Smart Manufacturing Platform Market by Type (Device Management, Connectivity Management, Application Enablement Platform), Application (Performance, Optimization, Asset & Condition Monitoring), Industry, Region (2021-2026)

Updated on : October 22, 2024

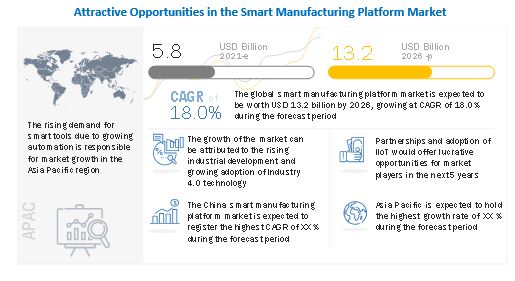

[263 Pages Report] The global Smart manufacturing platform market is projected to reach USD 13.2 billion by 2026, growing at a CAGR of 18.0%.

The growth of the market is attributed to growth in industrial automation, growing adoption of smart manufacturing platforms in automotive industry, increasing support from governments for industrial automation, and growing need for streamlined and automated data to boost productivity. However, factors such as lacked of skilled IoT-related workforce and requirement of maintenance attributed to frequent software upgradation. On the flip side, growth in adoption of IIoT and cloud technologies and partnership of platform providers with cloud service providers are expected to create opportunities for the adoption of smart manufacturing platform in the coming years. Moreover, the complexity in integration of smart manufacturing platforms and concern related to security in wireless networking acts as a challenge for the smart manufacturing platform industry .

To know about the assumptions considered for the study, download the pdf brochure

Impact of COVID-19 on the smart manufacturing platform market

COVID-19 has severely impacted the global economy and all the industries throughout the globe. Governments of various countries have imposed lockdowns to contain the spread of the epidemic. The complete global lockdown in the initial stage of the pandemic in various countries severely impacted the livelihoods of people and quality of life. This has resulted into the disruptions in the supply chain across the globe. The economies across the world have declined as there is a major decline in the demand for products. The production across industries has been limited due to the pandemic resulting in the shortage of raw material. The decline in exports and the disruptions in the supply chain are the major factors contributing to the decline in production.

Demand for smart manufacturing has significantly reduced owing to the shutdown of manufacturing facilities across the world in the Q1 and Q2 of 2020. However, industrial plants are expected to resume their production activities, which is expected to increase the demand for smart manufacturing platforms in various industries. Besides, manufacturers are highly focusing on digitization after the outbreak of the pandemic which is increasing the adoption of smart manufacturing platform. However, the market value may not reach that of the pre-COVID-19 value until 2026.

Smart Manufacturing Platfrom Market Dynamics

DRIVERS : Growth in industrial automation

Industrial automation is defined as the use of control systems such as robots or computers for handling machinery and different processes in any industry. For instance, in the manufacturing industry, intelligent machines are being used to carry out the manufacturing process without any human intervention. Companies engaged in industrial manufacturing are witnessing high pressure to increase productivity, as well as lower the manufacturing cost. Thus, to reduce manufacturing costs, increase productivity, and optimize resources, they are adopting industrial automation. Industrial automation systems eliminate human intervention; help in reducing the work, waste, and labor cost; minimize downtime and inaccuracies; increase process quality; and reduce the response and processing time. In addition, the systems also monitor and record valuable information to enhance the manufacturing process, identify patterns, and implement changes to prevent future events.

RESTRAINT: Lack of skilled IoT-related workforce

The growing need to boost productivity, optimize resources, and lower manufacturing costs are factors responsible for the increasing demand for smart manufacturing platforms in manufacturing facilities. Smart manufacturing platforms help manufacturers to collect and manage data automatically to make informed decisions. This data from machines and sensors is communicated to the cloud via IoT technology. Several companies across the globe have highly invested in research and development and are adopting IoT technologies to automate their manufacturing processes. However, some companies are still following the traditional manufacturing practices owing to a lack of a skilled workforce related to IoT technology.

OPPORTUNITIES : Growth in adoption of IIoT and cloud technologies

IIoT is the application of connected sensors, instrumentation, and other machinery devices in the manufacturing industry. IIoT is revolutionizing manufacturing plants by connecting a wide network of intelligent devices that can increase automation in plants. With IIoT, plant floors are becoming increasingly interconnected and integrated, which has led to the transformation of industrial automation into smart automation, enabling manufacturers to gain a higher return on investment. IIoT enables users to access data of the inaccessible areas of a plant at any time. The IIoT makes industrial processes efficient, productive, and innovative, as the architecture provides information about operational and business systems on a real-time basis. The manufacturers investing in the IIoT are gaining benefits such as increased and efficient productivity through connectivity, automation, and analytics. IIoT provides complete visibility of assets, resources, processes, and products to the plant managers. The major companies utilizing IIoT for the transformation of businesses are ABB (Switzerland), Microsoft Corporation (US), Amazon (US), Bosch (Germany), and Hitachi (Japan), among others.

CHALLENGES: Complexity in integration of smart manufacturing platforms

Intensifying competition, growing instability in the business arena, and technological advancements are necessitating the need to change the way manufacturing enterprises operate and the way they expand their business. To tackle these issues, organizations need to accomplish seamless interoperability. Information availability and e-communication are essential in any manufacturing enterprise for smooth operation. This can only be achieved with the optimal IT networks and infrastructure. The manufacturing operations with respect to monitoring, resolution, economic performance assessment, self-adaptation, interpretation, and implementation issues are addressed with the best quality IT networks and infrastructure.

Process industry to grow at the fastest rate during the forecast period

The process industry includes oil & gas, chemical, energy and power, food & beverage; pharmaceutical; mining & metals industries; and others. The power & gas industry faces various challenges such environmental impact and scarcity associated with conventional source might lead to a probable energy crisis in the coming years. Hence, optimization in the energy & power industry has become necessary to increase productivity, efficiency, and their utilization, which has increased the adoption of smart manufacturing platforms in the power &energy industry. Followed by power & energy industry, chemical industry is also estimated to hold significant share of the smart manufacturing platform market, as the industry is benefited by the smart manufacturing platform offering which include predictive maintenance, enhances process yield, reduced energy expenses, and minimizes supply chain risks.

Device management to hold the largest share of smart manufacturing platform market by 2026

The emergence of artificial intelligence, IIoT, smart manufacturing, Industry 4.0, digitization, and connected enterprise has influenced various industries to deploy advanced solutions in their plants. As a large amount of data is generated from various devices used in industrial facilities thus, it has become vital to manage the devices and data generated. The device management platform allows to connect and disconnect new devices, control various devices, view details of devices and check their status, and monitor devices remotely.

