Smart Card IC Market by Type (Microprocessor, Memory), Architecture (16-bit, 32-bit), Interface, Application (USIMs/eSIMs, ID Cards, Financial Cards), End-user Industry (Telecommunications, BFSI) and Region - Global Forecast to 2027

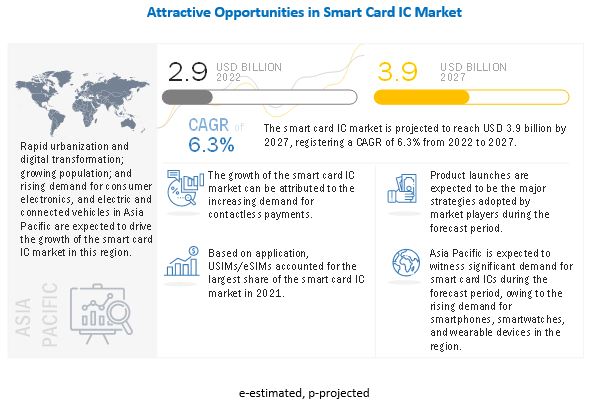

[222 Pages Report] The global smart card IC market is projected to reach USD 3.9 billion by 2027 from an estimated USD 2.9 billion in 2022, at a CAGR of 6.3% from 2022 to 2027. The growth of the smart card IC market can be attributed to rise in the contactless payments post COVID-19 outbreak and adoption of ID cards across various organizations and educational institutions.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics of Smart Card IC Market

Drivers: Rise in contactless payments post COVID-19 outbreak

Earlier, most people were using contact-type smart cards. However, with the outbreak of the COVID-19 pandemic, people shifted towards contactless payment options. Contactless payment refers to a no-touch form of payment using a credit, debit, or gift card on a point-of-sale (POS) system equipped with adequate technology. Also, they are transactions made by tapping a contactless chip card, payment-enabled mobile device, QR code, or wearable device over a contactless-enabled payment terminal. These cards use radio frequency identification (RFID) technology and near-field communication (NFC) to process transactions. These cards emit short-range electromagnetic waves containing information to be captured by the POS system and processed to complete the transaction.

Restraints: Data security of eSIMs

eSIM cards allow remote provisioning of SIM profiles by enabling automatic interoperability between connectivity platforms and multiple SIM operator profiles. However, the operational flexibility achieved by an eSIM would be futile if its security is compromised. An eSIM collects and stores the credentials of mobile network operators (MNOs) in the inbuilt software of the device, which is prone to various security hacks. In addition, it operates through multiple MNOs and physical platforms, thereby exposing it to the risk of the virtual environment.

Opportunities: Increased adoption of IoT by end-user industries

Industry 4.0 fully automates manufacturing processes with very little to negligible human interference. It works on the Internet of Things (IoT), cyber-physical systems, cloud robotics, cloud computing, and big data. Thus, IoT has gained the attention of technology vendors, organizations, business decision-makers, and consumers in recent years. Industry players are focusing on adopting IoT due to continuous technological advancements, increasing cellular connectivity & data transfer rates, and cloud infrastructure development. IoT can be implemented using various smart and connected devices integrated into various smart payment systems, smart homes, and connected cars. Additionally, the rising penetration of IoT in telecommunications, BFSI, transportation, and retail end-user industries has led to an upsurge in the demand for low-cost and highly efficient smart card IC used for secured data storage and data transmission.

Challenges: Global semiconductor chip supply shortage

The trade war between the US and China added to the supply chain disruption. China being a key supplier of semiconductors, delay in the supply of semiconductors due to the increased tariffs rates and pandemic has created impediments in the development of smart card ICs industry. The increase in demand for chips and supply shortage has resulted in increased lead times as well as their price. Wafers, substrates, logistics, assembly and testing, and operational costs have all become more expensive. In turn, semiconductor suppliers are being forced to pass their costs on to their customers to help stabilize the supply chain.

Smart Card IC Ecosystem

The ID cards application is projected to register the highest CAGR 2022 to 2027

The ID cards application is projected to register the highest CAGR during the forecast period. The growth can be attributed to rising focus of government of different countries on transforming paper-based ID cards into chip-based ID cards to avoid illegal activities and protect citizens from identity theft. Governments of several European countries have rolled out circulars for mandating the integration of chips in ID cards. In response to this, there were over 9 million university students using student smart cards across 279 universities in Spain, Portugal, and Latin America.

Government and healthcare segment is projected to register the highest CAGR during the forecast period

The government and healthcare segment is projected to grow at the highest CAGR during the forecast period. The growth of the segment can be attributed to an increase in the adoption of eID cards, including national cards, drivers’ license, ePassports, ID cards, eHealth cards, and other vital government documents. The COVID-19 pandemic fueled the need to regulate the use of e-government documents as they can help in tracking citizen details. Further, e-health cards have the potential to improve the patient experience by storing key medical data and medication history and by serving as an electronic prescription. These cards can also be used to securely store social security numbers.

Asia Pacific is expected to register the highest growth in the smart card IC market during the forecast period

The smart card IC market in the Asia Pacific is expected to register the highest growth during the forecast period due to the ongoing technological innovations in the telecommunications, BFSI, government and healthcare, and transportation verticals, the increasing adoption of digital technologies, and rapid urbanization and industrialization. Other prominent drivers are the rising adoption of IoT devices, increasing deployment of digital technologies in retail, corporate, education, and entertainment industries, and growing electrification in the transportation industry.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Some of the smart card IC companies are Infineon Technologies AG (Germany), NXP Semiconductors N.V. (Netherland), Samsung Electronics Co., Ltd. (South Korea), STMicroelectronics N.V. (Switzerland), Microchip Technology Incorporated (US), CEC Huada Electronic Design Co., Ltd. (China), Analog Devices, Inc. (US), Sony Group Corporation (Japan), Toshiba Corporation (Japan), and ON Semiconductor Corporation (US).

