Solvent Evaporation Market by Evaporator Type (Rotary Evaporator, Nitrogen Blow Down Evaporator, Centrifugal Evaporator), End-User (Pharmaceutical & Biopharmaceutical, Diagnostic Laboratories, Research & Academic Institute), Region - Global Forecast to 2024

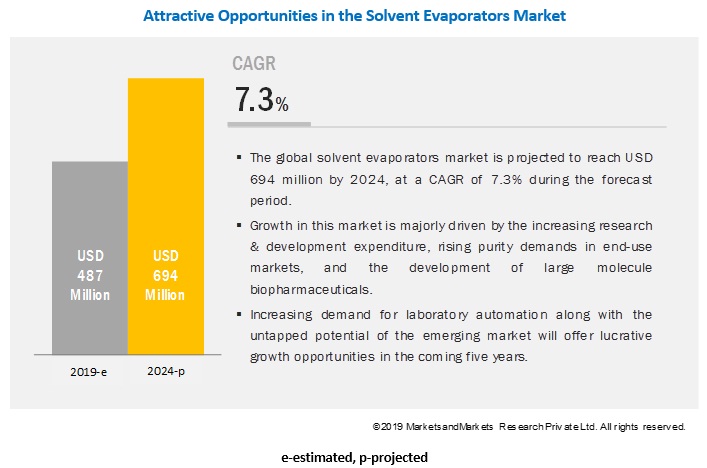

[138 Pages Report] The global solvent evaporation market size is projected to reach USD 694 million by 2024 from USD 487 million in 2019, at a CAGR of 7.3%. Growth in this market is driven majorly by the growth of the biologics sector, increasing research & development expenditure, rising purity demands in end-use markets, and the growing development of large molecule biopharmaceuticals.

The rotary evaporators segment is expected to account for the largest solvent evaporators market share in 2018

Rotary evaporators are expected to be the most significant revenue contributor to the global market in 2018. The large share of this segment can be attributed to the increasing demand for efficient & pure samples, growing investments in research & development by research institutes, rising demand for industrial-scale automation in terms of digitization, and the growing need for advanced analytical tools during drug diagnosis & research studies.

The research & academic institutes end-user segment is expected to grow at a high CAGR

The solvent evaporation market, by the end-user, includes pharmaceutical & biopharmaceutical industry, diagnostic laboratories, and research & academic institutes. The research & academic institutes segment is expected to grow at the highest CAGR during the forecast period due to factors such as the increasing drug development studies and the rising demand for continuous innovation and enhancement of existing products.

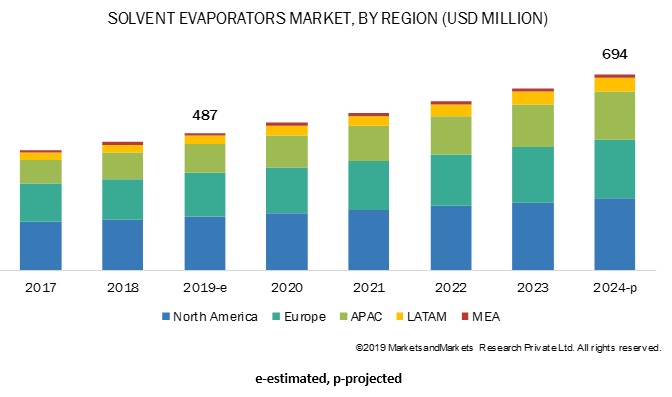

North America is expected to account for the largest share of the solvent evaporation market in 2018

The North American market accounted for the largest share of the solvent evaporators industry in 2018. This is attributed to the increase in life sciences R&D, rising focus on improving the safety & quality of healthcare, growing efforts to increase the output of the healthcare industry, growth in the biosimilars & generics market, rising demand for high-quality research tools for data reproducibility, and increasing focus on developing personalized therapeutics. The presence of a large number of global players in this region is another key factor contributing to the large share of this market segment.

