Sovereign Cloud Market - Global Forecast to 2029

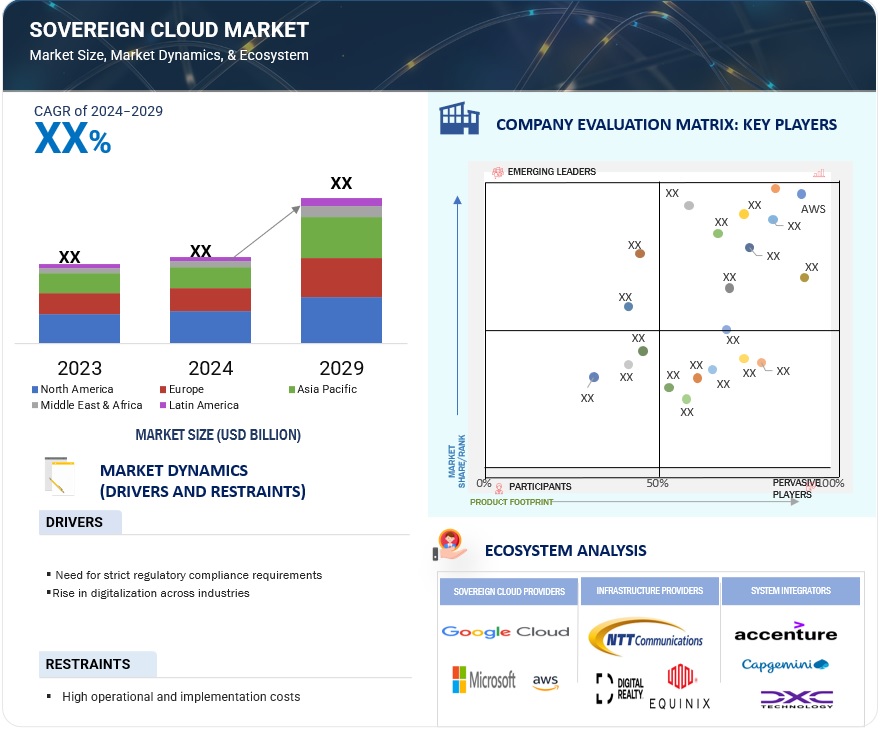

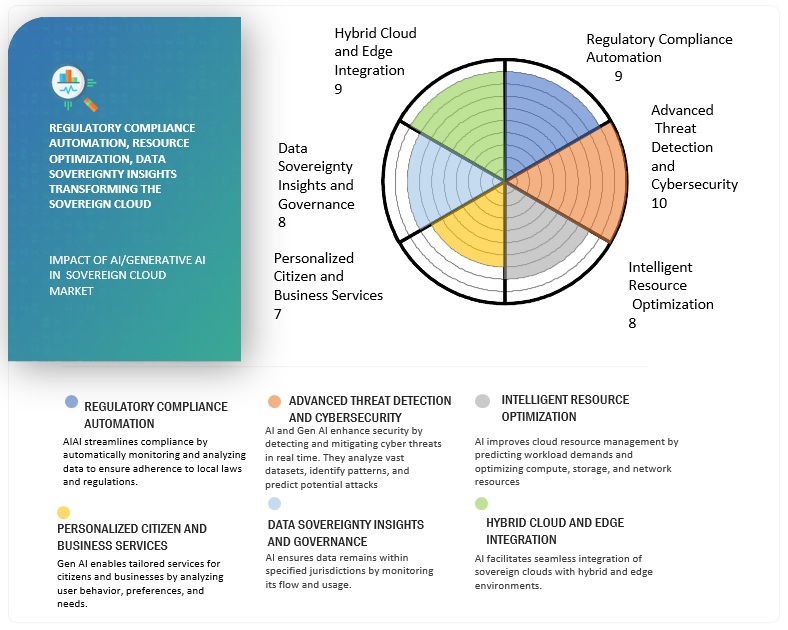

The sovereign cloud market will grow from USD xx billion in 2024 to USD xx billion by 2029 at a compounded annual growth rate (CAGR) of xx% during the forecast period. The growth of the sovereign cloud market is driven by rising privacy, legal, and data security risks. Scalability and cost-effectiveness were the key concepts when cloud services first emerged, according to major international hyperscalers such as AWS, Microsoft, and Google. However, the need for cloud services that comply with data privacy laws grew as these laws became more stringent, such as the GDPR in the European Union and comparable national laws in other nations. The resulting sovereign cloud solution complies with all relevant local regulations because the data is stored within a clearly defined geographic border.

In the mid-2010s, as both businesses and governments began to want greater control over their data, this began to develop significantly. Numerous nations in Asia and Europe established data sovereignty laws requiring that data centers be set up within national borders. During this period, cloud service providers began to scale their operations based on the demands of regulations and often did so through localized partnerships or joint ventures. Businesses and governments started realizing the benefits of safe and legal cloud environments such as government, healthcare, and finance, in the late 2010s and early 2020s. This led to local players expanding their sovereign clouds besides the cloud giants. As cloud computing is increasingly used for critical infrastructure, national security, and data breaches are the main drivers of the sovereign cloud rather than regulatory compliance. As more and more businesses embrace sovereign cloud solutions, the trend of public and private sector investments continues.

To know about the assumptions considered for the study, Request for Free Sample Report

Sovereign Cloud Market Dynamics

Driver: Need for strict regulatory compliance requirements

Higher regulatory compliance requirements drive the growth of the sovereign cloud market as governments and industries increasingly mandate localized data storage and processing to ensure compliance with national laws and privacy standards. Sovereign clouds provide a secure, jurisdiction-specific environment that guarantees data residency, aligns with industry-specific regulations such as GDPR, and meets the stringent demands of sectors such