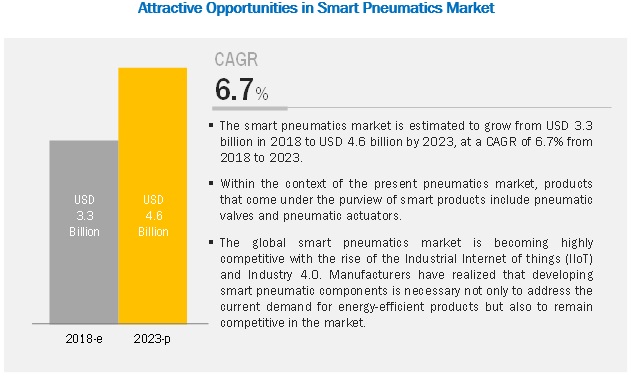

Smart Pneumatics Market by Component (Hardware, Software, and Services), Type (Valves, Actuators, and Modules), Industries (Automotive, Semiconductor, Food & Beverage, Water & Wastewater, Oil & Gas), and Geography - Global Forecast to 2023

Smart pneumatics market report share is projected to grow USD 4.6 billion by 2023, at a CAGR of 6.7% from 2018 to 2023. The growth of this market will be propelled by growing awareness about predictive maintenance, penetration of digitization and IIoT, and need for wireless infrastructure to maintain/monitor equipment in plants.

Market for smart pneumatic actuators is expected to grow at a higher rate during the forecast period

The report covers the smart pneumatics market segmented by component, type, industry, and geographic region. The smart pneumatic actuators segment is expected to hold the largest share of the market by 2023. Smart pneumatic actuators use sensors and other electronics to provide operational feedback (such as speed, force, end-of-travel, stroke length, and cycle time) to controllers. The collected data enable condition monitoring to determine if an actuator is performing as intended. Beside pneumatic valves and actuators, the market also includes modules or platforms that are used to monitor the operation and efficiency of a system. A module basically communicates via an I/O link with sensors on pneumatic systems, through which users can anticipate issues before they culminate to machine breakdowns.

Software and services component to witness the highest CAGR during the forecast period.

In the smart pneumatics market, the software and services segment is expected to grow at the highest growth rate during the forecast period. Software is an essential part of a smart pneumatic system; the raw data extracted via hardware components is collected, processed, and analyzed by software. A variety of software solutions are available in the market, working on different technologies but mostly featuring some common functions, such as data integration, diagnostic reporting, order tracking analysis, and parameter calculation. Manufacturers are focusing on offering monitoring services, in terms of extracting and analyzing the data.

Automotive industry accounted for the largest market share during forecast period.

The automotive industry accounted for the largest share of the smart pneumatics market in 2018. The global automotive industry is witnessing significant growth in the number of units produced per day. The machinery on the production floor needs proper maintenance to shorten production cycles and increase production output. Smart pneumatic systems play a crucial role in ensuring efficient manufacturing processes. Automotive manufacturers are also adopting IIoT systems to increase energy efficiency and monitor asset condition. This is creating a huge potential for smart pneumatics in the automotive industry.

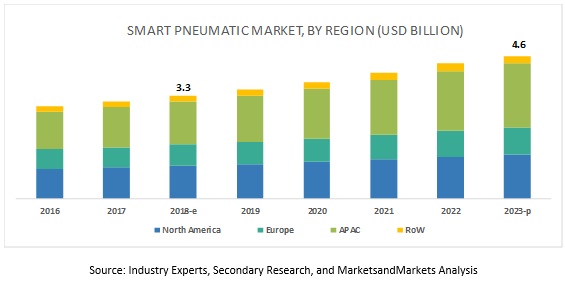

APAC to dominate the smart pneumatics market during forecast period

APAC held the largest share of the smart pneumatics market in 2018. The growing adoption of smart manufacturing or Industry 4.0 in various industries is creating a huge demand for smart pneumatics in the region. Besides, factors like growing focus on optimum asset utilization; stringent government regulations for workplace and personal safety; and tight quality control in the automotive, semiconductor, chemicals, and food & beverages industries are driving the demand for smart pneumatic systems in APAC. Besides, North America is a mature market for industrial automation. The region leads in terms of advanced automation technology and the use of advanced manufacturing techniques. These factors contribute to the growth of the market in this region.

