Sodium Hypophosphite Market by Function (Reducing Agents, Catalysts & Stabilizers, Chemical Intermediates), Application (Electroplating, Water Treatment, Chemicals & Pharmaceuticals), Grade (Electrical, Industrial), and Region - Global Forecast to 2025

Sodium Hypophosphite Market

Sodium Hypophosphite Market Key Drivers, Restraints & Challenges:

Sodium hypophosphite is the sodium salt of hypophophorous acid and is often encountered as the monohydrate. It is an odorless white crystal, remains solid at room temperature, soluble in water, and easily absorbs moisture from the air. The global sodium hypophosphite market is expected to grow owning to its increased demand from various end use industries such as automotive, and aerospace & defense.

Key Drivers:

- Expansion of the electronics and automotive sectors in the Asia Pacific region

- Rise in demand for water treatment in industrial applications

Key Restraint & Challenge:

- Rise in the price of phosphorous rocks owning to scarcity in supply

- Availability of alternatives in the market

Grades of Sodium Hypophosphite :

Sodium hypophosphite has been gaining widespread acceptance across various industrial applications owning to its multifunctional properties. It is renowned for its application as a reducing agent in electroless nickel plating which makes it an ideal product to be used in the automotive, electronics, and chemical industries. It holds high growth prospects in the Asia Pacific region owning to the expansion of the industrial sector.

- Electrical

- Industrial

- Others

Top 10 players in sodium hypophosphite industry:

The competitive landscape provides an overview of the relative market position of the key players operating in the sodium hypophosphite market, based on the strength of their project offerings and business strategies, analyzed based on a proprietary model. Key players in the market have majorly adopted strategies such as new product launches, agreements, collaborations, and joint ventures, expansions, and acquisitions. Some of the major players in the market are:

- Arkema

- Solvay

- Nippon chemical Industrial Co Ltd

- Stigma-Aldrich

- Hubei Xingfa Chemicals group Co Ltd

- Changshu New-Tech Chemicals Co Ltd

- Jiangxi Fuerxin Medicine Chemical Co Ltd

- Jiangsu Kangxiang Industrial Group Co Ltd

- Hubei Lianxing Chemical Co Ltd

- Jiangsu Dan AI Chemical Co Ltd

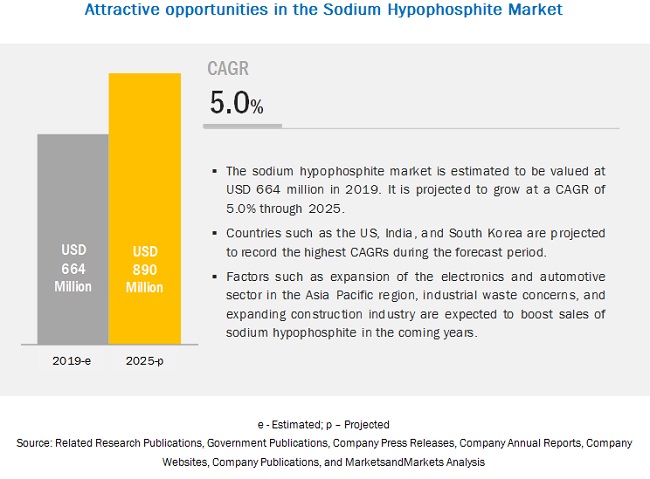

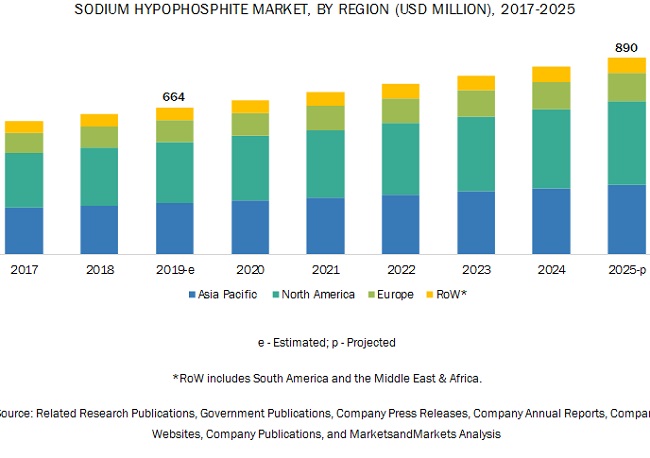

[130 Pages Report] The sodium hypophosphite market is estimated to be valued at USD 664 million in 2019 and is projected to grow at a CAGR of 5.0% from 2019, to reach a value of USD 890 million by 2025. Increasing demand from various end-use industries such as automotive, aviation, electronics, and construction is expected to drive this market in the coming years.

