items

TABLE 67 CANADA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 68 CANADA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 69 CANADA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 70 CANADA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 71 CANADA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN HEALTHCARE/ MEDICAL APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 72 CANADA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN HEALTHCARE/ MEDICAL APPLICATION, 2019–2026 (USD MILLION)

TABLE 73 CANADA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN TEXTILE APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 74 CANADA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN TEXTILE APPLICATION, 2019–2026 (USD MILLION)

8.2.3 MEXICO

8.2.3.1 Growth in demand for hygiene products and textile applications to boost the market

TABLE 75 MEXICO: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 76 MEXICO: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 77 MEXICO: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 78 MEXICO: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 79 MEXICO: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN HEALTHCARE/ MEDICAL APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 80 MEXICO: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN HEALTHCARE/ MEDICAL APPLICATION, 2019–2026 (USD MILLION)

TABLE 81 MEXICO: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN TEXTILE APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 82 MEXICO: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN TEXTILE APPLICATION, 2019–2026 (USD MILLION)

8.3 APAC

FIGURE 28 APAC: SPECIALTY BREATHABLE MEMBRANES MARKET SNAPSHOT

TABLE 83 APAC: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION SQUARE METER)

TABLE 84 APAC: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 85 APAC: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 86 APAC: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 87 APAC: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 88 APAC: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 89 APAC: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN HEALTHCARE/ MEDICAL APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 90 APAC: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN HEALTHCARE/ MEDICAL APPLICATION, 2019–2026 (USD MILLION)

TABLE 91 APAC: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN TEXTILE APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 92 APAC: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN TEXTILE APPLICATION, 2019–2026 (USD MILLION)

8.3.1 CHINA

8.3.1.1 Early recovery of the economy and healthy growth of the manufacturing sector to propel the market

TABLE 93 CHINA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 94 CHINA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 95 CHINA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 96 CHINA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 97 CHINA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN HEALTHCARE/ MEDICAL APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 98 CHINA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN HEALTHCARE/ MEDICAL APPLICATION, 2019–2026 (USD MILLION)

TABLE 99 CHINA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN TEXTILE APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 100 CHINA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN TEXTILE APPLICATION, 2019–2026 (USD MILLION)

8.3.2 INDIA

8.3.2.1 The expected rise in demand for healthcare& medical products will support the growth of the market

TABLE 101 INDIA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 102 INDIA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 103 INDIA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 104 INDIA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 105 INDIA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN HEALTHCARE/ MEDICAL APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 106 INDIA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN HEALTHCARE/ MEDICAL APPLICATION, 2019–2026 (USD MILLION)

TABLE 107 INDIA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN TEXTILE APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 108 INDIA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN TEXTILE APPLICATION, 2019–2026 (USD MILLION)

8.3.3 JAPAN

8.3.3.1 Aging population, coupled with significant production capacity, driving the market in Japan

FIGURE 29 BABY DIAPER PRODUCTION IN JAPAN, 2015–2019 (MILLION PIECES)

TABLE 109 JAPAN: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 110 JAPAN: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 111 JAPAN: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 112 JAPAN: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 113 JAPAN: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN HEALTHCARE/ MEDICAL APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 114 JAPAN: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN HEALTHCARE/ MEDICAL APPLICATION, 2019–2026 (USD MILLION)

TABLE 115 JAPAN: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN TEXTILE APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 116 JAPAN: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN TEXTILE APPLICATION, 2019–2026 (USD MILLION)

8.3.4 SOUTH KOREA

8.3.4.1 Demand for adult diapers to drive the market

TABLE 117 SOUTH KOREA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 118 SOUTH KOREA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 119 SOUTH KOREA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 120 SOUTH KOREA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 121 SOUTH KOREA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN HEALTHCARE/ MEDICAL APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 122 SOUTH KOREA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN HEALTHCARE/ MEDICAL APPLICATION, 2019–2026 (USD MILLION)