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2018–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast unit |

Value (USD Million/Thousand/ Billion) |

|

Segments Covered |

By Type, By Architecture, By Interface, By Application, By End-user Industry, and By Region |

|

Geographies covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies covered |

Infineon Technologies AG (Germany), NXP Semiconductors N.V. (Netherland), Samsung Electronics Co., Ltd. (South Korea), STMicroelectronics N.V. (Switzerland), Microchip Technology Incorporated (US), CEC Huada Electronic Design Co., Ltd. (China), Analog Devices, Inc. (US), Sony Group Corporation (Japan), Toshiba Corporation (Japan), and ON Semiconductor Corporation (US); are some of the key players in the smart card IC market. |

This research report categorizes the smart card IC market based type, architecture, interface, application, end-user industry, and region.

Based on Type

- Microcontroller

- Memory

Based on Architecture

- 16-bit

- 32-bit

Based on Interface

- Contact

- Contactless

- Dual Interface

Based on Application

- USIMs/eSIMs

-

ID cards

- Employee ID

- Citizen ID

- ePassport

- Driving License

- Financial Cards

- IoT Devices

Based on End-user Industry

- Telecommunications

- BFSI

- Government & Healthcare

- Transportation

- Education

- Retail

- Others

Based on Region

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- UK

- France

- Italy

- Rest of Europe

-

Aisa Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

-

Rest of the world

- Middle East & Africa

- South America

Recent Developments

- In July 2022, Infineon Technologies AG launched OPTIGA Trust M Express, a high-end security solution that provides an anchor of trust for connecting IoT devices to the cloud, giving every IoT device its own unique identity. It is ideal for industrial and building automation applications, smart homes, and connected consumer devices.

- In June 2022, STMicroelectronics N.V. launched the ST4SIM-201 embedded SIM (eSIM) for machine-to-machine (M2M) communication, which meets the latest standards for 5G network access, M2M security, and flexible remote provisioning and management.

- In December 2021, Infineon Technologies AG partnered with MK Smart, a subsidiary of MK Group, to deliver smart card chips for Vietnam's national ID card. For this, Infineon Technologies AG supplied the SLC37 security controller using the latest 40nm security chip technology and innovative dual-interface packaging (Coil on Module). The chips and their operating system are capable of securely storing ICAO-compliance e-ID data and enable protected biometrics and digital signing to access citizenry services on government and private portals.

- In August 2021, Analog Devices, Inc. (ADI) acquired Maxim Integrated Products, Inc. to strengthen ADI's position as a high-performance analog semiconductor company.

- In June 2020, Sony Group Corporation established a research company, "Sony Research India Private Limited (Sony Research India)," in India. It consists of R&D centers in Bengaluru and Mumbai, which will be part of Sony's Global R&D centers. Sony Research India aims to accelerate the collaboration with its entertainment and electronics business groups while further enhancing the competitiveness and capability of research and development in India.

Frequently Asked Questions (FAQ):

Which is the potential market for smart card IC in terms of the region?

Asia Pacific is expected to dominate the smart card ICmarket due to the presence of numerous consumers and suppliers of smart card IC.

Which are the major companies in the global smart card IC market? What are their major strategies to strengthen their market presence?

Infineon Technologies AG (Germany), NXP Semiconductors N.V. (Netherland), Samsung Electronics Co., Ltd. (South Korea), STMicroelectronics N.V. (Switzerland), Microchip Technology Incorporated (US), are some of the key players in the smart card ICmarket. These players have adopted various growth strategies such as product launches, collaborations, partnerships, contracts, expansions, and acquisitions to expand their global presence and increase their share in the global smart card IC market.

What are the major opportunities for the smart card IC market?

Government agencies promoting digitalization and surging demand for advanced telematics and infotainment systems from automotive sector are among the key opportunities that are expected to support market growth in future.

What are the growing applications in the smart card IC market?

The smart card IC market is led by telecommunications segment. Besides, the demand from BFSI and government and healthcare segments is expected to generate huge demand for smart card ICin future.

Which is the majorly used type of smart card IC market?

Microprocessors are widely used smart card IC for almost all end-user industries.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 28)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 SMART CARD IC MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 33)

2.1 RESEARCH DATA

FIGURE 2 SMART CARD IC MARKET: RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.2 SECONDARY DATA

2.1.2.1 List of key secondary sources

2.1.2.2 Secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Primary interviews with experts

2.1.3.2 Breakdown of primaries

2.1.3.3 Key data from primary sources

2.1.3.4 Key industry insights

2.2 FACTOR ANALYSIS

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 – TOP-DOWN (SUPPLY SIDE): REVENUES GENERATED BY COMPANIES FROM SALES OF SMART CARD ICS

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 – TOP-DOWN (SUPPLY SIDE): ILLUSTRATION OF REVENUE ESTIMATIONS FOR ONE COMPANY IN SMART CARD IC MARKET

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 – BOTTOM-UP (DEMAND SIDE): DEMAND FOR SMART CARD ICS, BY APPLICATION

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

2.3.1.1 Approach to obtain market size using bottom-up analysis (demand side)

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

2.3.2.1 Approach to obtain market size using top-down analysis (supply side)

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3.3 GROWTH PROJECTIONS AND FORECASTING ASSUMPTIONS

TABLE 1 MARKET GROWTH ASSUMPTIONS

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.5 RESEARCH ASSUMPTIONS

2.5.1 ASSUMPTIONS

2.5.2 LIMITATIONS

2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 46)

FIGURE 9 DUAL INTERFACE SEGMENT TO EXHIBIT HIGHEST CAGR IN SMART CARD IC MARKET FROM 2022 TO 2027

FIGURE 10 ID CARDS TO EXHIBIT HIGHEST CAGR IN SMART CARD IC MARKET FROM 2022 TO 2027

FIGURE 11 GOVERNMENT & HEALTHCARE SEGMENT TO RECORD HIGHEST CAGR IN SMART CARD IC MARKET DURING FORECAST PERIOD

FIGURE 12 ASIA PACIFIC LIKELY TO BE FASTEST-GROWING MARKET FOR SMART CARD ICS DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SMART CARD IC MARKET

