Speaker Driver Market by Device Type (Headphones/Earphones, Mobile Phones/Tablets, Smart Speakers), Driver Type (Dynamic Driver, Balanced Armature Driver), Size, Application, and Geography - Global Forecast to 2025

The Speaker Driver Market is projected to USD 29.3 billion by 2025 from USD 27.1 billion in 2022 at a CAGR of 2.5% during the forecast period. It was observed that the growth rate was 0.6% from 2021 to 2022. Balanced Armature Driver segment is expected to grow at a highest CAGR of 3.76%.

Major factors driving the growth of the market include the increasing demand for smartphones owing to the surge in the adoption of audio and video streaming services and the growing popularity of True Wireless earphones. Opportunities for the market include the increase in the sale of smartphones owing to the expansion of the 5G network; and the release of new headphones and earphones as a result of new advancements in wireless technology standards such as the new Wi-fi 6 and Bluetooth 5.2.

To know about the assumptions considered for the study, Request for Free Sample Report

Covid-19 Impact on the Speaker Driver Market

- As the impact of COVID-19 has been witnessed on the income of households across the globe, a cut down on the expenditure of various products or delays are expected to be witnessed throughout the year. There is a larger probability of people holding on to their current smartphones/tablets or headphones till the COVID-19 situation begins to improve across the globe.

- Due to the lockdown measures imposed across the globe, the production facilities and workforce numbers were impacted, resulting in a cut down of production. As the demand and production of various devices that are integrated with speaker drivers have declined, the volume figures of speaker drivers have been affected. Huawei’s smartphone sales dropped by 6.8% in Q2, totaling 54 million units. Samsung only sold 55 million smartphones in the period, a decline of 27.1% year-on-year.

Speaker Driver Market Dynamics

Drivers : Surge in adoption of audio and video streaming services to fuel demand for speaker drivers

The growing popularity of over-the-top (OTT) solutions, increasing number of subscriptions, growing trend of mobile video streaming, and increasing digitalization have increased the usage of audio and video streaming services.

The increasing penetration of smartphones, availability of high-speed internet plans at low cost, and growing popularity of on-demand video streaming are factors supporting the increasing usage of audio/video streaming services. The OTT segment is gaining high popularity among consumers owing to the free delivery of TV and film content through the internet.

The proliferation of smartphones and high-speed internet technologies, such as 4G and LTE networks, has led to easy access to media services for entertainment purposes. These services are offering access to millions of songs with uninterrupted access, along with innovative services such as personalized playlists and individual preferences. This is increasing the demand for headphones, earphones, and other devices integrated with high-quality speaker drivers.

Restraints : Harmful effects on the health of listeners

The World Health Organization (WHO) estimated that around a billion young people across the globe could be at the risk of hearing loss because of the unsafe listening habits they practice through headphones/earphones. The major concern with the headphones is the volume exposure that they give the ear.

According to a study undertaken by the New York City Health Department, continuous exposure to loud noise (via loudspeakers, headphones, and so on) can damage the delicate inner ear cells and result in hearing impairment or complete hearing loss. Typically, large-sized drivers generate a louder sound output. Such drivers in headphones are capable of producing very loud levels of sound very close to the ear, thus being dangerous for the ears.

Opportunities : Expansion of 5G network to increase sale of smartphones and speaker drivers

With the introduction of the 5G network in many countries, the commercialization of 5G phones is expected to accelerate in the coming years. In 2020, Xiaomi has announced the plan to launch a 5G-enabled smartphone under USD 300, which is expected to result in a high sale of 5G phones as compared to the 4G phones in the coming years.

The announcement of 5G mobile chipsets by Qualcomm and MediaTek is expected to create opportunities for smartphone manufacturers to increase the sales volume globally. In 2020, Qualcomm announced that it aims to bring 5G to its entry-level 4 Series of chipsets, specifically meant for phones in the USD 125–250 price range.

Similarly, in 2020, Mediatek announced the plan to launch a new 5G mobile chipset for entry-level smartphones. This will create an opportunity for several smartphone manufacturers to capture the maximum share of the smartphone market and result in the development of new 5G-compatible phones. The introduction of new 5G phones will consequently fuel the demand for speaker drivers for these devices during the forecast period.

Cleaner bass may lead to irregular frequency response

Speaker drivers play a very important role in reducing the audio output quality of the headphones. As the demand for bass-heavy headphones is increasing, the integration of large-sized drivers has become the prime focus. The area covered by the magnet or the size of this field is directly proportional to its bass effect.

A large magnetic field generates deep bass. The large the air displacement, the higher the volume. To recreate realistic bass response in a driver, the driver must be able to displace air. Dynamic drivers are excellent in displacing air. Therefore, these drivers are most suited for creating an impressive bass response. However, large-sized drivers and the need for powerful bass come with a challenge.

While bass might be better with bigger headphone drivers, treble (higher frequencies) can be harder to replicate. A large-sized driver to produce powerful bass comes along with the challenge of reducing the possibility of an irregular frequency response. Generally, larger drivers can generate cleaner bass, but less accurate high frequencies.

To know about the assumptions considered for the study, download the pdf brochure

Speaker Driver Market Segment Overview

The Headphones/Earphones segment is expected to account for the largest size (Value) of the Speaker Driver market from 2020 to 2025.

Owing to the increasing demand for wireless and small-sized earphones among fitness enthusiasts, the supply for earbuds has increased, leading to an increase in the demand for speaker drivers. As consumers are focusing on product aesthetics and add-on features for earphones, along with a compact size, the true wireless earbud category of earphones has been gaining popularity.

Apple (US) has set this trend with the launch of AirPods in 2016. The other players, such as Oppo and Xiamoi, have also started integrating foray into their headphones. Bass boosting technology, active noise cancellation technology, hand-free calling features along wireless technology are increasing the popularity of true wireless earbuds, thereby presenting an opportunity for the manufacturers of drivers to acquire a larger share of the market.

The Others application segment of the Speaker Driver market including banking, travel and tourism, hospitality, and education is projected to grow at the highest CAGR (Volume) during the forecast period.

The hospitality and travel and tourism application have tremendous potential for the growth of smart speakers in the coming years. In the hospitality application, these can be used for room control lighting, playing audio content, learning about weather and travel updates, ordering room service and housekeeping, calling reception, and checking out.