Smart manufacturing platform in APAC to grow at the highest CAGR

APAC is expected to hold the largest growth rate of the global smart manufacturing platform market during the forecast period. APAC has been showing impressive development in industrialization for the last few years and is at the forefront of the digital revolution from rest of the world. The region can be seen steadily advancing toward the digital future. In APAC, there is a large number of emerging new small- and medium-sized businesses. It is easier for emerging businesses to adopt digitalization. Hence, the rate of digitalization is consistently growing in the region. Countries such as China, Japan, and India have undertaken numerous initiatives to encourage the implementation of IIoT in their domestic industries. Government support for the adoption of automation technologies and rapid industrialization and urbanization are some of the major factors driving the growth of the IIoT market in APAC, which, in turn, is expected to fuel the growth of the smart manufacturing platform market.

Top Smart manufacturing platform Companies - Key Market Players :

-

ABB (Switzerland),

-

Siemens (Germany),

-

Schneider Electric (France),

-

IBM (US),

-

PTC Inc. (US),

-

SAP SE (Germany),

Smart Manufacturing Platform Market Report Scope :

|

Report Metric |

Details |

| Estimated Market Size |

USD 5.8 Billion

|

| Projected Market | USD 13.2 Billion |

| Growth Rate | 18.0% CAGR |

|

Market size available for years |

2017–2026 |

|

Forecast Period |

2021–2026 |

| Base Year considered | 2020 |

|

Forecast Units |

Value (USD Billion/Million) |

|

Segments Covered |

|

|

Region Covered |

|

| Market Leaders |

|

| Largest Growing Region | Asia-Pacific |

| Largest Market Share Segment | Device management |

This research report categorizes the smart manufacturing platform market by frequency type, type, industry, and region.

By Type:

- Device Management

- Connectivity Management

- Application Enablement Platform

By Organization Size:

- Small & Medium Enterprises

- Large Enterprises

By Application:

- Performance Optimization

- Asset and Condition Monitoring

- Others

By Industry:

-

Process Industry

- Oil & Gas

- Power & Energy

- Chemicals

- Pharmaceuticals

- Food & Beverages

- Metals & Mining

- Others

-

Discrete Industry

- Automotive

- Electronics & Semiconductor

- Industrial Manufacturing

- Medical Devices

- Aerospace & Defense

- Others

By Deployment Type:

- Cloud

- On-Premises

By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

Recent Developments in Smart Manufacturing Platfrom Industry

- In October 2020, Schneider Electric introduced EcoStruxure Automation Expert, the world’s first software-centric industrial automation system. Through this innovation, the company aims to help the customers unlock the full potential of the fourth industrial revolution.

- In July 2020, ABB announced the launch of new analytical software and services, namely, ABB Ability Genix Industrial Analytics and AI Suite, which are capable of combining operational data with IT and engineering data to deliver actionable intelligence. The newly launched software will help industries optimize asset management, enhance operations, streamline business sustainability, and ensure process safety.

- In June 2020, PTC announced the release of the newest version of the Industrial IoT platform, namely, ThingWorx 9.0, with new features to help industrial companies implement, create, customize, and scale their solutions. ThingWorx 9.0 has introduced an optimized clustered configuration, which will enhance the horizontal scalability of the platform.

Frequently Asked Questions (FAQ):

What is the total CAGR expected to be recorded for the smart manufacturing platform market during 2021-2026?

The global smart manufacturing platform market is expected to record the CAGR of 18.0% from 2021–2026.

Does this report include the impact of COVID-19 on the smart manufacturing platform?

Yes, the report includes the impact of COVID-19 on the smart manufacturing platform market. It illustrates the post- COVID-19 market scenario.

What are the driving factors for the smart manufacturing platform?

Growth in industrial automation, growing adoption of smart manufacturing platforms in automotive industry, increasing support from governments for industrial automation, and growing need for streamlined and automated data to boost productivity

Which are the significant players operating in the smart manufacturing platform market?

ABB (Switzerland), Siemens (Germany), Schneider Electric (France), IBM (US), PTC Inc. (US), SAP SE (Germany), Emerson Electric Co. (US), and GENERAL ELECTRIC (US) are some of the major companies operating in the smart manufacturing platform market.

Which region will lead the smart manufacturing platform market in the future?

APAC is expected to lead the smart manufacturing platform market during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

|

2020 |

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 33)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 37)

2.1 RESEARCH DESIGN

FIGURE 1 SMART MANUFACTURING PLATFORM MARKET: RESEARCH DESIGN

2.1.1 SECONDARY & PRIMARY RESEARCH

2.1.2 SECONDARY DATA

2.1.2.1 List of major secondary sources

2.1.2.2 Key data from secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Primary interviews with experts

2.1.3.2 Key data from primary sources

2.1.3.3 Key industry insights

2.1.3.4 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH (SUPPLY SIDE): REVENUE OF PRODUCTS/SOLUTIONS/SERVICES OF SMART MANUFACTURING PLATFORM MARKET SIZE

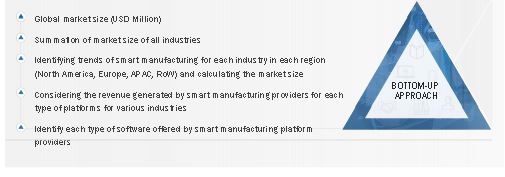

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at market share by bottom-up analysis (demand side)

FIGURE 3 SMART MANUFACTURING PLATFORM MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing market share by top-down analysis (supply side)

FIGURE 4 SMART MANUFACTURING PLATFORM MARKET: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 RISK ASSESSMENT

TABLE 1 LIMITATIONS & ASSOCIATED RESULTS

3 EXECUTIVE SUMMARY (Page No. - 47)

FIGURE 6 COVID-19 IMPACT ANALYSIS ON SMART MANUFACTURING PLATFORM MARKET

3.1 REALISTIC SCENARIO

3.2 PESSIMISTIC SCENARIO

3.3 OPTIMISTIC SCENARIO

FIGURE 7 CLOUD DEPLOYMENT TYPE TO EXHIBIT HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 8 PROCESS INDUSTRY TO HOLD LARGEST SHARE OF SMART MANUFACTURING PLATFORM MARKET IN 2021

FIGURE 9 APAC SMART MANUFACTURING PLATFORM MARKET TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 51)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR SMART MANUFACTURING PLATFORM MARKET

FIGURE 10 INCREASING IMPLEMENTATION OF IIOT IN VARIOUS INDUSTRIES TO CREATE LUCRATIVE OPPORTUNITIES FOR APAC SMART MANUFACTURING PLATFORM MARKET

4.2 SMART MANUFACTURING PLATFORM MARKET, BY TYPE

FIGURE 11 DEVICE MANAGEMENT SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4.3 SMART MANUFACTURING PLATFORM MARKET, BY DISCRETE INDUSTRY

