Smart Government Market by Solution (Government Resource Planning System, Security, Analytics, Open Data Platform, Network Management, and Remote Monitoring), Service (Professional and Managed), Deployment, and Region - Global Forecast to 2022

[147 Pages Report] The smart government market is expected to grow from USD 11.73 Billion in 2017 to USD 28.24 Billion by 2022, at a Compound Annual Growth Rate (CAGR) of 19.2%. The base year considered for the study is 2016 and the forecast period is 2017-2022.

Objectives of the Study

- To determine and forecast the global smart government market on the basis of types (solutions and services), deployments, and regions

- To analyze the various macro and micro economic factors that affect the market growth

- To forecast the size of the market segments with respect to the 5 main regions, namely, North America, Europe, Latin America, Asia Pacific (APAC), and Middle East and Africa (MEA)

- To provide detailed information regarding the major factors influencing the growth of the smart government market (drivers, restraints, opportunities, and challenges)

- To analyze each submarket with respect to the individual growth trends, future prospects, and contributions to the total market

- To analyze the opportunities in the market for stakeholders by identifying high-growth segments in the market

- To profile key market players and provide a comparative analysis on the basis of business overview, regional presence, product offerings, business strategies, and key financials

- To illustrate the competitive landscape of the smart government market.

- To track and analyze competitive developments, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities in the market

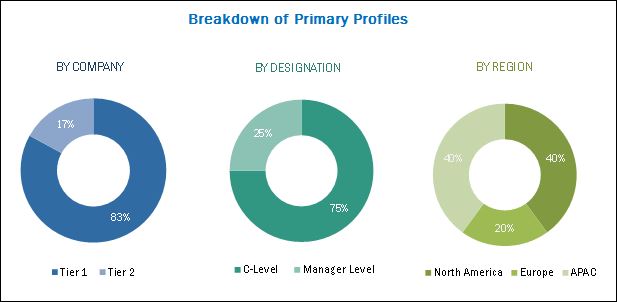

The research methodology used to estimate and forecast the smart government market began with the capturing of data on the key vendor revenues. The market size of the individual segments was determined through various secondary sources: industry associations such as the Government Information Quarterly and Electronic Government; white papers; and associations such as CTIA and Information Technology Industry Council (ITI). The vendor offerings were also taken into consideration to determine the market segmentations. The bottom-up procedure was employed to arrive at the overall market size of the global smart governments market from the individual technology segment. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key industry personnel, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The breakdown of the profiles of the primary discussion participants is depicted in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The smart government market ecosystem includes players such as ABB Ltd. (Switzerland), Amazon Web Services, Inc. (US), Avaya Inc. (US), Cap Gemini S.A. (France), Cisco Systems, Inc. (US), Entrust Datacard Corporation (US), Huawei Technologies Co., Ltd. (China), Hughes Identification Devices (HID) Global Corporation (US), IBM Corporation (US), Imex Systems Inc. (Canada), Nokia Corporation (Finland), OpenGov (US), Oracle Corporation (US), Socrata (US), Symantec Corporation (US), and UTI Grup (Romania). These players provide numerous solutions and services required for smart governments operations. These Smart Governments Solutions Vendors are rated and listed by us on the basis of product quality, reliability, and their business strategy. Please visit 360Quadrants to see the vendor listing of Smart Governments Solutions.

Key Target Audience for Smart Government Market

- System integrators

- Cloud service providers

- Security service providers

- Local, state, and central governments

- Government organizations at all levels

- Government consultants and advisors

- Information Technology (IT) companies

- Analytics solutions and services providers

- Professional and managed services providers

Scope of the Smart Government Market Report

The market takes into account the smart technologies adopted and deployed by the government sector to enable digital transformation across all government bodies. The research report categorizes the market to forecast the revenues and analyze the trends in each of the following subsegments:

By Type

- Solution

- Government resource planning system

- Security

- Analytics

- Remote monitoring

- Network management

- Open data platform

- Others

- Service

- Professional services

- Managed services

By Deployment

- On-Premises

- Hosted/Cloud

By Region

- North America

- Europe

- APAC

- MEA

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customization as per the companys specific requirements. The following customization options are available for the report:

Geographic Analysis

- Further country-level breakdown of the North American smart government market

- Further country-level breakdown of the European market

- Further country-level breakdown of the APAC market

- Further country-level breakdown of the MEA market

- Further country-level breakdown of the Latin American market

Company Information

- Detailed analysis and profiling of additional market players

The smart government market size is expected to grow from USD 11.73 Billion in 2017 to USD 28.24 Billion by 2022, at a Compound Annual Growth Rate (CAGR) of 19.2%. The major drivers of the market include growing data from multiple sources and increasing global demand for adoption of sophisticated and smart technologies.