Key Market Players

The prominent players in the global solvent evaporation market include Yamato Scientific Co., Ltd. (Japan), BÜCHI Labortechnik AG (Switzerland), Biotage AB (Sweden), Heidolph Instruments GmbH & CO. KG (Germany), Labconco Corporation (US), Porvair plc (UK), IKA Works GmbH & Co. KG (Germany), Steroglass Srl (Italy), Organomation Associates, Inc. (US), KNF Neuberger, Inc. (US), BioChromato, Inc. (Japan), Radleys (UK), LabTech S.r.l. (Italy), Abel Industries Canada Ltd. (Canada), DOÐA Limited (Turkey), ANPEL Laboratory Technologies Inc. (China), Asahi Glassplant Inc. (Japan), EYELA (Japan), Pope Scientific, Inc. (US), and SP Industries, Inc. (UK).

BÜCHI Labortechnik AG (Switzerland)

BÜCHI Labortechnik AG is a prominent player in the solvent evaporation market. The company has a strong geographic footprint, serving over 40,000 customers in pharmaceutical and biopharmaceutical companies. BÜCHI also has an extensive distribution channel across the globe. The company offers a variety of reliable solutions during the production of a new drug, from lead generation to final registration. The company’s major selling rotary evaporator models are Rotavapor R-300 and Rotavapor R-220 Pro.

Heidolph Instruments GmbH & CO. KG (Germany)

Heidolph Instruments GmbH & CO. KG is a leading provider of advanced rotary evaporators for drug manufacturing, biologics research and production, and laboratory testing. Heidolph’s key advantage over its competitors is that it leverages its industry scale in high-growth and emerging markets such as China and India. This can be reflected in its strong performance in these markets, which represented 20% of its total revenue in 2018.

Biotage AB (Sweden)

Biotage AB offers a wide range of nitrogen blowdown evaporators like TurboVap Evaporators and 96 Well Plate Evaporators. As a solvent evaporator manufacturer, the company provides integrated products with various technologies that span the whole pharmaceutical value chain. The major end-users of the company’s products include pharmaceutical and biotechnology companies, government research institutes, consumer and healthcare product manufacturers, formulators, and diagnostic laboratories. The company has a strong presence in the North American region. It has direct sales operations in India, where a lot of effort has been put into setting up and improving sales. In Europe, the company has strengthened its sales organization and established direct sales in the Benelux.

Scope of the Report:

|

Report Metric |

Details |

|

Market size available for years |

2017–2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2024 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Type, End-User, and Region |

|

Geographies covered |

North America, Europe, APAC, Latin America, and the Middle East & Africa |

|

Companies covered |

Yamato Scientific Co., Ltd. (Japan), BÜCHI Labortechnik AG (Switzerland), Biotage AB (Sweden), Heidolph Instruments GmbH & CO. KG (Germany), Labconco Corporation (US), Porvair plc (UK), IKA Works GmbH & Co. KG (Germany), Steroglass Srl (Italy), Organomation Associates, Inc. (US), KNF Neuberger, Inc. (US), BioChromato, Inc. (Japan), Radleys (UK), LabTech S.r.l. (Italy), Abel Industries Canada Ltd. (Canada), DOÐA Limited (Turkey), ANPEL Laboratory Technologies Inc. (China), Asahi Glassplant Inc. (Japan), EYELA (Japan), Pope Scientific, Inc. (US), and SP Industries, Inc. (UK) |

The research report categorizes the market into the following segments and subsegments:

By Type

- Rotary Evaporators

- Small Volume Rotary Evaporators

- Large Volume Rotary Evaporators

- Centrifugal Evaporators

- Nitrogen Blowdown Evaporators

- Spiral Air Flow Evaporators/ Smart Evaporators/ Intelligent Evaporators

By End-User

- Pharmaceutical and Biopharmaceutical Industry

- Diagnostic Laboratories

- Research and Academic Institutes

By Region

- North America

- US

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Rest of APAC

- Latin America

- Middle East & Africa

Recent Developments

- In June 2019, Yamato Scientific relocated its headquarters to Tokyo, Japan.

- In July 2019, Organomation Associates, Inc. partnered with BioChromato to provide a vacuum-assisted Smart Evaporator to customers in North America.

- In April 2018, Yamato Scientific opened its new R&D Center in Saitama Prefecture, Japan.

- In May 2017, Organomation Associates enhanced its MICROVAP product line with the addition of four new product offerings.

Critical questions the report answers:

- Where will all these developments take the industry in the medium to long-term?

- Which are the major types of products offered in solvent evaporators?

- Which geographies are likely to grow at the highest CAGR?

- What are the major end-users of the market?