FIGURE 13 RISING DEMAND FOR CONTACTLESS PAYMENT TO FUEL MARKET GROWTH FROM 2022 TO 2027

4.2 SMART CARD IC MARKET, BY TYPE

FIGURE 14 MICROPROCESSOR TO HOLD LARGER SHARE OF SMART CARD IC MARKET IN 2022

4.3 SMART CARD IC MARKET, BY ARCHITECTURE

FIGURE 15 32-BIT SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2027

4.4 SMART CARD IC MARKET, BY INTERFACE

FIGURE 16 CONTACTLESS INTERFACE TO CAPTURE LARGEST MARKET SHARE IN 2027

4.5 SMART CARD IC MARKET, BY APPLICATION

FIGURE 17 FINANCIAL CARDS TO ACCOUNT FOR LARGEST SHARE OF SMART CARD IC MARKET, BY APPLICATION, IN 2027

4.6 SMART CARD IC MARKET, BY END-USER INDUSTRY

FIGURE 18 TELECOMMUNICATIONS SEGMENT TO ACCOUNT FOR LARGEST SHARE OF SMART CARD IC MARKET IN 2027

4.7 SMART CARD IC MARKET, BY REGION

FIGURE 19 ASIA PACIFIC TO CAPTURE LARGEST SHARE OF SMART CARD IC MARKET IN 2027

4.8 SMART CARD IC MARKET, BY COUNTRY

FIGURE 20 INDIA TO REGISTER HIGHEST CAGR IN GLOBAL SMART CARD IC MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 54)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 21 SMART CARD IC MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Rising usage of SIMs and eSIMs in smartphones

FIGURE 22 NUMBER OF SMARTPHONE AND MOBILE PHONE USERS GLOBALLY (BILLION) (2020–2025)

5.2.1.2 Adoption of ID cards across various organizations and educational institutions

5.2.1.3 Rise in contactless payments post COVID-19 outbreak

FIGURE 23 SMART CARD IC MARKET DRIVERS AND THEIR IMPACT

5.2.2 RESTRAINTS

5.2.2.1 Data security concerns related to eSIMs

FIGURE 24 SMART CARD IC MARKET RESTRAINTS AND THEIR IMPACT

5.2.3 OPPORTUNITIES

5.2.3.1 Government agencies promoting digitalization

5.2.3.2 Surging demand for advanced telematics and infotainment systems from automotive sector

5.2.3.3 Increased adoption of IoT by end-user industries

FIGURE 25 SMART CARD IC MARKET OPPORTUNITIES AND THEIR IMPACT

5.2.4 CHALLENGES

5.2.4.1 Global semiconductor chip supply shortage

FIGURE 26 SMART CARD IC MARKET CHALLENGES AND THEIR IMPACT

5.3 VALUE CHAIN ANALYSIS

FIGURE 27 SMART CARD IC VALUE CHAIN ANALYSIS

5.4 ECOSYSTEM

FIGURE 28 SMART CARD ECOSYSTEM

TABLE 2 LIST OF SMART CARD IC MANUFACTURERS

5.5 PRICING ANALYSIS

TABLE 3 AVERAGE SELLING PRICE OF SMART CARD ICS, BY APPLICATION (2021)

FIGURE 29 AVERAGE SELLING PRICE OF SMART CARD ICS OFFERED BY KEY PLAYERS, BY APPLICATION

TABLE 4 AVERAGE SELLING PRICE OF SMART CARD ICS OFFERED BY KEY PLAYERS, BY APPLICATION

FIGURE 30 AVERAGE SELLING PRICE TREND FOR SMART CARD ICS, 2018–2027 (USD)

5.6 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR SMART CARD IC MARKET PLAYERS

FIGURE 31 REVENUE SHIFT FOR SMART CARD IC MARKET PLAYERS

5.7 TECHNOLOGY ANALYSIS

5.7.1 KEY TECHNOLOGIES

5.7.1.1 Coil on Module technology

5.7.2 COMPLEMENTARY TECHNOLOGIES

5.7.2.1 Near-field communication technology

5.7.2.2 Radio frequency technology

5.7.2.3 Artificial intelligence technology

5.8 EMERGING TRENDS

5.8.1 BIOMETRIC CARDS

FIGURE 32 CONSTRUCTION OF BIOMETRIC CARDS

5.9 PORTER’S FIVE FORCES ANALYSIS

TABLE 5 SMART CARD IC MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 33 PORTER’S FIVE FORCES ANALYSIS

5.9.1 INTENSITY OF COMPETITIVE RIVALRY

5.9.2 THREAT OF SUBSTITUTES

5.9.3 BARGAINING POWER OF BUYERS

5.9.4 BARGAINING POWER OF SUPPLIERS

5.9.5 THREAT OF NEW ENTRANTS

5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 34 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR MAJOR END-USER INDUSTRIES

TABLE 6 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR MAJOR END-USER INDUSTRIES (%)

5.10.2 BUYING CRITERIA

FIGURE 35 KEY BUYING CRITERIA FOR MAJOR END-USER INDUSTRIES

TABLE 7 KEY BUYING CRITERIA FOR MAJOR END-USER INDUSTRIES

5.11 CASE STUDY ANALYSIS

TABLE 8 KERETA COMMUTER INDONESIA (KCI) USES SONY’S FELICA TECHNOLOGY FOR TICKETING

5.12 TRADE ANALYSIS

5.12.1 IMPORT SCENARIO

TABLE 9 IMPORT DATA, BY COUNTRY, 2017–2021 (USD MILLION)

