Smart Shopping Cart Market

Smart Shopping Cart Market by Cart Type (Fully Integrated Carts, Retrofit Kits), Application Area (Shopping Malls, Supermarkets), Mode of Sale (Direct, Distributor) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The smart shopping cart market size is projected to grow from USD 326.0 million in 2025 to USD 1,423.1 million by 2030 at a CAGR of 34.4% during the forecast period. Continuous innovations in AI, computer vision, edge computing, and sensor technology are making smart cart solutions more accurate, reliable, and increasingly affordable. As these technologies mature and become more cost-effective, their widespread adoption by a broader range of retailers becomes more feasible, further fueling market expansion.

KEY TAKEAWAYS

-

By RegionThe North American smart shopping cart market accounted for a 42.1% revenue share in 2025.

-

By Application AreaBy application area, the supermarkets segment is expected to register the highest CAGR of 35.0%.

-

By Mode of SaleBy mode of sale, the distributor segment is projected to grow at the highest rate from 2025 to 2030.

-

Competitive LandscapeCompanies such as Caper (Caper Cart), SuperHii (Smart Cart S700), Amazon (Dash Cart), and Retail AI, Inc. (Skip Cart) were identified as some of the star players in the smart shopping cart market (global), given their strong market share and product footprint.

The global smart shopping cart market growth is primarily driven by the escalating demand for an enhanced and frictionless customer shopping experience. Consumers increasingly expect the convenience of online shopping to be replicated in physical stores, demanding faster checkouts, personalized interactions, and an intuitive way to manage their shopping lists. Smart carts directly address this by offering real-time basket totals, personalized promotions, and the ability to bypass traditional checkout lines, significantly improving customer satisfaction and driving adoption among forward-thinking retailers aiming to differentiate their in-store offerings.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on customers' businesses in the smart shopping cart market is driven by the evolving demand for faster checkout, improved store flow management, and accurate inventory tracking. Retailers, store operators, and digital transformation teams increasingly depend on AI-enabled smart shopping carts for real-time item recognition, seamless self-checkout, in-cart personalized promotions, and automated billing. Trends such as computer-vision-based real-time item recognition, integrated loyalty programs, and data-driven merchandising planning are reshaping in-store retail strategies. These innovations directly enhance customer experience, reduce shrinkage and operational costs, and promote more enjoyable shopping journeys.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing consumer demand for frictionless, contactless, and personalized shopping

-

Technological advancements in computer vision, sensors, and edge computing enable reliable, low-latency item recognition

Level

-

High upfront hardware and integration costs

-

Integration complexity with POS, inventory, and loyalty systems

Level

-

Retrofit devices/attachable solutions for existing carts, reducing the deployment cost

-

In-cart promotions, targeted offers, and ads create recurring revenue streams

Level

-

Robust item recognition across SKUs and packaging changes

-

Maintaining uptime, battery logistics, and field servicing across thousands of carts complicates scaling

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing consumer demand for frictionless, contactless, and personalized shopping

The shift in consumer expectations toward faster, more convenient, and highly personalized in-store shopping experiences is a major driver accelerating the adoption of smart shopping carts. Post-pandemic behavior has amplified the preference for contactless interactions, reducing reliance on traditional staffed checkouts and minimizing touchpoints across the entire shopping journey. Smart carts enable this by allowing shoppers to scan, weigh, and pay directly through the cart, eliminating queues and reducing overall store congestion. Additionally, rising comfort with digital interfaces and mobile-based retail experiences is increasing consumer readiness for such innovations inside physical stores. Smart carts also support personalized shopping by delivering real-time recommendations, loyalty benefits, ingredient information, and promotional offers based on the shopper’s cart content. Retailers leverage these carts to create a seamless omnichannel experience that merges in-store and digital engagement. Personalization enhances customer satisfaction, increases basket sizes, and strengthens brand loyalty. As consumers prioritize convenience, transparency, and speed, the demand for frictionless solutions continues to grow, reinforcing the need for smart shopping cart systems. This trend is particularly strong in urban supermarkets, hypermarkets, and premium retail chains, where quick checkout, personalized engagement, and improved store navigation significantly influence purchase decisions and overall customer experience