Massive transformation in the industrial sector has made Asia Pacific a high growth market for sodium hypophosphite manufacturers. The region consists of populated countries such as China and India that have witnessed development in the electronics and automotive industries where hypophosphite finds widespread applications.

By function, the reducing agent segment is projected to dominate the sodium hypophosphite market during the forecast period.

Sodium hypophosphite is used as a reducing agent, catalyst & stabilizer, and chemical intermediate. Sodium hypophosphite acts as a reducing agent for electroless nickel plating application, which finds its usage in the electronics and automotive industry. These industries are booming in the emerging economies of Asia Pacific, South America, and the Middle East and African regions. In water treatment as well, sodium hypophosphite, acts as a reducing agent, to reduce the metal ion content in industrial waste before being discharged in water.

By grade, the electrical segment is projected to dominate the sodium hypophosphite market during the forecast period.

Sodium hypophosphite in its electrical grade is used for electroless nickel plating. Electroless nickel plating is gaining widespread acceptance in the automotive and electronics industry. These industries are expanding at a high pace in the Asia Pacific region owing to urbanization, creating growth opportunities for sodium hypophosphite manufacturers in the coming years.

Rising demand for water treatment in industrial applications is projected to drive the sodium hypophosphite market in Asia Pacific.

The growing industrialization has increased the amount of waste discharged in water bodies. Additionally, unregulated discharge of industrial and domestic contaminants into water bodies causes health problems in human beings and the destruction of aquatic life, thereby necessitating the use of water treatment chemicals. The polluted water further affects the use of water for drinking, recreation, household needs, transportation, and commerce.

Metals are one of the most common pollutants in wastewater. Humans can be exposed to these metals, which can cause health issues such as dysfunction of the kidney, liver, reproduction system, and central nervous system. Thus, the discharge of such wastewater needs to be controlled and monitored. Sodium hypophosphite is an effective reducing agent for the recovery of Ni, Cu, and Fe as per the study, The removal of Ni, Cu & Fe from a Mixed Metal System using Sodium Hypophosphite as a Reducing Agent by Promise Sethembiso Ngema, Freeman Ntuli, and Mohamed Belaid. Thus, sodium hypophosphite holds high-growth prospects in the coming years in water treatment applications.

Key Market Players

The key players in global sodium hypophosphite market include Arkema (France), Solvay S.A. (Belgium), Nippon Chemical Industrial Co., Ltd. (Japan), Sigma-Aldrich (US), Hubei Xingfa Chemicals Group Co., Ltd. (China), Changshu New-Tech Chemicals Co., Ltd. (China), Jiangxi Fuerxin Medicine Chemical Co., Ltd. (China), Jiangsu Kangxiang Industrial Group Co., Ltd. (China), Hubei Lianxing Chemical Co., Ltd. (China), Jiangsu Danai Chemical Co., Ltd. (China), Hubei Sky Lake Chemical Co., Ltd. (China), and Huanggang Quanwang Chemical Co., Ltd. (China).

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2017-2025 |

|

Base year considered |

2018 |

|

Forecast period |

2019-2025 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

Function, Grade, Application, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, and Rest of World (RoW) |

|

Companies covered |

Arkema (France), Solvay S.A. (Belgium), Nippon Chemical Industrial Co., Ltd. (Japan), Sigma-Aldrich (US), Hubei Xingfa Chemicals Group Co., Ltd. (China), Changshu New-Tech Chemicals Co., Ltd. (China), Jiangxi Fuerxin Medicine Chemical Co., Ltd. (China), Jiangsu Kangxiang Industrial Group Co., Ltd. (China), Hubei Lianxing Chemical Co., Ltd. (China), Jiangsu Danai Chemical Co., Ltd. (China), Hubei Sky Lake Chemical Co., Ltd. (China), and Huanggang Quanwang Chemical Co., Ltd. (China). |

This research report categorizes the sodium hypophosphite market based on function, grade, application, and region.