FIGURE 12 AUTOMOTIVE INDUSTRY TO HOLD LARGEST SHARE OF SMART MANUFACTURING PLATFORM MARKET IN 2026

4.4 SMART MANUFACTURING PLATFORM MARKET, BY GEOGRAPHY

FIGURE 13 NORTH AMERICA HOLD LARGEST SIZE OF SMART MANUFACTURING PLATFORM MARKET IN 2021

5 MARKET OVERVIEW (Page No. - 53)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 14 SMART MANUFACTURING PLATFORM MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Growth in industrial automation

5.2.1.2 Growing adoption of smart manufacturing platforms in automotive industry

5.2.1.3 Increasing support from governments for industrial automation

5.2.1.4 Growing need for streamlined and automated data to boost productivity

FIGURE 15 DRIVERS OF GLOBAL SMART MANUFACTURING PLATFORM MARKET AND THEIR IMPACT

5.2.2 RESTRAINTS

5.2.2.1 Lack of skilled IoT-related workforce

5.2.2.2 Requirement of maintenance attributed to frequent software upgradation

FIGURE 16 RESTRAINTS FOR GLOBAL SMART MANUFACTURING PLATFORM MARKET AND THEIR IMPACT

5.2.3 OPPORTUNITIES

5.2.3.1 Growth in adoption of IIoT and cloud technologies

5.2.3.2 Partnerships of platform providers with cloud service providers

FIGURE 17 OPPORTUNITIES FOR GLOBAL SMART MANUFACTURING PLATFORM MARKET AND THEIR IMPACT

5.2.4 CHALLENGES

5.2.4.1 Complexity in integration of smart manufacturing platforms

5.2.4.2 Concerns related to security in wireless networking

FIGURE 18 CHALLENGES FOR GLOBAL SMART MANUFACTURING PLATFORM MARKET AND THEIR IMPACT

5.3 VALUE CHAIN

FIGURE 19 VALUE CHAIN ANALYSIS: GLOBAL SMART MANUFACTURING PLATFORM MARKET

5.4 ECOSYSTEM

FIGURE 20 GLOBAL SMART MANUFACTURING PLATFORM MARKET: ECOSYSTEM

TABLE 2 SMART MANUFACTURING PLATFORM MARKET: ECOSYSTEM

5.5 YC–YCC SHIFT FOR SMART MANUFACTURING PLATFORM MARKET

FIGURE 21 YC–YCC SHIFT FOR SMART MANUFACTURING PLATFORM MARKET

5.6 PORTER’S FIVE FORCE ANALYSIS

TABLE 3 IMPACT OF EACH FORCE ON SMART MANUFACTURING PLATFORM MARKET

5.7 CASE STUDY

5.7.1 USE CASE 1: MICROSOFT CORPORATION

5.7.2 USE CASE 2: PTC INC.

5.8 TECHNOLOGY TRENDS

5.8.1 ARTIFICIAL INTELLIGENCE (AI)

5.8.2 INTERNET OF THINGS (IOT)

5.8.3 BLOCKCHAIN

5.8.4 AUGMENTED REALITY (AR) & VIRTUAL REALITY (VR)

5.8.5 COLLABORATIVE ROBOTS

5.9 PRICING ANALYSIS

5.10 TRADE ANALYSIS

FIGURE 22 IMPORT DATA FOR INDUSTRIAL ROBOTS, 2016–2020 (USD MILLION)

FIGURE 23 EXPORT DATA FOR INDUSTRIAL ROBOT, 2015–2019 (USD MILLION)

TABLE 4 IMPORT OF INDUSTRIAL ROBOTS, BY REGION, 2015–2019 (USD MILLION)

5.11 PATENT ANALYSIS

FIGURE 24 TOP COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS

FIGURE 25 PATENT ANALYSIS RELATED TO SMART MANUFACTURING PLATFORM MARKET

5.12 STANDARDS & REGULATORY LANDSCAPE

5.12.1 IEC TS 62832-1: 2020

5.12.2 OPEN PLATFORM COMMUNICATIONS UNIFIED ARCHITECTURE (OPC UA)

5.12.3 ISO/IEC TR 63306-1:2020

5.12.4 ISO 55001: 2014

5.12.5 REGULATORY LANDSCAPE OF SMART MANUFACTURING PLATFORM

5.12.5.1 Society 5.0 - Japan

5.12.5.2 RIE2020 - Singapore

5.12.5.3 High-Tech Strategy 2020 - Germany

6 SMART MANUFACTURING PLATFORM MARKET, BY TYPE (Page No. - 73)

6.1 INTRODUCTION

FIGURE 26 SMART MANUFACTURING PLATFORM MARKET, BY TYPE

FIGURE 27 DEVICE MANAGEMENT SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 5 SMART MANUFACTURING PLATFORM MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 6 SMART MANUFACTURING PLATFORM MARKET, BY TYPE, 2021–2026 (USD MILLION)

6.2 DEVICE MANAGEMENT

6.2.1 INCREASING NUMBER OF IOT DEVICES THAT REQUIRE DEVICE MANAGEMENT PLATFORMS TO DRIVE GROWTH OF SEGMENT

6.3 CONNECTIVITY MANAGEMENT

6.3.1 GROWING NEED FOR MANAGING NETWORK CONNECTIVITY TO BOOST GROWTH OF CONNECTIVITY MANAGEMENT PLATFORM SEGMENT

6.4 APPLICATION ENABLEMENT PLATFORM

6.4.1 MARKET FOR APPLICATION ENABLEMENT PLATFORM TO GROW AT SIGNIFICANT RATE

7 SMART MANUFACTURING PLATFORM MARKET, BY ORGANIZATION SIZE (Page No. - 77)

7.1 INTRODUCTION

FIGURE 28 SMART MANUFACTURING PLATFORM MARKET, BY ORGANIZATION SIZE

7.2 SMALL & MEDIUM ENTERPRISES

7.2.1 INCREASING DEMAND FOR SMART MANUFACTURING PLATFORMS IN SMALL & MEDIUM ENTERPRISES TO ELIMINATE HUMAN INTERVENTION TO FUEL MARKET GROWTH

7.3 LARGE ENTERPRISES

7.3.1 LARGE ENTERPRISES SEGMENT TO HOLD LARGEST MARKET SHARE

8 SMART MANUFACTURING PLATFORM MARKET, BY APPLICATION (Page No. - 79)

8.1 INTRODUCTION

FIGURE 29 SMART MANUFACTURING PLATFORM MARKET, BY APPLICATION

FIGURE 30 PERFORMANCE OPTIMIZATION APPLICATION SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 7 SMART MANUFACTURING PLATFORM MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 8 SMART MANUFACTURING PLATFORM MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