For instance, the InterContinental Hotels Group (IHG) uses a customized version of Baidu’s DuerOS AI solution that includes voice assistant functionality and its smart speakers at its InterContinental Beijing Sanlitun and InterContinental Guangzhou Exhibition Centre properties, that allows guests to ask for basic information, such as the current travel time to the airport, as well as other types of room service like ordering food..

The 20–110 mm segment holds the largest size (Volume) of the Speaker Driver market in 2020.

Due to the increasing popularity of audio and video features on social networking apps, including TikTok, Dubsmash, and Funimate, which has increased the demand for smartphones, the 20–110 mm segment holds the largest size (Volume) of the market. For instance, in 2019, Instagram launched the trial of a new feature called Reels.

Also, as people begin to confine themselves within their homes and work from home, video conferencing has become increasingly common. Several video conferencing software such as Zoom, Cisco Webex Meetings, and Microsoft teams are being utilized increasingly. Thus, the demand for high quality Speaker Drivers in Smartphones is expected to increase.

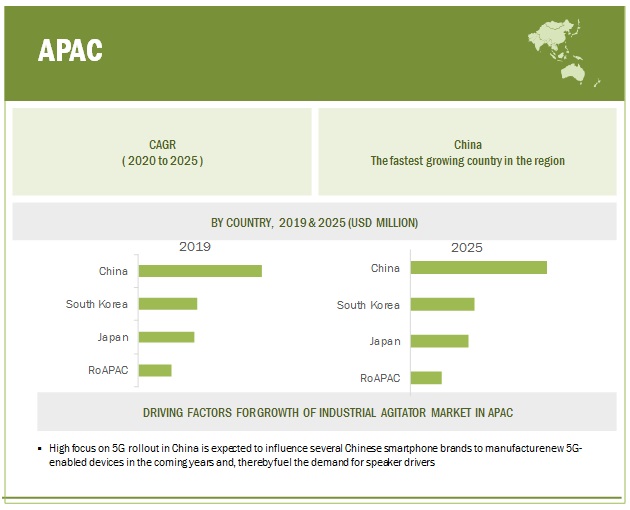

APAC Speaker Driver market to hold the largest market share in 2019 (Both Volume and Value).

Major headphone/earphone, mobile phone, and tablet manufacturers are also based in APAC, including Samsung Electronics Co., Ltd., Sony Corporation, Xiaomi Corporation, Oppo, Vivo, Oneplus, and Realme.

These players give a tough competition in the smartphone and headphone/earphone market with several product launches and developments, which is increasing the demand for speaker drivers in the region. With the growing demand for smartphones and the rising preference for a high-quality audio experience via headphones/earphones, the abovementioned players are planning to roll out new models with new drivers.

Owing to the impact of COVID-19 which has impacted income of households across the globe, a cut down on the expenditure of various products or delays are expected to be witnessed throughout the year. People are expected to hold on to their current smartphones/tablets or headphones till the COVID-19 situation begins to improve across the globe. Due to the lockdown measures imposed across the globe, the production facilities and workforce numbers were impacted, resulting in a cut down of production. Thus, the production of Speaker Drivers will be impacted in 2020.

Key Market Players in Speaker Driver Industry

Key players in the Speaker Driver market include Sennheiser Electronic GmbH & Co. KG (Germany), Samsung Electronics (South Korea), Sony Corporation (Japan), Knowles Electronics (US), Goertek (China).

Speaker Driver Market Report Scope

|

Report Metric |

Detail |

| Market Size Value in 2020 | USD 25.9 billion |

| Market Size Value in 2025 | USD 29.3 billion |

| Growth Rate | CAGE of 2.5% |

|

Market Size Availability Years |

2017–2025 |

|

Base Year |

2019 |

|

Forecast Period |

2020–2025 |

|

Forecast Units |

Value (USD million) Volume (Million Units) |

|

Covered Segments |

Device type, driver type, Size, Application and Geography |

|

Covered Regions |

North America, Europe, APAC, and RoW |

|

Covered Companies |

|

Speaker Driver Market Categorization:

In this report, the Speaker Driver market has been segmented into the following categories:

Based on the Device Type

- Headphones/Earphones

- Hearing Aids

- Smart Speakers

- Mobile Phones/Tablets

- Loudspeakers

Based on Driver Type

- Dynamic Drivers

- Balanced Armature Drivers

- Planar Magentic

- ElectroStatic

- Others

Based on the Size

- Below 20 mm

- 20–110 mm

- Others

Based on the Application

- Consumer

- Professional/Enterprise

- Medical

- Others

Based on the region:

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

Recent Developments in Speaker Driver Industry Size

- In September 2020, Sennheiser launched the CX 400BT True Wireless. It is equipped with 7mm dynamic drivers and delivers high-fidelity stereo sound with deep bass, natural mids, and clear, detailed treble.

- In May 2020, Sennheiser launched the HD 458BT wireless headphones. It is a special edition of its HD 450BT over-ear wireless headphones with bold red accents that lift the minimalist design to stylish new heights.

- In August 2019, HARMAN launched a lifestyle audio device brand—Infinity by HARMAN—in India. As part of this brand launch, the company launched 11 new audio products, including 6 Infinity headphones, 4 portable Bluetooth speakers, and a multimedia 2.1 Bluetooth system.

- In November 2019, Knowles Electronics announced a partnership with GN Store Nord A/S (Denmark), which offers intelligent hearing, audio, and video collaboration solutions. Through this partnership, GN has selected Knowles as a key supplier of balanced armature speakers and MEMS microphones for GN Hearing’s continuing leading-edge technology platforms.

Frequently Asked Questions (FAQ):

What companies operate in the Speaker Driver market?

Some of the companies in the Speaker Driver market include Sennheiser Electronic GmbH & Co. KG (Germany), Samsung Electronics (South Korea), Sony Corporation (Japan), Knowles Electronics (US), Goertek (China), Beyerdynamic GmbH & Co. KG (Germany), Fostex International (Tokyo), Merry Electronics co., ltd.(Taiwan), Concraft Holding co., ltd (Taiwan), Eastech (Taiwan), Voz Electronic co., ltd (Taiwan), Fortune Grand Technology inc.(US), Tymphany (China), Premium Sound Solutions (Belgium), Ole Wolff (Denmark), AAC Technologies (China), 1More (California), Sonion (Zealand), Bellsing (China), Molex (US) Audeze llc (US).

What are some of the drivers for the growth of the Speaker Driver Market?