FIGURE 36 SMART CARD IC: IMPORT DATA FOR MAJOR COUNTRIES, 2017–2021

5.12.2 EXPORT SCENARIO

TABLE 10 EXPORT DATA, BY COUNTRY, 2017–2021 (USD MILLION)

FIGURE 37 SMART CARD IC: EXPORT DATA FOR MAJOR COUNTRIES, 2017–2021

5.13 PATENT ANALYSIS

TABLE 11 LIST OF SOME PATENTS IN SMART CARD IC MARKET, 2018–2022

FIGURE 38 PATENTS GRANTED WORLDWIDE, 2012–2021

TABLE 12 TOP 20 PATENT OWNERS IN US, 2012–2021

FIGURE 39 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2012–2021

5.14 KEY CONFERENCES AND EVENTS, 2022–2023

TABLE 13 SMART CRAD IC MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.15 TARIFF ANALYSIS

5.16 STANDARDS AND REGULATORY LANDSCAPE

5.16.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.16.1.1 North America

5.16.1.2 Europe

5.16.2 STANDARDS

6 SMART CARD IC MARKET, BY TYPE (Page No. - 84)

6.1 INTRODUCTION

FIGURE 40 SMART CARD IC MARKET, BY TYPE

FIGURE 41 MICROPROCESSOR SEGMENT TO HOLD LARGER SHARE OF SMART CARD IC MARKET FROM 2022 TO 2027

TABLE 14 SMART CARD IC MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 15 SMART CARD IC MARKET, BY TYPE, 2022–2027 (USD MILLION)

6.2 MICROPROCESSOR

6.2.1 ENABLES ADDITION, DELETION, AND MANIPULATION OF DATA

TABLE 16 MICROPROCESSOR: SMART CARD IC MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 17 MICROPROCESSOR: SMART CARD IC MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3 MEMORY

6.3.1 LESS EXPENSIVE THAN MICROCONTROLLERS

TABLE 18 MEMORY: SMART CARD IC MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 19 MEMORY: SMART CARD IC MARKET, BY REGION, 2022–2027 (USD MILLION)

7 SMART CARD IC MARKET, BY ARCHITECTURE (Page No. - 89)

7.1 INTRODUCTION

FIGURE 42 SMART CARD IC MARKET, BY ARCHITECTURE

FIGURE 43 32-BIT SEGMENT TO HOLD LARGER SHARE OF SMART CARD IC MARKET FROM 2022 TO 2027

TABLE 20 SMART CARD IC MARKET, BY ARCHITECTURE, 2018–2021 (USD MILLION)

TABLE 21 SMART CARD IC MARKET, BY ARCHITECTURE, 2022–2027 (USD MILLION)

7.2 16-BIT

7.2.1 OFFERS HIGH CLOCK SPEED AND WIDER DATA PATHS

7.3 32-BIT

7.3.1 CAPABLE OF STORING LARGE VOLUMES OF DATA

8 SMART CARD IC MARKET, BY INTERFACE (Page No. - 92)

8.1 INTRODUCTION

FIGURE 44 SMART CARD IC MARKET, BY INTERFACE

FIGURE 45 CONTACTLESS INTERFACE SEGMENT TO HOLD LARGEST SHARE OF SMART CARD IC MARKET FROM 2022 TO 2027

TABLE 22 SMART CARD IC MARKET, BY INTERFACE, 2018–2021 (USD MILLION)

TABLE 23 SMART CARD IC MARKET, BY INTERFACE, 2022–2027 (USD MILLION)

8.2 CONTACT INTERFACE

8.2.1 CONTACT WITH CARD READER NECESSARY TO FACILITATE READING

TABLE 24 CONTACT: SMART CARD IC MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 25 CONTACT: SMART CARD IC MARKET, BY REGION, 2022–2027 (USD THOUSAND)

8.3 CONTACTLESS INTERFACE

8.3.1 CONTACTLESS CARDS USE RADIO FREQUENCY TO READ DATA

TABLE 26 CONTACTLESS: SMART CARD IC MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 27 CONTACTLESS: SMART CARD IC MARKET, BY REGION, 2022–2027 (USD MILLION)

8.4 DUAL INTERFACE

8.4.1 COMBINES FEATURES OF BOTH CONTACT AND CONTACTLESS INTERFACES

TABLE 28 DUAL INTERFACE: SMART CARD IC MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 29 DUAL INTERFACE: SMART CARD IC MARKET, BY REGION, 2022–2027 (USD MILLION)

9 SMART CARD IC MARKET, BY APPLICATION (Page No. - 98)

9.1 INTRODUCTION

FIGURE 46 SMART CARD IC MARKET, BY APPLICATION

FIGURE 47 USIMS/ESIMS APPLICATION TO HOLD LARGEST SHARE OF SMART CARD IC MARKET FROM 2022 TO 2027

TABLE 30 SMART CARD IC MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 31 SMART CARD IC MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 32 SMART CARD IC MARKET, BY APPLICATION, 2018–2021 (MILLION UNITS)

TABLE 33 SMART CARD IC MARKET, BY APPLICATION, 2022–2027 (MILLION UNITS)

9.2 USIMS/ESIMS

9.2.1 OFFER ENHANCED DATA SECURITY COMPARED WITH TRADITIONAL SIM CARDS

TABLE 34 USIMS/ESIMS: SMART CARD IC MARKET, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 35 USIMS/ESIMS: SMART CARD IC MARKET, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

TABLE 36 USIMS/ESIMS: SMART CARD IC MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 37 USIMS/ESIMS: SMART CARD IC MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 ID CARDS