TABLE 123 SOUTH KOREA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN TEXTILE APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 124 SOUTH KOREA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN TEXTILE APPLICATION, 2019–2026 (USD MILLION)

8.3.5 REST OF APAC

TABLE 125 REST OF APAC: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 126 REST OF APAC: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 127 REST OF APAC: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 128 REST OF APAC: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 129 REST OF APAC: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN HEALTHCARE/ MEDICAL APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 130 REST OF APAC: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN HEALTHCARE/ MEDICAL APPLICATION, 2019–2026 (USD MILLION)

TABLE 131 REST OF APAC: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN TEXTILE APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 132 REST OF APAC: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN TEXTILE APPLICATION, 2019–2026 (USD MILLION)

8.4 EUROPE

TABLE 133 EUROPE: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION SQUARE METER)

TABLE 134 EUROPE: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 135 EUROPE: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 136 EUROPE: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 137 EUROPE: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 138 EUROPE: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 139 EUROPE: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN HEALTHCARE/ MEDICAL APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 140 EUROPE: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN HEALTHCARE/ MEDICAL APPLICATION, 2019–2026 (USD MILLION)

TABLE 141 EUROPE: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN TEXTILE APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 142 EUROPE: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN TEXTILE APPLICATION, 2019–2026 (USD MILLION)

8.4.1 GERMANY

8.4.1.1 Growth of health & hygiene sector is a key driver for the market

TABLE 143 GERMANY: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 144 GERMANY: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 145 GERMANY: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 146 GERMANY: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 147 GERMANY: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN HEALTHCARE/ MEDICAL APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 148 GERMANY: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN HEALTHCARE/ MEDICAL APPLICATION, 2019–2026 (USD MILLION)

TABLE 149 GERMANY: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN TEXTILE APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 150 GERMANY: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN TEXTILE APPLICATION, 2019–2026 (USD MILLION)

8.4.2 UK

8.4.2.1 An expected rise in demand for healthcare and hygiene products will support the growth of the market

TABLE 151 UK: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 152 UK: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 153 UK: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 154 UK: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 155 UK: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN HEALTHCARE/ MEDICAL APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 156 UK: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN HEALTHCARE/ MEDICAL APPLICATION, 2019–2026 (USD MILLION)

TABLE 157 UK: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN TEXTILE APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 158 UK: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN TEXTILE APPLICATION, 2019–2026 (USD MILLION)

8.4.3 FRANCE

8.4.3.1 Significant production capacity of diapers, healthcare products, and textile products to drive the market

TABLE 159 FRANCE: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 160 FRANCE: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 161 FRANCE: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 162 FRANCE: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 163 FRANCE: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN HEALTHCARE/ MEDICAL APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 164 FRANCE: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN HEALTHCARE/ MEDICAL APPLICATION, 2019–2026 (USD MILLION)

TABLE 165 FRANCE: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN TEXTILE APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 166 FRANCE: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN TEXTILE APPLICATION, 2019–2026 (USD MILLION)

8.4.4 ITALY

8.4.4.1 Increasing local production of healthcare goods and sports articles to drive the market

TABLE 167 ITALY: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 168 ITALY: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 169 ITALY: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 170 ITALY: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 171 ITALY: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN HEALTHCARE/ MEDICAL APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 172 ITALY: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN HEALTHCARE/ MEDICAL APPLICATION, 2019–2026 (USD MILLION)

TABLE 173 ITALY: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN TEXTILE APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 174 ITALY: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN TEXTILE APPLICATION, 2019–2026 (USD MILLION)

8.4.5 SPAIN

8.4.5.1 Growth in footwear and medical industries to drive the market

TABLE 175 SPAIN: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 176 SPAIN: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 177 SPAIN: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 178 SPAIN: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 179 SPAIN: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN HEALTHCARE/ MEDICAL APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 180 SPAIN: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN HEALTHCARE/ MEDICAL APPLICATION, 2019–2026 (USD MILLION)