- What are the different drivers & restraints of the market, and what will their impact be during the forecast period?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition & Scope

1.2.1 Markets Covered

1.2.2 Years Considered for the Study

1.3 Currency

1.4 Stakeholders

1.5 Limitations

2 Research Methodology (Page No. - 17)

2.1 Research Approach

2.1.1 Secondary Research

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Research

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.3 Data Triangulation Approach

2.4 Market Ranking Analysis

2.5 Assumptions for the Study

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 28)

4.1 Solvent Evaporators Market Overview

4.2 Asia Pacific: Market, By Type

4.3 Market: Geographic Growth Opportunities

4.4 Market, By Region (2017–2024)

4.5 Solvent Evaporation Market: Developed vs. Developing Markets

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing R&D Expenditure

5.2.1.2 Increasing Demand for Pure Samples in End-Use Markets

5.2.1.3 Growing Development of Large-Molecule Biopharmaceuticals

5.2.2 Restraints

5.2.2.1 High Manufacturing and Product Costs

5.2.3 Opportunities

5.2.3.1 Untapped Markets in Emerging Regions

5.2.3.2 Increasing Demand for Laboratory Automation

5.2.4 Challenges

5.2.4.1 Sample Loss Due to Solvent Bumping and Splashing

5.2.4.2 Dearth of A Skilled Workforce

5.2.4.3 Lack of Product Differentiation

6 Solvent Evaporation Market, By Type (Page No. - 38)

6.1 Introduction

6.2 Rotary Evaporators

6.2.1 Small-Volume Rotary Evaporators

6.2.1.1 Rising Healthcare Expenditure and Increasing Demand for Advanced Analytical Tools are Driving the Growth of This Market Segment

6.2.2 Large-Volume Rotary Evaporators

6.2.2.1 Availability of Technologically Advanced Equipment and the Growing Demand for Large-Volume Manufacturing are Expected to Boost Market Growth

6.3 Nitrogen Blowdown Evaporators

6.3.1 Advantages Like Fast and Safe Evaporation of Volatile Solvents Along With the Growing Need to Analyze Small-Volume Samples are Supporting Market Growth

6.4 Centrifugal Evaporators

6.4.1 Centrifugal Evaporators are Not Suitable for High Boiling Point Solvents

6.5 Spiral Air Flow Evaporators

6.5.1 Increasing Usage of High Boiling Point Liquids and Need for Higher Sample Yields During Drug Sample Analysis are Driving the Adoption of Spiral Air Flow Evaporators

7 Solvent Evaporation Market, By End User (Page No. - 52)

7.1 Introduction

7.2 Pharmaceutical & Biopharmaceutical Industry

7.2.1 Pharmaceutical & Biotechnology Industry Forms the Largest End-User Segment of the Solvent Evaporators Market

7.3 Research & Academic Institutes

7.3.1 Increasing Drug Development Studies and the Need for Improved Quality of Healthcare to Support Market Growth

7.4 Diagnostic Laboratories

7.4.1 Growing Number of Diagnostic Tests to Drive the Adoption of Solvent Evaporators Among Diagnostic Laboratories

8 Solvent Evaporation Market, By Region (Page No. - 59)

8.1 Introduction

8.2 North America

8.2.1 US

8.2.1.1 The US Dominates the North American Market

8.2.2 Canada

8.2.2.1 Strong Infrastructure and Availability of Funding for Biomedical Research Will Aid Market Growth

8.3 Europe

8.3.1 Germany

8.3.1.1 High Healthcare Expenditure and Increased Pharmaceutical Production to Support Market Growth

8.3.2 UK

8.3.2.1 Growing Awareness About Solvent Evaporators and the Need for Quality Manufacturing are Driving Market Growth

8.3.3 France

8.3.3.1 Government Support for Driving Research in Academia and Laboratories Will Further Boost Market Growth

8.3.4 Italy

8.3.4.1 The Healthcare System in Italy Promotes the Use of Solvent Evaporators in Academia and Research Laboratories

8.3.5 Spain

8.3.5.1 The Well-Established Network of Research and Academic Centers Forms an Ideal Environment for the Growth of the Solvent Evaporation Market in Spain