9.3.1 EMPLOYEE ID

9.3.1.1 Smart employee ID cards used to secure access to physical facilities and computer systems and networks

9.3.2 CITIZEN ID

9.3.2.1 Captured largest share of smart card IC market in 2021

9.3.3 EPASSPORT

9.3.3.1 Helps reduce circulation of fake passports

9.3.4 DRIVING LICENSE

9.3.4.1 Smart chips embedded licenses protect against falsification of documents

FIGURE 48 EPASSPORT SEGMENT TO REGISTER HIGHEST CAGR FROM 2022 TO 2027

TABLE 38 ID CARDS: SMART CARD IC MARKET, BY SUB TYPE, 2018–2021 (USD MILLION)

TABLE 39 ID CARDS: SMART CARD IC MARKET, BY SUB TYPE, 2022–2027 (USD MILLION)

TABLE 40 ID CARDS: SMART CARD IC MARKET, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 41 ID CARDS: SMART CARD IC MARKET, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

TABLE 42 ID CARDS: SMART CARD IC MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 43 ID CARDS: SMART CARD IC MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4 FINANCIAL CARDS

9.4.1 CREDIT CARDS

9.4.1.1 Adoption of credit cards to propel demand for smart card ICs

9.4.2 DEBIT CARDS

9.4.2.1 Contactless payments to fuel demand for debit cards

TABLE 44 FINANCIAL CARDS: SMART CARD IC MARKET, BY SUB TYPE, 2018–2021 (USD MILLION)

TABLE 45 FINANCIAL CARDS: SMART CARD IC MARKET, BY SUB TYPE, 2022–2027 (USD MILLION)

TABLE 46 FINANCIAL CARDS: SMART CARD IC MARKET, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 47 FINANCIAL CARDS: SMART CARD IC MARKET, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

TABLE 48 FINANCIAL CARDS: SMART CARD IC MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 49 FINANCIAL CARDS: SMART CARD IC MARKET, BY REGION, 2022–2027 (USD MILLION)

9.5 IOT DEVICES

9.5.1 INTEGRATED ICS TO ELEVATE LEVEL OF SECURITY AND PREVENT UNAUTHORIZED TAMPERING

TABLE 50 IOT DEVICES: SMART CARD IC MARKET, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 51 IOT DEVICES: SMART CARD IC MARKET, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

TABLE 52 IOT DEVICES: SMART CARD IC MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 53 IOT DEVICES: SMART CARD IC MARKET, BY REGION, 2022–2027 (USD MILLION)

10 SMART CARD IC MARKET, BY END-USER INDUSTRY (Page No. - 112)

10.1 INTRODUCTION

FIGURE 49 SMART CARD IC MARKET, BY END-USER INDUSTRY

FIGURE 50 TELECOMMUNICATIONS SEGMENT TO LEAD SMART CARD IC MARKET FROM 2022 TO 2027

TABLE 54 SMART CARD IC MARKET, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 55 SMART CARD IC MARKET, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

10.2 TELECOMMUNICATIONS

10.2.1 EXTENSIVELY USES SMART CARD ICS IN USIM CARDS

TABLE 56 TELECOMMUNICATIONS: SMART CARD IC MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 57 TELECOMMUNICATIONS: SMART CARD IC MARKET, BY REGION, 2022–2027 (USD MILLION)

10.3 BFSI

10.3.1 BFSI PRIME USER OF SMART CARD TECHNOLOGY

FIGURE 51 ASIA PACIFIC TO CAPTURE LARGEST SHARE OF SMART CARD IC MARKET FOR BFSI IN 2022

TABLE 58 BFSI: SMART CARD IC MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 59 BFSI: SMART CARD IC MARKET, BY REGION, 2022–2027 (USD MILLION)

10.4 GOVERNMENT AND HEALTHCARE

10.4.1 GOVERNMENT INITIATIVES TO DIGITALIZE DOCUMENTATION TO FUEL ADOPTION OF SMART CARDS

TABLE 60 GOVERNMENT & HEALTHCARE: SMART CARD IC MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 61 GOVERNMENT & HEALTHCARE: SMART CARD IC MARKET, BY REGION, 2022–2027 (USD MILLION)

10.5 TRANSPORTATION

10.5.1 SMART CARDS ENSURE SMOOTH PASSENGER FLOW IN SUBWAYS, BUSES, TROLLEYS, AND OTHER PUBLIC TRANSPORT MEDIUMS

TABLE 62 TRANSPORTATION: SMART CARD IC MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 63 TRANSPORTATION: SMART CARD IC MARKET, BY REGION, 2022–2027 (USD MILLION)

10.6 EDUCATION

10.6.1 USES SMART CARDS TO MANAGE ACCESS TO CAMPUS AND MAINTAIN STUDENT RECORDS

TABLE 64 EDUCATION: SMART CARD IC MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 65 EDUCATION: SMART CARD IC MARKET, BY REGION, 2022–2027 (USD THOUSAND)

10.7 RETAIL

10.7.1 USES SMART CARDS TO ACQUIRE CUSTOMER DATA

TABLE 66 RETAIL: SMART CARD IC MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 67 RETAIL: SMART CARD IC MARKET, BY REGION, 2022–2027 (USD THOUSAND)

10.8 OTHERS

TABLE 68 OTHERS: SMART CARD IC MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 69 OTHERS: SMART CARD IC MARKET, BY REGION, 2022–2027 (USD MILLION)

11 SMART CARD IC MARKET, BY REGION (Page No. - 124)

11.1 INTRODUCTION

FIGURE 52 REGIONAL SPLIT OF SMART CARD IC MARKET

FIGURE 53 ASIA PACIFIC TO LEAD GLOBAL SMART CARD IC MARKET IN 2022

TABLE 70 SMART CARD IC MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 71 SMART CARD IC MARKET, BY REGION, 2022–2027 (USD MILLION)

11.2 NORTH AMERICA

FIGURE 54 NORTH AMERICA: SMART CARD IC MARKET SNAPSHOT

FIGURE 55 US TO REGISTER HIGHEST CAGR IN NORTH AMERICAN SMART CARD IC MARKET FROM 2022 TO 2027

TABLE 72 NORTH AMERICA: SMART CARD IC MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 73 NORTH AMERICA: SMART CARD IC MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 74 NORTH AMERICA: SMART CARD IC MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 75 NORTH AMERICA: SMART CARD IC MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 76 NORTH AMERICA: SMART CARD IC MARKET, BY INTERFACE, 2018–2021 (USD MILLION)