TABLE 181 SPAIN: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN TEXTILE APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 182 SPAIN: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN TEXTILE APPLICATION, 2019–2026 (USD MILLION)

8.4.6 RUSSIA

8.4.6.1 Government initiative to boost the textile industry to spur market growth

TABLE 183 RUSSIA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 184 RUSSIA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 185 RUSSIA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 186 RUSSIA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 187 RUSSIA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN HEALTHCARE/ MEDICAL APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 188 RUSSIA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN HEALTHCARE/ MEDICAL APPLICATION, 2019–2026 (USD MILLION)

TABLE 189 RUSSIA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN TEXTILE APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 190 RUSSIA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN TEXTILE APPLICATION, 2019–2026 (USD MILLION)

8.4.7 REST OF EUROPE

TABLE 191 REST OF EUROPE: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 192 REST OF EUROPE: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 193 REST OF EUROPE: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 194 REST OF EUROPE: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 195 REST OF EUROPE: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN HEALTHCARE/ MEDICAL APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 196 REST OF EUROPE: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN HEALTHCARE/ MEDICAL APPLICATION, 2019–2026 (USD MILLION)

TABLE 197 REST OF EUROPE: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN TEXTILE APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 198 REST OF EUROPE: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN TEXTILE APPLICATION, 2019–2026 (USD MILLION)

8.5 MIDDLE EAST & AFRICA

TABLE 199 MIDDLE EAST & AFRICA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION SQUARE METER)

TABLE 200 MIDDLE EAST & AFRICA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 201 MIDDLE EAST & AFRICA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 202 MIDDLE EAST & AFRICA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 203 MIDDLE EAST & AFRICA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 204 MIDDLE EAST & AFRICA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 205 MIDDLE EAST & AFRICA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN HEALTHCARE/MEDICAL APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 206 MIDDLE EAST & AFRICA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN HEALTHCARE/MEDICAL APPLICATION, 2019–2026 (USD MILLION)

TABLE 207 MIDDLE EAST & AFRICA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN TEXTILE APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 208 MIDDLE EAST & AFRICA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN TEXTILE APPLICATION, 2019–2026 (USD MILLION)

8.5.1 SAUDI ARABIA

8.5.1.1 Growth in construction and medical industries to drive the market

TABLE 209 SAUDI ARABIA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 210 SAUDI ARABIA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 211 SAUDI ARABIA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 212 SAUDI ARABIA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 213 SAUDI ARABIA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN HEALTHCARE/ MEDICAL APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 214 SAUDI ARABIA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN HEALTHCARE/ MEDICAL APPLICATION, 2019–2026 (USD MILLION)

TABLE 215 SAUDI ARABIA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN TEXTILE APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 216 SAUDI ARABIA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN TEXTILE APPLICATION, 2019–2026 (USD MILLION)

8.5.2 SOUTH AFRICA

8.5.2.1 Growing demand for baby diapers from neighboring countries driving the market

TABLE 217 SOUTH AFRICA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 218 SOUTH AFRICA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 219 SOUTH AFRICA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 220 SOUTH AFRICA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 221 SOUTH AFRICA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN HEALTHCARE/ MEDICAL APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 222 SOUTH AFRICA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN HEALTHCARE/ MEDICAL APPLICATION, 2019–2026 (USD MILLION)

TABLE 223 SOUTH AFRICA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN TEXTILE APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 224 SOUTH AFRICA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN TEXTILE APPLICATION, 2019–2026 (USD MILLION)

8.5.3 REST OF MIDDLE EAST & AFRICA

TABLE 225 REST OF MIDDLE EAST & AFRICA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 226 REST OF MIDDLE EAST & AFRICA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 227 REST OF MIDDLE EAST & AFRICA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 228 REST OF MIDDLE EAST & AFRICA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 229 REST OF MIDDLE EAST & AFRICA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN HEALTHCARE/MEDICAL APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 230 REST OF MIDDLE EAST & AFRICA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN HEALTHCARE/MEDICAL APPLICATION, 2019–2026 (USD MILLION)