Smart Pneumatics Market Key Players

Emerson Electric Co. (US), Festo AG & Co. KG (Germany), Parker Hannifin Corporation (US), Bimba Manufacturing Co. (US), Rotork plc (UK), Metso Corporation (Finland), and Thomson Industries, Inc. (US). are the major players operating in this market.

Festo is one of the prominent players in the smart pneumatics market. It manufactures factory and process automation solutions. The company offers pneumatics and electrical control and drive technology solutions. It carries over 80 years of experience in innovating motion control solutions. Its smart pneumatic product range consists of Festo Motion Terminal, which is a cyber-physical system with combined mechanics, electronics components, and software. The company has a global presence (manufacturing facilities and sales subsidiaries at multiple locations). Festo focuses on product and technology innovations to strengthen its market posture.

Smart Pneumatics Market Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2018 |

USD 3.3 Billion |

| Revenue Forecast in 2023 | USD 4.6 Billion |

| Growth Rate | 6.7% |

| Base Year Considered | 2017 |

| Historical Data Available for Years | 2016–2023 |

|

Forecast Period |

2018–2023 |

|

Segments Covered |

|

|

Region Covered |

|

| Market Leaders |

|

| Top Companies in North America |

|

| Largest Growing Region | Asia Pacific |

| Largest Market Share Segment | Smart Pneumatic Actuators Segment |

| Highest CAGR Segment | Software and Services Segment |

| Largest Application Market Share | Automotive Application |

In this report, the market has been segmented into the following categories:

Smart Pneumatics Market, by Component

- Hardware

- Software and Services

Smart Pneumatics Market, by Type

- Smart Pneumatic Valves

- Smart Pneumatic Actuators

- Smart Pneumatic Modules

Smart Pneumatics Market, by Industry

- Oil & Gas

- Energy & Power

- Water & Wastewater

- Automotive

- Semiconductor

- Food & Beverage

- Others (Pharmaceuticals, Chemicals, and Metal & Mining)

Geographic Analysis

- North America (US, Canada, and Mexico)

- Europe (UK, Germany, France, and Rest of Europe)

- Asia Pacific (China, Japan, India, and Rest of APAC)

- Rest of the World (South America, Middle East, and Africa)

Recent Developments

- In July 2018, Emerson Electric acquired Aventics GmbH (Germany) a global leader in smart pneumatics technologies that power machines and factory automation applications.

- In February 2018, Bimba Manufacturing was acquired by Norgren Ltd.’s IMI Precision Engineering business unit (US). This created a significant opportunity to enhance IMI Precision Engineering’s position in the US Industrial Automation market and grow the Bimba brand internationally.

- In December 2017, Thomson Industries launched smart actuators with integrated electronics, such as sensors and communications technologies, to meet the demand for improved connectivity, application flexibility, and cost efficiency as well as to build smart machines for factory automation applications.

- In March 2017, Festo launched the VTEM Motion Terminal–a system intended to help transform a pneumatic product into an Industry 4.0 component.

Critical questions would be:

- Will suppliers continue to explore new avenues for smart pneumatics?

- What are the adjacencies that companies can leverage or explore?

- Is there a threat from substitute products?

- Where will all the developments take the industry in the mid-to-long term?

- Most suppliers adopt agreements, partnerships, contracts, and collaborations as key growth strategies (as seen from their recent developments); where will these take the industry in the mid to long term?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Study Objectives

1.2 Definition

1.3 Study Scope

1.3.1 Geographic Scope

1.3.2 Years Considered

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.2 Secondary and Primary Research

2.2.1 Secondary Data

2.2.1.1 Secondary Sources

2.2.2 Primary Data

2.2.2.1 Primary Sources

2.2.2.2 Key Industry Insights

2.2.2.3 Breakdown of Primaries

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Data Triangulation

2.5 Research Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 33)

4.1 Attractive Growth Opportunities in Smart Pneumatics Market

4.2 Market, By Type

4.3 Market in North America, By Country and Industry

4.4 Market, By Industry

4.5 Market, By Country, 2018

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Awareness Toward Predictive Maintenance