Some of the drivers of the Speaker Driver market include, Growing popularity of bass-heavy headphones; Growing adoption of a new category of earphones—true wireless earbuds; and the Surge in adoption of audio and video streaming services to fuel demand for speaker drivers. The growing popularity of over-the-top (OTT) solutions, increasing number of subscriptions, growing trend of mobile video streaming, and increasing digitalization have increased the usage of audio and video streaming services. The increasing penetration of smartphones, availability of high-speed internet plans at low cost, and growing popularity of on-demand video streaming are factors supporting the increasing usage of audio/video streaming services. This is increasing the demand for headphones, earphones, and other devices integrated with high-quality speaker drivers.

What is an opportunity for the growth of the Speaker Driver Market?

An opportunity for the Speaker Driver market includes the expansion of 5G network to increase sale of smartphones and speaker drivers. With the introduction of the 5G network in many countries, the commercialization of 5G phones is expected to accelerate in the coming years. In 2020, Xiaomi has announced the plan to launch a 5G-enabled smartphone under USD 300, which is expected to result in a high sale of 5G phones as compared to the 4G phones in the coming years. The announcement of 5G mobile chipsets by Qualcomm and MediaTek is expected to create opportunities for smartphone manufacturers to increase the sales volume globally. In 2020, Qualcomm announced that it aims to bring 5G to its entry-level 4 Series of chipsets, specifically meant for phones in the USD 125–250 price range. Similarly, in 2020, Mediatek announced the plan to launch a new 5G mobile chipset for entry-level smartphones. This will create an opportunity for several smartphone manufacturers to capture the maximum share of the smartphone market and result in the development of new 5G-compatible phones. The introduction of new 5G phones will consequently fuel the demand for speaker drivers for these devices during the forecast period.

What is a challenge for the Speaker Driver Market?

A challenge for the Speaker Driver Market is that a cleaner bass may lead to irregular frequency response. large-sized drivers and the need for powerful bass come with a challenge. While bass might be better with bigger headphone drivers, treble (higher frequencies) can be harder to replicate. A large-sized driver to produce powerful bass comes along with the challenge of reducing the possibility of an irregular frequency response. Generally, larger drivers can generate cleaner bass, but less accurate high frequencies.

What is a restraint for the Speaker Driver Market?

ARestraint for the Speaker Driver market includes its harmful effects on the health of listeners. The World Health Organization (WHO) estimated that around a billion young people across the globe could be at the risk of hearing loss because of the unsafe listening habits they practice through headphones/earphones. The major concern with the headphones is the volume exposure that they give the ear. According to a study undertaken by the New York City Health Department, continuous exposure to loud noise (via loudspeakers, headphones, and so on) can damage the delicate inner ear cells and result in hearing impairment or complete hearing loss. Typically, large-sized drivers generate a louder sound output. Such drivers in headphones are capable of producing very loud levels of sound very close to the ear, thus being dangerous for the ears. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 24)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS & EXCLUSIONS

1.4 STUDY SCOPE

1.4.1 MARKETS COVERED

1.4.2 GEOGRAPHIC SCOPE

1.4.3 YEAR CONSIDERED

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 28)

2.1 RESEARCH DATA

FIGURE 1 GLOBAL SPEAKER DRIVER MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Primary breakdown

FIGURE 2 BREAKDOWN OF PRIMARIES ACROSS REGIONS, DESIGNATIONS, AND COMPANY TYPES

FIGURE 3 LIST OF PRIMARIES BY COMPANY NAMES & DESIGNATIONS

2.2 MARKET SIZE ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.4 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 36)

FIGURE 7 DYNAMIC DRIVER SEGMENT (UNITS) TO DOMINATE MARKET, BY DRIVER TYPE, DURING FORECAST PERIOD

FIGURE 8 BELOW 20MM DRIVER SIZE SEGMENT (UNITS) TO DOMINATE MARKET, BY DRIVER SIZE, DURING FORECAST PERIOD

FIGURE 9 APAC ACCOUNTED FOR LARGEST SHARE OF MARKET IN 2019

4 PREMIUM INSIGHTS (Page No. - 40)

4.1 OPPORTUNITIES IN SPEAKER DRIVER MARKET

FIGURE 10 GROWING POPULARITY OF TRUE WIRELESS EARBUDS, 5G ROLLOUT FOR SMARTPHONES, WIRELESS CONNECTIVITY STANDARD UPGRADES, INCREASING ADOPTION OF VIDEO CONFERENCING & AUDIO AND VIDEO STREAMING SERVICES TO FUEL MARKET GROWTH FROM 2020 TO 2025

4.2 MARKET, BY DEVICE TYPE (UNITS)

FIGURE 11 MOBILE PHONES/TABLETS SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

4.3 HEADPHONES/EARPHONES MARKET, BY DRIVER TYPE (UNITS)

FIGURE 12 BALANCED ARMATURE DRIVERS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4.4 APAC SPEAKER DRIVER MARKET, BY COUNTRY

FIGURE 13 CHINA TO LEAD MARKET IN APAC IN 2020

5 MARKET OVERVIEW (Page No. - 42)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 14 MARKET OVERVIEW: SPEAKER DRIVER