Based on Function, the market has been segmented as follows:

- Reducing agents

- Catalysts & stabilizers

- Chemical intermediates

- Others (food additives and flame-retardants)

Based on Grade, the market has been segmented as follows

- Electrical

- Industrial

- Others (agriculture and food)

Based on Application, the market has been segmented as follows

- Electroplating

- Water treatment

- Chemicals & pharmaceuticals

- Others (food and polymers)

Based on the Region, the market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- Rest of the World (RoW) (South America and the Middle East & Africa)

Key questions addressed by the report

- What are the new application areas the sodium hypophosphite companies are exploring?

- Which are the key players in the sodium hypophosphite market and how intense is the competition?

- What kind of competitors and stakeholders, such as electronics and automotive companies, would be interested in this market? What will be their go-to-market strategy, and which emerging market will be of significant interest?

- How are the current R&D activities and M&As in the sodium hypophosphite market projected to create a disrupting environment in the coming years?

- What will be the level of impact, on the revenues of stakeholders, of the benefits of sodium hypophosphite to different stakeholders‒‒from rising revenue, environmental regulatory compliance, to sustainable profits for the suppliers?

Frequently Asked Questions (FAQ):

Is country-level analysis considered in the study? Main interest is in China and Asia Pacific countries?

Major countries in Asia Pacific have been covered in the study report:

- China

- India

- Japan

- South Korea

- Rest of Asia Pacific (Vietnam, Taiwan, Thailand, Indonesia and the Philippines)

What are the functions of sodium hypophosphite covered in the report?

The applications of sodium hypophosphite has not been restricted to FnB application in the report and hence, all the major functions are considered and studied in the report:

- Reducing agents

- Catalysts & stabilizers

- Chemical intermediates

- Others (food additives and flame retardants)

Are the major opportunities included in this market?

The opportunities tapped in this market are:

- Growing demand in emerging markets

- Changing lifestyle of consumers

- Favorable marketing and correct positioning of sodium hypophosphite

Can you provide country wise estimation for segments?

Yes, country wise estimation can we provided for segments.

Please let us know which segments country wise estimation is required.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.2.1 Markets Covered

1.2.2 Geographic Segmentation

1.3 Periodization Considered

1.4 Currency Considered

1.5 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primary Interviews

2.1.3 Market Size Estimation

2.2 Market Breakdown and Data Triangulation

2.3 Research Assumptions & Limitations

2.3.1 Assumptions

2.3.2 Limitations

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 31)

4.1 Opportunities in this Market

4.2 Sodium Hypophosphite Market: Key Countries

4.3 Market, By Function and Region

4.4 Market, By Application & Region

4.5 Asia Pacific: Sodium Hypophosphite Market, By Function & Country

4.6 Market, By Grade

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Expansion of the Electronics and Automotive Sectors in the Asia Pacific Region

5.2.1.2 Rise in Demand for Water Treatment in Industrial Applications

5.2.2 Restraints

5.2.2.1 Rise in the Price of Phosphorous Rocks Owing to Scarcity in Supply

5.2.3 Opportunities

5.2.3.1 Food Industry: Key Revenue Generator in the Coming Years

5.2.4 Challenges

5.2.4.1 Availability of Alternatives in the Market

5.3 Supply Chain Analysis

6 Sodium Hypophosphite Market, By Function (Page No. - 40)

6.1 Introduction

6.2 Reducing Agents

6.2.1 Rise in Chemical Nickel-Plating and Surface Plating

6.3 Catalysts & Stabilizers

6.3.1 Rise in Investment in Pharmaceutical Applications That Incorporate Sodium Hypophosphite

6.4 Chemical Intermediates

6.4.1 Sodium Hypophosphite is Used as A Raw Material to Produce Other Chemicals

6.5 Others

6.5.1 Government Initiatives Toward the Usage of Sodium Hypophosphite in the Food Industry

7 Sodium Hypophosphite Market, By Grade (Page No. - 47)

7.1 Introduction

7.2 Electrical

7.2.1 Expansion of the Automotive and Electronics Industries in the Asia Pacific Region to Boost Sales of Sodium Hypophosphite