as finance, healthcare, and defense. These solutions help organizations sidestep non-compliance risks, penalties, and data governance needs in highly regulated markets by alleviating rising concerns surrounding cross-border data transfer and the potential access of foreign governments to data. In increasingly more complex global regulatory environments, sovereignty is increasingly used to build the trust and control needed to create, maintain, and sustain regulatory compliance.

Restraint: Growing concerns about data privacy of sensitive consumer information

The implementation and operational costs of adopting sovereign cloud are impacting the mass adoption of sovereign cloud solutions. Establishing and running sovereign cloud infrastructures entails a significant investment in specialized data centers, highly advanced security protocols, and measures to comply with local regulations. Further increasing costs are the operational expenses in the form of localized IT resources management and stringent regulatory compliance. Such costs are prohibitive for small entities and developing markets, consequently not providing the much-needed opportunity to leverage sovereign cloud solutions. Even going by itself, it is sufficient to make integration with present IT environments quite complicated and require competent personnel to implement all that, which can prove quite costly- an essential challenge for general usage. This is challenging for over-stretched organizations with limited budgets and businesses within less mature cloud markets.

Opportunity: Rising adoption of hybrid cloud models

Adopting hybrid cloud models offers the sovereign cloud market massive growth opportunities as organizations seek solutions that balance scalability, flexibility, and compliance. Hybrid cloud environments, which leverage the best features of public and private clouds, enable businesses to optimize workloads by keeping sensitive and compliance-critical data in a secure, sovereign environment while leveraging public cloud resources for less sensitive tasks. These clouds focus on sovereign data, localized residency, regulatory compliance, and added security measures, which are highly context-specific depending on jurisdiction. One would expect strict data sovereignty and governance in the highly regulated industries of finance, health care, and government. Hybrid ecologies with sovereign clouds should be integrated into various organizations' systems. These ensure data security, mandates on compliance, and operational efficiency drive this market segment.