TABLE 231 REST OF MIDDLE EAST & AFRICA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN TEXTILE APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 232 REST OF MIDDLE EAST & AFRICA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN TEXTILE APPLICATION, 2019–2026 (USD MILLION)

8.6 SOUTH AMERICA

TABLE 233 SOUTH AMERICA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION SQUARE METER)

TABLE 234 SOUTH AMERICA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 235 SOUTH AMERICA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 236 SOUTH AMERICA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 237 SOUTH AMERICA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 238 SOUTH AMERICA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 239 SOUTH AMERICA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN HEALTHCARE/ MEDICAL APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 240 SOUTH AMERICA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN HEALTHCARE/ MEDICAL APPLICATION, 2019–2026 (USD MILLION)

TABLE 241 SOUTH AMERICA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN TEXTILE APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 242 SOUTH AMERICA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN TEXTILE APPLICATION, 2019–2026 (USD MILLION)

8.6.1 BRAZIL

8.6.1.1 The decline in consumer purchasing power is affecting the market growth in Brazil

TABLE 243 BRAZIL: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 244 BRAZIL: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 245 BRAZIL: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 246 BRAZIL: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 247 BRAZIL: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN HEALTHCARE/ MEDICAL APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 248 BRAZIL: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN HEALTHCARE/ MEDICAL APPLICATION, 2019–2026 (USD MILLION)

TABLE 249 BRAZIL: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN TEXTILE APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 250 BRAZIL: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN TEXTILE APPLICATION, 2019–2026 (USD MILLION)

8.6.2 REST OF SOUTH AMERICA

TABLE 251 REST OF SOUTH AMERICA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 252 REST OF SOUTH AMERICA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 253 REST OF SOUTH AMERICA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 254 REST OF SOUTH AMERICA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 255 REST OF SOUTH AMERICA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN HEALTHCARE/MEDICAL APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 256 REST OF SOUTH AMERICA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN HEALTHCARE/MEDICAL APPLICATION, 2019–2026 (USD MILLION)

TABLE 257 REST OF SOUTH AMERICA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN TEXTILE APPLICATION, 2019–2026 (MILLION SQUARE METER)

TABLE 258 REST OF SOUTH AMERICA: SPECIALTY BREATHABLE MEMBRANES MARKET SIZE IN TEXTILE APPLICATION, 2019–2026 (USD MILLION)

9 COMPETITIVE LANDSCAPE (Page No. - 208)

9.1 INTRODUCTION

FIGURE 30 EXPANSION OF FACILITIES IS A KEY STRATEGY ADOPTED BY PLAYERS BETWEEN 2018 AND 2021

9.2 MARKET SHARE ANALYSIS

FIGURE 31 MARKET SHARE OF KEY PLAYERS, 2020

TABLE 259 DEGREE OF COMPETITION IN SPECIALTY BREATHABLE MEMBRANES MARKET

TABLE 260 STRATEGIC POSITIONING OF KEY PLAYERS

9.3 COMPANY EVALUATION QUADRANT DEFINITION

9.3.1 STAR

9.3.2 PERVASIVE

9.3.3 EMERGING LEADER

9.3.4 PARTICIPANT

FIGURE 32 SPECIALTY BREATHABLE MEMBRANES MARKET:COMPANY EVALUATION MATRIX, 2020

9.4 STARTUPS AND SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX

9.4.1 RESPONSIVE COMPANIES

9.4.2 DYNAMIC COMPANIES

9.4.3 STARTING BLOCKS

FIGURE 33 STARTUPS AND SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX, 2020