8.2 PERFORMANCE OPTIMIZATION

8.2.1 GROWING NEED FOR MONITORING OPERATIONS AND PRODUCTION PROCESSES TO DRIVE GROWTH OF MARKET

TABLE 9 MARKET FOR PERFORMANCE OPTIMIZATION, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 10 MARKET FOR PERFORMANCE OPTIMIZATION, BY INDUSTRY, 2021–2026 (USD MILLION)

TABLE 11 MARKET FOR PERFORMANCE OPTIMIZATION, BY DISCRETE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 12 MARKET FOR PERFORMANCE OPTIMIZATION, BY DISCRETE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 13 MARKET FOR PERFORMANCE OPTIMIZATION, BY PROCESS INDUSTRY, 2017–2020 (USD MILLION)

TABLE 14 MARKET FOR PERFORMANCE OPTIMIZATION, BY PROCESS INDUSTRY, 2021–2026 (USD MILLION)

8.3 ASSET AND CONDITION MONITORING

8.3.1 GROWING NEED FOR MONITORING EQUIPMENT AND ASSETS IN REAL TIME IS FUELING MARKET GROWTH

TABLE 15 MARKET FOR ASSET AND CONDITION MONITORING, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 16 MARKET FOR ASSET AND CONDITION MONITORING, BY INDUSTRY, 2021–2026 (USD MILLION)

TABLE 17 MARKET FOR ASSET AND CONDITION MONITORING, BY DISCRETE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 18 MARKET FOR ASSET AND CONDITION MONITORING, BY DISCRETE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 19 MARKET FOR ASSET AND CONDITION MONITORING, BY PROCESS INDUSTRY, 2017–2020 (USD MILLION)

TABLE 20 MARKET FOR ASSET AND CONDITION MONITORING, BY PROCESS INDUSTRY, 2021–2026 (USD MILLION)

8.4 OTHERS

TABLE 21 SMART MANUFACTURING PLATFORM MARKET FOR OTHERS, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 22 MARKET FOR OTHERS, BY INDUSTRY, 2021–2026 (USD MILLION)

TABLE 23 MARKET FOR OTHERS, BY DISCRETE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 24 MARKET FOR OTHERS, BY DISCRETE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 25 MARKET FOR OTHERS, BY PROCESS INDUSTRY, 2017–2020 (USD MILLION)

TABLE 26 MARKET FOR OTHERS, BY PROCESS INDUSTRY, 2021–2026 (USD MILLION)

9 SMART MANUFACTURING PLATFORM MARKET, BY INDUSTRY (Page No. - 89)

9.1 INTRODUCTION

FIGURE 31 SMART MANUFACTURING PLATFORM MARKET, BY INDUSTRY

FIGURE 32 DISCRETE INDUSTRY TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 27 SMART MANUFACTURING PLATFORM MARKET, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 28 SMART MANUFACTURING PLATFORM MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

9.2 PROCESS INDUSTRY

FIGURE 33 POWER & ENERGY INDUSTRY TO EXHIBIT HIGHEST CAGR IN SMART MANUFACTURING PLATFORM MARKET FOR DISCRETE INDUSTRY DURING FORECAST PERIOD

TABLE 29 MARKET, BY PROCESS INDUSTRY, 2017–2020 (USD MILLION)

TABLE 30 MARKET, BY PROCESS INDUSTRY, 2021–2026 (USD MILLION)

TABLE 31 MARKET FOR PROCESS INDUSTRY, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 32 MARKET FOR PROCESS INDUSTRY, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 33 MARKET FOR PROCESS INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 34 MARKET FOR PROCESS INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

9.2.1 OIL & GAS

9.2.1.1 Oil & gas industry to hold significant market share during forecast period

9.2.1.2 Impact of COVID-19 on oil & gas industry

TABLE 35 SMART MANUFACTURING PLATFORM MARKET FOR OIL & GAS INDUSTRY, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 36 MARKET FOR OIL & GAS INDUSTRY, BY APPLICATION, 2021–2026 (USD MILLION)

FIGURE 34 MARKET FOR OIL & GAS INDUSTRY IN APAC TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

TABLE 37 MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 38 MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

9.2.2 POWER & ENERGY

9.2.2.1 Power & energy is fastest growing process industry for smart manufacturing platform market as it requires optimum utilization of available resources

9.2.2.2 Impact of COVID-19 on power & energy industry

TABLE 39 SMART MANUFACTURING PLATFORM MARKET FOR POWER & ENERGY INDUSTRY, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 40 MARKET FOR POWER & ENERGY INDUSTRY, BY APPLICATION, 2021–2026 (USD MILLION)

FIGURE 35 MARKET FOR POWER & ENERGY INDUSTRY IN NORTH AMERICA TO HOLD LARGEST SHARE IN 2026

TABLE 41 MARKET FOR POWER & ENERGY INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 42 MARKET FOR POWER & ENERGY INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

9.2.3 CHEMICAL

9.2.3.1 Chemical industry to witness highest growth rate in coming years

9.2.3.2 Impact of COVID-19 on chemical industry

TABLE 43 SMART MANUFACTURING PLATFORM MARKET FOR CHEMICAL INDUSTRY, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 44 MARKET FOR CHEMICAL INDUSTRY, BY APPLICATION, 2021–2026 (USD MILLION)

FIGURE 36 NORTH AMERICA TO HOLD LARGEST SIZE OF SMART MANUFACTURING PLATFORM MARKET FOR CHEMICAL INDUSTRY DURING FORECAST PERIOD

TABLE 45 MARKET FOR CHEMICAL INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 46 MARKET FOR CHEMICAL INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

9.2.4 PHARMACEUTICAL

9.2.4.1 Increasing automation to improve compliance and minimizing deviation in manufacturing process to fuel market growth

9.2.4.2 Impact of COVID-19 on pharmaceutical industry

TABLE 47 SMART MANUFACTURING PLATFORM MARKET FOR PHARMACEUTICAL INDUSTRY, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 48 MARKET FOR PHARMACEUTICAL INDUSTRY, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 49 MARKET FOR PHARMACEUTICAL INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 50 MARKET FOR PHARMACEUTICAL INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

9.2.5 FOOD & BEVERAGE

9.2.5.1 Growing requirement for increasing productivity and reducing downtime is fueling demand for smart manufacturing platforms in food & beverage industry

9.2.5.2 Impact of COVID-19 on food & beverage industry

TABLE 51 SMART MANUFACTURING PLATFORM MARKET FOR FOOD & BEVERAGE INDUSTRY, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 52 MARKET FOR FOOD & BEVERAGE INDUSTRY, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 53 MARKET FOR FOOD & BEVERAGE INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 54 MARKET FOR FOOD & BEVERAGE INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