5.2.1.2 Penetration of Digitization and IIoT

5.2.1.3 Demand for Smart Pneumatics Due to Remote Monitoring Capabilities

5.2.1.4 Need for Wireless Infrastructure to Maintain/Monitor Equipment in Plants

5.2.1.5 Stringent Environmental and Safety Regulations in Energy Industry

5.2.2 Restraints

5.2.2.1 High Initial Investments in Valve Projects

5.2.2.2 Lack of Common Platform for Zigbee, Profibus, and Ethernet

5.2.2.3 Lack of Standardized Certifications and Government Policies

5.2.3 Opportunities

5.2.3.1 Technological Innovations With Improved Capabilities

5.2.3.2 Advent of Artificial Intelligence and Machine Learning

5.2.4 Challenges

5.2.4.1 High Cost of Fabrication

5.2.4.2 Duplication of Technology

5.2.4.3 Increasing Security Risks Associated With Cloud Platform

5.3 Value Chain Analysis

6 Smart Pneumatics Market, By Component (Page No. - 42)

6.1 Introduction

6.2 Hardware

6.2.1 Sensor

6.2.2 Communications Technology

6.3 Software and Services

6.3.1 Software

6.3.1.1 Data Integration

6.3.1.2 Diagnostic Reporting

6.3.1.3 Parameter Calculation

6.3.2 Services

7 Smart Pneumatics Market, By Type (Page No. - 47)

7.1 Introduction

7.2 Smart Pneumatic Valves

7.2.1 With IIoT Trending, Pneumatic Valves Have Emerged as the Center of the Smart Movement

7.3 Smart Pneumatic Actuators

7.3.1 Smart Pneumatic Actuators are Expected to Grow at A Significant Rate During the Forcast Period

7.4 Smart Pneumatic Modules

7.4.1 Smart Pneumatic Modules Facilitate Predictive Maintenance

8 Smart Pneumatics Market, By Industry (Page No. - 53)

8.1 Introduction

8.2 Oil & Gas

8.2.1 Smart Pneumatic Solutions are Mostly Employed in Downstream Operations

8.3 Energy & Power

8.3.1 APAC Held the Largest Share of the Market for the Energy & Power Industry in 2017

8.4 Water & Wastewater

8.4.1 Proper Operation and Maintenance of Pneumatic Systems Contribute to the Smooth Operation of Water/Wastewater Facilities.

8.5 Automotive

8.5.1 Smart Pneumatic Systems Play A Crucial Role in Ensuring Efficient, Continuous Manufacturing Processes.

8.6 Semiconductor

8.6.1 New Technologies, Such as IoT, and Advanced Analytics, Have Boosted the Sales of Semiconductor and Electronic Devices

8.7 Food & Beverages

8.7.1 Food and Beverages Industry to Hold A Significant Market for Smart Pneumatic Systems

8.8 Others

8.8.1 Metal and Mining

8.8.1.1 Increasing Complexity of Machinery and the Growing Demand for Greater Productivity, has Led to the Adoption of Smart Pneumatic Systems

8.8.2 Chemicals

8.8.2.1 Smart Pneumatics is Used to Monitor the Chemical Processes in A Plant

8.8.3 Pharmaceuticals

8.8.3.1 The Use of Smart Pneumatics has Helped Pharmaceutical Companies in Eliminating Process Constraints

9 Geographic Analysis (Page No. - 69)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.1.1 Accounted for the Largest Share for Smart Pneumatic Market in North America

9.2.2 Canada

9.2.2.1 Canada is Promoting the Adoption of New Manufacturing Technologies and Processes Related to Automation

9.2.3 Mexico

9.2.3.1 Low Cost Labor and Necessary Infrastructure Boost the Growth of Smart Pneumatic Market

9.3 Europe

9.3.1 Germany

9.3.1.1 Germany Held the Largest Share of the Market in Europe

9.3.2 UK

9.3.2.1 Growth in the Industrial Automation Market in the UK, to Provide Potential Growth Opportunities for the Market

9.3.3 France

9.3.3.1 Manufacturers in France are Adopting Smart Factory Initiatives to Automate Their Manufacturing Processes and Enhance Competitiveness

9.3.4 Rest of Europe

9.3.4.1 Manufacturers in France are Adopting Smart Factory Initiatives to Automate Their Manufacturing Processes and Enhance Competitiveness

9.4 APAC

9.4.1 China

9.4.1.1 China Holds Immense Potential for the Growth of the Smart Pneumatics Market

9.4.2 Japan

9.4.2.1 Japan’s Significant Advancements in Technology has Increased FDI Inflow in Its Industrial Sector

9.4.3 India

9.4.3.1 India Presents Huge Growth Opportunities for the IIoT Market Given Its Large-Scale Industrial Development

9.4.4 Rest of APAC

9.4.4.1 Availability of Labor at Considerably Lower Rates Than in Other Regions and the Growing Number of Production-Based Companies are the Key Factors Driving the Growth of the Market