5.2.1 DRIVERS

5.2.1.1 Growing popularity of bass-heavy headphones

5.2.1.2 Growing adoption of a new category of earphones—true wireless earbuds

5.2.1.3 Surge in adoption of audio and video streaming services to fuel demand for speaker drivers

5.2.1.3.1 Increasing popularity of video streaming services

5.2.1.3.2 Growing adoption of audio streaming services across the globe

5.2.2 RESTRAINTS

5.2.2.1 Harmful effects on the health of listeners

5.2.3 OPPORTUNITIES

5.2.3.1 Expansion of 5G network to increase sale of smartphones and speaker drivers

5.2.3.2 Advancements in wireless technology standards to boost demand for speaker drivers

5.2.3.2.1 Bluetooth 5.2:

5.2.3.2.2 Wi-Fi 6:

5.2.3.3 Advancements in hearing aid technology

5.2.3.3.1 Bluetooth compatibility

5.2.3.3.2 Tinnitus masking feature

5.2.3.4 Increasing use of video conferencing platforms to benefit speaker driver manufacturers

5.2.4 CHALLENGES

5.2.4.1 Cleaner bass may lead to irregular frequency response

5.3 TECHNOLOGY TRENDS

5.3.1 HYBRID DRIVER TECHNOLOGY

5.3.2 DYNAMIC DRIVER LPF (LOW FREQUENCY PASS FILTERS) TECHNOLOGY

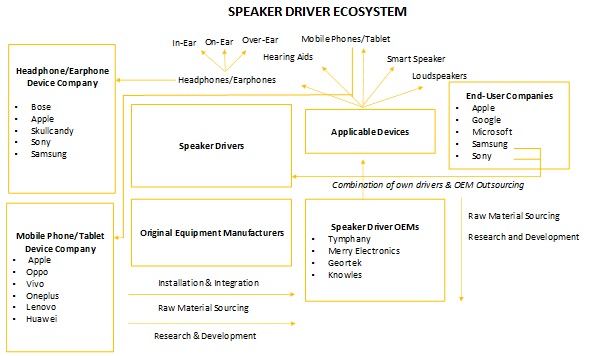

5.4 ECOSYSTEM ANALYSIS

5.4.1 SUPPLY CHAIN ANALYSIS

5.5 TARIFF AND REGULATIONS

5.6 CASE STUDY ANALYSIS

5.6.1 ONEPLUS SELECTS KNOWLES’ BALANCED ARMATURE DRIVER TECHNOLOGY

5.6.2 64 AUDIO LAUNCHES WORLD’S FIRST 18 BALANCED ARMATURE IEM

5.6.3 AUDEZE BREAKS AFFORDABILITY BARRIER WITH ITS LCD-1 HEADPHONES

5.7 PATENT ANALYSIS

TABLE 1 LIST OF PATENTS – COMPANY NAME, DATE OF PATENT, PATENT NO.

5.8 VALUE CHAIN/SUPPLY CHAIN ANALYSIS

FIGURE 15 VALUE CHAIN ANALYSIS

5.9 COVID-19 IMPACT ANALYSIS FOR SPEAKER DRIVER MARKET

5.10 MARKET SCENARIOS—PESSIMISTIC AND OPTIMISTIC

FIGURE 16 PESSIMISTIC AND OPTIMISTIC SCENARIOS FOR MARKET

TABLE 2 PESSIMISTIC AND OPTIMISTIC SCENARIO OF MARKET, 2017–2019 (MILLION UNITS)

TABLE 3 PESSIMISTIC AND OPTIMISTIC SCENARIO OF MARKET, 2020–2025 (MILLION UNITS)

5.10.1 PESSIMISTIC APPROACH

FIGURE 17 SPEAKER DRIVER MARKET SIZE (MILLION UNITS) (PESSIMISTIC APPROACH)

5.10.2 OPTIMISTIC APPROACH

FIGURE 18 MARKET SIZE (MILLION UNITS) (OPTIMISTIC APPROACH)

5.11 ASP ANALYSIS

6 SPEAKER DRIVER MARKET, BY DEVICE TYPE (Page No. - 57)

6.1 INTRODUCTION

TABLE 4 MARKET, BY DEVICE TYPE, 2017–2019 (MILLION UNITS)

TABLE 5 MARKET, BY DEVICE TYPE, 2020–2025 (MILLION UNITS)

TABLE 6 MARKET, BY DEVICE TYPE, 2017–2019 (USD MILLION)

TABLE 7 MARKET, BY DEVICE TYPE, 2020–2025 (USD MILLION)

6.2 HEADPHONE/EARPHONE

6.2.1 HIGH APPLICATION OF DYNAMIC DRIVERS IN HEADPHONES/EARPHONES

TABLE 8 SPEAKER DRIVER MARKET FOR HEADPHONES/EARPHONES, BY DEVICE TYPE, 2017–2019 (MILLION UNITS)

TABLE 9 MARKET FOR HEADPHONES/EARPHONES, BY DEVICE TYPE, 2020–2025 (MILLION UNITS)

TABLE 10 MARKET FOR HEADPHONES/EARPHONES, BY DEVICE TYPE, 2017–2019 (USD MILLION)

TABLE 11 MARKET FOR HEADPHONES/EARPHONES, BY DEVICE TYPE, 2020–2025 (USD MILLION)

TABLE 12 MARKET FOR HEADPHONES/EARPHONES, BY DRIVER SIZE, 2017–2019 (MILLION UNITS)

TABLE 13 MARKET FOR HEADPHONES/EARPHONES, BY DRIVER SIZE, 2020–2025 (MILLION UNITS)

TABLE 14 MARKET FOR HEADPHONES/EARPHONES, BY DRIVER SIZE, 2017–2019 (USD MILLION)

TABLE 15 SPEAKER DRIVER MARKET FOR HEADPHONES/EARPHONES, BY DRIVER SIZE, 2020–2025 (USD MILLION)

TABLE 16 MARKET FOR HEADPHONES/EARPHONES, BY APPLICATION, 2017–2019 (MILLION UNITS)

TABLE 17 MARKET FOR HEADPHONES/EARPHONES, BY APPLICATION, 2020–2025 (MILLION UNITS)

TABLE 18 MARKET FOR HEADPHONES/EARPHONES, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 19 MARKET FOR HEADPHONES/EARPHONES, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 20 MARKET FOR HEADPHONES/EARPHONES, BY REGION, 2017–2019 (MILLION UNITS)

TABLE 21 MARKET FOR HEADPHONES/EARPHONES, BY REGION, 2020–2025 (MILLION UNITS)

TABLE 22 MARKET FOR HEADPHONES/EARPHONES, BY REGION, 2017–2019 (USD MILLION)

TABLE 23 MARKET FOR HEADPHONES/EARPHONES, BY REGION, 2020–2025 (USD MILLION)

6.3 HEARING AID

6.3.1 HIGH COST OF MANUFACTURING IS REASON FOR THEIR PREMIUM PRICE

TABLE 24 SPEAKER DRIVER MARKET FOR HEARING AIDS, BY REGION, 2017–2019 (MILLION UNITS)

TABLE 25 MARKET FOR HEARING AIDS, BY REGION, 2020–2025 (MILLION UNITS)

TABLE 26 MARKET FOR HEARING AIDS, BY REGION, 2017–2019 (USD MILLION)

TABLE 27 MARKET FOR HEARING AIDS, BY REGION, 2020–2025 (USD MILLION))

6.4 MOBILE PHONES/TABLETS

6.4.1 SPEAKER DRIVERS DELIVER CLEAR SOUND ALONG WITH WIDE FREQUENCY RESPONSE

TABLE 28 MARKET FOR MOBILE PHONES/TABLETS, BY APPLICATION, 2017–2019 (MILLION UNITS)