Challenge: Integration with the existing IT systems

One of the significant issues with adopting sovereign cloud is the integration challenges, as these specialized platforms often cannot be aligned with an existing IT infrastructure. Many organizations work in complex hybrid environments, integrating legacy systems, public cloud services, and on-premises solutions. The customization involved in integrating sovereign clouds with such ecosystems is high to ensure interoperability and operations continuity. Besides this, variations in data format, API, and compliance frameworks present added complexities to the processes, giving rise to extra implementation costs and additional time duration. Technical restrictions may impede companies' adoption of sovereign clouds without adequate information technology infrastructure and expertise. Thus, seamless exchange of information, uniform behavior, compliance across systems, and overcoming integration issues remain on the same plane for sovereign clouds.

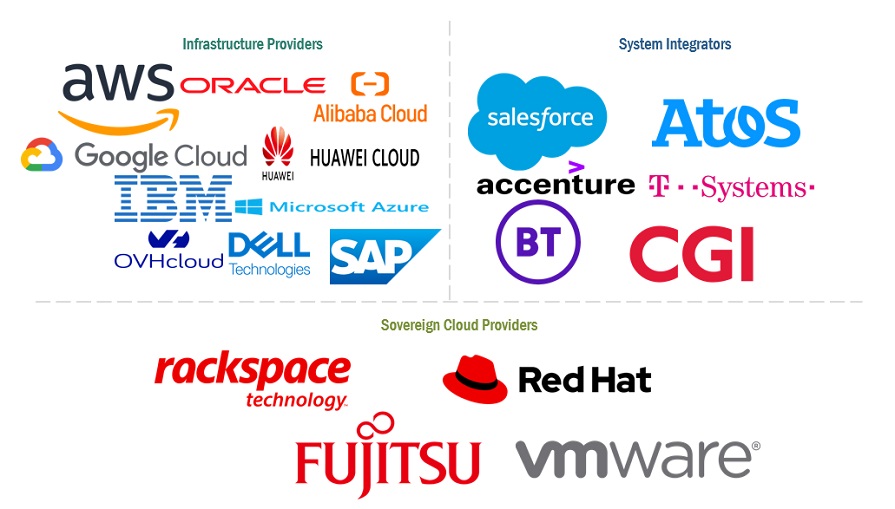

The Sovereign Cloud Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

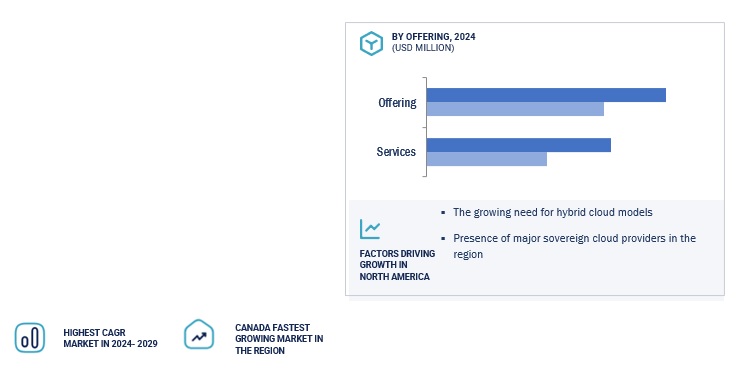

Based on the service model, the IaaS segment is expected to hold the largest market share in 2024.

Infrastructure as a Service is essential for the sovereign cloud. It helps organizations meet regulatory compliance and data security standards. Sovereign cloud IaaS ensures that data is preserved and handled within the country of origin while adhering to local norms and regulations such as CCPA in the US and GDPR in Europe. The sovereign cloud is especially important for government agencies, healthcare providers, and banks that handle sensitive information.

Leading providers such as Microsoft Azure, AWS, and Google Cloud have tailored IaaS offerings for sovereign clouds, establishing local data centers and collaborating with governments to meet regulatory requirements. Key features include secure access, keeping data within the country, and strong encryption.