7.3 Industrial

7.3.1 Multifunctionality of Sodium Hypophosphite Across Various Industries Expected to Boost Its Sales

7.4 Others

7.4.1 Food Industry Expected to Be the Key Revenue Generator in the Coming Years

8 Sodium Hypophosphite Market, By Application (Page No. - 53)

8.1 Introduction

8.2 Electroplating

8.2.1 Rise in Demand for Nickel Plating and Surface Plating in End-Use Industries

8.3 Water Treatment

8.3.1 Growth in Awareness for Waste-Water Recycling for Industrial Purpose

8.4 Chemicals & Pharmaceuticals

8.4.1 Increase in Investment and R&D on Environment-Friendly and Durable Pharma Products

8.5 Others

8.5.1 Increase in Government Initiatives to Encourage the Adoption of Shp in Convenience Foods

9 Sodium Hypophosphite Market, By Region (Page No. - 61)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.1.1 High Demand for Corrosion-Resistant Products and Growth in Manufacturing and Construction Industries Drive the Market in the US

9.2.2 Canada

9.2.2.1 Highly Diversified Electronics Industry Drives the Market

9.2.3 Mexico

9.2.3.1 Increase in Investment in the Construction Industry

9.3 Asia Pacific

9.3.1 China

9.3.1.1 Science and Technology Development Contribute to the Growth of Industries

9.3.2 Japan

9.3.2.1 R&D Activities for Various Phosphorus-Based Chemicals

9.3.3 India

9.3.3.1 Improved Infrastructure and Government Initiatives Such as Make in India to Contribute to the Market Growth

9.3.4 South Korea

9.3.4.1 The Growing Electronics and Automotive Industries in South Korea to Drive Demand for Sodium Hypophosphite

9.3.5 Rest of Asia Pacific

9.4 Europe

9.4.1 Germany

9.4.1.1 Booming Automotive and Electronics Industries in the Country to Boost Sales of Sodium Hypophosphite

9.4.2 France

9.4.2.1 Demand From the Plastic Industry Holds A Lucrative Opportunity

9.4.3 Italy

9.4.3.1 Demand From the Automotive Industry is Expected to Drive this Market

9.4.4 Spain

9.4.4.1 The Construction Sector is Expected to Offer A Lucrative Opportunity in the Coming Years

9.4.5 Poland

9.4.5.1 Strong GDP Performance Boosting the Industrial Sector

9.4.6 Rest of Europe

9.4.6.1 Demand From the Plastic Industry Holds A Lucrative Opportunity

9.5 RoW

9.5.1 South America

9.5.1.1 Brazil: the Key Revenue Pocket in the Region

9.5.2 Middle East & Africa

9.5.2.1 Development of the Automotive, Electrical & Electronics, and Manufacturing Industries Expected to Create A Lucrative Opportunity

10 Competitive Landscape (Page No. - 99)

10.1 Competitive Leadership Mapping (Overall Market)

10.1.1 Terminology/Nomenclature

10.1.1.1 Visionary Leaders

10.1.1.2 Innovators

10.1.1.3 Dynamic Differentiators

10.1.1.4 Emerging Companies

10.2 Ranking of Key Players, 2018

11 Company Profiles (Page No. - 102)

(Business overview, Products offered, Recent Developments, SWOT analysis, MNM view)*

11.1 Arkema

11.2 Solvay

11.3 Nippon Chemical Industrial Co., Ltd

11.4 Sigma-Aldrich

11.5 Hubei Xingfa Chemicals Group Co., Ltd.

11.6 Changshu New-Tech Chemicals Co., Ltd.

11.7 Jiangxi Fuerxin Medicine Chemical Co., Ltd.

11.8 Jiangsu Kangxiang Industrial Group Co., Ltd.

11.9 Hubei Lianxing Chemical Co., Ltd.

11.10 Jiangsu Dan AI Chemical Co., Ltd.

11.11 Hubei Sky Lake Chemical Co., Ltd.

11.12 Huanggang Quanwang Chemical Co., Ltd.

*Details on Business overview, Products offered, Recent Developments, SWOT analysis, MNM view might not be captured in case of unlisted companies.