TABLE 77 NORTH AMERICA: SMART CARD IC MARKET, BY INTERFACE, 2022–2027 (USD MILLION)

TABLE 78 NORTH AMERICA: SMART CARD IC MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 79 NORTH AMERICA: SMART CARD IC MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 80 NORTH AMERICA: SMART CARD IC MARKET, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 81 NORTH AMERICA: SMART CARD IC MARKET, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

11.2.1 US

11.2.1.1 Likely to register highest CAGR in North America during forecast period

11.2.2 CANADA

11.2.2.1 Extensive adoption of smart card ICs in diverse applications to substantiate market growth

11.2.3 MEXICO

11.2.3.1 ePassport project initiated by government to accelerate market growth

11.3 EUROPE

FIGURE 56 EUROPE: SMART CARD IC MARKET SNAPSHOT

TABLE 82 EUROPE: SMART CARD IC MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 83 EUROPE: SMART CARD IC MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 84 EUROPE: SMART CARD IC MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 85 EUROPE: SMART CARD IC MARKET, BY TYPE, 2022–2027 (USD MILLION)

FIGURE 57 CONTACTLESS INTERFACE SEGMENT TO LEAD SMART CARD IC MARKET IN EUROPE FROM 2022 TO 2027

TABLE 86 EUROPE: SMART CARD IC MARKET, BY INTERFACE, 2018–2021 (USD MILLION)

TABLE 87 EUROPE: SMART CARD IC MARKET, BY INTERFACE, 2022–2027 (USD MILLION)

TABLE 88 EUROPE: SMART CARD IC MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 89 EUROPE: SMART CARD IC MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 90 EUROPE: SMART CARD IC MARKET, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 91 EUROPE: SMART CARD IC MARKET, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

11.3.1 UK

11.3.1.1 BFSI industry to fuel market growth in UK

11.3.2 GERMANY

11.3.2.1 Demand from BFSI and government sector to boost market

11.3.3 FRANCE

11.3.3.1 Focus on strengthening public safety to lead to adoption of smart card ICs

11.3.4 ITALY

11.3.4.1 Issuance of government ID documents to accelerate market growth

11.3.5 REST OF EUROPE

11.4 ASIA PACIFIC

FIGURE 58 ASIA PACIFIC: SMART CARD IC MARKET SNAPSHOT

TABLE 92 ASIA PACIFIC: SMART CARD IC MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 93 ASIA PACIFIC: SMART CARD IC MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 94 ASIA PACIFIC: SMART CARD IC MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 95 ASIA PACIFIC: SMART CARD IC MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 96 ASIA PACIFIC: SMART CARD IC MARKET, BY INTERFACE, 2018–2021 (USD MILLION)

TABLE 97 ASIA PACIFIC: SMART CARD IC MARKET, BY INTERFACE, 2022–2027 (USD MILLION)

TABLE 98 ASIA PACIFIC: SMART CARD IC MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 99 ASIA PACIFIC: SMART CARD IC MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

FIGURE 59 TELECOMMUNICATIONS SEGMENT TO LEAD SMART CARD IC MARKET IN ASIA PACIFIC FROM 2022 TO 2027

TABLE 100 ASIA PACIFIC: SMART CARD IC MARKET, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 101 ASIA PACIFIC: SMART CARD IC MARKET, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

11.4.1 CHINA

11.4.1.1 Fastest-growing country-level market in Asia Pacific

11.4.2 JAPAN

11.4.2.1 Digitalization initiatives by government to spur market growth

11.4.3 INDIA

11.4.3.1 Technological developments in telecommunications and government verticals to generate demand for smart card ICs

11.4.4 SOUTH KOREA

11.4.4.1 Widespread adoption of 5G to induce demand for smart card ICs

11.4.5 REST OF ASIA PACIFIC

11.5 REST OF THE WORLD (ROW)

FIGURE 60 SOUTH AMERICA TO REGISTER HIGHER CAGR THAN MIDDLE EAST & AFRICA FROM 2022 TO 2027

TABLE 102 REST OF THE WORLD: SMART CARD IC MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 103 REST OF THE WORLD: SMART CARD IC MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 104 REST OF THE WORLD: SMART CARD IC MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 105 REST OF THE WORLD: SMART CARD IC MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 106 REST OF THE WORLD: SMART CARD IC MARKET, BY INTERFACE, 2018–2021 (USD THOUSAND)

TABLE 107 REST OF THE WORLD: SMART CARD IC MARKET, BY INTERFACE, 2022–2027 (USD THOUSAND)

TABLE 108 REST OF THE WORLD: SMART CARD IC MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 109 REST OF THE WORLD: SMART CARD IC MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 110 REST OF THE WORLD: SMART CARD IC MARKET, BY END-USER INDUSTRY, 2018–2021 (USD THOUSAND)

TABLE 111 REST OF THE WORLD: SMART CARD IC MARKET, BY END-USER INDUSTRY, 2022–2027 (USD THOUSAND)

11.5.1 MIDDLE EAST & AFRICA (MEA)

11.5.1.1 To account for larger share of smart card IC market in RoW

11.5.2 SOUTH AMERICA

11.5.2.1 Rapid adoption of smart student ID cards to favor market

12 COMPETITIVE LANDSCAPE (Page No. - 150)

12.1 OVERVIEW

12.2 MARKET EVALUATION FRAMEWORK

TABLE 112 REVIEW OF STRATEGIES ADOPTED BY KEY SMART CARD IC MANUFACTURERS

12.2.1 PRODUCT PORTFOLIO

12.2.2 REGIONAL FOCUS

12.2.3 MANUFACTURING FOOTPRINT

12.2.4 ORGANIC/INORGANIC STRATEGIES

12.3 MARKET SHARE ANALYSIS, 2021

FIGURE 61 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS IN SMART CARD IC MARKET, 2021