9.5 RoW

9.5.1 Middle East

9.5.1.1 Increasing Demand From the Oil & Gas Vertical and Numerous Smart Cities Initiatives Have Boosted the Adoption of IoT in the Middle East

9.5.2 South America

9.5.2.1 Industries in South America are Also Focusing on Smart Manufacturing to Produce High-Quality End Products

9.5.3 Africa

9.5.3.1 Increasing Investments in Infrastructure Development and Wider Adoption of Advanced Technologies Would Create Growth Avenues for the Market in the Near Future

10 Competitive Landscape (Page No. - 87)

10.1 Overview

10.2 Ranking Analysis, 2017

10.3 Competitive Situations and Trends

10.3.1 Product Launches and Developments

10.3.2 Acquisition, Collaborations, and Partnerships

10.3.3 Contracts, and Expansions

11 Company Profiles (Page No. - 91)

11.1 Key Players

(Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

11.1.1 Emerson Electric

11.1.2 Festo

11.1.3 Parker Hannifin

11.1.4 Bimba Manufcatruing

11.1.5 Rotork

11.1.6 Mesto

11.1.7 Thomson Industries

*Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 108)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (30 Tables)

Table 1 Smart Pneumatics Market, By Type, 2016–2023 (USD Million)

Table 2 Market, By Type, 2016–2023 (USD Million)

Table 3 Smart Pneumatic Valve Market, By Industry, 2016–2023 (USD Million)

Table 4 Smart Pneumatic Actuators Market, By Industry, 2016–2023 (USD Million)

Table 5 Smart Pneumatic Modules Market, By Industry, 2016–2023 (USD Million)

Table 6 Market, By Industry, 2016–2023 (USD Million)

Table 7 Market for Oil & Gas, By Type, 2016–2023 (USD Million)

Table 8 Market for Oil & Gas, By Region, 2016–2023 (USD Million)

Table 9 Market for Energy & Power, By Type, 2016–2023 (USD Million)

Table 10 Market for Energy & Power, By Region, 2016–2023 (USD Million)

Table 11 Market for Water & Wastewater, By Type, 2016–2023 (USD Million)

Table 12 Market for Water & Wastewater, By Region, 2016–2023 (USD Million)

Table 13 Market for Automotive, By Type, 2016–2023 (USD Million)

Table 14 Market for Automotive, By Region, 2016–2023 (USD Million)

Table 15 Market for Semiconductor, By Type, 2016–2023 (USD Million)

Table 16 Market for Semiconductor, By Region, 2016–2023 (USD Million)

Table 17 Market for Food & Beverages, By Type, 2016–2023 (USD Million)

Table 18 Market for Food & Beverages, By Region, 2016–2023 (USD Million)

Table 19 Market for Others, By Type, 2016–2023 (USD Million)

Table 20 Market for Others, By Region, 2016–2023 (USD Million)

Table 21 Market, By Region, 2016–2023 (USD Million)

Table 22 Market in North America, By Country, 2016–2023 (USD Million)

Table 23 Market in North America, By Industry, 2016–2023 (USD Million)

Table 24 Market in Europe, By Country, 2016–2023 (USD Million)

Table 25 Market in Europe, By Industry, 2016–2023 (USD Million)

Table 26 Market in APAC, By Country, 2016–2023 (USD Million)

Table 27 Market in APAC, By Industry, 2016–2023 (USD Million)

Table 28 Market in RoW, By Region, 2016–2023 (USD Million)

Table 29 Market in South America, By Country, 2016–2023 (USD Million)

Table 30 Smart Pneumatics Market in RoW, By Industry, 2016–2023 (USD Million)

List of Figures (38 Figures)

Figure 1 Research Design

Figure 2 Bottom-Up Approach

Figure 3 Top-Down Approach

Figure 4 Data Triangulation

Figure 5 Smart Pneumatics Market, in Terms of Value, 2016–2023

Figure 6 Snapshot of Market: Smart Pneumatic Valves to Hold Larger Market Size in 2018

Figure 7 Hardware Component to Dominate the Market During Forecast Period, in Terms of Size

Figure 8 Market for Automotive Applications to Grow at Highest CAGR During Forecast Period

Figure 9 APAC to Hold Largest Share of Market in 2018

Figure 10 Rise in Adoption of IIoT to Creat Attractive Growth Opportunities for Market Players

Figure 11 Smart Pneumatic Actuators Market to Grow at Highest CAGR During Forecast Period