12 Appendix (Page No. - 120)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

List of Tables (80 Tables)

Table 1 USD Exchange Rate, 20142018

Table 2 Sodium Hypophosphite Market Snapshot, 2019 vs 2025

Table 3 Market Size for Sodium Hypophosphite, By Function, 20172025 (USD Million)

Table 4 Market Size, By Function, 20172025 (KT)

Table 5 Reducing Agents Market Size, By Region, 20172025 (USD Million)

Table 6 Reducing Agents Market Size, By Region, 20172025 (KT)

Table 7 Catalyst & Stabilizers Market Size, By Region, 20172025 (USD Thousand)

Table 8 Catalyst & Stabilizers Market Size, By Region, 20172025 (KT)

Table 9 Chemical Intermediates Market Size, By Region, 20172025 (USD Thousand)

Table 10 Chemical Intermediates Market Size, By Region, 20172025 (Ton)

Table 11 Others Market Size, By Region, 20172025 (USD Thousand)

Table 12 Others Market Size, By Region, 20172025 (Ton)

Table 13 Sodium Hypophosphite Market Size, By Grade, 20172025 (USD Million)

Table 14 Market Size, By Grade, 20172025 (KT)

Table 15 Electrical: Sodium Hypophosphite Market Size, By Region, 20172025 (USD Million)

Table 16 Electrical: Market Size, By Region, 20172025 (KT)

Table 17 Industrial: Market Size for Sodium Hypophosphite, By Region, 20172025 (USD Million)

Table 18 Industrial: Market Size, By Region, 20172025 (KT)

Table 19 Others: Sodium Hypophosphite Market Size, By Region, 20172025 (USD Million)

Table 20 Others: Market Size, By Region, 20172025 (KT)

Table 21 Market Size for Sodium Hypophosphite, By Application, 20172025 (USD Million)

Table 22 Market Size, By Application, 20172025 (KT)

Table 23 Sodium Hypophosphite Market Size in Electroplating, By Region, 20172025 (USD Million)

Table 24 Market Size in Electroplating, By Region, 20172025 (KT)

Table 25 Sodium Hypophosphite Market Size in Water Treatment, By Region, 20172025 (USD Thousand)

Table 26 Market Size in Water Treatment, By Region, 20172025 (KT)

Table 27 Sodium Hypophosphite Market Size in Chemicals & Pharmaceuticals, By Region, 20172025 (USD Thousand)

Table 28 Market Size in Chemicals & Pharmaceuticals, By Region, 20172025 (Ton)

Table 29 Sodium Hypophosphite Market Size in Other Applications, By Region, 20172025 (USD Thousand)

Table 30 Market Size in Other Applications, By Region, 20172025 (Ton)

Table 31 Market Size for Sodium Hypophosphite, By Region, 20172025 (USD Million)

Table 32 Market Size, By Region, 20172025 (KT)

Table 33 North America: Sodium Hypophosphite Market Size, By Country, 20172025 (USD Million)

Table 34 North America: Market Size, By Country, 20172025 (KT)

Table 35 North America: Market Size, By Function, 20172025 (USD Million)

Table 36 North America: Market Size, By Function, 20172025 (KT)

Table 37 North America: Market Size, By Application, 20172025 (USD Million)

Table 38 North America: Market Size, By Application, 20172025 (KT)

Table 39 North America: Market Size, By Grade, 20172025 (USD Million)

Table 40 North America: Market Size, By Grade, 20172025 (Ton)

Table 41 US: Sodium Hypophosphite Market Size, By Application, 20172025 (USD Million)

Table 42 Canada: Market Size for Sodium Hypophosphite, By Application, 20172025 (USD Thousand)

Table 43 Mexico: Sodium Hypophosphite Market Size, By Application, 20172025 (USD Thousand)

Table 44 Asia Pacific: Market Size for Sodium Hypophosphite, By Country, 20172025 (USD Million)

