Smart Surface Market

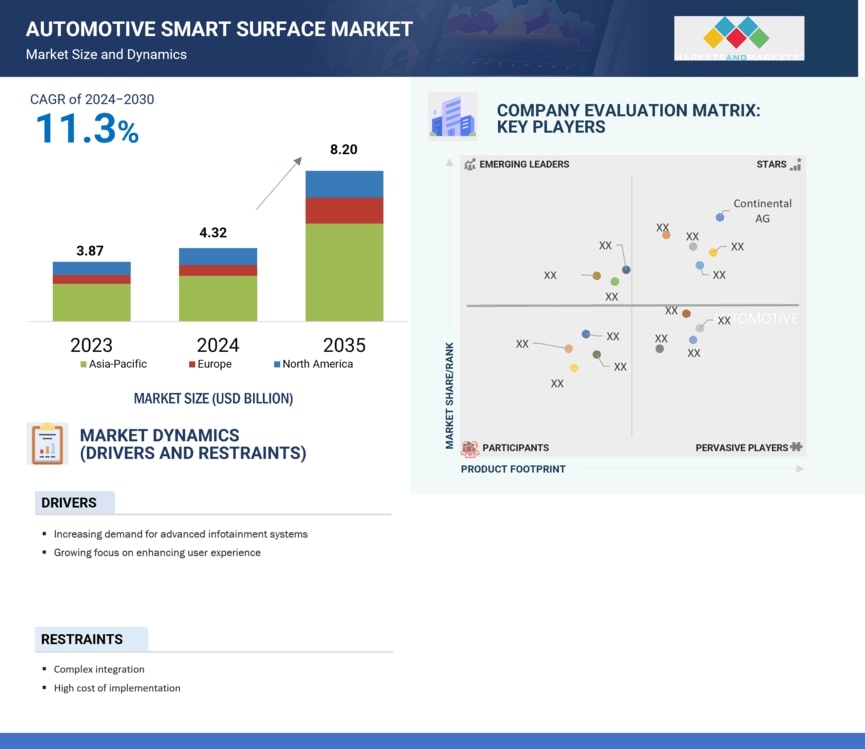

The Smart Surface Market size is projected to grow from USD 4.3 billion in 2024 to USD 8.2 billion by 2030, at a CAGR of 11.3%. The market is growing due to rising demand for advanced HMIs that offer seamless and intuitive vehicle interactions. One of the key trends in the market is the use of lightweight and sustainable materials, including in-mold electronics, such as the ones offered by ams-OSRAM AG and Marelli Holdings Co., Ltd., are gaining traction for their aesthetic and functional benefits, aiming to improve fuel efficiency. Similarly, technological progress in flexible electronics and conductive materials, along with funding from firms such as Continental and Yanfeng, is further boosting market expansion. Furthermore, in January 2024, MacDermid Alpha Electronics Solutions introduced its XtraForm 3D Matt material, aimed at sophisticated automotive uses, improving resilience and design versatility for producers.

Premium interior designs with touch-responsive panels, ambient illumination, and gesture controls are becoming more common in luxury and electric vehicles, like BMW i7 and 7 Series. Smart surface technologies are increasingly being integrated into mid-size vehicles, reflecting a trend initiated by luxury models. For example, the Tesla Model 3 features haptic feedback controls on its steering wheel, while the Haval H6 includes a center console with touch controls. This shift is driven by consumer demand for enhanced user experiences, improved aesthetics, and more intuitive interfaces, enabling mid-size cars to offer functionalities once reserved for higher-end models.

To know about the assumptions considered for the study, Request for Free Sample Report

Interior segment is anticipated to be the largest market during the forecast period.

The smart surface market's interior segment is expected to be the largest during the forecast period, driven by the rising demand for enhanced user experience, personalization, and sustainability in vehicle interiors. Focusing on enhancing comfort and usability, OEMs are progressively incorporating smart surfaces and sustainable materials into vehicle interiors. Innovations such as Antolin's introduction of the NEXUS door panel concept in January 2024, blending intelligent surfaces with eco-friendly materials, illustrate this transition toward cutting-edge interior designs. Moreover, EurA AG's focus on intelligent coatings that improve functionality and minimize upkeep further highlights the changing requirements for automotive interiors. In June 2024, Ams OSRAM unveiled cutting-edge automotive lighting solutions consisting of intelligent in-cabin systems, emphasizing the increasing importance of smart surfaces for safety and customization. The interior sector of the smart surface market is poised for considerable expansion as consumers seek more upscale, personalized, and environmentally friendly car interiors.