9.2.6 METAL & MINING

9.2.6.1 Growing adoption of smart manufacturing platform to ensure safety of mining operation to fuel market growth

9.2.6.2 Impact of COVID-19 on metal and mining industry

TABLE 55 SMART MANUFACTURING PLATFORM MARKET FOR METAL & MINING INDUSTRY, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 56 MARKET FOR METAL & MINING INDUSTRY, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 57 MARKET FOR METAL & MINING INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 58 MARKET FOR METAL & MINING INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

9.2.7 OTHERS

9.2.7.1 Impact of COVID-19 on other industries

TABLE 59 SMART MANUFACTURING PLATFORM MARKET, FOR OTHER PROCESS INDUSTRIES, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 60 MARKET, FOR OTHER PROCESS INDUSTRIES, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 61 MARKET, FOR OTHER PROCESS INDUSTRIES, BY REGION, 2017–2020 (USD MILLION)

TABLE 62 MARKET, FOR OTHER PROCESS INDUSTRIES, BY REGION, 2021–2026 (USD MILLION)

9.3 DISCRETE INDUSTRY

FIGURE 37 AUTOMOTIVE INDUSTRY TO GROW AT HIGHEST CAGR IN SMART MANUFACTURING PLATFORM MARKET DURING FORECAST PERIOD

TABLE 63 SMART MANUFACTURING PLATFORM MARKET FOR DISCRETE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 64 MARKET FOR DISCRETE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 65 MARKET FOR DISCRETE INDUSTRY, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 66 MARKET FOR DISCRETE INDUSTRY, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 67 SMARKET FOR DISCRETE INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 68 MARKET FOR DISCRETE INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

9.3.1 AUTOMOTIVE

9.3.1.1 Growing adoption of advanced technologies—machine vision, collaborative robots, and artificial intelligence—to drive growth of market

9.3.1.2 Impact of COVID-19 on automotive industry

TABLE 69 SMART MANUFACTURING PLATFORM MARKET, FOR AUTOMOTIVE INDUSTRY, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 70 MARKET FOR AUTOMOTIVE INDUSTRY, BY APPLICATION, 2021–2026 (USD MILLION)

FIGURE 38 MARKET FOR AUTOMOTIVE INDUSTRY IN APAC TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 71 MARKET FOR AUTOMOTIVE INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 72 MARKET FOR AUTOMOTIVE INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

9.3.2 ELECTRONICS & SEMICONDUCTOR

9.3.2.1 Intense cost pressure and requirement of faster time-to-market for automation technologies to drive growth of market

9.3.2.2 Impact of COVID-19 on electronic and semiconductor industry

TABLE 73 SMART MANUFACTURING PLATFORM MARKET FOR ELECTRONICS & SEMICONDUCTOR INDUSTRY, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 74 MARKET FOR ELECTRONICS & SEMICONDUCTOR INDUSTRY, BY APPLICATION, 2021–2026 (USD MILLION)

FIGURE 39 SMART MANUFACTURING PLATFORM MARKET FOR ELECTRONICS AND SEMICONDUCTOR INDUSTRY IN APAC TO HOLD LARGEST MARKET SHARE IN 2026

TABLE 75 MARKET FOR ELECTRONICS & SEMICONDUCTOR INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 76 MARKET FOR ELECTRONICS & SEMICONDUCTOR INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

9.3.3 INDUSTRIAL MANUFACTURING

9.3.3.1 Rising usage of smart manufacturing platforms to reduce downtime and enhance operational efficiency to fuel market growth

9.3.3.2 Impact of COVID-19 on industrial manufacturing industry

TABLE 77 MARKET FOR INDUSTRIAL MANUFACTURING INDUSTRY, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 78 MARKET FOR INDUSTRIAL MANUFACTURING INDUSTRY, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 79 MARKET FOR INDUSTRIAL MANUFACTURING INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 80 MARKET FOR INDUSTRIAL MANUFACTURING INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

9.3.4 MEDICAL DEVICE

9.3.4.1 Increasing automation to ensure safety, accuracy, and regulatory compliance throughout production process to drive market growth

9.3.4.2 Impact of COVID-19 on medical device industry

TABLE 81 MARKET FOR MEDICAL DEVICE INDUSTRY, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 82 MARKET FOR MEDICAL DEVICE INDUSTRY, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 83 MARKET FOR MEDICAL DEVICE INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 84 MARKET FOR MEDICAL DEVICE INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

9.3.5 AEROSPACE & DEFENSE

9.3.5.1 Long product life cycles and regulatory compliance to fuel demand for automation technologies

9.3.5.2 Impact of COVID-19 on aerospace & defense industry

TABLE 85 SMART MANUFACTURING PLATFORM MARKET FOR AEROSPACE & DEFENSE INDUSTRY, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 86 MARKET FOR AEROSPACE & DEFENSE INDUSTRY, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 87 MARKET FOR AEROSPACE & DEFENSE INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 88 MARKET FOR AEROSPACE & DEFENSE INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

9.3.6 OTHERS

9.3.6.1 Impact of COVID-19 on other industries

TABLE 89 MARKET FOR OTHER DISCRETE INDUSTRY, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 90 MARKET FOR OTHER DISCRETE INDUSTRY, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 91 MARKET FOR OTHER DISCRETE INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 92 MARKET FOR OTHER DISCRETE INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

10 SMART MANUFACTURING PLATFORM MARKET, BY DEPLOYMENT TYPE (Page No. - 126)

10.1 INTRODUCTION

FIGURE 40 SMART MANUFACTURING PLATFORM, BY DEPLOYMENT TYPE

FIGURE 41 CLOUD SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 93 SMART MANUFACTURING PLATFORM MARKET, BY DEPLOYMENT TYPE, 2017–2020 (USD MILLION)

TABLE 94 SMART MANUFACTURING PLATFORM MARKET, BY DEPLOYMENT TYPE, 2021–2026 (USD MILLION)

10.2 CLOUD

10.2.1 GROWING ADOPTION OF CLOUD DEPLOYMENT TYPE TO REMOVE THE HASSLE OF MAINTAINING AND UPDATING SOFTWARE

10.3 ON-PREMISE

10.3.1 ON-PREMISES DEPLOYMENT TYPE HOLD LARGEST SIZE IN MARKET

11 SMART MANUFACTURING PLATFORM MARKET, BY GEOGRAPHY (Page No. - 130)

11.1 INTRODUCTION

FIGURE 42 SMART MANUFACTURING PLATFORM MARKET, BY REGION

FIGURE 43 GEOGRAPHIC SNAPSHOT: SMART MANUFACTURING PLATFORM MARKET

TABLE 95 SMART MANUFACTURING PLATFORM MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 96 SMART MANUFACTURING PLATFORM MARKET, BY REGION, 2021–2026 (USD MILLION)