8.3.6 Rest of Europe

8.4 Asia Pacific

8.4.1 China

8.4.1.1 China Accounted for the Largest Share of the APAC Market in 2018

8.4.2 Japan

8.4.2.1 Growing Healthcare Quality Concerns to Drive the Demand for Solvent Evaporators

8.4.3 India

8.4.3.1 Growing Focus on Regulatory Requirements of Healthcare Products to Drive Market Growth

8.4.4 Rest of Asia Pacific

8.5 Latin America

8.5.1 Favorable Cost Structure and Government Investments to Drive Pharmaceutical Production in Latam

8.6 Middle East & Africa

8.6.1 Government Support to Boost the Local Production of Drugs in the Coming Years is Expected to Drive Market Growth

9 Competitive Landscape (Page No. - 99)

9.1 Overview

9.2 Market Ranking Analysis

9.3 Competitive Leadership Mapping

9.3.1 Visionary Leaders

9.3.2 Innovators

9.3.3 Dynamic Differentiators

9.3.4 Emerging Companies

9.4 Competitive Situation and Trends

9.4.1 Product Launches

9.4.2 Expansions

9.4.3 Acquisitions

9.4.4 Other Strategies

10 Company Profiles (Page No. - 106)

10.1 Büchi Labortechnik Ag

10.2 Biotage AB

10.3 Labconco Corporation

10.4 Heidolph Instruments GmbH & Co. KG

10.5 Yamato Scientific Co., Ltd.

10.6 Porvair PLC

10.7 IKA Works GmbH & Co. KG

10.8 Steroglass Srl

10.9 Organomation Associates, Inc.

10.10 KNF Neuberger, Inc.

10.11 Biochromato, Inc.

10.12 Radleys

10.13 Labtech S.R.L.

10.14 Pope Scientific, Inc.

10.15 SP Industries, Inc. (Genevac)

10.16 Other Major Companies

11 Appendix (Page No. - 130)

11.1 Insights of Industry Experts

11.2 Discussion Guide

11.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

11.4 Available Customizations

11.5 Related Reports

11.6 Author Details

List of Tables (77 Tables)

Table 1 Solvent Evaporation Market, By Type, 2017–2024 (USD Million)

Table 2 Market, By Country, 2017–2024 (USD Million)

Table 3 Rotary Evaporators Market, By Type, 2017–2024 (USD Million)

Table 4 Rotary Evaporators Market, By Country, 2017–2024 (USD Million)

Table 5 Small-Volume Rotary Evaporators Offered By Major Players

Table 6 Small-Volume Rotary Evaporators Market, By Country, 2017–2024 (USD Million)

Table 7 Large-Volume Rotary Evaporators Offered By Major Players

Table 8 Large-Volume Rotary Evaporators Market, By Country, 2017–2024 (USD Million)

Table 9 Nitrogen Blowdown Evaporators Offered By Major Players

Table 10 Nitrogen Blowdown Evaporators Market, By Country, 2017–2024 (USD Million)

Table 11 Centrifugal Evaporators Offered By Major Players

Table 12 Centrifugal Evaporators Market, By Country, 2017–2024 (USD Million)

Table 13 Spiral Air Flow Evaporators Offered By Major Players

Table 14 Spiral Air Flow Evaporators Market, By Country, 2017–2024 (USD Million)

Table 15 Solvent Evaporators Market, By End User, 2017–2024 (USD Million)

Table 16 Market for Pharmaceutical & Biopharmaceutical Industry, By Country, 2017–2024 (USD Million)

Table 17 Market for Research & Academic Institutes, By Country, 2017–2024 (USD Million)

Table 18 Solvent Evaporation Market for Diagnostic Laboratories, By Country, 2017–2024 (USD Million)

Table 19 Market, By Region, 2017–2024 (USD Million)

Table 20 North America: Solvent Evaporation Market, By Country, 2017–2024 (USD Million)

Table 21 North America: Market, By Type, 2017–2024 (USD Million)

Table 22 North America: Rotary Evaporators Market, By Type, 2017–2024 (USD Million)

Table 23 North America: Solvent Evaporators Market, By End User, 2017–2024 (USD Million)

Table 24 US: Market, By Type, 2017–2024 (USD Million)

Table 25 US: Rotary Evaporators Market, By Type, 2017–2024 (USD Million)

Table 26 US: Market, By End User, 2017–2024 (USD Million)

Table 27 Canada: Market, By Type, 2017–2024 (USD Million)