Table 45 Asia Pacific: Market Size, By Country, 20172025 (KT)

Table 46 Asia Pacific: Market Size, By Function, 20172025 (USD Thousand)

Table 47 Asia Pacific: Market Size, By Function, 20172025 (KT)

Table 48 Asia Pacific: Market Size, By Application, 20172025 (USD Million)

Table 49 Asia Pacific: Market Size, By Application, 20172025 (KT)

Table 50 Asia Pacific: Market Size, By Grade, 20172025 (USD Million)

Table 51 Asia Pacific: Market Size, By Grade, 20172025 (KT)

Table 52 China: Sodium Hypophosphite Market Size, By Application, 20172025 (USD Million)

Table 53 Japan: Market Size for Sodium Hypophosphite, By Application, 20172025 (USD Thousand)

Table 54 India: Market Size for Sodium Hypophosphite, By Application, 20172025 (USD Million)

Table 55 South Korea: Sodium Hypophosphite Market Size, By Application, 20172025 (USD Million)

Table 56 Rest of Asia Pacific: Market Size for Sodium Hypophosphite, By Application, 20172025 (USD Million)

Table 57 Europe: Sodium Hypophosphite Market Size, By Country, 2017-2025 (USD Million)

Table 58 Europe: Market Size, By Country, 20172025 (KT)

Table 59 Europe: Market Size, By Function, 20172025 (USD Thousand)

Table 60 Europe: Market Size, By Function, 20172025 (Ton)

Table 61 Europe: Market Size, By Application, 20172025 (USD Thousand)

Table 62 Europe: Market Size, By Application, 20172025 (Ton)

Table 63 Europe: Market Size, By Grade, 20172025 (USD Million)

Table 64 Europe: Market Size, By Grade, 20172025 (Ton)

Table 65 Germany: Sodium Hypophoshite Market Size, By Application, 20172025 (USD Thousand)

Table 66 France: Sodium Hypophoshite Market Size, By Application, 20172025 (USD Thousand)

Table 67 Italy: Sodium Hypophoshite Market Size, By Application, 20172025 (USD Thousand)

Table 68 Spain: Sodium Hypophoshite Market Size, By Application, 20172025 (USD Thousand)

Table 69 Poland: Sodium Hypophoshite Market Size, By Application, 20172025 (USD Thousand)

Table 70 Rest of Europe: Sodium Hypophoshite Market Size, By Application, 20172025 (USD Thousand)

Table 71 RoW: Sodium Hypophosphite Market Size, By Region, 20172025 (USD Million)

Table 72 RoW: Market Size, By Region, 20172025 (KT)

Table 73 RoW: Market Size, By Function, 20172025 (USD Thousand)

Table 74 RoW: Market Size, By Function, 20172025 (Ton)

Table 75 RoW: Market Size, By Application, 20172025 (USD Thousand)

Table 76 RoW: Market Size, By Application, 20172025 (Ton)

Table 77 RoW: Market Size, By Grade, 20172025 (USD Thousand)

Table 78 RoW: Market Size, By Grade, 20172025 (Ton)

Table 79 South America: Sodium Hypophosphite Market Size, By Application, 20172025 (Ton)

Table 80 Middle East & Africa: Market Size for Sodium Hypophosphite, By Application, 20172025 (Ton)

List of Figures (34 Figures)

Figure 1 Sodium Hypophosphite Market Snapshot

Figure 2 Market, By Region

Figure 3 Market: Research Design

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Market Breakdown and Data Triangulation

Figure 8 Sodium Hypophosphite Market Size, By Function, 2019 vs 2025 (USD Million)

Figure 9 Market Size, By Application, 2019 vs 2025 (USD Million)

Figure 10 Market Size for Sodium Hypophosphite, By Grade, 2019 vs 2025 (USD Million)

Figure 11 Market Share & Growth (Value), By Region, 2018

Figure 12 Rise in Application of Sodium Hypophosphite as A Reducing Agent and Antioxidant in Metal, Plastic, and Fiber Products Across Various End-Use Industries to Drive the Market

Figure 13 US and China Projected to Dominate the Sodium Hypophosphite Market Between 2019 & 2025