MicroLEDs to experience a notable growth over the forecast period.

MicroLEDs offer unparalleled image quality and design flexibility, making them ideal for enhancing the aesthetics and functionality of vehicle interiors. In addition, longer durability, energy efficiency and superior brightness over conventional display technologies, make microLEDs a promising contender in smart surfaces. The recent developments made by the Tier Is in this space underscore this trend:

With rising consumer demand for premium and immersive in-car experiences, the microLED segment is poised to become a key growth driver in the smart surface market.

Asia Pacific is anticipated to hold a significant market share over the forecast period

The Asia Pacific is projected to capture a sizable portion of the smart surface market, fueled by the swift uptake of sophisticated in-vehicle technologies, and increasing consumer inclination towards high-end and environmentally friendly car interiors. The area also gains advantages from the presence of significant market participants such as Marelli Holdings Co., Ltd. (Japan) and AUO Corporation (Taiwan), both of which are elevating industry standards through their innovations in smart surfaces. Additionally, leading OEMs such as Li Auto Inc. (China) are incorporating smart surface products into their vehicle designs, driving market expansion. In China, the demand of smart surface is growing as consumers seek intuitive and safer user experiences. The Geely ZEEKR X combines touch and physical buttons, while the Hongqi E001, launched in April 2023, offers touch-sensitive icons and pressure-sensing for improved usability. Models like the SAIC IM L7 and ARCFOX Kaola feature smart surfaces on doors, steering wheels, and center consoles, meeting the demand for innovative interfaces.

Recent developments highlight this trend:

As investments in innovation and sustainability rise, the Asia Pacific region is set to become a significant force in the worldwide smart surface market.

The breakup of primary respondents

- By Company: Tier 1 – 65%, OEM – 35%. .

- By Designation: C Level – 36%, D Level – 45%, and Others – 19%

- By Region: North America – 26%, Europe – 40%, and Asia Pacific – 34%

Research Coverage

The report covers the Smart surface Market in terms of Technology (Touchscreen, Haptic Feedback, Gesture Recognition, Voice Recognition, Touchscreen + Haptic Feedback, Voice Recognition + Gesture Recognition, and Touchscreen + Gesture Recognition + Voice Recognition), Application [Interior (Center Console, Door Panel, Dashboard, Steering Wheel, Seat, Overhead Console) and Exterior (Smart Grill, Adaptive Lighting Panel, Roof Panel, Exterior Mirror, and Body Panel)], Passenger Cars Class (Economy, Mid-size, and Luxury), Component (Displays (LCD, OLED, and MicroLED), Sensors, and Others), Sales Channel (OEM and Aftermarket), Electric Vehicle Type (Battery Electric Vehicles, Hybrid Electric Vehicles, Plug-In Hybrid Electric Vehicles, and Fuel Cell Electric Vehicles), and Region. It covers the competitive landscape and company profiles of the significant Smart surface Market players.

The study also includes an in-depth competitive analysis of the key market players, their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report:

- The report will help market leaders/new entrants with information on the closest approximations of revenue numbers for the Smart surface Market and its subsegments.

- This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies.

- This report provides stakeholders, new entrants, and market leaders with valuable insights into promising regional markets and effective OEM strategies, enabling informed decision-making and competitive positioning in the Smart surface Market.

- The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

- The report also helps stakeholders understand the current and future pricing trends of the Smart surface Market.

- The report will help market leaders/new entrants with information on the most promising segment of interior applications in the Smart surface Market..

The report provides insight on the following pointers:

- Analysis of key drivers (Increasing demand for advanced infotainment systems, Growing focus on enhancing user experience), restraints (Complex integration, High cost of implementation), opportunities (Rising demand for sustainable and eco-friendly materials, Expansion of autonomous vehicles with added features), and challenges (Regulatory hurdles, Compatibility with legacy systems)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the Smart surface Market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the Smart surface Market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the Smart surface Market.

- Competitive Assessment: In-depth assessment of market share, growth strategies, and service offerings of leading players like ams-OSRAM AG (Austria), FORVIA HELLA (Germany), Continental AG (Germany), Marelli Holdings Co., Ltd. (Japan), Valeo (France), Visteon Corporation (US) among others in Smart surface Market..

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Growth opportunities and latent adjacency in Smart Surface Market