Table 28 Canada: Rotary Evaporators Market, By Type, 2017–2024 (USD Million)

Table 29 Canada: Market, By End User, 2017–2024 (USD Million)

Table 30 Europe: Solvent Evaporation Market, By Country, 2017–2024 (USD Million)

Table 31 Europe: Solvent Evaporators Market, By Type, 2017–2024 (USD Million)

Table 32 Europe: Rotary Evaporators Market, By Type, 2017–2024 (USD Million)

Table 33 Europe: Market, By End User, 2017–2024 (USD Million)

Table 34 Germany: Market, By Type, 2017–2024 (USD Million)

Table 35 Germany: Rotary Evaporators Market, By Type, 2017–2024 (USD Million)

Table 36 Germany: Market, By End User, 2017–2024 (USD Million)

Table 37 UK: Market, By Type, 2017–2024 (USD Million)

Table 38 UK: Rotary Evaporators Market, By Type, 2017–2024 (USD Million)

Table 39 UK: Market, By End User, 2017–2024 (USD Million)

Table 40 France: Market, By Type, 2017–2024 (USD Million)

Table 41 France: Rotary Evaporators Market, By Type, 2017–2024 (USD Million)

Table 42 France: Market, By End User, 2017–2024 (USD Million)

Table 43 Italy: Market, By Type, 2017–2024 (USD Million)

Table 44 Italy: Rotary Evaporators Market, By Type, 2017–2024 (USD Million)

Table 45 Italy: Market, By End User, 2017–2024 (USD Million)

Table 46 Spain: Solvent Evaporation Market, By Type, 2017–2024 (USD Million)

Table 47 Spain: Rotary Evaporators Market, By Type, 2017–2024 (USD Million)

Table 48 Spain: Solvent Evaporators Market, By End User, 2017–2024 (USD Million)

Table 49 RoE: Market, By Type, 2017–2024 (USD Million)

Table 50 RoE: Rotary Evaporators Market, By Type, 2017–2024 (USD Million)

Table 51 RoE: Solvent Evaporation Market, By End User, 2017–2024 (USD Million)

Table 52 Asia Pacific: Market, By Country, 2017–2024 (USD Million)

Table 53 Asia Pacific: Market, By Type, 2017–2024 (USD Million)

Table 54 Asia Pacific: Rotary Evaporators Market, By Type, 2017–2024 (USD Million)

Table 55 Asia Pacific: Market, By End User, 2017–2024 (USD Million)

Table 56 China: Solvent Evaporation Market, By Type, 2017–2024 (USD Million)

Table 57 China: Rotary Evaporators Market, By Type, 2017–2024 (USD Million)

Table 58 China: Market, By End User, 2017–2024 (USD Million)

Table 59 Japan: Market, By Type, 2017–2024 (USD Million)

Table 60 Japan: Rotary Evaporators Market, By Type, 2017–2024 (USD Million)

Table 61 Japan: Market, By End User, 2017–2024 (USD Million)

Table 62 India: Market, By Type, 2017–2024 (USD Million)

Table 63 India: Rotary Evaporators Market, By Type, 2017–2024 (USD Million)

Table 64 India: Solvent Evaporation Market, By End User, 2017–2024 (USD Million)

Table 65 RoAPAC: Market, By Type, 2017–2024 (USD Million)

Table 66 RoAPAC: Rotary Evaporators Market, By Type, 2017–2024 (USD Million)

Table 67 RoAPAC: Market, By End User, 2017–2024 (USD Million)

Table 68 Latin America: Market, By Type, 2017–2024 (USD Million)

Table 69 Latin America: Rotary Evaporators Market, By Type, 2017–2024 (USD Million)

Table 70 Latin America: Market, By End User, 2017–2024 (USD Million)

Table 71 Middle East & Africa: Solvent Evaporators Market, By Type, 2017–2024 (USD Million)

Table 72 Middle East & Africa: Rotary Evaporators Market, By Type, 2017–2024 (USD Million)

Table 73 Middle East & Africa: Market, By End User, 2017–2024 (USD Million)

Table 74 Product Launches, 2017–2019

Table 75 Expansions, 2017–2019

Table 76 Acquisitions, 2017–2019

Table 77 Other Strategies, 2017–2019

List of Figures (26 Figures)