TABLE 29 MARKET FOR MOBILE PHONES/TABLETS, BY APPLICATION, 2020–2025 (MILLION UNITS)

TABLE 30 MARKET FOR MOBILE PHONES/TABLETS, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 31 MARKET FOR MOBILE PHONES/TABLETS, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 32 SPEAKER DRIVER MARKET FOR MOBILE PHONES/TABLETS, BY REGION, 2017–2019 (MILLION UNITS)

TABLE 33 MARKET FOR MOBILE PHONES/TABLETS, BY REGION, 2020–2025 (MILLION UNITS)

TABLE 34 MARKET FOR MOBILE PHONES/TABLETS, BY REGION, 2017–2019 (USD MILLION)

TABLE 35 MARKET FOR MOBILE PHONES/TABLETS, BY REGION, 2020–2025 (USD MILLION)

6.5 SMART SPEAKERS

6.5.1 HIGH-QUALITY SOUND REPRODUCTION TO INCREASE DEMAND FOR SUPERIOR-QUALITY DRIVERS

TABLE 36 SPEAKER DRIVER MARKET FOR SMART SPEAKERS, BY APPLICATION, 2017–2019 (MILLION UNITS)

TABLE 37 MARKET FOR SMART SPEAKERS BY APPLICATION, 2020–2025 (MILLION UNITS)

TABLE 38 MARKET FOR SMART SPEAKERS, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 39 MARKET FOR SMART SPEAKERS, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 40 MARKET FOR SMART SPEAKERS, BY REGION, 2017–2019 (MILLION UNITS)

TABLE 41 MARKET FOR SMART SPEAKERS, BY REGION, 2020–2025 (MILLION UNITS)

TABLE 42 MARKET FOR SMART SPEAKERS, BY REGION, 2017–2019 (USD MILLION)

TABLE 43 MARKET FOR SMART SPEAKERS, BY REGION, 2020–2025 (USD MILLION)

6.6 LOUDSPEAKERS

6.6.1 INCREASING USAGE OF PROFESSIONAL LOUDSPEAKERS TO BOOST DEMAND FOR SPEAKER DRIVER

TABLE 44 SPEAKER DRIVER MARKET FOR LOUDSPEAKERS, BY DRIVER TYPE, 2017–2019 (MILLION UNITS)

TABLE 45 MARKET FOR LOUDSPEAKERS, BY DRIVER TYPE, 2020–2025 (MILLION UNITS)

TABLE 46 MARKET FOR LOUDSPEAKERS, BY DRIVER TYPE, 2017–2019 (USD MILLION)

TABLE 47 MARKET FOR LOUDSPEAKERS, BY DRIVER TYPE, 2020–2025 (USD MILLION)

TABLE 48 MARKET FOR LOUDSPEAKERS, BY DRIVER SIZE, 2017–2019 (MILLION UNITS)

TABLE 49 MARKET FOR LOUDSPEAKERS, BY DRIVER SIZE, 2020–2025 (MILLION UNITS)

TABLE 50 MARKET FOR LOUDSPEAKERS, BY DRIVER SIZE, 2017–2019 (USD MILLION)

TABLE 51 SPEAKER DRIVER MARKET FOR LOUDSPEAKERS, BY DRIVER SIZE, 2020–2025 (USD MILLION)

TABLE 52 MARKET FOR LOUDSPEAKERS, BY APPLICATION, 2017–2019 (MILLION UNITS)

TABLE 53 MARKET FOR LOUDSPEAKERS, BY APPLICATION, 2020–2025 (MILLION UNITS)

TABLE 54 MARKET FOR LOUDSPEAKERS, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 55 MARKET FOR LOUDSPEAKERS, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 56 MARKET FOR LOUDSPEAKERS, BY REGION, 2017–2019 (MILLION UNITS)

TABLE 57 MARKET FOR LOUDSPEAKERS, BY REGION, 2020–2025 (MILLION UNITS)

TABLE 58 MARKET FOR LOUDSPEAKERS, BY REGION, 2017–2019 (USD MILLION)

TABLE 59 MARKET FOR LOUDSPEAKERS, BY REGION, 2020–2025 (USD MILLION)

7 SPEAKER DRIVER MARKET, BY DRIVER TYPE (Page No. - 79)

7.1 INTRODUCTION

TABLE 60 MARKET, BY DRIVER TYPE, 2017–2019 (MILLION UNITS)

TABLE 61 MARKET, BY DRIVER TYPE, 2020–2025 (MILLION UNITS)

TABLE 62 MARKET, BY DRIVER TYPE, 2017–2019 (USD MILLION)

TABLE 63 MARKET, BY DRIVER TYPE, 2020–2025 (USD MILLION)

7.2 DYNAMIC DRIVERS

7.2.1 MOST COMMONLY USED DRIVERS IN HEADPHONES/EARPHONES

TABLE 64 DYNAMIC SPEAKER DRIVER MARKET, BY DEVICE TYPE, 2017–2019 (MILLION UNITS)

TABLE 65 DYNAMIC SPEAKER DRIVER, BY DEVICE TYPE, 2020–2025 (MILLION UNITS)

TABLE 66 DYNAMIC SPEAKER DRIVER, BY DEVICE TYPE, 2017–2019 (USD MILLION)

TABLE 67 DYNAMIC SPEAKER DRIVER, BY DEVICE TYPE, 2020–2025 (USD MILLION)

7.3 PLANAR MAGNETIC DRIVERS

7.3.1 INVOLVE HIGH COST OF MANUFACTURING THAT RESULTS IN PREMIUM PRICING

TABLE 68 PLANAR MAGNETIC SPEAKER DRIVER MARKET, BY DEVICE TYPE, 2017–2019 (MILLION UNITS)

TABLE 69 PLANAR MAGNETIC SPEAKER DRIVER, BY DEVICE TYPE, 2020–2025 (MILLION UNITS)

TABLE 70 PLANAR MAGNETIC SPEAKER DRIVER, BY DEVICE TYPE, 2017–2019 (USD MILLION)

TABLE 71 PLANAR MAGNETIC SPEAKER DRIVER, BY DEVICE TYPE, 2020–2025 (USD MILLION)

7.4 ELECTROSTATIC DRIVERS

7.4.1 HELP IN DELIVERING CLEAR SOUND ALONG WITH A WIDE FREQUENCY RESPONSE

TABLE 72 ELECTROSTATIC SPEAKER DRIVER MARKET, BY DEVICE TYPE, 2017–2019 (MILLION UNITS)