The scope of the report covers the smart government market analysis by solution, service, deployment, and region. The remote monitoring solutions segment is expected to grow at the highest CAGR during the forecast period owing to the declining cost of sensors which is boosting the deployment of smart solutions across government bodies.

The professional services segment is expected to have the largest market share during the forecast period owing to the need of technological consulting, and continuous support and maintenance activities for the deployment of smart technologies.

The cloud deployment segment is expected to grow at the highest rate during the forecast period owing to the increased adoption of cloud services by government agencies to achieve cost benefits, real-time access, and zero maintenance downtime.

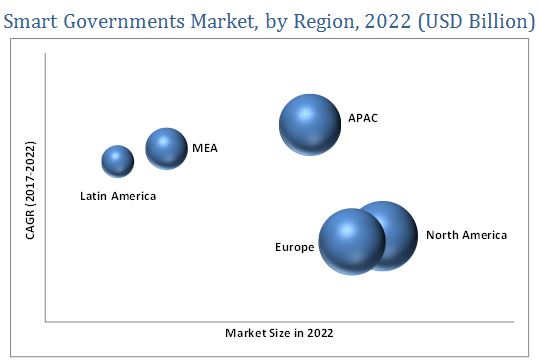

As per the geographic analysis, North America is expected to witness a significant growth in the smart government market during the forecast period due to increased penetration of smart technologies, such as big data, Internet of Things (IoT), analytics, and cloud computing. Moreover, there is an increased spending for the deployment of smart solutions across various government levels in the North American regions.

The major restraining factor that is limiting the smart government market growth is inadequate funding, which is affecting and halting the development of government projects midway. The major vendors profiled in the report include ABB Ltd. (Switzerland), Amazon Web Services, Inc. (US), Avaya Inc. (US), Cap Gemini S.A. (France), Cisco Systems, Inc. (US), Entrust Datacard Corporation (US), Huawei Technologies Co., Ltd. (China), Hughes Identification Devices (HID) Global Corporation (US), IBM Corporation (US), Imex Systems Inc. (Canada), Nokia Corporation (Finland), OpenGov (US), Oracle Corporation (US), Socrata (US), Symantec Corporation (US), and UTI Grup (Romania).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Microquadrant Methodology

2.4 Research Assumptions and Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 31)

4.1 Attractive Market Opportunities in the Smart Government Market

4.2 Smart Government Market 2017 vs 2022

4.3 Market By Type, 20172022

4.4 Market By Solution, 20172022

4.5 Market By Service, 20172022

4.6 Lifecycle Analysis, By Region 2017

4.7 Market Investment Scenario

5 Smart Government Market Overview and Industry Trends (Page No. - 35)

5.1 Introduction

5.2 Egovernment vs Smart Government

5.3 Smart Government: A Transition From Traditional to Egovernment

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Digital Revolution of Smac

5.4.1.2 Emerging Digital Lifecycle of Consumers Expected to Boost the Demand for Smart Technologies

5.4.1.3 Growing Data From Multiple Sources Allowing the Government to Process Them for Digital Transformation

5.4.2 Restraints

5.4.2.1 Inadequate Funding Affecting and Halting the Development of Government Projects Midway

5.4.2.2 Lack of Uniform Laws and Regulations in Data Sharing By Government Across Ministries and Services, and the Private Sector

5.4.3 Opportunities

5.4.3.1 Open Government Data Likely to Offer A Huge Potential for Efficient and Effective Governance

5.4.3.2 Increased Revenue Opportunity for the It Sector By Working in Collaboration With the Government, Aiding in Smart Governance