Figure 1 Research Design

Figure 2 Breakdown of Primary Interviews: By Company Type, Designations, and Region

Figure 3 Market Sizing Approach

Figure 4 Top-Down Approach

Figure 5 Data Triangulation Methodology

Figure 6 Market, By Type, 2019 vs. 2024 (USD Million)

Figure 7 Solvent Evaporation Market, By End User, 2019 vs. 2024 (USD Million)

Figure 8 Geographic Analysis: Market

Figure 9 Increasing R&D in the Pharmaceutical Industry is the Major Factor Driving Market Growth

Figure 10 Rotary Evaporators Accounted for the Largest Share of the APAC Market in 2018

Figure 11 China Registers the Highest Revenue Growth During the Forecast Period

Figure 12 North America Will Continue to Dominate the Market in 2024

Figure 13 Developing Markets to Register A Higher Growth Rate in the Forecast Period

Figure 14 Solvent Evaporators Market: Drivers, Restraints, Opportunities, and Challenges

Figure 15 Global Life Science R&D Spending (2016–2018)

Figure 16 Solvent Evaporation Market, By Type, 2019 vs. 2024 (USD Million)

Figure 17 Market, By End User, 2019 vs. 2024 (USD Million)

Figure 18 Market: Geographical Snapshot

Figure 19 North America: Market Snapshot

Figure 20 Europe: Market Snapshot

Figure 21 Asia Pacific: Market Snapshot

Figure 22 Key Growth Strategies Adopted By Market Players From January 2017 to October 2019

Figure 23 Market Ranking, By Key Player, 2018

Figure 24 Solvent Evaporation Market (Global) Competitive Leadership Mapping, 2018

Figure 25 Biotage AB: Company Snapshot (2018)

Figure 26 Porvair PLC: Company Snapshot (2018)

In this report, the global market for solvent evaporators was arrived at after the assessment of major product segments and their shares. For this purpose, the share of major product segments was determined through various insights gathered during primary and secondary research. The research process involved the study of multiple factors affecting the industry to identify segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

This research study involved the use of comprehensive secondary sources; directories; databases such as D&B Hoovers, Bloomberg Businessweek, and Factiva; white papers; annual reports; and companies’ house documents. Secondary research was used to identify and collect information for this extensive, technical, market-oriented, and commercial study of the global solvent evaporators market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, technology perspectives, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, manufacturing managers, and related key executives from various key companies and organizations operating in the global solvent evaporation market. The primary sources from the demand side included purchase & sales managers, research organizations, and pharmaceutical & biotechnology companies.

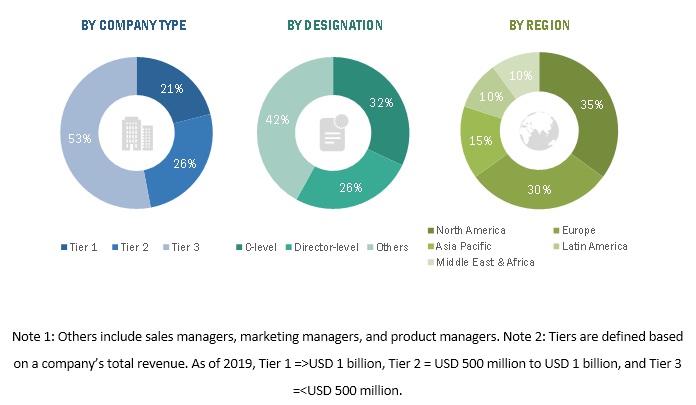

Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends & key market dynamics. A breakdown of the primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (segmental analysis of major segments) and top-down approach (assessment of utilization/adoption/penetration trends, by type, end-user, and region).

Data Triangulation

After arriving at the market size, the total market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments & subsegments, data triangulation, and market breakdown procedures were employed, wherever applicable.

Objectives of the Study

- To define, describe, and forecast the market by type, end user, and region

- To provide detailed information about the major factors influencing market growth (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments in North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile key players and comprehensively analyze their market shares and core competencies2 in the solvent evaporation market

- To track and analyze competitive developments such as partnerships, acquisitions, product enhancements, and geographical expansions in the solvent evaporators market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- A further breakdown of the Latin American solvent evaporation market into Brazil, Mexico, and other countries

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Solvent Evaporation Market