TABLE 113 MARKET SHARE ANALYSIS OF TOP FIVE COMPANIES (2021)

12.4 REVENUE ANALYSIS: TOP FIVE COMPANIES (2017–2021)

FIGURE 62 FIVE-YEAR REVENUE ANALYSIS OF TOP FIVE PLAYERS IN SMART CARD IC MARKET, 2017–2021

12.5 COMPANY EVALUATION QUADRANT

12.5.1 STARS

12.5.2 EMERGING LEADERS

12.5.3 PERVASIVE PLAYERS

12.5.4 PARTICIPANTS

FIGURE 63 COMPANY EVALUATION QUADRANT, 2021

TABLE 114 COMPANY INTERFACE FOOTPRINT

TABLE 115 COMPANY APPLICATION FOOTPRINT

TABLE 116 COMPANY REGION FOOTPRINT

TABLE 117 COMPANY OVERALL FOOTPRINT

12.6 COMPETITIVE SCENARIOS AND TRENDS

12.6.1 PRODUCT LAUNCHES

TABLE 118 PRODUCT LAUNCHES, 2020–2022

12.6.2 DEALS

TABLE 119 DEALS, 2020–2022

12.6.3 OTHERS

TABLE 120 OTHERS, 2020–2022

13 COMPANY PROFILES (Page No. - 165)

(Business Overview, Products/Solutions offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