TABLE 73 ELECTROSTATIC SPEAKER DRIVER, BY DEVICE TYPE, 2020–2025 (MILLION UNITS)

TABLE 74 ELECTROSTATIC SPEAKER DRIVER, BY DEVICE TYPE, 2017–2019 (USD MILLION)

TABLE 75 ELECTROSTATIC SPEAKER DRIVER, BY DEVICE TYPE, 2020–2025 (USD MILLION)

7.5 BALANCED ARMATURES

7.5.1 WIDELY USED IN IN-EAR HEADPHONES FOR PREMIUM SOUND EXPERIENCE

TABLE 76 BALANCED ARMATURE SPEAKER DRIVER MARKET, BY DEVICE TYPE, 2017–2029 (MILLION UNITS)

TABLE 77 BALANCED ARMATURE SPEAKER DRIVER, BY DEVICE TYPE, 2020–2025 (MILLION UNITS)

TABLE 78 BALANCED ARMATURE SPEAKER DRIVER, BY DEVICE TYPE, 2017–2019 (USD MILLION)

TABLE 79 BALANCED ARMATURE SPEAKER DRIVER, BY DEVICE TYPE, 2020–2025 (USD MILLION)

7.6 OTHERS

8 SPEAKER DRIVER MARKET, BY DRIVER SIZE (Page No. - 89)

8.1 INTRODUCTION

TABLE 80 MARKET, BY DRIVER SIZE, 2017–2019 (MILLION UNITS)

TABLE 81 MARKET, BY DRIVER SIZE, 2020–2025 (MILLION UNITS)

TABLE 82 MARKET, BY DRIVER SIZE, 2017–2019 (USD MILLION)

TABLE 83 MARKET, BY DRIVER SIZE, 2020–2025 (USD MILLION)

8.2 BELOW 20 MM

8.2.1 DRIVER UNITS IN THIS SIZE RANGE ARE MOSTLY USED FOR OUTDOOR APPLICATIONS

TABLE 84 BELOW 20 MM SPEAKER DRIVER MARKET, BY DEVICE TYPE, 2017–2019 (MILLION UNITS)

TABLE 85 BELOW 20 MM SPEAKER DRIVER, BY DEVICE TYPE, 2020–2025 (MILLION UNITS)

TABLE 86 BELOW 20 MM SPEAKER DRIVER, BY DEVICE TYPE, 2017–2019 (USD MILLION)

TABLE 87 BELOW 20 MM SPEAKER DRIVER, BY DEVICE TYPE, 2020–2025 (USD MILLION)

8.3 20–110 MM

8.3.1 DRIVER UNITS OF THIS DIAMETER SIZE ARE PRICED AT PREMIUM DUE TO THEIR LARGE SIZE

TABLE 88 20–110 MM SPEAKER DRIVER MARKET, BY DEVICE TYPE, 2017–2019 (MILLION UNITS)

TABLE 89 20–110 MM SPEAKER DRIVER, BY DEVICE TYPE, 2020–2025 (MILLION UNITS)

TABLE 90 20–110 MM SPEAKER DRIVER, BY DEVICE TYPE, 2017–2019 (USD MILLION)

TABLE 91 20–110 MM SPEAKER DRIVER, BY DEVICE TYPE, 2020–2025 (USD MILLION)

8.4 OTHERS

9 SPEAKER DRIVER MARKET, BY APPLICATION (Page No. - 96)

9.1 INTRODUCTION

TABLE 92 MARKET, BY APPLICATION, 2017–2019 (MILLION UNITS)

TABLE 93 MARKET, BY APPLICATION, 2020–2025 (MILLION UNITS)

TABLE 94 MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 95 MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

9.2 CONSUMER

9.2.1 HEALTHY GROWTH OF SMARTPHONE MARKET TO FUEL DEMAND FOR SPEAKER DRIVERS

TABLE 96 SPEAKER DRIVER MARKET FOR CONSUMER APPLICATION, BY DEVICE TYPE, 2017–2019 (MILLION UNITS)

TABLE 97 MARKET FOR CONSUMER APPLICATION, BY DEVICE TYPE, 2020–2025 (MILLION UNITS)

TABLE 98 MARKET FOR CONSUMER APPLICATION, BY DEVICE TYPE, 2017–2019 (USD MILLION)

TABLE 99 MARKET FOR CONSUMER APPLICATION, BY DEVICE TYPE, 2020–2025 (USD MILLION)

9.3 PROFESSIONAL/ENTERPRISE

9.3.1 GROWING POPULARITY OF HEADPHONES FOR CONTENT CREATION TO BOOST DEMAND FOR SPEAKER DRIVERS

TABLE 100 SPEAKER DRIVER MARKET FOR PROFESSIONAL APPLICATION, BY DEVICE TYPE, 2017–2019 (MILLION UNITS)

TABLE 101 MARKET FOR PROFESSIONAL APPLICATION, BY DEVICE TYPE, 2020–2025 (MILLION UNITS)

TABLE 102 MARKET FOR PROFESSIONAL APPLICATION, BY DEVICE TYPE, 2017–2019 (USD MILLION)

TABLE 103 MARKET FOR PROFESSIONAL APPLICATION, BY DEVICE TYPE, 2020–2025 (USD MILLION)

9.4 MEDICAL

9.4.1 ADVANCEMENTS IN HEARING AID TECHNOLOGY TO INCREASE DEMAND FOR SPEAKER DRIVERS

9.5 OTHERS

10 SPEAKER DRIVER MARKET, BY REGION (Page No. - 105)

10.1 INTRODUCTION

FIGURE 19 MARKET: GEOGRAPHIC SNAPSHOT

TABLE 104 MARKET, BY REGION, 2017–2019 (MILLION UNITS)

TABLE 105 MARKET, BY REGION, 2020–2025 (MILLION UNITS)

TABLE 106 MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 107 MARKET, BY REGION, 2020–2025 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 20 SNAPSHOT OF SPEAKER DRIVER MARKET IN NORTH AMERICA

TABLE 108 NORTH AMERICA MARKET, BY DEVICE TYPE, 2017–2019 (MILLION UNITS)

TABLE 109 NORTH AMERICA MARKET, BY DEVICE TYPE, 2020–2025 (MILLION UNITS)

TABLE 110 NORTH AMERICA MARKET, BY DEVICE TYPE, 2017–2019 (USD MILLION)