Restraint: High upfront hardware and integration costs

A key restraint limiting the widespread adoption of smart shopping carts is the high initial cost associated with procuring hardware, integrating multiple systems, and deploying fleets across large retail networks. Smart carts require expensive components such as, including advanced cameras, load cells, barcode scanners, high-capacity batteries, embedded processors, and ruggedized touchscreens. When multiplied across hundreds or thousands of carts per retailer, total capital expenditure becomes substantial. In addition, stores must redesign or upgrade their digital infrastructure to support real-time data exchange between the carts and Additionally, stores must redesign or upgrade their digital infrastructure to support real-time data exchange between the carts and their backend systems. Integration with complex retail IT stacks POS, inventory management, ERP, and loyalty platforms, including POS, inventory management, ERP, and loyalty platforms, adds further cost and technical effort. Many mid-size and small retailers find such investments financially challenging, especially when margins are already tight. Ongoing maintenance costs, battery replacements, camera calibration, software updates, and physical repairs also add to lifetime ownership expenses. Retailers may be hesitant to adopt technology with long payback cycles or uncertain ROI, particularly in markets with price-sensitive customers. As a result, while large retailers can absorb these costs, widespread adoption remains limited across developing markets and smaller store formats. These financial hurdles slow down the overall market expansion and delay technology penetration the penetration of technology into mainstream retail segments.

Opportunity: Retrofit devices/attachable solutions for existing carts, reducing the deployment cost

Retrofit or attachable smart cart modules present one of the biggest growth opportunities in the market, as they allow retailers to upgrade existing traditional carts without purchasing expensive new smart carts. These retrofit kits typically include camera units, portable vision sensors, weight modules, barcode scanners, and compact touchscreens that can be mounted onto existing steel or plastic frameworks. This dramatically reduces the overall deployment cost and makes smart cart technology accessible to mid-sized and budget-conscious retailers. Retrofits also shorten implementation timelines, enabling rapid scaling across multiple store locations. Retailers benefit from faster ROI, minimal disruption to store operations, and the flexibility to adopt smart carts incrementally. Retrofit solutions are especially attractive in emerging markets, where replacing entire cart fleets is financially unfeasible. Additionally, attachable modules encourage experimentation with new business models such as subscription-based usage, leasing models, or SaaS-enabled analytical dashboards. Vendors offering retrofit solutions can tap into a much wider market and accelerate penetration across both premium and value-driven retail segments. As the technology matures, retrofittable systems will continue to create strong adoption momentum and open lucrative long-term revenue streams for vendors.

Challenge: Robust item recognition across SKUs and packaging changes

Ensuring high-accuracy item recognition remains one of the most difficult technical challenges for smart shopping carts. Retailers manage thousands of SKUs that vary widely in size, shape, packaging material, and barcode placement. Frequent packaging changes—such as seasonal variants, promotional wraps, or rebranded designs—complicate recognition, often requiring model retraining or database updates. Fresh produce, items without standardized barcodes, reflective packaging, and transparent containers make accurate identification even harder. Variations in store lighting, shadows, customer handling, and basket movement further impact recognition performance. Maintaining near-perfect accuracy is essential, as errors reduce customer trust and disrupt the frictionless experience smart carts aim to deliver. Additionally, maintaining real-time synchronization with POS pricing and promotions is critical to prevent discrepancies at checkout. These challenges require continuous algorithm improvement, rigorous data annotation, and advanced multilayer sensor fusion. As retailers expand their SKU assortments and adopt dynamic pricing models, the complexity of recognition intensifies. Overcoming these technical and operational hurdles is crucial to enabling broader scalability and reliable day-to-day usage of smart carts across diverse retail environments.