11.2 NORTH AMERICA

11.2.1 IMPACT OF COVID-19 ON NORTH AMERICAN MARKET

FIGURE 44 SNAPSHOT: SMART MANUFACTURING PLATFORM MARKET IN NORTH AMERICA

FIGURE 45 US TO LEAD SMART MANUFACTURING PLATFORM MARKET IN NORTH AMERICA DURING FORECAST PERIOD

TABLE 97 MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 98 MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 99 MARKET IN NORTH AMERICA, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 100 MARKET IN NORTH AMERICA, BY INDUSTRY, 2021–2026 (USD MILLION)

TABLE 101 MARKET IN NORTH AMERICA, BY DISCRETE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 102 MARKET IN NORTH AMERICA, BY DISCRETE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 103 MARKET IN NORTH AMERICA, BY PROCESS INDUSTRY, 2017–2020 (USD MILLION)

TABLE 104 MARKET IN NORTH AMERICA, FOR PROCESS INDUSTRY, 2021–2026 (USD MILLION)

11.2.2 US

11.2.2.1 Increasing efforts of leading players and start-ups to explore opportunities in smart manufacturing platform ecosystem to drive market growth

11.2.3 CANADA

11.2.3.1 Growing adoption of ai, IIOT, and machine learning technologies in discrete industries to boost market growth

11.2.4 MEXICO

11.2.4.1 Increasing investments by different countries in Mexico to create lucrative growth opportunities for market

11.3 EUROPE

11.3.1 IMPACT OF COVID-19 ON EUROPEAN MARKET

FIGURE 46 SNAPSHOT: SMART MANUFACTURING PLATFORM MARKET IN EUROPE

FIGURE 47 UK TO HOLD LARGEST SHARE OF SMART MANUFACTURING PLATFORM MARKET IN EUROPE DURING FORECAST PERIOD

TABLE 105 MARKET IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 106 MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 107 MARKET IN EUROPE, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 108 MARKET IN EUROPE, BY INDUSTRY, 2021–2026 (USD MILLION)

TABLE 109 MARKET IN EUROPE, BY DISCRETE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 110 MARKET IN EUROPE, BY DISCRETE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 111 MARKET IN EUROPE, BY PROCESS INDUSTRY, 2017–2020 (USD MILLION)

TABLE 112 MARKET IN EUROPE, BY PROCESS INDUSTRY, 2021–2026 (USD MILLION)

11.3.2 UK

11.3.2.1 Growing adoption of smart manufacturing platforms in automotive industry to boost growth of smart manufacturing platform market

11.3.3 GERMANY

11.3.3.1 Germany to witness highest growth rate during forecast period

11.3.4 FRANCE

11.3.4.1 France to hold significant share of smart manufacturing platform market

11.3.5 ITALY

11.3.5.1 Collaboration with different government bodies and strategic partnerships to create growth opportunities for smart manufacturing platform market

11.3.6 REST OF EUROPE

11.4 APAC

11.4.1 IMPACT OF COVID-19 ON APAC MARKET

FIGURE 48 SNAPSHOT: SMART MANUFACTURING PLATFORM MARKET IN APAC

FIGURE 49 CHINA TO BE DOMINANT MARKET FOR SMART MANUFACTURING PLATFORMS IN APAC DURING FORECAST PERIOD

TABLE 113 MARKET IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 114 MARKET IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 115 MARKET IN APAC, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 116 SMMARKET IN APAC, BY INDUSTRY, 2021–2026 (USD MILLION)

TABLE 117 MARKET IN APAC, BY DISCRETE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 118 MARKET IN APAC, BY DISCRETE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 119 MARKET IN APAC, BY PROCESS INDUSTRY, 2017–2020 (USD MILLION)

TABLE 120 SMART MANUFACTURING PLATFORM MARKET IN APAC, BY PROCESS INDUSTRY, 2021–2026 (USD MILLION)

11.4.2 CHINA

11.4.2.1 Growing need for adoption of automation technologies and government support to spur growth of industrialization are driving growth of smart manufacturing platform market

11.4.3 JAPAN

11.4.3.1 Automotive, consumer electronics, and industrial manufacturing are important industries that would create growth opportunities for smart manufacturing platform market

11.4.4 SOUTH KOREA

11.4.4.1 Government support to modernize manufacturing industry to fuel market growth

11.4.5 INDIA

11.4.5.1 Government-led initiatives to support growth of manufacturing sector to fuel growth of smart manufacturing platform market

11.4.6 REST OF APAC

11.5 ROW

11.5.1 IMPACT OF COVID-19 ON ROW MARKET

FIGURE 50 SOUTH AMERICA TO LEAD MARKET IN ROW DURING FORECAST PERIOD

TABLE 121 MARKET IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 122 MARKET IN ROW, BY REGION, 2021–2026 (USD MILLION)

TABLE 123 MARKET IN ROW, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 124 MARKET IN ROW, BY INDUSTRY, 2021–2026 (USD MILLION)

TABLE 125 MARKET IN ROW, BY DISCRETE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 126 MARKET IN ROW, BY DISCRETE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 127 MARKET IN ROW, BY PROCESS INDUSTRY, 2017–2020 (USD MILLION)

TABLE 128 MARKET IN ROW, BY PROCESS INDUSTRY, 2021–2026 (USD MILLION)

11.5.2 SOUTH AMERICA

11.5.2.1 Growing adoption of IOT technologies in different industries to drive growth of market

11.5.3 MIDDLE EAST & AFRICA

11.5.3.1 Growing implementation of advanced technologies in oil & gas and mining industries to propel market growth

12 COMPETITIVE LANDSCAPE (Page No. - 162)

12.1 INTRODUCTION

12.1.1 REVENUE ANALYSIS OF TOP 5 COMPANIES

FIGURE 51 SMART MANUFACTURING PLATFORM MARKET: MARKET SHARE ANALYSIS (2020)