13.1 KEY PLAYERS

13.1.1 INFINEON TECHNOLOGIES AG

TABLE 121 INFINEON TECHNOLOGIES AG: BUSINESS OVERVIEW

FIGURE 64 INFINEON TECHNOLOGIES AG: COMPANY SNAPSHOT

TABLE 122 INFINEON TECHNOLOGIES AG: PRODUCTS/SOLUTIONS OFFERINGS

TABLE 123 INFINEON TECHNOLOGIES AG: PRODUCT LAUNCHES

TABLE 124 INFINEON TECHNOLOGIES AG: DEALS

13.1.2 NXP SEMICONDUCTORS N.V.

TABLE 125 NXP SEMICONDUCTORS N.V.: BUSINESS OVERVIEW

FIGURE 65 NXP SEMICONDUCTORS N.V.: COMPANY SNAPSHOT

TABLE 126 NXP SEMICONDUCTORS N.V.: PRODUCTS/SOLUTIONS OFFERINGS

TABLE 127 NXP SEMICONDUCTORS N.V.: PRODUCT LAUNCHES

TABLE 128 NXP SEMICONDUCTORS N.V.: DEALS

13.1.3 SAMSUNG ELECTRONICS CO., LTD.

TABLE 129 SAMSUNG ELECTRONICS CO., LTD.: BUSINESS OVERVIEW

FIGURE 66 SAMSUNG ELECTRONICS CO., LTD.: COMPANY SNAPSHOT

TABLE 130 SAMSUNG ELECTRONICS CO., LTD.: PRODUCTS/SOLUTIONS OFFERINGS

TABLE 131 SAMSUNG ELECTRONICS CO., LTD.: PRODUCT LAUNCHES

13.1.4 STMICROELECTRONICS N.V.

TABLE 132 STMICROELECTRONICS N.V.: BUSINESS OVERVIEW

FIGURE 67 STMICROELECTRONICS N.V.: COMPANY SNAPSHOT

TABLE 133 STMICROELECTRONICS N.V.: PRODUCTS/SOLUTIONS OFFERINGS

TABLE 134 STMICROELECTRONICS N.V.: PRODUCT LAUNCHES

TABLE 135 STMICROELECTRONICS N.V.: DEALS

13.1.5 MICROCHIP TECHNOLOGY INCORPORATED (ATMEL CORPORATION)

TABLE 136 MICROCHIP TECHNOLOGY INCORPORATED (ATMEL CORPORATION): BUSINESS OVERVIEW

FIGURE 68 MICROCHIP TECHNOLOGY INCORPORATED (ATMEL CORPORATION): COMPANY SNAPSHOT

TABLE 137 MICROCHIP TECHNOLOGY INCORPORATED: PRODUCTS/SOLUTIONS OFFERINGS

13.1.6 CEC HUADA ELECTRONIC DESIGN CO., LTD.

TABLE 138 CEC HUADA ELECTRONIC DESIGN CO., LTD.: BUSINESS OVERVIEW

TABLE 139 CEC HUADA ELECTRONIC DESIGN CO., LTD.: PRODUCTS/SOLUTIONS OFFERINGS

13.1.7 ANALOG DEVICES, INC.

TABLE 140 ANALOG DEVICES, INC.: BUSINESS OVERVIEW

FIGURE 69 ANALOG DEVICES, INC.: COMPANY SNAPSHOT

TABLE 141 ANALOG DEVICES, INC.: PRODUCTS/SOLUTIONS OFFERINGS

TABLE 142 ANALOG DEVICES, INC.: DEALS

13.1.8 SONY GROUP CORPORATION

TABLE 143 SONY GROUP CORPORATION: BUSINESS OVERVIEW

FIGURE 70 SONY GROUP CORPORATION: COMPANY SNAPSHOT

TABLE 144 SONY GROUP CORPORATION: PRODUCTS/SOLUTIONS OFFERINGS

TABLE 145 SONY GROUP CORPORATION: PRODUCT LAUNCHES

TABLE 146 SONY GROUP CORPORATION: OTHERS

13.1.9 TOSHIBA CORPORATION

TABLE 147 TOSHIBA CORPORATION: BUSINESS OVERVIEW

FIGURE 71 TOSHIBA CORPORATION: COMPANY SNAPSHOT

TABLE 148 TOSHIBA CORPORATION: PRODUCTS/SOLUTIONS OFFERINGS

13.1.10 ON SEMICONDUCTOR CORPORATION

TABLE 149 ON SEMICONDUCTOR CORPORATION: BUSINESS OVERVIEW

FIGURE 72 ON SEMICONDUCTOR CORPORATION: COMPANY SNAPSHOT

TABLE 150 ON SEMICONDUCTOR CORPORATION: PRODUCTS/SOLUTIONS OFFERINGS

13.2 OTHER PLAYERS

13.2.1 SHANGHAI FUDAN MICROELECTRONICS GROUP CO., LTD.

13.2.2 WATCH DATA CO., LTD.

13.2.3 TEXAS INSTRUMENTS INCORPORATED

13.2.4 NATIONS TECHNOLOGIES INC.

13.2.5 ZIGUANG TONGXIN MICROELECTRONICS CO., LTD. (TMC)

13.2.6 KONA I

13.2.7 HT MICRON

13.2.8 IMATRIC LLC

13.2.9 ICTK HOLDINGS CO., LTD.

13.2.10 EM MICROELECTRONIC

*Details on Business Overview, Products/Solutions offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 215)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 CUSTOMIZATION OPTIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

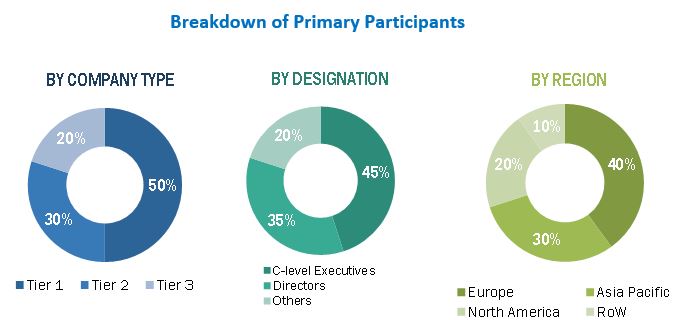

The study involved four major activities in estimating the size of the smart card IC market. Exhaustive secondary research was done to collect information on the market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market’s size. After that, market breakdown and data triangulation were used to determine the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources have been referred to identify and collect information relevant to this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles from recognized authors; directories; and databases. Secondary research has been mainly conducted to obtain key information about the industry's supply chain, value chain of the market, the total pool of key players, market classification and segmentation according to industry trends, geographic markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

Extensive primary research has been conducted after understanding and analyzing the smart card IC market scenario through secondary research. Several primary interviews have been conducted with key opinion leaders from both the demand- and supply-side vendors across four major regions—North America, Europe, Asia Pacific, and Rest of the World (South America, the Middle East, and Africa). Approximately 25% of the primary interviews have been conducted with the demand side and 75% with the supply side. This primary data has been collected mainly through telephonic interviews, which consists 80% of total primary interviews; however, questionnaires and e-mails have also been used to collect the data.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up approach has been implemented to arrive at the overall size of the smart card IC market from the revenues of the key players in the market. Calculations based on the revenue of the key players identified in the market led to the overall market size.

- Identifying various key players offering smart card IC

- Analyzing the global penetration of smart card IC in various applications and end-user industries

- Estimating the market for smart card IC, by end-user industry

- Tracking the ongoing and upcoming developments in smart card IC applications and forecasting the market based on these developments and other critical parameters

- Undertaking multiple discussions with key opinion leaders to understand working principle of smart card IC and their applications, which helped analyze the impact of developments undertaken by each major company to increase their share in the smart card IC market

- Verifying and crosschecking estimates at every level with key opinion leaders, including chief executive officers (CEOs), directors, and operation managers, and then finally with the domain experts at MarketsandMarkets

- Studying various paid and unpaid sources of information such as annual reports, press releases, white papers, and databases for the company- and region-specific developments undertaken in the smart card IC market

Smart Card IC Market Size: Bottom-Up Approach:

In the top-down approach, the overall market size has been used to estimate the size of the individual markets (mentioned in the market segmentation) through percentage splits obtained from the secondary and primary research processes.

- Focusing initially on the investments and expenditures undertaken in the ecosystem of smart card IC; further splitting them into type, architecture, interface, application, end-user industry, and region and listing key developments in major market areas

- Identifying key players in the smart card IC market based on application and end-user industry and verifying the findings through secondary research and brief discussions with industry experts

- Analyzing revenues, product mix, geographic presence, and key end-use applications of smart card IC to estimate and arrive at the percentage splits

- Discussing these splits with industry experts to validate the information and identify key growth pockets across all major segments

- Breaking down the total market based on verified splits and key growth pockets across all segments

Smart Card IC Market Size: Top-Down Approach:

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedure has been employed, wherever applicable. The data has been triangulated by studying various factors and trends in both the demand and supply sides. Along with this, the market has been validated using both top-down and bottom-up approaches.

Report Objectives:

- To describe, segment, and forecast the smart card integrated circuit (IC) market, by type, architecture, interface, and end-user industry, in terms of value

- To describe and forecast the market size for different applications of smart card IC, in terms of value and volume

- To describe and forecast the market for four key regions, namely, North America, Europe, Asia Pacific, and Rest of the World (RoW), in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the smart card IC market

- To provide a detailed overview of the value chain pertaining to the smart card IC ecosystem, along with the average selling prices of smart card IC for different applications

- To strategically analyze the ecosystem, Porter’s five forces, technologies, tariffs and regulations, patent landscape, trade landscape, key conferences and events, and case studies pertaining to the market under study

- To strategically analyze micromarkets1 with regard to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of the market

- To analyze competitive developments such as product launches, collaborations, partnerships, contracts, expansions, and acquisitions in the smart card IC market

- To strategically profile the key players in the smart card IC market and comprehensively analyze their market ranking and core competencies2

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players based on various blocks of the supply chain

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Smart Card IC Market