smart-shopping-cart-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Provides a "Just Walk Out" shopping experience in smaller format grocery stores, allowing customers to skip traditional checkout lines entirely with automatic billing. | Drastically reduces checkout times, enhances customer convenience, collects real-time purchase data, and minimizes labor requirements for checkout staff. |

|

Integrates AI-powered computer vision and weight sensors into shopping carts for automatic item recognition as items are added, facilitating frictionless self-checkout. | Eliminates manual scanning, reduces errors and shrinkage, personalizes in-cart promotions, and improves overall store throughput during peak hours. |

|

Offers smart cart attachments that convert existing shopping carts into intelligent self-checkout systems with visual recognition, personalized offers, and secure payment. | Lowers capital expenditure for retailers (uses existing carts), provides real-time sales insights, offers dynamic in-store advertising, and reduces queue times. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The smart shopping cart ecosystem comprises retrofit kit providers (Shopic, SuperHii, Tracxpoint), fully integrated cart providers (Retail AI, Inc., Caper, SuperHii, Veeve, Cust2Mate, KBST, Shopreme, Swiftforce), and regulatory bodies (Consumer Protection, GDPR, CCPA). These vendors collectively support the development and deployment of intelligent carts, real-time item recognition, automated checkout, and secure data handling, while regulatory bodies ensure compliance and consumer trust.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Smart Shopping Cart Market, By Application Area

Supermarkets are the primary adopters of smart shopping carts due to their diverse product range, high basket sizes, and need for operational efficiency. The technology supports rapid item recognition, dynamic pricing prompts, and in-cart payment to eliminate checkout lines. Supermarkets benefit from detailed behavioral analytics on popular routes, dwell times, and product interactions, which help refine inventory placement. Smart carts also reduce shrinkage by verifying items through multi-sensor validation and alerting staff to anomalies. Recent pilots in major regional chains show that shoppers increasingly trust automated cart systems, especially when carts provide accurate running totals and intuitive user interfaces.

Smart Shopping Cart Market, By Mode of Sale

Distributor channels enable vendors to scale across multiple regions with reduced logistical overhead. Distributors handle procurement, warehousing, installation, and first-level support, making them ideal for smaller retailers or large geographic rollouts. This model reduces the burden on vendors’ internal teams while ensuring local availability of spare parts and technicians. However, successful distributor operations require training, standardized processes, and remote monitoring tools to maintain consistent performance across fleets. This channel enables manufacturers to expand their market presence geographically and across various retail verticals more efficiently than by building a massive direct sales force.

REGION

Asia Pacific to be the fastest-growing region in the global smart shopping cart market during the forecast period

The Asia Pacific smart shopping cart market is experiencing rapid expansion, driven by the region's accelerating retail modernization, growing urban population, and widespread adoption of AI and IoT technologies. Countries such as China, Japan, and India are at the forefront of implementing digital retail solutions that enhance customer convenience and operational agility. Retailers like Aeon (Japan), Reliance Retail (India), and Alibaba's Freshippo (China) are investing heavily in AI-enabled carts that combine mobile payment integration, personalized recommendations, and real-time product tracking. Regional vendors, including SmartCart, Tracxpoint, and DeepMagic, are also partnering with supermarkets and convenience stores to expand their reach. Moreover, Asia Pacific's growing middle-class population and increasing retail automation budgets position the region as one of the fastest-growing markets for smart shopping carts.

smart-shopping-cart-market: COMPANY EVALUATION MATRIX

In the smart shopping cart market matrix, Caper (Star) leads with a strong market share and advanced AI-powered carts widely adopted by major retailers for seamless checkout and real-time analytics. Shekel (Emerging Leader) is gaining visibility with its innovative weighing technology and frictionless shopping solutions, strengthening its position through fast, secure, and cost-effective retail integrations. While Caper dominates through large-scale deployments and data-driven features, Shekel shows significant potential to move toward the leaders' quadrant as demand for autonomous shopping and digital retail experiences continues to rise.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Amazon (US)