12.2 MARKET SHARE ANALYSIS OF TOP 5 PLAYERS, 2020

TABLE 129 SMART MANUFACTURING PLATFORM MARKET: DEGREE OF COMPETITION

12.3 COMPETITIVE EVALUATION QUADRANT, 2020

12.3.1 STAR

12.3.2 EMERGING LEADER

12.3.3 PERVASIVE

12.3.4 PARTICIPANTS

FIGURE 52 SMART MANUFACTURING PLATFORM MARKET (GLOBAL) COMPANY EVALUATION QUADRANT, 2020

12.4 SMALL AND MEDIUM-SIZED ENTERPRISE (SME) EVALUATION QUADRANT, 2020

12.4.1 PROGRESSIVE COMPANY

12.4.2 RESPONSIVE COMPANY

12.4.3 DYNAMIC COMPANY

12.4.4 STARTING BLOCK

FIGURE 53 SMART MANUFACTURING PLATFORM MARKET (GLOBAL) SME EVALUATION QUADRANT, 2020

12.4.5 SMART MANUFACTURING PLATFORM MARKET: COMPANY FOOTPRINT

TABLE 130 COMPANY PRODUCT FOOTPRINT

FIGURE 54 COMPANY INDUSTRY FOOTPRINT

TABLE 131 COMPANY REGIONAL FOOTPRINT

12.5 COMPETITIVE SITUATIONS AND TRENDS

12.5.1 PRODUCT LAUNCHES

TABLE 132 MARKET: PRODUCT LAUNCHES, JUNE 2020–MARCH 2021

12.5.2 DEALS

TABLE 133 SMART MANUFACTURING PLATFORM MARKET: DEALS, APRIL 2020–MARCH 2021

13 COMPANY PROFILES (Page No. - 179)

13.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View)*

13.1.1 ABB

TABLE 134 ABB: BUSINESS OVERVIEW

FIGURE 55 ABB: COMPANY SNAPSHOT

13.1.2 SCHNEIDER ELECTRIC

TABLE 135 SCHNEIDER ELECTRIC: BUSINESS OVERVIEW

FIGURE 56 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

13.1.3 SIEMENS

TABLE 136 SIEMENS: BUSINESS OVERVIEW

FIGURE 57 SIEMENS: COMPANY SNAPSHOT

13.1.4 EMERSON ELECTRIC CO.

TABLE 137 EMERSON ELECTRIC CO.: BUSINESS OVERVIEW

FIGURE 58 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

13.1.5 GENERAL ELECTRIC CO.

TABLE 138 GENERAL ELECTRIC CO.: BUSINESS OVERVIEW

FIGURE 59 GENERAL ELECTRIC CO.: COMPANY SNAPSHOT

13.1.6 AMAZON WEB SERVICES, INC.

TABLE 139 AMAZON WEB SERVICES, INC.: BUSINESS OVERVIEW

FIGURE 60 AMAZON WEB SERVICES, INC.: COMPANY SNAPSHOT

13.1.7 FUJITSU LTD.

TABLE 140 FUJITSU LTD.: BUSINESS OVERVIEW

FIGURE 61 FUJITSU LTD.: COMPANY SNAPSHOT

13.1.8 HITACHI

TABLE 141 HITACHI: BUSINESS OVERVIEW

FIGURE 62 HITACHI: COMPANY SNAPSHOT

13.1.9 IBM

TABLE 142 IBM: BUSINESS OVERVIEW

FIGURE 63 IBM: COMPANY SNAPSHOT

13.1.10 MICROSOFT CORPORATION

TABLE 143 MICROSOFT CORPORATION: BUSINESS OVERVIEW

FIGURE 64 MICROSOFT CORPORATION: COMPANY SNAPSHOT

13.1.11 PTC INC.

TABLE 144 PTC INC.: BUSINESS OVERVIEW

FIGURE 65 PTC INC.: COMPANY SNAPSHOT

13.1.12 ROBERT BOSCH GMBH

TABLE 145 ROBERT BOSCH GMBH: BUSINESS OVERVIEW

FIGURE 66 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

13.1.13 ROCKWELL AUTOMATION

TABLE 146 ROCKWELL AUTOMATION: BUSINESS OVERVIEW

FIGURE 67 ROCKWELL AUTOMATION: COMPANY SNAPSHOT

13.1.14 SAP SE

TABLE 147 SAP SE: BUSINESS OVERVIEW

FIGURE 68 SAP SE: COMPANY SNAPSHOT

13.1.15 TELIT

TABLE 148 TELIT: BUSINESS OVERVIEW

FIGURE 69 TELIT: COMPANY SNAPSHOT

* Business Overview, Products Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

13.2 OTHER PLAYERS

13.2.1 ALTIZON

13.2.2 C3.AI

13.2.3 PUNZENBERGER COPA-DATA GMBH

13.2.4 DXC TECHNOLOGY COMPANY

13.2.5 FLUTURA

13.2.6 LITMUS AUTOMATION INC.

13.2.7 LOSANT

13.2.8 QIO TECHNOLOGIES

13.2.9 SEEBO INTERACTIVE LTD

13.2.10 ZYFRA LLC

14 ADJACENT & RELATED MARKETS (Page No. - 234)

14.1 INTRODUCTION

14.2 LIMITATIONS

14.3 DIGITAL TWIN MARKET, BY APPLICATION

14.3.1 INTRODUCTION

TABLE 149 DIGITAL TWIN MARKET, BY APPLICATION, 2016–2019 (USD BILLION)

TABLE 150 DIGITAL TWIN MARKET, BY APPLICATION, 2020–2026 (USD BILLION)

14.3.2 PRODUCT DESIGN & DEVELOPMENT

14.3.2.1 Product design & development segment to register steady growth in digital twin market

TABLE 151 DIGITAL TWIN MARKET FOR PRODUCT DESIGN & DEVELOPMENT, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 152 DIGITAL TWIN MARKET FOR PRODUCT DESIGN & DEVELOPMENT, BY INDUSTRY, 2020–2026 (USD MILLION)

14.3.3 PERFORMANCE MONITORING

14.3.3.1 Performance management plays a vital role in digital twin market

TABLE 153 DIGITAL TWIN MARKET, FOR PERFORMANCE MONITORING, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 154 DIGITAL TWIN MARKET FOR PERFORMANCE MONITORING, BY INDUSTRY, 2020–2026 (USD MILLION)

14.3.4 PREDICTIVE MAINTENANCE

14.3.4.1 Predictive maintenance segment to witness healthy growth in market

TABLE 155 DIGITAL TWIN MARKET FOR PREDICTIVE MAINTENANCE, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 156 DIGITAL TWIN MARKET FOR PREDICTIVE MAINTENANCE, BY INDUSTRY, 2020–2026 (USD MILLION)

14.3.5 INVENTORY MANAGEMENT

14.3.5.1 Inventory management will play a major role in transportation & logistics industry for digital twin solutions

TABLE 157 DIGITAL TWIN MARKET FOR INVENTORY MANAGEMENT, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 158 DIGITAL TWIN MARKET FOR INVENTORY MANAGEMENT, BY INDUSTRY, 2020–2026 (USD MILLION)

14.3.6 BUSINESS OPTIMIZATION

14.3.6.1 Business optimization segment to dominate digital twin market during forecast period

TABLE 159 DIGITAL TWIN MARKET FOR BUSINESS OPTIMIZATION, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 160 DIGITAL TWIN MARKET FOR BUSINESS OPTIMIZATION, BY INDUSTRY, 2020–2026 (USD MILLION)