TABLE 111 NORTH AMERICA SPEAKER DRIVER, BY DEVICE TYPE, 2020–2025 (USD MILLION)

TABLE 112 NORTH AMERICA SPEAKER DRIVER, BY COUNTRY, 2017–2019 (MILLION UNITS)

TABLE 113 NORTH AMERICA SPEAKER DRIVER, BY COUNTRY, 2020–2025 (MILLION UNITS)

TABLE 114 NORTH AMERICA SPEAKER DRIVER, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 115 NORTH AMERICA SPEAKER DRIVER, BY COUNTRY, 2020–2025 (USD MILLION)

10.2.1 US

10.2.1.1 High demand for speaker drivers owing to large presence of major brands in the US

10.2.2 CANADA

10.2.2.1 Growing trend of audio and video streaming services

10.2.3 MEXICO

10.2.3.1 Growing internet penetration to fuel growth of speaker drivers

10.3 ASIA PACIFIC

FIGURE 21 SNAPSHOT OF SPEAKER DRIVER MARKET IN APAC

TABLE 116 APAC MARKET, BY DEVICE TYPE, 2017–2019 (MILLION UNITS)

TABLE 117 APAC MARKET, BY DEVICE TYPE, 2020–2025 (MILLION UNITS)

TABLE 118 APAC MARKET, BY DEVICE TYPE, 2017–2019 (USD MILLION)

TABLE 119 APAC MARKET, BY DEVICE TYPE, 2020–2025 (USD MILLION)

TABLE 120 APAC SPEAKER DRIVER MARKET, BY COUNTRY, 2017–2019 (MILLION UNITS)

TABLE 121 APAC SPEAKER DRIVER, BY COUNTRY, 2020–2025 (MILLION UNITS)

TABLE 122 APAC SPEAKER DRIVER, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 123 APAC SPEAKER DRIVER, BY COUNTRY, 2020–2025 (USD MILLION)

10.3.1 CHINA

10.3.1.1 High demand for speaker driver units owing to fierce global competition in smartphone market

10.3.2 JAPAN

10.3.2.1 Presence of major players such as Panasonic and Sony

10.3.3 SOUTH KOREA

10.3.3.1 Increasing product launches by key players to boost market growth

10.3.4 REST OF APAC

10.4 EUROPE

FIGURE 22 SNAPSHOT OF SPEAKER DRIVER MARKET IN EUROPE

TABLE 124 EUROPE MARKET, BY DEVICE TYPE, 2017–2019 (MILLION UNITS)

TABLE 125 EUROPE MARKET, BY DEVICE TYPE, 2020–2025 (MILLION UNITS)

TABLE 126 EUROPE MARKET, BY DEVICE TYPE, 2017–2019 (USD MILLION)

TABLE 127 EUROPE SPEAKER DRIVER MARKET, BY DEVICE TYPE, 2020–2025 (USD MILLION)

TABLE 128 EUROPE SPEAKER DRIVER, BY COUNTRY, 2017–2019 (MILLION UNITS)

TABLE 129 EUROPE SPEAKER DRIVER, BY COUNTRY, 2020–2025 (MILLION UNITS)

TABLE 130 EUROPE SPEAKER DRIVER, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 131 EUROPE SPEAKER DRIVER, BY COUNTRY, 2020–2025 (USD MILLION)

10.4.1 UK

10.4.1.1 High demand for speaker drivers from leading headphone/earphone brands

10.4.2 GERMANY

10.4.2.1 High focus on expansion of portfolios to increase demand for speaker drivers

10.4.3 FRANCE

10.4.3.1 New developments to target audiophiles to fuel demand for speaker drivers

10.4.4 RUSSIA

10.4.4.1 Large presence of mobile phone companies

10.4.5 REST OF EUROPE

10.5 ROW

TABLE 132 ROW SPEAKER DRIVER MARKET, BY DEVICE TYPE, 2017–2019 (MILLION UNITS)

TABLE 133 ROW MARKET, BY DEVICE TYPE, 2020–2025 (MILLION UNITS)

TABLE 134 ROW MARKET, BY DEVICE TYPE, 2017–2019 (USD MILLION)

TABLE 135 ROW MARKET, BY DEVICE TYPE, 2020–2025 (USD MILLION)

TABLE 136 ROW SPEAKER DRIVER, BY REGION, 2017–2019 (MILLION UNITS)

TABLE 137 ROW SPEAKER DRIVER, BY REGION, 2020–2025 (MILLION UNITS)

TABLE 138 ROW SPEAKER DRIVER, BY REGION, 2017–2019 (USD MILLION)

TABLE 139 ROW SPEAKER DRIVER, BY REGION, 2020–2025 (USD MILLION)

10.5.1 MEA

10.5.1.1 Increasing sale of speaker drivers with growing demand for smartphones

10.5.2 SOUTH AMERICA

10.5.2.1 Increasing penetration of 4G and 5G rollout to surge smartphone manufacturing and demand for speaker drivers

11 COMPETITIVE LANDSCAPE (Page No. - 126)

11.1 INTRODUCTION

FIGURE 23 KEY GROWTH STRATEGIES ADOPTED BY TOP COMPANIES FROM 2017 TO 2020

11.2 MARKET RANKING ANALYSIS: SPEAKER DRIVER MARKET

FIGURE 24 MARKET RANKING OF TOP 5 PLAYERS IN MARKET, 2019

11.3 MARKET SHARE ANALYSIS

11.4 COMPANY EVALUATION QUADRANT

11.4.1 STAR

11.4.2 PERVASIVE

11.4.3 EMERGING LEADER

11.4.4 PARTICIPANT

FIGURE 25 SPEAKER DRIVER MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2019