Figure 12 US to Hold Largest Share of Market in North America By 2023

Figure 13 Automotive Industry to Dominate Market During 2018–2023

Figure 14 APAC Expected to Witness the Highest Growth Rate During the Forecast Period

Figure 15 Inherent Advantages Drive Market

Figure 16 Market: Major Value Added By Manufacturers and Component Providers

Figure 17 Smart Pneumatic Market, By Type

Figure 18 Market for Software and Services to Grow at Highest CAGR From 2018 to 2023

Figure 19 Smart Pneumatic Market, By Type, 2017

Figure 20 Market for Smart Pneumatic Actuators to Grow at Highest CAGR From 2018 to 2023

Figure 21 Automotive to Dominate Smart Pneumatic Actuators Market By 2023

Figure 22 Smart Pneumatic Market, By Industry

Figure 23 Market for Automotive Expected to Grow at Highest CAGR From 2018 to 2023

Figure 24 APAC to Hold Largest Share of Market for Energy & Power During Forecast Period

Figure 25 Smart Pneumatic Modules Market for Automotive Industry to Grow at Highest CAGR During Forecast Period

Figure 26 APAC Expected to Hold Largest Share of Market for Food & Beverages Industry By 2023

Figure 27 Smart Pneumatic Valves Market for Others to Grow at Highest Rate During Forecast Period

Figure 28 Geographic Snapshot: India Expected to Witness Significant Growth During Forecast Period

Figure 29 APAC Held Largest Share of Market in 2017

Figure 30 North America: Snapshot of Market

Figure 31 Europe: Snapshot of Market

Figure 32 APAC: Snapshot of Market

Figure 33 Product Launches and Developments Adopted as Key Growth Strategies From January 2016 to November 2018

Figure 34 Smart Pneumatic Market: Ranking Analysis (2017)

Figure 35 Emerson Electric: Company Snapshot

Figure 36 Parker Hannifin: Company Snapshot

Figure 37 Rotork: Company Snapshot

Figure 38 Metso: Company Snapshot

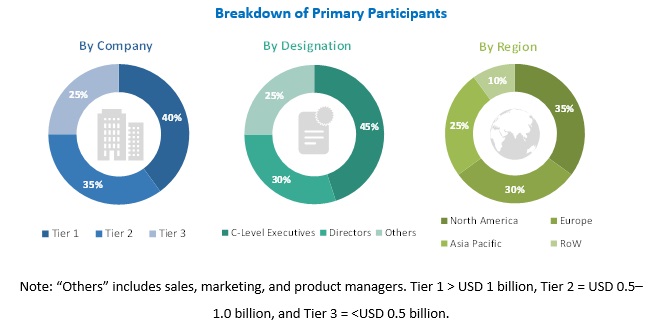

The study involved four major activities in estimating the current size of the smart pneumatic market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation methods were used to estimate the market size of segments and subsegments.

Secondary Research

The research methodology used to estimate and forecast the smart pneumatic market begins with capturing data on revenue of key vendors in the market through secondary research. This study incorporates the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource to identify and collect information useful for the technical, market-oriented, and commercial study of the smart pneumatic market. Vendor offerings have also been considered to determine the market segmentation. This entire research methodology includes the study of annual and financial reports of top players, presentations, press releases, journals, paid databases, trade directories, regulatory bodies, and safety standard organizations

Primary Research

Smart pneumatic market comprises several stakeholders, such as suppliers of raw material and manufacturing equipment; standard components, original equipment manufacturers (OEMs); original device manufacturers (ODMs) of smart pneumatic; solutions providers; vendors of assembly, testing, and packaging solutions; and system integrators in the supply chain. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the smart pneumatics market. These methods have been also used extensively to estimate the size of various subsegments in the market. The following method has been used to estimate the market size:

- Major players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches

Report Objectives

- To describe and forecast the smart pneumatics market, in terms of value, by component, type, and industry

- To describe and forecast the smart pneumatics market, in terms of value, by region—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)—along with respective countries

- To provide detailed information regarding the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the smart pneumatic market

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of the smart pneumatics market

- To analyze market opportunities for stakeholders by identifying high-growth segments of the smart pneumatics ecosystem

- To strategically profile key players and comprehensively analyze their market positions, in terms of ranking and core competencies, along with detailing the competitive landscape for market leaders

- To analyze strategic approaches, such as product launches, acquisitions, collaborations, contracts, agreements, expansions, and partnerships, in the smart pneumatics market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of a company. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Smart Pneumatics Market