5.4.3.3 PPP Model is Expected to Enable Increased Access to State-Of-The-Art Technologies and Private Expertise

5.4.4 Challenges

5.4.4.1 Community Engagement Challenges Expected to Pose A Barrier to the Trust Between Public and Government

5.4.4.2 Increase in Sophistication of Threats is Expected to Augment the Impact of Cyber-Attacks in Smart Infrastructure

6 Smart Government Market Analysis, By Type (Page No. - 41)

6.1 Introduction

6.2 Solutions

6.2.1 Open Data Platform

6.2.2 Analytics

6.2.2.1 Location Analytics

6.2.2.2 Streaming Analytics

6.2.2.3 Social Media Analytics

6.2.2.4 Edge Analytics

6.2.3 Government Resource Planning System

6.2.3.1 Asset Lifecycle Management

6.2.3.2 Financial Management

6.2.3.3 Workforce Management

6.2.3.4 Supply Chain Management

6.2.3.5 Others

6.2.4 Security

6.2.4.1 Risk and Compliance Management

6.2.4.2 Identity and Access Management

6.2.4.3 Security and Vulnerability Management

6.2.4.4 Others

6.2.5 Remote Monitoring

6.2.6 Network Management

6.2.7 Others

6.3 Services

6.3.1 Professional Services

6.3.1.1 Consulting Services

6.3.1.2 System Integration and Deployment

6.3.1.3 Support and Maintenance

6.3.2 Managed Services

7 Smart Government Market Analysis, By Deployment (Page No. - 65)

7.1 Introduction

7.1.1 On-Premises

7.1.2 Hosted/Cloud

8 Geographic Analysis (Page No. - 69)

8.1 Introduction

8.2 North America

8.3 Europe

8.4 Asia Pacific

8.5 Middle East and Africa

8.6 Latin America

9 Competitive Landscape (Page No. - 92)

9.1 Microquadrant Overview

9.1.1 Vanguards

9.1.2 Innovators

9.1.3 Dynamic

9.1.4 Emerging

9.2 Product Offerings

9.3 Business Strategies

10 Company Profiles (Page No. - 96)

(Business Overview, Product Offerings & Business Strategies, Recent Developments)*

10.1 ABB Ltd.

10.2 Amazon Web Services, Inc.

10.3 Avaya Inc.

10.4 Capgemini S.A.

10.5 Cisco Systems, Inc.

10.6 Entrust Datacard Corporation

10.7 Huawei Technologies Co., Ltd.

10.8 Hughes Identification Devices (HID) Global Corporation

10.9 International Business Machines (IBM) Corporation

10.10 Imex Systems Inc.

10.11 Nokia Corporation

10.12 OpenGov

10.13 Oracle Corporation

10.14 Socrata

10.15 Symantec Corporation

10.16 UTI Grup

*Details on Business Overview, Product Offerings & Business Strategies, Recent Developments Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 141)

11.1 Discussion Guide

11.2 Knowledge Store: Marketsandmarkets Subscription Portal

11.3 Introducing RT: Real-Time Market Intelligence

11.4 Available Customization

11.5 Related Reports

11.6 Author Details

List of Tables (79 Tables)

Table 1 United States Dollar Exchange Rate, 20142016

Table 2 Smart Government Market Size, By Type, 20152022 (USD Million)

Table 3 Market Size, By Solution, 20152022 (USD Million)

Table 4 Solutions: Smart Government Market Size, By Region, 20152022 (USD Million)

Table 5 Open Data Platform Market Size, By Region, 20152022 (USD Million)

Table 6 Analytics Market Size, By Type, 20152022 (USD Million)

Table 7 Analytics Market Size, By Region, 20152022 (USD Million)

Table 8 Location Analytics Market Size, By Region, 20152022 (USD Million)

Table 9 Streaming Analytics Market Size, By Region, 20152022 (USD Million)

Table 10 Social Media Analytics Market Size, By Region, 20152022 (USD Million)

Table 11 Edge Analytics Market Size, By Region, 20152022 (USD Million)

Table 12 Government Resource Planning System Market Size, By Type, 20152022 (USD Million)

Table 13 Government Resource Planning System Market Size, By Region, 20152022 (USD Million)

Table 14 Asset Lifecycle Management Market Size, By Region, 20152022 (USD Million)

Table 15 Financial Management Market Size, By Region, 20152022 (USD Million)

Table 16 Workforce Management Market Size, By Region, 20152022 (USD Million)

Table 17 Supply Chain Management Market Size, By Region, 20152022 (USD Million)

Table 18 Other Government Resource Planning System Modules Market Size, By Region, 20152022 (USD Million)

Table 19 Security Market Size, By Type, 20152022 (USD Million)

Table 20 Security Market Size, By Region, 20152022 (USD Million)

Table 21 Risk and Compliance Management Market Size, By Region, 20152022 (USD Million)

Table 22 Identity and Access Management Market Size, By Region, 20152022 (USD Million)

Table 23 Security and Vulnerability Management Market Size, By Region, 20152022 (USD Million)

Table 24 Other Security Solutions Market Size, By Region, 20152022 (USD Million)

Table 25 Remote Monitoring Market Size, By Region, 20152022 (USD Million)

Table 26 Network Management Market Size, By Region, 20152022 (USD Million)

Table 27 Other Solutions Market Size, By Region, 20152022 (USD Million)

Table 28 Smart Government Market Size, By Service, 20152022 (USD Million)