11.5 STARTUP/SME EVALUATION MATRIX, 2020

11.5.1 PROGRESSIVE COMPANIES

11.5.2 RESPONSIVE COMPANIES

11.5.3 DYNAMIC COMPANIES

11.5.4 STARTING BLOCKS

FIGURE 31 STARTUP/SME VALUATION MATRIX, 2020

11.6 COMPANY EVALUATION QUADRANT – PRODUCT FOOTPRINT

11.6.1 COMPANY FOOTPRINT, BY PRODUCT TYPE

11.6.2 COMPANY FOOTPRINT, BY APPLICATION

11.6.3 COMPANY FOOTPRINT, BY REGION

11.6.4 TOTAL SCORE

11.7 COMPETITIVE SCENARIO

11.7.1 PRODUCT LAUNCHES

TABLE 140 PRODUCT LAUNCHES, 2017–2020

11.7.2 PARTNERSHIPS, EXPANSION, AND JOINT VENTURES

TABLE 141 PARTNERSHIPS, EXPANSION, AND JOINT VENTURES, 2017–2020

11.8 MARKET EVALUATION FRAMEWORK

12 COMPANY PROFILES (Page No. - 142)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, Right to win, and MnM View)*

12.1 KEY PLAYERS

12.1.1 SENNHEISER ELECTRONIC GMBH & CO. KG

FIGURE 32 SENNHEISER ELECTRONIC GMBH & CO. KG: COMPANY SNAPSHOT

12.1.2 SAMSUNG ELECTRONICS

FIGURE 33 SAMSUNG ELECTRONICS: COMPANY SNAPSHOT

12.1.3 SONY CORPORATION

FIGURE 34 SONY CORPORATION: COMPANY SNAPSHOT

12.1.4 KNOWLES ELECTRONICS

FIGURE 35 KNOWLES ELECTRONICS: COMPANY SNAPSHOT

12.1.5 GOERTEK

FIGURE 36 GOERTEK INC.: COMPANY SNAPSHOT

12.1.6 BEYERDYNAMIC GMBH & CO. KG

12.1.7 FOSTEX INTERNATIONAL

FIGURE 37 FOSTEX INTERNATIONAL: COMPANY SNAPSHOT

12.1.8 MERRY ELECTRONICS CO., LTD.

FIGURE 38 MERRY ELECTRONICS CO., LTD.: COMPANY SNAPSHOT

12.1.9 CONCRAFT HOLDING CO., LTD

FIGURE 39 CONCRAFT HOLDING CO., LTD: COMPANY SNAPSHOT

12.1.10 EASTECH

FIGURE 40 EASTECH: COMPANY SNAPSHOT

12.2 OTHER PLAYERS

12.2.1 VOZ ELECTRONIC CO., LTD

12.2.2 FORTUNE GRAND TECHNOLOGY INC.

12.2.3 TYMPHANY

12.2.4 PREMIUM SOUND SOLUTIONS

12.2.5 OLE WOLFF

12.2.6 AAC TECHNOLOGIES

12.2.7 1MORE

12.2.8 SONION

12.2.9 BELLSING

12.2.10 MOLEX

12.2.11 AUDEZE LLC

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, Right to win, and MnM View might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 174)

13.1 INSIGHTS OF INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 AUTHOR DETAILS

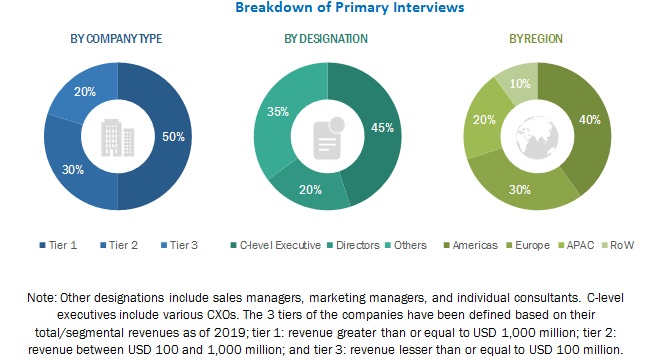

This research study involves extensive use of secondary sources, directories, and databases, such as Hoovers, BusinessWeek, OneSource, and Factiva, to identify and collect information useful for this technical, market-oriented, and commercial study of the Speaker Driver market. Primary respondents, including experts from core and related industries, preferred suppliers, and service providers, have been interviewed to obtain and verify critical qualitative and quantitative information, as well as to assess the market’s prospects. The key market players have been identified through secondary research, and their market ranking has been determined through primary and secondary research. The research also includes the study of the annual reports of top market players and interviews of key opinion leaders such as CEOs, directors, and marketing personnel.

Secondary Research

In the secondary research process, various secondary sources were referred to for the identification and collection of relevant information for this study on the Speaker Driver market. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers; journals and certified publications; and articles by recognized authors, websites, directories, and databases. Secondary research was conducted to obtain the key information regarding the supply chain and value chain of the industry, the total pool of key players, the market segmentation according to industry trends the geographic markets, and the key developments from the market. Secondary data was collected and analyzed to arrive at the overall size of the market that was further validated by primary research.

Primary Research

Extensive primary research has been conducted after acquiring knowledge about the global Speaker Driver market scenario through secondary research. Several primary interviews have been conducted with market experts from both demand (Device manufacturers) and supply (Speaker Driver Providers) sides across four major regions: North America, Europe, APAC, and RoW (South America, the Middle East, and Africa). This primary data has been collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

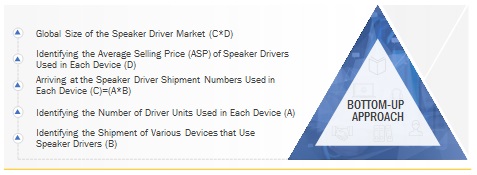

Market Size Estimation

Top-down and bottom-up approaches were implemented to estimate and validate the total size of the Speaker Driver market. These methods were used extensively to estimate the size of the market based on various segments and subsegments. The research methodology used to estimate the market size included the following steps:

In the top-down approach, the overall market size has been used to estimate the size of the individual markets (mentioned in the market segmentation) through percentage splits from secondary and primary research. In the bottom-up procedure, the shipments of devices that employ speaker drivers have been identified along with the number of speaker driver units that are integrated into each of these devices. The ASPs of each device have been multiplied with the above arrived figures. With the data triangulation procedure and validation of data through primaries, the overall parent market size and each individual market size have been determined and confirmed in this study. The data triangulation procedure implemented for this study has been explained.

Global Speaker Driver Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from the demand and supply sides across different applications.

Report Objectives

- To define, describe, and forecast the speaker driver market on the basis of device type, size, driver type, application, and geography.

- To forecast the market size in terms of value for various segments with respect to four main regions, namely, North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze the opportunities in the market for various stakeholders by identifying the high-growth segments

- To strategically profile the key players, comprehensively analyze their market position in terms of ranking and core competencies1, and provide the competitive landscape of the market

- To analyze competitive developments such as new product launches and developments, agreements and contracts, mergers and acquisitions, and expansion in the speaker driver market.

Available Customizations:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of APAC Speaker Driver market.

- Further breakdown of the RoW Speaker Driver market at the country level.

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Speaker Driver Market