Sovereign cloud IaaS also helps with digital transformation programs, allowing businesses to integrate current technologies such as ML and analytics while protecting sovereignty over their data. Furthermore, the advent of hybrid cloud solutions brings together sovereign cloud IaaS and on-premises systems, providing smooth operations and data localization.

Based on verticals, the BFSI vertical is expected to hold the largest market share in 2024.

Strong demand for strict data privacy, security, and regulatory compliance drives faster adoption of sovereign cloud solutions in the BFSI sector. The pressure on financial institutions to abide by the data residency laws is rising exponentially, especially in the EU region, which has implemented strict data protection measures under GDPR. Sovereign clouds ensure that the above institutions store and process data within the borders of specified jurisdictions, satisfying all regulatory compliances and securing their sensitive BFSI data. The BFSI companies look upon the sovereign clouds to enhance the security measures as the number of cyber-attacks has increased, from better data control and increased transparency on infrastructure usage. Another attractive model for hybrid clouds for the BFSI industry is that it enables the storage of sensitive data on private clouds and less sensitive operations on public clouds with great scalability. Therefore, in the BFSI sector, sovereign cloud adoption is compliant, secure, and scalable.

Based on the region, North America holds the largest market share during the forecast period.

North America's growing digital sovereignty concerns are increasingly driving sovereign cloud adoption. Organizations such as government agencies, financial institutions, and other sectors look to cloud models that assure control over data storage and processing and compliance with local regulations. This trend is motivated by a growing need to secure sensitive data from unauthorized external access, especially by foreign governments or multinational tech companies. The second focus area for businesses is data privacy and sovereignty. Due to the worldwide regulation frameworks, such as GDPR in Europe and data residency laws, North American companies are going for sovereign cloud solutions, mainly private and hybrid cloud models.

Key Market Players

The sovereign cloud market is dominated by a few globally established players such as Oracle (US), AWS (US), Microsoft (US), IBM (US), Alibaba Cloud (China), Huawei Cloud (US), SAP (US), Rackspace Technology (US), OVHcloud (France), Atos (France), T-Systems (Germany), VMware (US), among others, are the key vendors that secured sovereign cloud marketing last few years.

Recent Developments:

- In May 2024, AWS announced its plan to invest Euro 7.8 billion in the AWS Sovereign cloud in Germany till 2040 to meet Europe's digital sovereignty demand.

- In March 2024, Rackspace Technology launched the Rackspace UK Sovereign Services as part of its next-generation product set. The offering offers end-to-end, digitally sovereign cloud services for the UK public sector and other regulated industries.

- In November 2024, SAP announced the general availability of its Sovereign Cloud capabilities in the UK, which is a significant step for the company in fulfilling its commitment to providing secure, local cloud solutions tailored to the unique needs of public sector organizations, critical national infrastructure, and highly regulated industries.

- In November 2024, Atos announced the launch of the Atos Sovereign AI Platform to help public and private sector organizations set up optimized, on-premise infrastructure and provide end-to-end customized services for producing and maintaining AI and GenAI models. The new offering is part of the Sovereign AI portfolio within the Atos Group. It complements the existing BullSequana AI offering designed to help organizations address data sovereignty, privacy, and latency concerns.

- In September 2024, Indosat Ooredoo Hutchison partnered with Accenture to accelerate the development of a sovereign AI cloud platform to drive AI-driven digital transformation across Indonesia.

Frequently Asked Questions (FAQ):

What is a sovereign cloud?

What initiatives has the tech giant implemented to enhance the development of the Sovereign Cloud Market?

Which are the key vendors exploring sovereign cloud?

What is the total CAGR recorded for the sovereign cloud market from 2024 to 2029?

Who are vital clients adopting sovereign cloud?

Key clients adopting the sovereign cloud include: -

- Government and Public Sector

- Healthcare and Pharmaceutical Firms

- Telecommunications Companies

- Technology Companies

- Retail Companies

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Growth opportunities and latent adjacency in Sovereign Cloud Market