Table 29 Services: Market Size, By Region, 20152022 (USD Million)

Table 30 Professional Services Market Size, By Type, 20152022 (USD Million)

Table 31 Professional Services Market Size, By Region, 20152022 (USD Million)

Table 32 Consulting Services Market Size, By Region, 20152022 (USD Million)

Table 33 System Integration and Deployment Market Size, By Region, 20152022 (USD Million)

Table 34 Support and Maintenance Market Size, By Region, 20152022 (USD Million)

Table 35 Managed Services Market Size, By Region, 20152022 (USD Million)

Table 36 Smart Government Market Size, By Deployment, 20152022 (USD Million)

Table 37 On-Premises: Market Size, By Region, 20152022 (USD Million)

Table 38 Hosted/Cloud: Market Size, By Region, 20152022 (USD Million)

Table 39 Smart Government Market Size, By Region, 20172022 (USD Million)

Table 40 North America: Market Size, By Type, 20172022 (USD Million)

Table 41 North America: Smart Government Market Size, By Solution, 20172022 (USD Million)

Table 42 North America: Analytics Solution Market Size, By Type, 20172022 (USD Million)

Table 43 North America: Government Resource Planning System Solution Market Size, By Type, 20172022 (USD Million)

Table 44 North America: Security Solution Market Size, By Type, 20172022 (USD Million)

Table 45 North America: Market Size, By Service, 20172022 (USD Million)

Table 46 North America: Smart Government Professional Services Market Size, By Type, 20172022 (USD Million)

Table 47 North America: Market Size, By Deployment, 20172022 (USD Million)

Table 48 Europe: Smart Government Market Size, By Type, 20172022 (USD Million)

Table 49 Europe: Market Size, By Solution, 20172022 (USD Million)

Table 50 Europe: Analytics Market Size, By Type, 20172022 (USD Million)

Table 51 Europe: Government Resource Planning System Solution Market Size, By Type, 20172022 (USD Million)

Table 52 Europe: Security Market Size, By Type, 20172022 (USD Million)

Table 53 Europe: Market Size, By Service, 20172022 (USD Million)

Table 54 Europe: Professional Services Market Size, By Type, 20172022 (USD Million)

Table 55 Europe: Smart Government Market Size, By Deployment, 20172022 (USD Million)

Table 56 Asia Pacific: Market Size, By Type, 20172022 (USD Million)

Table 57 Asia Pacific: Market Size, By Solution, 20172022 (USD Million)

Table 58 Asia Pacific: Analytics Solution Market Size, By Type, 20172022 (USD Million)

Table 59 Asia Pacific: Government Resource Planning System Solution Market Size, By Type, 20172022 (USD Million)

Table 60 Asia Pacific: Security Solution Market Size, By Type, 20172022 (USD Million)

Table 61 Asia Pacific: Smart Government Market Size, By Service, 20172022 (USD Million)

Table 62 Asia Pacific: Professional Services Market Size, By Type, 20172022 (USD Million)

Table 63 Asia Pacific: Market Size, By Deployment, 20172022 (USD Million)

Table 64 Middle East and Africa: Market Size, By Type, 20172022 (USD Million)

Table 65 Middle East and Africa: Market Size, By Solution, 20172022 (USD Million)

Table 66 Middle East and Africa: Government Resource Planning System Solution Market Size, By Type, 20172022 (USD Million)

Table 67 Middle East and Africa: Security Solution Market Size, By Type, 20172022 (USD Million)

Table 68 Middle East and Africa: Smart Government Market Size, By Service, 20172022 (USD Million)

Table 69 Middle East and Africa: Professional Services Market Size, By Type, 20172022 (USD Million)

Table 70 Middle East and Africa: Market Size, By Deployment, 20172022 (USD Million)

Table 71 Latin America: Smart Government Market Size, By Type, 20172022 (USD Million)

Table 72 Latin America: Market Size, By Solution, 20172022 (USD Million)

Table 73 Latin America: Analytics Solution Market Size, By Type, 20172022 (USD Million)

Table 74 Latin America: Government Resource Planning System Solution Market Size, By Type, 20172022 (USD Million)

Table 75 Latin America: Security Solution Market Size, By Type, 20172022 (USD Million)

Table 76 Latin America: Market Size, By Service, 20172022 (USD Million)

Table 77 Latin America: Professional Services Market Size, By Type, 20172022 (USD Million)

Table 78 Latin America: Market Size, By Deployment, 20172022 (USD Million)

Table 79 Market Ranking for the Smart Government Market, 2017

List of Figures (67 Figures)