9.5 REVENUE ANALYSIS OF TOP PLAYERS

FIGURE 34 REVENUE ANALYSIS FOR PUBLIC COMPANIES IN PAST 5 YEARS

TABLE 261 REVENUE ANALYSIS OF KEY PLAYERS

9.6 COMPANY PRODUCT FOOTPRINT

TABLE 262 COMPANY FOOTPRINT, BY END-USE INDUSTRY

FIGURE 35 COMPANY FOOTPRINT, BY APPLICATION

TABLE 263 COMPANY FOOTPRINT, BY REGION

9.7 KEY MARKET DEVELOPMENT

9.7.1 EXPANSIONS

9.7.2 ACQUISITIONS

9.7.3 NEW PRODUCT LAUNCHES

10 COMPANY PROFILES (Page No. - 221)

(Business Overview, Products Offered, Recent Developments, Winning Imperatives, and MnM View)*

10.1 COVESTRO AG

TABLE 264 COVESTRO AG: BUSINESS OVERVIEW

FIGURE 36 COVESTRO AG: COMPANY SNAPSHOT

TABLE 265 ACQUISITIONS

TABLE 266 DIVESTMENT

FIGURE 37 COVESTRO’S CAPABILITIES IN THE SPECIALTY BREATHABLE MEMBRANES MARKET

10.2 BERRY GLOBAL GROUP

TABLE 267 BERRY GLOBAL: BUSINESS OVERVIEW

FIGURE 38 BERRY GLOBAL: COMPANY SNAPSHOT

FIGURE 39 BERRY GLOBAL’S CAPABILITIES IN THE SPECIALTY BREATHABLE MEMBRANES MARKET

10.3 TORAY INDUSTRIES

TABLE 268 TORAY INDUSTRIES: BUSINESS OVERVIEW

FIGURE 40 TORAY INDUSTRIES: COMPANY SNAPSHOT

FIGURE 41 TORAY’S CAPABILITIES IN THE SPECIALTY BREATHABLE MEMBRANES MARKET

10.4 SCHWEITZER-MAUDUIT INTERNATIONAL

TABLE 269 SCHWEITZER- MAUDUIT INTERNATIONAL: BUSINESS OVERVIEW

FIGURE 42 SCHWEITZER-MAUDUIT INTERNATIONAL: COMPANY SNAPSHOT

FIGURE 43 SCHWEITZER-MAUDUIT INTERNATIONAL’S CAPABILITIES IN THE SPECIALTY BREATHABLE MEMBRANES MARKET

10.5 ARKEMA S.A.

TABLE 270 ARKEMA S.A.: BUSINESS OVERVIEW

FIGURE 44 ARKEMA S.A.: COMPANY SNAPSHOT

TABLE 271 COMPANIES ACQUIRED

TABLE 272 EXPANSIONS

10.5.1 Focus on enhancing footprint in the global market

FIGURE 45 ARKEMA’S CAPABILITIES IN THE SPECIALTY BREATHABLE MEMBRANES MARKET

10.6 RKW GROUP

TABLE 273 RKW GROUP: BUSINESS OVERVIEW

10.7 NITTO DENKO

TABLE 274 NITTO DENKO: BUSINESS OVERVIEW

FIGURE 46 NITTO DENKO: COMPANY SNAPSHOT

FIGURE 47 NITTO DENKO’S CAPABILITIES IN THE SPECIALTY BREATHABLE MEMBRANES MARKET

10.8 SYMPATEX TECHNOLOGIES GMBH

TABLE 275 SYMPATEX TECHNOLOGIES GMBH: BUSINESS OVERVIEW

10.9 PIL MEMBRANES LTD

TABLE 276 PIL MEMBRANES LTD: BUSINESS OVERVIEW

10.10 EVENT FABRICS

TABLE 277 EVENT FABRICS: BUSINESS OVERVIEW

10.11 DINGZING ADVANCED MATERIALS INC.

TABLE 278 DINGZING ADVANCED MATERIALS INC.: BUSINESS OVERVIEW

10.12 FAIT PLAST S.P.A

TABLE 279 FAIT PLAST S.P.A.: BUSINESS OVERVIEW

10.13 W. L. GORE & ASSOCIATES

TABLE 280 W. L. GORE & ASSOCIATES: BUSINESS OVERVIEW

10.14 FATRA A.S.

TABLE 281 FATRA A.S.: BUSINESS OVERVIEW

10.15 DSM ENGINEERING PLASTICS

10.16 TEKNOR APEX COMPANY

10.17 DAIKA KOGYO

10.18 SUNPLAC CORPORATION

10.19 TRIOPLAST INDUSTRIES AB

TABLE 282 TRIOPLAST INDUSTRIES AB: BUSINESS OVERVIEW

10.2 CELANESE

10.21 RAHIL FOAM PVT. LTD.

10.22 SKYMARK PACKAGING

10.23 AMERICAN POLYFILM

10.24 INNOVIA FILMS

Business Overview, Products Offered, Recent Developments, Winning Imperatives, and MnM View might not be captured in case of unlisted companies.

11 APPENDIX (Page No. - 268)

11.1 DISCUSSION GUIDE

11.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

11.3 AVAILABLE CUSTOMIZATIONS

11.4 RELATED REPORTS

11.5 AUTHOR DETAILS