- Caper (US)

- Retail AI (Japan)

- Shopic (Israel)

- SuperHii (China)

- Tracxpoint (Israel)

- Cust2Mate (Israel)

- Shekel (Israel)

- Faytech (US)

- KBST (Germany)

- MetroClick (US)

- Pentland Firth Software (Germany)

- VasyERP (India)

- Smapca (India)

- SwiftForce (India)

- Kwikkart (US)

- ZeroQs (Poland)

- Shopreme (Austria)

- Trollee (Hong Kong)

- Veeve (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 326.0 Million |

| Market Forecast in 2030 (Value) | USD 1,423.1 Million |

| Growth Rate | CAGR of 34.3% from 2025 to 2030 |

| Years Considered | 2025-2030 |

| Base Year | 2025 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East & Africa |

WHAT IS IN IT FOR YOU: smart-shopping-cart-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Service Provider (US) |

|

|

| Company Information | Detailed analysis and profiling of additional market players (up to 5) |

|

RECENT DEVELOPMENTS

- July 2025 : Instacart announced a pilot deployment of its AI-powered smart shopping carts, called Caper Carts, at Wegmans’ Dewitt store in Syracuse, New York, marking the first use of Caper Carts in a Wegmans location.

- March 2025 : Dimar, an Italian supermarket chain, announced a partnership with Shopic and Retex to deploy Shopic’s AI-powered smart carts in its Mercato stores, with a focus on enhancing store efficiency and customer engagement.

- April 2024 : Amazon expanded its smart cart pilot testing, initiated at Price Chopper and McKeever’s Market locations in Kansas and Missouri, to validate the integration and performance of third-party technology across diverse retail formats. The pilot programs tested integration with different POS systems and store configurations, collecting operational data for refinement before wider rollout.

- January 2024 : Al Meera Consumer Goods Company announced a partnership with Veeve, Inc. to launch the region’s first “smart” shopping carts beginning January 1, 2024, at its Wakrah South branch, followed by Leabaib 1. These carts were equipped with a touchscreen, barcode reader, and cameras that allow customers to log in, scan items, add them to the cart, and bypass traditional checkout lines; the screen displays nearby deals linked to the Meera Rewards loyalty program.

- April 2023 : Tracxpoint completed the AI smart cart pilot program and deployed the AI Cart Platform at Conad, introducing AI-powered carts with automatic checkout, in-store navigation, and analytics.

Table of Contents

Methodology

This research study extensively utilized secondary sources, directories, and databases, including Dun & Bradstreet (D&B), Hoovers, and Bloomberg Businessweek, to identify and collect information relevant to a technical, market-oriented, and commercial study of the smart shopping cart market. The primary sources have primarily consisted of industry experts from core and related industries, as well as preferred suppliers, manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all segments of the value chain of this market. In-depth interviews have been conducted with various primary respondents, including key industry participants, subject matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information.

Secondary Research

The market size of companies offering smart shopping carts worldwide was arrived at based on secondary data available through paid and unpaid sources. It was also arrived at by analyzing the product portfolio of major companies and rating them based on their performance and quality. In the secondary research process, various secondary sources were referred to identify and collect information for the study. The secondary sources included annual reports, press releases, investor presentations of companies, white papers, certified publications, and articles from recognized associations and government publishing sources. Several journals and associations, such as The Grocer & Progressive Grocer, and the International Journal of Retail & Distribution Management, were also referenced. Secondary research was employed to gather key information on industry insights, the market’s monetary chain, the overall pool of key players, market classification, and segmentation according to industry trends, regional markets, and key developments from both market- and technology-oriented perspectives.

Secondary research was mainly used to obtain key information about the industry’s value chain and supply chain and to identify key players through various solutions and services, market classification and segmentation according to offerings of major players, industry trends related to technologies, applications, and regions, and key developments from both market-oriented and technology-oriented perspectives.