Figure 1 Smart Government Market Segmentation

Figure 2 Market Research Design

Figure 3 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 4 Data Triangulation

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Microquadrant: Criteria Weightage

Figure 8 Smart Government Market: Assumptions

Figure 9 Emerging Digital Lifecycle and Government Initiatives for Smart Cities are Expected to Drive the Market During the Forecast Period

Figure 10 Top 3 Leading Segments for the Market, 2017

Figure 11 Asia Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 12 Increasing Adoption of Smart Technologies By Government Departments is Expected to Drive the Growth of the Market

Figure 13 Asia Pacific is Expected to Witness the Highest Growth Rate During the Forecast Period

Figure 14 Solutions Segment is Expected to Be the Major Contributor to the Smart Government Market During the Forecast Period

Figure 15 Government Resource Planning System is Expected to Lead the Smart Government Solutions in 2017

Figure 16 Professional Services Segment is Expected to Hold A Larger Market Share in the Smart Government Market During the Forecast Period

Figure 17 Smart Government: Transition Diagram

Figure 18 Smart Government Market Drivers, Restraints, Opportunities, and Challenges

Figure 19 Solutions Segment is Expected to Hold A Major Share in the Market During the Forecast Period

Figure 20 Government Resource Planning System is Expected to Hold the Largest Share in the Market During the Forecast Period

Figure 21 Professional Services Segment is Expected to Hold A Larger Market Share in the Market

Figure 22 On-Premises Deployment Segment is Expected to Hold A Larger Market Share in the Smart Government Market

Figure 23 North America is Expected to Have the Largest Market Size in the Market

Figure 24 Asia Pacific is Expected to Be A Hotspot for the Smart Government Market During the Forecast Period

Figure 25 North America: Smart Government Market Snapshot

Figure 26 Asia Pacific: Market Snapshot

Figure 27 Microquadrant

Figure 28 ABB Ltd.: Company Snapshot

Figure 29 ABB Ltd.: Product Offering Scorecard

Figure 30 ABB Ltd.: Business Strategy Scorecard

Figure 31 Amazon Web Services, Inc.: Product Offering Scorecard

Figure 32 Amazon Web Services, Inc.: Business Strategy Scorecard

Figure 33 Avaya Inc.: Product Offering Scorecard

Figure 34 Avaya Inc.: Business Strategy Scorecard

Figure 35 Capgemini S.A.: Company Snapshot

Figure 36 Capgemini S.A.: Product Offering Scorecard

Figure 37 Capgemini S.A.: Business Strategy Scorecard

Figure 38 Cisco Systems, Inc.: Company Snapshot

Figure 39 Cisco Systems, Inc.: Product Offering Scorecard

Figure 40 Cisco Systems, Inc.: Business Strategy Scorecard

Figure 41 Entrust Datacard Corporation: Product Offering Scorecard

Figure 42 Entrust Datacard Corporation: Business Strategy Scorecard

Figure 43 Huawei Technologies Co., Ltd.: Company Snapshot

Figure 44 Huawei Technologies Co., Ltd.: Product Offering Scorecard

Figure 45 Huawei Technologies Co., Ltd.: Business Strategy Scorecard

Figure 46 Hughes Identification Devices Global Corporation: Product Offering Scorecard

Figure 47 Hughes Identification Devices Global Corporation: Business Strategy Scorecard

Figure 48 International Business Machines Corporation: Company Snapshot

Figure 49 International Business Machines Corporation: Product Offering Scorecard

Figure 50 International Business Machines Corporation: Business Strategy Scorecard

Figure 51 Imex Systems Inc.: Product Offering Scorecard

Figure 52 Imex Systems Inc.: Business Strategy Scorecard

Figure 53 Nokia Corporation: Company Snapshot

Figure 54 Nokia Corporation: Product Offering Scorecard

Figure 55 Nokia Corporation: Business Strategy Scorecard

Figure 56 Opengov: Product Offering Scorecard

Figure 57 Opengov: Business Strategy Scorecard

Figure 58 Oracle Corporation: Company Snapshot

Figure 59 Oracle Corporation: Product Offering Scorecard

Figure 60 Oracle Corporation: Business Strategy Scorecard

Figure 61 Socrata: Product Offering Scorecard

Figure 62 Socrata: Business Strategy Scorecard

Figure 63 Symantec Corporation: Company Snapshot

Figure 64 Symantec Corporation: Product Offering Scorecard

Figure 65 Symantec Corporation: Business Strategy Scorecard

Figure 66 UTI Grup: Product Offering Scorecard

Figure 67 UTI Grup: Business Strategy Scorecard

Growth opportunities and latent adjacency in Smart Government Market