Figure 14 Asia Pacific Dominated the Reducing Agents Segment in the Sodium Hypophosphite Market, By Function, in 2018

Figure 15 Electroplating Segment to Dominate the Global Market, By Application, Throughout 2025

Figure 16 China Accounted for the Largest Share in 2018

Figure 17 Electrical Segment to Account for the Largest Share in this Market Throughout 2025

Figure 18 Sodium Hypophosphite Market: Drivers, Restraints, Opportunities, and Challenges

Figure 19 China: Yellow Phosphorous Production, 2013-2018

Figure 20 Sodium Hypophosphite Market: Supply Chain Analysis

Figure 21 Market Size for Sodium Hypophosphite, By Function, 2019 vs 2025 (USD Million)

Figure 22 Market Size, By Grade, 20192025 (USD Million)

Figure 23 Market Size, By Application, 2019 vs 2025 (USD Million)

Figure 24 Market, By Key Country, 2019-2025

Figure 25 Market, By Region, 2019 vs 2025 (USD Million)

Figure 26 North America: Regional Snapshot

Figure 27 Asia Pacific: Sodium Hypophosphite Market,2018

Figure 28 Europe: Sodium Hypophosphite Market Snapshot

Figure 29 Global Sodium Hypophisphite Market: Competitive Leadership Mapping, 2018

Figure 30 Arkema Led the Sodium Hypophisphite Market in 2018

Figure 31 Arkema: Company Snapshot

Figure 32 Solvay: Company Snapshot

Figure 33 Nippon Chemical Industrial Co., Ltd.: Company Snapshot

Figure 34 Sigma-Aldrich: Company Snapshot

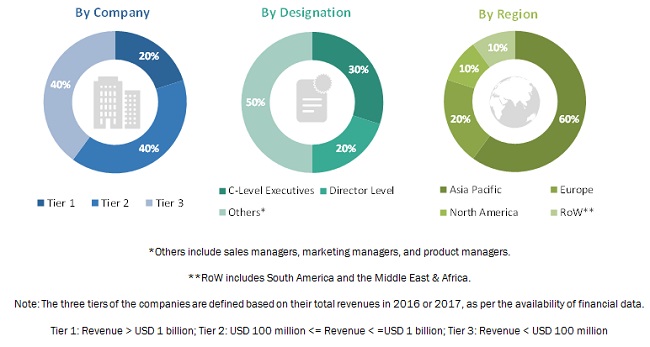

The study involves four major activities to estimate the current market size for sodium hypophosphite. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. These findings, assumptions, and market size were validated with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, trade directories, and databases.

Primary Research

The sodium hypophosphite market comprises several stakeholders such as manufacturers of sodium hypophosphite, suppliers & distributors of sodium hypophosphite (SHP) and suppliers, Chemical & Allied Industries Association, government & research organizations, and industry bodies. The demand-side of this market is characterized by the rising demand for from various end-use industries such as automotive, aerospace & defense, electrical & electronics, industrial machinery, medical device, and construction. The supply-side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the sodium hypophosphite market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industrys supply chain and market size, in terms of value and volume, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary respondents

Data Triangulation

After arriving at the overall market sizeusing the market size estimation processes, as explained abovethe market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed. The data was triangulated by studying various factors and trends from both the demand and supply sides in the food industry.

Report Objectives

- To define, segment, and project the global market size for the sodium hypophosphite market

- To understand the structure of the sodium hypophosphite market by identifying its various subsegments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the micro-markets, with respect to individual growth trends, future prospects, and their contribution to the total sodium hypophosphite market

- To project the size of the market and its submarkets, in terms of value and volume, with respect to the regions (along with their respective key countries)

- To profile the key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify the major growth strategies adopted by the players across key regions

- To analyze the competitive developments such as expansions & investments, mergers & acquisitions, new product launches, partnerships, joint ventures, and agreements

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports as per client-specific requirements. The available customization options are as follows:

Regional Analysis

- Further breakdown of the Rest of Asia Pacific sodium hypophosphite market, by country

- Further breakdown of other Rest of Europe sodium hypophosphite market, by country

- Further breakdown of other Rest of the World sodium hypophosphite market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Sodium Hypophosphite Market