14.3.7 OTHERS

TABLE 161 DIGITAL TWIN MARKET FOR OTHERS, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 162 DIGITAL TWIN MARKET FOR OTHERS, BY INDUSTRY, 2020–2026 (USD MILLION)

14.4 DIGITAL TWIN MARKET, BY GEOGRAPHY

14.4.1 INTRODUCTION

TABLE 163 DIGITAL TWIN MARKET, BY REGION, 2016–2019 (USD BILLION)

TABLE 164 DIGITAL TWIN MARKET, BY REGION, 2020–2026 (USD BILLION)

14.4.2 NORTH AMERICA

TABLE 165 DIGITAL TWIN MARKET IN NORTH AMERICA, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 166 DIGITAL TWIN MARKET IN NORTH AMERICA, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 167 DIGITAL TWIN MARKET IN NORTH AMERICA, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 168 DIGITAL TWIN MARKET IN NORTH AMERICA, BY INDUSTRY, 2020–2026 (USD MILLION)

14.4.2.1 US

14.4.2.1.1 US holds largest share of digital twin market in North America

14.4.2.2 Canada

14.4.2.2.1 Emerging digital technologies to drive growth of digital twin market in Canada

14.4.2.3 Mexico

14.4.2.3.1 Increasing adoption of digitization in the home & commercial segments in Mexico

14.4.3 EUROPE

TABLE 169 DIGITAL TWIN MARKET IN EUROPE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 170 DIGITAL TWIN MARKET IN EUROPE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 171 DIGITAL TWIN MARKET IN EUROPE, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 172 DIGITAL TWIN MARKET IN EUROPE, BY INDUSTRY, 2020–2026 (USD MILLION)

14.4.3.1 Germany

14.4.3.1.1 Industry 4.0 initiative to drive digital twin market in Germany

14.4.3.2 UK

14.4.3.2.1 Digital twin market in UK to witness healthy growth during forecast period

14.4.3.3 France

14.4.3.3.1 IOT & cloud to play vital role in growth of digital twin market in France

14.4.3.4 Rest of Europe

14.4.4 APAC

TABLE 173 MARKET IN APAC, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 174 MARKET IN APAC, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 175 MARKET IN APAC, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 176 MARKET IN APAC, BY INDUSTRY, 2020–2026 (USD MILLION)

14.4.4.1 China

14.4.4.1.1 China to hold largest share of digital twin market during forecast period

14.4.4.2 Japan

14.4.4.2.1 Growing adoption of IoT to drive digital twin market in Japan

14.4.4.3 India

14.4.4.3.1 Government initiatives pertaining to digitalization to spur growth of digital twin market in India

14.4.4.4 South Korea

14.4.4.4.1 South Korea to record high growth rate during forecast period

14.4.4.5 Rest of APAC

14.4.5 ROW

TABLE 177 DIGITAL TWIN MARKET IN ROW, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 178 MARKET IN ROW, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 179 MARKET IN ROW, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 180 MARKET IN ROW, BY INDUSTRY, 2020–2026 (USD MILLION)

14.4.5.1 Middle East

14.4.5.1.1 Growth of oil & gas industry to drive digital twin market in the Middle East

14.4.5.2 South America

14.4.5.2.1 Brazil and Argentina are major contributors to growth of digital twin market in South America

14.4.5.3 Africa

14.4.5.3.1 African telecommunication industry to see significant growth for digital twin market

15 APPENDIX (Page No. - 257)

15.1 INSIGHTS OF INDUSTRY EXPERTS

15.2 DISCUSSION GUIDE

15.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.4 AVAILABLE CUSTOMIZATIONS

15.5 RELATED REPORTS

15.6 AUTHOR DETAILS

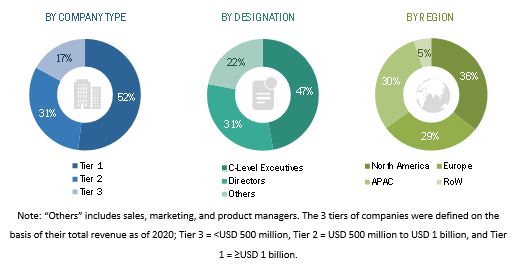

The study involved four major activities in estimating the current size of the smart manufacturing platform market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. To validate these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments. Two sources of information—secondary and primary—have been used to identify and collect information for an extensive technical and commercial study of the smart manufacturing platform market.

Secondary Research

Secondary sources include company websites, magazines, industry news, associations, and databases (Factiva and Bloomberg). These secondary sources include annual reports, press releases, and investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

The impact and implication of COVID-19 on various industries, as well as smart manufacturing platform, have also been discussed in this section. Various secondary sources include corporate filings such as annual reports, investor presentations, and financial statements, trade, business and professional associations, white papers, manufacturing associations, and more.

Primary Research

Primary sources mainly consist of several experts from the core and related industries, along with preferred platform developers, platform providers, alliances, standards, and certification organizations related to various segments of this industry’s value chain.

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply-side included various industry experts (with a key focus on the impact of COVID-19), such as Chief X Officers (CXOs), Vice Presidents (VPs), and Directors from business development, marketing, product development/innovation teams, and related key executives from smart manufacturing platform providers , such as ABB (Switzerland), Siemens (Germany), Schneider Electric (France), IBM (US), PTC Inc. (US), SAP SE (Germany), Emerson Electric Co. (US), GENERAL ELECTRIC (US); research organizations, distributors, professional and managed service providers, industry associations, and key opinion leaders. Following is the breakdown of primary respondents

The breakdown of primary respondents is provided below.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the smart manufacturing platform market. These methods have also been used extensively to estimate the size of various subsegments in the market. The following research methodology has been used to estimate the market size:

- Major players in the industry and markets have been identified through extensive secondary research.

- The industry’s value chain and market size (in terms of value) have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Smart manufacturing platform market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall market has been split into several segments and subsegments. The market breakdown and data triangulation procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Report Objectives

- To describe and forecast the smart manufacturing platform market, in terms of type, organization size, application, industry, and deployment type.

- To describe and forecast the market, in terms of value, with regard to four main regions: Asia Pacific (APAC), Europe, North America, and Rest of the World (RoW) along with their respective countries

- To provide detailed information regarding major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To provide a detailed overview of the value chain of smart manufacturing platform.

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the smart manufacturing platform market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the smart manufacturing platform

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape for market leaders.

- To analyze competitive strategies, such as product launches, expansions, and acquisitions, adopted by key market players in the smart manufacturing platform market

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports according to the client’s specific requirements. The available customization options are as follows:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Smart Manufacturing Platform Market