The study involved four major activities for estimating the current size of the global specialty breathable membranes market. Exhaustive secondary research was carried out to collect information on the market, the peer market, and the parent market. The COVID-19 pandemic impact on the demand regarding end-use industries, application areas, and countries was comprehended. The next step was to validate these findings, assumptions and sizes with the industry experts across the supply chain of breathable membranes market through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the specialty breathable membranes market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to identify and collect this study's breathable membranes market. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; regulatory bodies, trade directories, and databases.

Primary Research

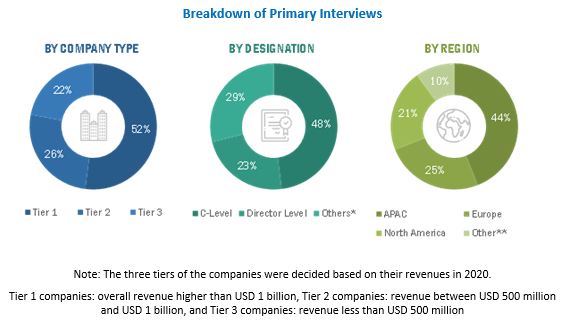

Various primary sources from both the supply and demand sides of the specialty breathable membranes market were interviewed to obtain qualitative and quantitative information. The primary sources from the supply-side included industry experts, such as Chief Executive Officers (CEOs), vice presidents, marketing directors, sales professionals, and related key executives from various leading companies and organizations operating in the breathable membranes marketindustry. The primary sources from the demand side included key executives from end-use industries. The breakdown of the profiles of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the global breathable membranes market size. These approaches were also used extensively to estimate the size of various segments of the market. The research methodology used to estimate the market size included the following details:

- The key players were identified through extensive secondary research.

- In terms of value, the industry's supply chain and market size were determined through primary and secondary research processes.

- Impact of COVID-19 pandemic was ascertained

- All percentage split and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments of the breathable membranes market. The data was triangulated by studying various factors and trends from both the demand- and supply-side.

Report Objectives

- To define, analyze, and project the size of the specialty breathable membranes market in terms of value and volume based on type, application, and region

- To project the size of the market and its segments with respect to the five main regions, namely, North America, Europe, Asia Pacific, Middle East & Africa, and South America

- To provide detailed information about the key factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market

- To strategically analyze the micromarkets with respect to individual growth trends, COVID-19 pandemic impact, prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape of the market leaders

- To analyze the competitive developments, such as new product launches, expansions, and acquisitions, in the specialty breathable membranes market

- To strategically profile the key players operating in the market and comprehensively analyze their market shares and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the specialty breathable membranes market report:

Product Analysis

- Product matrix, which offers a detailed comparison of the product portfolio of companies

Regional Analysis

- Further breakdown of the Rest of the APAC specialty breathable membranes market into more nations not covered in the study

- Further breakdown of Rest of Europe specialty breathable membranes market into more nations not covered in the study

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Specialty Breathable Membranes Market