Primary Research

During the primary research process, various primary sources from both the supply and demand sides were interviewed to gather qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs), Vice Presidents (VPs), directors from business development, marketing, and product development/innovation teams, related key executives from Smart shopping cart solution vendors, professional service providers, and industry associations, and key opinion leaders.

Primary interviews were conducted to gather insights, including market statistics, revenue data collected from solutions and services, market segmentations, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using smart shopping cart solutions, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of smart shopping cart solutions, which would impact the overall smart shopping cart market.

Breakdown of Primaries:

*Others include sales managers, marketing managers, and product managers. Note: Tier 1 companies’ revenue is more than USD 1 billion; Tier 2 companies’ revenue ranges between USD 500 million to 1 billion; and Tier 3 companies’ revenue ranges between USD 100 million and USD 500 million

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the size of the smart shopping cart market. The first approach involves estimating market size by summing up the revenue generated by companies through the sale of smart shopping cart solutions.

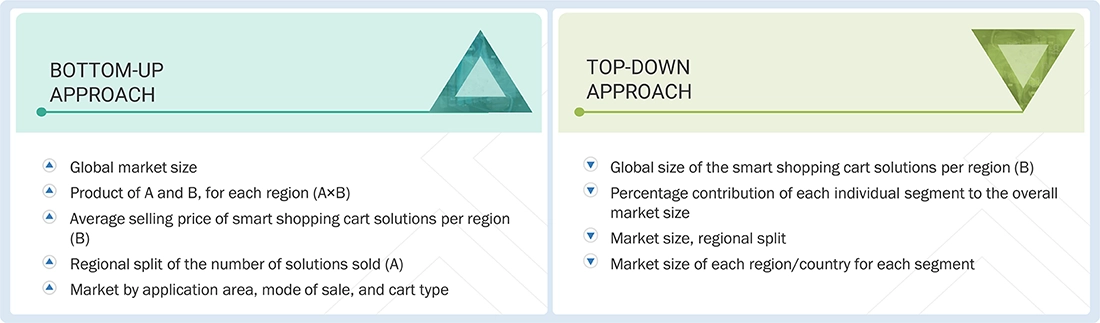

Top-down and bottom-up approaches were used to estimate and validate the total size of the smart shopping cart market. These methods were also extensively used to estimate the size of various market segments. The research methodology used to evaluate the market size is listed below.

- Key players in the market have been identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size have been determined through a combination of primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

After determining the overall market size, the smart shopping cart market was segmented into several categories and subcategories. A data triangulation procedure was employed to complete the overall market engineering process and derive the precise statistics for all segments and subsegments, as applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. In addition to data triangulation and market breakdown, the market size was validated using both top-down and bottom-up approaches.

Market Definition

A smart shopping cart is an Internet of Things (IoT)-enabled retail device that integrates advanced hardware and software, such as barcode scanners, computer vision cameras, weight sensors, and touchscreens, directly into the physical shopping trolley. This technology allows customers to scan, weigh, and pay for items directly at the cart, by-passing traditional checkout lines while providing retailers with real-time data on shopping behaviors and inventory levels.

Stakeholders

- Technology & Hardware Providers

- Retailers

- End Users

- Infrastructure & Enablers

- Regulatory & Governance Organizations

- Software and Connectivity Providers

- Consulting and Advisory Firms

- Investors and Venture Capitalists

- Independent Software Vendors (ISVs)

- Value-added Resellers (VARs) and Distributors

Report Objectives

- To determine and forecast the global smart shopping cart market by application area, mode of sale, cart type, and region

- To forecast the size of the market segments for North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the smart shopping cart market

- To analyze each submarket concerning individual growth trends, prospects, and contributions to the overall smart shopping cart market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the smart shopping cart market

- To profile the key market players, provide a comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials, and illustrate the market’s competitive landscape

- Track and analyze competitive developments in the market, such as mergers and acquisitions, product development, partnerships and collaborations, and research and development (R&D) activities

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Smart Shopping Cart Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Smart Shopping Cart Market